Dental Insurance Market Size, Share, and Trends Analysis Report

CAGR :

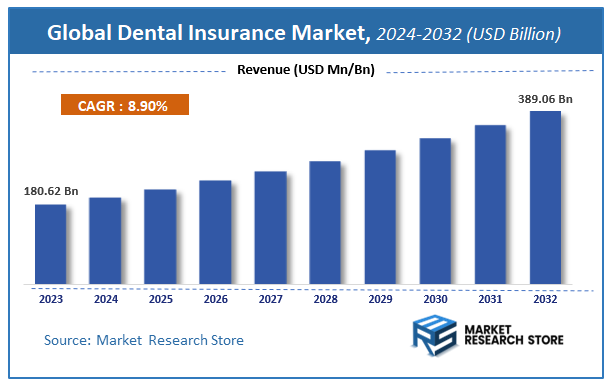

| Market Size 2023 (Base Year) | USD 180.62 Billion |

| Market Size 2032 (Forecast Year) | USD 389.06 Billion |

| CAGR | 8.9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Dental Insurance Market Insights:

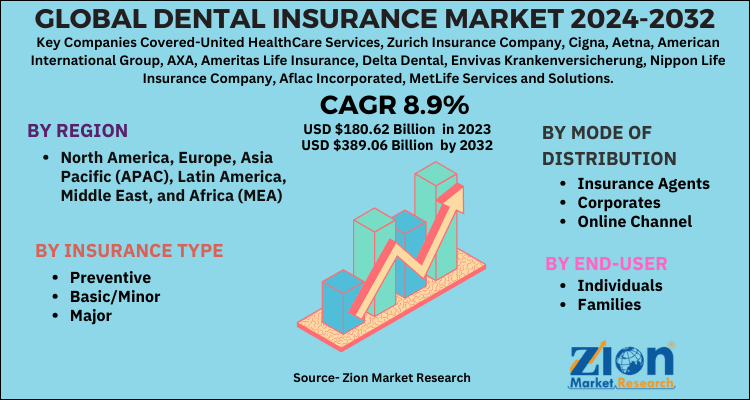

The global dental insurance market size was worth around USD 180.62 billion in 2023 and is predicted to grow to around USD 389.06 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.9% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the dental insurance market on a global and regional level.

To Get more Insights, Request a Free Sample

Dental Insurance Market: Overview

Dental insurance is a form of health insurance that covers only the dental health or oral health of a person. This insurance reimburses any kind of dental costs incurred by the patients. The most common type of dental insurance plan is preferred provider organizations (PPO) or dental health maintenance organizations (DHMO).

Oral diseases are the most commonly found NCDs (non-communicable diseases), which also affects one’s lives, causing disfigurement, discomfort, pain, and even death. There are seven major oral diseases and conditions that account for most of the oral diseases’ burden. These major oral diseases are oro-dental trauma, periodontal (gum) diseases, oral cancers, cleft lip and palate, oral manifestations of HIV, dental caries (tooth decay), and noma. Almost all these conditions can be either largely prevented or treated in their early stages. According to the Global Burden of Disease Study, half of the world’s population (3.58 billion people) was affected by oral diseases in their permanent teeth in 2016. This growing prevalence of oral diseases among the different-aged population is creating awareness about dental insurance, due to the recurring treatment required for oral problems. The high cost of the dental procedures is fueling the dental insurance market, as people opt for dental insurances as it helps in decreasing the spending on dental procedures.

To Get more Insights, Request a Free Sample

Dental Insurance Market: Segmentation

The study provides a decisive view of the dental insurance market by segmenting it based on insurance type, mode of distribution, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By insurance type, the dental insurance market is segmented into preventive, basic/minor, and major. The basic/minor segment dominated the market in 2023, as it covers mostly both the important and common dental procedures.

Based on mode of distribution, the dental insurance market includes insurance agents, corporates, and online channel. The online channel is anticipated to show a high growth rate in the years ahead, owing to the increase in the use of the internet and electronic gadgets in every region.

Based on end-user, the dental insurance market includes individuals and families. Families dominated the market in 2023, due to its cost-effectiveness as compared to that of an individual end-user.

Dental Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dental Insurance Market |

| Market Size in 2023 | USD 180.62 Billion |

| Market Forecast in 2032 | USD 389.06 Billion |

| Growth Rate | CAGR of 8.9% |

| Number of Pages | 155 |

| Key Companies Covered | United HealthCare Services, Zurich Insurance Company, Cigna, Aetna, American International Group, AXA, Ameritas Life Insurance, Delta Dental, Envivas Krankenversicherung, Nippon Life Insurance Company, Aflac Incorporated, MetLife Services and Solutions, Colonial Life & Accident Insurance Company, and Allstate Benefits |

| Segments Covered | By insurance type, By mode of distribution, By end-user and By region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dental Insurance Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further classification into major countries.

North America dominated the global dental insurance market in 2023, owing to the early introduction of highly developed dental surgical equipment, increase in regional healthcare spending, high costs of dental procedures, and the presence of the major market players. Asia Pacific is expected to show the highest CAGR in the dental insurance market globally in the future, due to the growing awareness about dental care procedures and the benefits of dental insurances and growing prevalence of oral health problems in developing countries like India.

Dental Insurance Market: Competitive Players

Some leading players operating in the global dental insurance market include:

- United HealthCare Services

- Zurich Insurance Company

- Cigna

- Aetna

- American International Group

- AXA

- Ameritas Life Insurance

- Delta Dental

- Envivas Krankenversicherung

- Nippon Life Insurance Company

- Aflac Incorporated

- MetLife Services and Solutions

- Colonial Life & Accident Insurance Company

- Allstate Benefits

The Global Dental Insurance Market is segmented as follows:

Global Dental Insurance Market: Insurance Type Analysis

- Preventive

- Basic/Minor

- Major

Global Dental Insurance Market: Mode of Distribution Analysis

- Insurance Agents

- Corporates

- Online Channel

Global Dental Insurance Market: End-User Analysis

- Individuals

- Families

Global Dental Insurance Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Dental Insurance

Request Sample

Dental Insurance