Antioxidants Market Size, Share, and Trends Analysis Report

CAGR :

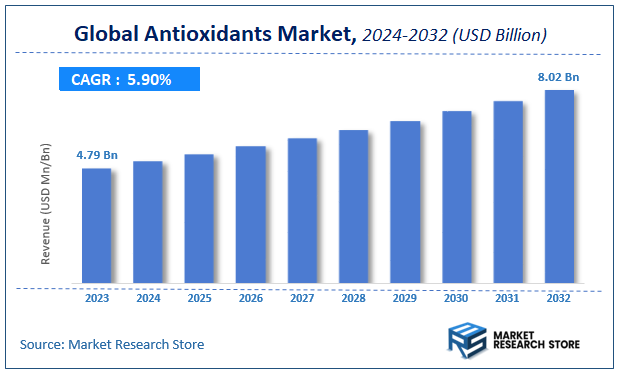

| Market Size 2023 (Base Year) | USD 4.79 Billion |

| Market Size 2032 (Forecast Year) | USD 8.02 Billion |

| CAGR | 5.9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Antioxidants Market Insights

According to Market Research Store, the global antioxidants market size was valued at around USD 4.79 billion in 2023 and is estimated to reach USD 8.02 billion by 2032, to register a CAGR of approximately 5.9% in terms of revenue during the forecast period 2024-2032.

The antioxidants report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Antioxidants Market: Overview

Antioxidants are molecules that inhibit the oxidation of other molecules, thereby protecting cells and tissues from damage caused by free radicals—unstable atoms or molecules that can lead to cellular degradation, aging, and various chronic diseases. Antioxidants neutralize free radicals by donating electrons, effectively stabilizing them and preventing chain reactions that contribute to oxidative stress. They occur naturally in many foods, particularly fruits, vegetables, nuts, and whole grains, and can also be synthesized for use in dietary supplements, pharmaceuticals, cosmetics, and food preservation.

The growth of the antioxidants market is driven by increasing consumer awareness of health and wellness, rising demand for functional foods and supplements, and the expanding use of antioxidants in cosmetics and pharmaceuticals. In the food industry, antioxidants are used to extend shelf life and preserve color, flavor, and nutritional value by preventing lipid oxidation. In skincare and personal care products, they protect against environmental stressors and aging-related skin damage.

Key Highlights

- The antioxidants market is anticipated to grow at a CAGR of 5.9% during the forecast period.

- The global antioxidants market was estimated to be worth approximately USD 4.79 billion in 2023 and is projected to reach a value of USD 8.02 billion by 2032.

- The growth of the antioxidants market is being driven by rising awareness of health and wellness, increasing demand for processed and functional foods.

- Based on the application, the food &beverage segment is growing at a high rate and is projected to dominate the market.

- On the basis of source, the natural segment is projected to swipe the largest market share.

- In terms of form, the powder segment is expected to dominate the market.

- Based on the end use, the dietary supplements segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Antioxidants Market Dynamics

Key Growth Drivers:

- Growing Health and Wellness Trend in Food & Beverages: This is a major driver. Increasing consumer awareness about the health benefits of antioxidants in preventing chronic diseases, boosting immunity, and combating aging drives demand for antioxidant-rich functional foods, beverages, and dietary supplements. This leads to higher inclusion of natural antioxidants like Vitamin C, E, and carotenoids.

- Expansion of the Processed Food Industry: As global demand for processed and packaged foods rises due to urbanization and changing lifestyles, there's an increasing need for antioxidants to extend shelf life, prevent rancidity, and maintain the quality, flavor, and color of food products.

- Increasing Demand from the Animal Feed Industry: Antioxidants are crucial in animal feed to prevent oxidation of fats and vitamins, preserving the nutritional value and palatability of feed, and ultimately improving animal health and growth. The growing livestock and aquaculture industries globally drive this demand.

- Growth in the Plastics and Polymer Industry: Antioxidants are indispensable additives in plastics, rubbers, and polymers to protect them from degradation caused by heat, light (UV radiation), and oxygen during processing and throughout their service life, extending product durability and performance.

Restraints:

- Stringent Regulations on Synthetic Antioxidants: Growing concerns about the safety and potential health risks of synthetic antioxidants (e.g., BHT, BHA) in food and feed applications have led to stricter regulations, reduced permissible limits, and a push for their replacement with natural alternatives, which can be more expensive or less effective in some industrial uses.

- High Cost of Natural Antioxidants: While highly desired, natural antioxidants (e.g., tocopherols, carotenoids from plant extracts) are generally more expensive to produce and incorporate compared to their synthetic counterparts. This cost differential can be a restraint, particularly in price-sensitive applications.

- Availability and Purity Challenges for Natural Sources: Sourcing consistent, high-purity natural antioxidant extracts can be challenging due to seasonal variations, geographical limitations, and the complexities of extraction processes, potentially impacting supply and cost.

Opportunities:

- Booming Demand for Natural and Clean Label Antioxidants: This is the most significant opportunity. The strong consumer preference for natural ingredients, clean labels, and transparency in food, feed, and cosmetic products drives massive R&D and market growth for plant-based antioxidants, botanical extracts, and naturally derived alternatives.

- Development of Novel and High-Performance Natural Antioxidants: Significant opportunities exist in discovering, extracting, and commercializing new sources of natural antioxidants from underutilized plant materials, algae, or microbial fermentation, offering enhanced efficacy, stability, and cost-effectiveness.

- Synergistic Blends and Encapsulation Technologies: Developing synergistic blends of different antioxidants (natural or synthetic) to maximize efficacy and stability, and utilizing encapsulation technologies to improve delivery, protect activity, and extend shelf life of antioxidants, presents a key opportunity.

Challenges:

- Cost-Performance Balance of Natural vs. Synthetic: The primary challenge is to develop natural antioxidants that can consistently match the cost-effectiveness and performance (e.g., heat stability, radical scavenging efficiency) of established synthetic antioxidants across all industrial applications.

- Regulatory Complexity and Varied Definitions: The diverse and evolving regulatory landscape for food additives, feed additives, and cosmetic ingredients, particularly concerning "natural" and "organic" claims and permissible limits, creates a complex environment for manufacturers.

- Ensuring Purity, Efficacy, and Stability of Natural Extracts: Sourcing, processing, and ensuring the consistent purity, potency, and stability of natural antioxidant extracts, which can vary significantly due to agricultural practices, harvesting, and extraction methods, is a major technical challenge.

Antioxidants Market: Report Scope

This report thoroughly analyzes the Antioxidants Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Antioxidants Market |

| Market Size in 2023 | USD 4.79 Billion |

| Market Forecast in 2032 | USD 8.02 Billion |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 160 |

| Key Companies Covered | Aland (Jiangsu) Nutraceutical Co., Ltd., Archer-Daniels-Midland Company, BASF S.E, Cargill Incorporated, DuPont, Kalsec Inc., Kemin Industries, Inc., Koninklijke DSM N.V., Naturex S.A., Nutreco N.V., and Vitablend Nederland B.V |

| Segments Covered | By Product, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Antioxidants Market: Segmentation Insights

The global antioxidants market is divided by application, source, form, end use, and region.

Based on application, the global antioxidants market is divided into food &beverage, cosmetics, pharmaceuticals, animal feed, and nutraceuticals. Food & Beverage is the dominant application segment in the Antioxidants Market, driven by increasing consumer demand for products with extended shelf life, improved nutritional profiles, and clean-label ingredients. Antioxidants such as ascorbic acid (vitamin C), tocopherols (vitamin E), and natural extracts like rosemary and green tea are extensively used to prevent oxidative degradation in oils, fats, and processed foods. They help maintain product color, flavor, and freshness while complying with regulatory standards related to food preservation and safety. The rising awareness about health and wellness is also encouraging manufacturers to replace synthetic antioxidants with natural alternatives. With growing consumption of packaged and convenience foods across emerging economies, the use of antioxidants in this sector continues to see robust growth, securing its position as the leading application area.

On the basis of source, the global antioxidants market is bifurcated into natural, synthetic, and biotechnology. Natural antioxidants are the dominant source segment in the Antioxidants Market, largely driven by rising consumer awareness of clean-label products, health-conscious lifestyles, and demand for minimally processed ingredients. These antioxidants are derived from plant-based sources such as fruits, vegetables, herbs, spices, and seeds, and include compounds like tocopherols (vitamin E), ascorbic acid (vitamin C), flavonoids, carotenoids, and polyphenols. They are widely used across food & beverage, cosmetics, nutraceuticals, and pharmaceuticals due to their broad-spectrum efficacy and consumer appeal. As regulatory agencies and consumers increasingly prefer natural ingredients over synthetic additives, industries are shifting toward botanical extracts and essential oils that offer antioxidant protection while enhancing product appeal.

In terms of form, the global antioxidants market is bifurcated into powder, liquid, capsules, and tablets. Powder is the dominant form segment in the Antioxidants Market, primarily due to its stability, ease of handling, and versatility across multiple industries. Antioxidants in powder form are widely used in the food & beverage sector for preserving processed foods, bakery items, dairy products, and beverages without altering texture or flavor. In pharmaceuticals and nutraceuticals, powders offer excellent solubility, fast absorption rates, and compatibility with a wide range of delivery formats including capsules, tablets, and drink mixes. Moreover, powder antioxidants are easier to package, store, and transport compared to liquid alternatives, making them highly preferred in global supply chains. The growing demand for powdered botanical extracts, plant-based ingredients, and functional food formulations further supports this segment’s dominance in the overall antioxidants market.

Based on end use, the global antioxidants market is bifurcated into dietary supplements, personal care products, food preservation, and medicinal products. Dietary Supplements represent the dominant end-use segment in the Antioxidants Market, driven by the growing global emphasis on preventive healthcare, wellness trends, and aging populations. Antioxidants such as vitamin C, vitamin E, coenzyme Q10, selenium, resveratrol, and astaxanthin are widely incorporated into dietary supplements to combat oxidative stress, support immune function, and promote overall health. The segment benefits from rising consumer awareness about the role of free radicals in chronic diseases and the increasing popularity of natural and plant-based antioxidant sources.

Antioxidants Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the antioxidants market due to its large-scale food, pharmaceutical, cosmetic, and polymer industries that rely heavily on antioxidants for shelf-life extension, stabilization, and health-related applications. The United States leads the region, driven by significant demand for both synthetic and natural antioxidants in processed foods, dietary supplements, and personal care products. Consumers in the region are increasingly health-conscious, leading to higher usage of natural antioxidants such as tocopherols, ascorbic acid, and polyphenols in functional foods and nutraceuticals. In the industrial segment, synthetic antioxidants like BHA, BHT, and phosphites are used extensively in plastics and rubber to prevent oxidative degradation. Regulatory bodies like the FDA and EPA enforce strict guidelines, promoting safe usage and driving innovations in bio-based and low-toxicity antioxidant formulations. Canada also contributes to regional growth through its rising demand for organic and health-focused food products, further strengthening North America's leadership.

Europe holds a significant share in the antioxidants market, supported by stringent regulations, strong consumer preference for clean-label products, and a robust food and pharmaceutical manufacturing base. Countries like Germany, France, the UK, and Italy are at the forefront of market demand, especially for natural antioxidants derived from plant sources such as rosemary extract, grape seed extract, and carotenoids. The European Food Safety Authority (EFSA) imposes tight regulations on synthetic additives, which has accelerated the shift toward natural antioxidants in food and beverage applications. The region also sees strong demand in cosmetics and skincare, where antioxidants are used to combat oxidative stress and aging. In addition, antioxidants play a crucial role in industrial applications such as plastic stabilization and lubricant formulations. Europe’s focus on sustainability and clean production practices ensures ongoing growth in demand for eco-friendly antioxidant solutions.

Asia-Pacific is the fastest-growing region in the antioxidants market, driven by rapid urbanization, expanding food processing and plastic manufacturing industries, and increasing health awareness among consumers. China, India, Japan, and South Korea are major contributors. In China and India, rising disposable income and dietary shifts have led to increased demand for antioxidant-enriched supplements, fortified foods, and beauty products. Industrial demand is also high, particularly in plastics and rubber manufacturing, where synthetic antioxidants such as amines and phenolics are used to enhance product durability. Japan and South Korea focus on high-quality natural antioxidants in pharmaceuticals and advanced skincare formulations, reflecting their strong R&D capabilities and consumer preferences for premium products. Despite the region’s dynamic growth, challenges such as regulatory variability and concerns over synthetic antioxidant residues in food remain, prompting further innovation and market adaptation.

Latin America represents a growing antioxidants market, with Brazil, Mexico, and Argentina leading demand across the food, beverage, and agriculture sectors. The food industry drives most of the regional demand, particularly for antioxidants used as preservatives in meat, dairy, and snack products. Brazil is also a significant market for plant-based antioxidants like acerola extract and açaí, given its rich biodiversity and growing focus on health and wellness. Mexico’s rising middle class and expanding processed food sector further contribute to antioxidant usage in both food and packaging applications. However, the market is constrained by limited consumer awareness and inconsistent regulatory frameworks across countries. Still, increasing investment in food processing, pharmaceuticals, and natural product development is expected to support regional market expansion in the near future.

Middle East & Africa are emerging regions in the antioxidants market, with increasing applications in food preservation, cosmetics, and industrial materials. In the Middle East, countries like the UAE and Saudi Arabia are seeing rising demand for packaged food, dietary supplements, and anti-aging cosmetics, which require antioxidant ingredients to maintain quality and effectiveness. Industrial growth in polymer and lubricant production also supports synthetic antioxidant demand. In Africa, South Africa leads regional adoption, particularly in food and agricultural applications. However, challenges such as limited local production, higher import dependence, and uneven regulatory enforcement impact market growth. Nonetheless, rising health awareness, expanding urban populations, and increasing adoption of Western dietary and cosmetic trends point toward steady growth in antioxidant usage throughout the region.

Antioxidants Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the antioxidants market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global antioxidants market include:

- Aland (Jiangsu) Nutraceutical Co.,Ltd.

- Archer-Daniels-Midland Company

- BASF S.E

- Cargill Incorporated

- DuPont

- Kalsec Inc.

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Naturex S.A.

- Nutreco N.V.

- Vitablend Nederland B.V.

- Lonza

- ChromaDex

- Nutraceutics

- Sabinsa

- Aker BioMarine

- Royal DSM

- ADM

- Tetra Pak

- Indena

- Nutritional Holdings

- Evonik Industries

- SigmaAldrich

The global antioxidants market is segmented as follows:

By Application

- Food &Beverage

- Cosmetics

- Pharmaceuticals

- Animal Feed

- Nutraceuticals

By Source

- Natural

- Synthetic

- Biotechnology

By Form

- Powder

- Liquid

- Capsules

- Tablets

By End Use

- Dietary Supplements

- Personal Care Products

- Food Preservation

- Medicinal Products

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Preface

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global antioxidants market, 2014 - 2020, (USD Million)

- 2.2. Antioxidants: Market snapshot

- Chapter 3. Antioxidants Market: Industry Analysis

- 3.1. Antioxidants: Market dynamics

- 3.2. Value Chain Analysis

- 3.3. Market Drivers

- 3.3.1. Growing demand for food & beverages

- 3.3.2. Strong growth of food and beverages industry

- 3.3.3. Growth of pharmaceuticals industry

- 3.3.4. Rising demand for animal feed additives

- 3.4. Restraints

- 3.4.1. Increasing threat of synthetic antioxidants as a substitute

- 3.5. Opportunity

- 3.5.1. Rising demand for natural antioxidants in niche applications

- 3.6. Porter’s Five Forces Analysis

- 3.7. Market Attractiveness Analysis

- 3.7.1. Market attractiveness analysis by product segment

- 3.7.2. Market attractiveness analysis by application segment

- 3.7.3. Market attractiveness analysis by regional segment

- Chapter 4. Global Antioxidants Market: Competitive Landscape

- 4.1. Company market share analysis, 2014

- 4.2. Production capacity (subject to data availability)

- 4.3. Raw material analysis

- 4.4. Price trend analysis

- Chapter 5. Global Antioxidants Market: Product Analysis

- 5.1. Global antioxidants market share, by product, 2014 & 2020

- 5.2. Global natural antioxidants for global antioxidants market, 2014 – 2020 (USD Million)

- 5.3. Global synthetic antioxidants for global antioxidants market, 2014 – 2020 (USD Million)

- Chapter 6. Global Antioxidants Market: Application Overview

- 6.1. Global antioxidants market share, by application, 2014 and 2020

- 6.2. Global antioxidants market for pharmaceuticals, 2014 - 2020 (USD Million)

- 6.3. Global antioxidants market for food & beverages sector, 2014 - 2020(USD Million)

- 6.4. Global antioxidants market for feed additives, 2014 - 2020 (USD Million)

- 6.5. Global antioxidants market for cosmetic industry, 2014 - 2020 (USD Million)

- 6.6. Global antioxidants market for other applications, 2014 – 2020 (USD Million)

- Chapter 7. Antioxidants Market: Regional Analysis

- 7.1. Global antioxidants market: Regional overview

- 7.1.1. Global antioxidants market share, by region, 2014 and 2020

- 7.2. North America

- 7.2.1. North America antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.2.2. North America antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.2.3. U.S.

- 7.2.3.1. U.S. antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.2.3.2. U.S. antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.3. Europe

- 7.3.1. Europe antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.2. Europe antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.3.3. Germany

- 7.3.3.1. Germany antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.3.2. Germany antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.3.4. UK

- 7.3.4.1. UK antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.4.2. UK antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.3.5. France

- 7.3.5.1. France antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.5.2. France antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia-Pacific antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.2. Asia-Pacific antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.3. China

- 7.4.3.1. China antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.3.2. China antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.4. Japan

- 7.4.4.1. Japan antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.4.2. Japan antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.5. India

- 7.4.5.1. India antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.5.2. India antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.2. Latin America antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.5.3. Brazil

- 7.5.3.1. Brazil antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.3.2. Brazil antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.6. Middle East & Africa

- 7.6.1. Middle East & Africa antioxidants market revenue, by product, 2014 – 2020 (USD Million)

- 7.6.2. Middle East & Africa antioxidants market revenue, by application, 2014 – 2020 (USD Million)

- 7.1. Global antioxidants market: Regional overview

- Chapter 8. Company Profiles

- 8.1. Aland (Jiangsu) Nutraceutical Co Ltd

- 8.1.1. Overview

- 8.1.2. Financials

- 8.1.3. Product portfolio

- 8.1.4. Business strategy

- 8.1.5. Recent developments

- 8.2. BASF

- 8.2.1. Overview

- 8.2.2. Financials

- 8.2.3. Product portfolio

- 8.2.4. Business strategy

- 8.2.5. Recent developments

- 8.3. DuPont

- 8.3.1. Overview

- 8.3.2. Financials

- 8.3.3. Product portfolio

- 8.3.4. Business strategy

- 8.3.5. Recent developments

- 8.4. Archer-Daniels-Midland Company

- 8.4.1. Overview

- 8.4.2. Financials

- 8.4.3. Product portfolio

- 8.4.4. Business strategy

- 8.4.5. Recent developments

- 8.5. Cargill Incorporated

- 8.5.1. Overview

- 8.5.2. Financials

- 8.5.3. Product portfolio

- 8.5.4. Business strategy

- 8.5.5. Recent developments

- 8.6. Kalsec Inc

- 8.6.1. Overview

- 8.6.2. Financials

- 8.6.3. Product portfolio

- 8.6.4. Business strategy

- 8.6.5. Recent developments

- 8.7. Kemin Industries Inc

- 8.7.1. Overview

- 8.7.2. Financials

- 8.7.3. Product portfolio

- 8.7.4. Business strategy

- 8.7.5. Recent developments

- 8.8. Koninklijke DSM N.V.

- 8.8.1. Overview

- 8.8.2. Financials

- 8.8.3. Product portfolio

- 8.8.4. Business strategy

- 8.8.5. Recent developments

- 8.9. Naturex S.A.

- 8.9.1. Overview

- 8.9.2. Financials

- 8.9.3. Product portfolio

- 8.9.4. Business strategy

- 8.9.5. Recent developments

- 8.10. Nutreco N.V.

- 8.10.1. Overview

- 8.10.2. Financials

- 8.10.3. Product portfolio

- 8.10.4. Business strategy

- 8.10.5. Recent developments

- 8.11. Vitablend Nederland B.V.

- 8.11.1. Overview

- 8.11.2. Financials

- 8.11.3. Product portfolio

- 8.11.4. Business strategy

- 8.11.5. Recent developments

- 8.1. Aland (Jiangsu) Nutraceutical Co Ltd

Inquiry For Buying

Antioxidants

Request Sample

Antioxidants