Loudspeaker Market Size, Share, and Trends Analysis Report

CAGR :

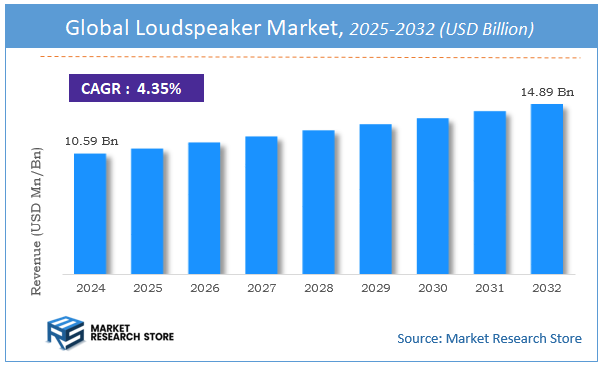

| Market Size 2024 (Base Year) | USD 10.59 Billion |

| Market Size 2032 (Forecast Year) | USD 14.89 Billion |

| CAGR | 4.35% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global loudspeaker market, estimating its value at USD 10.59 Billion in 2024, with projections indicating it will reach USD 14.89 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 4.35% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the loudspeaker industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Loudspeaker Market: Overview

The growth of the loudspeaker market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The loudspeaker market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the loudspeaker market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, Application, End User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global loudspeaker market is estimated to grow annually at a CAGR of around 4.35% over the forecast period (2025-2032).

- In terms of revenue, the global loudspeaker market size was valued at around USD 10.59 Billion in 2024 and is projected to reach USD 14.89 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for high-quality audio systems, increasing adoption in entertainment and public address applications, and rising consumer spending on home audio equipment are fueling the Loudspeaker market.

- Based on the Type, the Satellite Loudspeakers segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Laptop segment is anticipated to command the largest market share.

- In terms of End User, the Household segment is projected to lead the global market.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Loudspeaker Market: Report Scope

This report thoroughly analyzes the loudspeaker market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Loudspeaker Market |

| Market Size in 2024 | USD 10.59 Billion |

| Market Forecast in 2032 | USD 14.89 Billion |

| Growth Rate | CAGR of 4.35% |

| Number of Pages | 203 |

| Key Companies Covered | Bose Corporation, Harman International, Sony Corporation, Yamaha Corporation, Sennheiser electronic SE & Co. KG, Bang & Olufsen, Klipsch Audio Technologies, Masimo. (Bowers & Wilkins), Pioneer Corporation, KEF International |

| Segments Covered | By Type, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Loudspeaker Market: Dynamics

Key Growth Drivers :

The loudspeaker market is being driven by the convergence of several major trends. The proliferation of smart devices and the rise of the smart home ecosystem are significant catalysts, as consumers increasingly seek out voice-controlled smart speakers that act as central hubs for home automation and entertainment. The demand for high-quality audio is another key driver, particularly in the home entertainment and gaming sectors, as consumers upgrade to soundbars, home theater systems, and immersive multi-room audio setups. Furthermore, the automotive industry is a major growth area, with the increasing integration of premium and advanced audio systems in vehicles, particularly in the booming electric vehicle and connected car markets. Finally, the growing global population and rising disposable incomes, especially in developing economies in the Asia-Pacific region, are expanding the consumer base for a wide range of audio products.

Restraints :

Despite these drivers, the loudspeaker market faces several notable restraints. Intense competition and price sensitivity are major challenges, as the market is highly fragmented with numerous players, leading to price wars that can compress profit margins. Furthermore, the loudspeaker industry is subject to supply chain disruptions and component shortages, particularly for critical electronic components like semiconductors, which can lead to production delays and increased costs. The availability of high-quality, more personal audio alternatives, such as headphones and earbuds, poses a significant competitive threat, as these products offer a portable and private listening experience that can substitute for traditional loudspeakers.

Opportunities :

The loudspeaker market is ripe with opportunities for innovation and expansion. The increasing demand for wireless and portable audio solutions, driven by a desire for convenience and mobility, presents a significant opportunity for product development. The integration of advanced technologies like AI, machine learning, and spatial audio in loudspeakers can create new value propositions by offering features such as personalized sound, automatic room calibration, and enhanced user experiences. There is also a growing opportunity in niche markets, such as all-weather outdoor speakers for residential and commercial spaces, as well as specialized professional audio solutions for live events and venues. The push for sustainability also provides an opportunity for manufacturers to develop and market products using eco-friendly materials and production processes.

Challenges :

The market is confronted by a number of complex challenges. The need to balance innovation with affordability is a persistent challenge, as consumers in many markets are price-sensitive but still expect advanced features. The lack of standardized protocols and interoperability between different smart home ecosystems can create a fragmented market and a confusing user experience. Furthermore, the industry must address potential health concerns related to high-decibel exposure and the environmental impact of electronic waste. Finally, the rapidly evolving nature of consumer preferences and the continuous development of new technologies in the broader consumer electronics market require loudspeaker manufacturers to invest heavily in research and development to remain competitive.

Loudspeaker Market: Segmentation Insights

The global loudspeaker market is segmented based on Type, Application, End User, and Region. All the segments of the loudspeaker market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global loudspeaker market is divided into Satellite Loudspeakers, Subwoofer Loudspeakers, Wall-mounted Loudspeakers, Outdoor Loudspeakers, Soundbars, Multimedia Loudspeakers, Other Loudspeaker.

On the basis of Application, the global loudspeaker market is bifurcated into Laptop, Phones, Computer, Tablets, Others.

In terms of End User, the global loudspeaker market is categorized into Household, Commercial, Others.

Loudspeaker Market: Regional Insights

The Asia-Pacific (APAC) region is the dominant force in the global loudspeaker market, accounting for the largest share of both production and consumption. This leadership is overwhelmingly driven by China, which serves as the world's primary manufacturing hub for consumer electronics and audio components.

The region's dominance is fueled by massive production scale, cost-effective supply chains, and a vast domestic market with growing demand for audio products in home entertainment, automotive, and mobile devices. While North America and Europe remain key markets for high-end, premium brands, APAC's unparalleled manufacturing capacity and rapidly expanding consumer base solidify its position as the central pillar of the global loudspeaker industry.

Loudspeaker Market: Competitive Landscape

The loudspeaker market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Loudspeaker Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Bose Corporation

- Harman International

- Sony Corporation

- Yamaha Corporation

- Sennheiser electronic SE & Co. KG

- Bang & Olufsen

- Klipsch Audio Technologies

- Masimo. (Bowers & Wilkins)

- Pioneer Corporation

- KEF International

The Global Loudspeaker Market is Segmented as Follows:

By Type

- Satellite Loudspeakers

- Subwoofer Loudspeakers

- Wall-mounted Loudspeakers

- Outdoor Loudspeakers

- Soundbars

- Multimedia Loudspeakers

- Other Loudspeaker

By Application

- Laptop

- Phones

- Computer

- Tablets

- Others

By End User

- Household

- Commercial

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Global Loudspeaker Industry Market Research Report 1 Loudspeaker Introduction and Market Overview 1.1 Objectives of the Study 1.2 Definition of Loudspeaker 1.3 Loudspeaker Market Scope and Market Size Estimation 1.3.1 Market Concentration Ratio and Market Maturity Analysis 1.3.2 Global Loudspeaker Value ($) and Growth Rate from 2014-2024 1.4 Market Segmentation 1.4.1 Types of Loudspeaker 1.4.2 Applications of Loudspeaker 1.4.3 Research Regions 1.4.3.1 North America Loudspeaker Production Value ($) and Growth Rate (2014-2019) 1.4.3.2 Europe Loudspeaker Production Value ($) and Growth Rate (2014-2019) 1.4.3.3 China Loudspeaker Production Value ($) and Growth Rate (2014-2019) 1.4.3.4 Japan Loudspeaker Production Value ($) and Growth Rate (2014-2019) 1.4.3.5 Middle East & Africa Loudspeaker Production Value ($) and Growth Rate (2014-2019) 1.4.3.6 India Loudspeaker Production Value ($) and Growth Rate (2014-2019) 1.4.3.7 South America Loudspeaker Production Value ($) and Growth Rate (2014-2019) 1.5 Market Dynamics 1.5.1 Drivers 1.5.1.1 Emerging Countries of Loudspeaker 1.5.1.2 Growing Market of Loudspeaker 1.5.2 Limitations 1.5.3 Opportunities 1.6 Industry News and Policies by Regions 1.6.1 Industry News 1.6.2 Industry Policies 2 Industry Chain Analysis 2.1 Upstream Raw Material Suppliers of Loudspeaker Analysis 2.2 Major Players of Loudspeaker 2.2.1 Major Players Manufacturing Base and Market Share of Loudspeaker in 2018 2.2.2 Major Players Product Types in 2018 2.3 Loudspeaker Manufacturing Cost Structure Analysis 2.3.1 Production Process Analysis 2.3.2 Manufacturing Cost Structure of Loudspeaker 2.3.3 Raw Material Cost of Loudspeaker 2.3.4 Labor Cost of Loudspeaker 2.4 Market Channel Analysis of Loudspeaker 2.5 Major Downstream Buyers of Loudspeaker Analysis 3 Global Loudspeaker Market, by Type 3.1 Global Loudspeaker Value ($) and Market Share by Type (2014-2019) 3.2 Global Loudspeaker Production and Market Share by Type (2014-2019) 3.3 Global Loudspeaker Value ($) and Growth Rate by Type (2014-2019) 3.4 Global Loudspeaker Price Analysis by Type (2014-2019) 4 Loudspeaker Market, by Application 4.1 Global Loudspeaker Consumption and Market Share by Application (2014-2019) 4.2 Downstream Buyers by Application 4.3 Global Loudspeaker Consumption and Growth Rate by Application (2014-2019) 5 Global Loudspeaker Production, Value ($) by Region (2014-2019) 5.1 Global Loudspeaker Value ($) and Market Share by Region (2014-2019) 5.2 Global Loudspeaker Production and Market Share by Region (2014-2019) 5.3 Global Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 5.4 North America Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 5.5 Europe Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 5.6 China Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 5.7 Japan Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 5.8 Middle East & Africa Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 5.9 India Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 5.10 South America Loudspeaker Production, Value ($), Price and Gross Margin (2014-2019) 6 Global Loudspeaker Production, Consumption, Export, Import by Regions (2014-2019) 6.1 Global Loudspeaker Consumption by Regions (2014-2019) 6.2 North America Loudspeaker Production, Consumption, Export, Import (2014-2019) 6.3 Europe Loudspeaker Production, Consumption, Export, Import (2014-2019) 6.4 China Loudspeaker Production, Consumption, Export, Import (2014-2019) 6.5 Japan Loudspeaker Production, Consumption, Export, Import (2014-2019) 6.6 Middle East & Africa Loudspeaker Production, Consumption, Export, Import (2014-2019) 6.7 India Loudspeaker Production, Consumption, Export, Import (2014-2019) 6.8 South America Loudspeaker Production, Consumption, Export, Import (2014-2019) 7 Global Loudspeaker Market Status and SWOT Analysis by Regions 7.1 North America Loudspeaker Market Status and SWOT Analysis 7.2 Europe Loudspeaker Market Status and SWOT Analysis 7.3 China Loudspeaker Market Status and SWOT Analysis 7.4 Japan Loudspeaker Market Status and SWOT Analysis 7.5 Middle East & Africa Loudspeaker Market Status and SWOT Analysis 7.6 India Loudspeaker Market Status and SWOT Analysis 7.7 South America Loudspeaker Market Status and SWOT Analysis 8 Competitive Landscape 8.1 Competitive Profile 8.2 Panasonic 8.2.1 Company Profiles 8.2.2 Loudspeaker Product Introduction 8.2.3 Panasonic Production, Value ($), Price, Gross Margin 2014-2019 8.2.4 Panasonic Market Share of Loudspeaker Segmented by Region in 2018 8.3 VOXX international 8.3.1 Company Profiles 8.3.2 Loudspeaker Product Introduction 8.3.3 VOXX international Production, Value ($), Price, Gross Margin 2014-2019 8.3.4 VOXX international Market Share of Loudspeaker Segmented by Region in 2018 8.4 Bowers & Wilkins 8.4.1 Company Profiles 8.4.2 Loudspeaker Product Introduction 8.4.3 Bowers & Wilkins Production, Value ($), Price, Gross Margin 2014-2019 8.4.4 Bowers & Wilkins Market Share of Loudspeaker Segmented by Region in 2018 8.5 Yamaha 8.5.1 Company Profiles 8.5.2 Loudspeaker Product Introduction 8.5.3 Yamaha Production, Value ($), Price, Gross Margin 2014-2019 8.5.4 Yamaha Market Share of Loudspeaker Segmented by Region in 2018 8.6 Atlantic Technology 8.6.1 Company Profiles 8.6.2 Loudspeaker Product Introduction 8.6.3 Atlantic Technology Production, Value ($), Price, Gross Margin 2014-2019 8.6.4 Atlantic Technology Market Share of Loudspeaker Segmented by Region in 2018 8.7 Cambridge SoundWorks 8.7.1 Company Profiles 8.7.2 Loudspeaker Product Introduction 8.7.3 Cambridge SoundWorks Production, Value ($), Price, Gross Margin 2014-2019 8.7.4 Cambridge SoundWorks Market Share of Loudspeaker Segmented by Region in 2018 8.8 Bose 8.8.1 Company Profiles 8.8.2 Loudspeaker Product Introduction 8.8.3 Bose Production, Value ($), Price, Gross Margin 2014-2019 8.8.4 Bose Market Share of Loudspeaker Segmented by Region in 2018 8.9 RCF 8.9.1 Company Profiles 8.9.2 Loudspeaker Product Introduction 8.9.3 RCF Production, Value ($), Price, Gross Margin 2014-2019 8.9.4 RCF Market Share of Loudspeaker Segmented by Region in 2018 8.10 Pioneer 8.10.1 Company Profiles 8.10.2 Loudspeaker Product Introduction 8.10.3 Pioneer Production, Value ($), Price, Gross Margin 2014-2019 8.10.4 Pioneer Market Share of Loudspeaker Segmented by Region in 2018 8.11 DEI Holdings 8.11.1 Company Profiles 8.11.2 Loudspeaker Product Introduction 8.11.3 DEI Holdings Production, Value ($), Price, Gross Margin 2014-2019 8.11.4 DEI Holdings Market Share of Loudspeaker Segmented by Region in 2018 8.12 Logitech 8.12.1 Company Profiles 8.12.2 Loudspeaker Product Introduction 8.12.3 Logitech Production, Value ($), Price, Gross Margin 2014-2019 8.12.4 Logitech Market Share of Loudspeaker Segmented by Region in 2018 8.13 Sennheiser Electronic 8.13.1 Company Profiles 8.13.2 Loudspeaker Product Introduction 8.13.3 Sennheiser Electronic Production, Value ($), Price, Gross Margin 2014-2019 8.13.4 Sennheiser Electronic Market Share of Loudspeaker Segmented by Region in 2018 8.14 Pyle 8.14.1 Company Profiles 8.14.2 Loudspeaker Product Introduction 8.14.3 Pyle Production, Value ($), Price, Gross Margin 2014-2019 8.14.4 Pyle Market Share of Loudspeaker Segmented by Region in 2018 8.15 Shure 8.15.1 Company Profiles 8.15.2 Loudspeaker Product Introduction 8.15.3 Shure Production, Value ($), Price, Gross Margin 2014-2019 8.15.4 Shure Market Share of Loudspeaker Segmented by Region in 2018 8.16 KEF 8.16.1 Company Profiles 8.16.2 Loudspeaker Product Introduction 8.16.3 KEF Production, Value ($), Price, Gross Margin 2014-2019 8.16.4 KEF Market Share of Loudspeaker Segmented by Region in 2018 8.17 HARMAN International 8.18 Koninklijke Philips 8.19 JBL 8.20 Electro-Voice 9 Global Loudspeaker Market Analysis and Forecast by Type and Application 9.1 Global Loudspeaker Market Value ($) & Volume Forecast, by Type (2019-2024) 9.1.1 Satellite/subwoofer Market Value ($) and Volume Forecast (2019-2024) 9.1.2 Subwoofers Market Value ($) and Volume Forecast (2019-2024) 9.1.3 In wall Market Value ($) and Volume Forecast (2019-2024) 9.1.4 Outdoor Market Value ($) and Volume Forecast (2019-2024) 9.1.5 Soundbar Market Value ($) and Volume Forecast (2019-2024) 9.1.6 Multimedia Market Value ($) and Volume Forecast (2019-2024) 9.2 Global Loudspeaker Market Value ($) & Volume Forecast, by Application (2019-2024) 9.2.1 Household Market Value ($) and Volume Forecast (2019-2024) 9.2.2 Commercial Market Value ($) and Volume Forecast (2019-2024) 10 Loudspeaker Market Analysis and Forecast by Region 10.1 North America Market Value ($) and Consumption Forecast (2019-2024) 10.2 Europe Market Value ($) and Consumption Forecast (2019-2024) 10.3 China Market Value ($) and Consumption Forecast (2019-2024) 10.4 Japan Market Value ($) and Consumption Forecast (2019-2024) 10.5 Middle East & Africa Market Value ($) and Consumption Forecast (2019-2024) 10.6 India Market Value ($) and Consumption Forecast (2019-2024) 10.7 South America Market Value ($) and Consumption Forecast (2019-2024) 11 New Project Feasibility Analysis 11.1 Industry Barriers and New Entrants SWOT Analysis 11.2 Analysis and Suggestions on New Project Investment 12 Research Finding and Conclusion 13 Appendix 13.1 Discussion Guide 13.2 Knowledge Store: Maia Subscription Portal 13.3 Research Data Source 13.4 Research Assumptions and Acronyms Used

Inquiry For Buying

Loudspeaker

Request Sample

Loudspeaker