Clinical Diagnosis Automation Market Size, Share, and Trends Analysis Report

CAGR :

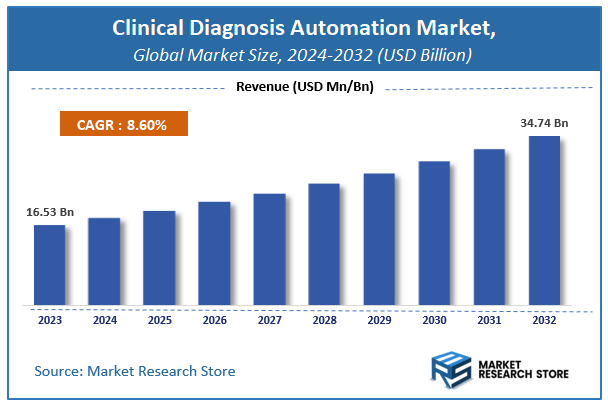

| Market Size 2023 (Base Year) | USD 16.53 Billion |

| Market Size 2032 (Forecast Year) | USD 34.74 Billion |

| CAGR | 8.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Clinical Diagnosis Automation Market Insights

According to Market Research Store, the global clinical diagnosis automation market size was valued at around USD 16.53 billion in 2023 and is estimated to reach USD 34.74 billion by 2032, to register a CAGR of approximately 8.6% in terms of revenue during the forecast period 2024-2032.

The clinical diagnosis automation report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Clinical Diagnosis Automation Market: Overview

Clinical diagnosis automation refers to the use of advanced technologies, including robotics, artificial intelligence (AI), machine learning, and laboratory information systems (LIS), to streamline and enhance the efficiency, accuracy, and consistency of diagnostic testing processes in healthcare laboratories. Automated systems are applied across various diagnostic disciplines—such as hematology, immunology, microbiology, molecular diagnostics, and clinical chemistry—to perform tasks like sample handling, reagent dispensing, analysis, data interpretation, and reporting with minimal human intervention.

The growth of the clinical diagnosis automation market is driven by increasing demand for high-throughput testing, rising global disease burden, and the need to reduce diagnostic turnaround times and operational errors. As healthcare systems strive for improved patient outcomes and cost-effectiveness, automated diagnostic solutions enable laboratories to process larger volumes of tests with enhanced precision and reliability.

Key Highlights

- The clinical diagnosis automation market is anticipated to grow at a CAGR of 8.6% during the forecast period.

- The global clinical diagnosis automation market was estimated to be worth approximately USD 16.53 billion in 2023 and is projected to reach a value of USD 34.74 billion by 2032.

- The growth of the clinical diagnosis automation market is being driven by the increasing need for high-throughput, accurate, and efficient diagnostic processes amid rising patient volumes, growing prevalence of chronic diseases, and the global emphasis on healthcare efficiency.

- Based on the technology type, the artificial intelligence (AI) segment is growing at a high rate and is projected to dominate the market.

- On the basis of application area, the radiology segment is projected to swipe the largest market share.

- In terms of deployment type, the cloud-based solutions segment is expected to dominate the market.

- Based on the end-user type, the hospitals segment is expected to dominate the market.

- In terms of component type, the software segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Clinical Diagnosis Automation Market: Dynamics

Key Growth Drivers:

- Increasing Volume and Complexity of Medical Data: Modern healthcare generates an exponential amount of data from various diagnostic tests, genomics, medical imaging, and electronic health records. Manual processing and analysis of this vast, complex data are unsustainable. Automation, coupled with AI and ML, is crucial for efficiently handling, interpreting, and deriving actionable insights from this data, driving the market.

- Rising Demand for Faster and More Accurate Diagnostic Results: Timely and accurate diagnoses are critical for effective treatment and improved patient outcomes, especially for conditions like cancer, infectious diseases, and chronic illnesses. Automation significantly speeds up laboratory workflows, reduces turnaround times, and minimizes the potential for human error, leading to more precise and reliable results.

- Shortage of Skilled Healthcare Professionals and Labor Costs: The global healthcare sector faces a persistent shortage of skilled laboratory technicians, pathologists, and other diagnostic personnel. Automation helps address this challenge by reducing the reliance on manual labor for repetitive tasks, allowing existing staff to focus on more complex analyses and critical decision-making, while also helping to control rising labor costs.

Restraints:

- High Initial Investment and Implementation Costs: The upfront cost of acquiring and installing advanced automation systems, including robotics, sophisticated analyzers, and integrated software, can be substantial. This significant capital expenditure, along with costs for infrastructure upgrades, customization, and staff training, can be a barrier for smaller hospitals, clinics, and laboratories.

- Integration Challenges with Existing Legacy Systems: Many healthcare facilities operate with established, often disparate, legacy IT systems and laboratory equipment. Integrating new, highly automated diagnostic platforms with these older systems can be complex, time-consuming, and prone to interoperability issues, leading to data inconsistencies and workflow disruptions.

- Lack of Skilled Professionals for Advanced Systems: While automation addresses labor shortages for routine tasks, it creates a demand for a new set of skills. There is a shortage of IT professionals, biomedical engineers, and data scientists with the expertise required to implement, manage, troubleshoot, and optimize complex automated diagnostic systems and interpret AI-driven insights.

Opportunities:

- Expansion of AI-Powered Diagnostics and AIOps in Healthcare: Further integration of AI and machine learning for enhanced diagnostic accuracy, predictive analytics for disease progression, and automated interpretation of complex medical images (radiology, pathology) presents significant opportunities. AIOps (AI for IT Operations) can also be applied to optimize the performance and reliability of the diagnostic automation infrastructure itself.

- Growth in Point-of-Care Testing (POCT) Automation: The demand for rapid, near-patient diagnostics, particularly outside traditional laboratory settings (e.g., emergency rooms, clinics, remote areas), is growing. Opportunities exist in developing highly automated, portable POCT devices that offer quick results with minimal manual intervention, enhancing accessibility and efficiency of diagnosis.

- Leveraging Cloud Computing for Scalability and Accessibility: Cloud-based automation solutions offer scalability, reduced upfront IT infrastructure costs, and enhanced accessibility for remote data analysis and collaboration. This deployment model is particularly attractive for smaller labs and facilitates real-time data sharing among different healthcare providers, fostering integrated care.

Challenges:

- Ensuring Accuracy and Validation of AI/ML Algorithms: A critical challenge is ensuring the consistent accuracy, reliability, and lack of bias in AI and ML algorithms used for diagnostic interpretation. Rigorous validation, ongoing monitoring, and clear regulatory guidelines are needed to build trust and ensure safe and effective clinical use.

- Ethical Considerations and Accountability: The increasing reliance on automated systems and AI in diagnosis raises ethical questions regarding decision-making processes, potential for algorithmic bias, and accountability in cases of diagnostic error. Establishing clear ethical guidelines and frameworks for responsibility is a significant challenge.

- Standardization of Data and Interoperability: Achieving true interoperability and data standardization across a diverse range of diagnostic instruments, Laboratory Information Management Systems (LIMS), and Electronic Health Records (EHRs) from different vendors remains a major hurdle. This fragmentation can limit the full potential of automated insights and seamless data flow.

Clinical Diagnosis Automation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Clinical Diagnosis Automation Market |

| Market Size in 2023 | USD 16.53 Billion |

| Market Forecast in 2032 | USD 34.74 Billion |

| Growth Rate | CAGR of 8.6% |

| Number of Pages | 170 |

| Key Companies Covered | Eppendor, Beckman Coulter Inc, Hudson Robotics, Bio-Rad Laboratories Inc, Caliper Life Sciences, Siemens Healthcare, Roche Diagnostics and others |

| Segments Covered | By Type, By Application, By Software, By And Equipment, By , And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Clinical Diagnosis Automation Market: Segmentation Insights

The global clinical diagnosis automation market is divided by technology type, application area, deployment type, end-user type, component type, and region.

Based on technology type, the global clinical diagnosis automation market is divided into artificial intelligence (AI), machine learning (ml), natural language processing (NLP) and robotic process automation (RPA). Artificial Intelligence (AI) dominates the Clinical Diagnosis Automation Market due to its transformative impact on diagnostic accuracy, speed, and decision support in clinical settings. AI technologies enable automated pattern recognition, predictive analytics, and image interpretation, which significantly enhance diagnostic outcomes in radiology, pathology, and genomics. AI-powered tools are widely used in early disease detection such as cancer, cardiovascular conditions, and neurological disorders through the analysis of medical images, patient histories, and lab data. These systems also support personalized medicine by integrating heterogeneous data to suggest tailored treatment pathways. As healthcare providers strive to reduce diagnostic errors and improve workflow efficiency, AI remains the most influential and widely adopted technology in this market.

On the basis of application area, the global clinical diagnosis automation market is bifurcated into radiology, pathology, cardiology, oncology, genomics, and digital health records management. Radiology dominates the Clinical Diagnosis Automation Market due to the widespread integration of advanced imaging analysis tools powered by artificial intelligence (AI) and machine learning (ML). Automated diagnostic platforms assist radiologists in detecting abnormalities in X-rays, CT scans, MRI, and PET images with improved speed and precision. These systems enable early identification of critical conditions such as fractures, tumors, pulmonary diseases, and stroke. Automation supports image segmentation, anomaly detection, and report generation, significantly reducing interpretation time and radiologist fatigue. With increasing imaging volumes and demand for faster diagnostics, radiology remains the leading application area for diagnostic automation, especially in high-throughput hospital systems and teleradiology networks.

In terms of deployment type, the global clinical diagnosis automation market is bifurcated into cloud-based solutions, on-premise solutions, and hybrid solutions. Cloud-based Solutions dominate the Clinical Diagnosis Automation Market due to their scalability, cost-effectiveness, and accessibility across healthcare networks. These solutions allow diagnostic data, imaging results, and patient records to be processed and stored securely on remote servers, enabling real-time collaboration among clinicians, labs, and diagnostic centers. Cloud platforms support advanced analytics, AI algorithms, and machine learning models that continuously update and improve diagnostic accuracy. Their ability to integrate with multiple data sources, including electronic health records (EHRs), wearable devices, and lab information systems, enhances diagnostic workflow automation.

Based on end-user type, the global clinical diagnosis automation market is bifurcated into hospitals, diagnostic laboratories, research institutes, clinics, and pharmaceutical companies. Hospitals dominate the Clinical Diagnosis Automation Market due to their comprehensive diagnostic capabilities, high patient volumes, and demand for integrated systems that enhance accuracy, speed, and efficiency. Hospitals utilize automation across radiology, pathology, cardiology, and laboratory diagnostics to streamline workflows, reduce human error, and support timely clinical decision-making. Advanced AI-driven platforms, robotic process automation (RPA), and machine learning (ML) tools are deployed to automate test result interpretation, imaging analysis, and electronic health record (EHR) integration. The growing focus on operational efficiency, quality of care, and cost containment is driving hospitals particularly tertiary care and multi-specialty institutions to invest heavily in diagnostic automation technologies.

In terms of component type, the global clinical diagnosis automation market is bifurcated into hospitals, diagnostic laboratories, research institutes, clinics, and pharmaceutical companies. Hospitals dominate the Clinical Diagnosis Automation Market due to their comprehensive diagnostic capabilities, high patient volumes, and demand for integrated systems that enhance accuracy, speed, and efficiency. Hospitals utilize automation across radiology, pathology, cardiology, and laboratory diagnostics to streamline workflows, reduce human error, and support timely clinical decision-making. Advanced AI-driven platforms, robotic process automation (RPA), and machine learning (ML) tools are deployed to automate test result interpretation, imaging analysis, and electronic health record (EHR) integration. The growing focus on operational efficiency, quality of care, and cost containment is driving hospitals particularly tertiary care and multi-specialty institutions to invest heavily in diagnostic automation technologies.

Clinical Diagnosis Automation Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the clinical diagnosis automation market, driven by a highly developed healthcare infrastructure, strong adoption of advanced diagnostic technologies, and increasing demand for high-throughput laboratory workflows. The United States is the primary contributor, with widespread deployment of fully and semi-automated diagnostic systems in clinical laboratories, hospitals, and reference labs. Rising test volumes, labor shortages, and the need for faster turnaround times are prompting health systems to invest in automation across processes such as sample preparation, testing, data analysis, and reporting. The region also benefits from a large base of diagnostics companies, continuous regulatory approvals, and integration of artificial intelligence and robotics in lab automation. Canada also supports growth with rising investments in centralized lab services and automated immunoassay and hematology platforms across regional health networks.

Asia-Pacific is the fastest-growing region in the clinical diagnosis automation market, owing to increasing healthcare expenditure, growing patient volumes, and expanding access to diagnostic services. China and India are leading this growth. In China, large urban hospitals are rapidly adopting clinical lab automation to manage high test volumes, reduce diagnostic delays, and improve workflow efficiency. India is seeing gradual automation, particularly in private diagnostic chains and metropolitan hospitals, with growing investments in automated blood testing, RT-PCR platforms, and immunoassays. Japan and South Korea already have highly automated lab environments driven by technology-intensive healthcare systems and strong domestic manufacturing of diagnostic devices. Southeast Asia is emerging, with countries like Thailand, Malaysia, and Vietnam upgrading diagnostic capacity in response to rising demand for early disease detection and infectious disease surveillance.

Europe holds a substantial share of the clinical diagnosis automation market, supported by aging populations, chronic disease prevalence, and national initiatives to modernize healthcare infrastructure. Countries like Germany, the UK, France, and the Netherlands are at the forefront, with advanced public and private labs adopting automation for microbiology, clinical chemistry, molecular diagnostics, and histopathology workflows. Germany’s highly structured healthcare system and its emphasis on efficiency and standardization are driving high demand for total lab automation (TLA) and middleware solutions. In the UK and France, national health services are increasingly relying on automated platforms to enhance accuracy and reduce human error. Cross-laboratory data integration, rising digital pathology usage, and government-backed laboratory consolidation programs continue to support market expansion.

Clinical Diagnosis Automation Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the clinical diagnosis automation market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global clinical diagnosis automation market include:

- PerkinElmer

- Danaher

- Abbott

- Eppendor

- Beckman Coulter Inc

- Hudson Robotics

- Bio-Rad Laboratories Inc

- Caliper Life Sciences

- Siemens Healthcare

- Roche Diagnostics

The global clinical diagnosis automation market is segmented as follows:

By Technology Type

- Artificial Intelligence (AI)

- Machine Leaing (ML)

- Natural Language Processing (NLP)

- Robotic Process Automation (RPA)

By Application Area

- Radiology

- Pathology

- Cardiology

- Oncology

- Genomics

- Digital Health Records Management

By Deployment Type

- Cloud-based Solutions

- On-premise Solutions

- Hybrid Solutions

By End-user Type

- Hospitals

- Diagnostic Laboratories

- Research Institutes

- Clinics

- Pharmaceutical Companies

By Component Type

- Software

- Hardware

- Services

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Chapter 1. Preface

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

Chapter 2. Executive Summary

- 2.1. Global clinical diagnosis automation market , 2014 - 2020, (USD Million)

- 2.2. Clinical diagnosis automation: Market snapshot

Chapter 3. Clinical diagnosis automation market : Industry Analysis

- 3.1. Clinical diagnosis automation: Market dynamics

- 3.2. Value Chain Analysis

- 3.3. Market Drivers

- 3.3.1. Rising diagnostic rates

- 3.3.2. Increasing need for cost reduction and improved personnel safety

- 3.4. Restraints

- 3.4.1. High operating cost

- 3.5. Opportunity

- 3.5.1. Technological innovation for space and cost reduction

- 3.6. Porter’s Five Forces Analysis

- 3.7. Market Attractiveness Analysis

- 3.7.1. Market attractiveness analysis by type segment

- 3.7.2. Market attractiveness analysis by application segment

- 3.7.3. Market attractiveness analysis by software and equipment segment

- 3.7.4. Market attractiveness analysis by regional segment

Chapter 4. Global Clinical diagnosis automation market : Competitive Landscape

- 4.1. Company market share analysis, 2014

Chapter 5. Global Clinical diagnosis automation market : Type Overview

- 5.1. Global clinical diagnosis automation market share, by type, 2014 and 2020

- 5.2. Global clinical diagnosis automation market for modular automation, 2014 - 2020 (USD Million)

- 5.3. Global clinical diagnosis automation market for total lab automation, 2014 - 2020 (USD Million)

Chapter 6. Global Clinical diagnosis automation market : Application Overview

- 6.1. Global clinical diagnosis automation market share, by application, 2014 and 2020

- 6.2. Global clinical diagnosis automation market for clinical diagnostics, 2014 - 2020 (USD Million)

- 6.3. Global clinical diagnosis automation market for drug discovery, 2014 - 2020 (USD Million)

- 6.4. Global clinical diagnosis automation market for proteomics solutions, 2014 - 2020 (USD Million)

- 6.5. Global clinical diagnosis automation market for others, 2014 – 2020 (USD Million)

Chapter 7. Global Clinical diagnosis automation market : software and equipment Overview

- 7.1. Global clinical diagnosis automation market share, by software and equipment, 2014 and 2020

- 7.2. Global clinical diagnosis automation market for automated liquid handling, 2014 - 2020 (USD Million)

- 7.3. Global clinical diagnosis automation market for microplate readers, 2014 - 2020 (USD Million)

- 7.4. Global clinical diagnosis automation market for standalone robots, 2014 - 2020 (USD Million)

- 7.5. Global clinical diagnosis automation market for automated storage, 2014 - 2020 (USD Million)

- 7.6. Global clinical diagnosis automation market for software and informatics, 2014 - 2020 (USD Million)

- 7.7. Global clinical diagnosis automation market for others, 2014 - 2020 (USD Million)

Chapter 8. Global Clinical diagnosis automation market – Regional Segment Analysis

- 8.1. Global clinical diagnosis automation market : Regional overview

- 8.1.1. Global clinical diagnosis automation market revenue share, by region, 2014 and 2020

- 8.2. North America

- 8.2.1. North America clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.2.2. North America clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.2.3. North America clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.2.4. U.S.

- 8.2.4.1. U.S. clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.2.4.2. U.S. clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.2.4.3. U.S. clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.3. Europe

- 8.3.1. Europe clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.3.2. Europe clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.3.3. Europe clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.3.4. Germany

- 8.3.4.1. Germany clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.3.4.2. Germany clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.3.4.3. Germany clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.3.5. France

- 8.3.5.1. France clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.3.5.2. France clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.3.5.3. France clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.3.6. UK

- 8.3.6.1. U.K. clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.3.6.2. U.K. clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.3.6.3. U.K. clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.4. Asia Pacific

- 8.4.1. Asia Pacific clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.4.2. Asia Pacific clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.4.3. Asia Pacific clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.4.4. China

- 8.4.4.1. China clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.4.4.2. China clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.4.4.3. China clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.4.5. Japan

- 8.4.5.1. Japan clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.4.5.2. Japan clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.4.5.3. Japan clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.4.6. India

- 8.4.6.1. India clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.4.6.2. India clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.4.6.3. India clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.5. Latin America

- 8.5.1. Latin America clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.5.2. Latin America clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.5.3. Latin America clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.5.4. Brazil

- 8.5.4.1. Brazil clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.5.4.2. Brazil clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.5.4.3. Brazil clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

- 8.6. Middle East & Africa

- 8.6.1. Middle East & Africa clinical diagnosis automation market revenue, by type, 2014 – 2020 (USD Million)

- 8.6.2. Middle East & Africa clinical diagnosis automation market revenue, by application, 2014 – 2020 (USD Million)

- 8.6.3. Middle East & Africa clinical diagnosis automation market revenue, by software and equipment, 2014 – 2020 (USD Million)

Chapter 9. Company Profile

- 9.1. Abott Diagnostics

- 9.1.1. Overview

- 9.1.2. Financials

- 9.1.3. Product portfolio

- 9.1.4. Business strategy

- 9.1.5. Recent developments

- 9.2. Caliper Life Sciences

- 9.2.1. Overview

- 9.2.2. Financials

- 9.2.3. Product portfolio

- 9.2.4. Business strategy

- 9.2.5. Recent developments

- 9.3. Eppendor

- 9.3.1. Overview

- 9.3.2. Financials

- 9.3.3. Product portfolio

- 9.3.4. Business strategy

- 9.3.5. Recent developments

- 9.4. Beckman Coulter Inc

- 9.4.1. Overview

- 9.4.2. Financials

- 9.4.3. Product portfolio

- 9.4.4. Business strategy

- 9.4.5. Recent developments

- 9.5. Roche Diagnostics

- 9.5.1. Overview

- 9.5.2. Financials

- 9.5.3. Product portfolio

- 9.5.4. Business strategy

- 9.5.5. Recent developments

- 9.6. Siemens Healthcare

- 9.6.1. Overview

- 9.6.2. Financials

- 9.6.3. Product portfolio

- 9.6.4. Business strategy

- 9.6.5. Recent developments

Inquiry For Buying

Clinical Diagnosis Automation

Request Sample

Clinical Diagnosis Automation