Li-ion Battery for E-cigarette Market Size, Share, and Trends Analysis Report

CAGR :

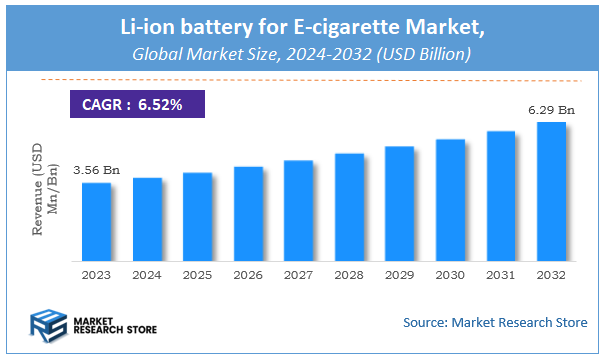

| Market Size 2023 (Base Year) | USD 3.56 Billion |

| Market Size 2032 (Forecast Year) | USD 6.29 Billion |

| CAGR | 6.52% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Li-ion battery for E-cigarette Market Insights

According to Market Research Store, the global li-ion battery for e-cigarette market size was valued at around USD 3.56 billion in 2023 and is estimated to reach USD 6.29 billion by 2032, to register a CAGR of approximately 6.52% in terms of revenue during the forecast period 2024-2032.

The li-ion battery for e-cigarette report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Li-ion Battery for E-cigarette Market: Overview

The Li-ion Battery for E-cigarette Market centers on the use of lithium-ion batteries as a reliable power source for e-cigarettes and vaping devices. These batteries are favored in this application due to their compact size, lightweight design, high energy density, and ability to deliver consistent power output, essential for the performance and functionality of e-cigarettes.

The market is driven by the growing popularity of e-cigarettes as an alternative to traditional smoking, spurred by increased awareness of the harmful effects of conventional tobacco products and a shift toward reduced-risk products. Li-ion batteries provide the long-lasting power needed for various e-cigarette designs, including pod systems and advanced mods, which require higher wattage and longer usage times. Advancements in battery safety features, such as overcharge protection and thermal stability, are further enhancing the adoption of Li-ion batteries in this market. Additionally, the rising demand for compact, rechargeable devices in the vaping industry continues to propel the growth of Li-ion batteries tailored for e-cigarettes.

Key Highlights

- The li-ion battery for e-cigarette market is anticipated to grow at a CAGR of 6.52% during the forecast period.

- The global li-ion battery for e-cigarette market was estimated to be worth approximately USD 3.56 billion in 2023 and is projected to reach a value of USD 6.29 billion by 2032.

- The growth of the li-ion battery for e-cigarette market is being driven by the increasing popularity of e-cigarettes as an alternative to traditional smoking, coupled with advancements in battery technology.

- Based on the product, the 18650 segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the advanced personal vaporizers (APVs) or mods segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Li-ion Battery for E-cigarette Market: Dynamics

Key Growth Drivers

- Rising Popularity of E-cigarettes: The increasing popularity of e-cigarettes as an alternative to traditional cigarettes is a major driver for the demand for Li-ion batteries in this market.

- Technological Advancements: Advancements in battery technology, such as increased energy density and improved charging capabilities, are enabling the development of more powerful and longer-lasting e-cigarettes.

- Diverse Product Offerings: The growing variety of e-cigarette devices, including pod systems, disposable vapes, and high-powered mods, is driving demand for a range of battery sizes and capacities.

Restraints

- Safety Concerns: Safety concerns related to overheating, fires, and explosions, particularly with low-quality batteries, pose a significant risk and can negatively impact market growth.

- Regulatory Scrutiny: Increasing regulatory scrutiny and restrictions on e-cigarettes in many countries can create uncertainty and hinder market growth.

- Health Concerns: Growing public health concerns about the potential risks of e-cigarette use can discourage adoption and negatively impact market demand.

Opportunities

- Development of Safer and More Reliable Batteries: Focus on developing safer and more reliable battery technologies, such as those with improved thermal management and overcharge protection.

- Miniaturization and Integration: Developing smaller and more integrated battery solutions to enable the design of more compact and stylish e-cigarette devices.

- Exploring Alternative Battery Chemistries: Exploring alternative battery chemistries, such as lithium polymer batteries, that offer improved safety and performance.

Challenges

- Maintaining Quality and Consistency: Ensuring consistent quality and performance across different battery manufacturers and suppliers is crucial for maintaining consumer trust and safety.

- Addressing Environmental Concerns: Addressing environmental concerns related to battery production, use, and disposal is critical for the long-term sustainability of the market.

- Staying Ahead of Regulations: Adapting to evolving regulations and safety standards in the e-cigarette industry is essential for continued market success.

Li-ion battery for E-cigarette Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Li-ion battery for E-cigarette Market |

| Market Size in 2023 | USD 3.56 Billion |

| Market Forecast in 2032 | USD 6.29 Billion |

| Growth Rate | CAGR of 6.52% |

| Number of Pages | 140 |

| Key Companies Covered | Samsung SDI, LG Chem, Panasonic Corporation, Sony Corporation, A123 Systems, Tianjin Lishen Battery Co., Ltd., Shenzhen BAK Battery Co., Ltd., BYD Company Limited, EVE Energy Co., Ltd., ATL (Amperex Technology Limited), Johnson Controls International plc, Murata Manufacturing Co., Ltd., Saft Groupe S.A., GS Yuasa Corporation, Hitachi Chemical Co., Ltd., VARTA AG, EnerSys, SK Innovation Co., Ltd., Toshiba Corporation, Maxell Holdings, Ltd. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Li-ion Battery for E-cigarette Market: Segmentation Insights

The global li-ion battery for e-cigarette market is divided by product, application, and region.

Segmentation Insights by Product

Based on Product, the global li-ion battery for e-cigarette market is divided into 18650, 18500, 18350, and 26650.

The 18650 segment is the leading product category in the Li-ion Battery for E-cigarette Market, driven by its high energy density, long cycle life, and consistent performance. These cylindrical batteries are widely used in larger e-cigarette devices and advanced vape mods that require significant power for prolonged usage. The 18650 battery’s standardized size and widespread availability make it a preferred choice for manufacturers and users alike. Its ability to provide stable power output and support extended vaping sessions makes it the dominant segment in the market. Additionally, advancements in 18650 battery technology, such as improved safety features and higher capacity options, continue to enhance its appeal in the e-cigarette market.

The 18500 segment caters to medium-sized e-cigarette devices that prioritize a balance between portability and battery life. These batteries are slightly smaller than the 18650 variant, making them suitable for compact vape devices without compromising too much on power output. The 18500 battery is favored by users who seek a more portable vaping experience but still require reliable performance. While not as widely adopted as the 18650, the 18500 segment serves a niche market of e-cigarette users who prioritize device ergonomics and ease of handling.

The 18350 segment is specifically used in ultra-compact e-cigarette devices, where size and weight are critical factors. These batteries are ideal for small, portable vaping devices and pod systems that prioritize discreetness and convenience. While the 18350 battery offers a lower capacity compared to larger variants, it is suitable for devices with lower power requirements. The growing demand for lightweight and pocket-friendly e-cigarettes supports the steady growth of this segment, particularly among casual users and those new to vaping.

The 26650 segment is gaining traction in the high-performance e-cigarette market, where power output and battery capacity are prioritized. These larger batteries are commonly used in advanced vape mods and devices designed for extended use and cloud chasing. The 26650 battery's higher capacity and ability to deliver significant power make it ideal for enthusiasts and heavy vapers who require long-lasting performance. However, its larger size makes it less suitable for portable or compact devices, limiting its adoption to specific user groups.

Segmentation Insights by Application

On the basis of Application, the global li-ion battery for e-cigarette market is bifurcated into advanced personal vaporizers (APVs) or mods, the disposable one-piece, the rechargeable two and three-piece, e cigars, and others.

The Advanced Personal Vaporizers (APVs) or Mods segment dominates the market, driven by the growing popularity of high-performance devices among experienced vapers and enthusiasts. APVs and mods typically utilize high-capacity Li-ion batteries, such as the 18650 or 26650, to support customizable settings like variable wattage and temperature control. These devices require powerful batteries capable of delivering consistent performance over extended periods. The demand for APVs and mods is fueled by the growing trend of "cloud chasing" and the preference for advanced features that enhance the vaping experience. This segment represents a significant share of the market, catering to the needs of heavy and dedicated vapers.

The Disposable One-Piece segment holds a significant share in the Li-ion Battery for E-cigarette Market, driven by the popularity of single-use e-cigarettes among new and casual users. These devices are pre-charged, compact, and convenient, eliminating the need for maintenance or recharging. Li-ion batteries used in disposable e-cigarettes are lightweight and have limited capacity, optimized for short-term usage. While the disposable nature of these devices raises concerns about environmental impact, their affordability and ease of use continue to attract a large consumer base, particularly in regions where vaping is gaining traction as an alternative to traditional smoking.

The Rechargeable Two and Three-Piece segment is another major contributor to the market, catering to users who prefer devices with replaceable components like cartridges and rechargeable batteries. These e-cigarettes typically utilize mid-sized Li-ion batteries, such as the 18500 or 18650 variants, offering a balance between portability and performance. The rechargeable design appeals to regular vapers who value cost-effectiveness and flexibility in terms of flavor and nicotine strength customization. As the demand for more sustainable vaping solutions grows, this segment is expected to witness steady growth, driven by advancements in battery technology that enhance lifespan and safety.

The E Cigars segment serves a niche market of consumers seeking a vaping experience that mimics traditional cigars. These devices typically use compact Li-ion batteries, optimized for moderate power output and longer operational life to replicate the slow-burning nature of cigars. While the segment is relatively small compared to other categories, the demand for e-cigars is growing among cigar enthusiasts and smokers transitioning to vaping, particularly in regions with strict anti-smoking regulations.

Li-ion Battery for E-cigarette Market: Regional Insights

- North America currently leads the global li-ion battery for e-cigarette market

North America is a leading market for Li-ion batteries in e-cigarettes, with the United States as the dominant player. The growth is driven by the widespread adoption of vaping devices and e-cigarettes as smoking cessation tools. Increasing health awareness among smokers and the availability of a wide variety of vaping products have further boosted the demand for reliable and long-lasting Li-ion batteries. The region also benefits from stringent regulations emphasizing battery safety in vaping devices, encouraging manufacturers to focus on high-quality Li-ion battery solutions.

Europe is a significant market for Li-ion batteries in e-cigarettes, driven by increasing consumer awareness of the health risks of traditional smoking and the shift toward vaping as an alternative. Countries like the UK, France, and Germany lead the adoption of e-cigarettes, supported by regulatory frameworks that allow the sale of vaping products with strict safety standards. European consumers' preference for compact, high-performance vaping devices has driven demand for advanced Li-ion batteries with improved safety features. Additionally, growing trends toward sustainability and rechargeable solutions further contribute to the market’s expansion.

Asia-Pacific is the fastest-growing market for Li-ion batteries in e-cigarettes, led by countries such as China, Japan, and South Korea. China, being a major hub for e-cigarette manufacturing, is also a significant producer of Li-ion batteries for these devices. The growing popularity of vaping in countries like Malaysia, Indonesia, and the Philippines is also fueling demand for efficient batteries. As disposable income rises and awareness of vaping as an alternative to traditional smoking increases, the adoption of e-cigarettes and related battery technologies is expanding in the region.

Latin America is an emerging market for Li-ion batteries in e-cigarettes, with growth driven by increased awareness of the health risks of smoking and the availability of affordable vaping products. Countries like Brazil and Mexico are seeing rising adoption of e-cigarettes, particularly among urban populations. Although the market is still in its nascent stage, the growing middle class and increased disposable income in the region are expected to drive demand for reliable and durable Li-ion batteries in vaping devices.

The Middle East and Africa (MEA) region is witnessing steady growth in the adoption of e-cigarettes, particularly in the UAE and South Africa, where vaping is becoming increasingly popular. Rising disposable incomes and changing lifestyles are contributing to the market expansion. However, challenges such as limited awareness and regulatory barriers in some countries may restrain the market growth. As demand for e-cigarettes increases, the need for high-quality Li-ion batteries for these devices is expected to rise, particularly in urban areas.

Li-ion Battery for E-cigarette Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the li-ion battery for e-cigarette market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global li-ion battery for e-cigarette market include:

- EVE Energy

- LG Chem

- Panasonic

- Samsung SDI

- Shenzen FEST Technology

- Shenzhen Mxjo Technology

- Sony

- Vapor Hub International

The global li-ion battery for e-cigarette market is segmented as follows:

By Product

- 18650

- 18500

- 18350

- 26650

By Application

- Advanced Personal Vaporizers (APVs) or Mods

- The Disposable One-Piece

- The Rechargeable Two and Three-Piece

- E Cigars

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global li-ion battery for e-cigarette market size was projected at approximately US$ 3.56 billion in 2023. Projections indicate that the market is expected to reach around US$ 6.29 billion in revenue by 2032.

The global li-ion battery for e-cigarette market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 6.52% during the forecast period from 2024 to 2032.

North America is expected to dominate the global li-ion battery for e-cigarette market.

The global lithium-ion battery market for e-cigarettes is primarily driven by the rising popularity of e-cigarettes, increasing demand for high-performance batteries, and advancements in battery technology.

Some of the prominent players operating in the global li-ion battery for e-cigarette market are; EVE Energy, LG Chem, Panasonic, Samsung SDI, Shenzen FEST Technology, Shenzhen Mxjo Technology, Sony, Vapor Hub International, and others.

The global li-ion battery for e-cigarette market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

Li-ion Battery for E-cigarette

Request Sample

Li-ion Battery for E-cigarette