Automotive fasteners Market Size, Share, and Trends Analysis Report

CAGR :

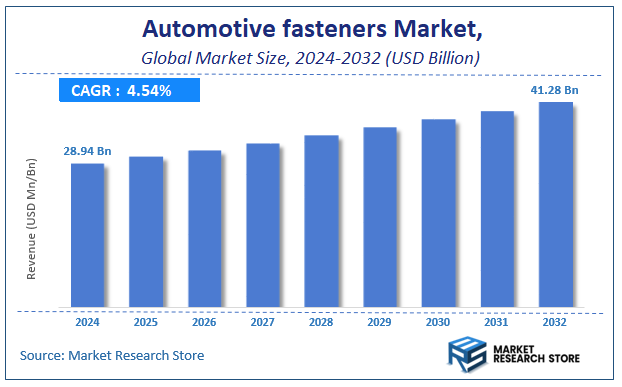

| Market Size 2024 (Base Year) | USD 28.94 Billion |

| Market Size 2032 (Forecast Year) | USD 41.28 Billion |

| CAGR | 4.54% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global automotive fasteners market, estimating its value at USD 28.94 Billion in 2024, with projections indicating it will reach USD 41.28 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 4.54% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the automotive fasteners industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Automotive fasteners Market: Overview

The growth of the automotive fasteners market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The automotive fasteners market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the automotive fasteners market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Application, Type, Materials, End Use, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global automotive fasteners market is estimated to grow annually at a CAGR of around 4.54% over the forecast period (2025-2032).

- In terms of revenue, the global automotive fasteners market size was valued at around USD 28.94 Billion in 2024 and is projected to reach USD 41.28 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing automotive production, increasing demand for durable and lightweight components, and rising aftermarket replacement activities are fueling the Automotive Fasteners market.

- Based on the Application, the Body Structure segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Type, the Bolts segment is anticipated to command the largest market share.

- In terms of Materials, the Steel segment is projected to lead the global market.

- By End Use, the Outlook segment is predicted to dominate the global market.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Automotive fasteners Market: Report Scope

This report thoroughly analyzes the automotive fasteners market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive fasteners Market |

| Market Size in 2024 | USD 28.94 Billion |

| Market Forecast in 2032 | USD 41.28 Billion |

| Growth Rate | CAGR of 4.54% |

| Number of Pages | 223 |

| Key Companies Covered | Warth, ITW, Stanley, Araymond, KAMAX, Shanghai PMC (Nedschroef), Aoyama Seisakusho, Meidoh, Fontana, Agrati Group, LISI, Nifco, Topura, Meira, Böllhoff, Norma Group, Bulten, Precision Castparts, Chunyu, Boltun, Samjin, Sundram Fasteners, SFS Group, STL, Keller & Kalmbach, Piolax, EJOT Group, GEM-YEAR, RUIBIAO, Shenzhen AERO, Dongfeng Auto, Chongqing Standard |

| Segments Covered | By Application, By Type, By Materials, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive fasteners Market: Dynamics

Key Growth Drivers :

The automotive fasteners market is experiencing robust growth driven by the overall expansion of global vehicle production, particularly in emerging economies with rising disposable incomes. The increasing demand for vehicle safety and performance is a major catalyst. Stringent government regulations and safety standards, such as those from the NCAP, are pushing automakers to use high-strength, durable, and reliable fastening systems to enhance a vehicle's structural integrity. Furthermore, the rapid transition to electric vehicles (EVs) is a significant driver, as EVs require specialized fasteners for battery packs, thermal management systems, and high-voltage components. The trend of vehicle lightweighting to improve fuel efficiency and battery range also fuels the demand for fasteners made from advanced materials like aluminum and composites.

Restraints :

Despite the strong drivers, the automotive fasteners market faces several key restraints. The most prominent is the volatility of raw material prices, especially for steel, aluminum, and other specialty alloys. Fluctuations in these commodity prices can directly impact manufacturing costs and profit margins. Another significant challenge is the intense competition from alternative fastening technologies, such as welding, clinching, and adhesives. These alternatives can reduce assembly time and labor costs, posing a direct threat to the traditional mechanical fasteners market. Additionally, the automotive industry's complex and globalized supply chain is highly vulnerable to disruptions, which can lead to production delays and increased costs.

Opportunities :

The automotive fasteners market is ripe with opportunities for innovation and expansion. The most significant opportunity lies in the continued growth of the electric vehicle (EV) segment, which demands specialized, high-performance fasteners with properties like electrical insulation and corrosion resistance. The trend towards modular vehicle platforms also presents a major opportunity, as it requires standardized and precision-engineered fasteners for efficient assembly. The burgeoning aftermarket segment provides a massive market for maintenance and repair, particularly in regions with an aging vehicle fleet. Furthermore, the development of smart fasteners with integrated sensors for real-time monitoring of tension and stress offers a lucrative path to a new generation of high-value products that enhance vehicle safety and diagnostics.

Challenges :

The market must navigate several complex challenges to maintain its growth trajectory. A key challenge is the constant need for research and development to create fasteners that can meet the evolving demands of new materials, designs, and vehicle technologies, such as autonomous systems. Ensuring consistent quality and reliability across a global supply chain is a significant hurdle, as a single fastener failure can lead to a costly vehicle recall. The industry also faces the challenge of complying with stringent and varying international regulations for safety, emissions, and materials, which can complicate product development and market entry. Finally, the over-reliance on a few key suppliers for certain raw materials can create bottlenecks and increase the risk of supply chain disruptions.

Automotive fasteners Market: Segmentation Insights

The global automotive fasteners market is segmented based on Application, Type, Materials, End Use, and Region. All the segments of the automotive fasteners market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Application, the global automotive fasteners market is divided into Body Structure, Chassis, Engine Components, Transmission, Interior.

On the basis of Type, the global automotive fasteners market is bifurcated into Bolts, Nuts, Screws, Washers, Rivets.

In terms of Materials, the global automotive fasteners market is categorized into Steel, Aluminum, Plastic, Titanium, Copper.

Based on End Use, the global automotive fasteners market is split into Outlook, Passenger Vehicles, Commercial Vehicles, Two-Wheelers .

Automotive fasteners Market: Regional Insights

The Asia-Pacific (APAC) region is the dominant force in the global automotive fasteners market. This leadership is overwhelmingly driven by its position as the world's largest automotive manufacturing hub, centered in China, Japan, and India. The region's dominance is fueled by massive vehicle production volumes for both domestic consumption and global export, which creates immense, consistent demand for fasteners. A dense, cost-competitive network of fastener manufacturers supports the extensive supply chains of both domestic automakers and international OEMs with local production facilities.

While North America and Europe remain significant, high-value markets characterized by stringent quality standards and the presence of premium vehicle manufacturers, their growth is more stable and tied to replacement demand. APAC's unparalleled scale of automobile production, coupled with its integrated supply ecosystem and expanding electric vehicle (EV) manufacturing, solidifies its position as the largest consumer and producer of automotive fasteners globally.

Automotive fasteners Market: Competitive Landscape

The automotive fasteners market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Automotive fasteners Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Warth

- ITW

- Stanley

- Araymond

- KAMAX

- Shanghai PMC (Nedschroef)

- Aoyama Seisakusho

- Meidoh

- Fontana

- Agrati Group

- LISI

- Nifco

- Topura

- Meira

- Böllhoff

- Norma Group

- Bulten

- Precision Castparts

- Chunyu

- Boltun

- Samjin

- Sundram Fasteners

- SFS Group

- STL

- Keller & Kalmbach

- Piolax

- EJOT Group

- GEM-YEAR

- RUIBIAO

- Shenzhen AERO

- Dongfeng Auto

- Chongqing Standard

The Global Automotive fasteners Market is Segmented as Follows:

By Application

- Body Structure

- Chassis

- Engine Components

- Transmission

- Interior

By Type

- Bolts

- Nuts

- Screws

- Washers

- Rivets

By Materials

- Steel

- Aluminum

- Plastic

- Titanium

- Copper

By End Use

- Outlook

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Automotive fasteners Market Share by Type (2020-2026) 1.5.2 Threaded Fasteners 1.5.3 Non-Threaded Fasteners 1.6 Market by Application 1.6.1 Global Automotive fasteners Market Share by Application (2020-2026) 1.6.2 Truck Industry 1.6.3 Passenger Car Industry 1.6.4 Others 1.7 Automotive fasteners Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Automotive fasteners Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Automotive fasteners Market 3.1 Value Chain Status 3.2 Automotive fasteners Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Automotive fasteners 3.2.3 Labor Cost of Automotive fasteners 3.2.3.1 Labor Cost of Automotive fasteners Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Precision Castparts 4.1.1 Precision Castparts Basic Information 4.1.2 Automotive fasteners Product Profiles, Application and Specification 4.1.3 Precision Castparts Automotive fasteners Market Performance (2015-2020) 4.1.4 Precision Castparts Business Overview 4.2 Topura 4.2.1 Topura Basic Information 4.2.2 Automotive fasteners Product Profiles, Application and Specification 4.2.3 Topura Automotive fasteners Market Performance (2015-2020) 4.2.4 Topura Business Overview 4.3 Fontana Gruppo 4.3.1 Fontana Gruppo Basic Information 4.3.2 Automotive fasteners Product Profiles, Application and Specification 4.3.3 Fontana Gruppo Automotive fasteners Market Performance (2015-2020) 4.3.4 Fontana Gruppo Business Overview 4.4 Keller & Kalmbach 4.4.1 Keller & Kalmbach Basic Information 4.4.2 Automotive fasteners Product Profiles, Application and Specification 4.4.3 Keller & Kalmbach Automotive fasteners Market Performance (2015-2020) 4.4.4 Keller & Kalmbach Business Overview 4.5 Samjin 4.5.1 Samjin Basic Information 4.5.2 Automotive fasteners Product Profiles, Application and Specification 4.5.3 Samjin Automotive fasteners Market Performance (2015-2020) 4.5.4 Samjin Business Overview 4.6 RUIBIAO 4.6.1 RUIBIAO Basic Information 4.6.2 Automotive fasteners Product Profiles, Application and Specification 4.6.3 RUIBIAO Automotive fasteners Market Performance (2015-2020) 4.6.4 RUIBIAO Business Overview 4.7 Nifco 4.7.1 Nifco Basic Information 4.7.2 Automotive fasteners Product Profiles, Application and Specification 4.7.3 Nifco Automotive fasteners Market Performance (2015-2020) 4.7.4 Nifco Business Overview 4.8 Aoyama Seisakusho 4.8.1 Aoyama Seisakusho Basic Information 4.8.2 Automotive fasteners Product Profiles, Application and Specification 4.8.3 Aoyama Seisakusho Automotive fasteners Market Performance (2015-2020) 4.8.4 Aoyama Seisakusho Business Overview 4.9 Gem-Year Industrial 4.9.1 Gem-Year Industrial Basic Information 4.9.2 Automotive fasteners Product Profiles, Application and Specification 4.9.3 Gem-Year Industrial Automotive fasteners Market Performance (2015-2020) 4.9.4 Gem-Year Industrial Business Overview 4.10 Meira 4.10.1 Meira Basic Information 4.10.2 Automotive fasteners Product Profiles, Application and Specification 4.10.3 Meira Automotive fasteners Market Performance (2015-2020) 4.10.4 Meira Business Overview 4.11 EJOT Group 4.11.1 EJOT Group Basic Information 4.11.2 Automotive fasteners Product Profiles, Application and Specification 4.11.3 EJOT Group Automotive fasteners Market Performance (2015-2020) 4.11.4 EJOT Group Business Overview 4.12 Kamax 4.12.1 Kamax Basic Information 4.12.2 Automotive fasteners Product Profiles, Application and Specification 4.12.3 Kamax Automotive fasteners Market Performance (2015-2020) 4.12.4 Kamax Business Overview 4.13 Stanley 4.13.1 Stanley Basic Information 4.13.2 Automotive fasteners Product Profiles, Application and Specification 4.13.3 Stanley Automotive fasteners Market Performance (2015-2020) 4.13.4 Stanley Business Overview 4.14 Chunyu 4.14.1 Chunyu Basic Information 4.14.2 Automotive fasteners Product Profiles, Application and Specification 4.14.3 Chunyu Automotive fasteners Market Performance (2015-2020) 4.14.4 Chunyu Business Overview 4.15 Agrati Group 4.15.1 Agrati Group Basic Information 4.15.2 Automotive fasteners Product Profiles, Application and Specification 4.15.3 Agrati Group Automotive fasteners Market Performance (2015-2020) 4.15.4 Agrati Group Business Overview 4.16 Norma Group 4.16.1 Norma Group Basic Information 4.16.2 Automotive fasteners Product Profiles, Application and Specification 4.16.3 Norma Group Automotive fasteners Market Performance (2015-2020) 4.16.4 Norma Group Business Overview 4.17 SFS intec 4.17.1 SFS intec Basic Information 4.17.2 Automotive fasteners Product Profiles, Application and Specification 4.17.3 SFS intec Automotive fasteners Market Performance (2015-2020) 4.17.4 SFS intec Business Overview 4.18 Sterling Tools 4.18.1 Sterling Tools Basic Information 4.18.2 Automotive fasteners Product Profiles, Application and Specification 4.18.3 Sterling Tools Automotive fasteners Market Performance (2015-2020) 4.18.4 Sterling Tools Business Overview 4.19 Araymond 4.19.1 Araymond Basic Information 4.19.2 Automotive fasteners Product Profiles, Application and Specification 4.19.3 Araymond Automotive fasteners Market Performance (2015-2020) 4.19.4 Araymond Business Overview 4.20 Würth 4.20.1 Würth Basic Information 4.20.2 Automotive fasteners Product Profiles, Application and Specification 4.20.3 Würth Automotive fasteners Market Performance (2015-2020) 4.20.4 Würth Business Overview 4.21 Meidoh 4.21.1 Meidoh Basic Information 4.21.2 Automotive fasteners Product Profiles, Application and Specification 4.21.3 Meidoh Automotive fasteners Market Performance (2015-2020) 4.21.4 Meidoh Business Overview 4.22 Piolax 4.22.1 Piolax Basic Information 4.22.2 Automotive fasteners Product Profiles, Application and Specification 4.22.3 Piolax Automotive fasteners Market Performance (2015-2020) 4.22.4 Piolax Business Overview 4.23 Bulten 4.23.1 Bulten Basic Information 4.23.2 Automotive fasteners Product Profiles, Application and Specification 4.23.3 Bulten Automotive fasteners Market Performance (2015-2020) 4.23.4 Bulten Business Overview 5 Global Automotive fasteners Market Analysis by Regions 5.1 Global Automotive fasteners Sales, Revenue and Market Share by Regions 5.1.1 Global Automotive fasteners Sales by Regions (2015-2020) 5.1.2 Global Automotive fasteners Revenue by Regions (2015-2020) 5.2 North America Automotive fasteners Sales and Growth Rate (2015-2020) 5.3 Europe Automotive fasteners Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Automotive fasteners Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Automotive fasteners Sales and Growth Rate (2015-2020) 5.6 South America Automotive fasteners Sales and Growth Rate (2015-2020) 6 North America Automotive fasteners Market Analysis by Countries 6.1 North America Automotive fasteners Sales, Revenue and Market Share by Countries 6.1.1 North America Automotive fasteners Sales by Countries (2015-2020) 6.1.2 North America Automotive fasteners Revenue by Countries (2015-2020) 6.1.3 North America Automotive fasteners Market Under COVID-19 6.2 United States Automotive fasteners Sales and Growth Rate (2015-2020) 6.2.1 United States Automotive fasteners Market Under COVID-19 6.3 Canada Automotive fasteners Sales and Growth Rate (2015-2020) 6.4 Mexico Automotive fasteners Sales and Growth Rate (2015-2020) 7 Europe Automotive fasteners Market Analysis by Countries 7.1 Europe Automotive fasteners Sales, Revenue and Market Share by Countries 7.1.1 Europe Automotive fasteners Sales by Countries (2015-2020) 7.1.2 Europe Automotive fasteners Revenue by Countries (2015-2020) 7.1.3 Europe Automotive fasteners Market Under COVID-19 7.2 Germany Automotive fasteners Sales and Growth Rate (2015-2020) 7.2.1 Germany Automotive fasteners Market Under COVID-19 7.3 UK Automotive fasteners Sales and Growth Rate (2015-2020) 7.3.1 UK Automotive fasteners Market Under COVID-19 7.4 France Automotive fasteners Sales and Growth Rate (2015-2020) 7.4.1 France Automotive fasteners Market Under COVID-19 7.5 Italy Automotive fasteners Sales and Growth Rate (2015-2020) 7.5.1 Italy Automotive fasteners Market Under COVID-19 7.6 Spain Automotive fasteners Sales and Growth Rate (2015-2020) 7.6.1 Spain Automotive fasteners Market Under COVID-19 7.7 Russia Automotive fasteners Sales and Growth Rate (2015-2020) 7.7.1 Russia Automotive fasteners Market Under COVID-19 8 Asia-Pacific Automotive fasteners Market Analysis by Countries 8.1 Asia-Pacific Automotive fasteners Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Automotive fasteners Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Automotive fasteners Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Automotive fasteners Market Under COVID-19 8.2 China Automotive fasteners Sales and Growth Rate (2015-2020) 8.2.1 China Automotive fasteners Market Under COVID-19 8.3 Japan Automotive fasteners Sales and Growth Rate (2015-2020) 8.3.1 Japan Automotive fasteners Market Under COVID-19 8.4 South Korea Automotive fasteners Sales and Growth Rate (2015-2020) 8.4.1 South Korea Automotive fasteners Market Under COVID-19 8.5 Australia Automotive fasteners Sales and Growth Rate (2015-2020) 8.6 India Automotive fasteners Sales and Growth Rate (2015-2020) 8.6.1 India Automotive fasteners Market Under COVID-19 8.7 Southeast Asia Automotive fasteners Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Automotive fasteners Market Under COVID-19 9 Middle East and Africa Automotive fasteners Market Analysis by Countries 9.1 Middle East and Africa Automotive fasteners Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Automotive fasteners Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Automotive fasteners Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Automotive fasteners Market Under COVID-19 9.2 Saudi Arabia Automotive fasteners Sales and Growth Rate (2015-2020) 9.3 UAE Automotive fasteners Sales and Growth Rate (2015-2020) 9.4 Egypt Automotive fasteners Sales and Growth Rate (2015-2020) 9.5 Nigeria Automotive fasteners Sales and Growth Rate (2015-2020) 9.6 South Africa Automotive fasteners Sales and Growth Rate (2015-2020) 10 South America Automotive fasteners Market Analysis by Countries 10.1 South America Automotive fasteners Sales, Revenue and Market Share by Countries 10.1.1 South America Automotive fasteners Sales by Countries (2015-2020) 10.1.2 South America Automotive fasteners Revenue by Countries (2015-2020) 10.1.3 South America Automotive fasteners Market Under COVID-19 10.2 Brazil Automotive fasteners Sales and Growth Rate (2015-2020) 10.2.1 Brazil Automotive fasteners Market Under COVID-19 10.3 Argentina Automotive fasteners Sales and Growth Rate (2015-2020) 10.4 Columbia Automotive fasteners Sales and Growth Rate (2015-2020) 10.5 Chile Automotive fasteners Sales and Growth Rate (2015-2020) 11 Global Automotive fasteners Market Segment by Types 11.1 Global Automotive fasteners Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Automotive fasteners Sales and Market Share by Types (2015-2020) 11.1.2 Global Automotive fasteners Revenue and Market Share by Types (2015-2020) 11.2 Threaded Fasteners Sales and Price (2015-2020) 11.3 Non-Threaded Fasteners Sales and Price (2015-2020) 12 Global Automotive fasteners Market Segment by Applications 12.1 Global Automotive fasteners Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Automotive fasteners Sales and Market Share by Applications (2015-2020) 12.1.2 Global Automotive fasteners Revenue and Market Share by Applications (2015-2020) 12.2 Truck Industry Sales, Revenue and Growth Rate (2015-2020) 12.3 Passenger Car Industry Sales, Revenue and Growth Rate (2015-2020) 12.4 Others Sales, Revenue and Growth Rate (2015-2020) 13 Automotive fasteners Market Forecast by Regions (2020-2026) 13.1 Global Automotive fasteners Sales, Revenue and Growth Rate (2020-2026) 13.2 Automotive fasteners Market Forecast by Regions (2020-2026) 13.2.1 North America Automotive fasteners Market Forecast (2020-2026) 13.2.2 Europe Automotive fasteners Market Forecast (2020-2026) 13.2.3 Asia-Pacific Automotive fasteners Market Forecast (2020-2026) 13.2.4 Middle East and Africa Automotive fasteners Market Forecast (2020-2026) 13.2.5 South America Automotive fasteners Market Forecast (2020-2026) 13.3 Automotive fasteners Market Forecast by Types (2020-2026) 13.4 Automotive fasteners Market Forecast by Applications (2020-2026) 13.5 Automotive fasteners Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Automotive fasteners

Request Sample

Automotive fasteners