Intelligent Document Processing Market Size, Share, and Trends Analysis Report

CAGR :

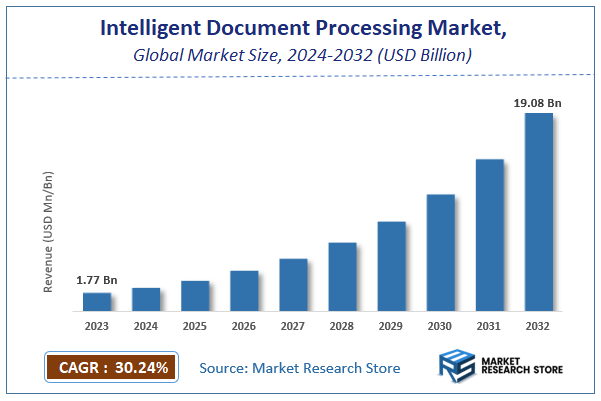

| Market Size 2023 (Base Year) | USD 1.77 Billion |

| Market Size 2032 (Forecast Year) | USD 19.08 Billion |

| CAGR | 30.24% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Intelligent Document Processing Market Insights

According to Market Research Store, the global intelligent document processing market size was valued at around USD 1.77 billion in 2023 and is estimated to reach USD 19.08 billion by 2032, to register a CAGR of approximately 30.24% in terms of revenue during the forecast period 2024-2032.

The intelligent document processing report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Intelligent Document Processing Market: Overview

Intelligent Document Processing (IDP) is an advanced technology that uses artificial intelligence (AI) techniques—including machine learning (ML), natural language processing (NLP), and computer vision—to automatically capture, extract, and process data from a wide variety of document formats, such as PDFs, images, scanned papers, emails, and forms. Unlike traditional optical character recognition (OCR), which only reads static text, IDP can understand context, classify document types, extract relevant information, and validate data with high accuracy—even from unstructured or semi-structured formats. It significantly reduces manual effort, improves data accuracy, and accelerates workflows, making it a valuable tool for industries such as banking, insurance, healthcare, government, and logistics.

Key Highlights

- The intelligent document processing market is anticipated to grow at a CAGR of 30.24% during the forecast period.

- The global intelligent document processing market was estimated to be worth approximately USD 1.77 billion in 2023 and is projected to reach a value of USD 19.08 billion by 2032.

- The growth of the intelligent document processing market is being driven by rising demand for automation in document-heavy business processes, increasing volumes of unstructured data, and the need for faster and more efficient decision-making.

- Based on the component, the solution segment is growing at a high rate and is projected to dominate the market.

- On the basis of technology, the machine learning segment is projected to swipe the largest market share.

- In terms of deployment, the cloud segment is expected to dominate the market.

- Based on the organization size, the large enterprises segment is expected to dominate the market.

- In terms of end-use, the BFSI segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Intelligent Document Processing Market: Dynamics

Key Growth Drivers:

- Rising Demand for Automation in Document-Intensive Workflows: Organizations are seeking to reduce manual data entry and improve operational efficiency by automating high-volume document processing tasks using IDP solutions.

- Increased Adoption of AI and Machine Learning: The integration of AI, ML, and natural language processing allows IDP systems to intelligently extract and interpret unstructured data, enhancing decision-making and reducing errors.

- Growth in Unstructured and Semi-Structured Data: As businesses generate more complex documents from emails, invoices, contracts, and forms, the need for tools that can accurately process and extract insights from these data types is growing rapidly.

Restraints:

- High Implementation Costs: The initial investment in IDP solutions, including software licensing, integration, and employee training, can be a significant barrier for small and mid-sized enterprises.

- Data Privacy and Compliance Concerns: Handling sensitive information such as financial or healthcare documents raises concerns about data security and regulatory compliance, which can slow down adoption.

Opportunities:

- Expansion into Emerging Markets: Developing regions are undergoing digital transformation and present significant growth opportunities for IDP vendors offering cost-effective, scalable solutions.

- Integration with RPA and Enterprise Platforms: The increasing convergence of IDP with robotic process automation, enterprise resource planning (ERP), and customer relationship management (CRM) platforms opens new use cases and enhances end-to-end automation.

Challenges:

- Complexity of Multilingual and Unstructured Documents: Processing documents that vary in format, language, and quality requires sophisticated AI models and customization, which can complicate deployments.

- Shortage of Skilled Workforce: The need for expertise in AI, data science, and process engineering poses a challenge for organizations trying to maximize the potential of IDP solutions.

Intelligent Document Processing Market: Report Scope

This report thoroughly analyzes the Intelligent Document Processing Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Intelligent Document Processing Market |

| Market Size in 2023 | USD 1.77 Billion |

| Market Forecast in 2032 | USD 19.08 Billion |

| Growth Rate | CAGR of 30.24% |

| Number of Pages | 155 |

| Key Companies Covered | Datamatics, Deloitte, ABBYY, IBM, Automation Anywhere, IRIS, Evolution AI, Appian, Kofax, WorkFusion, UiPath, AntWorks, Parascript, Hyperscience, Extract Systems, Infrrd, Celaton, HCL Technologies, AmyGB, OpenText, Kodak Alaris, Rossum, InData Labs, Ephesoft, BIS, and Hyland |

| Segments Covered | By Component, By Deployment, By Organization Size, By Technology, By End-use, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Intelligent Document Processing Market: Segmentation Insights

The global intelligent document processing market is divided by component, technology, deployment, organization size, end-use, and region.

Based on component, the global intelligent document processing market is divided into solution and services. The solution segment is the most dominant component, accounting for the largest share of market demand. Organizations across industries are increasingly deploying IDP software solutions to automate the extraction, classification, and validation of data from a wide range of documents including invoices, forms, contracts, and emails. These solutions leverage advanced technologies such as machine learning, natural language processing, and computer vision to process both structured and unstructured data with high accuracy. The scalability, integration capabilities with enterprise systems like RPA and ERP, and ability to handle complex document workflows make IDP solutions the core driver of digital transformation initiatives.

On the basis of technology, the global intelligent document processing market is bifurcated into machine learning, natural language processing (NLP), and computer vision. Machine learning is the most dominant technology, playing a foundational role in enabling systems to learn from data patterns and improve document processing accuracy over time. Machine learning algorithms are crucial for classifying documents, recognizing data fields, and continuously enhancing performance through feedback loops. Its adaptability across various document types and industries makes it the core driver of most IDP solutions.

Based on deployment, the global intelligent document processing market is divided into on-premise and cloud. The cloud deployment segment is the most dominant, driven by its scalability, flexibility, and lower upfront costs. Cloud-based IDP solutions enable organizations to quickly deploy and update systems, access data from multiple locations, and integrate easily with other cloud-based applications such as RPA, CRM, and ERP platforms. This model is particularly favored by businesses undergoing digital transformation, as it supports remote workforces and provides real-time processing capabilities with minimal IT infrastructure requirements.

On the basis of organization size, the global intelligent document processing market is bifurcated into small & medium sized enterprises (SMEs) and large size enterprises. Large enterprises represent the most dominant segment by organization size. These organizations typically deal with high volumes of complex, document-centric workflows across departments such as finance, HR, legal, and customer service. Large enterprises have the resources to invest in advanced IDP solutions and integrate them with existing enterprise systems like ERP and RPA. Their focus on operational efficiency, compliance, and automation at scale drives substantial demand for IDP technologies.

By end-use, the global intelligent document processing market is bifurcated into BFSI, healthcare, manufacturing, retail, government & public sector, transportation & logistics, IT & telecom, and others. The BFSI (Banking, Financial Services, and Insurance) sector stands as the most dominant end-use segment. Financial institutions process vast volumes of documents daily, including loan applications, insurance claims, compliance forms, and customer onboarding records. IDP enables these organizations to automate data extraction, reduce manual errors, ensure regulatory compliance, and accelerate decision-making processes, making it a vital tool for operational efficiency and customer satisfaction.

Intelligent Document Processing Market: Regional Insights

- North America is expected to dominates the global market

North America holds the leading position in the Intelligent Document Processing (IDP) market, driven by high adoption of automation technologies across industries such as BFSI, healthcare, and government. The presence of major IDP vendors, a mature digital infrastructure, and widespread use of cloud and AI-based platforms contribute significantly to regional dominance. Enterprises in the United States and Canada are aggressively deploying IDP solutions to streamline document-centric workflows, ensure compliance, and enhance data-driven decision-making. The increasing integration of IDP with robotic process automation (RPA) and enterprise content management systems is further accelerating market growth in the region.

Europe is the second most dominant region in the IDP market, supported by strong regulatory frameworks around data privacy and growing digital transformation initiatives across key sectors. Countries such as Germany, the United Kingdom, and France are investing in intelligent automation to improve operational efficiency in banking, insurance, healthcare, and public administration. The adoption of IDP solutions is being fueled by the need to handle complex multilingual documents, reduce administrative burdens, and comply with stringent standards like GDPR. European organizations are also prioritizing sustainability and paperless operations, which aligns well with the core value proposition of IDP technologies.

Asia Pacific is experiencing rapid growth in the intelligent document processing market, driven by increasing digitization, a rising number of small and medium-sized enterprises, and government-led digital initiatives across countries like China, India, Japan, and South Korea. The region is witnessing strong demand for cost-effective, scalable IDP solutions to automate high-volume document processing in sectors such as manufacturing, logistics, finance, and healthcare. As enterprises continue to embrace AI and cloud technologies to modernize legacy systems, IDP is playing a crucial role in enabling data accuracy, real-time analytics, and operational agility across fast-growing economies.

Latin America is gradually gaining momentum in the IDP market as more organizations recognize the benefits of automation in document processing. Countries like Brazil, Mexico, and Colombia are adopting intelligent solutions to reduce paperwork, improve compliance, and enhance service delivery in both private and public sectors. However, challenges such as budget constraints, limited awareness, and slow IT infrastructure development in some parts of the region have somewhat limited large-scale deployment. Still, with increasing cloud penetration and digital innovation efforts, the region is expected to witness steady growth in IDP adoption.

Middle East and Africa represent the smallest share in the global intelligent document processing market, primarily due to lower digitization levels and limited technological infrastructure in many parts of the region. However, some countries like the UAE, Saudi Arabia, and South Africa are actively investing in intelligent automation as part of broader digital transformation goals. Government initiatives, rising demand for smart governance, and growth in financial services and healthcare sectors are gradually paving the way for IDP implementation. Despite its early stage of market maturity, the region holds long-term potential as awareness and infrastructure continue to improve.

Intelligent Document Processing Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the intelligent document processing market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global intelligent document processing market include:

- Datamatics

- Deloitte

- ABBYY

- IBM

- Automation Anywhere

- IRIS

- Evolution AI

- Appian

- Kofax

- WorkFusion

- UiPath

- AntWorks

- Parascript

- Hyperscience

- Extract Systems

- Infrrd

- Celaton

- HCL Technologies

- AmyGB

- OpenText

- Kodak Alaris

- Rossum

- InData Labs

- Ephesoft

- BIS

- Hyland

The global intelligent document processing market is segmented as follows:

By Component

- Solution

- Services

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

By Deployment

- On-premise

- Cloud

By Organization Size

- Small and Medium Sized Enterprises (SMEs)

- Large Size Enterprises

By End-use

- BFSI

- Healthcare

- Manufacturing

- Retail

- Government & Public Sector

- Transportation & Logistics

- IT & Telecom

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Who are the leading players functioning in the global intelligent document processing market growth?

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Intelligent Document Processing

- 1.2. Global Intelligent Document Processing Market, 2020 & 2026 (USD Million)

- 1.3. Global Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 1.4. Global Intelligent Document Processing Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Intelligent Document Processing Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- 1.6. COVID-19 Impacts on Intelligent Document Processing Market

- 1.6.1. COVID-19 Impact on the Players

- 1.6.2. Business Strategies and Recommendations

- Chapter 2 Intelligent Document Processing Market – Component Analysis

- 2.1. Global Intelligent Document Processing Market – Component Overview

- 2.2. Global Intelligent Document Processing Market Share, by Component, 2020 & 2026 (USD Million)

- 2.3. Sulutions

- 2.3.1. Global Sulutions Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 2.4. Services

- 2.4.1. Global Services Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- Chapter 3 Intelligent Document Processing Market – Deployment Analysis

- 3.1. Global Intelligent Document Processing Market – Deployment Overview

- 3.2. Global Intelligent Document Processing Market Share, by Deployment, 2020 & 2026 (USD Million)

- 3.3. On-Premise

- 3.3.1. Global On-Premise Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 3.4. Cloud

- 3.4.1. Global Cloud Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- Chapter 4 Intelligent Document Processing Market – Organization Size Analysis

- 4.1. Global Intelligent Document Processing Market – Organization Size Overview

- 4.2. Global Intelligent Document Processing Market Share, by Organization Size, 2020 & 2026 (USD Million)

- 4.3. SMEs

- 4.3.1. Global SMEs Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 4.4. Large Enterprises

- 4.4.1. Global Large Enterprises Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- Chapter 5 Intelligent Document Processing Market – Technulogy Analysis

- 5.1. Global Intelligent Document Processing Market – Technulogy Overview

- 5.2. Global Intelligent Document Processing Market Share, by Technulogy, 2020 & 2026 (USD Million)

- 5.3. Optical Character Recognition (OCR)

- 5.3.1. Global Optical Character Recognition (OCR) Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 5.4. Natural Language Processing (NLP)

- 5.4.1. Global Natural Language Processing (NLP) Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 5.5. Artificial Intelligence (AI)

- 5.5.1. Global Artificial Intelligence (AI) Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 5.6. Machine Learning (ML)

- 5.6.1. Global Machine Learning (ML) Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 5.7. Google Vision

- 5.7.1. Global Google Vision Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 5.8. Robotic Process Automation (RPA)

- 5.8.1. Global Robotic Process Automation (RPA) Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 5.9. Deep Learning (DL)

- 5.9.1. Global Deep Learning (DL) Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- Chapter 6 Intelligent Document Processing Market – Vertical Analysis

- 6.1. Global Intelligent Document Processing Market – Vertical Overview

- 6.2. Global Intelligent Document Processing Market Share, by Vertical, 2020 & 2026 (USD Million)

- 6.3. BFSI

- 6.3.1. Global BFSI Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 6.4. Manufacturing

- 6.4.1. Global Manufacturing Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 6.5. Government

- 6.5.1. Global Government Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 6.6. Healthcare and Life Sciences

- 6.6.1. Global Healthcare and Life Sciences Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 6.7. Transportation & Logistics

- 6.7.1. Global Transportation & Logistics Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 6.8. Retail and eCommerce

- 6.8.1. Global Retail and eCommerce Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 6.9. Others

- 6.9.1. Global Others Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- Chapter 7 Intelligent Document Processing Market – Regional Analysis

- 7.1. Global Intelligent Document Processing Market Regional Overview

- 7.2. Global Intelligent Document Processing Market Share, by Region, 2020 & 2026 (USD Million)

- 7.3. North America

- 7.3.1. North America Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.3.1.1. North America Intelligent Document Processing Market, by Country, 2016 - 2026 (USD Million)

- 7.3.2. North America Intelligent Document Processing Market, by Component, 2016 – 2026

- 7.3.2.1. North America Intelligent Document Processing Market, by Component, 2016 – 2026 (USD Million)

- 7.3.3. North America Intelligent Document Processing Market, by Deployment, 2016 – 2026

- 7.3.3.1. North America Intelligent Document Processing Market, by Deployment, 2016 – 2026 (USD Million)

- 7.3.4. North America Intelligent Document Processing Market, by Organization Size, 2016 – 2026

- 7.3.4.1. North America Intelligent Document Processing Market, by Organization Size, 2016 – 2026 (USD Million)

- 7.3.5. North America Intelligent Document Processing Market, by Technulogy, 2016 – 2026

- 7.3.5.1. North America Intelligent Document Processing Market, by Technulogy, 2016 – 2026 (USD Million)

- 7.3.6. North America Intelligent Document Processing Market, by Vertical, 2016 – 2026

- 7.3.6.1. North America Intelligent Document Processing Market, by Vertical, 2016 – 2026 (USD Million)

- 7.3.7. U.S.

- 7.3.7.1. U.S. Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.3.8. Canada

- 7.3.8.1. Canada Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.3.1. North America Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4. Europe

- 7.4.1. Europe Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4.1.1. Europe Intelligent Document Processing Market, by Country, 2016 - 2026 (USD Million)

- 7.4.2. Europe Intelligent Document Processing Market, by Component, 2016 – 2026

- 7.4.2.1. Europe Intelligent Document Processing Market, by Component, 2016 – 2026 (USD Million)

- 7.4.3. Europe Intelligent Document Processing Market, by Deployment, 2016 – 2026

- 7.4.3.1. Europe Intelligent Document Processing Market, by Deployment, 2016 – 2026 (USD Million)

- 7.4.4. Europe Intelligent Document Processing Market, by Organization Size, 2016 – 2026

- 7.4.4.1. Europe Intelligent Document Processing Market, by Organization Size, 2016 – 2026 (USD Million)

- 7.4.5. Europe Intelligent Document Processing Market, by Technulogy, 2016 – 2026

- 7.4.5.1. Europe Intelligent Document Processing Market, by Technulogy, 2016 – 2026 (USD Million)

- 7.4.6. Europe Intelligent Document Processing Market, by Vertical, 2016 – 2026

- 7.4.6.1. Europe Intelligent Document Processing Market, by Vertical, 2016 – 2026 (USD Million)

- 7.4.7. Germany

- 7.4.7.1. Germany Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4.8. France

- 7.4.8.1. France Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4.9. U.K.

- 7.4.9.1. U.K. Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4.10. Italy

- 7.4.10.1. Italy Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4.11. Spain

- 7.4.11.1. Spain Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4.12. Rest of Europe

- 7.4.12.1. Rest of Europe Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.4.1. Europe Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5. Asia Pacific

- 7.5.1. Asia Pacific Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5.1.1. Asia Pacific Intelligent Document Processing Market, by Country, 2016 - 2026 (USD Million)

- 7.5.2. Asia Pacific Intelligent Document Processing Market, by Component, 2016 – 2026

- 7.5.2.1. Asia Pacific Intelligent Document Processing Market, by Component, 2016 – 2026 (USD Million)

- 7.5.3. Asia Pacific Intelligent Document Processing Market, by Deployment, 2016 – 2026

- 7.5.3.1. Asia Pacific Intelligent Document Processing Market, by Deployment, 2016 – 2026 (USD Million)

- 7.5.4. Asia Pacific Intelligent Document Processing Market, by Organization Size, 2016 – 2026

- 7.5.4.1. Asia Pacific Intelligent Document Processing Market, by Organization Size, 2016 – 2026 (USD Million)

- 7.5.5. Asia Pacific Intelligent Document Processing Market, by Technulogy, 2016 – 2026

- 7.5.5.1. Asia Pacific Intelligent Document Processing Market, by Technulogy, 2016 – 2026 (USD Million)

- 7.5.6. Asia Pacific Intelligent Document Processing Market, by Vertical, 2016 – 2026

- 7.5.6.1. Asia Pacific Intelligent Document Processing Market, by Vertical, 2016 – 2026 (USD Million)

- 7.5.7. China

- 7.5.7.1. China Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5.8. Japan

- 7.5.8.1. Japan Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5.9. India

- 7.5.9.1. India Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5.10. South Korea

- 7.5.10.1. South Korea Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5.11. South-East Asia

- 7.5.11.1. South-East Asia Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5.12. Rest of Asia Pacific

- 7.5.12.1. Rest of Asia Pacific Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.5.1. Asia Pacific Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.6. Latin America

- 7.6.1. Latin America Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.6.1.1. Latin America Intelligent Document Processing Market, by Country, 2016 - 2026 (USD Million)

- 7.6.2. Latin America Intelligent Document Processing Market, by Component, 2016 – 2026

- 7.6.2.1. Latin America Intelligent Document Processing Market, by Component, 2016 – 2026 (USD Million)

- 7.6.3. Latin America Intelligent Document Processing Market, by Deployment, 2016 – 2026

- 7.6.3.1. Latin America Intelligent Document Processing Market, by Deployment, 2016 – 2026 (USD Million)

- 7.6.4. Latin America Intelligent Document Processing Market, by Organization Size, 2016 – 2026

- 7.6.4.1. Latin America Intelligent Document Processing Market, by Organization Size, 2016 – 2026 (USD Million)

- 7.6.5. Latin America Intelligent Document Processing Market, by Technulogy, 2016 – 2026

- 7.6.5.1. Latin America Intelligent Document Processing Market, by Technulogy, 2016 – 2026 (USD Million)

- 7.6.6. Latin America Intelligent Document Processing Market, by Vertical, 2016 – 2026

- 7.6.6.1. Latin America Intelligent Document Processing Market, by Vertical, 2016 – 2026 (USD Million)

- 7.6.7. Brazil

- 7.6.7.1. Brazil Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.6.8. Mexico

- 7.6.8.1. Mexico Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.6.9. Rest of Latin America

- 7.6.9.1. Rest of Latin America Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.6.1. Latin America Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.7. The Middle-East and Africa

- 7.7.1. The Middle-East and Africa Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.7.1.1. The Middle-East and Africa Intelligent Document Processing Market, by Country, 2016 - 2026 (USD Million)

- 7.7.2. The Middle-East and Africa Intelligent Document Processing Market, by Component, 2016 – 2026

- 7.7.2.1. The Middle-East and Africa Intelligent Document Processing Market, by Component, 2016 – 2026 (USD Million)

- 7.7.3. The Middle-East and Africa Intelligent Document Processing Market, by Deployment, 2016 – 2026

- 7.7.3.1. The Middle-East and Africa Intelligent Document Processing Market, by Deployment, 2016 – 2026 (USD Million)

- 7.7.4. The Middle-East and Africa Intelligent Document Processing Market, by Organization Size, 2016 – 2026

- 7.7.4.1. The Middle-East and Africa Intelligent Document Processing Market, by Organization Size, 2016 – 2026 (USD Million)

- 7.7.5. The Middle-East and Africa Intelligent Document Processing Market, by Technulogy, 2016 – 2026

- 7.7.5.1. The Middle-East and Africa Intelligent Document Processing Market, by Technulogy, 2016 – 2026 (USD Million)

- 7.7.6. The Middle-East and Africa Intelligent Document Processing Market, by Vertical, 2016 – 2026

- 7.7.6.1. The Middle-East and Africa Intelligent Document Processing Market, by Vertical, 2016 – 2026 (USD Million)

- 7.7.7. GCC Countries

- 7.7.7.1. GCC Countries Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.7.8. South Africa

- 7.7.8.1. South Africa Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.7.9. Rest of Middle-East Africa

- 7.7.9.1. Rest of Middle-East Africa Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- 7.7.1. The Middle-East and Africa Intelligent Document Processing Market, 2016 – 2026 (USD Million)

- Chapter 8 Intelligent Document Processing Market – Competitive Landscape

- 8.1. Competitor Market Share – Revenue

- 8.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 8.3. Strategic Developments

- 8.3.1. Acquisitions and Mergers

- 8.3.2. New Products

- 8.3.3. Research & Development Activities

- Chapter 9 Company Profiles

- 9.1. Parascript

- 9.1.1. Company Overview

- 9.1.2. Product/Service Portfulio

- 9.1.3. Parascript Sales, Revenue, and Gross Margin

- 9.1.4. Parascript Revenue and Growth Rate

- 9.1.5. Parascript Market Share

- 9.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.2. Hyperscience

- 9.2.1. Company Overview

- 9.2.2. Product/Service Portfulio

- 9.2.3. Hyperscience Sales, Revenue, and Gross Margin

- 9.2.4. Hyperscience Revenue and Growth Rate

- 9.2.5. Hyperscience Market Share

- 9.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.3. IBM

- 9.3.1. Company Overview

- 9.3.2. Product/Service Portfulio

- 9.3.3. IBM Sales, Revenue, and Gross Margin

- 9.3.4. IBM Revenue and Growth Rate

- 9.3.5. IBM Market Share

- 9.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.4. Hyland

- 9.4.1. Company Overview

- 9.4.2. Product/Service Portfulio

- 9.4.3. Hyland Sales, Revenue, and Gross Margin

- 9.4.4. Hyland Revenue and Growth Rate

- 9.4.5. Hyland Market Share

- 9.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.5. Automation Anywhere

- 9.5.1. Company Overview

- 9.5.2. Product/Service Portfulio

- 9.5.3. Automation Anywhere Sales, Revenue, and Gross Margin

- 9.5.4. Automation Anywhere Revenue and Growth Rate

- 9.5.5. Automation Anywhere Market Share

- 9.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.6. IRIS

- 9.6.1. Company Overview

- 9.6.2. Product/Service Portfulio

- 9.6.3. IRIS Sales, Revenue, and Gross Margin

- 9.6.4. IRIS Revenue and Growth Rate

- 9.6.5. IRIS Market Share

- 9.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.7. Evulution AI

- 9.7.1. Company Overview

- 9.7.2. Product/Service Portfulio

- 9.7.3. Evulution AI Sales, Revenue, and Gross Margin

- 9.7.4. Evulution AI Revenue and Growth Rate

- 9.7.5. Evulution AI Market Share

- 9.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.8. Appian

- 9.8.1. Company Overview

- 9.8.2. Product/Service Portfulio

- 9.8.3. Appian Sales, Revenue, and Gross Margin

- 9.8.4. Appian Revenue and Growth Rate

- 9.8.5. Appian Market Share

- 9.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.9. Kofax

- 9.9.1. Company Overview

- 9.9.2. Product/Service Portfulio

- 9.9.3. Kofax Sales, Revenue, and Gross Margin

- 9.9.4. Kofax Revenue and Growth Rate

- 9.9.5. Kofax Market Share

- 9.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.10. WorkFusion

- 9.10.1. Company Overview

- 9.10.2. Product/Service Portfulio

- 9.10.3. WorkFusion Sales, Revenue, and Gross Margin

- 9.10.4. WorkFusion Revenue and Growth Rate

- 9.10.5. WorkFusion Market Share

- 9.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.11. UiPath

- 9.11.1. Company Overview

- 9.11.2. Product/Service Portfulio

- 9.11.3. UiPath Sales, Revenue, and Gross Margin

- 9.11.4. UiPath Revenue and Growth Rate

- 9.11.5. UiPath Market Share

- 9.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.12. Datamatics

- 9.12.1. Company Overview

- 9.12.2. Product/Service Portfulio

- 9.12.3. Datamatics Sales, Revenue, and Gross Margin

- 9.12.4. Datamatics Revenue and Growth Rate

- 9.12.5. Datamatics Market Share

- 9.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.13. Deloitte

- 9.13.1. Company Overview

- 9.13.2. Product/Service Portfulio

- 9.13.3. Deloitte Sales, Revenue, and Gross Margin

- 9.13.4. Deloitte Revenue and Growth Rate

- 9.13.5. Deloitte Market Share

- 9.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.14. ABBYY

- 9.14.1. Company Overview

- 9.14.2. Product/Service Portfulio

- 9.14.3. ABBYY Sales, Revenue, and Gross Margin

- 9.14.4. ABBYY Revenue and Growth Rate

- 9.14.5. ABBYY Market Share

- 9.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.15. AntWorks

- 9.15.1. Company Overview

- 9.15.2. Product/Service Portfulio

- 9.15.3. AntWorks Sales, Revenue, and Gross Margin

- 9.15.4. AntWorks Revenue and Growth Rate

- 9.15.5. AntWorks Market Share

- 9.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.16. Extract Systems

- 9.16.1. Company Overview

- 9.16.2. Product/Service Portfulio

- 9.16.3. Extract Systems Sales, Revenue, and Gross Margin

- 9.16.4. Extract Systems Revenue and Growth Rate

- 9.16.5. Extract Systems Market Share

- 9.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.17. Infrrd

- 9.17.1. Company Overview

- 9.17.2. Product/Service Portfulio

- 9.17.3. Infrrd Sales, Revenue, and Gross Margin

- 9.17.4. Infrrd Revenue and Growth Rate

- 9.17.5. Infrrd Market Share

- 9.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.18. Celaton

- 9.18.1. Company Overview

- 9.18.2. Product/Service Portfulio

- 9.18.3. Celaton Sales, Revenue, and Gross Margin

- 9.18.4. Celaton Revenue and Growth Rate

- 9.18.5. Celaton Market Share

- 9.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.19. Kodak Alaris

- 9.19.1. Company Overview

- 9.19.2. Product/Service Portfulio

- 9.19.3. Kodak Alaris Sales, Revenue, and Gross Margin

- 9.19.4. Kodak Alaris Revenue and Growth Rate

- 9.19.5. Kodak Alaris Market Share

- 9.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.20. AmyGB

- 9.20.1. Company Overview

- 9.20.2. Product/Service Portfulio

- 9.20.3. AmyGB Sales, Revenue, and Gross Margin

- 9.20.4. AmyGB Revenue and Growth Rate

- 9.20.5. AmyGB Market Share

- 9.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.21. OpenText

- 9.21.1. Company Overview

- 9.21.2. Product/Service Portfulio

- 9.21.3. OpenText Sales, Revenue, and Gross Margin

- 9.21.4. OpenText Revenue and Growth Rate

- 9.21.5. OpenText Market Share

- 9.21.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.22. Rossum

- 9.22.1. Company Overview

- 9.22.2. Product/Service Portfulio

- 9.22.3. Rossum Sales, Revenue, and Gross Margin

- 9.22.4. Rossum Revenue and Growth Rate

- 9.22.5. Rossum Market Share

- 9.22.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.23. InData Labs

- 9.23.1. Company Overview

- 9.23.2. Product/Service Portfulio

- 9.23.3. InData Labs Sales, Revenue, and Gross Margin

- 9.23.4. InData Labs Revenue and Growth Rate

- 9.23.5. InData Labs Market Share

- 9.23.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.24. Ephesoft

- 9.24.1. Company Overview

- 9.24.2. Product/Service Portfulio

- 9.24.3. Ephesoft Sales, Revenue, and Gross Margin

- 9.24.4. Ephesoft Revenue and Growth Rate

- 9.24.5. Ephesoft Market Share

- 9.24.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.25. BIS

- 9.25.1. Company Overview

- 9.25.2. Product/Service Portfulio

- 9.25.3. BIS Sales, Revenue, and Gross Margin

- 9.25.4. BIS Revenue and Growth Rate

- 9.25.5. BIS Market Share

- 9.25.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.26. HCL Technulogies

- 9.26.1. Company Overview

- 9.26.2. Product/Service Portfulio

- 9.26.3. HCL Technulogies Sales, Revenue, and Gross Margin

- 9.26.4. HCL Technulogies Revenue and Growth Rate

- 9.26.5. HCL Technulogies Market Share

- 9.26.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.1. Parascript

- Chapter 10 Intelligent Document Processing — Industry Analysis

- 10.1. Introduction and Taxonomy

- 10.2. Intelligent Document Processing Market – Key Trends

- 10.2.1. Market Drivers

- 10.2.2. Market Restraints

- 10.2.3. Market Opportunities

- 10.3. Value Chain Analysis

- 10.4. Key Mandates and Regulations

- 10.5. Technulogy Roadmap and Timeline

- 10.6. Intelligent Document Processing Market – Attractiveness Analysis

- 10.6.1. By Component

- 10.6.2. By Deployment

- 10.6.3. By Organization Size

- 10.6.4. By Technulogy

- 10.6.5. By Vertical

- 10.6.6. By Region

- Chapter 11 Report Conclusion & Key Insights

- 11.1. Key Insights from Primary Interviews & Surveys Respondents

- 11.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 12 Research Approach & Methodulogy

- 12.1. Report Description

- 12.2. Research Scope

- 12.3. Research Methodulogy

- 12.3.1. Secondary Research

- 12.3.2. Primary Research

- 12.3.3. Statistical Models

- 12.3.3.1. Company Share Analysis Model

- 12.3.3.2. Revenue Based Modeling

- 12.3.4. Research Limitations

Inquiry For Buying

Intelligent Document Processing

Request Sample

Intelligent Document Processing