Cultured Meat Alternative Protein Market Size, Share, and Trends Analysis Report

CAGR :

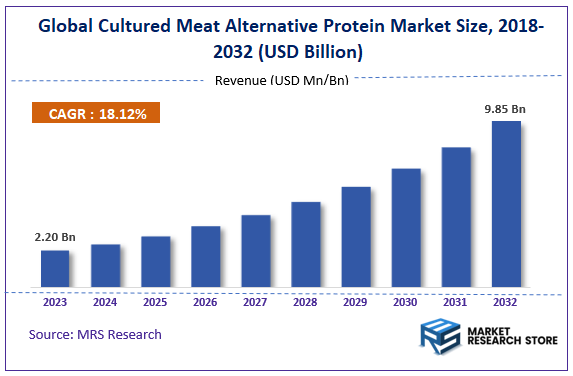

| Market Size 2023 (Base Year) | USD 2.20 Billion |

| Market Size 2032 (Forecast Year) | USD 9.85 Billion |

| CAGR | 18.12% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global cultured meat alternative protein market size was valued at around USD 2.20 billion in 2023 and is estimated to reach USD 9.85 billion by 2032, to register a CAGR of approximately 18.12% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The cultured meat alternative protein report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Cultured Meat Alternative Protein Market: Overview

The Cultured Meat Alternative Protein Market revolves around the development and commercialization of proteins derived from lab-grown or cultured meat and plant-based alternatives. Cultured meat, also known as lab-grown meat, is produced by cultivating animal cells in a controlled environment, eliminating the need for traditional animal farming.

This process mimics the texture, taste, and nutritional profile of conventional meat but without the environmental impact, ethical concerns, and resource inefficiency associated with livestock farming.

Plant-based protein alternatives, which aim to replicate the taste and texture of meat using plant-derived ingredients like soy, pea, and rice, are also gaining popularity as part of the broader movement toward sustainable, cruelty-free food options.

The market is being driven by several factors, including the growing demand for sustainable food sources, rising awareness of animal welfare, environmental concerns related to livestock farming (such as high carbon emissions, deforestation, and water use), and a shifting consumer preference toward plant-based and lab-grown alternatives.

Additionally, advancements in food technology, the increasing adoption of plant-based diets, and the significant investment in alternative protein startups have further fueled market growth.

As consumers become more health-conscious, they are seeking out meat alternatives that provide high protein content without the health risks often associated with traditional meat products, such as high cholesterol and saturated fats.

Key Highlights

- The cultured meat alternative protein market is anticipated to grow at a CAGR of 18.12% during the forecast period.

- The global cultured meat alternative protein market was estimated to be worth approximately USD 2.20 billion in 2023 and is projected to reach a value of USD 9.85 billion by 2032.

- Increasing awareness of the environmental impact of traditional meat production, which involves high greenhouse gas emissions, deforestation, and water usage, is pushing consumers toward more sustainable options like cultured meat.

- Based on the product, the matured alternative protein segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the food segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Cultured Meat Alternative Protein Market: Dynamics

Key Growth Drivers

- Ethical Concerns about Traditional Meat Production: Growing concerns about animal welfare, environmental impact, and food safety are driving the demand for alternative protein sources.

- Sustainability: Cultured meat offers a sustainable alternative to traditional meat production, reducing greenhouse gas emissions and land use.

- Food Security: As the global population grows, cultured meat can help address food security concerns by providing a reliable and scalable source of protein.

- Health Benefits: Cultured meat can be produced with specific nutritional profiles, such as reduced fat and cholesterol content, tailored to consumer preferences.

Restraints

- Regulatory Hurdles: The regulatory landscape for cultured meat is still evolving, and obtaining regulatory approval for commercialization can be a complex and time-consuming process.

- Consumer Perception: Overcoming consumer skepticism and negative perceptions about lab-grown meat is a significant challenge.

- High Production Costs: The current production costs of cultured meat are relatively high, limiting its affordability for consumers.

- Technological Challenges: Scaling up production and ensuring consistent product quality are technical challenges that need to be addressed.

Opportunities

- Product Innovation: Developing a diverse range of cultured meat products, including different cuts and flavors, can expand market reach.

- Partnerships and Collaborations: Collaborating with established food companies, retailers, and investors can accelerate market adoption and commercialization.

- Customization and Personalization: Tailoring cultured meat products to specific dietary needs and preferences can create niche market opportunities.

- Integration with Plant-Based and Traditional Meat: Combining cultured meat with plant-based ingredients or traditional meat can create hybrid products with unique flavors and textures.

Challenges

- Consumer Acceptance: Overcoming consumer resistance and educating the public about the benefits of cultured meat is crucial for market success.

- Scalability: Scaling up production to meet commercial demand while maintaining quality and consistency is a significant challenge.

- Cost Reduction: Reducing production costs to make cultured meat affordable for consumers is essential.

- Supply Chain and Distribution: Establishing efficient supply chains and distribution networks for cultured meat products is crucial for reaching consumers.

Cultured Meat Alternative Protein Market: Segmentation Insights

The global cultured meat alternative protein market is divided by product, application, and region.

Segmentation Insights by Product

Based on Product, the global cultured meat alternative protein market is divided into matured alternative protein, emerging alternative protein, adolescent alternative protein, and others.

The Matured Alternative Protein segment is the dominant segment in the Cultured Meat Alternative Protein Market. It currently holds the largest market share due to the widespread commercialization of plant-based proteins and early-stage cultured meat products. This segment has the highest market share, as it includes widely recognized and well-established products.

Emerging Alternative Protein refers to novel protein sources and technologies that are in the early stages of development. These products are often experimental or in research phases, with a focus on sustainable and scalable alternatives to traditional animal meat. This segment is characterized by innovation and technological advancements, with growing investments in research and development.

Adolescent Alternative Protein refers to alternative proteins that are past the experimental phase but are still in the early stages of commercialization. This includes plant-based proteins and some cultured meat products that are now being produced at a larger scale but are not yet fully mature in terms of consumer adoption or mass production. This segment is growing rapidly as these proteins move toward wider adoption.

Segmentation Insights by Application

On the basis of Application, the global cultured meat alternative protein market is bifurcated into food, feed, and others.

The Food application is the dominant segment in the Cultured Meat Alternative Protein Market. It is the largest contributor to market revenue and holds the highest growth potential, driven by the increasing consumer demand for plant-based diets, ethical food options, and the rise of lab-grown meat. This segment is experiencing rapid growth, driven by changing consumer preferences towards plant-based and lab-grown proteins.

The Feed application is still emerging but holds significant potential, especially in sectors like aquaculture (fish farming) where fishmeal is a major ingredient. As cultured meat and plant-based proteins become more available and affordable, there is a growing interest in incorporating them into animal feed. The Feed application involves using alternative proteins in animal feed, particularly for livestock and aquaculture.

Cultured Meat Alternative Protein Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cultured Meat Alternative Protein Market |

| Market Size in 2023 | USD 2.20 Billion |

| USD 9.85 Billion | |

| Growth Rate | CAGR of 18.12% |

| Number of Pages | 218 |

| Key Companies Covered | AgriProtein (South Africa), Aspire Food Group (U.S.), Enterra Feed Corporation (Canada), Entomo Farms (Canada), Global Bugs Asia Co., Ltd. (Thailand), Proti-Farm Holding NV (The Netherlands), Protix (The Netherlands), Tiny Farms (U.S.), Ynsect (France), and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cultured Meat Alternative Protein Market: Regional Insights

- North America currently leads the global cultured meat alternative protein market

North America, particularly the United States, is one of the largest markets for cultured meat and alternative proteins. The U.S. is home to several leading companies in the plant-based and cultured meat sectors, such as Beyond Meat, Impossible Foods, and Memphis Meats. The region's high awareness of sustainability, coupled with growing concerns about the environmental and ethical issues of traditional meat production, has driven consumer demand for meat alternatives.

Moreover, investments from major food and biotechnology companies are helping to push the market forward, with companies focusing on scaling up production to meet growing demand.

Europe is another key market for cultured meat and alternative proteins, driven by a strong consumer preference for sustainable, ethical food products. The European Union has implemented various sustainability and environmental goals, which have aligned with the growing popularity of plant-based proteins.

Leading European countries such as the UK, Germany, and the Netherlands are particularly focused on promoting plant-based foods and lab-grown meat. As in North America, European consumers are becoming more health-conscious and environmentally aware, further driving the market. Additionally, regulatory frameworks are being developed to support the commercialization of cultured meat in Europe, contributing to the market's growth.

The Asia-Pacific region is expected to witness significant growth in the cultured meat alternative protein market due to rising incomes, changing dietary habits, and increasing urbanization. In countries like China and Japan, there is growing interest in both plant-based and cultured meat products, as consumers seek alternatives to traditional animal-based proteins.

Asian markets are also investing in food technology, with some countries like Singapore leading the way in approving and promoting lab-grown meat. The demand for sustainable food solutions in rapidly developing markets, coupled with changing preferences towards more health-conscious diets, is driving the market’s growth in this region.

Latin America is still an emerging market for cultured meat and alternative proteins but is showing potential, especially in countries like Brazil and Argentina, where there is already a significant focus on meat production. The growing trend towards plant-based and sustainable diets is creating demand for alternative proteins.

Local companies are increasingly developing plant-based products to cater to the increasing number of consumers looking for healthier and more ethical protein options. However, the market for cultured meat in Latin America is still in the early stages compared to North America and Europe.

The Middle East & Africa region is an emerging market for cultured meat and plant-based proteins, driven by rising incomes and the adoption of modern diets. In the Middle East, particularly in countries like the UAE and Saudi Arabia, there is a growing interest in sustainable food solutions, including cultured meat. However, the market is still developing, with more focus on plant-based alternatives at this stage.

As the demand for healthier, more sustainable proteins increases, companies are exploring new opportunities in these regions, especially in urban centers.

Cultured Meat Alternative Protein Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the cultured meat alternative protein market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global cultured meat alternative protein market include:

- AgriProtein (South Africa)

- Aspire Food Group (U.S.)

- Enterra Feed Corporation (Canada)

- Entomo Farms (Canada)

- Global Bugs Asia Co.

- Ltd. (Thailand)

- Proti-Farm Holding NV (The Netherlands)

- Protix (The Netherlands)

- Tiny Farms (U.S.)

- Ynsect (France)

The global cultured meat alternative protein market is segmented as follows:

By Product

- Matured Alternative Protein

- Emerging Alternative Protein

- Adolescent Alternative Protein

By Application

- Food

- Feed

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global cultured meat alternative protein market size was projected at approximately US$ 2.20 billion in 2023. Projections indicate that the market is expected to reach around US$ 9.85 billion in revenue by 2032.

The global cultured meat alternative protein market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 18.12% during the forecast period from 2024 to 2032.

North America is expected to dominate the global cultured meat alternative protein market.

This shift is also influenced by growing concern for animal welfare, as cultured meat provides a cruelty-free alternative to conventional meat, appealing to those opposed to factory farming.

Some of the prominent players operating in the global cultured meat alternative protein market are; AgriProtein (South Africa), Aspire Food Group (U.S.), Enterra Feed Corporation (Canada), Entomo Farms (Canada), Global Bugs Asia Co., Ltd. (Thailand), Proti-Farm Holding NV (The Netherlands), Protix (The Netherlands), Tiny Farms (U.S.), Ynsect (France), and others.

Table Of Content

Inquiry For Buying

Cultured Meat Alternative Protein

Request Sample

Cultured Meat Alternative Protein