Liqueurs and Eaux de vie Market Size, Share, and Trends Analysis Report

CAGR :

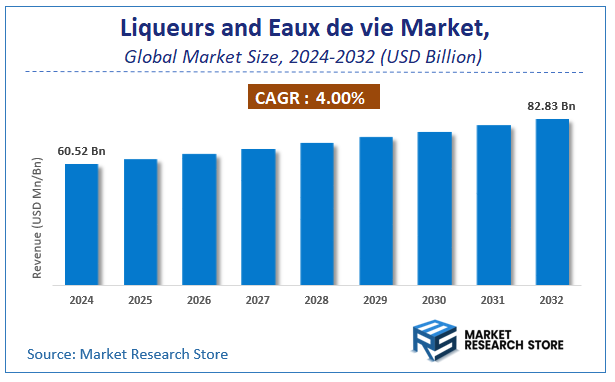

| Market Size 2024 (Base Year) | USD 60.52 Billion |

| Market Size 2032 (Forecast Year) | USD 82.83 Billion |

| CAGR | 4% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global liqueurs and eaux de vie market size was valued at approximately USD 60.52 Billion in 2024. The market is projected to grow significantly, reaching USD 82.83 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the liqueurs and eaux de vie industry.

To Get more Insights, Request a Free Sample

Liqueurs and Eaux de vie Market: Overview

The growth of the liqueurs and eaux de vie market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The liqueurs and eaux de vie market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the liqueurs and eaux de vie market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global liqueurs and eaux de vie market is estimated to grow annually at a CAGR of around 4% over the forecast period (2025-2032).

- In terms of revenue, the global liqueurs and eaux de vie market size was valued at around USD 60.52 Billion in 2024 and is projected to reach USD 82.83 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for premium and craft spirits, increasing disposable incomes, and evolving consumer preferences for artisanal and innovative flavor profiles are propelling this market.

- Based on the Products, the Liqueurs segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the Surper Market segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Liqueurs and Eaux de vie Market: Report Scope

This report thoroughly analyzes the liqueurs and eaux de vie market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Liqueurs and Eaux de vie Market |

| Market Size in 2024 | USD 60.52 Billion |

| Market Forecast in 2032 | USD 82.83 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 219 |

| Key Companies Covered | Pernod Ricard, Kahlua, Beam Suntory, Distell, De Kuyper, Gruppo Campari, Rémy Cointreau, Kwai Feh, Passoa, Thorntons, Stock Spirits Group, Diageo |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Liqueurs and Eaux de vie Market: Dynamics

Key Growth Drivers :

The global market for liqueurs and eaux-de-vie is significantly propelled by several factors. A major driver is the increasing consumer interest in premium and craft spirits. Consumers are seeking unique, high-quality, and artisanal products, leading to a surge in demand for well-crafted liqueurs and eaux-de-vie with distinct flavor profiles and heritage. Furthermore, the growing cocktail culture worldwide, especially in urban areas and among younger demographics, fuels the demand for these spirits as essential ingredients in both classic and innovative mixed drinks. The rise of e-commerce platforms and online retail also plays a crucial role, offering wider accessibility and convenience for consumers to explore and purchase a diverse range of these products from different regions. Additionally, gifting trends, particularly during holidays and special occasions, contribute to sales, as consumers often opt for premium spirits as presents.

Restraints :

Despite the growth, the market faces several restraints. High taxation and stringent regulatory frameworks on alcohol production, distribution, and sales in many countries can significantly impact profitability and market expansion. These regulations often involve complex licensing, advertising restrictions, and health warnings, which can be costly for producers to navigate. Intense competition from other alcoholic beverage categories, such as wine, beer, and other spirits, also poses a challenge. Consumers have a vast array of choices, and switching costs are low, making it difficult for liqueurs and eaux-de-vie to consistently capture market share without continuous innovation and marketing. Furthermore, health and wellness trends, coupled with a growing awareness of alcohol-related issues, are leading some consumers to reduce their alcohol intake or opt for low-alcohol and no-alcohol alternatives, potentially dampening demand for traditional spirits. Economic downturns or recessions can also negatively impact sales, as consumers may reduce discretionary spending on premium alcoholic beverages.

Opportunities :

The market presents several promising opportunities for growth and innovation. The expansion into emerging markets, particularly in Asia-Pacific and Latin America, where disposable incomes are rising and Western drinking habits are gaining traction, offers significant untapped potential. These markets represent a large consumer base with a growing appetite for diverse and premium spirits. Product innovation, including the development of new flavors, unique ingredient combinations, and limited-edition releases, can attract new consumers and maintain interest among existing ones. This also extends to the development of low-sugar or naturally sweetened options to cater to health-conscious consumers. The increasing popularity of home mixology and DIY cocktail kits provides an opportunity for brands to offer specialized sets and educational content, further engaging consumers. Furthermore, strategic collaborations with restaurants, bars, and tourism sectors can enhance brand visibility and encourage trial, especially through exclusive cocktail menus or tasting experiences.

Challenges :

The market is also confronted with several challenges that require strategic navigation. Counterfeit products and illicit trade pose a significant threat, eroding consumer trust, damaging brand reputation, and leading to revenue losses for legitimate producers. Ensuring product authenticity and implementing robust supply chain security measures are crucial. Changing consumer preferences and the need to constantly innovate to stay relevant in a fast-paced market are ongoing challenges. Brands must continuously monitor trends, invest in research and development, and adapt their offerings to meet evolving tastes. The ethical sourcing of ingredients and sustainable production practices are becoming increasingly important to consumers. Companies that fail to address these environmental and social concerns may face reputational damage and lose market share. Moreover, global supply chain disruptions, such as those caused by pandemics, geopolitical events, or climate change, can impact the availability of raw materials, production, and distribution, leading to increased costs and potential stock shortages.

Liqueurs and Eaux de vie Market: Segmentation Insights

The global liqueurs and eaux de vie market is segmented based on Products, Applications, and Region. All the segments of the liqueurs and eaux de vie market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global liqueurs and eaux de vie market is divided into Liqueurs, Eaux de vie.

On the basis of Applications, the global liqueurs and eaux de vie market is bifurcated into Surper Market, Convenience Stores, Retailers, On-Line Shopping, Other.

Liqueurs and Eaux de vie Market: Regional Insights

Europe dominates the global liqueurs and eaux-de-vie market, accounting for the largest revenue share, a position reinforced by its deep-rooted traditions and status as the production heartland for categories like Italian amari, French fruit eaux-de-vie, and cream liqueurs. According to industry data from sources like IWSR, the region's mature palates and high per-capita consumption, particularly in Germany, France, Italy, and the UK, drive steady volume. However, the Asia-Pacific region is projected as the fastest-growing market, fueled by rising disposable incomes, urbanization, and the growing popularity of western-style cocktails in countries like China, Japan, and India. While North America remains a significant and innovation-driven market, especially for premium and craft liqueurs, Europe's historical production authority and consistent consumption cement its current dominating position globally.

Liqueurs and Eaux de vie Market: Competitive Landscape

The liqueurs and eaux de vie market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Liqueurs and Eaux de vie Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Pernod Ricard

- Kahlua

- Beam Suntory

- Distell

- De Kuyper

- Gruppo Campari

- Rémy Cointreau

- Kwai Feh

- Passoa

- Thorntons

- Stock Spirits Group

- Diageo

The Global Liqueurs and Eaux de vie Market is Segmented as Follows:

By Products

- Liqueurs

- Eaux de vie

By Applications

- Surper Market

- Convenience Stores

- Retailers

- On-Line Shopping

- Other

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Liqueurs and Eaux de vie Market Share by Type (2020-2026) 1.5.2 Liqueurs 1.5.3 Eaux de vie 1.6 Market by Application 1.6.1 Global Liqueurs and Eaux de vie Market Share by Application (2020-2026) 1.6.2 Surper Market 1.6.3 Convenience Stores 1.6.4 Retailers 1.6.5 On-Line Shopping 1.6.6 Other 1.7 Liqueurs and Eaux de vie Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Liqueurs and Eaux de vie Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Liqueurs and Eaux de vie Market 3.1 Value Chain Status 3.2 Liqueurs and Eaux de vie Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Liqueurs and Eaux de vie 3.2.3 Labor Cost of Liqueurs and Eaux de vie 3.2.3.1 Labor Cost of Liqueurs and Eaux de vie Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Pernod Ricard 4.1.1 Pernod Ricard Basic Information 4.1.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.1.3 Pernod Ricard Liqueurs and Eaux de vie Market Performance (2015-2020) 4.1.4 Pernod Ricard Business Overview 4.2 Kahlua 4.2.1 Kahlua Basic Information 4.2.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.2.3 Kahlua Liqueurs and Eaux de vie Market Performance (2015-2020) 4.2.4 Kahlua Business Overview 4.3 Beam Suntory 4.3.1 Beam Suntory Basic Information 4.3.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.3.3 Beam Suntory Liqueurs and Eaux de vie Market Performance (2015-2020) 4.3.4 Beam Suntory Business Overview 4.4 Distell 4.4.1 Distell Basic Information 4.4.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.4.3 Distell Liqueurs and Eaux de vie Market Performance (2015-2020) 4.4.4 Distell Business Overview 4.5 De Kuyper 4.5.1 De Kuyper Basic Information 4.5.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.5.3 De Kuyper Liqueurs and Eaux de vie Market Performance (2015-2020) 4.5.4 De Kuyper Business Overview 4.6 Gruppo Campari 4.6.1 Gruppo Campari Basic Information 4.6.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.6.3 Gruppo Campari Liqueurs and Eaux de vie Market Performance (2015-2020) 4.6.4 Gruppo Campari Business Overview 4.7 Rémy Cointreau 4.7.1 Rémy Cointreau Basic Information 4.7.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.7.3 Rémy Cointreau Liqueurs and Eaux de vie Market Performance (2015-2020) 4.7.4 Rémy Cointreau Business Overview 4.8 Kwai Feh 4.8.1 Kwai Feh Basic Information 4.8.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.8.3 Kwai Feh Liqueurs and Eaux de vie Market Performance (2015-2020) 4.8.4 Kwai Feh Business Overview 4.9 Passoa 4.9.1 Passoa Basic Information 4.9.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.9.3 Passoa Liqueurs and Eaux de vie Market Performance (2015-2020) 4.9.4 Passoa Business Overview 4.10 Thorntons 4.10.1 Thorntons Basic Information 4.10.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.10.3 Thorntons Liqueurs and Eaux de vie Market Performance (2015-2020) 4.10.4 Thorntons Business Overview 4.11 Stock Spirits Group 4.11.1 Stock Spirits Group Basic Information 4.11.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.11.3 Stock Spirits Group Liqueurs and Eaux de vie Market Performance (2015-2020) 4.11.4 Stock Spirits Group Business Overview 4.12 Diageo 4.12.1 Diageo Basic Information 4.12.2 Liqueurs and Eaux de vie Product Profiles, Application and Specification 4.12.3 Diageo Liqueurs and Eaux de vie Market Performance (2015-2020) 4.12.4 Diageo Business Overview 5 Global Liqueurs and Eaux de vie Market Analysis by Regions 5.1 Global Liqueurs and Eaux de vie Sales, Revenue and Market Share by Regions 5.1.1 Global Liqueurs and Eaux de vie Sales by Regions (2015-2020) 5.1.2 Global Liqueurs and Eaux de vie Revenue by Regions (2015-2020) 5.2 North America Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 5.3 Europe Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 5.6 South America Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 6 North America Liqueurs and Eaux de vie Market Analysis by Countries 6.1 North America Liqueurs and Eaux de vie Sales, Revenue and Market Share by Countries 6.1.1 North America Liqueurs and Eaux de vie Sales by Countries (2015-2020) 6.1.2 North America Liqueurs and Eaux de vie Revenue by Countries (2015-2020) 6.1.3 North America Liqueurs and Eaux de vie Market Under COVID-19 6.2 United States Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 6.2.1 United States Liqueurs and Eaux de vie Market Under COVID-19 6.3 Canada Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 6.4 Mexico Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 7 Europe Liqueurs and Eaux de vie Market Analysis by Countries 7.1 Europe Liqueurs and Eaux de vie Sales, Revenue and Market Share by Countries 7.1.1 Europe Liqueurs and Eaux de vie Sales by Countries (2015-2020) 7.1.2 Europe Liqueurs and Eaux de vie Revenue by Countries (2015-2020) 7.1.3 Europe Liqueurs and Eaux de vie Market Under COVID-19 7.2 Germany Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 7.2.1 Germany Liqueurs and Eaux de vie Market Under COVID-19 7.3 UK Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 7.3.1 UK Liqueurs and Eaux de vie Market Under COVID-19 7.4 France Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 7.4.1 France Liqueurs and Eaux de vie Market Under COVID-19 7.5 Italy Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 7.5.1 Italy Liqueurs and Eaux de vie Market Under COVID-19 7.6 Spain Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 7.6.1 Spain Liqueurs and Eaux de vie Market Under COVID-19 7.7 Russia Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 7.7.1 Russia Liqueurs and Eaux de vie Market Under COVID-19 8 Asia-Pacific Liqueurs and Eaux de vie Market Analysis by Countries 8.1 Asia-Pacific Liqueurs and Eaux de vie Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Liqueurs and Eaux de vie Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Liqueurs and Eaux de vie Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Liqueurs and Eaux de vie Market Under COVID-19 8.2 China Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 8.2.1 China Liqueurs and Eaux de vie Market Under COVID-19 8.3 Japan Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 8.3.1 Japan Liqueurs and Eaux de vie Market Under COVID-19 8.4 South Korea Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 8.4.1 South Korea Liqueurs and Eaux de vie Market Under COVID-19 8.5 Australia Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 8.6 India Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 8.6.1 India Liqueurs and Eaux de vie Market Under COVID-19 8.7 Southeast Asia Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Liqueurs and Eaux de vie Market Under COVID-19 9 Middle East and Africa Liqueurs and Eaux de vie Market Analysis by Countries 9.1 Middle East and Africa Liqueurs and Eaux de vie Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Liqueurs and Eaux de vie Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Liqueurs and Eaux de vie Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Liqueurs and Eaux de vie Market Under COVID-19 9.2 Saudi Arabia Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 9.3 UAE Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 9.4 Egypt Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 9.5 Nigeria Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 9.6 South Africa Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 10 South America Liqueurs and Eaux de vie Market Analysis by Countries 10.1 South America Liqueurs and Eaux de vie Sales, Revenue and Market Share by Countries 10.1.1 South America Liqueurs and Eaux de vie Sales by Countries (2015-2020) 10.1.2 South America Liqueurs and Eaux de vie Revenue by Countries (2015-2020) 10.1.3 South America Liqueurs and Eaux de vie Market Under COVID-19 10.2 Brazil Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 10.2.1 Brazil Liqueurs and Eaux de vie Market Under COVID-19 10.3 Argentina Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 10.4 Columbia Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 10.5 Chile Liqueurs and Eaux de vie Sales and Growth Rate (2015-2020) 11 Global Liqueurs and Eaux de vie Market Segment by Types 11.1 Global Liqueurs and Eaux de vie Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Liqueurs and Eaux de vie Sales and Market Share by Types (2015-2020) 11.1.2 Global Liqueurs and Eaux de vie Revenue and Market Share by Types (2015-2020) 11.2 Liqueurs Sales and Price (2015-2020) 11.3 Eaux de vie Sales and Price (2015-2020) 12 Global Liqueurs and Eaux de vie Market Segment by Applications 12.1 Global Liqueurs and Eaux de vie Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Liqueurs and Eaux de vie Sales and Market Share by Applications (2015-2020) 12.1.2 Global Liqueurs and Eaux de vie Revenue and Market Share by Applications (2015-2020) 12.2 Surper Market Sales, Revenue and Growth Rate (2015-2020) 12.3 Convenience Stores Sales, Revenue and Growth Rate (2015-2020) 12.4 Retailers Sales, Revenue and Growth Rate (2015-2020) 12.5 On-Line Shopping Sales, Revenue and Growth Rate (2015-2020) 12.6 Other Sales, Revenue and Growth Rate (2015-2020) 13 Liqueurs and Eaux de vie Market Forecast by Regions (2020-2026) 13.1 Global Liqueurs and Eaux de vie Sales, Revenue and Growth Rate (2020-2026) 13.2 Liqueurs and Eaux de vie Market Forecast by Regions (2020-2026) 13.2.1 North America Liqueurs and Eaux de vie Market Forecast (2020-2026) 13.2.2 Europe Liqueurs and Eaux de vie Market Forecast (2020-2026) 13.2.3 Asia-Pacific Liqueurs and Eaux de vie Market Forecast (2020-2026) 13.2.4 Middle East and Africa Liqueurs and Eaux de vie Market Forecast (2020-2026) 13.2.5 South America Liqueurs and Eaux de vie Market Forecast (2020-2026) 13.3 Liqueurs and Eaux de vie Market Forecast by Types (2020-2026) 13.4 Liqueurs and Eaux de vie Market Forecast by Applications (2020-2026) 13.5 Liqueurs and Eaux de vie Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Liqueurs and Eaux de vie

Request Sample

Liqueurs and Eaux de vie