Acute Myeloid Leukemia (AML) Therapeutics Market Size, Share, and Trends Analysis Report

CAGR :

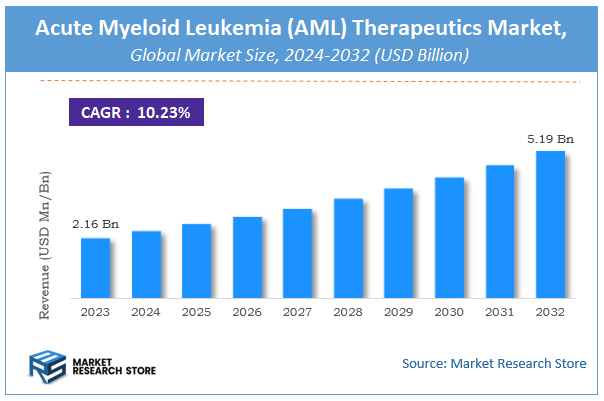

| Market Size 2023 (Base Year) | USD 2.16 Billion |

| Market Size 2032 (Forecast Year) | USD 5.19 Billion |

| CAGR | 10.23% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Acute Myeloid Leukemia (AML) Therapeutics Market Insights

According to Market Research Store, the global acute myeloid leukemia (AML) therapeutics market size was valued at around USD 2.16 billion in 2023 and is estimated to reach USD 5.19 billion by 2032, to register a CAGR of approximately 10.23% in terms of revenue during the forecast period 2024-2032.

The acute myeloid leukemia (AML) therapeutics report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Acute Myeloid Leukemia (AML) Therapeutics Market: Overview

Acute Myeloid Leukemia (AML) therapeutics encompass a variety of treatment options aimed at managing and potentially curing AML, a fast-progressing cancer of the blood and bone marrow that disrupts the normal production of healthy blood cells. The disease is characterized by the rapid accumulation of abnormal myeloid cells, leading to symptoms such as anemia, frequent infections, and bleeding complications. Current therapeutic approaches include chemotherapy, targeted therapies, immunotherapy, and stem cell transplantation, along with emerging precision medicine strategies designed to address specific genetic mutations. Advances in molecular diagnostics and drug development have significantly enhanced treatment personalization, improving remission rates and patient outcomes.

Key Highlights

- The acute myeloid leukemia (AML) therapeutics market is anticipated to grow at a CAGR of 10.23% during the forecast period.

- The global acute myeloid leukemia (AML) therapeutics market was estimated to be worth approximately USD 2.16 billion in 2023 and is projected to reach a value of USD 5.19 billion by 2032.

- The growth of the acute myeloid leukemia (AML) therapeutics market is being driven by rising disease prevalence, an aging global population, and ongoing innovation in oncology research.

- Based on the drug type, the chemotherapy segment is growing at a high rate and is projected to dominate the market.

- On the basis of treatment line, the first-line treatment segment is projected to swipe the largest market share.

- In terms of route of administration, the intravenous segment is expected to dominate the market.

- Based on the distribution channel, the hospital pharmacies segment is expected to dominate the market.

- In terms of patient age group, the 65 years and above segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Acute Myeloid Leukemia (AML) Therapeutics Market: Dynamics

Key Growth Drivers:

- Rising Incidence of AML Worldwide: Increasing prevalence of acute myeloid leukemia, particularly in aging populations, is driving demand for effective therapeutic options.

- Advancements in Targeted and Immunotherapies: The development of novel drugs such as FLT3 inhibitors, IDH inhibitors, and antibody-based therapies is improving treatment outcomes.

- Growing Investment in Cancer Research: Significant funding from governments, NGOs, and pharmaceutical companies is accelerating the pipeline for AML drugs.

- Faster Regulatory Approvals for Breakthrough Therapies: Expedited pathways for life-threatening diseases are enabling quicker access to innovative AML treatments.

Restraints:

- High Cost of AML Treatments: Advanced therapies, especially targeted and combination treatments, can be prohibitively expensive, limiting patient access in low-income regions.

- Severe Side Effects of Chemotherapy and Other Therapies: Treatment-related toxicities, including infections and organ damage, often hinder long-term patient compliance.

- Limited Success in Relapsed/Refractory Cases: Despite therapeutic advancements, treatment effectiveness remains low for patients with recurring acute myeloid leukemia.

Opportunities:

- Expansion of Personalized Medicine: Growing use of genetic and molecular profiling enables more precise and effective AML treatment strategies.

- Emerging Markets with Improving Healthcare Access: Developing regions with expanding oncology infrastructure present significant growth opportunities.

- Combination Therapies for Improved Survival Rates: Research into multi-drug regimens offers potential to enhance treatment efficacy and reduce resistance.

Challenges:

- High Clinical Trial Failure Rates: Acute myeloid leukemia drug development faces significant setbacks due to the complexity of the disease and its aggressive nature.

- Short Patient Survival Window for Treatment: The rapid progression of acute myeloid leukemia limits the available time for diagnosis, therapy selection, and drug administration.

- Regulatory and Ethical Hurdles in Experimental Treatments: Stringent approval processes and ethical concerns slow down access to novel but unproven therapies.

Acute Myeloid Leukemia (AML) Therapeutics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Acute Myeloid Leukemia (AML) Therapeutics Market |

| Market Size in 2023 | USD 2.16 Billion |

| Market Forecast in 2032 | USD 5.19 Billion |

| Growth Rate | CAGR of 10.23% |

| Number of Pages | 165 |

| Key Companies Covered | Ambit Biosciences Corporation, Genzyme Corporation, Celgene Corporation, Sunesis Pharmaceuticals Inc., Cephalon Inc., Abbvie Inc., Clavis Pharma ASA, Astellas Pharma Inc, Eisai Co. Ltd, and CTI Biopharma Corp. These key players in order to obtain a reputed position in the global market have implemented several strategies such as signing agreements, bonds, contracts, partnerships, joint ventures, new product launches, collaborations, and mergers & acquisitions |

| Segments Covered | By Treatment Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Acute Myeloid Leukemia (AML) Therapeutics Market: Segmentation Insights

The global acute myeloid leukemia (AML) therapeutics market is divided by drug type, treatment line, route of administration, distribution channel, patient age group, and region.

Based on drug type, the global acute myeloid leukemia (AML) therapeutics market is divided into chemotherapy, targeted therapy, immunotherapy, stem cell transplantation, and others. Chemotherapy is the most dominant segment, as it remains the standard first-line treatment for most AML patients. Chemotherapy regimens, such as cytarabine combined with anthracyclines, are widely used to induce remission by rapidly targeting and destroying leukemia cells. Despite the emergence of newer therapies, chemotherapy’s proven effectiveness, established clinical protocols, and broad accessibility ensure its leading role, particularly in newly diagnosed and younger patients. Targeted therapy holds the second-largest share, driven by the growing use of drugs designed to act on specific genetic mutations or molecular pathways in AML, such as FLT3, IDH1, and IDH2 inhibitors. These therapies offer greater precision, potentially fewer side effects, and improved survival outcomes for specific patient subgroups. The expansion of biomarker testing and personalized medicine is further fueling growth in this segment.

On the basis of treatment line, the global acute myeloid leukemia (AML) therapeutics market is bifurcated into first-line treatment, second-line treatment, third-line treatment, and relapsed/refractory treatment. First-line treatment is the most dominant segment, as it is administered immediately after diagnosis to induce remission and prevent disease progression. This stage primarily involves intensive chemotherapy regimens, often in combination with targeted therapies for patients with specific genetic mutations. The established effectiveness of first-line protocols, along with their universal application in newly diagnosed cases, ensures their leading position in the market. Second-line treatment is the next most significant segment, targeting patients who either do not respond adequately to initial therapy or relapse after remission. This phase often includes alternative chemotherapy drugs, targeted therapies, and sometimes immunotherapy options to overcome resistance and improve survival. The growing number of relapsed cases and advancements in precision medicine are driving expansion in this segment.

Based on route of administration, the global acute myeloid leukemia (AML) therapeutics market is divided into oral, injection, intravenous, and subcutaneous. Intravenous administration is the most dominant route, as it is the primary method for delivering intensive chemotherapy and many targeted therapies. This route ensures rapid drug delivery, precise dosing, and immediate therapeutic effects, making it essential for aggressive treatment regimens used in both induction and consolidation phases. Its widespread use in hospitals and oncology centers reinforces its leading position. Oral administration holds the second-largest share, driven by the development of targeted therapies and maintenance treatments that can be taken at home. Oral drugs, such as FLT3 and IDH inhibitors, offer greater convenience, improve patient compliance, and reduce hospital visits, making them an increasingly preferred option for long-term treatment and follow-up care.

In terms of distribution channel, the global acute myeloid leukemia (AML) therapeutics market is bifurcated into hospital pharmacies, retail pharmacies, online pharmacies, and specialty pharmacies. Hospital pharmacies are the most dominant distribution channel, as AML treatments particularly intensive chemotherapies, targeted infusions, and supportive care drugs are primarily administered in hospital settings under specialist supervision. Hospital pharmacies ensure timely access to critical medications, manage complex dosing requirements, and provide immediate medical oversight, making them the central hub for AML drug distribution. Specialty pharmacies hold the second-largest share, focusing on complex and high-cost AML medications that require special handling, storage, and patient support services. They play a key role in facilitating access to targeted oral therapies, coordinating insurance approvals, and providing patient education for long-term disease management.

On the basis of patient age group, the global acute myeloid leukemia (AML) therapeutics market is bifurcated into under 18 years, 18 to 44 years, 45 to 64 years, and 65 years and above. 65 years and above is the most dominant patient age group, as AML incidence significantly increases with age, and a large proportion of diagnoses occur in elderly patients. This group often requires tailored treatment strategies due to comorbidities, reduced tolerance for intensive chemotherapy, and the need for less aggressive yet effective regimens, making them the largest consumer segment for AML therapeutics. 45 to 64 years forms the second-largest segment, representing a substantial portion of the AML patient population. Patients in this age range are often fit enough to undergo intensive chemotherapy or stem cell transplantation, making them candidates for both traditional and newer targeted therapies. High treatment success rates in this group also encourage the adoption of advanced therapeutics.

Acute Myeloid Leukemia (AML) Therapeutics Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the AML therapeutics market, holding the largest share due to its advanced healthcare infrastructure, substantial funding for oncology research, and early adoption of innovative treatments such as immunotherapies and precision medicine. The United States leads the region, driven by strong insurance coverage, widespread access to cutting-edge therapies, and a high concentration of leading pharmaceutical and biotechnology companies actively engaged in AML drug development.

Europe ranks as the second-largest market, supported by well-structured healthcare systems, national cancer programs, and broad access to targeted AML treatments. Countries like Germany, France, and the UK are at the forefront, benefiting from government-funded research, rapid regulatory approvals, and strong collaboration between academic institutions and the pharmaceutical industry, which accelerates the availability of novel therapies.

Asia Pacific is emerging as the fastest-growing market, fueled by rising healthcare investment, expanding clinical trial activity, and increasing accessibility to advanced diagnostics and treatments. Nations such as China, Japan, and India are experiencing higher disease incidence and growing awareness, with government initiatives and R&D collaborations driving the rapid adoption of targeted and combination therapies.

Latin America shows steady market growth, primarily driven by increasing healthcare awareness, improvements in medical infrastructure, and partnerships with global pharmaceutical companies. Brazil and Argentina are leading in therapeutic adoption, although challenges such as limited funding, slower regulatory processes, and affordability issues hinder faster market expansion.

Middle East and Africa hold the smallest share in the AML therapeutics market, with growth mainly driven by healthcare modernization efforts in GCC nations and select African countries. Access to advanced diagnostics, specialized cancer centers, and innovative therapies remains limited, but government initiatives and international collaborations are gradually improving treatment capabilities and expanding market potential in the region.

Acute Myeloid Leukemia (AML) Therapeutics Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the acute myeloid leukemia (AML) therapeutics market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global acute myeloid leukemia (AML) therapeutics market include:

- Ambit Biosciences Corporation

- Genzyme Corporation

- Celgene Corporation

- Sunesis Pharmaceuticals Inc.

- Cephalon Inc.

- Abbvie Inc.

- Clavis Pharma ASA

- Astellas Pharma Inc

- Eisai Co. Ltd

- CTI Biopharma Corp.

The global acute myeloid leukemia (AML) therapeutics market is segmented as follows:

By Drug Type

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Stem Cell Transplantation

- Others

By Treatment Line

- First-line Treatment

- Second-line Treatment

- Third-line Treatment

- Relapsed/Refractory Treatment

By Route of Administration

- Oral

- Injection

- Intravenous

- Subcutaneous

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Specialty Pharmacies

By Patient Age Group

- Under 18 Years

- 18 to 44 Years

- 45 to 64 Years

- 65 Years and Above

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Acute Myeloid Leukemia (AML) Therapeutics

- 1.2. Global Acute Myeloid Leukemia (AML) Therapeutics Market, 2019 & 2026 (USD Million)

- 1.3. Global Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 1.4. Global Acute Myeloid Leukemia (AML) Therapeutics Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Acute Myeloid Leukemia (AML) Therapeutics Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Acute Myeloid Leukemia (AML) Therapeutics Market – Treatment Type Analysis

- 2.1. Global Acute Myeloid Leukemia (AML) Therapeutics Market – Treatment Type Overview

- 2.2. Global Acute Myeloid Leukemia (AML) Therapeutics Market Share, by Treatment Type, 2019 & 2026 (USD Million)

- 2.3. Radiation Therapy

- 2.3.1. Global Radiation Therapy Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 2.4. Targeted Therapy

- 2.4.1. Global Targeted Therapy Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 2.5. Stem Cell Transplant

- 2.5.1. Global Stem Cell Transplant Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 2.6. Chemotherapy

- 2.6.1. Global Chemotherapy Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 2.7. Others

- 2.7.1. Global Others Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- Chapter 3 Acute Myeloid Leukemia (AML) Therapeutics Market – End-User Analysis

- 3.1. Global Acute Myeloid Leukemia (AML) Therapeutics Market – End-User Overview

- 3.2. Global Acute Myeloid Leukemia (AML) Therapeutics Market Share, by End-User, 2019 & 2026 (USD Million)

- 3.3. Clinics

- 3.3.1. Global Clinics Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 3.4. Hospital

- 3.4.1. Global Hospital Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 3.5. Onculogy Centers

- 3.5.1. Global Onculogy Centers Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 3.6. Retails Drug Stores

- 3.6.1. Global Retails Drug Stores Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 3.7. Ambulatory Care Centers

- 3.7.1. Global Ambulatory Care Centers Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 3.8. Others

- 3.8.1. Global Others Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- Chapter 4 Acute Myeloid Leukemia (AML) Therapeutics Market – Regional Analysis

- 4.1. Global Acute Myeloid Leukemia (AML) Therapeutics Market Regional Overview

- 4.2. Global Acute Myeloid Leukemia (AML) Therapeutics Market Share, by Region, 2019 & 2026 (USD Million)

- 4.3. North America

- 4.3.1. North America Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.3.1.1. North America Acute Myeloid Leukemia (AML) Therapeutics Market, by Country, 2016 - 2026 (USD Million)

- 4.3.2. North America Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026

- 4.3.2.1. North America Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026 (USD Million)

- 4.3.3. North America Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026

- 4.3.3.1. North America Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026 (USD Million)

- 4.3.4. U.S.

- 4.3.4.1. U.S. Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.3.5. Canada

- 4.3.5.1. Canada Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.3.1. North America Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4. Europe

- 4.4.1. Europe Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4.1.1. Europe Acute Myeloid Leukemia (AML) Therapeutics Market, by Country, 2016 - 2026 (USD Million)

- 4.4.2. Europe Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026

- 4.4.2.1. Europe Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026 (USD Million)

- 4.4.3. Europe Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026

- 4.4.3.1. Europe Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026 (USD Million)

- 4.4.4. Germany

- 4.4.4.1. Germany Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4.5. France

- 4.4.5.1. France Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4.6. U.K.

- 4.4.6.1. U.K. Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4.7. Italy

- 4.4.7.1. Italy Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4.8. Spain

- 4.4.8.1. Spain Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4.9. Rest of Europe

- 4.4.9.1. Rest of Europe Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.4.1. Europe Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5. Asia Pacific

- 4.5.1. Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5.1.1. Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, by Country, 2016 - 2026 (USD Million)

- 4.5.2. Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026

- 4.5.2.1. Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026 (USD Million)

- 4.5.3. Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026

- 4.5.3.1. Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026 (USD Million)

- 4.5.4. China

- 4.5.4.1. China Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5.5. Japan

- 4.5.5.1. Japan Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5.6. India

- 4.5.6.1. India Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5.7. South Korea

- 4.5.7.1. South Korea Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5.8. South-East Asia

- 4.5.8.1. South-East Asia Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5.9. Rest of Asia Pacific

- 4.5.9.1. Rest of Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.5.1. Asia Pacific Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.6. Latin America

- 4.6.1. Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.6.1.1. Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, by Country, 2016 - 2026 (USD Million)

- 4.6.2. Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026

- 4.6.2.1. Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026 (USD Million)

- 4.6.3. Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026

- 4.6.3.1. Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026 (USD Million)

- 4.6.4. Brazil

- 4.6.4.1. Brazil Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.6.5. Mexico

- 4.6.5.1. Mexico Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.6.6. Rest of Latin America

- 4.6.6.1. Rest of Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.6.1. Latin America Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.7. The Middle-East and Africa

- 4.7.1. The Middle-East and Africa Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.7.1.1. The Middle-East and Africa Acute Myeloid Leukemia (AML) Therapeutics Market, by Country, 2016 - 2026 (USD Million)

- 4.7.2. The Middle-East and Africa Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026

- 4.7.2.1. The Middle-East and Africa Acute Myeloid Leukemia (AML) Therapeutics Market, by Treatment Type, 2016 – 2026 (USD Million)

- 4.7.3. The Middle-East and Africa Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026

- 4.7.3.1. The Middle-East and Africa Acute Myeloid Leukemia (AML) Therapeutics Market, by End-User, 2016 – 2026 (USD Million)

- 4.7.4. GCC Countries

- 4.7.4.1. GCC Countries Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.7.5. South Africa

- 4.7.5.1. South Africa Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.7.6. Rest of Middle-East Africa

- 4.7.6.1. Rest of Middle-East Africa Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- 4.7.1. The Middle-East and Africa Acute Myeloid Leukemia (AML) Therapeutics Market, 2016 – 2026 (USD Million)

- Chapter 5 Acute Myeloid Leukemia (AML) Therapeutics Market – Competitive Landscape

- 5.1. Competitor Market Share – Revenue

- 5.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 5.3. Strategic Developments

- 5.3.1. Acquisitions and Mergers

- 5.3.2. New Products

- 5.3.3. Research & Development Activities

- Chapter 6 Company Profiles

- 6.1. Ambit Biosciences Corporation

- 6.1.1. Company Overview

- 6.1.2. Product/Service Portfulio

- 6.1.3. Ambit Biosciences Corporation Sales, Revenue, and Gross Margin

- 6.1.4. Ambit Biosciences Corporation Revenue and Growth Rate

- 6.1.5. Ambit Biosciences Corporation Market Share

- 6.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.2. Genzyme Corporation

- 6.2.1. Company Overview

- 6.2.2. Product/Service Portfulio

- 6.2.3. Genzyme Corporation Sales, Revenue, and Gross Margin

- 6.2.4. Genzyme Corporation Revenue and Growth Rate

- 6.2.5. Genzyme Corporation Market Share

- 6.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.3. Celgene Corporation

- 6.3.1. Company Overview

- 6.3.2. Product/Service Portfulio

- 6.3.3. Celgene Corporation Sales, Revenue, and Gross Margin

- 6.3.4. Celgene Corporation Revenue and Growth Rate

- 6.3.5. Celgene Corporation Market Share

- 6.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.4. Sunesis Pharmaceuticals Inc.

- 6.4.1. Company Overview

- 6.4.2. Product/Service Portfulio

- 6.4.3. Sunesis Pharmaceuticals Inc. Sales, Revenue, and Gross Margin

- 6.4.4. Sunesis Pharmaceuticals Inc. Revenue and Growth Rate

- 6.4.5. Sunesis Pharmaceuticals Inc. Market Share

- 6.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.5. Cephalon Inc.

- 6.5.1. Company Overview

- 6.5.2. Product/Service Portfulio

- 6.5.3. Cephalon Inc. Sales, Revenue, and Gross Margin

- 6.5.4. Cephalon Inc. Revenue and Growth Rate

- 6.5.5. Cephalon Inc. Market Share

- 6.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.6. Abbvie Inc.

- 6.6.1. Company Overview

- 6.6.2. Product/Service Portfulio

- 6.6.3. Abbvie Inc. Sales, Revenue, and Gross Margin

- 6.6.4. Abbvie Inc. Revenue and Growth Rate

- 6.6.5. Abbvie Inc. Market Share

- 6.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.7. Clavis Pharma ASA

- 6.7.1. Company Overview

- 6.7.2. Product/Service Portfulio

- 6.7.3. Clavis Pharma ASA Sales, Revenue, and Gross Margin

- 6.7.4. Clavis Pharma ASA Revenue and Growth Rate

- 6.7.5. Clavis Pharma ASA Market Share

- 6.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.8. Astellas Pharma Inc

- 6.8.1. Company Overview

- 6.8.2. Product/Service Portfulio

- 6.8.3. Astellas Pharma Inc Sales, Revenue, and Gross Margin

- 6.8.4. Astellas Pharma Inc Revenue and Growth Rate

- 6.8.5. Astellas Pharma Inc Market Share

- 6.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.9. Eisai Co. Ltd

- 6.9.1. Company Overview

- 6.9.2. Product/Service Portfulio

- 6.9.3. Eisai Co. Ltd Sales, Revenue, and Gross Margin

- 6.9.4. Eisai Co. Ltd Revenue and Growth Rate

- 6.9.5. Eisai Co. Ltd Market Share

- 6.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.10. CTI Biopharma Corp

- 6.10.1. Company Overview

- 6.10.2. Product/Service Portfulio

- 6.10.3. CTI Biopharma Corp Sales, Revenue, and Gross Margin

- 6.10.4. CTI Biopharma Corp Revenue and Growth Rate

- 6.10.5. CTI Biopharma Corp Market Share

- 6.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.11. Others

- 6.11.1. Company Overview

- 6.11.2. Product/Service Portfulio

- 6.11.3. Others Sales, Revenue, and Gross Margin

- 6.11.4. Others Revenue and Growth Rate

- 6.11.5. Others Market Share

- 6.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 6.1. Ambit Biosciences Corporation

- Chapter 7 Acute Myeloid Leukemia (AML) Therapeutics — Industry Analysis

- 7.1. Introduction and Taxonomy

- 7.2. Acute Myeloid Leukemia (AML) Therapeutics Market – Key Trends

- 7.2.1. Market Drivers

- 7.2.2. Market Restraints

- 7.2.3. Market Opportunities

- 7.3. Value Chain Analysis

- 7.4. Key Mandates and Regulations

- 7.5. Technulogy Roadmap and Timeline

- 7.6. Acute Myeloid Leukemia (AML) Therapeutics Market – Attractiveness Analysis

- 7.6.1. By Treatment Type

- 7.6.2. By End-User

- 7.6.3. By Region

- Chapter 8 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 8.1. Acute Myeloid Leukemia (AML) Therapeutics Industrial Chain Analysis

- 8.2. Downstream Buyers

- 8.3. Distributors/Traders List

- Chapter 9 Marketing Strategy Analysis

- 9.1. Marketing Channel

- 9.2. Direct Marketing

- 9.3. Indirect Marketing

- 9.4. Marketing Channel Development Trends

- 9.5. Economic/Pulitical Environmental Change

- Chapter 10 Report Conclusion & Key Insights

- 10.1. Key Insights from Primary Interviews & Surveys Respondents

- 10.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 11 Research Approach & Methodulogy

- 11.1. Report Description

- 11.2. Research Scope

- 11.3. Research Methodulogy

- 11.3.1. Secondary Research

- 11.3.2. Primary Research

- 11.3.3. Statistical Models

- 11.3.3.1. Company Share Analysis Model

- 11.3.3.2. Revenue Based Modeling

- 11.3.4. Research Limitations

Inquiry For Buying

Acute Myeloid Leukemia (AML) Therapeutics

Request Sample

Acute Myeloid Leukemia (AML) Therapeutics