High Alumina Refractory Cement Market Size, Share, and Trends Analysis Report

CAGR :

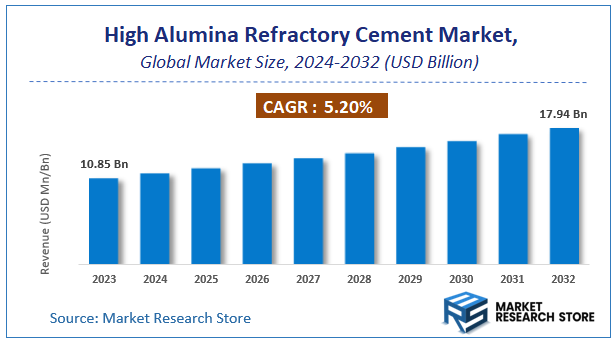

| Market Size 2023 (Base Year) | USD 10.85 Billion |

| Market Size 2032 (Forecast Year) | USD 17.94 Billion |

| CAGR | 5.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

High Alumina Refractory Cement Market Insights

According to Market Research Store, the global high alumina refractory cement market size was valued at around USD 10.85 billion in 2023 and is estimated to reach USD 17.94 billion by 2032, to register a CAGR of approximately 5.20% in terms of revenue during the forecast period 2024-2032.

The high alumina refractory cement report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global High Alumina Refractory Cement Market: Overview

High alumina refractory cement is a type of cement that contains a high percentage of alumina (usually over 50%), making it highly resistant to heat and chemical erosion. It is typically made by mixing bauxite, lime, and other raw materials in specific proportions. This cement is mainly used in applications requiring high heat resistance, such as in furnaces, kilns, boilers, and reactors. High alumina refractory cement has superior properties, including a high melting point and excellent resistance to thermal shock, making it ideal for industries like steel, ceramics, and cement manufacturing.

Key Highlights

- The high alumina refractory cement market is anticipated to grow at a CAGR of 5.20% during the forecast period.

- The global high alumina refractory cement market was estimated to be worth approximately USD 10.85 billion in 2023 and is projected to reach a value of USD 17.94 billion by 2032.

- The growth of the high alumina refractory cement market is being driven by the growing demand from industries requiring materials that can withstand extreme temperatures and aggressive chemical environments.

- Based on the type, the 0.7 segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the industrial kiln segment is projected to swipe the largest market share.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

High Alumina Refractory Cement Market: Dynamics

Key Growth Drivers:

- Rising Industrialization: Increased industrial activity across sectors like steel, cement, and power generation fuels demand for high-performance refractory materials.

- Demand for Energy Efficiency: Focus on energy efficiency in industrial processes drives the need for high-temperature resistant and durable materials like high alumina cement.

- Growing Construction Sector: Expansion in infrastructure projects, including power plants, refineries, and chemical plants, boosts the market.

Restraints:

- High Raw Material Costs: Fluctuations in the prices of key raw materials like bauxite can impact production costs.

- Stringent Environmental Regulations: Compliance with environmental regulations related to emissions and waste disposal can increase operational costs.

- Competition from Alternative Materials: Competition from other refractory materials like silica and chrome-based cements can limit market growth.

Opportunities:

- Development of Advanced Materials: Research and development of high-performance, energy-efficient, and environmentally friendly high alumina cements offer significant growth potential.

- Expansion in Emerging Markets: Growing industrialization in developing economies presents new market opportunities.

- Technological Advancements: Innovations in manufacturing processes and product design can improve efficiency and reduce costs.

Challenges:

- Maintaining Consistent Quality: Ensuring consistent quality and performance of high alumina cement across different production batches can be challenging.

- Technical Expertise: The need for skilled labor and technical expertise in handling and applying these specialized materials can pose a challenge.

- Market Volatility: Fluctuations in global economic conditions and energy prices can impact market demand and profitability.

High Alumina Refractory Cement Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High Alumina Refractory Cement Market |

| Market Size in 2023 | USD 10.85 Billion |

| Market Forecast in 2032 | USD 17.94 Billion |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 140 |

| Key Companies Covered | AGC, Almatis, Kerneos, Cimsa, Calucem, Imerys Group, Caltra Nederland, U.S. Electrofused Minerals, Shree Harikrushna Industries, HeNan JunSheng Refractories Limited, Zhengzhou Dengfeng Smelting Materials |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

High Alumina Refractory Cement Market: Segmentation Insights

The global high alumina refractory cement market is divided by technology, product, vertical, and region.

Segmentation Insights by Type

Based on type, the global high alumina refractory cement market is divided into 0.4, 0.55, 0.7, 0.8, and Others.

The 0.7 segment is the most dominant due to its versatility and widespread use in high-temperature industrial applications. This type of cement is known for its superior thermal stability and strength, making it suitable for a range of industries, including steel, cement, and petrochemical, where it withstands extreme conditions.

Following closely is the 0.8 segment, which is also highly regarded for its ability to endure higher temperatures and stresses compared to lower-alumina cements. It is particularly favored in industries that require long-lasting refractories with resistance to slag, alkalis, and metal penetration. While it is slightly less dominant than the 0.7 segment, it is still crucial in the maintenance of blast furnaces and kilns.

The 0.4 segment is used less extensively but is still essential for applications requiring moderate heat resistance and chemical stability. It is often preferred in sectors where the temperature requirements are not as high, such as in certain non-ferrous metal industries or in lighter refractory linings.

The 0.55 segment falls between the 0.4 and 0.7 categories, offering a balance of heat resistance and cost-effectiveness. It serves as a middle ground, with applications in industries where both temperature endurance and economic considerations are important.

Segmentation Insights by Application

On the basis of application, the global high alumina refractory cement market is bifurcated into special road & construction, industry kiln, sewer applications, and others.

Industrial kiln applications are the most dominant. High alumina refractory cement is essential in the lining of industrial kilns, where extreme temperatures and wear from aggressive materials demand durable and heat-resistant solutions. This segment covers a wide range of industries, such as cement, steel, and ceramics, where kilns are crucial for processing materials at high temperatures. The durability and thermal resistance of high alumina cements make them ideal for withstanding the harsh operating conditions within kilns, resulting in long service life and reduced downtime.

The special road & construction application follows as the second most significant segment. High alumina refractory cement is used in the construction of roads, tunnels, and other infrastructure where resistance to wear and high heat is needed. It is also employed in the repair and maintenance of road surfaces exposed to extreme conditions, such as heat from industrial processes or chemical reactions. This segment benefits from the increasing demand for durable materials in infrastructure projects, especially in regions where high-temperature stability is required.

Sewer applications represent a niche but essential segment. High alumina cements are used in sewer systems, especially in areas with aggressive chemical exposure or elevated temperatures. These cements provide resistance to corrosion, alkali attack, and high temperatures, making them ideal for environments that involve the handling of industrial waste, chemicals, and other aggressive substances. Though not as large as the industrial kiln or road construction applications, sewer applications are critical in maintaining the integrity and longevity of wastewater systems.

High Alumina Refractory Cement Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific dominates the high alumina refractory cement market, driven by significant industrialization and urbanization, particularly in countries like China and India. The region’s strong manufacturing and construction sectors are major contributors to the demand for high-performance materials. China, being the world’s largest producer of cement, plays a central role in this market, further enhancing the region’s dominance.

North America holds a considerable share, with the United States and Canada leading the way in infrastructure development and industrial applications. The growing need for durable, high-temperature resistant materials in various industries, including steel production and petrochemicals, significantly boosts demand for high alumina refractory cement in this region.

Europe also plays a key role in the market, with countries such as France and Germany focusing on energy-efficient and environmentally friendly industrial practices. The increasing demand for advanced refractory materials in steel plants, glass production, and energy sectors is driving growth in the region, which continues to focus on sustainable and durable building materials.

Latin America, with Brazil as a key player, is experiencing a rise in demand for high alumina refractory cement. The region’s growing industrial base, infrastructure development, and ongoing urbanization are contributing to an increased need for high-performance materials that can withstand extreme temperatures, particularly in steel, cement, and other manufacturing sectors.

The Middle East & Africa region is also witnessing growth, especially in countries like Saudi Arabia. Heavy investments in the petrochemical, oil, and gas industries drive demand for high alumina refractory cement, as these sectors require highly durable and heat-resistant materials to maintain equipment integrity in extreme conditions.

High Alumina Refractory Cement Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the high alumina refractory cement market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global high alumina refractory cement market include:

- AGC

- Almatis

- Kerneos

- Cimsa

- Calucem

- Imerys Group

- Caltra Nederland

- U.S. Electrofused Minerals

- Shree Harikrushna Industries

- HeNan JunSheng Refractories Limited

- Zhengzhou Dengfeng Smelting Materials

The global high alumina refractory cement market is segmented as follows:

By Type

- 0.4

- 0.55

- 0.7

- 0.8

- Others

By Application

- Special Road & Construction

- Industry Kiln

- Sewer Applications

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 High Alumina Refractory Cement Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global High Alumina Refractory Cement Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global High Alumina Refractory Cement Overall Market Size 2.1 Global High Alumina Refractory Cement Market Size: 2021 VS 2028 2.2 Global High Alumina Refractory Cement Revenue, Prospects & Forecasts: 2017-2028 2.3 Global High Alumina Refractory Cement Sales: 2017-2028 3 Company Landscape 3.1 Top High Alumina Refractory Cement Players in Global Market 3.2 Top Global High Alumina Refractory Cement Companies Ranked by Revenue 3.3 Global High Alumina Refractory Cement Revenue by Companies 3.4 Global High Alumina Refractory Cement Sales by Companies 3.5 Global High Alumina Refractory Cement Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 High Alumina Refractory Cement Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers High Alumina Refractory Cement Product Type 3.8 Tier 1, Tier 2 and Tier 3 High Alumina Refractory Cement Players in Global Market 3.8.1 List of Global Tier 1 High Alumina Refractory Cement Companies 3.8.2 List of Global Tier 2 and Tier 3 High Alumina Refractory Cement Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global High Alumina Refractory Cement Market Size Markets, 2021 & 2028 4.1.2 0.4 4.1.3 0.55 4.1.4 0.7 4.1.5 0.8 4.1.6 Others 4.2 By Type - Global High Alumina Refractory Cement Revenue & Forecasts 4.2.1 By Type - Global High Alumina Refractory Cement Revenue, 2017-2022 4.2.2 By Type - Global High Alumina Refractory Cement Revenue, 2023-2028 4.2.3 By Type - Global High Alumina Refractory Cement Revenue Market Share, 2017-2028 4.3 By Type - Global High Alumina Refractory Cement Sales & Forecasts 4.3.1 By Type - Global High Alumina Refractory Cement Sales, 2017-2022 4.3.2 By Type - Global High Alumina Refractory Cement Sales, 2023-2028 4.3.3 By Type - Global High Alumina Refractory Cement Sales Market Share, 2017-2028 4.4 By Type - Global High Alumina Refractory Cement Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global High Alumina Refractory Cement Market Size, 2021 & 2028 5.1.2 Special Road & Construction 5.1.3 Industry Kiln 5.1.4 Sewer Applications 5.1.5 Others 5.2 By Application - Global High Alumina Refractory Cement Revenue & Forecasts 5.2.1 By Application - Global High Alumina Refractory Cement Revenue, 2017-2022 5.2.2 By Application - Global High Alumina Refractory Cement Revenue, 2023-2028 5.2.3 By Application - Global High Alumina Refractory Cement Revenue Market Share, 2017-2028 5.3 By Application - Global High Alumina Refractory Cement Sales & Forecasts 5.3.1 By Application - Global High Alumina Refractory Cement Sales, 2017-2022 5.3.2 By Application - Global High Alumina Refractory Cement Sales, 2023-2028 5.3.3 By Application - Global High Alumina Refractory Cement Sales Market Share, 2017-2028 5.4 By Application - Global High Alumina Refractory Cement Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global High Alumina Refractory Cement Market Size, 2021 & 2028 6.2 By Region - Global High Alumina Refractory Cement Revenue & Forecasts 6.2.1 By Region - Global High Alumina Refractory Cement Revenue, 2017-2022 6.2.2 By Region - Global High Alumina Refractory Cement Revenue, 2023-2028 6.2.3 By Region - Global High Alumina Refractory Cement Revenue Market Share, 2017-2028 6.3 By Region - Global High Alumina Refractory Cement Sales & Forecasts 6.3.1 By Region - Global High Alumina Refractory Cement Sales, 2017-2022 6.3.2 By Region - Global High Alumina Refractory Cement Sales, 2023-2028 6.3.3 By Region - Global High Alumina Refractory Cement Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America High Alumina Refractory Cement Revenue, 2017-2028 6.4.2 By Country - North America High Alumina Refractory Cement Sales, 2017-2028 6.4.3 US High Alumina Refractory Cement Market Size, 2017-2028 6.4.4 Canada High Alumina Refractory Cement Market Size, 2017-2028 6.4.5 Mexico High Alumina Refractory Cement Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe High Alumina Refractory Cement Revenue, 2017-2028 6.5.2 By Country - Europe High Alumina Refractory Cement Sales, 2017-2028 6.5.3 Germany High Alumina Refractory Cement Market Size, 2017-2028 6.5.4 France High Alumina Refractory Cement Market Size, 2017-2028 6.5.5 U.K. High Alumina Refractory Cement Market Size, 2017-2028 6.5.6 Italy High Alumina Refractory Cement Market Size, 2017-2028 6.5.7 Russia High Alumina Refractory Cement Market Size, 2017-2028 6.5.8 Nordic Countries High Alumina Refractory Cement Market Size, 2017-2028 6.5.9 Benelux High Alumina Refractory Cement Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia High Alumina Refractory Cement Revenue, 2017-2028 6.6.2 By Region - Asia High Alumina Refractory Cement Sales, 2017-2028 6.6.3 China High Alumina Refractory Cement Market Size, 2017-2028 6.6.4 Japan High Alumina Refractory Cement Market Size, 2017-2028 6.6.5 South Korea High Alumina Refractory Cement Market Size, 2017-2028 6.6.6 Southeast Asia High Alumina Refractory Cement Market Size, 2017-2028 6.6.7 India High Alumina Refractory Cement Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America High Alumina Refractory Cement Revenue, 2017-2028 6.7.2 By Country - South America High Alumina Refractory Cement Sales, 2017-2028 6.7.3 Brazil High Alumina Refractory Cement Market Size, 2017-2028 6.7.4 Argentina High Alumina Refractory Cement Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa High Alumina Refractory Cement Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa High Alumina Refractory Cement Sales, 2017-2028 6.8.3 Turkey High Alumina Refractory Cement Market Size, 2017-2028 6.8.4 Israel High Alumina Refractory Cement Market Size, 2017-2028 6.8.5 Saudi Arabia High Alumina Refractory Cement Market Size, 2017-2028 6.8.6 UAE High Alumina Refractory Cement Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 AGC 7.1.1 AGC Corporate Summary 7.1.2 AGC Business Overview 7.1.3 AGC High Alumina Refractory Cement Major Product Offerings 7.1.4 AGC High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.1.5 AGC Key News 7.2 Almatis 7.2.1 Almatis Corporate Summary 7.2.2 Almatis Business Overview 7.2.3 Almatis High Alumina Refractory Cement Major Product Offerings 7.2.4 Almatis High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.2.5 Almatis Key News 7.3 Kerneos 7.3.1 Kerneos Corporate Summary 7.3.2 Kerneos Business Overview 7.3.3 Kerneos High Alumina Refractory Cement Major Product Offerings 7.3.4 Kerneos High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.3.5 Kerneos Key News 7.4 Cimsa 7.4.1 Cimsa Corporate Summary 7.4.2 Cimsa Business Overview 7.4.3 Cimsa High Alumina Refractory Cement Major Product Offerings 7.4.4 Cimsa High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.4.5 Cimsa Key News 7.5 Calucem 7.5.1 Calucem Corporate Summary 7.5.2 Calucem Business Overview 7.5.3 Calucem High Alumina Refractory Cement Major Product Offerings 7.5.4 Calucem High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.5.5 Calucem Key News 7.6 Imerys Group 7.6.1 Imerys Group Corporate Summary 7.6.2 Imerys Group Business Overview 7.6.3 Imerys Group High Alumina Refractory Cement Major Product Offerings 7.6.4 Imerys Group High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.6.5 Imerys Group Key News 7.7 Caltra Nederland 7.7.1 Caltra Nederland Corporate Summary 7.7.2 Caltra Nederland Business Overview 7.7.3 Caltra Nederland High Alumina Refractory Cement Major Product Offerings 7.7.4 Caltra Nederland High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.7.5 Caltra Nederland Key News 7.8 U.S. Electrofused Minerals 7.8.1 U.S. Electrofused Minerals Corporate Summary 7.8.2 U.S. Electrofused Minerals Business Overview 7.8.3 U.S. Electrofused Minerals High Alumina Refractory Cement Major Product Offerings 7.8.4 U.S. Electrofused Minerals High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.8.5 U.S. Electrofused Minerals Key News 7.9 Shree Harikrushna Industries 7.9.1 Shree Harikrushna Industries Corporate Summary 7.9.2 Shree Harikrushna Industries Business Overview 7.9.3 Shree Harikrushna Industries High Alumina Refractory Cement Major Product Offerings 7.9.4 Shree Harikrushna Industries High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.9.5 Shree Harikrushna Industries Key News 7.10 HeNan JunSheng Refractories Limited 7.10.1 HeNan JunSheng Refractories Limited Corporate Summary 7.10.2 HeNan JunSheng Refractories Limited Business Overview 7.10.3 HeNan JunSheng Refractories Limited High Alumina Refractory Cement Major Product Offerings 7.10.4 HeNan JunSheng Refractories Limited High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.10.5 HeNan JunSheng Refractories Limited Key News 7.11 Zhengzhou Dengfeng Smelting Materials 7.11.1 Zhengzhou Dengfeng Smelting Materials Corporate Summary 7.11.2 Zhengzhou Dengfeng Smelting Materials High Alumina Refractory Cement Business Overview 7.11.3 Zhengzhou Dengfeng Smelting Materials High Alumina Refractory Cement Major Product Offerings 7.11.4 Zhengzhou Dengfeng Smelting Materials High Alumina Refractory Cement Sales and Revenue in Global (2017-2022) 7.11.5 Zhengzhou Dengfeng Smelting Materials Key News 8 Global High Alumina Refractory Cement Production Capacity, Analysis 8.1 Global High Alumina Refractory Cement Production Capacity, 2017-2028 8.2 High Alumina Refractory Cement Production Capacity of Key Manufacturers in Global Market 8.3 Global High Alumina Refractory Cement Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 High Alumina Refractory Cement Supply Chain Analysis 10.1 High Alumina Refractory Cement Industry Value Chain 10.2 High Alumina Refractory Cement Upstream Market 10.3 High Alumina Refractory Cement Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 High Alumina Refractory Cement Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

High Alumina Refractory Cement

Request Sample

High Alumina Refractory Cement