Agriculture Tire Market Size, Share, and Trends Analysis Report

CAGR :

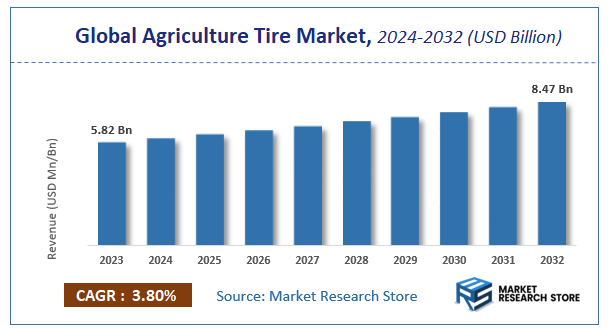

| Market Size 2023 (Base Year) | USD 5.82 Billion |

| Market Size 2032 (Forecast Year) | USD 8.47 Billion |

| CAGR | 3.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Agriculture Tire Market Insights

A latest report by Market Research Store estimates that the Global Agriculture Tire Market was valued at USD 5.82 Billion in 2023 and is expected to reach USD 8.47 Billion by 2032, with a CAGR of 3.8% during the forecast period 2024-2032. The report Agriculture Tire Market overview, growth factors, restraints, opportunities, segmentation, key developments, competitive landscape, consumer insights, and market growth forecast in terms of value or volume. These structured details offer an all-inclusive market overview, providing valuable insights for investment decisions, business decisions, strategic planning, and competitive analysis.

To Get more Insights, Request a Free Sample

Agriculture Tire Market: Overview

The growth of the agriculture tire market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The agriculture tire market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the agriculture tire market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, Application, Sales Channel, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global agriculture tire market is estimated to grow annually at a CAGR of around 3.8% over the forecast period (2024-2032).

- In terms of revenue, the global agriculture tire market size was valued at around USD 5.82 Billion in 2023 and is projected to reach USD 8.47 Billion by 2032.

- The market is projected to grow at a significant rate due to increasing mechanization in farming, rising demand for high-efficiency tires, growth in agricultural output, and the need for durable and fuel-efficient tire solutions.

- Based on the Type, the Bias Tires segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Tractors segment is anticipated to command the largest market share.

- In terms of Sales Channel, the OEM segment is projected to lead the global market.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Agriculture Tire Market: Report Scope

This report thoroughly analyzes the agriculture tire market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Agriculture Tire Market |

| Market Size in 2023 | USD 5.82 Billion |

| Market Forecast in 2032 | USD 8.47 Billion |

| Growth Rate | CAGR of 3.8% |

| Number of Pages | 185 |

| Key Companies Covered | Bridgestone Corp., Continental AG, Balakrishna Industries Limited, Titan International Inc., Trelleborg AB, Michelin, Nokian Tyres PLC, Pirelli & C SpA, Alliance Tire Group, and Apollo Tyres, Brunswick Corporation |

| Segments Covered | By Type, By Application, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Agriculture Tire Market: Dynamics

Key Growth Drivers

The Agriculture Tire market in India is experiencing significant growth driven by the increasing mechanization of agricultural practices across the country to improve efficiency and productivity. The rising adoption of tractors, combine harvesters, and other farm equipment necessitates a growing demand for agriculture tires. Furthermore, the government's focus on increasing agricultural output and providing subsidies for farm machinery further encourages the adoption of modern equipment and consequently, tires. The growing awareness among farmers about the benefits of using specialized tires designed for specific applications, such as improved traction, reduced soil compaction, and enhanced load-bearing capacity, is also contributing to market expansion. The increasing availability of credit and financing options for agricultural machinery makes it easier for farmers to invest in new equipment and the associated tires.

Restraints

Despite the positive growth drivers, the Agriculture Tire market in India faces certain restraints. The fragmented nature of the agricultural sector with a large number of small and marginal farmers, many of whom have limited purchasing power, can restrict the demand for premium or specialized tires. Price sensitivity among farmers often leads to a preference for cheaper, lower-quality tires, impacting the market share of established brands offering more durable and technologically advanced products. The seasonality of agricultural activities can lead to fluctuating demand for tires throughout the year. Furthermore, the availability and affordability of retreading services for agriculture tires can extend the lifespan of existing tires, reducing the need for new purchases. Inadequate road infrastructure in rural areas can lead to faster wear and tear of tires, but might not necessarily translate to increased demand for premium tires if cost remains the primary concern.

Opportunities

The Agriculture Tire market in India presents numerous opportunities for innovation and expansion. The increasing adoption of precision agriculture techniques and the use of advanced farm machinery create a demand for specialized tires with features like variable inflation pressure (VF) technology to optimize performance and minimize soil compaction. The development of more durable and longer-lasting tire compounds can appeal to farmers seeking better value for their investment. Furthermore, the growing focus on sustainable agriculture can drive demand for tires made with eco-friendly materials and designs that minimize environmental impact. The potential for offering value-added services such as on-farm tire maintenance, repair, and replacement can enhance customer loyalty. The expansion of the aftermarket for agriculture tires also provides opportunities for retreading services and the sale of replacement parts.

Challenges

The Agriculture Tire market in India faces challenges related to educating farmers about the long-term benefits of investing in higher-quality and application-specific tires despite the higher initial cost. Ensuring the availability of the right tire sizes and types across the diverse agricultural regions of India, with varying soil conditions and farming practices, requires a robust distribution network. Furthermore, combating the sale of counterfeit or low-quality tires that do not meet safety and performance standards is crucial for protecting farmers and the reputation of established brands. Keeping pace with the technological advancements in agricultural machinery and developing tires that can optimize the performance of these advanced implements requires continuous research and development. Finally, managing the supply chain and logistics to ensure timely delivery of tires, especially during peak agricultural seasons, can be a significant hurdle in a geographically vast country like India.

Agriculture Tire Market: Segmentation Insights

The global agriculture tire market is segmented based on Type, Application, Sales Channel, and Region. All the segments of the agriculture tire market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global agriculture tire market is divided into Bias Tires, Radial Tires.

On the basis of Application, the global agriculture tire market is bifurcated into Tractors, Combine Harvesters, Sprayers, Trailers, Loaders, Others.

In terms of Sales Channel, the global agriculture tire market is categorized into OEM, Aftermarket.

Agriculture Tire Market: Regional Insights

North America dominates the global Agriculture Tire Market, holding the largest revenue share (37.1% in 2024) and is projected to maintain its lead through 2033, driven by advanced mechanization, high farm consolidation, and robust government support for sustainable farming practices 410. The U.S. accounts for 87.64% of the regional market, fueled by large-scale precision farming, demand for high-performance radial tires, and subsidies promoting modern equipment like GPS-enabled tractors. Key players like Michelin and Bridgestone leverage technological innovations (e.g., low-compaction designs) to cater to the region’s focus on soil health and fuel efficiency.

Asia-Pacific emerges as the fastest-growing region (CAGR 7.33% by 2025), led by India and China, where government initiatives (e.g., India’s "Housing for All") and rubber production hubs drive demand for cost-effective bias tires 210. However, North America’s dominance is reinforced by higher adoption of radial tires (63% of sales) and stringent regulations like California’s emissions standards influencing tire design. Challenges include raw material volatility, but opportunities lie in smart tires with IoT integration, aligning with the region’s push for precision agriculture.

Key Trend: Continental’s exit from the ag tire market by 2025 highlights shifting competitive dynamics, with North American firms like Titan International expanding R&D in sustainable materials

Agriculture Tire Market: Competitive Landscape

The agriculture tire market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Agriculture Tire Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Bridgestone Corp.

- Continental AG

- Balakrishna Industries Limited

- Titan International Inc.

- Trelleborg AB

- Michelin

- Nokian Tyres PLC

- Pirelli & C SpA

- Alliance Tire Group

- and Apollo Tyres

- Brunswick Corporation

The Global Agriculture Tire Market is Segmented as Follows:

By Type

- Bias Tires

- Radial Tires

By Application

- Tractors

- Combine Harvesters

- Sprayers

- Trailers

- Loaders

- Others

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Evolution

This section evaluates the market position of the product or service by examining its development pathway and competitive dynamics. It provides a detailed overview of the product's growth stages, including the early (historical) phase, the mid-stage, and anticipated future advancements influenced by innovation and emerging technologies.

Porter’s Analysis

Porter’s Five Forces framework offers a strategic lens for assessing competitor behavior and the positioning of key players in the agriculture tire industry. This section explores the external factors shaping competitive dynamics and influencing market strategies in the years ahead. The analysis focuses on five critical forces:

- Competitive Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Supplier Bargaining Power

- Buyer Bargaining Power

Value Chain & Market Attractiveness Analysis

The value chain analysis helps businesses optimize operations by mapping the product flow from suppliers to end consumers, identifying opportunities to streamline processes and gain a competitive edge. Segment-wise market attractiveness analysis evaluates key dimensions like product categories, demographics, and regions, assessing growth potential, market size, and profitability. This enables businesses to focus resources on high-potential segments for better ROI and long-term value.

PESTEL Analysis

PESTEL analysis is a powerful tool in market research reports that enhances market understanding by systematically examining the external macro-environmental factors influencing a business or industry. The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors. By evaluating these dimensions, PESTEL analysis provides a comprehensive overview of the broader context within which a market operates, helping businesses identify potential opportunities and threats.

- Political factors assess government policies, stability, trade regulations, and political risks that could impact market operations.

- Economic factors examine variables like inflation, exchange rates, economic growth, and consumer spending power to determine market viability.

- Social factors explore cultural trends, demographics, and lifestyle changes that shape consumer behavior and preferences.

- Technological factors evaluate innovation, R&D, and technological advancements affecting product development and operational efficiencies.

- Environmental factors focus on sustainability, climate change impacts, and eco-friendly practices shaping market trends.

- Legal factors address compliance requirements, industry regulations, and intellectual property laws impacting market entry and operations.

Import-export Analysis & Pricing Analysis

An import-export analysis is vital for market research, revealing global trade dynamics, trends, and opportunities. It examines trade volumes, product categories, and regional competitiveness, offering insights into supply chains and market demand. This section also analyzes past and future pricing trends, helping businesses optimize strategies and enabling consumers to assess product value effectively.

Agriculture Tire Market: Company Profiles

The report identifies key players in the agriculture tire market through a competitive landscape and company profiles, evaluating their offerings, financial performance, strategies, and market positioning. It includes a SWOT analysis of the top 3-5 companies, assessing strengths, weaknesses, opportunities, and threats. The competitive landscape highlights rankings, recent activities (mergers, acquisitions, partnerships, product launches), and regional footprints using the Ace matrix. Customization is available to meet client-specific needs.

Regional & Industry Footprint

This section details the geographic reach, sales networks, and market penetration of companies profiled in the agriculture tire report, showcasing their operations and distribution across regions. It analyzes the alignment of companies with specific industry verticals, highlighting the industries they serve and the scope of their products and services within those sectors.

Ace Matrix

This section categorizes companies into four distinct groups—Active, Cutting Edge, Innovator, and Emerging—based on their product and business strategies. The evaluation of product strategy focuses on aspects such as the range and depth of offerings, commitment to innovation, product functionalities, and scalability. Key elements like global reach, sector coverage, strategic acquisitions, and long-term growth plans are considered for business strategy. This analysis provides a detailed view of companies' position within the market and highlights their potential for future growth and development.

Research Methodology

The qualitative and quantitative insights for the agriculture tire market are derived through a multi-faceted research approach, combining input from subject matter experts, primary research, and secondary data sources. Primary research includes gathering critical information via face-to-face or telephonic interviews, surveys, questionnaires, and feedback from industry professionals, key opinion leaders (KOLs), and customers. Regular interviews with industry experts are conducted to deepen the analysis and reinforce the existing data, ensuring a robust and well-rounded market understanding.

Secondary research for this report was carried out by the Market Research Store team, drawing on a variety of authoritative sources, such as:

- Official company websites, annual reports, financial statements, investor presentations, and SEC filings

- Internal and external proprietary databases, as well as relevant patent and regulatory databases

- Government publications, national statistical databases, and industry-specific market reports

- Media coverage, including news articles, press releases, and webcasts about market participants

- Paid industry databases for detailed market insights

Market Research Store conducted in-depth consultations with various key opinion leaders in the industry, including senior executives from top companies and regional leaders from end-user organizations. This effort aimed to gather critical insights on factors such as the market share of dominant brands in specific countries and regions, along with pricing strategies for products and services.

To determine total sales data, the research team conducted primary interviews across multiple countries with influential stakeholders, including:

- Distributors

- Marketing, Brand, and Product Managers

- Procurement and Production Managers

- Sales and Regional Sales Managers, Country Managers

- Technical Specialists

- C-Level Executives

These subject matter experts, with their extensive industry experience, helped validate and refine the findings. For secondary research, data was sourced from a wide range of materials, including online resources, company annual reports, industry publications, research papers, association reports, and government websites. These various sources provide a comprehensive and well-rounded perspective on the market.

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Agriculture Tire Market Share by Type (2020-2026) 1.5.2 Tractor Tires 1.5.3 Other Tires 1.6 Market by Application 1.6.1 Global Agriculture Tire Market Share by Application (2020-2026) 1.6.2 Replacement Agriculture Tires 1.6.3 OEM Agriculture Tires 1.7 Agriculture Tire Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Agriculture Tire Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Agriculture Tire Market 3.1 Value Chain Status 3.2 Agriculture Tire Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Agriculture Tire 3.2.3 Labor Cost of Agriculture Tire 3.2.3.1 Labor Cost of Agriculture Tire Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Apollo Tyres Ltd. 4.1.1 Apollo Tyres Ltd. Basic Information 4.1.2 Agriculture Tire Product Profiles, Application and Specification 4.1.3 Apollo Tyres Ltd. Agriculture Tire Market Performance (2015-2020) 4.1.4 Apollo Tyres Ltd. Business Overview 4.2 Pirelli & C. S.p.A. 4.2.1 Pirelli & C. S.p.A. Basic Information 4.2.2 Agriculture Tire Product Profiles, Application and Specification 4.2.3 Pirelli & C. S.p.A. Agriculture Tire Market Performance (2015-2020) 4.2.4 Pirelli & C. S.p.A. Business Overview 4.3 Continental Aktiengesellschaft 4.3.1 Continental Aktiengesellschaft Basic Information 4.3.2 Agriculture Tire Product Profiles, Application and Specification 4.3.3 Continental Aktiengesellschaft Agriculture Tire Market Performance (2015-2020) 4.3.4 Continental Aktiengesellschaft Business Overview 4.4 Bridgestone Corporation 4.4.1 Bridgestone Corporation Basic Information 4.4.2 Agriculture Tire Product Profiles, Application and Specification 4.4.3 Bridgestone Corporation Agriculture Tire Market Performance (2015-2020) 4.4.4 Bridgestone Corporation Business Overview 4.5 Titan Tire Corporation 4.5.1 Titan Tire Corporation Basic Information 4.5.2 Agriculture Tire Product Profiles, Application and Specification 4.5.3 Titan Tire Corporation Agriculture Tire Market Performance (2015-2020) 4.5.4 Titan Tire Corporation Business Overview 4.6 Trelleborg AB 4.6.1 Trelleborg AB Basic Information 4.6.2 Agriculture Tire Product Profiles, Application and Specification 4.6.3 Trelleborg AB Agriculture Tire Market Performance (2015-2020) 4.6.4 Trelleborg AB Business Overview 4.7 The Yokohama Rubber Co., Ltd. 4.7.1 The Yokohama Rubber Co., Ltd. Basic Information 4.7.2 Agriculture Tire Product Profiles, Application and Specification 4.7.3 The Yokohama Rubber Co., Ltd. Agriculture Tire Market Performance (2015-2020) 4.7.4 The Yokohama Rubber Co., Ltd. Business Overview 4.8 Prometeon Tyre Group S.r.l. 4.8.1 Prometeon Tyre Group S.r.l. Basic Information 4.8.2 Agriculture Tire Product Profiles, Application and Specification 4.8.3 Prometeon Tyre Group S.r.l. Agriculture Tire Market Performance (2015-2020) 4.8.4 Prometeon Tyre Group S.r.l. Business Overview 4.9 The Goodyear Tire & Rubber Company 4.9.1 The Goodyear Tire & Rubber Company Basic Information 4.9.2 Agriculture Tire Product Profiles, Application and Specification 4.9.3 The Goodyear Tire & Rubber Company Agriculture Tire Market Performance (2015-2020) 4.9.4 The Goodyear Tire & Rubber Company Business Overview 4.10 Hankook Tire Co. Ltd. 4.10.1 Hankook Tire Co. Ltd. Basic Information 4.10.2 Agriculture Tire Product Profiles, Application and Specification 4.10.3 Hankook Tire Co. Ltd. Agriculture Tire Market Performance (2015-2020) 4.10.4 Hankook Tire Co. Ltd. Business Overview 4.11 Balkrishna Industries Limited 4.11.1 Balkrishna Industries Limited Basic Information 4.11.2 Agriculture Tire Product Profiles, Application and Specification 4.11.3 Balkrishna Industries Limited Agriculture Tire Market Performance (2015-2020) 4.11.4 Balkrishna Industries Limited Business Overview 4.12 Sumitomo Rubber Industries, Ltd. 4.12.1 Sumitomo Rubber Industries, Ltd. Basic Information 4.12.2 Agriculture Tire Product Profiles, Application and Specification 4.12.3 Sumitomo Rubber Industries, Ltd. Agriculture Tire Market Performance (2015-2020) 4.12.4 Sumitomo Rubber Industries, Ltd. Business Overview 5 Global Agriculture Tire Market Analysis by Regions 5.1 Global Agriculture Tire Sales, Revenue and Market Share by Regions 5.1.1 Global Agriculture Tire Sales by Regions (2015-2020) 5.1.2 Global Agriculture Tire Revenue by Regions (2015-2020) 5.2 North America Agriculture Tire Sales and Growth Rate (2015-2020) 5.3 Europe Agriculture Tire Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Agriculture Tire Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Agriculture Tire Sales and Growth Rate (2015-2020) 5.6 South America Agriculture Tire Sales and Growth Rate (2015-2020) 6 North America Agriculture Tire Market Analysis by Countries 6.1 North America Agriculture Tire Sales, Revenue and Market Share by Countries 6.1.1 North America Agriculture Tire Sales by Countries (2015-2020) 6.1.2 North America Agriculture Tire Revenue by Countries (2015-2020) 6.1.3 North America Agriculture Tire Market Under COVID-19 6.2 United States Agriculture Tire Sales and Growth Rate (2015-2020) 6.2.1 United States Agriculture Tire Market Under COVID-19 6.3 Canada Agriculture Tire Sales and Growth Rate (2015-2020) 6.4 Mexico Agriculture Tire Sales and Growth Rate (2015-2020) 7 Europe Agriculture Tire Market Analysis by Countries 7.1 Europe Agriculture Tire Sales, Revenue and Market Share by Countries 7.1.1 Europe Agriculture Tire Sales by Countries (2015-2020) 7.1.2 Europe Agriculture Tire Revenue by Countries (2015-2020) 7.1.3 Europe Agriculture Tire Market Under COVID-19 7.2 Germany Agriculture Tire Sales and Growth Rate (2015-2020) 7.2.1 Germany Agriculture Tire Market Under COVID-19 7.3 UK Agriculture Tire Sales and Growth Rate (2015-2020) 7.3.1 UK Agriculture Tire Market Under COVID-19 7.4 France Agriculture Tire Sales and Growth Rate (2015-2020) 7.4.1 France Agriculture Tire Market Under COVID-19 7.5 Italy Agriculture Tire Sales and Growth Rate (2015-2020) 7.5.1 Italy Agriculture Tire Market Under COVID-19 7.6 Spain Agriculture Tire Sales and Growth Rate (2015-2020) 7.6.1 Spain Agriculture Tire Market Under COVID-19 7.7 Russia Agriculture Tire Sales and Growth Rate (2015-2020) 7.7.1 Russia Agriculture Tire Market Under COVID-19 8 Asia-Pacific Agriculture Tire Market Analysis by Countries 8.1 Asia-Pacific Agriculture Tire Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Agriculture Tire Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Agriculture Tire Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Agriculture Tire Market Under COVID-19 8.2 China Agriculture Tire Sales and Growth Rate (2015-2020) 8.2.1 China Agriculture Tire Market Under COVID-19 8.3 Japan Agriculture Tire Sales and Growth Rate (2015-2020) 8.3.1 Japan Agriculture Tire Market Under COVID-19 8.4 South Korea Agriculture Tire Sales and Growth Rate (2015-2020) 8.4.1 South Korea Agriculture Tire Market Under COVID-19 8.5 Australia Agriculture Tire Sales and Growth Rate (2015-2020) 8.6 India Agriculture Tire Sales and Growth Rate (2015-2020) 8.6.1 India Agriculture Tire Market Under COVID-19 8.7 Southeast Asia Agriculture Tire Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Agriculture Tire Market Under COVID-19 9 Middle East and Africa Agriculture Tire Market Analysis by Countries 9.1 Middle East and Africa Agriculture Tire Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Agriculture Tire Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Agriculture Tire Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Agriculture Tire Market Under COVID-19 9.2 Saudi Arabia Agriculture Tire Sales and Growth Rate (2015-2020) 9.3 UAE Agriculture Tire Sales and Growth Rate (2015-2020) 9.4 Egypt Agriculture Tire Sales and Growth Rate (2015-2020) 9.5 Nigeria Agriculture Tire Sales and Growth Rate (2015-2020) 9.6 South Africa Agriculture Tire Sales and Growth Rate (2015-2020) 10 South America Agriculture Tire Market Analysis by Countries 10.1 South America Agriculture Tire Sales, Revenue and Market Share by Countries 10.1.1 South America Agriculture Tire Sales by Countries (2015-2020) 10.1.2 South America Agriculture Tire Revenue by Countries (2015-2020) 10.1.3 South America Agriculture Tire Market Under COVID-19 10.2 Brazil Agriculture Tire Sales and Growth Rate (2015-2020) 10.2.1 Brazil Agriculture Tire Market Under COVID-19 10.3 Argentina Agriculture Tire Sales and Growth Rate (2015-2020) 10.4 Columbia Agriculture Tire Sales and Growth Rate (2015-2020) 10.5 Chile Agriculture Tire Sales and Growth Rate (2015-2020) 11 Global Agriculture Tire Market Segment by Types 11.1 Global Agriculture Tire Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Agriculture Tire Sales and Market Share by Types (2015-2020) 11.1.2 Global Agriculture Tire Revenue and Market Share by Types (2015-2020) 11.2 Tractor Tires Sales and Price (2015-2020) 11.3 Other Tires Sales and Price (2015-2020) 12 Global Agriculture Tire Market Segment by Applications 12.1 Global Agriculture Tire Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Agriculture Tire Sales and Market Share by Applications (2015-2020) 12.1.2 Global Agriculture Tire Revenue and Market Share by Applications (2015-2020) 12.2 Replacement Agriculture Tires Sales, Revenue and Growth Rate (2015-2020) 12.3 OEM Agriculture Tires Sales, Revenue and Growth Rate (2015-2020) 13 Agriculture Tire Market Forecast by Regions (2020-2026) 13.1 Global Agriculture Tire Sales, Revenue and Growth Rate (2020-2026) 13.2 Agriculture Tire Market Forecast by Regions (2020-2026) 13.2.1 North America Agriculture Tire Market Forecast (2020-2026) 13.2.2 Europe Agriculture Tire Market Forecast (2020-2026) 13.2.3 Asia-Pacific Agriculture Tire Market Forecast (2020-2026) 13.2.4 Middle East and Africa Agriculture Tire Market Forecast (2020-2026) 13.2.5 South America Agriculture Tire Market Forecast (2020-2026) 13.3 Agriculture Tire Market Forecast by Types (2020-2026) 13.4 Agriculture Tire Market Forecast by Applications (2020-2026) 13.5 Agriculture Tire Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Agriculture Tire

Request Sample

Agriculture Tire