Agricultural Enzymes Market Size, Share, and Trends Analysis Report

CAGR :

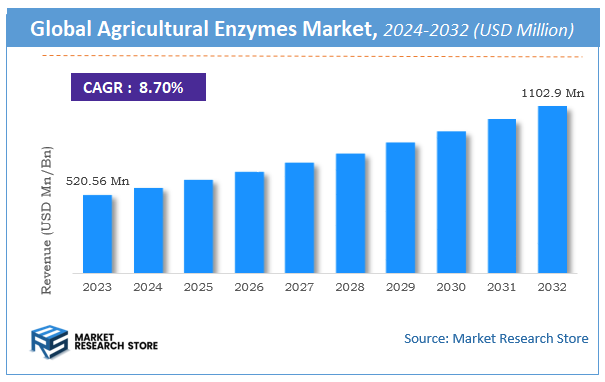

| Market Size 2023 (Base Year) | USD 520.56 Million |

| Market Size 2032 (Forecast Year) | USD 1102.9 Million |

| CAGR | 8.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Agricultural Enzymes Market Insights

According to Market Research Store, the global agricultural enzymes market size was valued at around USD 520.56 million in 2023 and is estimated to reach USD 1102.9 million by 2032, to register a CAGR of approximately 8.7% in terms of revenue during the forecast period 2024-2032.

The agricultural enzymes report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Agricultural Enzymes Market: Overview

Agricultural enzymes are specialized proteins that act as biological catalysts to enhance soil fertility and support crop growth by accelerating biochemical reactions in the soil and plant systems. These enzymes help decompose organic matter, improve nutrient availability, and promote efficient nutrient uptake by crops. Common types include phosphatases, proteases, ureases, and cellulases, each playing a specific role in breaking down compounds like phosphates, proteins, urea, and cellulose. Unlike synthetic agrochemicals, agricultural enzymes are eco-friendly and support sustainable farming practices by improving soil health, reducing dependency on chemical fertilizers, and increasing crop yield and quality.

Key Highlights

- The agricultural enzymes market is anticipated to grow at a CAGR of 8.7% during the forecast period.

- The global agricultural enzymes market was estimated to be worth approximately USD 520.56 million in 2023 and is projected to reach a value of USD 1102.9 million by 2032.

- The growth of the agricultural enzymes market is being driven by increasing demand for sustainable and organic farming practices.

- Based on the type, the phosphatases segment is growing at a high rate and is projected to dominate the market.

- On the basis of crop type, the cereals & grains segment is projected to swipe the largest market share.

- In terms of function, the soil fertility segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Agricultural Enzymes Market: Dynamics

Key Growth Drivers:

- Rising Demand for Organic Farming: The increasing consumer preference for chemical-free, organic produce is driving the use of bio-based agricultural inputs like enzymes that promote sustainable farming.

- Soil Fertility Improvement: Agricultural enzymes enhance nutrient availability and decomposition of organic matter in the soil, improving soil health and boosting crop yields.

- Increased Adoption of Precision Farming: Modern farming techniques increasingly rely on enzyme-based solutions for specific, targeted soil and crop needs, improving productivity and efficiency.

- Environmental Concerns with Chemical Fertilizers: Enzymes are gaining traction as safer alternatives to synthetic fertilizers and pesticides, which often harm ecosystems and soil quality.

Restraints:

- High Production Costs of Enzyme Products: The manufacturing and formulation of agricultural enzymes are relatively expensive, making them cost-prohibitive for small-scale farmers.

- Limited Awareness Among Farmers: In many developing regions, farmers lack knowledge about the benefits and application of enzyme-based agricultural products, hindering widespread adoption.

- Short Shelf Life and Storage Issues: Some agricultural enzymes are sensitive to temperature and moisture, which can reduce their efficacy if not stored properly.

Opportunities:

- Technological Advancements in Biotechnology: Innovations in enzyme engineering and microbial technology are enabling the development of more effective and stable agricultural enzyme formulations.

- Expanding Demand in Emerging Markets: Growing agricultural activity in countries across Asia-Pacific, Latin America, and Africa presents significant opportunities for enzyme adoption.

- Government Support for Sustainable Agriculture: Policy incentives, subsidies, and awareness programs promoting bio-agriculture are encouraging farmers to switch to enzyme-based solutions.

Challenges:

- Regulatory Hurdles in Product Approval: The introduction of new enzyme products often faces lengthy and complex approval processes, delaying market entry.

- Inconsistent Product Performance: Environmental factors such as pH, soil type, and climate can affect the efficiency of enzymes, leading to variable field results.

- Competitive Pressure from Conventional Products: Traditional agrochemicals remain dominant in many markets due to lower cost and widespread familiarity, limiting enzyme penetration.

Agricultural Enzymes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agricultural Enzymes Market |

| Market Size in 2023 | USD 520.56 Million |

| Market Forecast in 2032 | USD 1102.9 Million |

| Growth Rate | CAGR of 8.7% |

| Number of Pages | 160 |

| Key Companies Covered | Syngenta AG, DuPont, Bioworks, Inc., Bayer AG, Stoller USA, Inc., Deepak Fertilisers, Camson Bio Technologies Limited, Lonza Group, Bioresource International, Inc., Novozymes A/S, BASF SE, Koninklijke DSM N.V., Agri Life, Monsanto Company, AB Enzymes, Aries Agro Limited, Agrinos AS, and Chr. Hansen among others |

| Segments Covered | By Type, By Product Type, By Crop Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Agricultural Enzymes Market: Segmentation Insights

The global agricultural enzymes market is divided by type, crop type, function, and region.

Based on type, the global agricultural enzymes market is divided into phosphates, proteases, dehydrogenases, and others. Phosphatases are the most dominant segment due to their crucial role in enhancing phosphorus availability in the soil. These enzymes break down organic phosphorus compounds into inorganic forms that plants can easily absorb, improving root development and overall plant growth. Phosphatases are widely used across various crop types and soil conditions, making them the most commercially valuable and widely adopted enzyme type in agriculture. Proteases hold the second-largest share in the market. These enzymes facilitate the breakdown of protein-based organic matter in the soil into amino acids and simpler nitrogen compounds. This enhances nitrogen availability and uptake by plants, promoting healthier and faster crop growth.

On the basis of crop type, the global agricultural enzymes market is bifurcated into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. Cereals & grains represent the most dominant crop type segment due to their large-scale cultivation and critical role in global food security. Enzymes are widely applied in crops like wheat, rice, maize, and barley to improve nutrient availability, boost plant growth, and increase yield. The high demand for staple foods across regions and the need to enhance productivity from limited arable land have driven the adoption of enzyme-based solutions in cereal and grain farming. Oilseeds & pulses follow as the second most significant segment. Crops such as soybeans, canola, and lentils benefit from enzyme applications that enhance nitrogen fixation and improve protein synthesis. Enzymes support better root development and microbial activity in the soil, which is especially beneficial for legumes.

Based on function, the global agricultural enzymes market is divided into soil fertility and growth promoters. Soil fertility is the most dominant functional segment, as enzymes play a crucial role in enhancing soil health by improving nutrient cycling, organic matter decomposition, and microbial activity. Enzymes such as phosphatases, ureases, and dehydrogenases help release essential nutrients like phosphorus, nitrogen, and potassium from organic compounds, making them more accessible to plants. This leads to better root development, improved soil structure, and higher nutrient use efficiency, which is vital for sustainable farming and long-term productivity. Growth promoters form the second key functional segment, where enzymes support overall plant health by stimulating metabolic processes and enhancing resistance to environmental stress. These enzymes contribute to faster germination, stronger shoot and root growth, and improved flowering and fruiting. They are especially beneficial in organic and precision farming, where minimal chemical input is preferred.

Agricultural Enzymes Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the agricultural enzymes market, primarily due to the widespread adoption of sustainable agricultural practices and the high penetration of advanced farming technologies. The United States leads the region, with strong government support for organic farming, the presence of major enzyme manufacturers, and early adoption of biotech solutions. Farmers in North America are increasingly using enzyme-based products to improve soil fertility, crop yields, and environmental sustainability, making it the most mature and commercially active market for agricultural enzymes.

Europe holds the second-largest share in the agricultural enzymes market, driven by strict environmental regulations, strong advocacy for organic farming, and high consumer demand for chemical-free produce. Countries like Germany, France, and the Netherlands are at the forefront of promoting bio-based agricultural inputs. European Union policies that encourage sustainable farming, along with continuous research in enzyme technology, are further supporting the region’s growth. The well-established organic food industry also plays a key role in boosting enzyme application in European agriculture.

Asia Pacific is an emerging and rapidly growing market for agricultural enzymes, led by countries such as China, India, and Australia. The region's large agricultural base, increasing awareness of soil health, and growing population demanding higher food production are key growth drivers. Governments in the region are promoting eco-friendly farming techniques to reduce chemical usage, which is fostering the adoption of enzyme-based inputs. Despite being a developing market, APAC is gaining traction quickly due to its untapped potential and increasing investment in sustainable agricultural innovations.

Latin America shows moderate growth in the agricultural enzymes market, with countries like Brazil and Argentina making notable strides in adopting biological inputs in farming. The region has vast agricultural land and is a major producer of crops like soybeans and corn, offering a sizable opportunity for enzyme applications. However, limited awareness and relatively slow regulatory progress hinder more widespread adoption. With growing export demands and a gradual shift toward sustainable practices, the region is likely to gain momentum in the near future.

Agricultural Enzymes Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the agricultural enzymes market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global agricultural enzymes market include:

- Syngenta AG

- DuPont

- Bioworks Inc.

- Bayer AG

- Stoller USA Inc.

- Deepak Fertilisers

- Camson Bio Technologies Limited

- Lonza Group

- Bioresource International Inc.

- Novozymes A/S

- BASF SE

- Koninklijke DSM N.V.

- Agri Life

- Monsanto Company

- AB Enzymes

- Aries Agro Limited

- Agrinos AS

- Chr. Hansen

The global agricultural enzymes market is segmented as follows:

By Type

- Phosphates

- Proteases

- Dehydrogenases

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Function

- Soil Fertility

- Growth Promoters

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Agricultural Enzymes

- 1.2. Global Agricultural Enzymes Market, 2019 & 2026 (USD Million)

- 1.3. Global Agricultural Enzymes Market, 2016 – 2026 (USD Million) (Kilo Tons)

- 1.4. Global Agricultural Enzymes Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Agricultural Enzymes Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Agricultural Enzymes Market – Type Analysis

- 2.1. Global Agricultural Enzymes Market – Type Overview

- 2.2. Global Agricultural Enzymes Market Share, by Type, 2019 & 2026 (USD Million)

- 2.3. Global Agricultural Enzymes Market share, by Type, 2019 & 2026 (Kilo Tons)

- 2.4. Phosphatases

- 2.4.1. Global Phosphatases Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 2.4.2. Global Phosphatases Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 2.5. Dehydrogenases

- 2.5.1. Global Dehydrogenases Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Dehydrogenases Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 2.6. Proteases

- 2.6.1. Global Proteases Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 2.6.2. Global Proteases Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 2.7. Sulfatases

- 2.7.1. Global Sulfatases Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 2.7.2. Global Sulfatases Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 2.8. Others

- 2.8.1. Global Others Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 2.8.2. Global Others Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- Chapter 3 Agricultural Enzymes Market – Product Type Analysis

- 3.1. Global Agricultural Enzymes Market – Product Type Overview

- 3.2. Global Agricultural Enzymes Market Share, by Product Type, 2019 & 2026 (USD Million)

- 3.3. Global Agricultural Enzymes Market share, by Product Type, 2019 & 2026 (Kilo Tons)

- 3.4. Soil Fertility Products

- 3.4.1. Global Soil Fertility Products Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 3.4.2. Global Soil Fertility Products Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 3.5. Growth Enhancing Products

- 3.5.1. Global Growth Enhancing Products Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 3.5.2. Global Growth Enhancing Products Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 3.6. Contrul Products

- 3.6.1. Global Contrul Products Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Contrul Products Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- Chapter 4 Agricultural Enzymes Market – Crop Type Analysis

- 4.1. Global Agricultural Enzymes Market – Crop Type Overview

- 4.2. Global Agricultural Enzymes Market Share, by Crop Type, 2019 & 2026 (USD Million)

- 4.3. Global Agricultural Enzymes Market share, by Crop Type, 2019 & 2026 (Kilo Tons)

- 4.4. Cereals & Grains

- 4.4.1. Global Cereals & Grains Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Cereals & Grains Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 4.5. Fruits & Vegetables

- 4.5.1. Global Fruits & Vegetables Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 4.5.2. Global Fruits & Vegetables Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 4.6. Oilseeds & Pulses

- 4.6.1. Global Oilseeds & Pulses Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 4.6.2. Global Oilseeds & Pulses Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 4.7. Turfs & Ornamentals

- 4.7.1. Global Turfs & Ornamentals Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 4.7.2. Global Turfs & Ornamentals Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 4.8. Others

- 4.8.1. Global Others Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 4.8.2. Global Others Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- Chapter 5 Agricultural Enzymes Market – Regional Analysis

- 5.1. Global Agricultural Enzymes Market Regional Overview

- 5.2. Global Agricultural Enzymes Market Share, by Region, 2019 & 2026 (USD Million)

- 5.3. Global Agricultural Enzymes Market Share, by Region, 2019 & 2026 (Kilo Tons)

- 5.4. North America

- 5.4.1. North America Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.4.1.1. North America Agricultural Enzymes Market, by Country, 2016 – 2026 (USD Million)

- 5.4.2. North America Market, 2016 – 2026 (Kilo Tons)

- 5.4.2.1. North America Agricultural Enzymes Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.4.3. North America Agricultural Enzymes Market, by Type, 2016 – 2026

- 5.4.3.1. North America Agricultural Enzymes Market, by Type, 2016 – 2026 (USD Million)

- 5.4.3.2. North America Agricultural Enzymes Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.4.4. North America Agricultural Enzymes Market, by Product Type, 2016 – 2026

- 5.4.4.1. North America Agricultural Enzymes Market, by Product Type, 2016 – 2026 (USD Million)

- 5.4.4.2. North America Agricultural Enzymes Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.4.5. North America Agricultural Enzymes Market, by Crop Type, 2016 – 2026

- 5.4.5.1. North America Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (USD Million)

- 5.4.5.2. North America Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (Kilo Tons)

- 5.4.6. U.S.

- 5.4.6.1. U.S. Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.4.6.2. U.S. Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.4.7. Canada

- 5.4.7.1. Canada Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.4.7.2. Canada Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.4.1. North America Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5. Europe

- 5.5.1. Europe Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5.1.1. Europe Agricultural Enzymes Market, by Country, 2016 – 2026 (USD Million)

- 5.5.2. Europe Market, 2016 – 2026 (Kilo Tons)

- 5.5.2.1. Europe Agricultural Enzymes Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.5.3. Europe Agricultural Enzymes Market, by Type, 2016 – 2026

- 5.5.3.1. Europe Agricultural Enzymes Market, by Type, 2016 – 2026 (USD Million)

- 5.5.3.2. Europe Agricultural Enzymes Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.5.4. Europe Agricultural Enzymes Market, by Product Type, 2016 – 2026

- 5.5.4.1. Europe Agricultural Enzymes Market, by Product Type, 2016 – 2026 (USD Million)

- 5.5.4.2. Europe Agricultural Enzymes Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.5.5. Europe Agricultural Enzymes Market, by Crop Type, 2016 – 2026

- 5.5.5.1. Europe Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (USD Million)

- 5.5.5.2. Europe Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (Kilo Tons)

- 5.5.6. Germany

- 5.5.6.1. Germany Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5.6.2. Germany Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.5.7. France

- 5.5.7.1. France Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5.7.2. France Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.5.8. U.K.

- 5.5.8.1. U.K. Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5.8.2. U.K. Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.5.9. Italy

- 5.5.9.1. Italy Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5.9.2. Italy Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.5.10. Spain

- 5.5.10.1. Spain Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5.10.2. Spain Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.5.11. Rest of Europe

- 5.5.11.1. Rest of Europe Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.5.11.2. Rest of Europe Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.5.1. Europe Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6. Asia Pacific

- 5.6.1. Asia Pacific Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6.1.1. Asia Pacific Agricultural Enzymes Market, by Country, 2016 – 2026 (USD Million)

- 5.6.2. Asia Pacific Market, 2016 – 2026 (Kilo Tons)

- 5.6.2.1. Asia Pacific Agricultural Enzymes Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.6.3. Asia Pacific Agricultural Enzymes Market, by Type, 2016 – 2026

- 5.6.3.1. Asia Pacific Agricultural Enzymes Market, by Type, 2016 – 2026 (USD Million)

- 5.6.3.2. Asia Pacific Agricultural Enzymes Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.6.4. Asia Pacific Agricultural Enzymes Market, by Product Type, 2016 – 2026

- 5.6.4.1. Asia Pacific Agricultural Enzymes Market, by Product Type, 2016 – 2026 (USD Million)

- 5.6.4.2. Asia Pacific Agricultural Enzymes Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.6.5. Asia Pacific Agricultural Enzymes Market, by Crop Type, 2016 – 2026

- 5.6.5.1. Asia Pacific Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (USD Million)

- 5.6.5.2. Asia Pacific Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (Kilo Tons)

- 5.6.6. China

- 5.6.6.1. China Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6.6.2. China Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.6.7. Japan

- 5.6.7.1. Japan Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6.7.2. Japan Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.6.8. India

- 5.6.8.1. India Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6.8.2. India Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.6.9. South Korea

- 5.6.9.1. South Korea Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6.9.2. South Korea Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.6.10. South-East Asia

- 5.6.10.1. South-East Asia Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6.10.2. South-East Asia Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.6.11. Rest of Asia Pacific

- 5.6.11.1. Rest of Asia Pacific Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.6.11.2. Rest of Asia Pacific Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.6.1. Asia Pacific Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.7. Latin America

- 5.7.1. Latin America Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.7.1.1. Latin America Agricultural Enzymes Market, by Country, 2016 – 2026 (USD Million)

- 5.7.2. Latin America Market, 2016 – 2026 (Kilo Tons)

- 5.7.2.1. Latin America Agricultural Enzymes Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.7.3. Latin America Agricultural Enzymes Market, by Type, 2016 – 2026

- 5.7.3.1. Latin America Agricultural Enzymes Market, by Type, 2016 – 2026 (USD Million)

- 5.7.3.2. Latin America Agricultural Enzymes Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.7.4. Latin America Agricultural Enzymes Market, by Product Type, 2016 – 2026

- 5.7.4.1. Latin America Agricultural Enzymes Market, by Product Type, 2016 – 2026 (USD Million)

- 5.7.4.2. Latin America Agricultural Enzymes Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.7.5. Latin America Agricultural Enzymes Market, by Crop Type, 2016 – 2026

- 5.7.5.1. Latin America Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (USD Million)

- 5.7.5.2. Latin America Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (Kilo Tons)

- 5.7.6. Brazil

- 5.7.6.1. Brazil Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.7.6.2. Brazil Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.7.7. Mexico

- 5.7.7.1. Mexico Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.7.7.2. Mexico Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.7.8. Rest of Latin America

- 5.7.8.1. Rest of Latin America Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.7.8.2. Rest of Latin America Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.7.1. Latin America Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.8. The Middle-East and Africa

- 5.8.1. The Middle-East and Africa Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.8.1.1. The Middle-East and Africa Agricultural Enzymes Market, by Country, 2016 – 2026 (USD Million)

- 5.8.2. The Middle-East and Africa Market, 2016 – 2026 (Kilo Tons)

- 5.8.2.1. The Middle-East and Africa Agricultural Enzymes Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.8.3. The Middle-East and Africa Agricultural Enzymes Market, by Type, 2016 – 2026

- 5.8.3.1. The Middle-East and Africa Agricultural Enzymes Market, by Type, 2016 – 2026 (USD Million)

- 5.8.3.2. The Middle-East and Africa Agricultural Enzymes Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.8.4. The Middle-East and Africa Agricultural Enzymes Market, by Product Type, 2016 – 2026

- 5.8.4.1. The Middle-East and Africa Agricultural Enzymes Market, by Product Type, 2016 – 2026 (USD Million)

- 5.8.4.2. The Middle-East and Africa Agricultural Enzymes Market, by Product Type, 2016 – 2026 (Kilo Tons)

- 5.8.5. The Middle-East and Africa Agricultural Enzymes Market, by Crop Type, 2016 – 2026

- 5.8.5.1. The Middle-East and Africa Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (USD Million)

- 5.8.5.2. The Middle-East and Africa Agricultural Enzymes Market, by Crop Type, 2016 – 2026 (Kilo Tons)

- 5.8.6. GCC Countries

- 5.8.6.1. GCC Countries Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.8.6.2. GCC Countries Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.8.7. South Africa

- 5.8.7.1. South Africa Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.8.7.2. South Africa Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.8.8. Rest of Middle-East Africa

- 5.8.8.1. Rest of Middle-East Africa Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- 5.8.8.2. Rest of Middle-East Africa Agricultural Enzymes Market, 2016 – 2026 (Kilo Tons)

- 5.8.1. The Middle-East and Africa Agricultural Enzymes Market, 2016 – 2026 (USD Million)

- Chapter 6 Agricultural Enzymes Production, Consumption, Export, Import by Regions

- 6.1. Global Agricultural Enzymes Production and Consumption, 2016 – 2026 (Kilo Tons)

- 6.2. Global Import and Export Analysis, by Region

- Chapter 7 Agricultural Enzymes Market – Competitive Landscape

- 7.1. Competitor Market Share – Revenue

- 7.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 7.3. Competitor Market Share – Vulume

- 7.4. Strategic Developments

- 7.4.1. Acquisitions and Mergers

- 7.4.2. New Products

- 7.4.3. Research & Development Activities

- Chapter 8 Company Profiles

- 8.1. Novozymes A/S

- 8.1.1. Company Overview

- 8.1.2. Product/Service Portfulio

- 8.1.3. Novozymes A/S Sales, Revenue, Price, and Gross Margin

- 8.1.4. Novozymes A/S Revenue and Growth Rate

- 8.1.5. Novozymes A/S Market Share

- 8.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.2. Syngenta AG

- 8.2.1. Company Overview

- 8.2.2. Product/Service Portfulio

- 8.2.3. Syngenta AG Sales, Revenue, Price, and Gross Margin

- 8.2.4. Syngenta AG Revenue and Growth Rate

- 8.2.5. Syngenta AG Market Share

- 8.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.3. BASF SE

- 8.3.1. Company Overview

- 8.3.2. Product/Service Portfulio

- 8.3.3. BASF SE Sales, Revenue, Price, and Gross Margin

- 8.3.4. BASF SE Revenue and Growth Rate

- 8.3.5. BASF SE Market Share

- 8.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.4. DuPont

- 8.4.1. Company Overview

- 8.4.2. Product/Service Portfulio

- 8.4.3. DuPont Sales, Revenue, Price, and Gross Margin

- 8.4.4. DuPont Revenue and Growth Rate

- 8.4.5. DuPont Market Share

- 8.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.5. Koninklijke DSM N.V.

- 8.5.1. Company Overview

- 8.5.2. Product/Service Portfulio

- 8.5.3. Koninklijke DSM N.V. Sales, Revenue, Price, and Gross Margin

- 8.5.4. Koninklijke DSM N.V. Revenue and Growth Rate

- 8.5.5. Koninklijke DSM N.V. Market Share

- 8.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.6. Bioworks, Inc.

- 8.6.1. Company Overview

- 8.6.2. Product/Service Portfulio

- 8.6.3. Bioworks, Inc. Sales, Revenue, Price, and Gross Margin

- 8.6.4. Bioworks, Inc. Revenue and Growth Rate

- 8.6.5. Bioworks, Inc. Market Share

- 8.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.7. Agri Life

- 8.7.1. Company Overview

- 8.7.2. Product/Service Portfulio

- 8.7.3. Agri Life Sales, Revenue, Price, and Gross Margin

- 8.7.4. Agri Life Revenue and Growth Rate

- 8.7.5. Agri Life Market Share

- 8.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.8. Bayer AG

- 8.8.1. Company Overview

- 8.8.2. Product/Service Portfulio

- 8.8.3. Bayer AG Sales, Revenue, Price, and Gross Margin

- 8.8.4. Bayer AG Revenue and Growth Rate

- 8.8.5. Bayer AG Market Share

- 8.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.9. Monsanto Company

- 8.9.1. Company Overview

- 8.9.2. Product/Service Portfulio

- 8.9.3. Monsanto Company Sales, Revenue, Price, and Gross Margin

- 8.9.4. Monsanto Company Revenue and Growth Rate

- 8.9.5. Monsanto Company Market Share

- 8.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.10. Stuller USA, Inc.

- 8.10.1. Company Overview

- 8.10.2. Product/Service Portfulio

- 8.10.3. Stuller USA, Inc. Sales, Revenue, Price, and Gross Margin

- 8.10.4. Stuller USA, Inc. Revenue and Growth Rate

- 8.10.5. Stuller USA, Inc. Market Share

- 8.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.11. AB Enzymes

- 8.11.1. Company Overview

- 8.11.2. Product/Service Portfulio

- 8.11.3. AB Enzymes Sales, Revenue, Price, and Gross Margin

- 8.11.4. AB Enzymes Revenue and Growth Rate

- 8.11.5. AB Enzymes Market Share

- 8.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.12. Deepak Fertilisers

- 8.12.1. Company Overview

- 8.12.2. Product/Service Portfulio

- 8.12.3. Deepak Fertilisers Sales, Revenue, Price, and Gross Margin

- 8.12.4. Deepak Fertilisers Revenue and Growth Rate

- 8.12.5. Deepak Fertilisers Market Share

- 8.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.13. Aries Agro Limited

- 8.13.1. Company Overview

- 8.13.2. Product/Service Portfulio

- 8.13.3. Aries Agro Limited Sales, Revenue, Price, and Gross Margin

- 8.13.4. Aries Agro Limited Revenue and Growth Rate

- 8.13.5. Aries Agro Limited Market Share

- 8.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.14. Camson Bio Technulogies Limited

- 8.14.1. Company Overview

- 8.14.2. Product/Service Portfulio

- 8.14.3. Camson Bio Technulogies Limited Sales, Revenue, Price, and Gross Margin

- 8.14.4. Camson Bio Technulogies Limited Revenue and Growth Rate

- 8.14.5. Camson Bio Technulogies Limited Market Share

- 8.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.15. Agrinos AS

- 8.15.1. Company Overview

- 8.15.2. Product/Service Portfulio

- 8.15.3. Agrinos AS Sales, Revenue, Price, and Gross Margin

- 8.15.4. Agrinos AS Revenue and Growth Rate

- 8.15.5. Agrinos AS Market Share

- 8.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.16. Lonza Group

- 8.16.1. Company Overview

- 8.16.2. Product/Service Portfulio

- 8.16.3. Lonza Group Sales, Revenue, Price, and Gross Margin

- 8.16.4. Lonza Group Revenue and Growth Rate

- 8.16.5. Lonza Group Market Share

- 8.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.17. Chr. Hansen

- 8.17.1. Company Overview

- 8.17.2. Product/Service Portfulio

- 8.17.3. Chr. Hansen Sales, Revenue, Price, and Gross Margin

- 8.17.4. Chr. Hansen Revenue and Growth Rate

- 8.17.5. Chr. Hansen Market Share

- 8.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.18. Bioresource International, Inc.

- 8.18.1. Company Overview

- 8.18.2. Product/Service Portfulio

- 8.18.3. Bioresource International, Inc. Sales, Revenue, Price, and Gross Margin

- 8.18.4. Bioresource International, Inc. Revenue and Growth Rate

- 8.18.5. Bioresource International, Inc. Market Share

- 8.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.1. Novozymes A/S

- Chapter 9 Agricultural Enzymes — Industry Analysis

- 9.1. Introduction and Taxonomy

- 9.2. Agricultural Enzymes Market – Key Trends

- 9.2.1. Market Drivers

- 9.2.2. Market Restraints

- 9.2.3. Market Opportunities

- 9.3. Value Chain Analysis

- 9.4. Key Mandates and Regulations

- 9.5. Technulogy Roadmap and Timeline

- 9.6. Agricultural Enzymes Market – Attractiveness Analysis

- 9.6.1. By Type

- 9.6.2. By Product Type

- 9.6.3. By Crop Type

- 9.6.4. By Region

- Chapter 10 Raw Material Analysis

- 10.1. Agricultural Enzymes Key Raw Material Analysis

- 10.1.1. Key Raw Materials

- 10.1.2. Price Trend of Key Raw Materials

- 10.2. Key Suppliers of Raw Materials

- 10.3. Proportion of Manufacturing Cost Structure

- 10.3.1. Raw Materials Cost

- 10.3.2. Labor Cost

- 10.3.3. Manufacturing Expenses

- 10.3.4. Miscellaneous Expenses

- 10.4. Manufacturing Cost Analysis of Agricultural Enzymes

- 10.1. Agricultural Enzymes Key Raw Material Analysis

- Chapter 11 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 11.1. Agricultural Enzymes Industrial Chain Analysis

- 11.2. Upstream Raw Materials Sourcing

- 11.2.1. Risk Mitigation:

- 11.2.2. Supplier Relationships:

- 11.2.3. Business Processes:

- 11.2.4. Securing the Product:

- 11.3. Raw Materials Sources of Agricultural Enzymes Major Manufacturers

- 11.4. Downstream Buyers

- 11.5. Distributors/Traders List

- Chapter 12 Marketing Strategy Analysis, Distributors

- 12.1. Marketing Channel

- 12.2. Direct Marketing

- 12.3. Indirect Marketing

- 12.4. Marketing Channel Development Trends

- 12.5. Economic/Pulitical Environmental Change

- Chapter 13 Report Conclusion & Key Insights

- 13.1. Key Insights from Primary Interviews & Surveys Respondents

- 13.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 14 Research Approach & Methodulogy

- 14.1. Report Description

- 14.2. Research Scope

- 14.3. Research Methodulogy

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.3.3. Statistical Models

- 14.3.3.1. Company Share Analysis Model

- 14.3.3.2. Revenue Based Modeling

- 14.3.4. Research Limitations

Inquiry For Buying

Agricultural Enzymes

Request Sample

Agricultural Enzymes