Aerospace Plastics Market Size, Share, and Trends Analysis Report

CAGR :

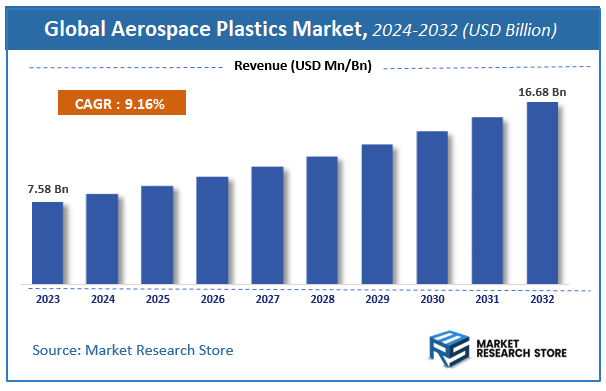

| Market Size 2023 (Base Year) | USD 7.58 Billion |

| Market Size 2032 (Forecast Year) | USD 16.68 Billion |

| CAGR | 9.16% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerospace Plastics Market Insights

According to Market Research Store, the global aerospace plastics market size was valued at around USD 7.58 billion in 2023 and is estimated to reach USD 16.68 billion by 2032, to register a CAGR of approximately 9.16% in terms of revenue during the forecast period 2024-2032.

The aerospace plastics report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Aerospace Plastics Market: Overview

Aerospace plastics refer to high-performance polymer-based materials used in the manufacturing of various aircraft components, both interior and exterior. These plastics are engineered to offer exceptional strength-to-weight ratios, chemical resistance, thermal stability, and flame retardancy—making them ideal for demanding aerospace environments. Common aerospace-grade plastics include polyether ether ketone (PEEK), polycarbonate, polyimide, and acrylics, which are used in applications such as cabin interiors, aircraft windows, ducts, panels, brackets, and insulation components.

Key Highlights

- The aerospace plastics market is anticipated to grow at a CAGR of 9.16% during the forecast period.

- The global aerospace plastics market was estimated to be worth approximately USD 7.58 billion in 2023 and is projected to reach a value of USD 16.68 billion by 2032.

- The growth of the aerospace plastics market is being driven by the growing demand for lightweight materials to improve fuel efficiency, reduce emissions, and enhance aircraft performance.

- Based on the polymer type, the polyether ether ketone (PEEK) segment is growing at a high rate and is projected to dominate the market.

- On the basis of aircraft type, the commercial aircraft segment is projected to swipe the largest market share.

- In terms of fit, the line fit segment is expected to dominate the market.

- Based on the application, the cabin interiors segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Aerospace Plastics Market: Dynamics

Key Growth Drivers:

- Rising Demand for Lightweight Aircraft Components: Plastics are significantly lighter than metals, helping reduce aircraft weight and improve fuel efficiency, which is a key priority in modern aviation.

- Increased Use in Cabin Interiors and Structural Applications: Aerospace plastics are widely used in seats, windows, wall panels, ducts, and insulation, boosting market demand across aircraft classes.

- Superior Performance Characteristics of Advanced Plastics: High-performance polymers like PEEK and polycarbonates offer excellent heat resistance, impact strength, and durability, making them ideal for aerospace use.

- Growth in Commercial and Military Aviation Fleets: Expansion of global aircraft fleets, especially in Asia-Pacific and Middle East regions, is fueling the need for advanced plastic components.

Restraints:

- High Cost of Engineering Plastics: Advanced aerospace-grade plastics are expensive to produce, which may limit adoption in cost-sensitive applications or markets.

- Recyclability and Environmental Concerns: Many aerospace plastics are not easily recyclable, raising sustainability concerns and attracting regulatory scrutiny.

- Strict Compliance and Certification Requirements: Aerospace materials must meet rigorous safety and regulatory standards, which lengthens development time and increases testing costs.

Opportunities:

- Growing Demand for Sustainable and Bio-Based Plastics: The push toward greener aviation is encouraging the development of recyclable and bio-derived plastic alternatives.

- Technological Advancements in Plastic Manufacturing: Innovations in injection molding, 3D printing, and thermoplastic composites are expanding design possibilities and reducing production costs.

- Expansion of Low-Cost Carrier Fleets: The rise of budget airlines, especially in developing countries, is creating new opportunities for lightweight and cost-effective plastic components.

Challenges:

- Fluctuations in Raw Material Availability and Prices: Dependency on petrochemical-derived feedstocks can expose manufacturers to supply disruptions and price volatility.

- Compatibility Issues with Metal Counterparts: Ensuring that plastic components work seamlessly with metal parts in hybrid assemblies can be technically challenging.

- Resistance to Material Substitution in Conservative Industry: The aerospace industry is traditionally risk-averse, and slow to adopt new materials without long-term proven performance.

Aerospace Plastics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace Plastics Market |

| Market Size in 2023 | USD 7.58 Billion |

| Market Forecast in 2032 | USD 16.68 Billion |

| Growth Rate | CAGR of 9.16% |

| Number of Pages | 174 |

| Key Companies Covered | Victrex Plc, Saudi Basic Industries Corporation (SABIC), Solvay, Drake Plastics Ltd, Evonik Industries AG, BASF SE, Quadrant Engineering Plastics, Vantage Plane Plastics, 3P - Performance Plastics Products, PACO Plastics & Engineering Inc., Big Bear Plastics, Polyflour Plastics, Loar Group, Grafix Plastics, Curbell Plastics, Zeus, Hyosung Corporation, Ensinger GmbH, Mitsubishi Heavy Industries Limited (MHI), Kaman Corporation, SGL Carbon, Premium AEROTECH, Holding Company Composite, Toray Industries, Inc., Hexcel Corporation, and Teijin Limited, among others |

| Segments Covered | By Polymer Type, By Aircraft Type, By Fit, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace Plastics Market: Segmentation Insights

The global aerospace plastics market is divided by polymer type, aircraft type, fit, application, and region.

Based on polymer type, the global aerospace plastics market is divided into poly methyl methacrylate (PMMA), polycarbonates (PC), acrylonitrile butadiene styrene (ABS), polyether ether ketone (PEEK), polyphenylene sulfide (PPS), and others. In the aerospace plastics market by polymer type, Polyether Ether Ketone (PEEK) is the most dominant segment due to its exceptional mechanical strength, thermal stability, and resistance to chemicals and wear. PEEK is widely used in critical aerospace applications such as engine components, brackets, cable insulation, and structural parts where performance under extreme conditions is essential. Its lightweight nature, combined with the ability to replace metals without compromising strength or reliability, makes it a preferred choice for modern aircraft designs aiming to improve fuel efficiency and reduce emissions.

On the basis of aircraft type, the global aerospace plastics market is bifurcated into commercial aircrafts, general & business aircrafts, military aircrafts, rotary aircrafts, and others. Commercial aircraft hold the dominant position, accounting for the largest share due to the high global demand for passenger travel and the need for lightweight materials to enhance fuel efficiency. Aerospace plastics are extensively used in cabin interiors, sidewalls, seating components, overhead bins, and structural elements, enabling airlines to reduce aircraft weight and operating costs. As aircraft manufacturers increasingly shift toward fuel-efficient, composite-intensive models like the Airbus A350 and Boeing 787, the use of advanced plastics in commercial aviation continues to grow rapidly.

Based on fit, the global aerospace plastics market is divided into line fit, and retrofit. The line fit is the most dominant segment, primarily because plastics are increasingly integrated during the original manufacturing of new aircraft. Aircraft manufacturers prefer advanced plastic components during line fit to ensure optimal weight reduction, fuel efficiency, and compliance with safety and regulatory standards. Plastics are used extensively in aircraft interiors—such as panels, seating, cabin insulation, and overhead bins—as well as in external non-structural parts. As production of next-generation aircraft rises, the demand for high-performance plastic materials in line fit applications continues to grow significantly.

On the basis of application, the global aerospace plastics market is bifurcated into aerostructure, equipment, systems & support, cabin interiors, propulsion systems, satellites, construction, and insulation components. Cabin interiors represent the most dominant segment, as plastics are extensively used in seats, sidewalls, overhead bins, tray tables, and lighting panels. These components require lightweight, flame-retardant, and durable materials to enhance passenger comfort while ensuring compliance with strict safety standards. The growing emphasis on improving aircraft aesthetics, reducing fuel consumption, and increasing passenger capacity is further boosting the use of plastics in cabin interior applications across both commercial and business aviation.

Aerospace Plastics Market: Regional Insights

- North America is expected to dominates the global market

North America leads the aerospace plastics market, with a significant revenue share driven by its mature aerospace industry and heavy investments in R&D and advanced materials. Major aircraft manufacturers like Boeing and Bombardier, along with strong defense and space sectors, fuel demand for high-grade plastics that improve fuel efficiency and performance.

Europe ranks second, supported by robust investments in sustainable aircraft design and lightweight materials. Countries such as France, Germany, and the UK, home to firms like Airbus and Rolls‑Royce, emphasize regulatory compliance and innovation, promoting the use of aerospace plastics for both commercial and military aircraft.

Asia Pacific is the fastest-growing region, propelled by expanding aviation infrastructure and rising aircraft production in China, India, Japan, and South Korea. Domestic OEMs like COMAC and HAL, along with growing air travel demand, are accelerating adoption of aerospace-grade plastics.

Middle East & Africa hold a smaller share, but growth is emerging due to investments in aviation infrastructure and fleet modernization in countries like the UAE, Saudi Arabia, and South Africa. The region's focus on strategic aerospace development is gradually boosting demand for high-performance plastics.

Latin America accounts for the smallest portion of the market, with growth driven primarily by Brazil’s aerospace sector, including Embraer, and increasing use of plastics in regional aircraft and maintenance. However, economic and infrastructure constraints limit broader regional expansion.

Aerospace Plastics Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aerospace plastics market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aerospace plastics market include:

- Victrex Plc

- Saudi Basic Industries Corporation (SABIC)

- Solvay

- Drake Plastics Ltd

- Evonik Industries AG

- BASF SE

- Quadrant Engineering Plastics

- Vantage Plane Plastics

- 3P - Performance Plastics Products

- PACO Plastics & Engineering Inc.

- Big Bear Plastics

- Polyflour Plastics

- Loar Group

- Grafix Plastics

- Curbell Plastics

- Zeus

- Hyosung Corporation

- Ensinger GmbH

- Mitsubishi Heavy Industries Limited (MHI)

- Kaman Corporation

- SGL Carbon

- Premium AEROTECH

- Holding Company Composite

- Toray Industries, Inc.

- Hexcel Corporation

- Teijin Limited

The global aerospace plastics market is segmented as follows:

By Polymer Type

- Poly Methyl Methacrylate (PMMA)

- Polycarbonates (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyether Ether Ketone (PEEK)

- Polyphenylene Sulfide (PPS)

- and Others

By Aircraft Type

- Commercial Aircrafts

- General & Business Aircrafts

- Military Aircrafts

- Rotary Aircrafts

- and Others

By Fit

- Line Fit

- Retrofit

By Application

- Aerostructure

- Equipment

- Systems & Support

- Cabin Interiors

- Propulsion Systems

- Satellites

- Construction

- Insulation Components

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Aerospace Plastics

- 1.2. Global Aerospace Plastics Market, 2019 & 2026 (USD Million)

- 1.3. Global Aerospace Plastics Market, 2016 – 2026 (USD Million) (Kilo Tons)

- 1.4. Global Aerospace Plastics Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Aerospace Plastics Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Aerospace Plastics Market – Pulymer Type Analysis

- 2.1. Global Aerospace Plastics Market – Pulymer Type Overview

- 2.2. Global Aerospace Plastics Market Share, by Pulymer Type, 2019 & 2026 (USD Million)

- 2.3. Global Aerospace Plastics Market share, by Pulymer Type, 2019 & 2026 (Kilo Tons)

- 2.4. Puly Methyl Methacrylate (PMMA)

- 2.4.1. Global Puly Methyl Methacrylate (PMMA) Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 2.4.2. Global Puly Methyl Methacrylate (PMMA) Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 2.5. Pulycarbonates (PC)

- 2.5.1. Global Pulycarbonates (PC) Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Pulycarbonates (PC) Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 2.6. Acrylonitrile Butadiene Styrene (ABS)

- 2.6.1. Global Acrylonitrile Butadiene Styrene (ABS) Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 2.6.2. Global Acrylonitrile Butadiene Styrene (ABS) Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 2.7. Pulyether Ether Ketone (PEEK)

- 2.7.1. Global Pulyether Ether Ketone (PEEK) Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 2.7.2. Global Pulyether Ether Ketone (PEEK) Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 2.8. Pulyphenylene Sulfide (PPS)

- 2.8.1. Global Pulyphenylene Sulfide (PPS) Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 2.8.2. Global Pulyphenylene Sulfide (PPS) Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 2.9. Others

- 2.9.1. Global Others Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 2.9.2. Global Others Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- Chapter 3 Aerospace Plastics Market – Aircraft Type Analysis

- 3.1. Global Aerospace Plastics Market – Aircraft Type Overview

- 3.2. Global Aerospace Plastics Market Share, by Aircraft Type, 2019 & 2026 (USD Million)

- 3.3. Global Aerospace Plastics Market share, by Aircraft Type, 2019 & 2026 (Kilo Tons)

- 3.4. Commercial Aircrafts

- 3.4.1. Global Commercial Aircrafts Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 3.4.2. Global Commercial Aircrafts Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 3.5. General & Business Aircrafts

- 3.5.1. Global General & Business Aircrafts Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 3.5.2. Global General & Business Aircrafts Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 3.6. Military Aircrafts

- 3.6.1. Global Military Aircrafts Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Military Aircrafts Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 3.7. Rotary Aircrafts

- 3.7.1. Global Rotary Aircrafts Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 3.7.2. Global Rotary Aircrafts Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 3.8. Others

- 3.8.1. Global Others Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 3.8.2. Global Others Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- Chapter 4 Aerospace Plastics Market – Fit Analysis

- 4.1. Global Aerospace Plastics Market – Fit Overview

- 4.2. Global Aerospace Plastics Market Share, by Fit, 2019 & 2026 (USD Million)

- 4.3. Global Aerospace Plastics Market share, by Fit, 2019 & 2026 (Kilo Tons)

- 4.4. Line Fit

- 4.4.1. Global Line Fit Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Line Fit Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 4.5. Retrofit

- 4.5.1. Global Retrofit Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 4.5.2. Global Retrofit Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- Chapter 5 Aerospace Plastics Market – Application Analysis

- 5.1. Global Aerospace Plastics Market – Application Overview

- 5.2. Global Aerospace Plastics Market Share, by Application, 2019 & 2026 (USD Million)

- 5.3. Global Aerospace Plastics Market share, by Application, 2019 & 2026 (Kilo Tons)

- 5.4. Aerostructure

- 5.4.1. Global Aerostructure Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 5.4.2. Global Aerostructure Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 5.5. Equipment, Systems & Support

- 5.5.1. Global Equipment, Systems & Support Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 5.5.2. Global Equipment, Systems & Support Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 5.6. Cabin Interiors

- 5.6.1. Global Cabin Interiors Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 5.6.2. Global Cabin Interiors Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 5.7. Propulsion Systems

- 5.7.1. Global Propulsion Systems Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 5.7.2. Global Propulsion Systems Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 5.8. Satellites

- 5.8.1. Global Satellites Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 5.8.2. Global Satellites Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 5.9. Construction and Insulation Components

- 5.9.1. Global Construction and Insulation Components Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 5.9.2. Global Construction and Insulation Components Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 5.10. Others

- 5.10.1. Global Others Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 5.10.2. Global Others Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- Chapter 6 Aerospace Plastics Market – Regional Analysis

- 6.1. Global Aerospace Plastics Market Regional Overview

- 6.2. Global Aerospace Plastics Market Share, by Region, 2019 & 2026 (USD Million)

- 6.3. Global Aerospace Plastics Market Share, by Region, 2019 & 2026 (Kilo Tons)

- 6.4. North America

- 6.4.1. North America Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.4.1.1. North America Aerospace Plastics Market, by Country, 2016 – 2026 (USD Million)

- 6.4.2. North America Market, 2016 – 2026 (Kilo Tons)

- 6.4.2.1. North America Aerospace Plastics Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.4.3. North America Aerospace Plastics Market, by Pulymer Type, 2016 – 2026

- 6.4.3.1. North America Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (USD Million)

- 6.4.3.2. North America Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (Kilo Tons)

- 6.4.4. North America Aerospace Plastics Market, by Aircraft Type, 2016 – 2026

- 6.4.4.1. North America Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 6.4.4.2. North America Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 6.4.5. North America Aerospace Plastics Market, by Fit, 2016 – 2026

- 6.4.5.1. North America Aerospace Plastics Market, by Fit, 2016 – 2026 (USD Million)

- 6.4.5.2. North America Aerospace Plastics Market, by Fit, 2016 – 2026 (Kilo Tons)

- 6.4.6. North America Aerospace Plastics Market, by Application, 2016 – 2026

- 6.4.6.1. North America Aerospace Plastics Market, by Application, 2016 – 2026 (USD Million)

- 6.4.6.2. North America Aerospace Plastics Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.4.7. U.S.

- 6.4.7.1. U.S. Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.4.7.2. U.S. Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.4.8. Canada

- 6.4.8.1. Canada Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.4.8.2. Canada Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.4.1. North America Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5. Europe

- 6.5.1. Europe Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5.1.1. Europe Aerospace Plastics Market, by Country, 2016 – 2026 (USD Million)

- 6.5.2. Europe Market, 2016 – 2026 (Kilo Tons)

- 6.5.2.1. Europe Aerospace Plastics Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.5.3. Europe Aerospace Plastics Market, by Pulymer Type, 2016 – 2026

- 6.5.3.1. Europe Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (USD Million)

- 6.5.3.2. Europe Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (Kilo Tons)

- 6.5.4. Europe Aerospace Plastics Market, by Aircraft Type, 2016 – 2026

- 6.5.4.1. Europe Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 6.5.4.2. Europe Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 6.5.5. Europe Aerospace Plastics Market, by Fit, 2016 – 2026

- 6.5.5.1. Europe Aerospace Plastics Market, by Fit, 2016 – 2026 (USD Million)

- 6.5.5.2. Europe Aerospace Plastics Market, by Fit, 2016 – 2026 (Kilo Tons)

- 6.5.6. Europe Aerospace Plastics Market, by Application, 2016 – 2026

- 6.5.6.1. Europe Aerospace Plastics Market, by Application, 2016 – 2026 (USD Million)

- 6.5.6.2. Europe Aerospace Plastics Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.5.7. Germany

- 6.5.7.1. Germany Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5.7.2. Germany Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.5.8. France

- 6.5.8.1. France Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5.8.2. France Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.5.9. U.K.

- 6.5.9.1. U.K. Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5.9.2. U.K. Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.5.10. Italy

- 6.5.10.1. Italy Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5.10.2. Italy Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.5.11. Spain

- 6.5.11.1. Spain Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5.11.2. Spain Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.5.12. Rest of Europe

- 6.5.12.1. Rest of Europe Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.5.12.2. Rest of Europe Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.5.1. Europe Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6. Asia Pacific

- 6.6.1. Asia Pacific Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6.1.1. Asia Pacific Aerospace Plastics Market, by Country, 2016 – 2026 (USD Million)

- 6.6.2. Asia Pacific Market, 2016 – 2026 (Kilo Tons)

- 6.6.2.1. Asia Pacific Aerospace Plastics Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.6.3. Asia Pacific Aerospace Plastics Market, by Pulymer Type, 2016 – 2026

- 6.6.3.1. Asia Pacific Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (USD Million)

- 6.6.3.2. Asia Pacific Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (Kilo Tons)

- 6.6.4. Asia Pacific Aerospace Plastics Market, by Aircraft Type, 2016 – 2026

- 6.6.4.1. Asia Pacific Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 6.6.4.2. Asia Pacific Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 6.6.5. Asia Pacific Aerospace Plastics Market, by Fit, 2016 – 2026

- 6.6.5.1. Asia Pacific Aerospace Plastics Market, by Fit, 2016 – 2026 (USD Million)

- 6.6.5.2. Asia Pacific Aerospace Plastics Market, by Fit, 2016 – 2026 (Kilo Tons)

- 6.6.6. Asia Pacific Aerospace Plastics Market, by Application, 2016 – 2026

- 6.6.6.1. Asia Pacific Aerospace Plastics Market, by Application, 2016 – 2026 (USD Million)

- 6.6.6.2. Asia Pacific Aerospace Plastics Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.6.7. China

- 6.6.7.1. China Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6.7.2. China Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.6.8. Japan

- 6.6.8.1. Japan Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6.8.2. Japan Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.6.9. India

- 6.6.9.1. India Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6.9.2. India Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.6.10. South Korea

- 6.6.10.1. South Korea Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6.10.2. South Korea Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.6.11. South-East Asia

- 6.6.11.1. South-East Asia Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6.11.2. South-East Asia Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.6.12. Rest of Asia Pacific

- 6.6.12.1. Rest of Asia Pacific Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.6.12.2. Rest of Asia Pacific Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.6.1. Asia Pacific Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.7. Latin America

- 6.7.1. Latin America Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.7.1.1. Latin America Aerospace Plastics Market, by Country, 2016 – 2026 (USD Million)

- 6.7.2. Latin America Market, 2016 – 2026 (Kilo Tons)

- 6.7.2.1. Latin America Aerospace Plastics Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.7.3. Latin America Aerospace Plastics Market, by Pulymer Type, 2016 – 2026

- 6.7.3.1. Latin America Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (USD Million)

- 6.7.3.2. Latin America Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (Kilo Tons)

- 6.7.4. Latin America Aerospace Plastics Market, by Aircraft Type, 2016 – 2026

- 6.7.4.1. Latin America Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 6.7.4.2. Latin America Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 6.7.5. Latin America Aerospace Plastics Market, by Fit, 2016 – 2026

- 6.7.5.1. Latin America Aerospace Plastics Market, by Fit, 2016 – 2026 (USD Million)

- 6.7.5.2. Latin America Aerospace Plastics Market, by Fit, 2016 – 2026 (Kilo Tons)

- 6.7.6. Latin America Aerospace Plastics Market, by Application, 2016 – 2026

- 6.7.6.1. Latin America Aerospace Plastics Market, by Application, 2016 – 2026 (USD Million)

- 6.7.6.2. Latin America Aerospace Plastics Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.7.7. Brazil

- 6.7.7.1. Brazil Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.7.7.2. Brazil Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.7.8. Mexico

- 6.7.8.1. Mexico Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.7.8.2. Mexico Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.7.9. Rest of Latin America

- 6.7.9.1. Rest of Latin America Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.7.9.2. Rest of Latin America Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.7.1. Latin America Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.8. The Middle-East and Africa

- 6.8.1. The Middle-East and Africa Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.8.1.1. The Middle-East and Africa Aerospace Plastics Market, by Country, 2016 – 2026 (USD Million)

- 6.8.2. The Middle-East and Africa Market, 2016 – 2026 (Kilo Tons)

- 6.8.2.1. The Middle-East and Africa Aerospace Plastics Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.8.3. The Middle-East and Africa Aerospace Plastics Market, by Pulymer Type, 2016 – 2026

- 6.8.3.1. The Middle-East and Africa Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (USD Million)

- 6.8.3.2. The Middle-East and Africa Aerospace Plastics Market, by Pulymer Type, 2016 – 2026 (Kilo Tons)

- 6.8.4. The Middle-East and Africa Aerospace Plastics Market, by Aircraft Type, 2016 – 2026

- 6.8.4.1. The Middle-East and Africa Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 6.8.4.2. The Middle-East and Africa Aerospace Plastics Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 6.8.5. The Middle-East and Africa Aerospace Plastics Market, by Fit, 2016 – 2026

- 6.8.5.1. The Middle-East and Africa Aerospace Plastics Market, by Fit, 2016 – 2026 (USD Million)

- 6.8.5.2. The Middle-East and Africa Aerospace Plastics Market, by Fit, 2016 – 2026 (Kilo Tons)

- 6.8.6. The Middle-East and Africa Aerospace Plastics Market, by Application, 2016 – 2026

- 6.8.6.1. The Middle-East and Africa Aerospace Plastics Market, by Application, 2016 – 2026 (USD Million)

- 6.8.6.2. The Middle-East and Africa Aerospace Plastics Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.8.7. GCC Countries

- 6.8.7.1. GCC Countries Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.8.7.2. GCC Countries Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.8.8. South Africa

- 6.8.8.1. South Africa Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.8.8.2. South Africa Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.8.9. Rest of Middle-East Africa

- 6.8.9.1. Rest of Middle-East Africa Aerospace Plastics Market, 2016 – 2026 (USD Million)

- 6.8.9.2. Rest of Middle-East Africa Aerospace Plastics Market, 2016 – 2026 (Kilo Tons)

- 6.8.1. The Middle-East and Africa Aerospace Plastics Market, 2016 – 2026 (USD Million)

- Chapter 7 Aerospace Plastics Production, Consumption, Export, Import by Regions

- 7.1. Global Aerospace Plastics Production and Consumption, 2016 – 2026 (Kilo Tons)

- 7.2. Global Import and Export Analysis, by Region

- Chapter 8 Aerospace Plastics Market – Competitive Landscape

- 8.1. Competitor Market Share – Revenue

- 8.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 8.3. Competitor Market Share – Vulume

- 8.4. Strategic Developments

- 8.4.1. Acquisitions and Mergers

- 8.4.2. New Products

- 8.4.3. Research & Development Activities

- Chapter 9 Company Profiles

- 9.1. Saudi Basic Industries Corporation (SABIC)

- 9.1.1. Company Overview

- 9.1.2. Product/Service Portfulio

- 9.1.3. Saudi Basic Industries Corporation (SABIC) Sales, Revenue, Price, and Gross Margin

- 9.1.4. Saudi Basic Industries Corporation (SABIC) Revenue and Growth Rate

- 9.1.5. Saudi Basic Industries Corporation (SABIC) Market Share

- 9.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.2. Victrex Plc

- 9.2.1. Company Overview

- 9.2.2. Product/Service Portfulio

- 9.2.3. Victrex Plc Sales, Revenue, Price, and Gross Margin

- 9.2.4. Victrex Plc Revenue and Growth Rate

- 9.2.5. Victrex Plc Market Share

- 9.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.3. Drake Plastics Ltd

- 9.3.1. Company Overview

- 9.3.2. Product/Service Portfulio

- 9.3.3. Drake Plastics Ltd Sales, Revenue, Price, and Gross Margin

- 9.3.4. Drake Plastics Ltd Revenue and Growth Rate

- 9.3.5. Drake Plastics Ltd Market Share

- 9.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.4. Sulvay

- 9.4.1. Company Overview

- 9.4.2. Product/Service Portfulio

- 9.4.3. Sulvay Sales, Revenue, Price, and Gross Margin

- 9.4.4. Sulvay Revenue and Growth Rate

- 9.4.5. Sulvay Market Share

- 9.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.5. BASF SE

- 9.5.1. Company Overview

- 9.5.2. Product/Service Portfulio

- 9.5.3. BASF SE Sales, Revenue, Price, and Gross Margin

- 9.5.4. BASF SE Revenue and Growth Rate

- 9.5.5. BASF SE Market Share

- 9.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.6. Evonik Industries AG

- 9.6.1. Company Overview

- 9.6.2. Product/Service Portfulio

- 9.6.3. Evonik Industries AG Sales, Revenue, Price, and Gross Margin

- 9.6.4. Evonik Industries AG Revenue and Growth Rate

- 9.6.5. Evonik Industries AG Market Share

- 9.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.7. Vantage Plane Plastics

- 9.7.1. Company Overview

- 9.7.2. Product/Service Portfulio

- 9.7.3. Vantage Plane Plastics Sales, Revenue, Price, and Gross Margin

- 9.7.4. Vantage Plane Plastics Revenue and Growth Rate

- 9.7.5. Vantage Plane Plastics Market Share

- 9.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.8. Quadrant Engineering Plastics

- 9.8.1. Company Overview

- 9.8.2. Product/Service Portfulio

- 9.8.3. Quadrant Engineering Plastics Sales, Revenue, Price, and Gross Margin

- 9.8.4. Quadrant Engineering Plastics Revenue and Growth Rate

- 9.8.5. Quadrant Engineering Plastics Market Share

- 9.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.9. PACO Plastics & Engineering Inc.

- 9.9.1. Company Overview

- 9.9.2. Product/Service Portfulio

- 9.9.3. PACO Plastics & Engineering Inc. Sales, Revenue, Price, and Gross Margin

- 9.9.4. PACO Plastics & Engineering Inc. Revenue and Growth Rate

- 9.9.5. PACO Plastics & Engineering Inc. Market Share

- 9.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.10. 3P - Performance Plastics Products

- 9.10.1. Company Overview

- 9.10.2. Product/Service Portfulio

- 9.10.3. 3P - Performance Plastics Products Sales, Revenue, Price, and Gross Margin

- 9.10.4. 3P - Performance Plastics Products Revenue and Growth Rate

- 9.10.5. 3P - Performance Plastics Products Market Share

- 9.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.11. Pulyflour Plastics

- 9.11.1. Company Overview

- 9.11.2. Product/Service Portfulio

- 9.11.3. Pulyflour Plastics Sales, Revenue, Price, and Gross Margin

- 9.11.4. Pulyflour Plastics Revenue and Growth Rate

- 9.11.5. Pulyflour Plastics Market Share

- 9.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.12. Big Bear Plastics

- 9.12.1. Company Overview

- 9.12.2. Product/Service Portfulio

- 9.12.3. Big Bear Plastics Sales, Revenue, Price, and Gross Margin

- 9.12.4. Big Bear Plastics Revenue and Growth Rate

- 9.12.5. Big Bear Plastics Market Share

- 9.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.13. Grafix Plastics

- 9.13.1. Company Overview

- 9.13.2. Product/Service Portfulio

- 9.13.3. Grafix Plastics Sales, Revenue, Price, and Gross Margin

- 9.13.4. Grafix Plastics Revenue and Growth Rate

- 9.13.5. Grafix Plastics Market Share

- 9.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.14. Loar Group

- 9.14.1. Company Overview

- 9.14.2. Product/Service Portfulio

- 9.14.3. Loar Group Sales, Revenue, Price, and Gross Margin

- 9.14.4. Loar Group Revenue and Growth Rate

- 9.14.5. Loar Group Market Share

- 9.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.15. Zeus

- 9.15.1. Company Overview

- 9.15.2. Product/Service Portfulio

- 9.15.3. Zeus Sales, Revenue, Price, and Gross Margin

- 9.15.4. Zeus Revenue and Growth Rate

- 9.15.5. Zeus Market Share

- 9.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.16. Curbell Plastics

- 9.16.1. Company Overview

- 9.16.2. Product/Service Portfulio

- 9.16.3. Curbell Plastics Sales, Revenue, Price, and Gross Margin

- 9.16.4. Curbell Plastics Revenue and Growth Rate

- 9.16.5. Curbell Plastics Market Share

- 9.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.17. Ensinger GmbH

- 9.17.1. Company Overview

- 9.17.2. Product/Service Portfulio

- 9.17.3. Ensinger GmbH Sales, Revenue, Price, and Gross Margin

- 9.17.4. Ensinger GmbH Revenue and Growth Rate

- 9.17.5. Ensinger GmbH Market Share

- 9.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.18. Hyosung Corporation

- 9.18.1. Company Overview

- 9.18.2. Product/Service Portfulio

- 9.18.3. Hyosung Corporation Sales, Revenue, Price, and Gross Margin

- 9.18.4. Hyosung Corporation Revenue and Growth Rate

- 9.18.5. Hyosung Corporation Market Share

- 9.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.19. Kaman Corporation

- 9.19.1. Company Overview

- 9.19.2. Product/Service Portfulio

- 9.19.3. Kaman Corporation Sales, Revenue, Price, and Gross Margin

- 9.19.4. Kaman Corporation Revenue and Growth Rate

- 9.19.5. Kaman Corporation Market Share

- 9.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.20. Mitsubishi Heavy Industries Limited (MHI)

- 9.20.1. Company Overview

- 9.20.2. Product/Service Portfulio

- 9.20.3. Mitsubishi Heavy Industries Limited (MHI) Sales, Revenue, Price, and Gross Margin

- 9.20.4. Mitsubishi Heavy Industries Limited (MHI) Revenue and Growth Rate

- 9.20.5. Mitsubishi Heavy Industries Limited (MHI) Market Share

- 9.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.21. Premium AEROTECH

- 9.21.1. Company Overview

- 9.21.2. Product/Service Portfulio

- 9.21.3. Premium AEROTECH Sales, Revenue, Price, and Gross Margin

- 9.21.4. Premium AEROTECH Revenue and Growth Rate

- 9.21.5. Premium AEROTECH Market Share

- 9.21.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.22. SGL Carbon

- 9.22.1. Company Overview

- 9.22.2. Product/Service Portfulio

- 9.22.3. SGL Carbon Sales, Revenue, Price, and Gross Margin

- 9.22.4. SGL Carbon Revenue and Growth Rate

- 9.22.5. SGL Carbon Market Share

- 9.22.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.23. Toray Industries, Inc.

- 9.23.1. Company Overview

- 9.23.2. Product/Service Portfulio

- 9.23.3. Toray Industries, Inc. Sales, Revenue, Price, and Gross Margin

- 9.23.4. Toray Industries, Inc. Revenue and Growth Rate

- 9.23.5. Toray Industries, Inc. Market Share

- 9.23.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.24. Hulding Company “Composite”

- 9.24.1. Company Overview

- 9.24.2. Product/Service Portfulio

- 9.24.3. Hulding Company “Composite” Sales, Revenue, Price, and Gross Margin

- 9.24.4. Hulding Company “Composite” Revenue and Growth Rate

- 9.24.5. Hulding Company “Composite” Market Share

- 9.24.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.25. Hexcel Corporation

- 9.25.1. Company Overview

- 9.25.2. Product/Service Portfulio

- 9.25.3. Hexcel Corporation Sales, Revenue, Price, and Gross Margin

- 9.25.4. Hexcel Corporation Revenue and Growth Rate

- 9.25.5. Hexcel Corporation Market Share

- 9.25.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.26. Teijin Limited

- 9.26.1. Company Overview

- 9.26.2. Product/Service Portfulio

- 9.26.3. Teijin Limited Sales, Revenue, Price, and Gross Margin

- 9.26.4. Teijin Limited Revenue and Growth Rate

- 9.26.5. Teijin Limited Market Share

- 9.26.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.1. Saudi Basic Industries Corporation (SABIC)

- Chapter 10 Aerospace Plastics — Industry Analysis

- 10.1. Introduction and Taxonomy

- 10.2. Aerospace Plastics Market – Key Trends

- 10.2.1. Market Drivers

- 10.2.2. Market Restraints

- 10.2.3. Market Opportunities

- 10.3. Value Chain Analysis

- 10.4. Key Mandates and Regulations

- 10.5. Technulogy Roadmap and Timeline

- 10.6. Aerospace Plastics Market – Attractiveness Analysis

- 10.6.1. By Pulymer Type

- 10.6.2. By Aircraft Type

- 10.6.3. By Fit

- 10.6.4. By Application

- 10.6.5. By Region

- Chapter 11 Raw Material Analysis

- 11.1. Aerospace Plastics Key Raw Material Analysis

- 11.1.1. Key Raw Materials

- 11.1.2. Price Trend of Key Raw Materials

- 11.2. Key Suppliers of Raw Materials

- 11.3. Proportion of Manufacturing Cost Structure

- 11.3.1. Raw Materials Cost

- 11.3.2. Labor Cost

- 11.3.3. Manufacturing Expenses

- 11.3.4. Miscellaneous Expenses

- 11.4. Manufacturing Cost Analysis of Aerospace Plastics

- 11.1. Aerospace Plastics Key Raw Material Analysis

- Chapter 12 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 12.1. Aerospace Plastics Industrial Chain Analysis

- 12.2. Upstream Raw Materials Sourcing

- 12.2.1. Risk Mitigation:

- 12.2.2. Supplier Relationships:

- 12.2.3. Business Processes:

- 12.2.4. Securing the Product:

- 12.3. Raw Materials Sources of Aerospace Plastics Major Manufacturers

- 12.4. Downstream Buyers

- 12.5. Distributors/Traders List

- Chapter 13 Marketing Strategy Analysis, Distributors

- 13.1. Marketing Channel

- 13.2. Direct Marketing

- 13.3. Indirect Marketing

- 13.4. Marketing Channel Development Trends

- 13.5. Economic/Pulitical Environmental Change

- Chapter 14 Report Conclusion & Key Insights

- 14.1. Key Insights from Primary Interviews & Surveys Respondents

- 14.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 15 Research Approach & Methodulogy

- 15.1. Report Description

- 15.2. Research Scope

- 15.3. Research Methodulogy

- 15.3.1. Secondary Research

- 15.3.2. Primary Research

- 15.3.3. Statistical Models

- 15.3.3.1. Company Share Analysis Model

- 15.3.3.2. Revenue Based Modeling

- 15.3.4. Research Limitations

Inquiry For Buying

Aerospace Plastics

Request Sample

Aerospace Plastics