Biodegradable Polymer Market Size, Share, and Trends Analysis Report

CAGR :

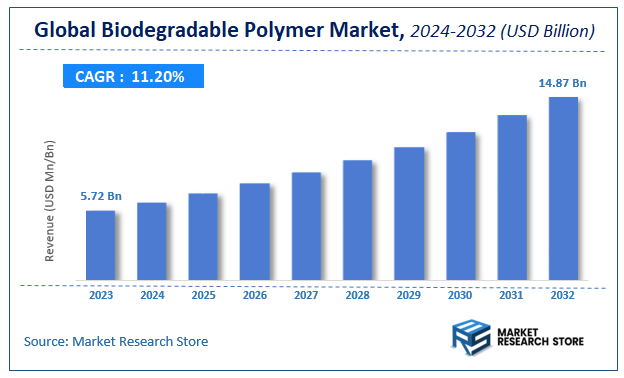

| Market Size 2023 (Base Year) | USD 5.72 Billion |

| Market Size 2032 (Forecast Year) | USD 14.87 Billion |

| CAGR | 11.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Biodegradable Polymer Market Insights

According to Market Research Store, the global biodegradable polymer market size was valued at around USD 5.72 billion in 2023 and is estimated to reach USD 14.87 billion by 2032, to register a CAGR of approximately 11.2% in terms of revenue during the forecast period 2024-2032.

The biodegradable polymer report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Biodegradable Polymer Market: Overview

Biodegradable polymers are a class of polymers that can break down into natural byproducts such as water, carbon dioxide, and biomass through the action of microorganisms, enzymes, or hydrolysis under appropriate environmental conditions. These materials are designed to reduce environmental impact by decomposing more rapidly than conventional petroleum-based plastics. Biodegradable polymers can be derived from renewable sources such as starch, cellulose, and polylactic acid (PLA), or synthesized from petrochemicals with engineered biodegradability, such as polycaprolactone (PCL) and polybutylene adipate terephthalate (PBAT).

The growth of the biodegradable polymer market is driven by increasing environmental concerns over plastic waste, government regulations promoting sustainable materials, and rising consumer preference for eco-friendly products. These polymers are used in a wide range of applications, including packaging, agriculture (e.g., mulch films), disposable cutlery, biomedical devices, and drug delivery systems. Advances in polymer science and manufacturing processes are also improving the performance and cost-competitiveness of biodegradable alternatives. As industries and consumers shift toward sustainable practices, biodegradable polymers are gaining momentum as a viable solution for reducing plastic pollution and promoting circular economy initiatives.

Key Highlights

- The biodegradable polymer market is anticipated to grow at a CAGR of 11.2% during the forecast period.

- The global biodegradable polymer market was estimated to be worth approximately USD 5.72 billion in 2023 and is projected to reach a value of USD 14.87 billion by 2032.

- The growth of the biodegradable polymer market is being driven by increasing environmental concerns, regulatory restrictions on conventional plastics, and rising consumer preference for sustainable materials across various industries.

- Based on the type, the polymers with carbon backbones segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the packaging segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Biodegradable Polymer Market: Dynamics

Key Growth Drivers:

Stringent Government Regulations and Plastic Bans

A primary driver is the increasing number of bans and regulations worldwide on single-use plastics and packaging. Governments are implementing policies, taxes, and incentives to encourage the adoption of biodegradable alternatives, pushing industries to shift away from conventional plastics and comply with environmental targets.

Rising Consumer Awareness and Demand for Sustainable Products

Growing global awareness about the detrimental environmental impact of plastic pollution (e.g., ocean plastic, microplastics) has led to a significant shift in consumer preferences. Consumers are increasingly seeking and willing to pay a premium for eco-friendly and biodegradable products, forcing brands to incorporate sustainable materials into their offerings.

Brand Commitments and Corporate Sustainability Initiatives

Many multinational corporations and major brands are setting ambitious sustainability goals, including reducing their plastic footprint and transitioning to compostable or biodegradable packaging. These corporate commitments create substantial demand for biodegradable polymers as part of their environmental, social, and governance (ESG) strategies.

Restraints:

Higher Production Costs Compared to Conventional Plastics

Despite advancements, biodegradable polymers generally have higher production costs than petroleum-based conventional plastics. This price disparity can deter widespread adoption, especially in cost-sensitive industries or for high-volume applications where economic viability is a critical factor.

Limited Availability of Suitable Infrastructure for Composting/Degradation

Many biodegradable polymers, particularly compostable plastics like PLA, require specific industrial composting facilities to degrade effectively. The global lack of widespread and adequate composting infrastructure, especially in developing regions, can limit the practical biodegradability and circularity of these materials, leading to them still ending up in landfills.

Opportunities:

Innovation in Bio-based and Marine-Degradable Polymers

A significant opportunity lies in further developing polymers derived from renewable biological resources (bio-based) and those that can degrade effectively in marine environments. Such innovations address both resource depletion and marine plastic pollution concerns, opening up new markets and applications.

Integration with Circular Economy Initiatives

As the focus shifts from linear "take-make-dispose" models to circular economies, biodegradable polymers can play a crucial role. Opportunities exist in developing closed-loop systems for these materials, including efficient collection, industrial composting, and potentially even chemical recycling or valorization of degraded products.

Challenges:

Ensuring Actual Biodegradability in Diverse Environments

A key challenge is ensuring that biodegradable polymers truly degrade in a wide range of natural environments (soil, freshwater, marine) and not just under specific industrial composting conditions. This requires rigorous testing and clear scientific validation to avoid unintended environmental accumulation.

Maintaining Performance Consistency and Quality Control

Scaling up production of biodegradable polymers while maintaining consistent quality, performance attributes, and batch-to-batch uniformity can be challenging due to variations in natural feedstocks and complex polymerization processes.

Biodegradable Polymer Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biodegradable Polymer Market |

| Market Size in 2023 | USD 5.72 Billion |

| Market Forecast in 2032 | USD 14.87 Billion |

| Growth Rate | CAGR of 11.2% |

| Number of Pages | 165 |

| Key Companies Covered | Cortec group, Mitsui Chemicals, BASF, BIOTEC GmbH& Co, Cereplast and FP International among others |

| Segments Covered | By Type, By Applications, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biodegradable Polymer Market: Segmentation Insights

The global biodegradable polymer market is divided by type, application, and region.

Based on type, the global biodegradable polymer market is divided into polymers with carbon backbones, polymers with hydrolyzable backbones, and natural polymers. Polymers with Carbon Backbones dominate the Biodegradable Polymer Market due to their synthetic origin and structural versatility, which allow them to mimic the properties of conventional plastics while remaining biodegradable under certain environmental conditions. These polymers are primarily derived from petrochemical or bio-based monomers and include materials such as polyvinyl alcohol (PVA), polycaprolactone (PCL), and certain copolymers like PBAT (polybutylene adipate terephthalate). Their degradation typically relies on microbial activity, which breaks the carbon backbone into smaller fragments. These polymers are widely used in packaging films, disposable items, agricultural mulch, and biomedical devices due to their durability, flexibility, and compatibility with existing plastic processing techniques. The segment benefits from increasing regulatory pressure to reduce conventional plastic waste and from ongoing innovation aimed at enhancing degradation rates in diverse environments.

On the basis of application, the global biodegradable polymer market is bifurcated into packaging, agricultural, medical, and others. Packaging dominates the Biodegradable Polymer Market, accounting for the largest share due to the global push to reduce plastic waste, particularly from single-use products. Biodegradable polymers such as polylactic acid (PLA), starch blends, and polybutylene adipate terephthalate (PBAT) are widely used in food packaging, shopping bags, trays, disposable cutlery, and compostable films. These materials offer comparable functionality to traditional plastics while being capable of degrading in industrial composting or, in some cases, home composting environments. The segment is driven by increasing regulatory bans on conventional plastics, consumer preference for eco-friendly alternatives, and demand from major food and beverage companies adopting sustainable packaging strategies. Additionally, advancements in polymer performance and improvements in shelf life and mechanical strength are broadening the application range of biodegradable packaging solutions across retail and industrial sectors.

Biodegradable Polymer Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the biodegradable polymer market, fueled by strong environmental regulations, increasing consumer awareness, and widespread adoption of sustainable packaging across industries. The United States leads regional demand with growing applications in food packaging, agriculture films, disposable cutlery, and biomedical devices. Major retail brands and packaging companies are shifting toward compostable and biodegradable alternatives to comply with tightening regulations on single-use plastics. Additionally, extensive research and development initiatives, along with government-backed sustainability programs, are driving innovation in bio-based polymers derived from starch, polylactic acid (PLA), and polyhydroxyalkanoates (PHA). Canada is also seeing increased demand, particularly in foodservice, healthcare packaging, and municipal composting programs. The presence of major biopolymer producers and supportive recycling and composting infrastructure further strengthens North America’s leadership in this market.

Asia-Pacific is the fastest-growing region in the biodegradable polymer market, supported by expanding urban populations, rising environmental concerns, and increasing government restrictions on conventional plastics. China and India are the key growth drivers. China is making rapid advances in compostable food packaging, agricultural films, and disposable items, spurred by government bans on non-degradable plastics in major cities. India has also implemented nationwide policies to curb plastic waste, encouraging adoption of biodegradable alternatives in packaging and foodservice. Japan and South Korea are investing in R&D and product development in the bioplastics sector, with demand focused on consumer electronics, automotive interiors, and green packaging. Southeast Asian countries, including Indonesia, Thailand, and Vietnam, are beginning to implement policies to support bio-based solutions in tourism, agriculture, and food packaging as part of their circular economy initiatives.

Europe holds a significant share in the biodegradable polymer market, driven by stringent regulatory frameworks such as the EU’s Single-Use Plastics Directive, strong sustainability goals, and high environmental consciousness among consumers. Countries like Germany, Italy, France, and the Netherlands are actively promoting the use of biodegradable polymers in agriculture, packaging, textiles, and consumer goods. Germany is a leader in bio-based research and industrial composting, while Italy has been at the forefront in mandating biodegradable materials for shopping bags and packaging. The market is also supported by favorable policies, such as incentives for bioplastic adoption and investments in end-of-life processing infrastructure. European industries are increasingly using biodegradable polymers in mulch films, compostable packaging, hygiene products, and pharmaceutical applications.

Biodegradable Polymer Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the biodegradable polymer market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global biodegradable polymer market include:

- Cortec group

- Mitsui Chemicals

- BASF

- BIOTEC GmbH& Co

- Cereplast

- FP International

- MetabolixInc

The global biodegradable polymer market is segmented as follows:

By Type

- Polymers with Carbon Backbones

- Polymers with Hydrolyzable Backbones

- Natural Polymers

By Application

- Packaging

- Agricultural

- Medical

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global market revenue, 2014 - 2020(USD Million)

- 2.2. Global biodegradable polymer market: Snapshot

- Chapter 3. Biodegradable polymer Market – Global and Industry Analysis

- 3.1. Biodegradable polymerBiodegradable polymer: Market dynamics

- 3.2. Market drivers

- 3.2.1. Drivers of global biodegradable polymer market: Impact analysis

- 3.2.2. Sustainable development policies

- 3.2.3. Rising concern for use of eco friendly product

- 3.2.4. Escalating price of crude oil

- 3.2.5. Supportive government initiatives

- 3.3. Market restraints

- 3.3.1. Restraints of global biodegradable polymer market: Impact analysis

- 3.3.2. Limited applications of biodegradable polymers

- 3.3.3. High manufacturing cost

- 3.4. Opportunities

- 3.4.1. Expanding end-use application

- 3.4.2. Cost-effective raw materials for biodegradable polymers

- 3.5. Porter’s five forces analysis

- 3.6. Market Attractiveness Analysis

- 3.6.1. Market attractiveness analysis by type segment

- 3.6.2. Market attractiveness analysis by applications segment

- 3.6.3. Market attractiveness analysis by regional segment

- Chapter 4. Global Biodegradable polymer Market - Competitive Landscape

- 4.1. Company market share, 2014

- 4.2. Price trend analysis

- Chapter 5. Global Biodegradable polymer Market – Type Segment Analysis

- 5.1. Global biodegradable polymer market: type overview

- 5.1.1. Global biodegradable polymer market revenue share, by type, 2014 - 2020

- 5.2. Polymers with hydrolyzable backbone

- 5.2.1. Global polymers with hydrolyzable backbone market, by type, 2014 – 2020 (USD Million)

- 5.3. Polymers with carbon backbone

- 5.3.1. Global polymers with carbon backbone market, by type, 2014 – 2020 (USD Million)

- 5.4. Natural polymers

- 5.4.1. Global natural polymers market, by type, 2014 – 2020 (USD Million)

- 5.1. Global biodegradable polymer market: type overview

- Chapter 6. Global Biodegradable polymer Market – Applications Segment Analysis

- 6.1. Global biodegradable polymer market: type overview

- 6.1.1. Global biodegradable polymer market revenue share, by type, 2014 - 2020

- 6.2. Packaging

- 6.2.1. Global packaging market, by type, 2014 – 2020 (USD Million)

- 6.3. Agricultural

- 6.3.1. Global agricultural market, by type, 2014 – 2020 (USD Million)

- 6.4. Medical

- 6.4.1. Global medical market, by type, 2014 – 2020 (USD Million)

- 6.5. Others

- 6.5.1. Global others market, by type, 2014 – 2020 (USD Million)

- 6.1. Global biodegradable polymer market: type overview

- Chapter 7. Global Biodegradable polymer market – Regional Segment Analysis

- 7.1. Global biodegradable polymer market: Regional overview

- 7.1.1. Global biodegradable polymer market revenue share by region, 2014 - 2020

- 7.2. North America

- 7.2.1. North America biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.2.2. North America biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.2.3. U.S.

- 7.2.3.1. U.S. biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.2.3.2. U.S. biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.3. Europe

- 7.3.1. Europe biodegradable polymer market revenue, by a type, 2014 – 2020 (USD Million)

- 7.3.2. Europe biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.3.3. Germany

- 7.3.3.1. Germany biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.3.3.2. Germany biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.3.4. France

- 7.3.4.1. France biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.3.4.2. France biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.3.5. UK

- 7.3.5.1. UK biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.3.5.2. UK biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.4.2. Asia Pacific biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.3. China

- 7.4.3.1. China biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.4.3.2. China biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.4. Japan

- 7.4.4.1. Japan biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.4.4.2. Japan biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.5. India

- 7.4.5.1. India biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.4.5.2. India biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.5.2. Latin America biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.5.3. Brazil

- 7.5.3.1. Brazil biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.5.3.2. Brazil biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa biodegradable polymer market revenue, by type, 2014 – 2020 (USD Million)

- 7.6.2. Middle East and Africa biodegradable polymer market revenue, by application, 2014 – 2020 (USD Million)

- 7.1. Global biodegradable polymer market: Regional overview

- Chapter 8. Company Profile

- 8.1. Cortec Group

- 8.1.1. Overview

- 8.1.2. Financials

- 8.1.3. Product portfolio

- 8.1.4. Business strategy

- 8.1.5. Recent developments

- 8.2. Mitsui Chemicals

- 8.2.1. Overview

- 8.2.2. Financials

- 8.2.3. Product portfolio

- 8.2.4. Business strategy

- 8.2.5. Recent developments

- 8.3. BASF

- 8.3.1. Overview

- 8.3.2. Financials

- 8.3.3. Product portfolio

- 8.3.4. Business strategy

- 8.3.5. Recent developments

- 8.4. BIOTEC GmbH& Co

- 8.4.1. Overview

- 8.4.2. Financials

- 8.4.3. Product portfolio

- 8.4.4. Business strategy

- 8.4.5. Recent developments

- 8.5. Cereplast

- 8.5.1. Overview

- 8.5.2. Financials

- 8.5.3. Product portfolio

- 8.5.4. Business strategy

- 8.5.5. Recent developments

- 8.6. FP International

- 8.6.1. Overview

- 8.6.2. Financials

- 8.6.3. Product portfolio

- 8.6.4. Business strategy

- 8.6.5. Recent developments

- 8.1. Cortec Group

Inquiry For Buying

Biodegradable Polymer

Request Sample

Biodegradable Polymer