CIS Tin Market Size, Share, and Trends Analysis Report

CAGR :

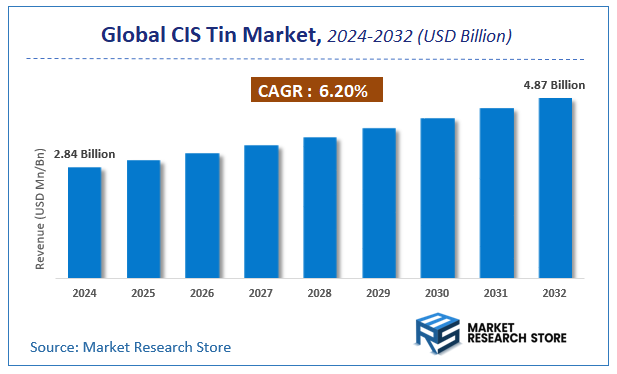

| Market Size 2024 (Base Year) | USD 2.84 Billion |

| Market Size 2032 (Forecast Year) | USD 4.87 Billion |

| CAGR | 6.2% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global CIS tin market size was valued at approximately USD 2.84 Billion in 2024. The market is projected to grow significantly, reaching USD 4.87 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the CIS tin industry.

To Get more Insights, Request a Free Sample

CIS Tin Market: Overview

The growth of the CIS tin market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The CIS tin market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the CIS tin market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on End-Use Industry, Product Form, Application, Distribution Channel, Geographic Market, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global CIS tin market is estimated to grow annually at a CAGR of around 6.2% over the forecast period (2024-2032).

- In terms of revenue, the global CIS tin market size was valued at around USD 2.84 Billion in 2024 and is projected to reach USD 4.87 Billion by 2032.

- The market is projected to grow at a significant rate due to rising demand for thin-film solar cells, flexible electronics, and sustainable photovoltaic technologies.

- Based on the End-Use Industry, the Automotive segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Product Form, the Tin Ingots segment is anticipated to command the largest market share.

- In terms of Application, the Coatings segment is projected to lead the global market.

- By Distribution Channel, the Direct Sales segment is predicted to dominate the global market.

- Based on the Geographic Market, the Domestic Market segment is expected to swipe the largest market share.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

CIS Tin Market: Report Scope

This report thoroughly analyzes the CIS tin market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | CIS Tin Market |

| Market Size in 2024 | USD 2.84 Billion |

| Market Forecast in 2032 | USD 4.87 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 200 |

| Key Companies Covered | Yunnan Tin, MSC, PT Timah, Minsur, Thaisarco, EM Vinto |

| Segments Covered | By End-Use Industry, By Product Form, By Application, By Distribution Channel, By Geographic Market, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

CIS Tin Market: Dynamics

Key Growth Drivers:

The primary driver for the CIS (Commonwealth of Independent States) Tin market is the increasing domestic demand from key industries such as electronics manufacturing, construction, and packaging within the region. As CIS countries continue their industrialization and develop their technological sectors, the need for tin in solders, tinplate for food and beverage cans, and various alloys is steadily rising. Furthermore, the region's existing industrial base, particularly in heavy industries and manufacturing, creates a consistent demand for tin as a component in diverse applications. Government initiatives aimed at promoting local production and reducing reliance on imports in strategic sectors can also provide a boost to domestic tin consumption and, consequently, the market for CIS tin.

Restraints:

Despite potential growth drivers, the CIS Tin market faces several significant restraints. One major obstacle is the often-limited domestic tin production capacity within many CIS countries, necessitating reliance on imports to meet industrial demand. This reliance exposes the market to fluctuations in global tin prices and supply chain disruptions, impacting the stability of local industries. Geopolitical instability and economic sanctions, particularly affecting key players like Russia, can severely disrupt trade routes, limit access to essential technologies for mining and refining, and restrict investment, thereby hindering market growth. Furthermore, the presence of aging mining infrastructure and the need for substantial capital investment to develop new tin deposits or modernize existing ones pose significant financial and logistical challenges.

Opportunities:

The CIS Tin market presents numerous opportunities for innovation and expansion. The potential for new exploration and development of tin deposits in underexplored regions within the CIS could significantly increase domestic supply and reduce import dependency. Opportunities also lie in the modernization and technological upgrade of existing tin mining and refining operations, aiming to improve efficiency, reduce costs, and adhere to international environmental standards. The increasing demand for sustainable and ethically sourced materials globally could position CIS tin producers favorably if they invest in responsible mining practices and gain relevant certifications. Furthermore, the development of downstream industries within the CIS that utilize tin, such as advanced electronics manufacturing or specialized alloys, could create captive demand and add value to the domestic tin market.

Challenges:

The CIS Tin market confronts several critical challenges that demand strategic attention. One major challenge is overcoming the historical underinvestment in tin mining and processing infrastructure, which has led to declining production in some areas and a reliance on outdated technologies. Attracting sufficient foreign and domestic investment into the capital-intensive mining sector, particularly given geopolitical risks and economic uncertainties in the region, remains a persistent hurdle. The market is also susceptible to global price volatility for tin, which can make long-term planning and investment decisions difficult for producers and consumers within the CIS. Lastly, navigating complex regulatory environments, varying environmental standards, and the need to address any legacy environmental issues from past mining operations presents ongoing compliance and operational complexities for companies in the CIS Tin market.

CIS Tin Market: Segmentation Insights

The global CIS tin market is segmented based on End-Use Industry, Product Form, Application, Distribution Channel, Geographic Market, and Region. All the segments of the CIS tin market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on End-Use Industry, the global CIS tin market is divided into Automotive, Electronics, Construction, Consumer Goods, Aerospace.

On the basis of Product Form, the global CIS tin market is bifurcated into Tin Ingots, Tin Alloys, Tin Foil, Tin Wire, Other Tin Products.

In terms of Application, the global CIS tin market is categorized into Coatings, Soldering Materials, Packaging, Electronics Manufacturing, Plating.

Based on Distribution Channel, the global CIS tin market is split into Direct Sales, Wholesale Distributors, Online Retailers, Specialty Retailers, Other Channels.

By Geographic Market, the global CIS tin market is divided into Domestic Market, International Market, Export, Import, Local vs. Global Players.

CIS Tin Market: Regional Insights

The CIS tin market is dominated by Russia, which holds the largest share due to its extensive tin reserves, robust production capabilities, and well-established mining infrastructure. Russia accounts for over 80% of the region's tin output, with key deposits located in the Far East and Siberia, particularly in the Khabarovsk and Primorsky regions. The country's leading producer, PJSC Novosibirsk Tin Works, plays a pivotal role in both domestic supply and exports, catering to industries such as electronics, packaging, and automotive.

Kazakhstan and Uzbekistan contribute smaller volumes, but Russia's dominance is reinforced by higher investment in mining technology and favorable government policies. Regional demand is driven by growing electronics manufacturing, though export reliance on China and Europe remains significant. Russia's strategic control over supply chains solidifies its position as the CIS tin market leader.

CIS Tin Market: Competitive Landscape

The CIS tin market Report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global CIS Tin Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Yunnan Tin

- MSC

- PT Timah

- Minsur

- Thaisarco

- EM Vinto

The Global CIS Tin Market is Segmented as Follows:

By End-Use Industry

- Automotive

- Electronics

- Construction

- Consumer Goods

- Aerospace

By Product Form

- Tin Ingots

- Tin Alloys

- Tin Foil

- Tin Wire

- Other Tin Products

By Application

- Coatings

- Soldering Materials

- Packaging

- Electronics Manufacturing

- Plating

By Distribution Channel

- Direct Sales

- Wholesale Distributors

- Online Retailers

- Specialty Retailers

- Other Channels

By Geographic Market

- Domestic Market

- International Market

- Export

- Import

- Local vs. Global Players

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global CIS Tin Market Share by Type (2020-2026) 1.5.2 Pyrogenic Process 1.5.3 Electrolytic Process 1.6 Market by Application 1.6.1 Global CIS Tin Market Share by Application (2020-2026) 1.6.2 Solder 1.6.3 Tinplate 1.6.4 Chemicals 1.6.5 Brass & bronze 1.6.6 Float glass 1.7 CIS Tin Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on CIS Tin Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of CIS Tin Market 3.1 Value Chain Status 3.2 CIS Tin Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of CIS Tin 3.2.3 Labor Cost of CIS Tin 3.2.3.1 Labor Cost of CIS Tin Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 PT Timah 4.1.1 PT Timah Basic Information 4.1.2 CIS Tin Product Profiles, Application and Specification 4.1.3 PT Timah CIS Tin Market Performance (2015-2020) 4.1.4 PT Timah Business Overview 4.2 Minsur 4.2.1 Minsur Basic Information 4.2.2 CIS Tin Product Profiles, Application and Specification 4.2.3 Minsur CIS Tin Market Performance (2015-2020) 4.2.4 Minsur Business Overview 4.3 MSC 4.3.1 MSC Basic Information 4.3.2 CIS Tin Product Profiles, Application and Specification 4.3.3 MSC CIS Tin Market Performance (2015-2020) 4.3.4 MSC Business Overview 4.4 Yunnan Tin 4.4.1 Yunnan Tin Basic Information 4.4.2 CIS Tin Product Profiles, Application and Specification 4.4.3 Yunnan Tin CIS Tin Market Performance (2015-2020) 4.4.4 Yunnan Tin Business Overview 4.5 EM Vinto 4.5.1 EM Vinto Basic Information 4.5.2 CIS Tin Product Profiles, Application and Specification 4.5.3 EM Vinto CIS Tin Market Performance (2015-2020) 4.5.4 EM Vinto Business Overview 4.6 Thaisarco 4.6.1 Thaisarco Basic Information 4.6.2 CIS Tin Product Profiles, Application and Specification 4.6.3 Thaisarco CIS Tin Market Performance (2015-2020) 4.6.4 Thaisarco Business Overview 5 Global CIS Tin Market Analysis by Regions 5.1 Global CIS Tin Sales, Revenue and Market Share by Regions 5.1.1 Global CIS Tin Sales by Regions (2015-2020) 5.1.2 Global CIS Tin Revenue by Regions (2015-2020) 5.2 North America CIS Tin Sales and Growth Rate (2015-2020) 5.3 Europe CIS Tin Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific CIS Tin Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa CIS Tin Sales and Growth Rate (2015-2020) 5.6 South America CIS Tin Sales and Growth Rate (2015-2020) 6 North America CIS Tin Market Analysis by Countries 6.1 North America CIS Tin Sales, Revenue and Market Share by Countries 6.1.1 North America CIS Tin Sales by Countries (2015-2020) 6.1.2 North America CIS Tin Revenue by Countries (2015-2020) 6.1.3 North America CIS Tin Market Under COVID-19 6.2 United States CIS Tin Sales and Growth Rate (2015-2020) 6.2.1 United States CIS Tin Market Under COVID-19 6.3 Canada CIS Tin Sales and Growth Rate (2015-2020) 6.4 Mexico CIS Tin Sales and Growth Rate (2015-2020) 7 Europe CIS Tin Market Analysis by Countries 7.1 Europe CIS Tin Sales, Revenue and Market Share by Countries 7.1.1 Europe CIS Tin Sales by Countries (2015-2020) 7.1.2 Europe CIS Tin Revenue by Countries (2015-2020) 7.1.3 Europe CIS Tin Market Under COVID-19 7.2 Germany CIS Tin Sales and Growth Rate (2015-2020) 7.2.1 Germany CIS Tin Market Under COVID-19 7.3 UK CIS Tin Sales and Growth Rate (2015-2020) 7.3.1 UK CIS Tin Market Under COVID-19 7.4 France CIS Tin Sales and Growth Rate (2015-2020) 7.4.1 France CIS Tin Market Under COVID-19 7.5 Italy CIS Tin Sales and Growth Rate (2015-2020) 7.5.1 Italy CIS Tin Market Under COVID-19 7.6 Spain CIS Tin Sales and Growth Rate (2015-2020) 7.6.1 Spain CIS Tin Market Under COVID-19 7.7 Russia CIS Tin Sales and Growth Rate (2015-2020) 7.7.1 Russia CIS Tin Market Under COVID-19 8 Asia-Pacific CIS Tin Market Analysis by Countries 8.1 Asia-Pacific CIS Tin Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific CIS Tin Sales by Countries (2015-2020) 8.1.2 Asia-Pacific CIS Tin Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific CIS Tin Market Under COVID-19 8.2 China CIS Tin Sales and Growth Rate (2015-2020) 8.2.1 China CIS Tin Market Under COVID-19 8.3 Japan CIS Tin Sales and Growth Rate (2015-2020) 8.3.1 Japan CIS Tin Market Under COVID-19 8.4 South Korea CIS Tin Sales and Growth Rate (2015-2020) 8.4.1 South Korea CIS Tin Market Under COVID-19 8.5 Australia CIS Tin Sales and Growth Rate (2015-2020) 8.6 India CIS Tin Sales and Growth Rate (2015-2020) 8.6.1 India CIS Tin Market Under COVID-19 8.7 Southeast Asia CIS Tin Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia CIS Tin Market Under COVID-19 9 Middle East and Africa CIS Tin Market Analysis by Countries 9.1 Middle East and Africa CIS Tin Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa CIS Tin Sales by Countries (2015-2020) 9.1.2 Middle East and Africa CIS Tin Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa CIS Tin Market Under COVID-19 9.2 Saudi Arabia CIS Tin Sales and Growth Rate (2015-2020) 9.3 UAE CIS Tin Sales and Growth Rate (2015-2020) 9.4 Egypt CIS Tin Sales and Growth Rate (2015-2020) 9.5 Nigeria CIS Tin Sales and Growth Rate (2015-2020) 9.6 South Africa CIS Tin Sales and Growth Rate (2015-2020) 10 South America CIS Tin Market Analysis by Countries 10.1 South America CIS Tin Sales, Revenue and Market Share by Countries 10.1.1 South America CIS Tin Sales by Countries (2015-2020) 10.1.2 South America CIS Tin Revenue by Countries (2015-2020) 10.1.3 South America CIS Tin Market Under COVID-19 10.2 Brazil CIS Tin Sales and Growth Rate (2015-2020) 10.2.1 Brazil CIS Tin Market Under COVID-19 10.3 Argentina CIS Tin Sales and Growth Rate (2015-2020) 10.4 Columbia CIS Tin Sales and Growth Rate (2015-2020) 10.5 Chile CIS Tin Sales and Growth Rate (2015-2020) 11 Global CIS Tin Market Segment by Types 11.1 Global CIS Tin Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global CIS Tin Sales and Market Share by Types (2015-2020) 11.1.2 Global CIS Tin Revenue and Market Share by Types (2015-2020) 11.2 Pyrogenic Process Sales and Price (2015-2020) 11.3 Electrolytic Process Sales and Price (2015-2020) 12 Global CIS Tin Market Segment by Applications 12.1 Global CIS Tin Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global CIS Tin Sales and Market Share by Applications (2015-2020) 12.1.2 Global CIS Tin Revenue and Market Share by Applications (2015-2020) 12.2 Solder Sales, Revenue and Growth Rate (2015-2020) 12.3 Tinplate Sales, Revenue and Growth Rate (2015-2020) 12.4 Chemicals Sales, Revenue and Growth Rate (2015-2020) 12.5 Brass & bronze Sales, Revenue and Growth Rate (2015-2020) 12.6 Float glass Sales, Revenue and Growth Rate (2015-2020) 13 CIS Tin Market Forecast by Regions (2020-2026) 13.1 Global CIS Tin Sales, Revenue and Growth Rate (2020-2026) 13.2 CIS Tin Market Forecast by Regions (2020-2026) 13.2.1 North America CIS Tin Market Forecast (2020-2026) 13.2.2 Europe CIS Tin Market Forecast (2020-2026) 13.2.3 Asia-Pacific CIS Tin Market Forecast (2020-2026) 13.2.4 Middle East and Africa CIS Tin Market Forecast (2020-2026) 13.2.5 South America CIS Tin Market Forecast (2020-2026) 13.3 CIS Tin Market Forecast by Types (2020-2026) 13.4 CIS Tin Market Forecast by Applications (2020-2026) 13.5 CIS Tin Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

CIS Tin

Request Sample

CIS Tin