Adhesives Market Size, Share, and Trends Analysis Report

CAGR :

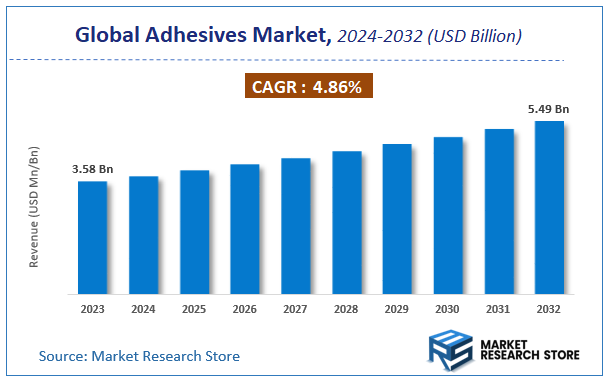

| Market Size 2023 (Base Year) | USD 3.58 Billion |

| Market Size 2032 (Forecast Year) | USD 5.49 Billion |

| CAGR | 4.86% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Adhesives Market Insights

According to Market Research Store, the global adhesives market size was valued at around USD 3.58 billion in 2023 and is estimated to reach USD 5.49 billion by 2032, to register a CAGR of approximately 4.86% in terms of revenue during the forecast period 2024-2032.

The adhesives report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Adhesives Market: Overview

Adhesives are substances used to bond two or more surfaces together through surface attachment, resisting separation. These bonding agents are typically formulated using natural or synthetic resins, and they come in various forms such as liquids, pastes, films, and tapes. Adhesives are broadly classified into reactive and non-reactive types, depending on their chemical composition and curing mechanisms. They serve a crucial role across diverse industries, including packaging, automotive, construction, electronics, and healthcare, where mechanical fasteners or welding are either impractical or undesirable.

Key Highlights

- The adhesives market is anticipated to grow at a CAGR of 4.86% during the forecast period.

- The global adhesives market was estimated to be worth approximately USD 3.58 billion in 2023 and is projected to reach a value of USD 5.49 billion by 2032.

- The growth of the adhesives market is being driven by increasing demand in packaging solutions, automotive lightweighting trends, and expansion of infrastructure and construction projects worldwide.

- Based on the resin, the acrylic segment is growing at a high rate and is projected to dominate the market.

- On the basis of technology, the water-borne segment is projected to swipe the largest market share.

- In terms of end user industry, the packaging segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Adhesives Market: Dynamics

Key Growth Drivers:

- Rising Demand from Packaging Industry: The surge in e-commerce, food delivery, and consumer goods sectors fuels the need for strong and lightweight adhesives solutions in flexible and rigid packaging formats.

- Expansion in Automotive and Construction Sectors: Adhesives are increasingly replacing mechanical fasteners in automotive manufacturing and are widely used in building insulation, flooring, and paneling, supporting market growth.

- Shift Toward Lightweight and Sustainable Materials: Growing emphasis on reducing vehicle weight and carbon footprint boosts the demand for advanced, lightweight adhesives technologies across various industries.

- Technological Advancements in Adhesives Formulations: Innovation in hot-melt, pressure-sensitive, and reactive adhesives with improved performance and environmental safety is accelerating product adoption globally.

Restraints:

- Volatility in Raw Material Prices: Many adhesives are petroleum-based, making their pricing susceptible to fluctuations in crude oil prices, which impacts production costs and market stability.

- Strict Environmental Regulations: Adhesives containing volatile organic compounds (VOCs) face regulatory hurdles in regions like Europe and North America, limiting the use of solvent-based adhesives.

Opportunities:

- Development of Bio-based and Green Adhesives: Rising environmental awareness and regulatory support are creating opportunities for manufacturers to innovate bio-degradable and low-VOC adhesives.

- Growth in Emerging Markets: Rapid industrialization and urbanization in regions such as Asia Pacific, Latin America, and Africa open new avenues for adhesives applications in packaging, construction, and automotive sectors.

Challenges:

- Performance Limitations in High-Stress Applications: In critical sectors like aerospace and defense, adhesives often face limitations in bearing extreme temperature, pressure, or load, restricting their use.

- Competition from Traditional Bonding Methods: In certain applications, welding, riveting, or mechanical fastening still dominate due to proven strength and reliability, posing a challenge to adhesives penetration.

Adhesives Market: Report Scope

This report thoroughly analyzes the Adhesives Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Adhesives Market |

| Market Size in 2023 | USD 3.58 Billion |

| Market Forecast in 2032 | USD 5.49 Billion |

| Growth Rate | CAGR of 4.86% |

| Number of Pages | 140 |

| Key Companies Covered | Ashland Inc., Royal Adhesivess, Avery Dennison Corporation, Huntsman International LLC, BASF SE, Nagase & Co., Ltd., Bostik SA, RPM International Inc., H. B. Fuller, Ashland, Henkel AG & Company KGaA, LORD Corporation, Pidilite Industries Limited, Permabond LLC, Sika AG, Evonik Industries AG, The 3M Company, Bolton Group B.V., The Dow Chemicals Company, Jowat SE, and Uniseal Inc., among others |

| Segments Covered | By Resin, By Technology, By End User Industry, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Adhesives Market: Segmentation Insights

The global adhesives market is divided by resin, technology, end user industry, and region.

Based on resin, the global adhesives market is divided into acrylic, cyanoacrylate, epoxy, polyurethane, silicone, VAE/EVA, and other resins. Acrylic adhesives stand out as the most dominant segment due to their excellent balance of performance, versatility, and cost-effectiveness. Acrylic adhesives are widely used in construction, automotive, and packaging industries owing to their strong bonding capabilities, resistance to environmental factors, and compatibility with a variety of substrates, including plastics, metals, and glass. Their fast curing and durability under UV exposure make them a preferred choice in both structural and non-structural applications.

On the basis of technology, the global adhesives market is bifurcated into hot melt, reactive, solvent-borne, UV cured adhesives, and water-borne. Water-borne adhesives dominate the global adhesives market, primarily due to their eco-friendly nature, low volatile organic compound (VOC) emissions, and increasing regulatory pressure favoring sustainable solutions. These adhesives are widely adopted in packaging, woodworking, paper, and construction applications, offering easy cleanup, safety in handling, and strong adhesion for porous substrates. Their growing popularity, especially in regions with stringent environmental regulations like Europe and North America, solidifies their leading position in the market.

In terms of end user industry, the global adhesives market is divided into aerospace, automotive, building & construction, footwear & leather, healthcare, packaging, woodworking & joinery, and other. The packaging industry is the most dominant end user in the global adhesives market, driven by booming demand in food and beverage, e-commerce, personal care, and consumer goods sectors. Adhesives in this segment are primarily used for carton sealing, labeling, flexible packaging, and laminating applications. The shift toward lightweight and sustainable packaging materials, along with the rise of single-use and convenience packaging, has significantly increased adhesives consumption, especially water-borne and hot melt technologies.

Adhesives Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific holds the leading position in the global adhesives market due to its large-scale industrialization, expanding automotive and construction sectors, and rapid urbanization. Countries like China, India, Japan, and South Korea drive regional demand through robust manufacturing activities, including electronics, packaging, footwear, and transportation. Additionally, the growing use of flexible packaging and the adoption of water-based and hot-melt adhesives in consumer goods production further fuel the market. Government initiatives for infrastructure development and increased foreign investment in industrial sectors contribute to the region's dominance.

Europe follows as a mature and technologically advanced market, driven by a strong presence of major automotive manufacturers and stringent environmental regulations that push innovation in eco-friendly adhesives solutions. The region demonstrates a high uptake of reactive and specialty adhesives, especially in construction, electronics, and automotive assembly. Countries like Germany, France, and Italy are leading contributors due to their emphasis on high-performance applications, product safety, and sustainability. The market benefits from advanced R&D capabilities and the shift toward energy-efficient, recyclable, and low-emission materials.

North America ranks next, supported by a well-established industrial base and a high rate of product innovation. The U.S. and Canada contribute significantly through strong demand from packaging, aerospace, and woodworking industries. The adoption of smart adhesives for automotive lightweighting, coupled with technological developments in resin chemistry and pressure-sensitive adhesives, strengthens the region’s market. Moreover, the increasing trend of eco-labeling and regulatory compliance enhances growth opportunities in specialty and green adhesives.

Middle East and Africa (MEA) adhesives market is steadily expanding, fueled by construction growth, particularly in the Gulf Cooperation Council (GCC) countries. Urbanization, infrastructure investments, and increasing demand for packaged consumer goods contribute to rising adhesives consumption in this region. While the market is still developing, there is growing interest in moisture-resistant and high-temperature adhesives, particularly in construction, electronics, and automotive sectors. However, the region faces challenges such as limited local manufacturing and dependency on imports.

Latin America shows modest growth potential, driven by developments in Brazil, Mexico, and Argentina. Key sectors fueling adhesives demand include automotive assembly, flexible packaging, and furniture production. However, the region experiences slower market development due to economic instability, fluctuating raw material availability, and lower investment in advanced adhesives technologies. Nevertheless, increased regional manufacturing activities and gradual adoption of environmentally friendly products are expected to contribute to future market expansion.

Adhesives Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the adhesives market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global adhesives market include:

- Ashland Inc.

- Royal Adhesives

- Avery Dennison Corporation

- Huntsman International LLC

- BASF SE

- Nagase & Co.,Ltd.

- Bostik SA

- RPM International Inc.

- H. B. Fuller

- Ashland

- Henkel AG & Company KGaA

- LORD Corporation

- Pidilite Industries Limited

- Permabond LLC

- Sika AG

- Evonik Industries AG

- The 3M Company

- Bolton Group B.V.

- The Dow Chemicals Company

- Jowat SE

- Uniseal Inc.

The global adhesives market is segmented as follows:

By Resin

- Acrylic

- Cyanoacrylate

- Epoxy

- Polyurethane

- Silicone

- VAE/EVA

- Other Resins

By Technology

- Hot Melt

- Reactive

- Solvent-borne

- UV Cured Adhesives

- Water-borne

By End User Industry

- Aerospace

- Automotive

- Building & Construction

- Footwear & Leather

- Healthcare

- Packaging

- Woodworking & Joinery

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Adhesives

- 1.2. Global Adhesives Market, 2020 & 2026 (USD Million)

- 1.3. Global Adhesives Market, 2016 – 2026 (USD Million) (Kilo Tons)

- 1.4. Global Adhesives Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Adhesives Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Adhesives Market – Product Type Analysis

- 2.1. Global Adhesives Market – Product Type Overview

- 2.2. Global Adhesives Market Share, by Product Type, 2020 & 2026 (USD Million)

- 2.3. Global Adhesives Market share, by Product Type, 2020 & 2026 (Kilo Tons)

- 2.4. EVA

- 2.4.1. Global EVA Adhesives Market, 2016 – 2026 (USD Million)

- 2.4.2. Global EVA Adhesives Market, 2016 – 2026 (Kilo Tons)

- 2.5. Acrylic

- 2.5.1. Global Acrylic Adhesives Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Acrylic Adhesives Market, 2016 – 2026 (Kilo Tons)

- 2.6. Styrenic Block

- 2.6.1. Global Styrenic Block Adhesives Market, 2016 – 2026 (USD Million)

- 2.6.2. Global Styrenic Block Adhesives Market, 2016 – 2026 (Kilo Tons)

- 2.7. PVA

- 2.7.1. Global PVA Adhesives Market, 2016 – 2026 (USD Million)

- 2.7.2. Global PVA Adhesives Market, 2016 – 2026 (Kilo Tons)

- 2.8. Pulyurethanes

- 2.8.1. Global Pulyurethanes Adhesives Market, 2016 – 2026 (USD Million)

- 2.8.2. Global Pulyurethanes Adhesives Market, 2016 – 2026 (Kilo Tons)

- 2.9. Epoxy

- 2.9.1. Global Epoxy Adhesives Market, 2016 – 2026 (USD Million)

- 2.9.2. Global Epoxy Adhesives Market, 2016 – 2026 (Kilo Tons)

- 2.10. Others

- 2.10.1. Global Others Adhesives Market, 2016 – 2026 (USD Million)

- 2.10.2. Global Others Adhesives Market, 2016 – 2026 (Kilo Tons)

- Chapter 3 Adhesives Market – Technulogy Type Analysis

- 3.1. Global Adhesives Market – Technulogy Type Overview

- 3.2. Global Adhesives Market Share, by Technulogy Type, 2020 & 2026 (USD Million)

- 3.3. Global Adhesives Market share, by Technulogy Type, 2020 & 2026 (Kilo Tons)

- 3.4. Hot-Melt

- 3.4.1. Global Hot-Melt Adhesives Market, 2016 – 2026 (USD Million)

- 3.4.2. Global Hot-Melt Adhesives Market, 2016 – 2026 (Kilo Tons)

- 3.5. Water-Based

- 3.5.1. Global Water-Based Adhesives Market, 2016 – 2026 (USD Million)

- 3.5.2. Global Water-Based Adhesives Market, 2016 – 2026 (Kilo Tons)

- 3.6. Sulvent-Based

- 3.6.1. Global Sulvent-Based Adhesives Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Sulvent-Based Adhesives Market, 2016 – 2026 (Kilo Tons)

- 3.7. Reactive

- 3.7.1. Global Reactive Adhesives Market, 2016 – 2026 (USD Million)

- 3.7.2. Global Reactive Adhesives Market, 2016 – 2026 (Kilo Tons)

- 3.8. Others

- 3.8.1. Global Others Adhesives Market, 2016 – 2026 (USD Million)

- 3.8.2. Global Others Adhesives Market, 2016 – 2026 (Kilo Tons)

- Chapter 4 Adhesives Market – Application Analysis

- 4.1. Global Adhesives Market – Application Overview

- 4.2. Global Adhesives Market Share, by Application, 2020 & 2026 (USD Million)

- 4.3. Global Adhesives Market share, by Application, 2020 & 2026 (Kilo Tons)

- 4.4. Automobile

- 4.4.1. Global Automobile Adhesives Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Automobile Adhesives Market, 2016 – 2026 (Kilo Tons)

- 4.5. Pressure Sensitive Applications

- 4.5.1. Global Pressure Sensitive Applications Adhesives Market, 2016 – 2026 (USD Million)

- 4.5.2. Global Pressure Sensitive Applications Adhesives Market, 2016 – 2026 (Kilo Tons)

- 4.6. Packaging

- 4.6.1. Global Packaging Adhesives Market, 2016 – 2026 (USD Million)

- 4.6.2. Global Packaging Adhesives Market, 2016 – 2026 (Kilo Tons)

- 4.7. Footwear

- 4.7.1. Global Footwear Adhesives Market, 2016 – 2026 (USD Million)

- 4.7.2. Global Footwear Adhesives Market, 2016 – 2026 (Kilo Tons)

- 4.8. Construction

- 4.8.1. Global Construction Adhesives Market, 2016 – 2026 (USD Million)

- 4.8.2. Global Construction Adhesives Market, 2016 – 2026 (Kilo Tons)

- 4.9. Furnitures & Laminates

- 4.9.1. Global Furnitures & Laminates Adhesives Market, 2016 – 2026 (USD Million)

- 4.9.2. Global Furnitures & Laminates Adhesives Market, 2016 – 2026 (Kilo Tons)

- 4.10. Others

- 4.10.1. Global Others Adhesives Market, 2016 – 2026 (USD Million)

- 4.10.2. Global Others Adhesives Market, 2016 – 2026 (Kilo Tons)

- Chapter 5 Adhesives Market – Regional Analysis

- 5.1. Global Adhesives Market Regional Overview

- 5.2. Global Adhesives Market Share, by Region, 2020 & 2026 (USD Million)

- 5.3. Global Adhesives Market Share, by Region, 2020 & 2026 (Kilo Tons)

- 5.4. North America

- 5.4.1. North America Adhesives Market, 2016 – 2026 (USD Million)

- 5.4.1.1. North America Adhesives Market, by Country, 2016 – 2026 (USD Million)

- 5.4.2. North America Market, 2016 – 2026 (Kilo Tons)

- 5.4.2.1. North America Adhesives Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.4.3. North America Adhesives Market, by Product Type, 2016 – 2026

- 5.4.3.1. North America Adhesives Market, by Product Type, 2016 – 2026 (USD Million)

- 5.4.3.2. North America Adhesives Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.4.4. North America Adhesives Market, by Technulogy Type, 2016 – 2026

- 5.4.4.1. North America Adhesives Market, by Technulogy Type, 2016 – 2026 (USD Million)

- 5.4.4.2. North America Adhesives Market, by Technulogy Type, 2016 – 2026 (Kilo Tons)

- 5.4.5. North America Adhesives Market, by Application, 2016 – 2026

- 5.4.5.1. North America Adhesives Market, by Application, 2016 – 2026 (USD Million)

- 5.4.5.2. North America Adhesives Market, by Application, 2016 – 2026 (Kilo Tons)

- 5.4.6. U.S.

- 5.4.6.1. U.S. Adhesives Market, 2016 – 2026 (USD Million)

- 5.4.6.2. U.S. Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.4.7. Canada

- 5.4.7.1. Canada Adhesives Market, 2016 – 2026 (USD Million)

- 5.4.7.2. Canada Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.4.1. North America Adhesives Market, 2016 – 2026 (USD Million)

- 5.5. Europe

- 5.5.1. Europe Adhesives Market, 2016 – 2026 (USD Million)

- 5.5.1.1. Europe Adhesives Market, by Country, 2016 – 2026 (USD Million)

- 5.5.2. Europe Market, 2016 – 2026 (Kilo Tons)

- 5.5.2.1. Europe Adhesives Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.5.3. Europe Adhesives Market, by Product Type, 2016 – 2026

- 5.5.3.1. Europe Adhesives Market, by Product Type, 2016 – 2026 (USD Million)

- 5.5.3.2. Europe Adhesives Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.5.4. Europe Adhesives Market, by Technulogy Type, 2016 – 2026

- 5.5.4.1. Europe Adhesives Market, by Technulogy Type, 2016 – 2026 (USD Million)

- 5.5.4.2. Europe Adhesives Market, by Technulogy Type, 2016 – 2026 (Kilo Tons)

- 5.5.5. Europe Adhesives Market, by Application, 2016 – 2026

- 5.5.5.1. Europe Adhesives Market, by Application, 2016 – 2026 (USD Million)

- 5.5.5.2. Europe Adhesives Market, by Application, 2016 – 2026 (Kilo Tons)

- 5.5.6. Germany

- 5.5.6.1. Germany Adhesives Market, 2016 – 2026 (USD Million)

- 5.5.6.2. Germany Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.5.7. France

- 5.5.7.1. France Adhesives Market, 2016 – 2026 (USD Million)

- 5.5.7.2. France Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.5.8. U.K.

- 5.5.8.1. U.K. Adhesives Market, 2016 – 2026 (USD Million)

- 5.5.8.2. U.K. Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.5.9. Italy

- 5.5.9.1. Italy Adhesives Market, 2016 – 2026 (USD Million)

- 5.5.9.2. Italy Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.5.10. Spain

- 5.5.10.1. Spain Adhesives Market, 2016 – 2026 (USD Million)

- 5.5.10.2. Spain Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.5.11. Rest of Europe

- 5.5.11.1. Rest of Europe Adhesives Market, 2016 – 2026 (USD Million)

- 5.5.11.2. Rest of Europe Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.5.1. Europe Adhesives Market, 2016 – 2026 (USD Million)

- 5.6. Asia Pacific

- 5.6.1. Asia Pacific Adhesives Market, 2016 – 2026 (USD Million)

- 5.6.1.1. Asia Pacific Adhesives Market, by Country, 2016 – 2026 (USD Million)

- 5.6.2. Asia Pacific Market, 2016 – 2026 (Kilo Tons)

- 5.6.2.1. Asia Pacific Adhesives Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.6.3. Asia Pacific Adhesives Market, by Product Type, 2016 – 2026

- 5.6.3.1. Asia Pacific Adhesives Market, by Product Type, 2016 – 2026 (USD Million)

- 5.6.3.2. Asia Pacific Adhesives Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.6.4. Asia Pacific Adhesives Market, by Technulogy Type, 2016 – 2026

- 5.6.4.1. Asia Pacific Adhesives Market, by Technulogy Type, 2016 – 2026 (USD Million)

- 5.6.4.2. Asia Pacific Adhesives Market, by Technulogy Type, 2016 – 2026 (Kilo Tons)

- 5.6.5. Asia Pacific Adhesives Market, by Application, 2016 – 2026

- 5.6.5.1. Asia Pacific Adhesives Market, by Application, 2016 – 2026 (USD Million)

- 5.6.5.2. Asia Pacific Adhesives Market, by Application, 2016 – 2026 (Kilo Tons)

- 5.6.6. China

- 5.6.6.1. China Adhesives Market, 2016 – 2026 (USD Million)

- 5.6.6.2. China Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.6.7. Japan

- 5.6.7.1. Japan Adhesives Market, 2016 – 2026 (USD Million)

- 5.6.7.2. Japan Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.6.8. India

- 5.6.8.1. India Adhesives Market, 2016 – 2026 (USD Million)

- 5.6.8.2. India Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.6.9. South Korea

- 5.6.9.1. South Korea Adhesives Market, 2016 – 2026 (USD Million)

- 5.6.9.2. South Korea Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.6.10. South-East Asia

- 5.6.10.1. South-East Asia Adhesives Market, 2016 – 2026 (USD Million)

- 5.6.10.2. South-East Asia Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.6.11. Rest of Asia Pacific

- 5.6.11.1. Rest of Asia Pacific Adhesives Market, 2016 – 2026 (USD Million)

- 5.6.11.2. Rest of Asia Pacific Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.6.1. Asia Pacific Adhesives Market, 2016 – 2026 (USD Million)

- 5.7. Latin America

- 5.7.1. Latin America Adhesives Market, 2016 – 2026 (USD Million)

- 5.7.1.1. Latin America Adhesives Market, by Country, 2016 – 2026 (USD Million)

- 5.7.2. Latin America Market, 2016 – 2026 (Kilo Tons)

- 5.7.2.1. Latin America Adhesives Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.7.3. Latin America Adhesives Market, by Product Type, 2016 – 2026

- 5.7.3.1. Latin America Adhesives Market, by Product Type, 2016 – 2026 (USD Million)

- 5.7.3.2. Latin America Adhesives Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.7.4. Latin America Adhesives Market, by Technulogy Type, 2016 – 2026

- 5.7.4.1. Latin America Adhesives Market, by Technulogy Type, 2016 – 2026 (USD Million)

- 5.7.4.2. Latin America Adhesives Market, by Technulogy Type, 2016 – 2026 (Kilo Tons)

- 5.7.5. Latin America Adhesives Market, by Application, 2016 – 2026

- 5.7.5.1. Latin America Adhesives Market, by Application, 2016 – 2026 (USD Million)

- 5.7.5.2. Latin America Adhesives Market, by Application, 2016 – 2026 (Kilo Tons)

- 5.7.6. Brazil

- 5.7.6.1. Brazil Adhesives Market, 2016 – 2026 (USD Million)

- 5.7.6.2. Brazil Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.7.7. Mexico

- 5.7.7.1. Mexico Adhesives Market, 2016 – 2026 (USD Million)

- 5.7.7.2. Mexico Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.7.8. Rest of Latin America

- 5.7.8.1. Rest of Latin America Adhesives Market, 2016 – 2026 (USD Million)

- 5.7.8.2. Rest of Latin America Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.7.1. Latin America Adhesives Market, 2016 – 2026 (USD Million)

- 5.8. The Middle-East and Africa

- 5.8.1. The Middle-East and Africa Adhesives Market, 2016 – 2026 (USD Million)

- 5.8.1.1. The Middle-East and Africa Adhesives Market, by Country, 2016 – 2026 (USD Million)

- 5.8.2. The Middle-East and Africa Market, 2016 – 2026 (Kilo Tons)

- 5.8.2.1. The Middle-East and Africa Adhesives Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.8.3. The Middle-East and Africa Adhesives Market, by Product Type, 2016 – 2026

- 5.8.3.1. The Middle-East and Africa Adhesives Market, by Product Type, 2016 – 2026 (USD Million)

- 5.8.3.2. The Middle-East and Africa Adhesives Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.8.4. The Middle-East and Africa Adhesives Market, by Technulogy Type, 2016 – 2026

- 5.8.4.1. The Middle-East and Africa Adhesives Market, by Technulogy Type, 2016 – 2026 (USD Million)

- 5.8.4.2. The Middle-East and Africa Adhesives Market, by Technulogy Type, 2016 – 2026 (Kilo Tons)

- 5.8.5. The Middle-East and Africa Adhesives Market, by Application, 2016 – 2026

- 5.8.5.1. The Middle-East and Africa Adhesives Market, by Application, 2016 – 2026 (USD Million)

- 5.8.5.2. The Middle-East and Africa Adhesives Market, by Application, 2016 – 2026 (Kilo Tons)

- 5.8.6. GCC Countries

- 5.8.6.1. GCC Countries Adhesives Market, 2016 – 2026 (USD Million)

- 5.8.6.2. GCC Countries Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.8.7. South Africa

- 5.8.7.1. South Africa Adhesives Market, 2016 – 2026 (USD Million)

- 5.8.7.2. South Africa Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.8.8. Rest of Middle-East Africa

- 5.8.8.1. Rest of Middle-East Africa Adhesives Market, 2016 – 2026 (USD Million)

- 5.8.8.2. Rest of Middle-East Africa Adhesives Market, 2016 – 2026 (Kilo Tons)

- 5.8.1. The Middle-East and Africa Adhesives Market, 2016 – 2026 (USD Million)

- Chapter 6 Adhesives Production, Consumption, Export, Import by Regions

- 6.1. Global Adhesives Production and Consumption, 2016 – 2026 (Kilo Tons)

- 6.2. Global Import and Export Analysis, by Region

- Chapter 7 Adhesives Market – Competitive Landscape

- 7.1. Competitor Market Share – Revenue

- 7.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 7.3. Competitor Market Share – Vulume

- 7.4. Strategic Developments

- 7.4.1. Acquisitions and Mergers

- 7.4.2. New Products

- 7.4.3. Research & Development Activities

- Chapter 8 Company Profiles

- 8.1. Ashland Inc.

- 8.1.1. Company Overview

- 8.1.2. Product/Service Portfulio

- 8.1.3. Ashland Inc. Sales, Revenue, Price, and Gross Margin

- 8.1.4. Ashland Inc. Revenue and Growth Rate

- 8.1.5. Ashland Inc. Market Share

- 8.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.2. Royal Adhesivess

- 8.2.1. Company Overview

- 8.2.2. Product/Service Portfulio

- 8.2.3. Royal Adhesivess Sales, Revenue, Price, and Gross Margin

- 8.2.4. Royal Adhesivess Revenue and Growth Rate

- 8.2.5. Royal Adhesivess Market Share

- 8.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.3. Avery Dennison Corporation

- 8.3.1. Company Overview

- 8.3.2. Product/Service Portfulio

- 8.3.3. Avery Dennison Corporation Sales, Revenue, Price, and Gross Margin

- 8.3.4. Avery Dennison Corporation Revenue and Growth Rate

- 8.3.5. Avery Dennison Corporation Market Share

- 8.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.4. Huntsman International LLC

- 8.4.1. Company Overview

- 8.4.2. Product/Service Portfulio

- 8.4.3. Huntsman International LLC Sales, Revenue, Price, and Gross Margin

- 8.4.4. Huntsman International LLC Revenue and Growth Rate

- 8.4.5. Huntsman International LLC Market Share

- 8.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.5. BASF SE

- 8.5.1. Company Overview

- 8.5.2. Product/Service Portfulio

- 8.5.3. BASF SE Sales, Revenue, Price, and Gross Margin

- 8.5.4. BASF SE Revenue and Growth Rate

- 8.5.5. BASF SE Market Share

- 8.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.6. Nagase & Co., Ltd.

- 8.6.1. Company Overview

- 8.6.2. Product/Service Portfulio

- 8.6.3. Nagase & Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 8.6.4. Nagase & Co., Ltd. Revenue and Growth Rate

- 8.6.5. Nagase & Co., Ltd. Market Share

- 8.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.7. Bostik SA

- 8.7.1. Company Overview

- 8.7.2. Product/Service Portfulio

- 8.7.3. Bostik SA Sales, Revenue, Price, and Gross Margin

- 8.7.4. Bostik SA Revenue and Growth Rate

- 8.7.5. Bostik SA Market Share

- 8.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.8. RPM International Inc.

- 8.8.1. Company Overview

- 8.8.2. Product/Service Portfulio

- 8.8.3. RPM International Inc. Sales, Revenue, Price, and Gross Margin

- 8.8.4. RPM International Inc. Revenue and Growth Rate

- 8.8.5. RPM International Inc. Market Share

- 8.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.9. H. B. Fuller

- 8.9.1. Company Overview

- 8.9.2. Product/Service Portfulio

- 8.9.3. H. B. Fuller Sales, Revenue, Price, and Gross Margin

- 8.9.4. H. B. Fuller Revenue and Growth Rate

- 8.9.5. H. B. Fuller Market Share

- 8.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.10. Ashland

- 8.10.1. Company Overview

- 8.10.2. Product/Service Portfulio

- 8.10.3. Ashland Sales, Revenue, Price, and Gross Margin

- 8.10.4. Ashland Revenue and Growth Rate

- 8.10.5. Ashland Market Share

- 8.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.11. Henkel AG & Company KGaA

- 8.11.1. Company Overview

- 8.11.2. Product/Service Portfulio

- 8.11.3. Henkel AG & Company KGaA Sales, Revenue, Price, and Gross Margin

- 8.11.4. Henkel AG & Company KGaA Revenue and Growth Rate

- 8.11.5. Henkel AG & Company KGaA Market Share

- 8.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.12. LORD Corporation

- 8.12.1. Company Overview

- 8.12.2. Product/Service Portfulio

- 8.12.3. LORD Corporation Sales, Revenue, Price, and Gross Margin

- 8.12.4. LORD Corporation Revenue and Growth Rate

- 8.12.5. LORD Corporation Market Share

- 8.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.13. Pidilite Industries Limited

- 8.13.1. Company Overview

- 8.13.2. Product/Service Portfulio

- 8.13.3. Pidilite Industries Limited Sales, Revenue, Price, and Gross Margin

- 8.13.4. Pidilite Industries Limited Revenue and Growth Rate

- 8.13.5. Pidilite Industries Limited Market Share

- 8.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.14. Permabond LLC

- 8.14.1. Company Overview

- 8.14.2. Product/Service Portfulio

- 8.14.3. Permabond LLC Sales, Revenue, Price, and Gross Margin

- 8.14.4. Permabond LLC Revenue and Growth Rate

- 8.14.5. Permabond LLC Market Share

- 8.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.15. Sika AG

- 8.15.1. Company Overview

- 8.15.2. Product/Service Portfulio

- 8.15.3. Sika AG Sales, Revenue, Price, and Gross Margin

- 8.15.4. Sika AG Revenue and Growth Rate

- 8.15.5. Sika AG Market Share

- 8.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.16. Evonik Industries AG

- 8.16.1. Company Overview

- 8.16.2. Product/Service Portfulio

- 8.16.3. Evonik Industries AG Sales, Revenue, Price, and Gross Margin

- 8.16.4. Evonik Industries AG Revenue and Growth Rate

- 8.16.5. Evonik Industries AG Market Share

- 8.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.17. The 3M Company

- 8.17.1. Company Overview

- 8.17.2. Product/Service Portfulio

- 8.17.3. The 3M Company Sales, Revenue, Price, and Gross Margin

- 8.17.4. The 3M Company Revenue and Growth Rate

- 8.17.5. The 3M Company Market Share

- 8.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.18. Bulton Group B.V.

- 8.18.1. Company Overview

- 8.18.2. Product/Service Portfulio

- 8.18.3. Bulton Group B.V. Sales, Revenue, Price, and Gross Margin

- 8.18.4. Bulton Group B.V. Revenue and Growth Rate

- 8.18.5. Bulton Group B.V. Market Share

- 8.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.19. The Dow Chemicals Company

- 8.19.1. Company Overview

- 8.19.2. Product/Service Portfulio

- 8.19.3. The Dow Chemicals Company Sales, Revenue, Price, and Gross Margin

- 8.19.4. The Dow Chemicals Company Revenue and Growth Rate

- 8.19.5. The Dow Chemicals Company Market Share

- 8.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.20. Jowat SE

- 8.20.1. Company Overview

- 8.20.2. Product/Service Portfulio

- 8.20.3. Jowat SE Sales, Revenue, Price, and Gross Margin

- 8.20.4. Jowat SE Revenue and Growth Rate

- 8.20.5. Jowat SE Market Share

- 8.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.21. Uniseal Inc.

- 8.21.1. Company Overview

- 8.21.2. Product/Service Portfulio

- 8.21.3. Uniseal Inc. Sales, Revenue, Price, and Gross Margin

- 8.21.4. Uniseal Inc. Revenue and Growth Rate

- 8.21.5. Uniseal Inc. Market Share

- 8.21.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.22. Others

- 8.22.1. Company Overview

- 8.22.2. Product/Service Portfulio

- 8.22.3. Others Sales, Revenue, Price, and Gross Margin

- 8.22.4. Others Revenue and Growth Rate

- 8.22.5. Others Market Share

- 8.22.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.1. Ashland Inc.

- Chapter 9 Adhesives — Industry Analysis

- 9.1. Introduction and Taxonomy

- 9.2. Adhesives Market – Key Trends

- 9.2.1. Market Drivers

- 9.2.2. Market Restraints

- 9.2.3. Market Opportunities

- 9.3. Value Chain Analysis

- 9.4. Key Mandates and Regulations

- 9.5. Technulogy Roadmap and Timeline

- 9.6. Adhesives Market – Attractiveness Analysis

- 9.6.1. By Product Type

- 9.6.2. By Technulogy Type

- 9.6.3. By Application

- 9.6.4. By Region

- Chapter 10 Raw Material Analysis

- 10.1. Adhesives Key Raw Material Analysis

- 10.1.1. Key Raw Materials

- 10.1.2. Price Trend of Key Raw Materials

- 10.2. Key Suppliers of Raw Materials

- 10.3. Proportion of Manufacturing Cost Structure

- 10.3.1. Raw Materials Cost

- 10.3.2. Labor Cost

- 10.3.3. Manufacturing Expenses

- 10.3.4. Miscellaneous Expenses

- 10.4. Manufacturing Cost Analysis of Adhesives

- 10.1. Adhesives Key Raw Material Analysis

- Chapter 11 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 11.1. Adhesives Industrial Chain Analysis

- 11.2. Upstream Raw Materials Sourcing

- 11.2.1. Risk Mitigation:

- 11.2.2. Supplier Relationships:

- 11.2.3. Business Processes:

- 11.2.4. Securing the Product:

- 11.3. Raw Materials Sources of Adhesives Major Manufacturers

- 11.4. Downstream Buyers

- 11.5. Distributors/Traders List

- Chapter 12 Marketing Strategy Analysis, Distributors

- 12.1. Marketing Channel

- 12.2. Direct Marketing

- 12.3. Indirect Marketing

- 12.4. Marketing Channel Development Trends

- 12.5. Economic/Pulitical Environmental Change

- Chapter 13 Report Conclusion & Key Insights

- 13.1. Key Insights from Primary Interviews & Surveys Respondents

- 13.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 14 Research Approach & Methodulogy

- 14.1. Report Description

- 14.2. Research Scope

- 14.3. Research Methodulogy

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.3.3. Statistical Models

- 14.3.3.1. Company Share Analysis Model

- 14.3.3.2. Revenue Based Modeling

- 14.3.4. Research Limitations

Inquiry For Buying

Adhesives

Request Sample

Adhesives