Electronic Security Market Size, Share, and Trends Analysis Report

CAGR :

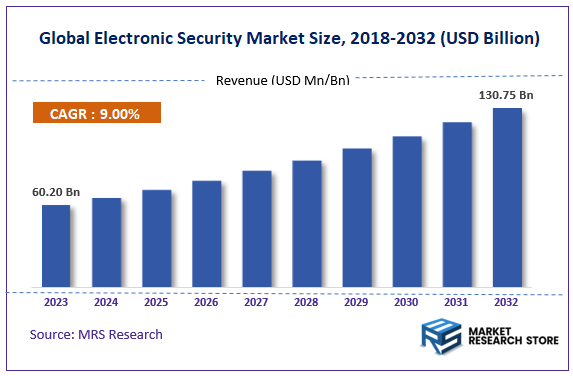

| Market Size 2023 (Base Year) | USD 60.20 Billion |

| Market Size 2032 (Forecast Year) | USD 130.75 Billion |

| CAGR | 9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global electronic security market size was valued at around USD 60.20 billion in 2023 and is estimated to reach USD 130.75 billion by 2032, to register a CAGR of approximately 9% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The electronic security report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Electronic Security Market: Overview

The Electronic Security Market refers to the development, production, and deployment of electronic security systems designed to protect assets, facilities, and individuals from unauthorized access, theft, and other security threats. These systems include video surveillance, access control systems, intruder alarms, biometric recognition, and cybersecurity solutions.

The market also encompasses various technologies such as cloud-based security solutions, Internet of Things (IoT) integration, and advanced analytics, which provide more efficient and reliable security systems for both commercial and residential use.

The market growth is driven by increasing concerns about safety and security in residential, commercial, and industrial sectors. The rise in crime rates, terrorism threats, and natural disasters has accelerated the adoption of electronic security systems worldwide.

Additionally, the growing demand for automation and remote monitoring has boosted the use of integrated security solutions. Key factors also include the integration of artificial intelligence (AI) and machine learning in security systems for real-time threat detection, as well as the rising trend of smart homes and IoT devices, which require advanced security infrastructure.

Key Highlights

- The electronic security market is anticipated to grow at a CAGR of 9% during the forecast period.

- The global electronic security market was estimated to be worth approximately USD 60.20 billion in 2023 and is projected to reach a value of USD 130.75 billion by 2032.

- The growth of the electronic security market is being driven by the increasing demand for advanced security solutions to protect people, property, and sensitive information. This is fueled by factors such as rising crime rates, increasing terrorist threats, and the growing adoption of smart technologies.

- Based on the product, the video surveillance segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the security as a service (SaaS) segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Electronic Security Market: Dynamics

Key Growth Drivers

- Rising Security Concerns: Increasing crime rates and security threats have driven the demand for electronic security systems.

- Technological Advancements: Advancements in surveillance technologies, such as IP cameras and video analytics, have enhanced security capabilities.

- Urbanization and Infrastructure Development: The growth of urban areas and infrastructure projects requires robust security solutions.

- Government Regulations: Stricter regulations regarding security and surveillance, especially in critical infrastructure, have boosted the market.

Restraints

- High Initial Investment: The initial cost of installing electronic security systems, particularly large-scale systems, can be significant.

- Complex Installation and Maintenance: The installation and maintenance of electronic security systems require specialized expertise.

- Cybersecurity Threats: Electronic security systems are vulnerable to cyberattacks, necessitating robust cybersecurity measures.

- Economic Fluctuations: Economic downturns can impact investment in security systems, particularly in non-essential sectors.

Opportunities

- Integration with IoT: Integrating electronic security systems with IoT devices can enable remote monitoring, automation, and predictive maintenance.

- Biometric Authentication: The adoption of biometric authentication technologies, such as fingerprint and facial recognition, can enhance security.

- Artificial Intelligence and Machine Learning: AI and ML can be used to improve video analytics, intrusion detection, and threat assessment.

- Cloud-Based Security Solutions: Cloud-based security solutions can offer scalability, flexibility, and cost-effectiveness.

Challenges

- False Alarms: False alarms can lead to unnecessary costs and inconvenience.

- Power Outages: Power outages can compromise the functionality of electronic security systems.

- Regulatory Compliance: Adhering to evolving regulatory standards can be challenging.

- Consumer Education: Educating consumers about the benefits of electronic security systems and addressing concerns about privacy and data security is crucial.

Electronic Security Market: Segmentation Insights

The global electronic security market is divided by product, application, and region.

Segmentation Insights by Product

Based on Product, the global electronic security market is divided into video surveillance, perimeter security, and others.

The Video Surveillance segment is the market leader, accounting for the largest share of the electronic security market. Its widespread adoption in both commercial and residential applications, as well as its integration with modern technologies like AI, facial recognition, and cloud-based analytics, has fueled its dominance. Video surveillance systems use cameras and monitoring equipment to capture and record activities in a designated area.

The Perimeter Security segment holds a substantial share of the market, driven by the growing need for enhanced security in both residential and commercial sectors. High-profile installations in government buildings, military sites, and large industrial facilities have significantly boosted demand. Perimeter security involves technologies and solutions designed to protect the boundary of a property or facility.

Segmentation Insights by Application

On the basis of Application, the global electronic security market is bifurcated into security as a service (SAAS), do-it-yourself (DIY) security, multiple-system operators (MSO), body-worn cameras (BWCS), and others.

The Security as a Service (SaaS) and DIY Security segments are currently among the dominant applications in the electronic security market. Both segments benefit from the increasing trend towards remote monitoring, affordability, and consumer demand for smart, flexible security solutions. The SaaS segment is growing rapidly due to the increasing demand for scalable and flexible security solutions that can be easily managed from anywhere.

The DIY Security segment is experiencing strong growth, especially in residential applications. Consumers are increasingly looking for affordable, easy-to-install solutions that offer flexibility and control. DIY security systems allow users to set up and manage their own security systems without requiring professional installation.

Multiple-System Operators have a strong presence in sectors like retail, healthcare, and enterprise businesses that require centralized management of their security infrastructure. The market share is growing as businesses look for efficient ways to manage large-scale security systems. MSOs are organizations that manage multiple security systems, often integrating them across various locations or facilities.

The Body-worn Cameras segment is growing rapidly, driven by the adoption of such devices in police forces, security services, and event management. Body-worn cameras are compact devices worn by security personnel, law enforcement, or other personnel to capture video footage for security purposes. They are especially useful in law enforcement, security monitoring, and event recording.

Electronic Security Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electronic Security Market |

| Market Size in 2023 | USD 60.20 Billion |

| USD 130.75 Billion | |

| Growth Rate | CAGR of 9% |

| Number of Pages | 226 |

| Key Companies Covered | 3M Cogent (USA), Allegion (Ireland), ASSA ABLOY (Sweden), Axis Communications (Sweden), BIO-key (USA), Bosch Security Systems (Germany), Changzhou Minking Electronics (China), CP PLUS (Germany), Dahua Technology (China), Diebold Nixdorf (USA), DoorKing (USA), dormakaba Holding (Switzerland), DT LLC (USA), Fermax Electronica (Spain), Gemalto (Netherlands), Genetec (Canada), Global Security Solutions (Canada), Gunnebo (Sweden), Hangzhou Hikvision Digital Technology (China), Hanwha Techwin (South Korea), Hanyang Hitao (South Korea), HID Global (USA), Honeywell International(USA), IDenticard Systems (USA), Identiv (USA), ISONAS (USA), and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electronic Security Market: Regional Insights

- North America currently leads the global electronic security market

North America is a key region for the electronic security market, particularly in the United States and Canada. The market is driven by a high demand for advanced security solutions across various sectors, including commercial, residential, government, and transportation.

Increasing concerns about cyber threats and physical security breaches are prompting businesses and individuals to invest in comprehensive security systems. The U.S. government’s strong focus on homeland security and surveillance technologies also fuels market growth.

Furthermore, the region is witnessing a surge in the adoption of integrated security systems, which combine video surveillance, access control, and alarm monitoring into a single platform. The rising popularity of smart homes, along with the expansion of connected devices and IoT technologies, is further driving demand for electronic security solutions.

Europe holds a significant share of the electronic security market, with countries like the UK, Germany, and France leading the adoption of advanced security technologies. Europe’s strict regulations related to data protection, such as the General Data Protection Regulation (GDPR), have also spurred the need for secure surveillance and monitoring systems that comply with these laws.

The market is characterized by the widespread use of video surveillance systems and access control solutions in both public and private spaces, including government buildings, transportation hubs, and critical infrastructure. Europe’s emphasis on smart city initiatives, along with increasing demand for cybersecurity and physical security systems, further boosts the market.

The Asia Pacific region is the fastest-growing market for electronic security, with China, India, Japan, and South Korea at the forefront. This region is seeing rapid urbanization, increasing infrastructure development, and rising concerns about safety and security, which are driving the adoption of electronic security solutions.

In China, government initiatives for surveillance in public spaces, including facial recognition systems and AI-powered surveillance cameras, are key drivers of market growth. India’s expanding commercial and residential sectors are contributing to the demand for electronic security systems, particularly in cities with high population densities. Japan and South Korea are investing heavily in smart cities and advanced security technologies, including biometrics and IoT-based security solutions.

Latin America is an emerging market for electronic security systems, with Brazil and Mexico leading the growth. The increasing number of security concerns, including criminal activities and property theft, has driven the demand for advanced security solutions in both residential and commercial sectors.

As urbanization and infrastructure development continue to increase, the adoption of surveillance cameras, access control systems, and alarm systems is expected to rise. Moreover, government spending on public safety and smart city projects in the region is promoting the adoption of electronic security technologies. The growing trend of digitalization and e-commerce also drives demand for cybersecurity solutions.

The Middle East and Africa (MEA) region is gradually expanding in terms of electronic security adoption. Countries like the UAE, Saudi Arabia, South Africa, and Israel are leading the way in implementing advanced surveillance systems and access control solutions. The region’s focus on infrastructure development, smart cities, and defense and military applications are major factors driving market growth.

The UAE, for example, is heavily investing in smart city projects that require comprehensive security solutions. In South Africa, security concerns related to crime rates have driven the need for advanced electronic security systems in both residential and commercial properties.

Electronic Security Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the electronic security market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global electronic security market include:

- 3M Cogent (USA)

- Allegion (Ireland)

- ASSA ABLOY (Sweden)

- Axis Communications (Sweden)

- BIO-key (USA)

- Bosch Security Systems (Germany)

- Changzhou Minking Electronics (China)

- CP PLUS (Germany)

- Dahua Technology (China)

- Diebold Nixdorf (USA)

- DoorKing (USA)

- dormakaba Holding (Switzerland)

- DT LLC (USA)

- Fermax Electronica (Spain)

- Gemalto (Netherlands)

- Genetec (Canada)

- Global Security Solutions (Canada)

- Gunnebo (Sweden)

- Hangzhou Hikvision Digital Technology (China)

- Hanwha Techwin (South Korea)

- Hanyang Hitao (South Korea)

- HID Global (USA)

- Honeywell International(USA)

- IDenticard Systems (USA)

- Identiv (USA)

- ISONAS (USA)

The global electronic security market is segmented as follows:

By Product

- Video Surveillance

- Perimeter Security

By Application

- Security as a Service (SaaS)

- Do-it-yourself (DIY) Security

- Multiple-System Operators (MSO)

- Body-worn Cameras (BWCs)

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global electronic security market size was projected at approximately US$ 60.20 billion in 2023. Projections indicate that the market is expected to reach around US$ 130.75 billion in revenue by 2032.

The global electronic security market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 9% during the forecast period from 2024 to 2032.

North America is expected to dominate the global electronic security market.

The global electronic security market is primarily driven by factors such as increasing urbanization, rising crime rates, growing awareness about security solutions, and advancements in technology.

Some of the prominent players operating in the global electronic security market are; 3M Cogent (USA), Allegion (Ireland), ASSA ABLOY (Sweden), Axis Communications (Sweden), BIO-key (USA), Bosch Security Systems (Germany), Changzhou Minking Electronics (China), CP PLUS (Germany), Dahua Technology (China), Diebold Nixdorf (USA), DoorKing (USA), dormakaba Holding (Switzerland), DT LLC (USA), Fermax Electronica (Spain), Gemalto (Netherlands), Genetec (Canada), Global Security Solutions (Canada), Gunnebo (Sweden), Hangzhou Hikvision Digital Technology (China), Hanwha Techwin (South Korea), Hanyang Hitao (South Korea), HID Global (USA), Honeywell International(USA), IDenticard Systems (USA), Identiv (USA), ISONAS (USA), and others.

Table Of Content

Inquiry For Buying

Electronic Security

Request Sample

Electronic Security