Alkyl Benzo Sulfonate Market Size, Share, and Trends Analysis Report

CAGR :

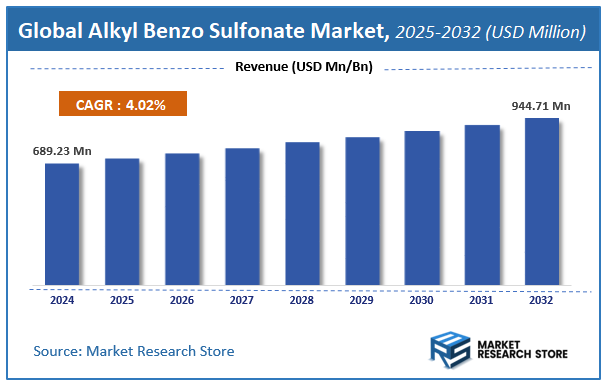

| Market Size 2024 (Base Year) | USD 689.23 Million |

| Market Size 2032 (Forecast Year) | USD 944.71 Million |

| CAGR | 4.02% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global alkyl benzo sulfonate market, estimating its value at USD 689.23 Million in 2024, with projections indicating it will reach USD 944.71 Million by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 4.02% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the alkyl benzo sulfonate industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Alkyl Benzo Sulfonate Market: Overview

The growth of the alkyl benzo sulfonate market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The alkyl benzo sulfonate market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the alkyl benzo sulfonate market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Product Type, Application, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global alkyl benzo sulfonate market is estimated to grow annually at a CAGR of around 4.02% over the forecast period (2025-2032).

- In terms of revenue, the global alkyl benzo sulfonate market size was valued at around USD 689.23 Million in 2024 and is projected to reach USD 944.71 Million by 2032.

- The market is projected to grow at a significant rate due to Growing demand in household detergents, rising applications in industrial cleaning, and increasing use in personal care products are driving the Alkyl Benzo Sulfonate market.

- Based on the Product Type, the Linear Alkyl Benzo Sulfonate segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Detergents and Cleaners segment is anticipated to command the largest market share.

- In terms of End-User, the Household segment is projected to lead the global market.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Alkyl Benzo Sulfonate Market: Report Scope

This report thoroughly analyzes the alkyl benzo sulfonate market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Alkyl Benzo Sulfonate Market |

| Market Size in 2024 | USD 689.23 Million |

| Market Forecast in 2032 | USD 944.71 Million |

| Growth Rate | CAGR of 4.02% |

| Number of Pages | 238 |

| Key Companies Covered | Stepan Company, BASF SE, Clariant AG, Croda International Plc, Evonik Industries AG, Huntsman Corporation, Solvay S.A., Kao Corporation, Galaxy Surfactants Ltd., Sasol Limited, Dow Chemical Company, Akzo Nobel N.V., Arkema Group, Ashland Global Holdings Inc., Lonza Group, Lubrizol Corporation, Pilot Chemical Company |

| Segments Covered | By Product Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Alkyl Benzo Sulfonate Market: Dynamics

Key Growth Drivers :

The Alkyl Benzene Sulfonate (ABS) market is experiencing significant growth primarily driven by the expanding global demand for detergents, cleaning products, and various industrial applications. ABS, particularly Linear Alkyl Benzene Sulfonate (LABS), is one of the most widely used anionic surfactants due to its excellent detergency, wetting, and emulsifying properties, making it an indispensable component in laundry detergents, dishwashing liquids, and industrial cleaners. The rapid urbanization and increasing disposable incomes in emerging economies fuel the consumption of household and personal care products, directly boosting the demand for ABS. Furthermore, its cost-effectiveness compared to some alternative surfactants, coupled with its proven performance, ensures its continued dominance in many formulations. The growing demand from the textile industry for scouring and dyeing agents, and from the agricultural sector for emulsifiers in pesticides, also contributes significantly to market expansion.

Restraints :

Despite its widespread utility, the Alkyl Benzene Sulfonate (ABS) market faces several notable restraints. A primary challenge is the stringent environmental regulations concerning the biodegradability of surfactants. While LABS is considered readily biodegradable, its predecessor, Branched Alkyl Benzene Sulfonate (BABS), was highly recalcitrant, and ongoing environmental scrutiny pushes for even greener alternatives or stricter discharge limits. The price volatility of crude oil and its derivatives, which are key raw materials for alkyl benzene (the precursor to ABS), can directly impact production costs and overall market stability. Furthermore, intense competition from alternative surfactants, including fatty alcohol sulfates, alpha-olefin sulfonates, and bio-based surfactants, which are often marketed as more environmentally friendly or specialized, can limit ABS market share growth. The health and safety concerns associated with the handling of certain raw materials and the manufacturing process, though managed with strict protocols, can also pose operational challenges.

Opportunities :

The Alkyl Benzene Sulfonate (ABS) market presents several compelling opportunities for growth and innovation. The continuous development of advanced LABS grades with enhanced performance attributes, such as improved cold-water solubility, better foam control, or increased biodegradability, can open new application areas and strengthen its position in existing markets. The expansion of the household and personal care sectors in rapidly developing economies, where millions are gaining access to modern cleaning products for the first time, offers vast untapped market potential. Research and development into novel synthetic routes for ABS that are more environmentally benign or utilize bio-based feedstocks could provide long-term sustainability advantages. Furthermore, the increasing demand for industrial cleaners, including those for institutional, commercial, and manufacturing applications, driven by hygiene and maintenance standards, ensures a steady demand for cost-effective and high-performance surfactants like ABS. The integration of ABS into complex multi-component formulations that require precise surfactant properties also creates opportunities for specialized product offerings.

Challenges :

The Alkyl Benzene Sulfonate (ABS) market also confronts several critical challenges that demand continuous innovation and strategic adaptation. One key challenge is ensuring compliance with evolving and increasingly stringent environmental regulations regarding biodegradability and chemical safety, which requires continuous investment in R&D and process optimization. Managing the supply chain and price volatility of key petrochemical feedstocks, such as benzene and linear paraffins, is crucial for maintaining cost-competitiveness in a highly price-sensitive market. The need to continuously innovate and differentiate ABS products from a wide array of alternative surfactants, particularly those positioned as "green" or "natural," is essential to maintain market share. Furthermore, fierce competition among major ABS producers, often leading to overcapacity in certain regions, can exert downward pressure on pricing and profit margins, making cost efficiency and scale of production critical for market players.

Alkyl Benzo Sulfonate Market: Segmentation Insights

The global alkyl benzo sulfonate market is segmented based on Product Type, Application, End-User, and Region. All the segments of the alkyl benzo sulfonate market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Product Type, the global alkyl benzo sulfonate market is divided into Linear Alkyl Benzo Sulfonate, Branched Alkyl Benzo Sulfonate.

On the basis of Application, the global alkyl benzo sulfonate market is bifurcated into Detergents and Cleaners, Personal Care Products, Industrial Applications, Others.

In terms of End-User, the global alkyl benzo sulfonate market is categorized into Household, Industrial, Institutional.

Alkyl Benzo Sulfonate Market: Regional Insights

The Asia-Pacific region, led by China, is the dominant force in the global alkyl benzo sulfonate market. This leadership is driven by the region's massive and growing detergent and cleaning products industry, which consumes alkyl benzo sulfonate as a key surfactant. The presence of large-scale chemical manufacturing facilities, cost-competitive production, and strong domestic demand from both household and industrial cleaning sectors solidify Asia-Pacific's position as the largest producer and consumer globally.

Alkyl Benzo Sulfonate Market: Competitive Landscape

The alkyl benzo sulfonate market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Alkyl Benzo Sulfonate Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Stepan Company

- BASF SE

- Clariant AG

- Croda International Plc

- Evonik Industries AG

- Huntsman Corporation

- Solvay S.A.

- Kao Corporation

- Galaxy Surfactants Ltd.

- Sasol Limited

- Dow Chemical Company

- Akzo Nobel N.V.

- Arkema Group

- Ashland Global Holdings Inc.

- Lonza Group

- Lubrizol Corporation

- Pilot Chemical Company

The Global Alkyl Benzo Sulfonate Market is Segmented as Follows:

By Product Type

- Linear Alkyl Benzo Sulfonate

- Branched Alkyl Benzo Sulfonate

By Application

- Detergents and Cleaners

- Personal Care Products

- Industrial Applications

- Others

By End-User

- Household

- Industrial

- Institutional

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Alkyl Benzo Sulfonate Market Share by Type (2020-2026) 1.5.2 Hard 1.5.3 Soft 1.6 Market by Application 1.6.1 Global Alkyl Benzo Sulfonate Market Share by Application (2020-2026) 1.6.2 Textile Industry 1.6.3 Electroplating Industry 1.7 Alkyl Benzo Sulfonate Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Alkyl Benzo Sulfonate Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Alkyl Benzo Sulfonate Market 3.1 Value Chain Status 3.2 Alkyl Benzo Sulfonate Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Alkyl Benzo Sulfonate 3.2.3 Labor Cost of Alkyl Benzo Sulfonate 3.2.3.1 Labor Cost of Alkyl Benzo Sulfonate Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Cepsa 4.1.1 Cepsa Basic Information 4.1.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.1.3 Cepsa Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.1.4 Cepsa Business Overview 4.2 Unger 4.2.1 Unger Basic Information 4.2.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.2.3 Unger Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.2.4 Unger Business Overview 4.3 HANSA 4.3.1 HANSA Basic Information 4.3.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.3.3 HANSA Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.3.4 HANSA Business Overview 4.4 Solvay 4.4.1 Solvay Basic Information 4.4.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.4.3 Solvay Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.4.4 Solvay Business Overview 4.5 Galil Raw Materials 4.5.1 Galil Raw Materials Basic Information 4.5.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.5.3 Galil Raw Materials Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.5.4 Galil Raw Materials Business Overview 4.6 Pilot Chemical 4.6.1 Pilot Chemical Basic Information 4.6.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.6.3 Pilot Chemical Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.6.4 Pilot Chemical Business Overview 4.7 Chevron Phillips Chemical 4.7.1 Chevron Phillips Chemical Basic Information 4.7.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.7.3 Chevron Phillips Chemical Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.7.4 Chevron Phillips Chemical Business Overview 4.8 Huntsman 4.8.1 Huntsman Basic Information 4.8.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.8.3 Huntsman Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.8.4 Huntsman Business Overview 4.9 Shell 4.9.1 Shell Basic Information 4.9.2 Alkyl Benzo Sulfonate Product Profiles, Application and Specification 4.9.3 Shell Alkyl Benzo Sulfonate Market Performance (2015-2020) 4.9.4 Shell Business Overview 5 Global Alkyl Benzo Sulfonate Market Analysis by Regions 5.1 Global Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Regions 5.1.1 Global Alkyl Benzo Sulfonate Sales by Regions (2015-2020) 5.1.2 Global Alkyl Benzo Sulfonate Revenue by Regions (2015-2020) 5.2 North America Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 5.3 Europe Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 5.6 South America Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 6 North America Alkyl Benzo Sulfonate Market Analysis by Countries 6.1 North America Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Countries 6.1.1 North America Alkyl Benzo Sulfonate Sales by Countries (2015-2020) 6.1.2 North America Alkyl Benzo Sulfonate Revenue by Countries (2015-2020) 6.1.3 North America Alkyl Benzo Sulfonate Market Under COVID-19 6.2 United States Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 6.2.1 United States Alkyl Benzo Sulfonate Market Under COVID-19 6.3 Canada Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 6.4 Mexico Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 7 Europe Alkyl Benzo Sulfonate Market Analysis by Countries 7.1 Europe Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Countries 7.1.1 Europe Alkyl Benzo Sulfonate Sales by Countries (2015-2020) 7.1.2 Europe Alkyl Benzo Sulfonate Revenue by Countries (2015-2020) 7.1.3 Europe Alkyl Benzo Sulfonate Market Under COVID-19 7.2 Germany Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 7.2.1 Germany Alkyl Benzo Sulfonate Market Under COVID-19 7.3 UK Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 7.3.1 UK Alkyl Benzo Sulfonate Market Under COVID-19 7.4 France Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 7.4.1 France Alkyl Benzo Sulfonate Market Under COVID-19 7.5 Italy Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 7.5.1 Italy Alkyl Benzo Sulfonate Market Under COVID-19 7.6 Spain Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 7.6.1 Spain Alkyl Benzo Sulfonate Market Under COVID-19 7.7 Russia Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 7.7.1 Russia Alkyl Benzo Sulfonate Market Under COVID-19 8 Asia-Pacific Alkyl Benzo Sulfonate Market Analysis by Countries 8.1 Asia-Pacific Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Alkyl Benzo Sulfonate Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Alkyl Benzo Sulfonate Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Alkyl Benzo Sulfonate Market Under COVID-19 8.2 China Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 8.2.1 China Alkyl Benzo Sulfonate Market Under COVID-19 8.3 Japan Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 8.3.1 Japan Alkyl Benzo Sulfonate Market Under COVID-19 8.4 South Korea Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 8.4.1 South Korea Alkyl Benzo Sulfonate Market Under COVID-19 8.5 Australia Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 8.6 India Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 8.6.1 India Alkyl Benzo Sulfonate Market Under COVID-19 8.7 Southeast Asia Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Alkyl Benzo Sulfonate Market Under COVID-19 9 Middle East and Africa Alkyl Benzo Sulfonate Market Analysis by Countries 9.1 Middle East and Africa Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Alkyl Benzo Sulfonate Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Alkyl Benzo Sulfonate Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Alkyl Benzo Sulfonate Market Under COVID-19 9.2 Saudi Arabia Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 9.3 UAE Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 9.4 Egypt Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 9.5 Nigeria Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 9.6 South Africa Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 10 South America Alkyl Benzo Sulfonate Market Analysis by Countries 10.1 South America Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Countries 10.1.1 South America Alkyl Benzo Sulfonate Sales by Countries (2015-2020) 10.1.2 South America Alkyl Benzo Sulfonate Revenue by Countries (2015-2020) 10.1.3 South America Alkyl Benzo Sulfonate Market Under COVID-19 10.2 Brazil Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 10.2.1 Brazil Alkyl Benzo Sulfonate Market Under COVID-19 10.3 Argentina Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 10.4 Columbia Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 10.5 Chile Alkyl Benzo Sulfonate Sales and Growth Rate (2015-2020) 11 Global Alkyl Benzo Sulfonate Market Segment by Types 11.1 Global Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Alkyl Benzo Sulfonate Sales and Market Share by Types (2015-2020) 11.1.2 Global Alkyl Benzo Sulfonate Revenue and Market Share by Types (2015-2020) 11.2 Hard Sales and Price (2015-2020) 11.3 Soft Sales and Price (2015-2020) 12 Global Alkyl Benzo Sulfonate Market Segment by Applications 12.1 Global Alkyl Benzo Sulfonate Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Alkyl Benzo Sulfonate Sales and Market Share by Applications (2015-2020) 12.1.2 Global Alkyl Benzo Sulfonate Revenue and Market Share by Applications (2015-2020) 12.2 Textile Industry Sales, Revenue and Growth Rate (2015-2020) 12.3 Electroplating Industry Sales, Revenue and Growth Rate (2015-2020) 13 Alkyl Benzo Sulfonate Market Forecast by Regions (2020-2026) 13.1 Global Alkyl Benzo Sulfonate Sales, Revenue and Growth Rate (2020-2026) 13.2 Alkyl Benzo Sulfonate Market Forecast by Regions (2020-2026) 13.2.1 North America Alkyl Benzo Sulfonate Market Forecast (2020-2026) 13.2.2 Europe Alkyl Benzo Sulfonate Market Forecast (2020-2026) 13.2.3 Asia-Pacific Alkyl Benzo Sulfonate Market Forecast (2020-2026) 13.2.4 Middle East and Africa Alkyl Benzo Sulfonate Market Forecast (2020-2026) 13.2.5 South America Alkyl Benzo Sulfonate Market Forecast (2020-2026) 13.3 Alkyl Benzo Sulfonate Market Forecast by Types (2020-2026) 13.4 Alkyl Benzo Sulfonate Market Forecast by Applications (2020-2026) 13.5 Alkyl Benzo Sulfonate Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Alkyl Benzo Sulfonate

Request Sample

Alkyl Benzo Sulfonate