Electronic Money Market Size, Share, and Trends Analysis Report

CAGR :

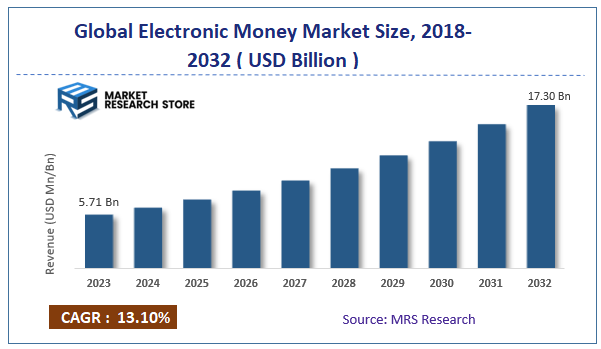

| Market Size 2023 (Base Year) | USD 5.71 Billion |

| Market Size 2032 (Forecast Year) | USD 17.30 Billion |

| CAGR | 13.1% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global electronic money market size was valued at around USD 5.71 billion in 2023 and is estimated to reach USD 17.30 billion by 2032, to register a CAGR of approximately 13.1% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The electronic money report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Electronic Money Market: Overview

The Electronic Money (e-money) Market refers to digital representations of fiat currency stored electronically, enabling secure online transactions and payments. E-money facilitates the exchange of value without the need for physical cash, and it includes digital wallets, prepaid cards, and mobile money services.

Unlike cryptocurrencies, e-money is typically tied to traditional fiat currencies like the U.S. dollar or euro and operates within the conventional financial system. It is widely used for online shopping, peer-to-peer transfers, and mobile payments, offering convenience and security for both consumers and businesses.

The market growth is primarily driven by the increasing adoption of digital payment solutions, the shift towards cashless economies, and the rise of mobile and internet banking. With the proliferation of smartphones, mobile wallets (such as PayPal, Apple Pay, and Google Pay) have become popular platforms for storing and using electronic money.

Key Highlights

- The electronic money market is anticipated to grow at a CAGR of 13.1% during the forecast period.

- The global electronic money market was estimated to be worth approximately USD 5.71 billion in 2023 and is projected to reach a value of USD 17.30 billion by 2032.

- The growth of the electronic money market is being driven by the increasing adoption of digital payment methods, the growing popularity of mobile wallets, and the increasing need for secure and efficient financial transactions.

- Based on the product, the FinTech segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the enterprise segment is projected to swipe the largest market share.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Electronic Money Market: Dynamics

Key Growth Drivers

- Digital Transformation: The increasing digitization of economies and the shift towards cashless transactions are driving the adoption of electronic money.

- E-commerce Growth: The rapid growth of e-commerce has fueled the demand for convenient and secure payment methods.

- Mobile Payments: The proliferation of smartphones and mobile wallets has made mobile payments a popular choice for consumers.

- Financial Inclusion: Electronic money can help to promote financial inclusion by providing access to financial services for underserved populations.

Restraints

- Security Concerns: Concerns about data breaches and cyberattacks can hinder the adoption of electronic money.

- Technical Infrastructure: Developing and maintaining the necessary infrastructure, such as payment gateways and point-of-sale terminals, can be costly.

- Regulatory Challenges: The regulatory environment for electronic money can be complex and vary across different jurisdictions.

- Consumer Trust: Building trust and confidence in electronic money systems is essential for widespread adoption.

Opportunities

- Innovation: The development of innovative electronic payment solutions, such as contactless payments and biometrics, can drive market growth.

- Cross-Border Payments: Electronic money can facilitate faster and cheaper cross-border transactions.

- Financial Inclusion: Expanding access to financial services through electronic money can benefit underserved populations.

- Data Analytics: Analyzing transaction data can provide valuable insights for businesses and policymakers.

Challenges

- Cybersecurity Threats: Protecting against cyberattacks and data breaches is a constant challenge.

- Interoperability: Ensuring seamless interoperability between different electronic payment systems can be complex.

- Consumer Education: Educating consumers about the benefits and security of electronic money is essential.

- Economic and Political Uncertainty: Economic downturns and geopolitical tensions can impact consumer confidence and spending habits.

Electronic Money Market: Segmentation Insights

The global electronic money market is divided by product, application, and region.

Segmentation Insights by Product

Based on Product, the global electronic money market is divided into FinTech, IT solution, bank, consulting, exchange, and other.

The FinTech segment is dominating the electronic money market due to its disruptive innovation and ability to offer highly scalable and flexible digital payment solutions. FinTech firms are transforming the financial services industry by providing faster, cheaper, and more accessible electronic money services to a global audience. The FinTech segment includes a broad range of financial technology services that enable electronic money transactions, such as peer-to-peer payment systems, mobile money platforms, and blockchain-based solutions.

The IT Solution segment is crucial to the growth of the electronic money market, as the backbone of most electronic money systems relies on sophisticated IT solutions for secure, efficient, and scalable payment processing. The IT Solution segment includes software, platforms, and infrastructure services that support the creation, management, and security of electronic money transactions.

The Bank segment has a substantial share of the electronic money market, particularly with the growing adoption of digital banking and mobile banking solutions. The Bank segment involves traditional and digital banking institutions that provide electronic money services such as digital wallets, e-banking, and online money transfers. Banks are key players in the market, leveraging their financial infrastructure to offer electronic money services.

The Consulting segment is vital but relatively smaller in market share compared to others. However, the segment is important for helping organizations in the e-money space develop the right strategies and comply with regulations. The Consulting segment includes firms and experts that offer strategic, technical, and regulatory consulting to businesses that are developing, implementing, or scaling electronic money services.

The Exchange segment is growing rapidly, particularly with the rise of cryptocurrencies, digital assets, and increasing demand for efficient and secure ways to exchange electronic money. The Exchange segment focuses on platforms and services that facilitate the exchange of electronic money, including cryptocurrency exchanges, foreign exchange platforms, and peer-to-peer exchange services.

Segmentation Insights by Application

On the basis of Application, the global electronic money market is bifurcated into enterprise, government, and others.

The Enterprise segment dominates the electronic money market due to the widespread use of electronic money solutions across commercial and private sector applications. From e-commerce giants to small businesses, the adoption of digital payments is ubiquitous in the private sector. The Enterprise application segment includes the use of electronic money in private sector operations, such as e-commerce, retail payments, B2B transactions, and business-to-consumer (B2C) platforms.

The Government segment holds a moderate share of the electronic money market, as many governments are increasingly exploring digital payment solutions for improving public sector operations and financial inclusion. The Government application segment involves the use of electronic money solutions in public sector services, including welfare distribution, tax collection, public payments, and other government-run financial systems.

Electronic Money Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electronic Money Market |

| Market Size in 2023 | USD 5.71 Billion |

| USD 17.30 Billion | |

| Growth Rate | CAGR of 13.1% |

| Number of Pages | 221 |

| Key Companies Covered | Accenture, Ant Financial, AWS, Baidu, Citi Bank, ELayaway, HSBC, IBM, JD Financial, Oklink, Oracle, Ripple, Rubix, Tecent, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electronic Money Market: Regional Insights

- Asia Pacific currently leads the global electronic money market

Asia Pacific is the dominant region in the electronic money market, driven by the widespread adoption of mobile payment systems in China, India, and other countries, alongside high smartphone penetration and strong governmental support for digital payment initiatives.

China stands as the largest e-money market globally, primarily due to the adoption of Alipay and WeChat Pay. The Asia Pacific region is also leading in the implementation of CBDCs, with China’s Digital Yuan setting a precedent for other countries.

North America, especially the United States, is a key market for electronic money, driven by the widespread adoption of digital payment solutions across various sectors. The U.S. has seen significant growth in mobile wallet usage, with platforms like PayPal, Apple Pay, and Google Pay becoming increasingly popular among consumers. The market is also benefiting from innovations in fintech and a shift toward cashless transactions in retail, e-commerce, and the financial services industry.

Additionally, regulatory clarity in the U.S. regarding digital payments and e-money platforms has facilitated growth in the sector. The growing use of digital wallets and prepaid cards, along with the rise of cryptocurrencies as an alternative form of digital money, is also driving the market forward.

Europe has one of the most advanced e-money markets, with high rates of digital payment adoption and a robust regulatory environment. The European Union has implemented several initiatives to promote digital payments and e-money usage, including the PSD2 (Payment Services Directive 2), which mandates stronger consumer protection and more competition in the payment sector.

In countries like the UK, Germany, and France, mobile wallets, contactless payments, and prepaid cards are widely used for both online and in-store transactions. Sweden stands out in Europe as one of the first countries moving towards a completely cashless society, with the adoption of digital currencies and mobile payment systems being particularly high.

Additionally, Europe is exploring CBDCs, with the European Central Bank working on the concept of a digital euro, which could further expand the digital money market.

In Latin America, electronic money adoption is growing, particularly in countries like Brazil, Mexico, and Argentina, driven by high smartphone penetration and the need for financial inclusion.

Prepaid cards, mobile wallets, and digital payment systems are becoming more popular, as they provide consumers with access to financial services without requiring traditional bank accounts. Brazil is one of the largest markets for e-money in the region, with platforms like PicPay and Mercado Pago offering digital wallets and payment solutions.

Additionally, the adoption of cryptocurrencies in countries like Argentina and Venezuela—where inflation and currency devaluation have eroded the value of national currencies—is further driving interest in digital money alternatives.

The Middle East and Africa (MEA) region is witnessing steady growth in the e-money market, particularly in countries like UAE, Saudi Arabia, and South Africa. In the UAE, the government has implemented several initiatives to promote a cashless society, with mobile payment systems, digital wallets, and prepaid cards becoming more widely used. Saudi Arabia is also pushing for digital transformation, with mobile payments gaining popularity in both retail and e-commerce.

In South Africa, platforms like SnapScan and Zapper are facilitating mobile payments and digital transactions. The African market is still developing, but the potential for growth is significant, especially as mobile phone usage increases, and the demand for financial inclusion in underserved regions grows.

Electronic Money Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the electronic money market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global electronic money market include:

- Accenture

- Ant Financial

- AWS

- Baidu

- Citi Bank

- ELayaway

- HSBC

- IBM

- JD Financial

- Oklink

- Oracle

- Ripple

- Rubix

- Tecent

The global electronic money market is segmented as follows:

By Product

- FinTech

- IT Solution

- Bank

- Consulting

- Exchange

- Other

By Application

- Enterprise

- Government

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global electronic money market size was projected at approximately US$ 5.71 billion in 2023. Projections indicate that the market is expected to reach around US$ 17.30 billion in revenue by 2032.

The global electronic money market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 13.1% during the forecast period from 2024 to 2032.

Asia Pacific is expected to dominate the global electronic money market.

The global electronic money market is primarily driven by factors such as increasing digitalization, growing consumer adoption of digital payment methods, the need for faster and more secure transactions, and the rising popularity of mobile wallets.

Some of the prominent players operating in the global electronic money market are; Accenture, Ant Financial, AWS, Baidu, Citi Bank, ELayaway, HSBC, IBM, JD Financial, Oklink, Oracle, Ripple, Rubix, Tecent, and others.

Table Of Content

Inquiry For Buying

Electronic Money

Request Sample

Electronic Money