Guided Vehicles Market Size, Share, and Trends Analysis Report

CAGR :

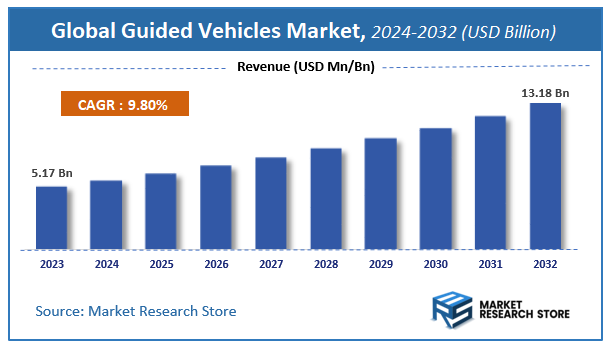

| Market Size 2023 (Base Year) | USD 5.17 Billion |

| Market Size 2032 (Forecast Year) | USD 13.18 Billion |

| CAGR | 9.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Guided Vehicles Market Insights

A latest report by Market Research Store estimates that the Global Guided Vehicles Market was valued at USD 5.17 Billion in 2023 and is expected to reach USD 13.18 Billion by 2032, with a CAGR of 9.8% during the forecast period 2024-2032. The report Guided Vehicles Market overview, growth factors, restraints, opportunities, segmentation, key developments, competitive landscape, consumer insights, and market growth forecast in terms of value or volume. These structured details offer an all-inclusive market overview, providing valuable insights for investment decisions, business decisions, strategic planning, and competitive analysis.

To Get more Insights, Request a Free Sample

Guided Vehicles Market: Overview

The growth of the guided vehicles market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The guided vehicles market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the guided vehicles market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Product Type, End-user, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global guided vehicles market is estimated to grow annually at a CAGR of around 9.8% over the forecast period (2024-2032).

- In terms of revenue, the global guided vehicles market size was valued at around USD 5.17 Billion in 2023 and is projected to reach USD 13.18 Billion by 2032.

- The market is projected to grow at a significant rate due to increasing demand for automation and efficiency in material handling across various industries, fueled by factors like rising labor costs, the growth of e-commerce, and advancements in technology such as AI and IoT.

- Based on the Product Type, the Automated Forklift segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of End-user, the Food & Beverage segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Guided Vehicles Market: Report Scope

This report thoroughly analyzes the guided vehicles market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Guided Vehicles Market |

| Market Size in 2023 | USD 5.17 Billion |

| Market Forecast in 2032 | USD 13.18 Billion |

| Growth Rate | CAGR of 9.8% |

| Number of Pages | 155 |

| Key Companies Covered | System Logistics S.P.A, Seegrid Corporation, SSI Schaefer Systems International DWC LLC, KUKA Group, Jungheinrich Group, Murata Machinery, Dematic Corp., Toyota Material Handling, Scott Technology Limited, John Bean Technologies (JBT) Corporation, Daifuku |

| Segments Covered | By Product Type, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Guided Vehicles Market: Dynamics

Key Growth Drivers

The guided vehicles market, encompassing Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), is experiencing substantial growth driven by the increasing need for automation in various industries to enhance efficiency, reduce labor costs, and improve safety. The rapid expansion of e-commerce and logistics sectors necessitates efficient material handling and warehousing solutions, making guided vehicles a compelling choice for streamlining operations. The rising adoption of Industry 4.0 principles and the integration of advanced technologies like artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities and flexibility of guided vehicles, further driving their demand. Moreover, the growing focus on workplace safety and the ability of guided vehicles to perform repetitive and potentially hazardous tasks contribute significantly to their increased adoption across manufacturing, healthcare, and other sectors.

Restraints

Despite the strong growth drivers, the guided vehicles market faces certain restraints. The initial investment costs associated with the purchase, installation, and integration of guided vehicle systems can be significant, particularly for smaller businesses or those with limited capital expenditure budgets. The need for robust infrastructure, such as reliable Wi-Fi connectivity, clear pathways, and potentially magnetic strips or QR codes for navigation (in the case of some AGVs), can pose a challenge in existing facilities. Concerns regarding the security and cybersecurity of autonomous systems and the potential for system failures or malfunctions can also hinder adoption. Furthermore, the need for skilled personnel for the programming, maintenance, and troubleshooting of guided vehicle systems can be a restraint, especially in regions facing a shortage of qualified technicians.

Opportunities

The guided vehicles market presents numerous opportunities for future expansion and innovation. The increasing advancements in sensor technologies, AI, and machine learning are enabling the development of more sophisticated and versatile AMRs capable of navigating complex and dynamic environments without fixed infrastructure. The growing demand for flexible automation solutions that can adapt to changing production needs and layouts creates a significant opportunity for mobile robots. The integration of guided vehicles with other warehouse and manufacturing systems, such as Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) systems, offers opportunities for enhanced data analytics and process optimization. Furthermore, the expansion of guided vehicle applications into new sectors like agriculture, hospitality, and retail presents significant growth potential. The development of more user-friendly interfaces and programming tools can also lower the barrier to entry for smaller businesses.

Challenges

The guided vehicles market faces several challenges that need to be addressed for continued growth. Ensuring seamless integration and interoperability between different guided vehicle systems and existing infrastructure can be complex and requires standardization efforts. Addressing safety concerns and establishing clear safety protocols for the operation of autonomous mobile robots in shared human-machine workspaces is crucial for widespread adoption. The need for robust cybersecurity measures to protect guided vehicle systems from cyber threats and data breaches is becoming increasingly important. Overcoming the perception of potential job displacement due to automation and addressing workforce retraining needs are also significant challenges. Furthermore, the lack of universal standards and regulations for the deployment and operation of guided vehicles can create complexities for manufacturers and end-users operating across different regions. Ensuring the reliability and robustness of guided vehicle systems in various industrial environments, including those with dust, temperature variations, or electromagnetic interference, remains a key challenge.

Guided Vehicles Market: Segmentation Insights

The global guided vehicles market is segmented based on Product Type, End-user, and Region. All the segments of the guided vehicles market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Product Type, the global guided vehicles market is divided into Automated Forklift, Automated Tow/Tractor/Tug, Unit Load, Assembly Line, Special Purpose.

On the basis of End-user, the global guided vehicles market is bifurcated into Food & Beverage, Automotive, Retail, Electronics & Electrical, General Manufacturing, Pharmaceuticals, Others.

Guided Vehicles Market: Regional Insights

The Guided Vehicles Market is experiencing rapid expansion, with Asia-Pacific (APAC) emerging as the dominant region. This leadership is driven by booming manufacturing sectors, rising automation in logistics, and government initiatives promoting Industry 4.0 in countries like China, Japan, and South Korea. APAC benefits from cost-competitive production, large-scale industrial parks, and increasing adoption of AGVs (Automated Guided Vehicles) and AMRs (Autonomous Mobile Robots) in e-commerce and automotive industries. North America and Europe also hold significant shares, supported by high labor costs, advanced warehouse automation, and stringent workplace safety regulations. However, APAC remains the largest and fastest-growing market, accounting for over 45% of global revenue, due to its massive electronics and automotive manufacturing base, coupled with investments in smart factories. The region’s dominance is further reinforced by local innovations in AI-driven navigation and 5G-enabled fleet management. With global supply chains prioritizing efficiency, APAC’s guided vehicles market is projected to maintain its lead through 2030.

Guided Vehicles Market: Competitive Landscape

The guided vehicles market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Guided Vehicles Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- System Logistics S.P.A

- Seegrid Corporation

- SSI Schaefer Systems International DWC LLC

- KUKA Group

- Jungheinrich Group

- Murata Machinery

- Dematic Corp.

- Toyota Material Handling

- Scott Technology Limited

- John Bean Technologies (JBT) Corporation

- Daifuku Co. LTD

The Global Guided Vehicles Market is Segmented as Follows:

By Product Type

- Automated Forklift

- Automated Tow/Tractor/Tug

- Unit Load

- Assembly Line

- Special Purpose

By End-user

- Food & Beverage

- Automotive

- Retail

- Electronics & Electrical

- General Manufacturing

- Pharmaceuticals

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Evolution

This section evaluates the market position of the product or service by examining its development pathway and competitive dynamics. It provides a detailed overview of the product's growth stages, including the early (historical) phase, the mid-stage, and anticipated future advancements influenced by innovation and emerging technologies.

Porter’s Analysis

Porter’s Five Forces framework offers a strategic lens for assessing competitor behavior and the positioning of key players in the guided vehicles industry. This section explores the external factors shaping competitive dynamics and influencing market strategies in the years ahead. The analysis focuses on five critical forces:

- Competitive Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Supplier Bargaining Power

- Buyer Bargaining Power

Value Chain & Market Attractiveness Analysis

The value chain analysis helps businesses optimize operations by mapping the product flow from suppliers to end consumers, identifying opportunities to streamline processes and gain a competitive edge. Segment-wise market attractiveness analysis evaluates key dimensions like product categories, demographics, and regions, assessing growth potential, market size, and profitability. This enables businesses to focus resources on high-potential segments for better ROI and long-term value.

PESTEL Analysis

PESTEL analysis is a powerful tool in market research reports that enhances market understanding by systematically examining the external macro-environmental factors influencing a business or industry. The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors. By evaluating these dimensions, PESTEL analysis provides a comprehensive overview of the broader context within which a market operates, helping businesses identify potential opportunities and threats.

- Political factors assess government policies, stability, trade regulations, and political risks that could impact market operations.

- Economic factors examine variables like inflation, exchange rates, economic growth, and consumer spending power to determine market viability.

- Social factors explore cultural trends, demographics, and lifestyle changes that shape consumer behavior and preferences.

- Technological factors evaluate innovation, R&D, and technological advancements affecting product development and operational efficiencies.

- Environmental factors focus on sustainability, climate change impacts, and eco-friendly practices shaping market trends.

- Legal factors address compliance requirements, industry regulations, and intellectual property laws impacting market entry and operations.

Import-Export Analysis & Pricing Analysis

An import-export analysis is vital for market research, revealing global trade dynamics, trends, and opportunities. It examines trade volumes, product categories, and regional competitiveness, offering insights into supply chains and market demand. This section also analyzes past and future pricing trends, helping businesses optimize strategies and enabling consumers to assess product value effectively.

Guided Vehicles Market: Company Profiles

The report identifies key players in the guided vehicles market through competitive landscape and company profiles, evaluating their offerings, financial performance, strategies, and market positioning. It includes a SWOT analysis of the top 3-5 companies, assessing strengths, weaknesses, opportunities, and threats. The competitive landscape highlights rankings, recent activities (mergers, acquisitions, partnerships, product launches), and regional footprints using the Ace matrix. Customization is available to meet client-specific needs.

Regional & Industry Footprint

This section details the geographic reach, sales networks, and market penetration of companies profiled in the guided vehicles report, showcasing their operations and distribution across regions. It analyzes the alignment of companies with specific industry verticals, highlighting the industries they serve and the scope of their products and services within those sectors.

Ace Matrix

This section categorizes companies into four distinct groups—Active, Cutting Edge, Innovator, and Emerging—based on their product and business strategies. The evaluation of product strategy focuses on aspects such as the range and depth of offerings, commitment to innovation, product functionalities, and scalability. Key elements like global reach, sector coverage, strategic acquisitions, and long-term growth plans are considered for business strategy. This analysis provides a detailed view of companies' position within the market and highlights their potential for future growth and development.

Research Methodology

The qualitative and quantitative insights for the guided vehicles market are derived through a multi-faceted research approach, combining input from subject matter experts, primary research, and secondary data sources. Primary research includes gathering critical information via face-to-face or telephonic interviews, surveys, questionnaires, and feedback from industry professionals, key opinion leaders (KOLs), and customers. Regular interviews with industry experts are conducted to deepen the analysis and reinforce the existing data, ensuring a robust and well-rounded market understanding.

Secondary research for this report was carried out by the Market Research Store team, drawing on a variety of authoritative sources, such as:

- Official company websites, annual reports, financial statements, investor presentations, and SEC filings

- Internal and external proprietary databases, as well as relevant patent and regulatory databases

- Government publications, national statistical databases, and industry-specific market reports

- Media coverage, including news articles, press releases, and webcasts about market participants

- Paid industry databases for detailed market insights

Market Research Store conducted in-depth consultations with various key opinion leaders in the industry, including senior executives from top companies and regional leaders from end-user organizations. This effort aimed to gather critical insights on factors such as the market share of dominant brands in specific countries and regions, along with pricing strategies for products and services.

To determine total sales data, the research team conducted primary interviews across multiple countries with influential stakeholders, including:

- Distributors

- Marketing, Brand, and Product Managers

- Procurement and Production Managers

- Sales and Regional Sales Managers, Country Managers

- Technical Specialists

- C-Level Executives

These subject matter experts, with their extensive industry experience, helped validate and refine the findings. For secondary research, data was sourced from a wide range of materials, including online resources, company annual reports, industry publications, research papers, association reports, and government websites. These various sources provide a comprehensive and well-rounded perspective on the market.

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Guided Vehicles Market Share by Type (2020-2026) 1.5.2 Unit Load Type 1.5.3 Automated Forklift Type 1.5.4 Tugger Type 1.6 Market by Application 1.6.1 Global Guided Vehicles Market Share by Application (2020-2026) 1.6.2 Production & Manufacturing 1.6.3 Distribution & Logistics 1.6.4 Others 1.7 Guided Vehicles Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Guided Vehicles Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Guided Vehicles Market 3.1 Value Chain Status 3.2 Guided Vehicles Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Guided Vehicles 3.2.3 Labor Cost of Guided Vehicles 3.2.3.1 Labor Cost of Guided Vehicles Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Swisslog 4.1.1 Swisslog Basic Information 4.1.2 Guided Vehicles Product Profiles, Application and Specification 4.1.3 Swisslog Guided Vehicles Market Performance (2015-2020) 4.1.4 Swisslog Business Overview 4.2 DS Automotion 4.2.1 DS Automotion Basic Information 4.2.2 Guided Vehicles Product Profiles, Application and Specification 4.2.3 DS Automotion Guided Vehicles Market Performance (2015-2020) 4.2.4 DS Automotion Business Overview 4.3 Egemin 4.3.1 Egemin Basic Information 4.3.2 Guided Vehicles Product Profiles, Application and Specification 4.3.3 Egemin Guided Vehicles Market Performance (2015-2020) 4.3.4 Egemin Business Overview 4.4 Dematic 4.4.1 Dematic Basic Information 4.4.2 Guided Vehicles Product Profiles, Application and Specification 4.4.3 Dematic Guided Vehicles Market Performance (2015-2020) 4.4.4 Dematic Business Overview 4.5 Yonegy 4.5.1 Yonegy Basic Information 4.5.2 Guided Vehicles Product Profiles, Application and Specification 4.5.3 Yonegy Guided Vehicles Market Performance (2015-2020) 4.5.4 Yonegy Business Overview 4.6 Atab 4.6.1 Atab Basic Information 4.6.2 Guided Vehicles Product Profiles, Application and Specification 4.6.3 Atab Guided Vehicles Market Performance (2015-2020) 4.6.4 Atab Business Overview 4.7 Aethon 4.7.1 Aethon Basic Information 4.7.2 Guided Vehicles Product Profiles, Application and Specification 4.7.3 Aethon Guided Vehicles Market Performance (2015-2020) 4.7.4 Aethon Business Overview 4.8 AGVE Group 4.8.1 AGVE Group Basic Information 4.8.2 Guided Vehicles Product Profiles, Application and Specification 4.8.3 AGVE Group Guided Vehicles Market Performance (2015-2020) 4.8.4 AGVE Group Business Overview 4.9 Seegrid 4.9.1 Seegrid Basic Information 4.9.2 Guided Vehicles Product Profiles, Application and Specification 4.9.3 Seegrid Guided Vehicles Market Performance (2015-2020) 4.9.4 Seegrid Business Overview 4.10 Rocla 4.10.1 Rocla Basic Information 4.10.2 Guided Vehicles Product Profiles, Application and Specification 4.10.3 Rocla Guided Vehicles Market Performance (2015-2020) 4.10.4 Rocla Business Overview 4.11 CSTCKM 4.11.1 CSTCKM Basic Information 4.11.2 Guided Vehicles Product Profiles, Application and Specification 4.11.3 CSTCKM Guided Vehicles Market Performance (2015-2020) 4.11.4 CSTCKM Business Overview 4.12 Daifuku 4.12.1 Daifuku Basic Information 4.12.2 Guided Vehicles Product Profiles, Application and Specification 4.12.3 Daifuku Guided Vehicles Market Performance (2015-2020) 4.12.4 Daifuku Business Overview 4.13 EK AUTOMATION 4.13.1 EK AUTOMATION Basic Information 4.13.2 Guided Vehicles Product Profiles, Application and Specification 4.13.3 EK AUTOMATION Guided Vehicles Market Performance (2015-2020) 4.13.4 EK AUTOMATION Business Overview 4.14 JBT 4.14.1 JBT Basic Information 4.14.2 Guided Vehicles Product Profiles, Application and Specification 4.14.3 JBT Guided Vehicles Market Performance (2015-2020) 4.14.4 JBT Business Overview 4.15 Aichikikai 4.15.1 Aichikikai Basic Information 4.15.2 Guided Vehicles Product Profiles, Application and Specification 4.15.3 Aichikikai Guided Vehicles Market Performance (2015-2020) 4.15.4 Aichikikai Business Overview 4.16 Toyota 4.16.1 Toyota Basic Information 4.16.2 Guided Vehicles Product Profiles, Application and Specification 4.16.3 Toyota Guided Vehicles Market Performance (2015-2020) 4.16.4 Toyota Business Overview 4.17 MTD 4.17.1 MTD Basic Information 4.17.2 Guided Vehicles Product Profiles, Application and Specification 4.17.3 MTD Guided Vehicles Market Performance (2015-2020) 4.17.4 MTD Business Overview 4.18 Hitachi 4.18.1 Hitachi Basic Information 4.18.2 Guided Vehicles Product Profiles, Application and Specification 4.18.3 Hitachi Guided Vehicles Market Performance (2015-2020) 4.18.4 Hitachi Business Overview 4.19 Siasun 4.19.1 Siasun Basic Information 4.19.2 Guided Vehicles Product Profiles, Application and Specification 4.19.3 Siasun Guided Vehicles Market Performance (2015-2020) 4.19.4 Siasun Business Overview 4.20 Meidensha 4.20.1 Meidensha Basic Information 4.20.2 Guided Vehicles Product Profiles, Application and Specification 4.20.3 Meidensha Guided Vehicles Market Performance (2015-2020) 4.20.4 Meidensha Business Overview 5 Global Guided Vehicles Market Analysis by Regions 5.1 Global Guided Vehicles Sales, Revenue and Market Share by Regions 5.1.1 Global Guided Vehicles Sales by Regions (2015-2020) 5.1.2 Global Guided Vehicles Revenue by Regions (2015-2020) 5.2 North America Guided Vehicles Sales and Growth Rate (2015-2020) 5.3 Europe Guided Vehicles Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Guided Vehicles Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Guided Vehicles Sales and Growth Rate (2015-2020) 5.6 South America Guided Vehicles Sales and Growth Rate (2015-2020) 6 North America Guided Vehicles Market Analysis by Countries 6.1 North America Guided Vehicles Sales, Revenue and Market Share by Countries 6.1.1 North America Guided Vehicles Sales by Countries (2015-2020) 6.1.2 North America Guided Vehicles Revenue by Countries (2015-2020) 6.1.3 North America Guided Vehicles Market Under COVID-19 6.2 United States Guided Vehicles Sales and Growth Rate (2015-2020) 6.2.1 United States Guided Vehicles Market Under COVID-19 6.3 Canada Guided Vehicles Sales and Growth Rate (2015-2020) 6.4 Mexico Guided Vehicles Sales and Growth Rate (2015-2020) 7 Europe Guided Vehicles Market Analysis by Countries 7.1 Europe Guided Vehicles Sales, Revenue and Market Share by Countries 7.1.1 Europe Guided Vehicles Sales by Countries (2015-2020) 7.1.2 Europe Guided Vehicles Revenue by Countries (2015-2020) 7.1.3 Europe Guided Vehicles Market Under COVID-19 7.2 Germany Guided Vehicles Sales and Growth Rate (2015-2020) 7.2.1 Germany Guided Vehicles Market Under COVID-19 7.3 UK Guided Vehicles Sales and Growth Rate (2015-2020) 7.3.1 UK Guided Vehicles Market Under COVID-19 7.4 France Guided Vehicles Sales and Growth Rate (2015-2020) 7.4.1 France Guided Vehicles Market Under COVID-19 7.5 Italy Guided Vehicles Sales and Growth Rate (2015-2020) 7.5.1 Italy Guided Vehicles Market Under COVID-19 7.6 Spain Guided Vehicles Sales and Growth Rate (2015-2020) 7.6.1 Spain Guided Vehicles Market Under COVID-19 7.7 Russia Guided Vehicles Sales and Growth Rate (2015-2020) 7.7.1 Russia Guided Vehicles Market Under COVID-19 8 Asia-Pacific Guided Vehicles Market Analysis by Countries 8.1 Asia-Pacific Guided Vehicles Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Guided Vehicles Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Guided Vehicles Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Guided Vehicles Market Under COVID-19 8.2 China Guided Vehicles Sales and Growth Rate (2015-2020) 8.2.1 China Guided Vehicles Market Under COVID-19 8.3 Japan Guided Vehicles Sales and Growth Rate (2015-2020) 8.3.1 Japan Guided Vehicles Market Under COVID-19 8.4 South Korea Guided Vehicles Sales and Growth Rate (2015-2020) 8.4.1 South Korea Guided Vehicles Market Under COVID-19 8.5 Australia Guided Vehicles Sales and Growth Rate (2015-2020) 8.6 India Guided Vehicles Sales and Growth Rate (2015-2020) 8.6.1 India Guided Vehicles Market Under COVID-19 8.7 Southeast Asia Guided Vehicles Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Guided Vehicles Market Under COVID-19 9 Middle East and Africa Guided Vehicles Market Analysis by Countries 9.1 Middle East and Africa Guided Vehicles Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Guided Vehicles Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Guided Vehicles Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Guided Vehicles Market Under COVID-19 9.2 Saudi Arabia Guided Vehicles Sales and Growth Rate (2015-2020) 9.3 UAE Guided Vehicles Sales and Growth Rate (2015-2020) 9.4 Egypt Guided Vehicles Sales and Growth Rate (2015-2020) 9.5 Nigeria Guided Vehicles Sales and Growth Rate (2015-2020) 9.6 South Africa Guided Vehicles Sales and Growth Rate (2015-2020) 10 South America Guided Vehicles Market Analysis by Countries 10.1 South America Guided Vehicles Sales, Revenue and Market Share by Countries 10.1.1 South America Guided Vehicles Sales by Countries (2015-2020) 10.1.2 South America Guided Vehicles Revenue by Countries (2015-2020) 10.1.3 South America Guided Vehicles Market Under COVID-19 10.2 Brazil Guided Vehicles Sales and Growth Rate (2015-2020) 10.2.1 Brazil Guided Vehicles Market Under COVID-19 10.3 Argentina Guided Vehicles Sales and Growth Rate (2015-2020) 10.4 Columbia Guided Vehicles Sales and Growth Rate (2015-2020) 10.5 Chile Guided Vehicles Sales and Growth Rate (2015-2020) 11 Global Guided Vehicles Market Segment by Types 11.1 Global Guided Vehicles Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Guided Vehicles Sales and Market Share by Types (2015-2020) 11.1.2 Global Guided Vehicles Revenue and Market Share by Types (2015-2020) 11.2 Unit Load Type Sales and Price (2015-2020) 11.3 Automated Forklift Type Sales and Price (2015-2020) 11.4 Tugger Type Sales and Price (2015-2020) 12 Global Guided Vehicles Market Segment by Applications 12.1 Global Guided Vehicles Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Guided Vehicles Sales and Market Share by Applications (2015-2020) 12.1.2 Global Guided Vehicles Revenue and Market Share by Applications (2015-2020) 12.2 Production & Manufacturing Sales, Revenue and Growth Rate (2015-2020) 12.3 Distribution & Logistics Sales, Revenue and Growth Rate (2015-2020) 12.4 Others Sales, Revenue and Growth Rate (2015-2020) 13 Guided Vehicles Market Forecast by Regions (2020-2026) 13.1 Global Guided Vehicles Sales, Revenue and Growth Rate (2020-2026) 13.2 Guided Vehicles Market Forecast by Regions (2020-2026) 13.2.1 North America Guided Vehicles Market Forecast (2020-2026) 13.2.2 Europe Guided Vehicles Market Forecast (2020-2026) 13.2.3 Asia-Pacific Guided Vehicles Market Forecast (2020-2026) 13.2.4 Middle East and Africa Guided Vehicles Market Forecast (2020-2026) 13.2.5 South America Guided Vehicles Market Forecast (2020-2026) 13.3 Guided Vehicles Market Forecast by Types (2020-2026) 13.4 Guided Vehicles Market Forecast by Applications (2020-2026) 13.5 Guided Vehicles Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Guided Vehicles

Request Sample

Guided Vehicles