Chemical Scrubber Biogas Upgrading Market Size, Share, and Trends Analysis Report

CAGR :

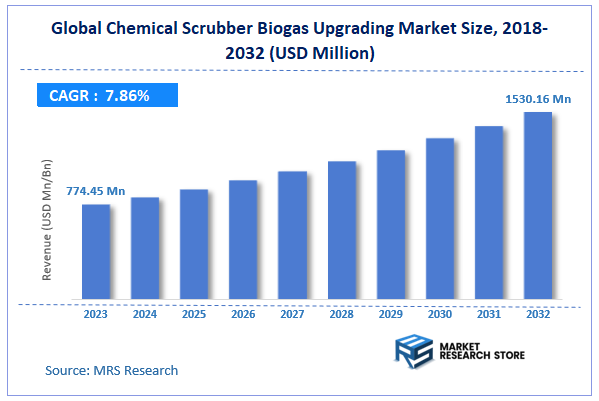

| Market Size 2023 (Base Year) | USD 774.45 Million |

| Market Size 2032 (Forecast Year) | USD 1530.16 Million |

| CAGR | 7.86% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global chemical scrubber biogas upgrading market size was valued at around USD 774.45 million in 2023 and is estimated to reach USD 1530.16 million by 2032, to register a CAGR of approximately 7.86% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The chemical scrubber biogas upgrading report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Chemical Scrubber Biogas Upgrading Market: Overview

Chemical Scrubber Biogas Upgrading is a method used to purify biogas by removing impurities, particularly carbon dioxide (CO2), hydrogen sulfide (H₂S), and other unwanted gases. This process involves the use of chemical solvents, such as amine or sodium hydroxide, which absorb CO2 and H₂S from the raw biogas, leaving behind biomethane, a higher-quality gas that can be used as a renewable energy source.

The chemical scrubber method is highly efficient, making it popular for large-scale biogas upgrading plants. The purified biomethane can be injected into natural gas grids or used as fuel for transportation.

Key Highlights

- The chemical scrubber biogas upgrading market is anticipated to grow at a CAGR of 7.86% during the forecast period.

- The global chemical scrubber biogas upgrading market was estimated to be worth approximately USD 774.45 million in 2023 and is projected to reach a value of USD 1530.16 million by 2032.

- The growth of the chemical scrubber biogas upgrading market is being driven by the increasing demand for clean energy solutions and the need to reduce greenhouse gas emissions.

- Based on the type, the large equipment segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the municipal segment is projected to swipe the largest market share.

- By region, Europe is expected to dominate the global market during the forecast period.

Chemical Scrubber Biogas Upgrading Market: Dynamics

Key Growth Drivers

- Increasing demand for renewable energy: The global shift towards sustainable energy sources is driving the demand for biogas, a renewable fuel produced from organic waste. Chemical scrubbers are essential for upgrading biogas to a quality suitable for various applications.

- Growing adoption of biogas in transportation: Biogas is gaining traction as a transportation fuel, especially in the form of biomethane. Chemical scrubbers play a crucial role in purifying biogas to meet the stringent quality standards required for vehicle engines.

- Advancements in chemical scrubber technology: Continuous innovations in chemical scrubber design and materials are improving their efficiency, reducing operating costs, and expanding their applicability.

Restraints

- High capital investment: The initial cost of installing chemical scrubber systems can be significant, which may deter smaller-scale biogas producers.

- Complexity of operation: Chemical scrubbers require skilled operators and careful maintenance to ensure optimal performance and avoid downtime.

- Environmental concerns: The use of chemicals in the scrubbing process can raise environmental concerns, particularly regarding potential water pollution and emissions.

Opportunities

- Integration with carbon capture and storage (CCS): Chemical scrubbers can be combined with CCS technologies to capture and store carbon dioxide emissions from biogas production, contributing to climate change mitigation.

- Expansion into emerging markets: Developing countries with growing populations and increasing urbanization present significant opportunities for biogas upgrading using chemical scrubbers.

- Synergies with other renewable energy sources: Chemical scrubbers can be integrated with other renewable energy technologies, such as solar and wind power, to create more sustainable and resilient energy systems.

Challenges

- Scalability: Scaling up chemical scrubber systems to meet the demands of large-scale biogas production can be challenging due to factors such as energy consumption and infrastructure requirements.

- Regulatory hurdles: The implementation of biogas upgrading projects may face regulatory obstacles related to environmental permits, safety standards, and grid connection.

- Competition from alternative technologies: Other biogas upgrading methods, such as membrane separation and pressure swing adsorption, may compete with chemical scrubbers in certain applications.

Chemical Scrubber Biogas Upgrading Market: Segmentation Insights

The global chemical scrubber biogas upgrading market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global chemical scrubber biogas upgrading market is divided into large equipment and small equipment.

Large chemical scrubbers dominate the market due to their capacity to handle substantial volumes of biogas. These systems are primarily used in large-scale biogas plants, such as those at municipal waste facilities or large industrial farms, where high biogas output requires robust, high-efficiency equipment.

Large scrubbers are engineered to remove impurities like carbon dioxide (CO2), hydrogen sulfide (H2S), and other trace gases, ensuring that the upgraded biogas meets commercial and grid-quality standards. Their design emphasizes high throughput and durability, making them ideal for continuous or high-demand operations. The dominance of this segment is largely driven by the increasing number of large biogas production facilities and the growing global demand for renewable natural gas (RNG).

Small chemical scrubbers cater to smaller biogas production setups, such as small farms or localized waste treatment facilities. These units are more compact and affordable, designed to meet the needs of lower-volume biogas producers. While not capable of processing the same volumes as large equipment, small scrubbers efficiently clean biogas to acceptable quality levels for local energy use or smaller-scale commercial applications. The rise in decentralized energy production and the need for biogas solutions in rural or off-grid areas have contributed to the demand for small equipment in this segment.

Segmentation Insights by Application

On the basis of application, the global chemical scrubber biogas upgrading market is bifurcated into municipal, agricultural, and other.

Municipal applications dominate the chemical scrubber biogas upgrading market due to the significant volume of biogas generated from wastewater treatment facilities and landfill gas recovery systems. These facilities process large amounts of organic waste, resulting in substantial biogas production.

Chemical scrubbers in municipal settings are essential for upgrading this biogas to meet quality standards required for injection into the natural gas grid or for use as renewable natural gas (RNG). The focus on sustainability and waste management in urban areas drives the demand for effective biogas upgrading solutions in municipal applications, making this segment the largest in the market.

Agricultural applications represent a vital segment of the market, as farms increasingly adopt biogas technology to manage organic waste, such as manure and crop residues. By using chemical scrubbers, these farms can upgrade biogas produced from anaerobic digestion processes to a quality suitable for energy production or direct use in agricultural operations. This segment benefits from the growing interest in renewable energy and sustainable farming practices, allowing farmers to reduce waste and create additional revenue streams from the sale of upgraded biogas.

Chemical Scrubber Biogas Upgrading Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Chemical Scrubber Biogas Upgrading Market |

| Market Size in 2023 | USD 774.45 Million |

| USD 1530.16 Million | |

| Growth Rate | CAGR of 7.86% |

| Number of Pages | 219 |

| Key Companies Covered | Beijing Sanyl, Inova BioMethan, Greenmac, Air Products and Chemicals Inc., GE Renewable Energy, Linde plc, Carbon Clean Solutions Limited, Xebec Adsorption Inc., Ecovapor, Aqua-Aerobic Systems Inc., Biogas Energy, DMT Environmental Technology, Vogt Power International, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Chemical Scrubber Biogas Upgrading Market: Regional Insights

- Europe is expected to dominates the global market

Europe dominates the chemical scrubber biogas upgrading market, driven by stringent environmental regulations and robust renewable energy policies. Countries such as Germany, Denmark, and Sweden have advanced biogas infrastructure, supported by government subsidies and mandates to reduce greenhouse gas emissions.

The region's strong emphasis on decarbonizing the energy and waste sectors fuels the demand for biogas upgrading technologies, including chemical scrubbers. The European Union's push for circular economy practices and the integration of biogas into the natural gas grid further strengthen the market.

North America holds a significant share of the market, led by the United States and Canada. The growth in this region is fueled by rising investments in renewable energy and the increasing use of biogas for electricity and heat generation. Government initiatives such as the Renewable Natural Gas (RNG) programs in the U.S. promote the upgrading of biogas through technologies like chemical scrubbers. Canada’s policies for reducing carbon emissions also encourage the adoption of biogas upgrading solutions, making North America a key player in this market.

The Asia-Pacific region is emerging as a strong market for chemical scrubber biogas upgrading, with countries like China, India, and Japan investing in biogas production and upgrading technologies. The region’s rapid industrialization, urbanization, and increasing demand for renewable energy sources drive the need for efficient biogas upgrading solutions.

Government policies in China and India, which focus on sustainable waste management and renewable energy, support the growth of the chemical scrubber biogas upgrading market. However, the market is still developing compared to Europe and North America.

Latin America has a growing market for chemical scrubber biogas upgrading, with countries like Brazil, Argentina, and Mexico leading the way. The region’s agricultural sector generates significant amounts of organic waste, providing a substantial source of biogas production. Government initiatives aimed at promoting renewable energy and waste-to-energy projects are pushing the adoption of biogas upgrading technologies. However, the market is relatively smaller compared to the top regions due to limited infrastructure and regulatory support.

The Middle East and Africa represent the least dominating region in the chemical scrubber biogas upgrading market. While there is growing interest in renewable energy and waste management in countries like South Africa and the United Arab Emirates, the biogas upgrading market is still in its infancy. Limited infrastructure, lower investment levels, and the focus on other forms of energy dominate the energy landscape in these regions. However, with increasing awareness and government initiatives focused on sustainability, the market is expected to develop over the coming years.

Chemical Scrubber Biogas Upgrading Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the chemical scrubber biogas upgrading market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global chemical scrubber biogas upgrading market include:

- Beijing Sanyl

- Inova BioMethan

- Greenmac

- Air Products and Chemicals Inc.

- GE Renewable Energy

- Linde plc

- Carbon Clean Solutions Limited

- Xebec Adsorption Inc.

- Ecovapor

- Aqua-Aerobic Systems Inc.

- Biogas Energy

- DMT Environmental Technology

- Vogt Power International

The global chemical scrubber biogas upgrading market is segmented as follows:

By Type

- Large Equipment

- Small Equipment

By Application

- Municipal

- Agricultural

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global chemical scrubber biogas upgrading market size was projected at approximately US$ 774.45 million in 2023. Projections indicate that the market is expected to reach around US$ 1530.16 million in revenue by 2032.

The global chemical scrubber biogas upgrading market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 7.86% during the forecast period from 2024 to 2032.

Europe is expected to dominate the global chemical scrubber biogas upgrading market.

The global chemical scrubber biogas upgrading market is driven by increasing demand for renewable energy sources, regulatory support for reducing greenhouse gas emissions, and advancements in biogas purification technologies.

Some of the prominent players operating in the global chemical scrubber biogas upgrading market are; Beijing Sanyl, Inova BioMethan, Greenmac, Air Products and Chemicals Inc., GE Renewable Energy, Linde plc, Carbon Clean Solutions Limited, Xebec Adsorption Inc., Ecovapor, Aqua-Aerobic Systems Inc., Biogas Energy, DMT Environmental Technology, Vogt Power International, and others.

Table Of Content

Inquiry For Buying

Chemical Scrubber Biogas Upgrading

Request Sample

Chemical Scrubber Biogas Upgrading