Electronic Currency Market Size, Share, and Trends Analysis Report

CAGR :

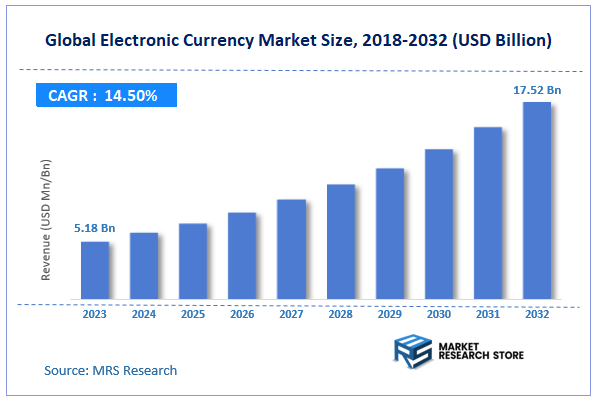

| Market Size 2023 (Base Year) | USD 5.18 Billion |

| Market Size 2032 (Forecast Year) | USD 17.52 Billion |

| CAGR | 14.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global electronic currency market size was valued at around USD 5.18 billion in 2023 and is estimated to reach USD 17.52 billion by 2032, to register a CAGR of approximately 14.5% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The electronic currency report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Electronic Currency Market: Overview

The Electronic Currency Market encompasses the use and exchange of digital or electronic forms of money, including cryptocurrencies, central bank digital currencies (CBDCs), and private digital payment platforms.

Unlike physical cash, electronic currencies operate on digital infrastructures, leveraging blockchain technology, cryptography, or centralized systems to enable secure and efficient transactions. These currencies are increasingly used for payments, investments, and cross-border transactions, providing an alternative to traditional banking methods.

The market growth is driven by the increasing adoption of blockchain technology, rising demand for cashless transactions, and advancements in financial technologies (FinTech). Cryptocurrencies like Bitcoin and Ethereum dominate the decentralized segment, offering transparency and decentralization, while CBDCs are gaining traction as governments explore secure and regulated alternatives to private digital currencies.

The surge in e-commerce, online payments, and the need for faster, cheaper cross-border remittances are also significant contributors to the market's expansion.

Key Highlights

- The electronic currency market is anticipated to grow at a CAGR of 14.5% during the forecast period.

- The global electronic currency market was estimated to be worth approximately USD 5.18 billion in 2023 and is projected to reach a value of USD 17.52 billion by 2032.

- The growth of the electronic currency market is being driven by the increasing adoption of digital payment methods, the growing popularity of cryptocurrencies, and the increasing need for secure and efficient financial transactions.

- Based on the product, the fintech segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the enterprise segment is projected to swipe the largest market share.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Electronic Currency Market: Dynamics

Key Growth Drivers

- Technological Advancements: The rapid advancement of blockchain technology and cryptocurrency has made digital currencies more accessible and secure.

- Financial Inclusion: Electronic currencies can provide financial inclusion to underserved populations, especially in developing countries.

- Cross-Border Transactions: Digital currencies can facilitate faster and cheaper cross-border transactions, reducing reliance on traditional banking systems.

- Privacy and Security: Cryptocurrencies offer a high degree of privacy and security, attracting users concerned about traditional banking systems.

Restraints

- Regulatory Uncertainty: The regulatory landscape for digital currencies is still evolving, creating uncertainty for businesses and consumers.

- Volatility: The price volatility of cryptocurrencies can deter mainstream adoption.

- Security Risks: Cyberattacks and hacking threats pose risks to digital currency exchanges and wallets.

- Lack of Consumer Trust: Many people are still sceptical about the security and legitimacy of digital currencies.

Opportunities

- Central Bank Digital Currencies (CBDCs): The development of CBDCs by central banks can provide a stable and regulated form of digital currency.

- Decentralized Finance (DeFi): DeFi applications, built on blockchain technology, can revolutionize traditional finance.

- Micropayments: Digital currencies can facilitate small, frequent transactions, enabling new business models.

- Global Payments: Cross-border payments can become faster, cheaper, and more efficient with digital currencies.

Challenges

- Scalability: As the number of users and transactions grows, scaling blockchain networks can become challenging.

- Energy Consumption: Some cryptocurrencies, like Bitcoin, require significant energy consumption for mining, raising environmental concerns.

- Legal and Tax Implications: The legal and tax implications of using and investing in digital currencies can be complex and vary across jurisdictions.

- Consumer Protection: Ensuring consumer protection and addressing fraud and scams in the digital currency market is essential.

Electronic Currency Market: Segmentation Insights

The global electronic currency market is divided by product, application, and region.

Segmentation Insights by Product

Based on Product, the global electronic currency market is divided into fintech, IT solution, bank, consulting, exchange, and other.

The FinTech segment dominates the Electronic Currency Market, fueled by its innovative approach to integrating traditional finance with digital currency ecosystems. While IT Solutions and Exchanges are vital for infrastructure and trading, FinTech’s ability to cater directly to consumer and business needs ensures its leadership position in the market. This segment represents financial technology companies innovating in electronic payment systems, peer-to-peer (P2P) lending, and cryptocurrency platforms.

The IT Solution segment is a key player in the market, driven by the increasing demand for robust and secure systems to support digital transactions and cryptocurrency management. This segment comprises software and hardware solutions enabling the adoption, storage, and management of electronic currencies, including blockchain infrastructure, wallets, and transaction processing systems.

Banks hold a substantial market share due to their established trust and regulatory backing, making them a preferred choice for users transitioning to electronic currencies. This segment includes traditional banking institutions integrating electronic currency services, such as enabling digital wallet services, issuing central bank digital currencies (CBDCs), and facilitating online transactions.

The Consulting segment is growing, albeit smaller compared to IT and FinTech, as businesses seek expertise in navigating the complex electronic currency landscape. Consulting firms provide advisory services to organizations entering the electronic currency space, including regulatory compliance, market strategy, and technical implementation of digital payment systems.

The Exchange segment is pivotal, driven by increasing trading volumes and expanding investor interest in cryptocurrencies. This segment encompasses cryptocurrency exchanges facilitating the buying, selling, and trading of electronic currencies like Bitcoin, Ethereum, and other digital assets.

Segmentation Insights by Application

On the basis of Application, the global electronic currency market is bifurcated into enterprise, government, and others.

The Enterprise segment is the dominant application segment, as commercial industries like aerospace, automotive, and energy utilize EBPVD coatings for their equipment to enhance durability, heat resistance, and corrosion protection. The Enterprise segment refers to applications of EBPVD coatings in commercial and industrial sectors, including aerospace, automotive, power generation, electronics, and other industries that require high-performance coatings for components like turbines, engines, and precision instruments.

The Government segment holds a significant portion of the market, driven by increasing defense budgets and the need for advanced technology in national security and military applications. The Government segment includes applications of EBPVD coatings in military, defense, and government-related infrastructure. This involves the use of coatings in defense equipment, aerospace components, power generation systems, and infrastructure that require high-performance and durability in harsh environments.

Electronic Currency Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electronic Currency Market |

| Market Size in 2023 | USD 5.18 Billion |

| USD 17.52 Billion | |

| Growth Rate | CAGR of 14.5% |

| Number of Pages | 228 |

| Key Companies Covered | Accenture, Ant Financial, AWS, Baidu, Citi Bank, ELayaway, HSBC, IBM, JD Financial, Oklink, Oracle, Ripple, Rubix, Tecent, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electronic Currency Market: Regional Insights

- Asia Pacific currently leads the global electronic currency market

The Asia Pacific region is the fastest-growing market for electronic currency, particularly in countries like China, Japan, South Korea, and India. China has been at the forefront of digital currency initiatives, with the People's Bank of China (PBoC) developing and testing its Digital Yuan (e-CNY). While the Chinese government has banned private cryptocurrencies, the country’s state-backed digital currency is gaining traction as a model for other nations.

Japan is another major player, being one of the first countries to legalize cryptocurrency as a form of payment. In South Korea, there is significant interest in both digital currencies and blockchain technology, with strong regulatory support for crypto exchanges and blockchain startups. India has seen increasing cryptocurrency adoption despite regulatory uncertainty, with rising interest in digital assets and government discussions on potential regulation.

North America, especially the United States, is a leading market for electronic currency, driven by the high adoption of cryptocurrencies, advancements in blockchain technology, and a supportive regulatory environment. The U.S. is home to some of the largest cryptocurrency exchanges, such as Coinbase, and many fintech companies that facilitate digital currency transactions.

The demand for cryptocurrencies is fueled by factors such as investment opportunities, the rise of decentralized finance (DeFi) platforms, and increasing consumer interest in digital assets. Additionally, there is ongoing discussion around creating a regulatory framework for Central Bank Digital Currencies (CBDCs), with the Federal Reserve and other financial institutions exploring their potential use.

Europe is another key region in the electronic currency market, with countries like Germany, the UK, and Switzerland leading the adoption of cryptocurrencies and blockchain technology. The EU is exploring regulatory measures for cryptocurrencies, and the European Central Bank (ECB) has made significant progress in its investigation of CBDCs, focusing on a potential "digital euro." Countries like Switzerland are known for their progressive approach to digital currencies and blockchain, with the country positioning itself as a hub for crypto-related businesses. The European market also benefits from strong fintech sectors and growing acceptance of digital payments.

In Latin America, the electronic currency market is gaining momentum, especially in countries like Brazil, Argentina, and Mexico. Cryptocurrencies are being adopted as an alternative to traditional currencies due to economic instability, inflation, and the need for financial inclusion.

In Argentina, for example, Bitcoin and other cryptocurrencies are seen as a hedge against hyperinflation, and in Brazil, cryptocurrencies are gaining acceptance for both investments and payments. Mexico is also becoming an increasingly important player in the digital currency space, with a growing interest in blockchain applications, crypto trading, and remittances.

The Middle East and Africa (MEA) region is experiencing growth in the electronic currency market, with countries like the UAE, Saudi Arabia, and South Africa taking the lead. The UAE is home to some of the most progressive cryptocurrency regulations in the region, with Dubai positioning itself as a global crypto hub.

Saudi Arabia has shown interest in blockchain technology, with initiatives for cross-border payments and blockchain-based solutions in its Vision 2030 development plan. South Africa is the leading cryptocurrency market in Africa, with increasing adoption of digital currencies as a store of value and for remittances. However, the market in Africa faces challenges such as regulatory uncertainty and lack of widespread infrastructure for digital payments.

Electronic Currency Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the electronic currency market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global electronic currency market include:

- Accenture

- Ant Financial

- AWS

- Baidu

- Citi Bank

- ELayaway

- HSBC

- IBM

- JD Financial

- Oklink

- Oracle

- Ripple

- Rubix

- Tecent

The global electronic currency market is segmented as follows:

By Product

- FinTech

- IT Solution

- Bank

- Consulting

- Exchange

- Other

By Application

- Enterprise

- Government

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global electronic currency market size was projected at approximately US$ 5.18 billion in 2023. Projections indicate that the market is expected to reach around US$ 17.52 billion in revenue by 2032.

The global electronic currency market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 14.5% during the forecast period from 2024 to 2032.

Asia Pacific is expected to dominate the global electronic currency market.

The global electronic currency market is primarily driven by factors such as increasing digitalization, growing consumer adoption of digital payment methods, the need for faster and more secure transactions, and the rising popularity of cryptocurrencies.

Some of the prominent players operating in the global electronic currency market are; Accenture, Ant Financial, AWS, Baidu, Citi Bank, ELayaway, HSBC, IBM, JD Financial, Oklink, Oracle, Ripple, Rubix, Tecent, and others.

Table Of Content

Inquiry For Buying

Electronic Currency

Request Sample

Electronic Currency