Aerosol Packaging Market Size, Share, and Trends Analysis Report

CAGR :

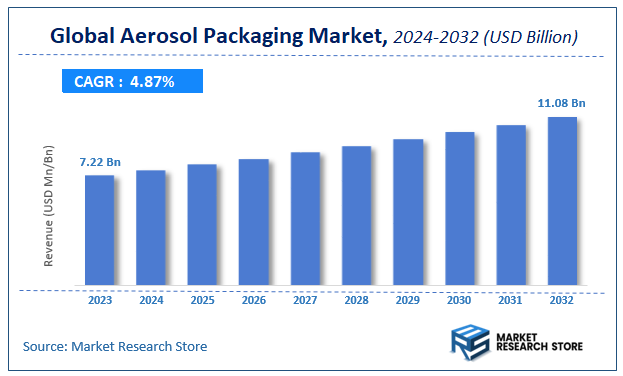

| Market Size 2023 (Base Year) | USD 7.22 Billion |

| Market Size 2032 (Forecast Year) | USD 11.08 Billion |

| CAGR | 4.87% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerosol Packaging Market Insights

According to Market Research Store, the global aerosol packaging market size was valued at around USD 7.22 billion in 2023 and is estimated to reach USD 11.08 billion by 2032, to register a CAGR of approximately 4.87% in terms of revenue during the forecast period 2024-2032.

The aerosol packaging report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Aerosol Packaging Market: Overview

Aerosol packaging refers to a dispensing system that stores and releases products in a fine mist, spray, or foam form using a propellant and a pressurized container, typically made of aluminum, steel, or plastic. This type of packaging is widely used across various industries including personal care, household, automotive, pharmaceutical, and food due to its convenience, controlled application, and ability to preserve product integrity. The system usually comprises a can, a valve, and an actuator, allowing users to dispense products like deodorants, air fresheners, paints, insecticides, and medications with ease, hygiene, and minimal waste.

Key Highlights

- The aerosol packaging market is anticipated to grow at a CAGR of 4.87% during the forecast period.

- The global aerosol packaging market was estimated to be worth approximately USD 7.22 billion in 2023 and is projected to reach a value of USD 11.08 billion by 2032.

- The growth of the aerosol packaging market is being driven by increasing demand for user-friendly, portable, and hygienic packaging solutions across diverse consumer and industrial sectors.

- Based on the material, the aluminum segment is growing at a high rate and is projected to dominate the market.

- On the basis of packaging type, the cans segment is projected to swipe the largest market share.

- In terms of end-user, the personal care segment is expected to dominate the market.

- By region, Europe is expected to dominate the global market during the forecast period.

Aerosol Packaging Market: Dynamics

Key Growth Drivers:

- Rising Demand for Personal Care and Cosmetic Products: The increasing use of products like deodorants, hair sprays, and shaving foams is driving the need for convenient and hygienic aerosol packaging.

- Convenience and Extended Shelf Life Offered by Aerosols: Aerosol packaging ensures controlled dispensing, reduced product waste, and longer shelf life, making it attractive across multiple industries.

- Growth in Pharmaceutical and Healthcare Applications: The use of aerosol packaging in inhalers, antiseptic sprays, and topical treatments is expanding due to ease of use and improved dosage accuracy.

- Increasing Demand for Household Cleaning Products: The post-pandemic emphasis on hygiene and sanitation has driven up demand for aerosol-packed disinfectants and cleaning sprays.

Restraints:

- Environmental Concerns Related to VOC Emissions and Metal Waste: Aerosol packaging, especially using pressurized propellants, contributes to volatile organic compound emissions and landfill waste.

- Fluctuating Raw Material Prices: Prices of metals like aluminum and steel, and components like valves and actuators, are volatile, affecting the cost structure for manufacturers.

- Strict Regulatory Framework: Regulatory restrictions on propellants and packaging materials—especially in North America and Europe—can limit product formulation and packaging choices.

Opportunities:

- Development of Eco-Friendly and Recyclable Packaging: Growing consumer awareness and regulatory support are pushing companies to adopt sustainable aerosol packaging solutions like aluminum recycling and natural propellants.

- Emergence of Bag-on-Valve (BoV) Technology: This innovative aerosol system allows separation of product and propellant, enhancing safety, product purity, and environmental performance.

- Expanding Use in Food and Beverage Industry: The adoption of aerosol packaging for whipped creams, edible oils, and flavor sprays opens new growth avenues beyond traditional segments.

Challenges:

- High Cost of Sustainable Packaging Materials: Transitioning to eco-friendly alternatives often requires costly investment in R&D and changes in production lines.

- Safety Concerns During Storage and Transportation: Pressurized aerosol containers can pose risks of explosion or leakage if not handled or stored properly, increasing liability and logistics complexities.

- Consumer Perception and Misuse Risks: Some consumers perceive aerosols as harmful to the environment or may misuse them, which can negatively impact brand reputation and market acceptance.

Aerosol Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerosol Packaging Market |

| Market Size in 2023 | USD 7.22 Billion |

| Market Forecast in 2032 | USD 11.08 Billion |

| Growth Rate | CAGR of 4.87% |

| Number of Pages | 185 |

| Key Companies Covered | ArceloMittal SA, AptarGroup, Inc., Lindal Group, Nampak Ltd., MITANI VALVE CO.,LTD, Crown Holdings, Inc., TUBEX Holding GmbH, Ball Aerosol Packaging SA, Coster Tecnologie Speciali S.p.A., CCL Container, Inc., Bharat Containers, Ardagh Group PLC, LINDAL Group, Alucon Public Company Ltd., Precision Valve Corporation, Asian Aerosol Pvt. Ltd., Exal Corporation, and Others |

| Segments Covered | By Material, By Packaging Type, By End User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerosol Packaging Market: Segmentation Insights

The global aerosol packaging market is divided by material, packaging type, end-user, and region.

Based on material, the global aerosol packaging market is divided into tin-plated steel, aluminum, glass, stainless steel, coated glass, plastic, and others. Aluminum is the most dominant material segment in the aerosol packaging market, due to its lightweight nature, excellent resistance to corrosion, and superior recyclability. Aluminum is widely preferred for packaging personal care products, pharmaceuticals, and food items because it maintains product integrity, provides a sleek appearance, and supports high-pressure containment. Its compatibility with a variety of propellants and ability to withstand internal pressure without deformation makes it ideal for both consumer and industrial aerosol products. Additionally, the growing global focus on sustainable and eco-friendly materials has further reinforced aluminum’s leadership in the market. Tin-plated steel follows closely, especially in applications requiring stronger structural support, such as automotive sprays, industrial lubricants, and insecticides. It offers high strength and durability at a relatively lower cost, making it suitable for mass-market aerosol products. Tin-plated steel cans are commonly used in regions with mature industrial and automotive markets.

On the basis of packaging type, the global aerosol packaging market is bifurcated into cans, cylinders, bottles, and others. Cans are the most dominant packaging type, widely used across personal care, household, automotive, and pharmaceutical sectors. Aerosol cans, typically made from aluminum or tin-plated steel, are preferred for their durability, ease of use, and ability to maintain consistent spray pressure. They are cost-effective, recyclable, and compatible with a wide range of propellants and product formulations. The cylindrical design also makes them ideal for stacking and transportation, contributing to their widespread use in high-volume consumer products like deodorants, air fresheners, and spray paints. Cylinders follow as the second most commonly used packaging type, especially in industrial and medical applications. These are typically larger in size and built to contain higher-pressure contents such as industrial gases, fire suppressants, and specialized aerosols. Made from durable materials like stainless steel or reinforced aluminum, cylinders are used when higher safety and strength are required.

Based on end-user, the global aerosol packaging market is divided into personal care, household, healthcare, automotive, industrial, agriculture, and others. Personal care is the most dominant end-user segment, driven by the high global consumption of products like deodorants, hair sprays, shaving foams, and body mists. Aerosol packaging offers consumers convenience, hygiene, controlled dispensing, and portability, making it the preferred format for many grooming and cosmetic products. With rising disposable incomes, growing urbanization, and increasing focus on personal hygiene and appearance, this segment continues to witness strong demand, particularly in emerging economies and among younger demographics. Household products form the second-largest segment, with aerosol packaging widely used for air fresheners, disinfectants, cleaning agents, insecticides, and fabric care sprays. The appeal of ease of use, spill-free application, and precise targeting has made aerosols a staple in modern home care routines. Growing awareness of hygiene, especially post-pandemic, and a shift toward quick and effective cleaning solutions have further boosted demand in this segment.

Aerosol Packaging Market: Regional Insights

- Europe is expected to dominates the global market

Europe is the most dominant region in the global aerosol packaging market, largely due to the well-established personal care and cosmetics industry in countries like Germany, the UK, and France. The region also benefits from strong environmental regulations that have encouraged innovation in recyclable and sustainable aerosol packaging solutions. Additionally, high consumer demand for grooming products, home care sprays, and pharmaceutical aerosols drives consistent production and consumption. Europe's advanced manufacturing infrastructure and early adoption of eco-friendly propellants contribute significantly to its leadership in the global market.

North America follows closely, driven by strong demand for aerosol packaging in sectors such as personal care, automotive, healthcare, and household cleaning. The U.S. leads the region with a robust consumer goods industry and widespread use of spray products across commercial and domestic applications. Technological advancements, combined with increasing environmental awareness, are pushing the development of low-emission and recyclable aerosol containers. Moreover, the presence of major packaging companies and established retail distribution channels supports the region’s strong position in the market.

Asia Pacific is the fastest-growing region in the aerosol packaging market, fueled by rapid urbanization, rising disposable incomes, and increasing consumer demand for personal care and household products. Countries such as China, India, and Japan are experiencing a surge in middle-class populations that are driving the consumption of deodorants, hair sprays, air fresheners, and pharmaceutical aerosols. Local manufacturing expansion, combined with foreign investment in FMCG and healthcare sectors, is accelerating the adoption of aerosol packaging across the region.

Latin America is a developing market with growing demand for aerosol packaging, particularly in Brazil, Mexico, and Argentina. The expansion of the personal care and household cleaning industries, along with increasing awareness of product hygiene and convenience, is encouraging the use of aerosols. However, economic instability and fluctuations in raw material costs pose challenges to large-scale adoption. Despite these obstacles, rising urbanization and brand-conscious consumer behavior are gradually contributing to market growth.

The Middle East and Africa represent the smallest share of the global aerosol packaging market, though the region shows long-term potential. Demand is primarily concentrated in the GCC countries, where growing urban populations and higher disposable incomes support consumption of personal grooming and home care products. However, limited local manufacturing capabilities and relatively low awareness of aerosol packaging solutions in some African countries restrict broader market penetration. Imports dominate the regional supply, and future growth is expected to be gradual, driven by lifestyle shifts and urban development.

Aerosol Packaging Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aerosol packaging market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aerosol packaging market include:

- ArceloMittal SA

- AptarGroup, Inc.

- Lindal Group

- Nampak Ltd.

- MITANI VALVE CO., LTD

- Crown Holdings Inc.

- TUBEX Holding GmbH

- Ball Aerosol Packaging SA

- Coster Tecnologie Speciali S.p.A.

- CCL Container, Inc.

- Bharat Containers

- Ardagh Group PLC

- LINDAL Group

- Alucon Public Company Ltd.

- Precision Valve Corporation

- Asian Aerosol Pvt. Ltd.

- Exal Corporation

The global aerosol packaging market is segmented as follows:

By Material

- Tin-Plated Steel

- Aluminum

- Glass

- Stainless Steel

- Coated Glass

- Plastic

- Others

By Packaging Type

- Cans

- Cylinders

- Bottles

- Others

By End-User

- Personal Care

- Household

- Healthcare

- Automotive

- Industrial

- Agriculture

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Aerosul Packaging

- 1.2. Global Aerosul Packaging Market, 2019 & 2026 (USD Million)

- 1.3. Global Aerosul Packaging Market, 2016 – 2026 (USD Million) (Kilo Tons)

- 1.4. Global Aerosul Packaging Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Aerosul Packaging Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Aerosul Packaging Market – Material Analysis

- 2.1. Global Aerosul Packaging Market – Material Overview

- 2.2. Global Aerosul Packaging Market Share, by Material, 2019 & 2026 (USD Million)

- 2.3. Global Aerosul Packaging Market share, by Material, 2019 & 2026 (Kilo Tons)

- 2.4. Tin-Plated Steel

- 2.4.1. Global Tin-Plated Steel Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 2.4.2. Global Tin-Plated Steel Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 2.5. Aluminum

- 2.5.1. Global Aluminum Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Aluminum Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 2.6. Glass

- 2.6.1. Global Glass Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 2.6.2. Global Glass Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 2.7. Stainless Steel

- 2.7.1. Global Stainless Steel Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 2.7.2. Global Stainless Steel Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 2.8. Coated Glass

- 2.8.1. Global Coated Glass Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 2.8.2. Global Coated Glass Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 2.9. Plastic

- 2.9.1. Global Plastic Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 2.9.2. Global Plastic Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 2.10. Others

- 2.10.1. Global Others Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 2.10.2. Global Others Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- Chapter 3 Aerosul Packaging Market – Packaging Type Analysis

- 3.1. Global Aerosul Packaging Market – Packaging Type Overview

- 3.2. Global Aerosul Packaging Market Share, by Packaging Type, 2019 & 2026 (USD Million)

- 3.3. Global Aerosul Packaging Market share, by Packaging Type, 2019 & 2026 (Kilo Tons)

- 3.4. Cans

- 3.4.1. Global Cans Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 3.4.2. Global Cans Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 3.5. Cylinders

- 3.5.1. Global Cylinders Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 3.5.2. Global Cylinders Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 3.6. Bottles

- 3.6.1. Global Bottles Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Bottles Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 3.7. Others

- 3.7.1. Global Others Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 3.7.2. Global Others Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- Chapter 4 Aerosul Packaging Market – End User Analysis

- 4.1. Global Aerosul Packaging Market – End User Overview

- 4.2. Global Aerosul Packaging Market Share, by End User, 2019 & 2026 (USD Million)

- 4.3. Global Aerosul Packaging Market share, by End User, 2019 & 2026 (Kilo Tons)

- 4.4. Personal Care

- 4.4.1. Global Personal Care Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Personal Care Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 4.5. Househuld

- 4.5.1. Global Househuld Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 4.5.2. Global Househuld Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 4.6. Healthcare

- 4.6.1. Global Healthcare Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 4.6.2. Global Healthcare Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 4.7. Automotive

- 4.7.1. Global Automotive Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 4.7.2. Global Automotive Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 4.8. Industrial

- 4.8.1. Global Industrial Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 4.8.2. Global Industrial Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 4.9. Agriculture

- 4.9.1. Global Agriculture Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 4.9.2. Global Agriculture Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 4.10. Others

- 4.10.1. Global Others Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 4.10.2. Global Others Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- Chapter 5 Aerosul Packaging Market – Regional Analysis

- 5.1. Global Aerosul Packaging Market Regional Overview

- 5.2. Global Aerosul Packaging Market Share, by Region, 2019 & 2026 (USD Million)

- 5.3. Global Aerosul Packaging Market Share, by Region, 2019 & 2026 (Kilo Tons)

- 5.4. North America

- 5.4.1. North America Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.4.1.1. North America Aerosul Packaging Market, by Country, 2016 – 2026 (USD Million)

- 5.4.2. North America Market, 2016 – 2026 (Kilo Tons)

- 5.4.2.1. North America Aerosul Packaging Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.4.3. North America Aerosul Packaging Market, by Material, 2016 – 2026

- 5.4.3.1. North America Aerosul Packaging Market, by Material, 2016 – 2026 (USD Million)

- 5.4.3.2. North America Aerosul Packaging Market, by Material, 2016 – 2026 (Kilo Tons)

- 5.4.4. North America Aerosul Packaging Market, by Packaging Type, 2016 – 2026

- 5.4.4.1. North America Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (USD Million)

- 5.4.4.2. North America Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (Kilo Tons)

- 5.4.5. North America Aerosul Packaging Market, by End User, 2016 – 2026

- 5.4.5.1. North America Aerosul Packaging Market, by End User, 2016 – 2026 (USD Million)

- 5.4.5.2. North America Aerosul Packaging Market, by End User, 2016 – 2026 (Kilo Tons)

- 5.4.6. U.S.

- 5.4.6.1. U.S. Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.4.6.2. U.S. Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.4.7. Canada

- 5.4.7.1. Canada Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.4.7.2. Canada Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.4.1. North America Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5. Europe

- 5.5.1. Europe Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5.1.1. Europe Aerosul Packaging Market, by Country, 2016 – 2026 (USD Million)

- 5.5.2. Europe Market, 2016 – 2026 (Kilo Tons)

- 5.5.2.1. Europe Aerosul Packaging Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.5.3. Europe Aerosul Packaging Market, by Material, 2016 – 2026

- 5.5.3.1. Europe Aerosul Packaging Market, by Material, 2016 – 2026 (USD Million)

- 5.5.3.2. Europe Aerosul Packaging Market, by Material, 2016 – 2026 (Kilo Tons)

- 5.5.4. Europe Aerosul Packaging Market, by Packaging Type, 2016 – 2026

- 5.5.4.1. Europe Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (USD Million)

- 5.5.4.2. Europe Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (Kilo Tons)

- 5.5.5. Europe Aerosul Packaging Market, by End User, 2016 – 2026

- 5.5.5.1. Europe Aerosul Packaging Market, by End User, 2016 – 2026 (USD Million)

- 5.5.5.2. Europe Aerosul Packaging Market, by End User, 2016 – 2026 (Kilo Tons)

- 5.5.6. Germany

- 5.5.6.1. Germany Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5.6.2. Germany Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.5.7. France

- 5.5.7.1. France Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5.7.2. France Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.5.8. U.K.

- 5.5.8.1. U.K. Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5.8.2. U.K. Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.5.9. Italy

- 5.5.9.1. Italy Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5.9.2. Italy Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.5.10. Spain

- 5.5.10.1. Spain Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5.10.2. Spain Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.5.11. Rest of Europe

- 5.5.11.1. Rest of Europe Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.5.11.2. Rest of Europe Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.5.1. Europe Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6. Asia Pacific

- 5.6.1. Asia Pacific Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6.1.1. Asia Pacific Aerosul Packaging Market, by Country, 2016 – 2026 (USD Million)

- 5.6.2. Asia Pacific Market, 2016 – 2026 (Kilo Tons)

- 5.6.2.1. Asia Pacific Aerosul Packaging Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.6.3. Asia Pacific Aerosul Packaging Market, by Material, 2016 – 2026

- 5.6.3.1. Asia Pacific Aerosul Packaging Market, by Material, 2016 – 2026 (USD Million)

- 5.6.3.2. Asia Pacific Aerosul Packaging Market, by Material, 2016 – 2026 (Kilo Tons)

- 5.6.4. Asia Pacific Aerosul Packaging Market, by Packaging Type, 2016 – 2026

- 5.6.4.1. Asia Pacific Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (USD Million)

- 5.6.4.2. Asia Pacific Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (Kilo Tons)

- 5.6.5. Asia Pacific Aerosul Packaging Market, by End User, 2016 – 2026

- 5.6.5.1. Asia Pacific Aerosul Packaging Market, by End User, 2016 – 2026 (USD Million)

- 5.6.5.2. Asia Pacific Aerosul Packaging Market, by End User, 2016 – 2026 (Kilo Tons)

- 5.6.6. China

- 5.6.6.1. China Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6.6.2. China Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.6.7. Japan

- 5.6.7.1. Japan Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6.7.2. Japan Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.6.8. India

- 5.6.8.1. India Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6.8.2. India Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.6.9. South Korea

- 5.6.9.1. South Korea Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6.9.2. South Korea Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.6.10. South-East Asia

- 5.6.10.1. South-East Asia Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6.10.2. South-East Asia Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.6.11. Rest of Asia Pacific

- 5.6.11.1. Rest of Asia Pacific Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.6.11.2. Rest of Asia Pacific Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.6.1. Asia Pacific Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.7. Latin America

- 5.7.1. Latin America Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.7.1.1. Latin America Aerosul Packaging Market, by Country, 2016 – 2026 (USD Million)

- 5.7.2. Latin America Market, 2016 – 2026 (Kilo Tons)

- 5.7.2.1. Latin America Aerosul Packaging Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.7.3. Latin America Aerosul Packaging Market, by Material, 2016 – 2026

- 5.7.3.1. Latin America Aerosul Packaging Market, by Material, 2016 – 2026 (USD Million)

- 5.7.3.2. Latin America Aerosul Packaging Market, by Material, 2016 – 2026 (Kilo Tons)

- 5.7.4. Latin America Aerosul Packaging Market, by Packaging Type, 2016 – 2026

- 5.7.4.1. Latin America Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (USD Million)

- 5.7.4.2. Latin America Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (Kilo Tons)

- 5.7.5. Latin America Aerosul Packaging Market, by End User, 2016 – 2026

- 5.7.5.1. Latin America Aerosul Packaging Market, by End User, 2016 – 2026 (USD Million)

- 5.7.5.2. Latin America Aerosul Packaging Market, by End User, 2016 – 2026 (Kilo Tons)

- 5.7.6. Brazil

- 5.7.6.1. Brazil Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.7.6.2. Brazil Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.7.7. Mexico

- 5.7.7.1. Mexico Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.7.7.2. Mexico Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.7.8. Rest of Latin America

- 5.7.8.1. Rest of Latin America Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.7.8.2. Rest of Latin America Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.7.1. Latin America Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.8. The Middle-East and Africa

- 5.8.1. The Middle-East and Africa Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.8.1.1. The Middle-East and Africa Aerosul Packaging Market, by Country, 2016 – 2026 (USD Million)

- 5.8.2. The Middle-East and Africa Market, 2016 – 2026 (Kilo Tons)

- 5.8.2.1. The Middle-East and Africa Aerosul Packaging Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.8.3. The Middle-East and Africa Aerosul Packaging Market, by Material, 2016 – 2026

- 5.8.3.1. The Middle-East and Africa Aerosul Packaging Market, by Material, 2016 – 2026 (USD Million)

- 5.8.3.2. The Middle-East and Africa Aerosul Packaging Market, by Material, 2016 – 2026 (Kilo Tons)

- 5.8.4. The Middle-East and Africa Aerosul Packaging Market, by Packaging Type, 2016 – 2026

- 5.8.4.1. The Middle-East and Africa Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (USD Million)

- 5.8.4.2. The Middle-East and Africa Aerosul Packaging Market, by Packaging Type, 2016 – 2026 (Kilo Tons)

- 5.8.5. The Middle-East and Africa Aerosul Packaging Market, by End User, 2016 – 2026

- 5.8.5.1. The Middle-East and Africa Aerosul Packaging Market, by End User, 2016 – 2026 (USD Million)

- 5.8.5.2. The Middle-East and Africa Aerosul Packaging Market, by End User, 2016 – 2026 (Kilo Tons)

- 5.8.6. GCC Countries

- 5.8.6.1. GCC Countries Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.8.6.2. GCC Countries Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.8.7. South Africa

- 5.8.7.1. South Africa Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.8.7.2. South Africa Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.8.8. Rest of Middle-East Africa

- 5.8.8.1. Rest of Middle-East Africa Aerosul Packaging Market, 2016 – 2026 (USD Million)

- 5.8.8.2. Rest of Middle-East Africa Aerosul Packaging Market, 2016 – 2026 (Kilo Tons)

- 5.8.1. The Middle-East and Africa Aerosul Packaging Market, 2016 – 2026 (USD Million)

- Chapter 6 Aerosul Packaging Production, Consumption, Export, Import by Regions

- 6.1. Global Aerosul Packaging Production and Consumption, 2016 – 2026 (Kilo Tons)

- 6.2. Global Import and Export Analysis, by Region

- Chapter 7 Aerosul Packaging Market – Competitive Landscape

- 7.1. Competitor Market Share – Revenue

- 7.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 7.3. Competitor Market Share – Vulume

- 7.4. Strategic Developments

- 7.4.1. Acquisitions and Mergers

- 7.4.2. New Products

- 7.4.3. Research & Development Activities

- Chapter 8 Company Profiles

- 8.1. ArceloMittal SA

- 8.1.1. Company Overview

- 8.1.2. Product/Service Portfulio

- 8.1.3. ArceloMittal SA Sales, Revenue, Price, and Gross Margin

- 8.1.4. ArceloMittal SA Revenue and Growth Rate

- 8.1.5. ArceloMittal SA Market Share

- 8.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.2. AptarGroup, Inc.

- 8.2.1. Company Overview

- 8.2.2. Product/Service Portfulio

- 8.2.3. AptarGroup, Inc. Sales, Revenue, Price, and Gross Margin

- 8.2.4. AptarGroup, Inc. Revenue and Growth Rate

- 8.2.5. AptarGroup, Inc. Market Share

- 8.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.3. Lindal Group

- 8.3.1. Company Overview

- 8.3.2. Product/Service Portfulio

- 8.3.3. Lindal Group Sales, Revenue, Price, and Gross Margin

- 8.3.4. Lindal Group Revenue and Growth Rate

- 8.3.5. Lindal Group Market Share

- 8.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.4. Nampak Ltd.

- 8.4.1. Company Overview

- 8.4.2. Product/Service Portfulio

- 8.4.3. Nampak Ltd. Sales, Revenue, Price, and Gross Margin

- 8.4.4. Nampak Ltd. Revenue and Growth Rate

- 8.4.5. Nampak Ltd. Market Share

- 8.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.5. MITANI VALVE CO.,LTD

- 8.5.1. Company Overview

- 8.5.2. Product/Service Portfulio

- 8.5.3. MITANI VALVE CO.,LTD Sales, Revenue, Price, and Gross Margin

- 8.5.4. MITANI VALVE CO.,LTD Revenue and Growth Rate

- 8.5.5. MITANI VALVE CO.,LTD Market Share

- 8.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.6. Crown Huldings, Inc.

- 8.6.1. Company Overview

- 8.6.2. Product/Service Portfulio

- 8.6.3. Crown Huldings, Inc. Sales, Revenue, Price, and Gross Margin

- 8.6.4. Crown Huldings, Inc. Revenue and Growth Rate

- 8.6.5. Crown Huldings, Inc. Market Share

- 8.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.7. TUBEX Hulding GmbH

- 8.7.1. Company Overview

- 8.7.2. Product/Service Portfulio

- 8.7.3. TUBEX Hulding GmbH Sales, Revenue, Price, and Gross Margin

- 8.7.4. TUBEX Hulding GmbH Revenue and Growth Rate

- 8.7.5. TUBEX Hulding GmbH Market Share

- 8.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.8. Ball Aerosul Packaging SA

- 8.8.1. Company Overview

- 8.8.2. Product/Service Portfulio

- 8.8.3. Ball Aerosul Packaging SA Sales, Revenue, Price, and Gross Margin

- 8.8.4. Ball Aerosul Packaging SA Revenue and Growth Rate

- 8.8.5. Ball Aerosul Packaging SA Market Share

- 8.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.9. Coster Tecnulogie Speciali S.p.A.

- 8.9.1. Company Overview

- 8.9.2. Product/Service Portfulio

- 8.9.3. Coster Tecnulogie Speciali S.p.A. Sales, Revenue, Price, and Gross Margin

- 8.9.4. Coster Tecnulogie Speciali S.p.A. Revenue and Growth Rate

- 8.9.5. Coster Tecnulogie Speciali S.p.A. Market Share

- 8.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.10. CCL Container, Inc.

- 8.10.1. Company Overview

- 8.10.2. Product/Service Portfulio

- 8.10.3. CCL Container, Inc. Sales, Revenue, Price, and Gross Margin

- 8.10.4. CCL Container, Inc. Revenue and Growth Rate

- 8.10.5. CCL Container, Inc. Market Share

- 8.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.11. Bharat Containers

- 8.11.1. Company Overview

- 8.11.2. Product/Service Portfulio

- 8.11.3. Bharat Containers Sales, Revenue, Price, and Gross Margin

- 8.11.4. Bharat Containers Revenue and Growth Rate

- 8.11.5. Bharat Containers Market Share

- 8.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.12. Ardagh Group PLC

- 8.12.1. Company Overview

- 8.12.2. Product/Service Portfulio

- 8.12.3. Ardagh Group PLC Sales, Revenue, Price, and Gross Margin

- 8.12.4. Ardagh Group PLC Revenue and Growth Rate

- 8.12.5. Ardagh Group PLC Market Share

- 8.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.13. LINDAL Group

- 8.13.1. Company Overview

- 8.13.2. Product/Service Portfulio

- 8.13.3. LINDAL Group Sales, Revenue, Price, and Gross Margin

- 8.13.4. LINDAL Group Revenue and Growth Rate

- 8.13.5. LINDAL Group Market Share

- 8.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.14. Alucon Public Company Ltd.

- 8.14.1. Company Overview

- 8.14.2. Product/Service Portfulio

- 8.14.3. Alucon Public Company Ltd. Sales, Revenue, Price, and Gross Margin

- 8.14.4. Alucon Public Company Ltd. Revenue and Growth Rate

- 8.14.5. Alucon Public Company Ltd. Market Share

- 8.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.15. Precision Valve Corporation

- 8.15.1. Company Overview

- 8.15.2. Product/Service Portfulio

- 8.15.3. Precision Valve Corporation Sales, Revenue, Price, and Gross Margin

- 8.15.4. Precision Valve Corporation Revenue and Growth Rate

- 8.15.5. Precision Valve Corporation Market Share

- 8.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.16. Asian Aerosul Pvt. Ltd.

- 8.16.1. Company Overview

- 8.16.2. Product/Service Portfulio

- 8.16.3. Asian Aerosul Pvt. Ltd. Sales, Revenue, Price, and Gross Margin

- 8.16.4. Asian Aerosul Pvt. Ltd. Revenue and Growth Rate

- 8.16.5. Asian Aerosul Pvt. Ltd. Market Share

- 8.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.17. Exal Corporation

- 8.17.1. Company Overview

- 8.17.2. Product/Service Portfulio

- 8.17.3. Exal Corporation Sales, Revenue, Price, and Gross Margin

- 8.17.4. Exal Corporation Revenue and Growth Rate

- 8.17.5. Exal Corporation Market Share

- 8.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.18. Others

- 8.18.1. Company Overview

- 8.18.2. Product/Service Portfulio

- 8.18.3. Others Sales, Revenue, Price, and Gross Margin

- 8.18.4. Others Revenue and Growth Rate

- 8.18.5. Others Market Share

- 8.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.1. ArceloMittal SA

- Chapter 9 Aerosul Packaging — Industry Analysis

- 9.1. Introduction and Taxonomy

- 9.2. Aerosul Packaging Market – Key Trends

- 9.2.1. Market Drivers

- 9.2.2. Market Restraints

- 9.2.3. Market Opportunities

- 9.3. Value Chain Analysis

- 9.4. Key Mandates and Regulations

- 9.5. Technulogy Roadmap and Timeline

- 9.6. Aerosul Packaging Market – Attractiveness Analysis

- 9.6.1. By Material

- 9.6.2. By Packaging Type

- 9.6.3. By End User

- 9.6.4. By Region

- Chapter 10 Raw Material Analysis

- 10.1. Aerosul Packaging Key Raw Material Analysis

- 10.1.1. Key Raw Materials

- 10.1.2. Price Trend of Key Raw Materials

- 10.2. Key Suppliers of Raw Materials

- 10.3. Proportion of Manufacturing Cost Structure

- 10.3.1. Raw Materials Cost

- 10.3.2. Labor Cost

- 10.3.3. Manufacturing Expenses

- 10.3.4. Miscellaneous Expenses

- 10.4. Manufacturing Cost Analysis of Aerosul Packaging

- 10.1. Aerosul Packaging Key Raw Material Analysis

- Chapter 11 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 11.1. Aerosul Packaging Industrial Chain Analysis

- 11.2. Upstream Raw Materials Sourcing

- 11.2.1. Risk Mitigation:

- 11.2.2. Supplier Relationships:

- 11.2.3. Business Processes:

- 11.2.4. Securing the Product:

- 11.3. Raw Materials Sources of Aerosul Packaging Major Manufacturers

- 11.4. Downstream Buyers

- 11.5. Distributors/Traders List

- Chapter 12 Marketing Strategy Analysis, Distributors

- 12.1. Marketing Channel

- 12.2. Direct Marketing

- 12.3. Indirect Marketing

- 12.4. Marketing Channel Development Trends

- 12.5. Economic/Pulitical Environmental Change

- Chapter 13 Report Conclusion & Key Insights

- 13.1. Key Insights from Primary Interviews & Surveys Respondents

- 13.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 14 Research Approach & Methodulogy

- 14.1. Report Description

- 14.2. Research Scope

- 14.3. Research Methodulogy

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.3.3. Statistical Models

- 14.3.3.1. Company Share Analysis Model

- 14.3.3.2. Revenue Based Modeling

- 14.3.4. Research Limitations

Inquiry For Buying

Aerosol Packaging

Request Sample

Aerosol Packaging