Freight Broker Software Market Size, Share, and Trends Analysis Report

CAGR :

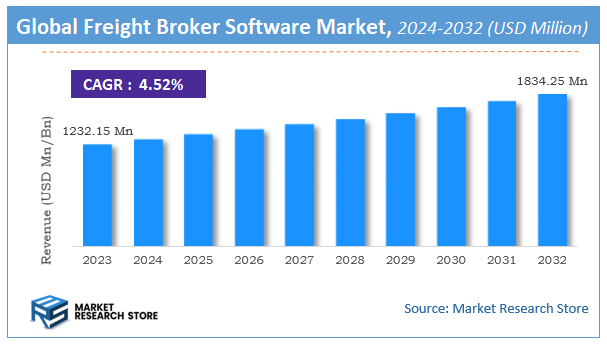

| Market Size 2023 (Base Year) | USD 1232.15 Million |

| Market Size 2032 (Forecast Year) | USD 1834.25 Million |

| CAGR | 4.52% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Freight Broker Software Market Insights

According to Market Research Store, the global freight broker software market size was valued at around USD 1232.15 million in 2023 and is estimated to reach USD 1834.25 million by 2032, to register a CAGR of approximately 4.52% in terms of revenue during the forecast period 2024-2032.

The freight broker software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Freight Broker Software Market: Overview

Freight broker software is a specialized digital tool designed to streamline and enhance the operations of freight brokers by managing their logistics and transportation processes. It helps brokers connect shippers with carriers, ensuring efficient load booking, real-time tracking, documentation management, and payment processing. The software integrates functionalities like load matching, rate management, customer relationship management (CRM), and analytics, empowering brokers to optimize workflows and improve customer service. By automating repetitive tasks, it reduces manual errors and boosts operational efficiency, making it a vital asset for modern freight management.

Key Highlights

- The freight broker software market is anticipated to grow at a CAGR of 4.52% during the forecast period.

- The global freight broker software market was estimated to be worth approximately USD 1232.15 million in 2023 and is projected to reach a value of USD 1834.25 million by 2032.

- The growth of the freight broker software market is being driven by the increasing demand for seamless logistics solutions and the digitization of supply chain processes.

- Based on the type, the cloud-based segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the large enterprises segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Freight Broker Software Market: Dynamics

Key Growth Drivers:

- Increased demand for supply chain visibility: Freight broker software provides real-time tracking and monitoring of shipments, enabling businesses to improve efficiency and reduce costs.

- Rise of e-commerce: The growth of e-commerce has led to a surge in demand for fast and reliable transportation services, driving the need for efficient freight brokering solutions.

- Advancements in technology: The development of new technologies such as artificial intelligence (AI) and machine learning is enabling freight broker software to become more intelligent and efficient.

Restraints:

- High cost of implementation: Freight broker software can be expensive to implement and maintain, particularly for small and medium-sized businesses.

- Integration challenges: Integrating freight broker software with existing enterprise systems can be complex and time-consuming.

- Security concerns: Freight broker software often handles sensitive data, such as customer information and financial transactions, raising concerns about data security and privacy.

Opportunities:

- Integration with other logistics technologies: Freight broker software can be integrated with other logistics technologies, such as warehouse management systems (WMS) and transportation management systems (TMS), to create a more comprehensive and efficient logistics solution.

- Development of new features and functionalities: There is a growing demand for new features and functionalities in freight broker software, such as predictive analytics and blockchain technology.

- Expansion into new markets: The freight broker software market is still relatively young, with significant opportunities for expansion into new markets, such as emerging economies.

Challenges:

- Competition: The freight broker software market is becoming increasingly competitive, with a growing number of players entering the market.

- Regulatory compliance: Freight brokers must comply with a variety of regulations, such as those related to data privacy and security.

- Talent shortage: There is a shortage of skilled workers in the freight brokering industry, making it difficult for companies to find and retain qualified employees.

Freight Broker Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Freight Broker Software Market |

| Market Size in 2023 | USD 1232.15 Million |

| Market Forecast in 2032 | USD 1834.25 Million |

| Growth Rate | CAGR of 4.52% |

| Number of Pages | 140 |

| Key Companies Covered | GoComet, Coyote Logistics, Echo Global Logistics Inc., Convoy, Transfix, LLC, Trucker Path Inc., Cargomatic Inc., Cargocentric Inc., J.B. Hunt Transport Inc., TGMatrix Limited, Uber Freight, Magaya Cargo System, CloudWadi, Infoplus, Rose Rocket, Royal 4 Systems, 3G-TM, Kuebix |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Freight Broker Software Market: Segmentation Insights

The global freight broker software market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global freight broker software market is divided into on-premise and cloud-based.

The cloud-based segment is the most dominant in the freight broker software market. Its prominence stems from its scalability, flexibility, and cost-effectiveness, which make it highly attractive for freight brokers of all sizes. Cloud-based solutions allow users to access the software remotely, eliminating the need for substantial upfront investments in hardware or infrastructure. Additionally, these systems offer real-time updates, data synchronization, and enhanced collaboration capabilities, ensuring brokers can manage operations efficiently, even from multiple locations. The demand for cloud-based freight broker software has surged due to the increasing adoption of digital transformation strategies and the need for seamless integration with other supply chain management tools.

The on-premise segment, while less dominant, still holds a significant market share, primarily among large enterprises with substantial resources and stringent security or compliance requirements. These systems are hosted on the company’s infrastructure, offering greater control over data and software customization. On-premise solutions are particularly appealing to organizations that operate in regions with limited internet connectivity or have specific regulatory mandates that necessitate localized data storage. However, the high initial investment, maintenance costs, and lack of flexibility compared to cloud-based options have led to a gradual decline in its adoption.

Segmentation Insights by Application

On the basis of application, the global freight broker software market is bifurcated into SMEs and large enterprises.

The large enterprises segment is the most dominant in the freight broker software market. Large enterprises typically have complex and extensive logistics and freight management operations, which require advanced software solutions to handle large volumes of data, manage numerous shipments, and ensure the smooth coordination of multiple stakeholders. Freight broker software helps these companies optimize routes, reduce costs, and improve operational efficiency. Due to their greater financial resources, large enterprises are more likely to invest in comprehensive, often customized software solutions that can be integrated into their existing infrastructure. They also benefit from dedicated support, scalability, and the ability to manage their operations across global networks, which enhances the demand for advanced software features.

The small and medium-sized enterprises (SMEs) segment, while growing, is less dominant compared to large enterprises. SMEs face unique challenges in freight brokerage, such as limited budgets and fewer resources for managing extensive operations. However, the increasing availability of cost-effective, cloud-based freight broker software tailored for smaller businesses has fueled growth in this segment. These software solutions often offer essential features, including shipment tracking, invoicing, and basic analytics, at a lower cost compared to their enterprise-level counterparts. As SMEs increasingly recognize the importance of technology in enhancing their competitiveness and operational efficiency, demand for freight broker software in this segment continues to rise, but it still lags behind large enterprises in terms of overall market share.

Freight Broker Software Market: Regional Insights

- North America is expected to dominates the global market

North America leads the market, driven by the early adoption of advanced technologies and the presence of established logistics and transportation companies. The United States, in particular, contributes significantly to this dominance, with a substantial share of the North American market. The region’s focus on technological innovations, such as AI and machine learning in freight management, enhances operational efficiency and transparency, further propelling market growth.

Europe holds a significant position in the freight broker software market, supported by stringent regulatory requirements and a well-established logistics infrastructure. Countries like Germany, the United Kingdom, and France are key contributors, with the manufacturing and retail sectors driving demand for efficient freight management solutions. The region’s emphasis on compliance and cross-border trade necessitates advanced software solutions to manage complex logistics operations effectively.

The Asia-Pacific region is experiencing rapid growth in the freight broker software market, fueled by the booming e-commerce sector and significant investments in infrastructure development. Nations such as China and India are at the forefront of this expansion, with China showing a notable growth rate. The increasing adoption of digital solutions to enhance logistics efficiency and the proliferation of advanced freight management software are key factors contributing to the market's expansion in this region.

Latin America is witnessing steady growth in the freight broker software market, driven by the expansion of the manufacturing and retail sectors, along with rising international trade. Countries like Brazil and Mexico are pivotal to this growth, as businesses seek to optimize their supply chain operations through digital solutions. Government initiatives aimed at improving logistics infrastructure further support the adoption of freight broker software in the region.

The Middle East and Africa region are gradually embracing freight broker software solutions, with increased investments in logistics infrastructure and a growing emphasis on efficient supply chain management. Nations such as the United Arab Emirates and South Africa are leading this adoption, recognizing the benefits of digital tools in enhancing trade operations. The region’s strategic location as a trade hub underscores the importance of advanced freight management solutions to facilitate seamless logistics operations.

Recent Developments:

- In June 2023, an industry consortium announced revised data security protocols for freight broker software, emphasizing enhanced cybersecurity to protect critical business information.

- In August 2023, major cloud computing providers introduced new services tailored for freight broker software enterprises, aiming to accelerate the adoption of advanced cloud-based solutions in the industry.

- In October 2023, several freight broker software companies unveiled AI capabilities, offering features like instant carrier selection, route optimization, and predictive analytics to improve efficiency and reduce costs for brokers.

Freight Broker Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the freight broker software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global freight broker software market include:

- GoComet

- Coyote Logistics

- Echo Global Logistics Inc.

- Convoy

- Transfix LLC

- Trucker Path Inc.

- Cargomatic Inc.

- Cargocentric Inc.

- J.B. Hunt Transport Inc.

- TGMatrix Limited

- Uber Freight

- Magaya Cargo System

- CloudWadi

- Infoplus

- Rose Rocket

- Royal 4 Systems

- 3G-TM

- Kuebix

The global freight broker software market is segmented as follows:

By Type

- On-Premise

- Cloud-Based

By Application

- SMEs

- Large Enterprises

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global freight broker software market size was projected at approximately US$ 1232.15 million in 2023. Projections indicate that the market is expected to reach around US$ 1834.25 million in revenue by 2032.

The global freight broker software market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 4.52% during the forecast period from 2024 to 2032.

North America is expected to dominate the global freight broker software market.

The global freight broker software market is driven by the rising demand for automated and efficient supply chain solutions, the growth of e-commerce, and the adoption of advanced technologies like AI and machine learning for enhanced logistics management.

Some of the prominent players operating in the global freight broker software market are; GoComet, Coyote Logistics, Echo Global Logistics Inc., Convoy, Transfix LLC, Trucker Path Inc., Cargomatic Inc., Cargocentric Inc., J.B. Hunt Transport Inc., TGMatrix Limited, Uber Freight, Magaya Cargo System, CloudWadi, Infoplus, Rose Rocket, Royal 4 Systems, 3G-TM, Kuebix, and others.

Table Of Content

Inquiry For Buying

Freight Broker Software

Request Sample

Freight Broker Software