Generator in the Data Center Market Size, Share, and Trends Analysis Report

CAGR :

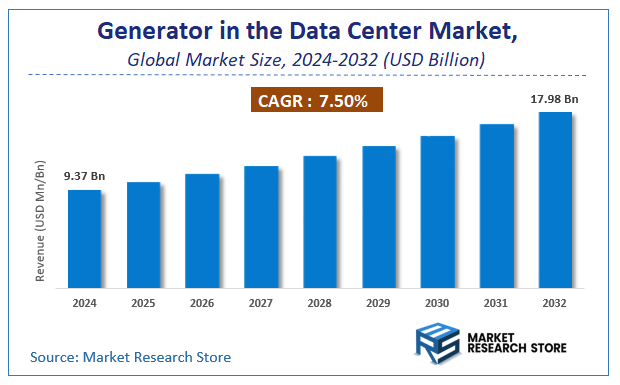

| Market Size 2024 (Base Year) | USD 9.37 Billion |

| Market Size 2032 (Forecast Year) | USD 17.98 Billion |

| CAGR | 7.5% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global generator in the data center market size was valued at approximately USD 9.37 Billion in 2024. The market is projected to grow significantly, reaching USD 17.98 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the generator in the data center industry.

To Get more Insights, Request a Free Sample

Generator in the Data Center Market: Overview

The growth of the generator in the data center market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The generator in the data center market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the generator in the data center market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global generator in the data center market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2025-2032).

- In terms of revenue, the global generator in the data center market size was valued at around USD 9.37 Billion in 2024 and is projected to reach USD 17.98 Billion by 2032.

- The market is projected to grow at a significant rate due to increasing need for uninterrupted power supply and operational reliability, the exponential growth in data consumption and storage, and the widespread adoption of cloud computing, AI, and IoT, which demand robust backup power solutions for continuous oper.

- Based on the Products, the Tier I segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the SMEs segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Generator in the Data Center Market: Report Scope

This report thoroughly analyzes the generator in the data center market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Generator in the Data Center Market |

| Market Size in 2024 | USD 9.37 Billion |

| Market Forecast in 2032 | USD 17.98 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 222 |

| Key Companies Covered | Innio, Caterpillar, Kohler Power, Yanmar Group (HIMOINSA), Cummins, Excel Generators Pvt. Ltd., Rolls Royce Power Systems AG (MTU On Site Energy), Inmesol, Generac Power Systems |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Generator in the Data Center Market: Dynamics

Key Growth Drivers

The primary growth driver for the generator in data center market is the exploding global demand for data centers themselves, fueled by rapid digitalization, the pervasive adoption of cloud computing, AI, IoT, and 5G technologies. As more data is generated, stored, and processed, the need for robust and continuous power supply in data centers becomes paramount, directly increasing the demand for reliable generators. Furthermore, increasing concerns about power grid instability and potential outages due to aging infrastructure, extreme weather events, and rising energy consumption compel data center operators to invest heavily in backup power solutions. Stringent regulatory compliance and uptime requirements for mission-critical operations, particularly in sectors like finance, healthcare, and government, mandate the deployment of robust backup power systems to ensure business continuity and avoid costly downtime.

Restraints

Despite the strong demand, the generator in data center market faces several restraints. Environmental regulations and increasing pressure for decarbonization pose a significant challenge, as traditional diesel generators emit greenhouse gases and pollutants. This leads to stricter emission standards and may limit operating hours in certain regions. The high initial capital expenditure required for purchasing, installing, and integrating large-scale generator sets, along with ongoing maintenance and fuel costs, can be substantial, impacting the total cost of ownership for data center operators. Moreover, the growing adoption of alternative and sustainable power solutions, such as renewable energy sources (solar, wind) coupled with advanced battery energy storage systems (BESS) and microgrids, could reduce the long-term reliance on conventional generators.

Opportunities

Significant opportunities are emerging in the generator in data center market, particularly through the development and adoption of cleaner fuel types. The shift towards natural gas generators, bi-fuel systems, and research into hydrogen fuel cells or hydrotreated vegetable oil (HVO) offers solutions that align with sustainability goals and evolving environmental regulations. The integration of generators into hybrid power solutions that combine with renewable energy sources and battery storage systems presents an opportunity to optimize energy consumption, reduce carbon footprint, and enhance overall grid resilience. Furthermore, the increasing demand for modular and scalable generator systems caters to the dynamic growth of data centers, allowing for incremental capacity additions and greater flexibility in power infrastructure.

Challenges

The generator in data center market also confronts notable challenges. Noise pollution concerns associated with generator operation can lead to severe restrictions on deployment, especially in urban or densely populated areas. Ensuring fuel supply security and logistics for diesel generators, particularly during prolonged outages or in remote locations, can be complex and costly. Balancing the need for high reliability and uptime with sustainability goals remains a critical dilemma for data center operators, as cleaner alternatives may not yet offer the same level of proven reliability or cost-effectiveness as traditional diesel. Lastly, the technical complexities of integrating generators with sophisticated data center infrastructure, including advanced power management systems and intelligent controls, require specialized expertise and can be prone to integration issues if not managed correctly.

Generator in the Data Center Market: Segmentation Insights

The global generator in the data center market is segmented based on Products, Applications, and Region. All the segments of the generator in the data center market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global generator in the data center market is divided into Tier I, Tier II, Tier III, Tier IV.

On the basis of Applications, the global generator in the data center market is bifurcated into SMEs, Large Enterprises.

Generator in the Data Center Market: Regional Insights

The North American region dominates the Generator in the Data Center Market, accounting for the largest market share due to its high concentration of hyperscale data centers, increasing demand for uninterrupted power supply, and stringent regulations on backup power reliability. According to recent market reports (2023-2024), North America held over 40% of the global market revenue, driven primarily by the U.S., where rising cloud computing demands, frequent extreme weather events, and investments in edge data centers boost generator adoption.

Europe follows as the second-largest market, with strong growth in Germany and the UK due to energy resilience concerns, while the Asia-Pacific region is expanding rapidly, led by China and India, fueled by digitalization and growing data center construction. North America’s leadership is further reinforced by advancements in fuel-efficient and hybrid generator systems tailored for sustainable data center operations.

Generator in the Data Center Market: Competitive Landscape

The generator in the data center market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Generator in the Data Center Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Innio

- Caterpillar

- Kohler Power

- Yanmar Group (HIMOINSA)

- Cummins

- Excel Generators Pvt. Ltd.

- Rolls Royce Power Systems AG (MTU On Site Energy)

- Inmesol

- Generac Power Systems

The Global Generator in the Data Center Market is Segmented as Follows:

By Products

- Tier I

- Tier II

- Tier III

- Tier IV

By Applications

- SMEs

- Large Enterprises

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Generator in the Data Center Market Share by Type (2020-2026) 1.5.2 Tier I 1.5.3 Tier II 1.5.4 Tier III 1.5.5 Tier IV 1.6 Market by Application 1.6.1 Global Generator in the Data Center Market Share by Application (2020-2026) 1.6.2 SMEs 1.6.3 Large Enterprises 1.7 Generator in the Data Center Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Generator in the Data Center Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Generator in the Data Center Market 3.1 Value Chain Status 3.2 Generator in the Data Center Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Generator in the Data Center 3.2.3 Labor Cost of Generator in the Data Center 3.2.3.1 Labor Cost of Generator in the Data Center Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Excel Generators Pvt. Ltd. 4.1.1 Excel Generators Pvt. Ltd. Basic Information 4.1.2 Generator in the Data Center Product Profiles, Application and Specification 4.1.3 Excel Generators Pvt. Ltd. Generator in the Data Center Market Performance (2015-2020) 4.1.4 Excel Generators Pvt. Ltd. Business Overview 4.2 Cummins 4.2.1 Cummins Basic Information 4.2.2 Generator in the Data Center Product Profiles, Application and Specification 4.2.3 Cummins Generator in the Data Center Market Performance (2015-2020) 4.2.4 Cummins Business Overview 4.3 Yanmar Group (HIMOINSA) 4.3.1 Yanmar Group (HIMOINSA) Basic Information 4.3.2 Generator in the Data Center Product Profiles, Application and Specification 4.3.3 Yanmar Group (HIMOINSA) Generator in the Data Center Market Performance (2015-2020) 4.3.4 Yanmar Group (HIMOINSA) Business Overview 4.4 Generac Power Systems 4.4.1 Generac Power Systems Basic Information 4.4.2 Generator in the Data Center Product Profiles, Application and Specification 4.4.3 Generac Power Systems Generator in the Data Center Market Performance (2015-2020) 4.4.4 Generac Power Systems Business Overview 4.5 Innio 4.5.1 Innio Basic Information 4.5.2 Generator in the Data Center Product Profiles, Application and Specification 4.5.3 Innio Generator in the Data Center Market Performance (2015-2020) 4.5.4 Innio Business Overview 4.6 Inmesol 4.6.1 Inmesol Basic Information 4.6.2 Generator in the Data Center Product Profiles, Application and Specification 4.6.3 Inmesol Generator in the Data Center Market Performance (2015-2020) 4.6.4 Inmesol Business Overview 4.7 Rolls Royce Power Systems AG (MTU On Site Energy) 4.7.1 Rolls Royce Power Systems AG (MTU On Site Energy) Basic Information 4.7.2 Generator in the Data Center Product Profiles, Application and Specification 4.7.3 Rolls Royce Power Systems AG (MTU On Site Energy) Generator in the Data Center Market Performance (2015-2020) 4.7.4 Rolls Royce Power Systems AG (MTU On Site Energy) Business Overview 4.8 Kohler Power 4.8.1 Kohler Power Basic Information 4.8.2 Generator in the Data Center Product Profiles, Application and Specification 4.8.3 Kohler Power Generator in the Data Center Market Performance (2015-2020) 4.8.4 Kohler Power Business Overview 4.9 Caterpillar 4.9.1 Caterpillar Basic Information 4.9.2 Generator in the Data Center Product Profiles, Application and Specification 4.9.3 Caterpillar Generator in the Data Center Market Performance (2015-2020) 4.9.4 Caterpillar Business Overview 5 Global Generator in the Data Center Market Analysis by Regions 5.1 Global Generator in the Data Center Sales, Revenue and Market Share by Regions 5.1.1 Global Generator in the Data Center Sales by Regions (2015-2020) 5.1.2 Global Generator in the Data Center Revenue by Regions (2015-2020) 5.2 North America Generator in the Data Center Sales and Growth Rate (2015-2020) 5.3 Europe Generator in the Data Center Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Generator in the Data Center Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Generator in the Data Center Sales and Growth Rate (2015-2020) 5.6 South America Generator in the Data Center Sales and Growth Rate (2015-2020) 6 North America Generator in the Data Center Market Analysis by Countries 6.1 North America Generator in the Data Center Sales, Revenue and Market Share by Countries 6.1.1 North America Generator in the Data Center Sales by Countries (2015-2020) 6.1.2 North America Generator in the Data Center Revenue by Countries (2015-2020) 6.1.3 North America Generator in the Data Center Market Under COVID-19 6.2 United States Generator in the Data Center Sales and Growth Rate (2015-2020) 6.2.1 United States Generator in the Data Center Market Under COVID-19 6.3 Canada Generator in the Data Center Sales and Growth Rate (2015-2020) 6.4 Mexico Generator in the Data Center Sales and Growth Rate (2015-2020) 7 Europe Generator in the Data Center Market Analysis by Countries 7.1 Europe Generator in the Data Center Sales, Revenue and Market Share by Countries 7.1.1 Europe Generator in the Data Center Sales by Countries (2015-2020) 7.1.2 Europe Generator in the Data Center Revenue by Countries (2015-2020) 7.1.3 Europe Generator in the Data Center Market Under COVID-19 7.2 Germany Generator in the Data Center Sales and Growth Rate (2015-2020) 7.2.1 Germany Generator in the Data Center Market Under COVID-19 7.3 UK Generator in the Data Center Sales and Growth Rate (2015-2020) 7.3.1 UK Generator in the Data Center Market Under COVID-19 7.4 France Generator in the Data Center Sales and Growth Rate (2015-2020) 7.4.1 France Generator in the Data Center Market Under COVID-19 7.5 Italy Generator in the Data Center Sales and Growth Rate (2015-2020) 7.5.1 Italy Generator in the Data Center Market Under COVID-19 7.6 Spain Generator in the Data Center Sales and Growth Rate (2015-2020) 7.6.1 Spain Generator in the Data Center Market Under COVID-19 7.7 Russia Generator in the Data Center Sales and Growth Rate (2015-2020) 7.7.1 Russia Generator in the Data Center Market Under COVID-19 8 Asia-Pacific Generator in the Data Center Market Analysis by Countries 8.1 Asia-Pacific Generator in the Data Center Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Generator in the Data Center Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Generator in the Data Center Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Generator in the Data Center Market Under COVID-19 8.2 China Generator in the Data Center Sales and Growth Rate (2015-2020) 8.2.1 China Generator in the Data Center Market Under COVID-19 8.3 Japan Generator in the Data Center Sales and Growth Rate (2015-2020) 8.3.1 Japan Generator in the Data Center Market Under COVID-19 8.4 South Korea Generator in the Data Center Sales and Growth Rate (2015-2020) 8.4.1 South Korea Generator in the Data Center Market Under COVID-19 8.5 Australia Generator in the Data Center Sales and Growth Rate (2015-2020) 8.6 India Generator in the Data Center Sales and Growth Rate (2015-2020) 8.6.1 India Generator in the Data Center Market Under COVID-19 8.7 Southeast Asia Generator in the Data Center Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Generator in the Data Center Market Under COVID-19 9 Middle East and Africa Generator in the Data Center Market Analysis by Countries 9.1 Middle East and Africa Generator in the Data Center Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Generator in the Data Center Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Generator in the Data Center Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Generator in the Data Center Market Under COVID-19 9.2 Saudi Arabia Generator in the Data Center Sales and Growth Rate (2015-2020) 9.3 UAE Generator in the Data Center Sales and Growth Rate (2015-2020) 9.4 Egypt Generator in the Data Center Sales and Growth Rate (2015-2020) 9.5 Nigeria Generator in the Data Center Sales and Growth Rate (2015-2020) 9.6 South Africa Generator in the Data Center Sales and Growth Rate (2015-2020) 10 South America Generator in the Data Center Market Analysis by Countries 10.1 South America Generator in the Data Center Sales, Revenue and Market Share by Countries 10.1.1 South America Generator in the Data Center Sales by Countries (2015-2020) 10.1.2 South America Generator in the Data Center Revenue by Countries (2015-2020) 10.1.3 South America Generator in the Data Center Market Under COVID-19 10.2 Brazil Generator in the Data Center Sales and Growth Rate (2015-2020) 10.2.1 Brazil Generator in the Data Center Market Under COVID-19 10.3 Argentina Generator in the Data Center Sales and Growth Rate (2015-2020) 10.4 Columbia Generator in the Data Center Sales and Growth Rate (2015-2020) 10.5 Chile Generator in the Data Center Sales and Growth Rate (2015-2020) 11 Global Generator in the Data Center Market Segment by Types 11.1 Global Generator in the Data Center Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Generator in the Data Center Sales and Market Share by Types (2015-2020) 11.1.2 Global Generator in the Data Center Revenue and Market Share by Types (2015-2020) 11.2 Tier I Sales and Price (2015-2020) 11.3 Tier II Sales and Price (2015-2020) 11.4 Tier III Sales and Price (2015-2020) 11.5 Tier IV Sales and Price (2015-2020) 12 Global Generator in the Data Center Market Segment by Applications 12.1 Global Generator in the Data Center Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Generator in the Data Center Sales and Market Share by Applications (2015-2020) 12.1.2 Global Generator in the Data Center Revenue and Market Share by Applications (2015-2020) 12.2 SMEs Sales, Revenue and Growth Rate (2015-2020) 12.3 Large Enterprises Sales, Revenue and Growth Rate (2015-2020) 13 Generator in the Data Center Market Forecast by Regions (2020-2026) 13.1 Global Generator in the Data Center Sales, Revenue and Growth Rate (2020-2026) 13.2 Generator in the Data Center Market Forecast by Regions (2020-2026) 13.2.1 North America Generator in the Data Center Market Forecast (2020-2026) 13.2.2 Europe Generator in the Data Center Market Forecast (2020-2026) 13.2.3 Asia-Pacific Generator in the Data Center Market Forecast (2020-2026) 13.2.4 Middle East and Africa Generator in the Data Center Market Forecast (2020-2026) 13.2.5 South America Generator in the Data Center Market Forecast (2020-2026) 13.3 Generator in the Data Center Market Forecast by Types (2020-2026) 13.4 Generator in the Data Center Market Forecast by Applications (2020-2026) 13.5 Generator in the Data Center Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Generator in the Data Center

Request Sample

Generator in the Data Center