Aerial Equipments Market Size, Share, and Trends Analysis Report

CAGR :

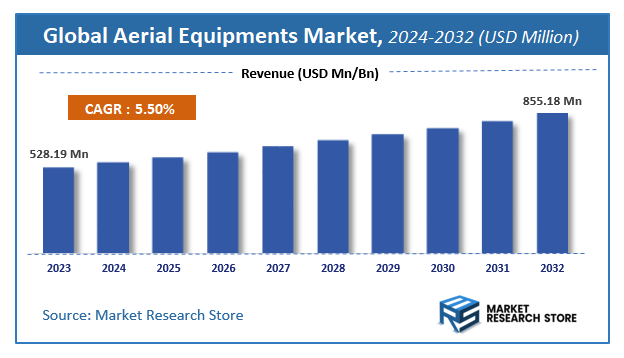

| Market Size 2023 (Base Year) | USD 528.19 Million |

| Market Size 2032 (Forecast Year) | USD 855.18 Million |

| CAGR | 5.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerial Equipments Market Insights

As per the published report by Market Research Store, the Global Aerial Equipments Market size was estimated at USD 528.19 Million in 2023 and is anticipated to reach reach USD 855.18 Million by 2032, growing at a projected CAGR of 5.5% during the forecast period 2024-2032. The report provides a detailed analysis of the global Aerial Equipments Market, including market trends, market dynamics, and market opportunities during the forecast period (2024-2032). It delves deeper into several market facets, such as market definition, size, growth, forecast, segmentation, competitive analysis, growth drivers, restraints, financial analysis, SWOT analysis, PORTER’s five force analysis, PESTEL analysis, market share analysis, cost-benefit analysis, challenges, restraints, strategic recommendations, and market players.

To Get more Insights, Request a Free Sample

Aerial Equipments Market: Overview

The growth of the aerial equipments market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The aerial equipments market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the aerial equipments market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Product, Technology, Ownership, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global aerial equipments market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2024-2032).

- In terms of revenue, the global aerial equipments market size was valued at around USD 528.19 Million in 2023 and is projected to reach USD 855.18 Million by 2032.

- The market is projected to grow at a significant rate due to increasing demand in construction and maintenance sectors, urbanization, infrastructure development, and technological advancements in safety and efficiency.

- Based on the Product, the Atrium / Spider Lifts segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Technology, the Unpowered segment is anticipated to command the largest market share.

- In terms of Ownership, the Rental segment is projected to lead the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Aerial Equipments Market: Report Scope

This report thoroughly analyzes the aerial equipments market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerial Equipments Market |

| Market Size in 2023 | USD 528.19 Million |

| Market Forecast in 2032 | USD 855.18 Million |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 184 |

| Key Companies Covered | Altec Industries, Aerial Access Equipment, Elliott Equipment Company, Grove, Haulotte, JLG, Linamar, MEC Aerial Work Platforms, Manitex International, Manitou, Nifty-lift, Oshkosh Corporation, Reachmaster, Snorkel, Terex Corporation, Tadano, Toyota Material Handling U.S.A(Aichi), XCMG Group. |

| Segments Covered | By Product, By Technology, By Ownership, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerial Equipments Market: Dynamics

Key Growth Drivers

The Aerial Equipment market in India is experiencing significant growth, primarily driven by the rapid expansion of infrastructure development across various sectors including construction, telecommunications, power transmission, and transportation. The increasing need for efficient and safe access to elevated work areas for installation, maintenance, and repair tasks is a major driver for the adoption of aerial work platforms (AWPs) like scissor lifts, boom lifts, and telehandlers. Furthermore, the growing awareness of workplace safety regulations and the benefits of using aerial equipment over traditional methods like scaffolding is contributing to increased demand. The rising investments in smart city projects and the development of modern logistics and warehousing facilities also necessitate the use of aerial equipment for various material handling and access requirements.

Restraints

Despite the strong growth drivers, the Aerial Equipment market in India faces certain restraints. The high initial capital investment required for purchasing aerial equipment can be a significant barrier for small and medium-sized enterprises (SMEs) and rental companies with limited budgets. A lack of skilled operators and maintenance technicians poses a challenge for the safe and efficient utilization of aerial platforms. Furthermore, the fragmented nature of the rental market with numerous small, unorganized players offering older or poorly maintained equipment can lead to price competition and safety concerns. Inadequate infrastructure, particularly road conditions and transportation limitations in some regions, can hinder the movement and deployment of large aerial equipment. The cyclical nature of the construction industry, a major end-user, can also lead to fluctuations in demand.

Opportunities

The Aerial Equipment market in India presents numerous opportunities for expansion and innovation. The growing rental penetration as companies increasingly prefer renting over purchasing due to cost considerations and project-based needs offers a significant avenue for growth for rental companies. The increasing focus on safety and productivity can drive demand for advanced aerial equipment with enhanced features and telematics for better monitoring and management. Furthermore, the development of specialized aerial equipment tailored to specific industry needs, such as compact and lightweight lifts for indoor applications or robust machines for challenging construction sites, can cater to niche markets. The integration of electric and hybrid powertrains in aerial equipment aligns with sustainability goals and can attract environmentally conscious customers. The potential for providing comprehensive service solutions, including operator training, maintenance contracts, and financing options, can enhance customer value and loyalty.

Challenges

The Aerial Equipment market in India faces challenges related to ensuring the safe operation and maintenance of aerial platforms through proper training and adherence to safety standards. Addressing the shortage of skilled operators and technicians requires investment in training programs and skill development initiatives. Furthermore, managing the diverse regulatory landscape related to equipment operation and safety across different states can be complex. Overcoming the price sensitivity of the market while offering high-quality and reliable equipment requires efficient manufacturing and sourcing strategies. Keeping pace with technological advancements and integrating new features like remote diagnostics and automation into aerial equipment demands continuous innovation. Finally, competing with the unorganized rental sector that often undercuts prices requires a focus on value-added services, equipment quality, and safety records.

Aerial Equipments Market: Segmentation Insights

The global aerial equipments market is segmented based on Product, Technology, Ownership, and Region. All the segments of the aerial equipments market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Product, the global aerial equipments market is divided into Atrium / Spider Lifts, Boom Lifts, Cranes, Scissor Lifts.

On the basis of Technology, the global aerial equipments market is bifurcated into Unpowered , Self-propelled , Vehicle-mounted.

In terms of Ownership, the global aerial equipments market is categorized into Rental, End-Use Industry.

Aerial Equipments Market: Regional Insights

The North America region dominates the Aerial Equipment Market, holding the largest market share due to its advanced construction sector, stringent safety regulations, and high adoption of technologically advanced aerial work platforms (AWPs). In 2024, North America accounted for the highest revenue share, driven by robust investments in commercial and residential construction, logistics expansion, and infrastructure modernization. The U.S. is the key contributor, supported by OSHA safety mandates and the growing e-commerce sector, which fuels demand for AWPs in warehouse automation and utility maintenance.

Asia-Pacific is projected to be the fastest-growing region, with a CAGR of 8–9% (2025–2032), attributed to rapid urbanization, infrastructure projects in China and India, and increasing industrialization. However, North America's dominance remains unchallenged due to higher fleet electrification trends, rental market maturity, and the presence of major players like Terex and JLG Industries.

Aerial Equipments Market: Competitive Landscape

The aerial equipments market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Aerial Equipments Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Altec Industries

- Aerial Access Equipment

- Elliott Equipment Company

- Grove

- Haulotte

- JLG

- Linamar

- MEC Aerial Work Platforms

- Manitex International

- Manitou

- Nifty-lift

- Oshkosh Corporation

- Reachmaster

- Snorkel

- Terex Corporation

- Tadano

- Toyota Material Handling U.S.A(Aichi)

- XCMG Group.

The Global Aerial Equipments Market is Segmented as Follows:

By Product

- Atrium / Spider Lifts

- Boom Lifts

- Cranes

- Scissor Lifts

By Technology

- Unpowered

- Self-propelled

- Vehicle-mounted

By Ownership

- Rental

- End-Use Industry

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Evolution

This section evaluates the market position of the product or service by examining its development pathway and competitive dynamics. It provides a detailed overview of the product's growth stages, including the early (historical) phase, the mid-stage, and anticipated future advancements influenced by innovation and emerging technologies.

Porter’s Analysis

Porter’s Five Forces framework offers a strategic lens for assessing competitor behavior and the positioning of key players in the aerial equipments industry. This section explores the external factors shaping competitive dynamics and influencing market strategies in the years ahead. The analysis focuses on five critical forces:

- Competitive Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Supplier Bargaining Power

- Buyer Bargaining Power

Value Chain & Market Attractiveness Analysis

The value chain analysis helps businesses optimize operations by mapping the product flow from suppliers to end consumers, identifying opportunities to streamline processes and gain a competitive edge. Segment-wise market attractiveness analysis evaluates key dimensions like product categories, demographics, and regions, assessing growth potential, market size, and profitability. This enables businesses to focus resources on high-potential segments for better ROI and long-term value.

PESTEL Analysis

PESTEL analysis is a powerful tool in market research reports that enhances market understanding by systematically examining the external macro-environmental factors influencing a business or industry. The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors. By evaluating these dimensions, PESTEL analysis provides a comprehensive overview of the broader context within which a market operates, helping businesses identify potential opportunities and threats.

- Political factors assess government policies, stability, trade regulations, and political risks that could impact market operations.

- Economic factors examine variables like inflation, exchange rates, economic growth, and consumer spending power to determine market viability.

- Social factors explore cultural trends, demographics, and lifestyle changes that shape consumer behavior and preferences.

- Technological factors evaluate innovation, R&D, and technological advancements affecting product development and operational efficiencies.

- Environmental factors focus on sustainability, climate change impacts, and eco-friendly practices shaping market trends.

- Legal factors address compliance requirements, industry regulations, and intellectual property laws impacting market entry and operations.

Import-export Analysis & Pricing Analysis

An import-export analysis is vital for market research, revealing global trade dynamics, trends, and opportunities. It examines trade volumes, product categories, and regional competitiveness, offering insights into supply chains and market demand. This section also analyzes past and future pricing trends, helping businesses optimize strategies and enabling consumers to assess product value effectively.

Aerial Equipments Market: Company Profiles

The report identifies key players in the aerial equipments market through a competitive landscape and company profiles, evaluating their offerings, financial performance, strategies, and market positioning. It includes a SWOT analysis of the top 3-5 companies, assessing strengths, weaknesses, opportunities, and threats. The competitive landscape highlights rankings, recent activities (mergers, acquisitions, partnerships, product launches), and regional footprints using the Ace matrix. Customization is available to meet client-specific needs.

Regional & Industry Footprint

This section details the geographic reach, sales networks, and market penetration of companies profiled in the aerial equipments report, showcasing their operations and distribution across regions. It analyzes the alignment of companies with specific industry verticals, highlighting the industries they serve and the scope of their products and services within those sectors.

Ace Matrix

This section categorizes companies into four distinct groups—Active, Cutting Edge, Innovator, and Emerging—based on their product and business strategies. The evaluation of product strategy focuses on aspects such as the range and depth of offerings, commitment to innovation, product functionalities, and scalability. Key elements like global reach, sector coverage, strategic acquisitions, and long-term growth plans are considered for business strategy. This analysis provides a detailed view of companies' position within the market and highlights their potential for future growth and development.

Research Methodology

The qualitative and quantitative insights for the aerial equipments market are derived through a multi-faceted research approach, combining input from subject matter experts, primary research, and secondary data sources. Primary research includes gathering critical information via face-to-face or telephonic interviews, surveys, questionnaires, and feedback from industry professionals, key opinion leaders (KOLs), and customers. Regular interviews with industry experts are conducted to deepen the analysis and reinforce the existing data, ensuring a robust and well-rounded market understanding.

Secondary research for this report was carried out by the Market Research Store team, drawing on a variety of authoritative sources, such as:

- Official company websites, annual reports, financial statements, investor presentations, and SEC filings

- Internal and external proprietary databases, as well as relevant patent and regulatory databases

- Government publications, national statistical databases, and industry-specific market reports

- Media coverage, including news articles, press releases, and webcasts about market participants

- Paid industry databases for detailed market insights

Market Research Store conducted in-depth consultations with various key opinion leaders in the industry, including senior executives from top companies and regional leaders from end-user organizations. This effort aimed to gather critical insights on factors such as the market share of dominant brands in specific countries and regions, along with pricing strategies for products and services.

To determine total sales data, the research team conducted primary interviews across multiple countries with influential stakeholders, including:

- Distributors

- Marketing, Brand, and Product Managers

- Procurement and Production Managers

- Sales and Regional Sales Managers, Country Managers

- Technical Specialists

- C-Level Executives

These subject matter experts, with their extensive industry experience, helped validate and refine the findings. For secondary research, data was sourced from a wide range of materials, including online resources, company annual reports, industry publications, research papers, association reports, and government websites. These various sources provide a comprehensive and well-rounded perspective on the market.

Frequently Asked Questions

Table Of Content

Table of Content 1 Aerial Equipments Market - Research Scope 1.1 Study Goals 1.2 Market Definition and Scope 1.3 Key Market Segments 1.4 Study and Forecasting Years 2 Aerial Equipments Market - Research Methodology 2.1 Methodology 2.2 Research Data Source 2.2.1 Secondary Data 2.2.2 Primary Data 2.2.3 Market Size Estimation 2.2.4 Legal Disclaimer 3 Aerial Equipments Market Forces 3.1 Global Aerial Equipments Market Size 3.2 Top Impacting Factors (PESTEL Analysis) 3.2.1 Political Factors 3.2.2 Economic Factors 3.2.3 Social Factors 3.2.4 Technological Factors 3.2.5 Environmental Factors 3.2.6 Legal Factors 3.3 Industry Trend Analysis 3.4 Industry Trends Under COVID-19 3.4.1 Risk Assessment on COVID-19 3.4.2 Assessment of the Overall Impact of COVID-19 on the Industry 3.4.3 Pre COVID-19 and Post COVID-19 Market Scenario 3.5 Industry Risk Assessment 4 Aerial Equipments Market - By Geography 4.1 Global Aerial Equipments Market Value and Market Share by Regions 4.1.1 Global Aerial Equipments Value ($) by Region (2015-2020) 4.1.2 Global Aerial Equipments Value Market Share by Regions (2015-2020) 4.2 Global Aerial Equipments Market Production and Market Share by Major Countries 4.2.1 Global Aerial Equipments Production by Major Countries (2015-2020) 4.2.2 Global Aerial Equipments Production Market Share by Major Countries (2015-2020) 4.3 Global Aerial Equipments Market Consumption and Market Share by Regions 4.3.1 Global Aerial Equipments Consumption by Regions (2015-2020) 4.3.2 Global Aerial Equipments Consumption Market Share by Regions (2015-2020) 5 Aerial Equipments Market - By Trade Statistics 5.1 Global Aerial Equipments Export and Import 5.2 United States Aerial Equipments Export and Import (2015-2020) 5.3 Europe Aerial Equipments Export and Import (2015-2020) 5.4 China Aerial Equipments Export and Import (2015-2020) 5.5 Japan Aerial Equipments Export and Import (2015-2020) 5.6 India Aerial Equipments Export and Import (2015-2020) 5.7 ... 6 Aerial Equipments Market - By Type 6.1 Global Aerial Equipments Production and Market Share by Types (2015-2020) 6.1.1 Global Aerial Equipments Production by Types (2015-2020) 6.1.2 Global Aerial Equipments Production Market Share by Types (2015-2020) 6.2 Global Aerial Equipments Value and Market Share by Types (2015-2020) 6.2.1 Global Aerial Equipments Value by Types (2015-2020) 6.2.2 Global Aerial Equipments Value Market Share by Types (2015-2020) 6.3 Global Aerial Equipments Production, Price and Growth Rate of Atrium/Spider Lifts (2015-2020) 6.4 Global Aerial Equipments Production, Price and Growth Rate of Boom Lifts (2015-2020) 6.5 Global Aerial Equipments Production, Price and Growth Rate of Cranes (2015-2020) 6.6 Global Aerial Equipments Production, Price and Growth Rate of Scissor Lifts (2015-2020) 6.7 Global Aerial Equipments Production, Price and Growth Rate of Single-Man Lifts (2015-2020) 7 Aerial Equipments Market - By Application 7.1 Global Aerial Equipments Consumption and Market Share by Applications (2015-2020) 7.1.1 Global Aerial Equipments Consumption by Applications (2015-2020) 7.1.2 Global Aerial Equipments Consumption Market Share by Applications (2015-2020) 7.2 Global Aerial Equipments Consumption and Growth Rate of Residential Construction (2015-2020) 7.3 Global Aerial Equipments Consumption and Growth Rate of Commercial Construction (2015-2020) 7.4 Global Aerial Equipments Consumption and Growth Rate of Public Infrastructure (2015-2020) 7.5 Global Aerial Equipments Consumption and Growth Rate of Ship & Offshore (2015-2020) 7.6 Global Aerial Equipments Consumption and Growth Rate of Equipment Maintenance (2015-2020) 8 North America Aerial Equipments Market 8.1 North America Aerial Equipments Market Size 8.2 United States Aerial Equipments Market Size 8.3 Canada Aerial Equipments Market Size 8.4 Mexico Aerial Equipments Market Size 8.5 The Influence of COVID-19 on North America Market 9 Europe Aerial Equipments Market Analysis 9.1 Europe Aerial Equipments Market Size 9.2 Germany Aerial Equipments Market Size 9.3 United Kingdom Aerial Equipments Market Size 9.4 France Aerial Equipments Market Size 9.5 Italy Aerial Equipments Market Size 9.6 Spain Aerial Equipments Market Size 9.7 The Influence of COVID-19 on Europe Market 10 Asia-Pacific Aerial Equipments Market Analysis 10.1 Asia-Pacific Aerial Equipments Market Size 10.2 China Aerial Equipments Market Size 10.3 Japan Aerial Equipments Market Size 10.4 South Korea Aerial Equipments Market Size 10.5 Southeast Asia Aerial Equipments Market Size 10.6 India Aerial Equipments Market Size 10.7 The Influence of COVID-19 on Asia Pacific Market 11 Middle East and Africa Aerial Equipments Market Analysis 11.1 Middle East and Africa Aerial Equipments Market Size 11.2 Saudi Arabia Aerial Equipments Market Size 11.3 UAE Aerial Equipments Market Size 11.4 South Africa Aerial Equipments Market Size 11.5 The Influence of COVID-19 on Middle East and Africa Market 12 South America Aerial Equipments Market Analysis 12.1 South America Aerial Equipments Market Size 12.2 Brazil Aerial Equipments Market Size 12.3 The Influence of COVID-19 on South America Market 13 Company Profiles 13.1 Terex 13.1.1 Terex Basic Information 13.1.2 Terex Product Profiles, Application and Specification 13.1.3 Terex Aerial Equipments Market Performance (2015-2020) 13.2 Snorkel 13.2.1 Snorkel Basic Information 13.2.2 Snorkel Product Profiles, Application and Specification 13.2.3 Snorkel Aerial Equipments Market Performance (2015-2020) 13.3 Altec 13.3.1 Altec Basic Information 13.3.2 Altec Product Profiles, Application and Specification 13.3.3 Altec Aerial Equipments Market Performance (2015-2020) 13.4 Reachmaster 13.4.1 Reachmaster Basic Information 13.4.2 Reachmaster Product Profiles, Application and Specification 13.4.3 Reachmaster Aerial Equipments Market Performance (2015-2020) 13.5 JLG 13.5.1 JLG Basic Information 13.5.2 JLG Product Profiles, Application and Specification 13.5.3 JLG Aerial Equipments Market Performance (2015-2020) 13.6 Elliott 13.6.1 Elliott Basic Information 13.6.2 Elliott Product Profiles, Application and Specification 13.6.3 Elliott Aerial Equipments Market Performance (2015-2020) 13.7 Manitou 13.7.1 Manitou Basic Information 13.7.2 Manitou Product Profiles, Application and Specification 13.7.3 Manitou Aerial Equipments Market Performance (2015-2020) 13.8 Tadano 13.8.1 Tadano Basic Information 13.8.2 Tadano Product Profiles, Application and Specification 13.8.3 Tadano Aerial Equipments Market Performance (2015-2020) 13.9 Nifty-lift 13.9.1 Nifty-lift Basic Information 13.9.2 Nifty-lift Product Profiles, Application and Specification 13.9.3 Nifty-lift Aerial Equipments Market Performance (2015-2020) 13.10 Linamar 13.10.1 Linamar Basic Information 13.10.2 Linamar Product Profiles, Application and Specification 13.10.3 Linamar Aerial Equipments Market Performance (2015-2020) 13.11 Haulotte 13.11.1 Haulotte Basic Information 13.11.2 Haulotte Product Profiles, Application and Specification 13.11.3 Haulotte Aerial Equipments Market Performance (2015-2020) 13.12 MEC Aerial Work Platforms 13.12.1 MEC Aerial Work Platforms Basic Information 13.12.2 MEC Aerial Work Platforms Product Profiles, Application and Specification 13.12.3 MEC Aerial Work Platforms Aerial Equipments Market Performance (2015-2020) 14 Market Forecast - By Regions 14.1 North America Aerial Equipments Market Forecast (2020-2025) 14.2 Europe Aerial Equipments Market Forecast (2020-2025) 14.3 Asia-Pacific Aerial Equipments Market Forecast (2020-2025) 14.4 Middle East and Africa Aerial Equipments Market Forecast (2020-2025) 14.5 South America Aerial Equipments Market Forecast (2020-2025) 15 Market Forecast - By Type and Applications 15.1 Global Aerial Equipments Market Forecast by Types (2020-2025) 15.1.1 Global Aerial Equipments Market Forecast Production and Market Share by Types (2020-2025) 15.1.2 Global Aerial Equipments Market Forecast Value and Market Share by Types (2020-2025) 15.2 Global Aerial Equipments Market Forecast by Applications (2020-2025)

Inquiry For Buying

Aerial Equipments

Request Sample

Aerial Equipments