Lower Extremities Market Size, Share, and Trends Analysis Report

CAGR :

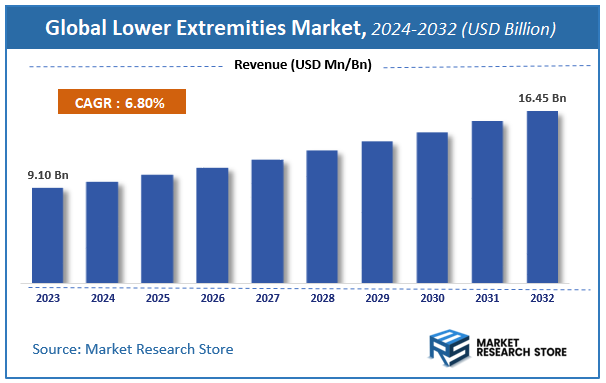

| Market Size 2023 (Base Year) | USD 9.10 Billion |

| Market Size 2032 (Forecast Year) | USD 16.45 Billion |

| CAGR | 6.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Lower Extremities Market Insights

According to Market Research Store, the global lower extremities market size was valued at around USD 9.10 billion in 2023 and is estimated to reach USD 16.45 billion by 2032, to register a CAGR of approximately 6.8% in terms of revenue during the forecast period 2024-2032.

The lower extremities report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Lower Extremities Market: Overview

The lower extremities refer to the lower portion of the human body, encompassing the hip, thigh, knee, leg, ankle, and foot. Structurally, they include major bones such as the femur (thigh bone), tibia and fibula (lower leg bones), and the bones of the foot including the tarsals, metatarsals, and phalanges. These skeletal elements are supported and moved by a complex network of muscles, tendons, ligaments, and joints that allow for mobility, balance, and weight-bearing functions. The lower extremities also contain essential vascular structures like the femoral and popliteal arteries and veins, as well as critical nerve pathways such as the sciatic nerve.

The health and function of the lower extremities are central to daily activities such as walking, running, standing, and maintaining posture. They are commonly affected by musculoskeletal conditions such as osteoarthritis, fractures, ligament injuries, peripheral artery disease, and diabetic foot complications. Proper care, rehabilitation, and ergonomics are essential in managing these issues. In clinical practice, the lower extremities are a major focus in orthopedics, physical therapy, vascular medicine, and rehabilitation disciplines, reflecting their vital role in overall mobility and quality of life.

Key Highlights

- The lower extremities market is anticipated to grow at a CAGR of 6.8% during the forecast period.

- The global lower extremities market was estimated to be worth approximately USD 9.10 billion in 2023 and is projected to reach a value of USD 16.45 billion by 2032.

- The growth of the lower extremities market is being driven by rising incidence of chronic diseases like diabetes and arthritis, both contributing to a greater need for joint replacements, trauma devices, and orthotics.

- Based on the type, the braces and supporting systems segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the hospitals segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Lower Extremities Market: Dynamics

Key Growth Drivers:

- Aging Population: As the global population ages, the prevalence of age-related degenerative conditions like osteoarthritis, which frequently affects the hip and knee, increases significantly, driving demand for joint replacement surgeries and related devices.

- Rising Incidence of Orthopedic Disorders: Conditions such as osteoporosis, rheumatoid arthritis, and bone fractures are becoming more common due to lifestyle factors and increased awareness, leading to a greater need for lower extremity interventions.

- Increasing Sports-Related Injuries and Trauma Cases: A more active population and higher participation in sports, along with a rise in road accidents, contribute to a greater number of lower extremity injuries requiring surgical and non-surgical treatments.

- Technological Advancements in Medical Devices: Continuous innovation in implant materials (e.g., biocompatible metals, ceramics, polymers), implant designs (e.g., personalized implants using 3D printing), surgical techniques (e.g., minimally invasive surgery, robotic-assisted surgery), and the development of smart implants are enhancing treatment outcomes and driving adoption.

- Growing Demand for Minimally Invasive Surgical Procedures: Patients and healthcare providers increasingly prefer minimally invasive surgeries due to their benefits, including shorter recovery times, reduced pain, and lower complication risks, fueling the development and adoption of compatible devices.

- Expanding Healthcare Infrastructure and Access to Care: Improvements in healthcare infrastructure and increased access to advanced medical treatments in developing economies are opening up new patient pools and driving market growth.

- Increasing Awareness of Available Treatment Options: Greater awareness among patients and healthcare professionals about the benefits of early intervention and advanced treatment options for lower extremity conditions is leading to increased demand.

Restraints:

- High Cost of Advanced Devices and Procedures: Cutting-edge implants, prosthetics, and surgical procedures can be very expensive, limiting accessibility, especially in cost-sensitive markets and for patients without adequate insurance coverage.

- Reimbursement Challenges: Inconsistent or insufficient reimbursement policies for certain devices or procedures can deter adoption, particularly for newer, more expensive technologies.

- Risk of Implant Complications and Revision Surgeries: The potential for implant failure, infection, or other complications necessitating revision surgeries can be a concern for patients and healthcare providers.

- Stringent Regulatory Approval Processes: The lengthy and complex regulatory pathways for new medical devices can delay market entry and increase development costs.

- Shortage of Skilled Healthcare Professionals: A lack of adequately trained orthopedic surgeons, prosthetists, orthotists, and rehabilitation specialists can hinder the widespread adoption and effective utilization of advanced lower extremity devices.

Opportunities

- Growth in Emerging Markets (e.g., India): Countries like India, with their large and aging populations, increasing disposable incomes, and improving healthcare infrastructure, represent significant untapped potential for lower extremity devices, particularly for cost-effective and functional solutions.

- Personalized Medicine and Patient-Specific Solutions: The trend towards personalized healthcare offers opportunities for customized implants, prosthetics, and orthotics tailored to individual patient anatomy and needs.

- Focus on Regenerative Medicine and Biologics: Research into biologics, stem cell therapies, and other regenerative approaches for cartilage repair and bone healing can complement or reduce the need for traditional implants, creating new market segments.

- Expansion of Tele-Rehabilitation and Digital Health: Leveraging telemedicine and digital platforms for pre-operative consultations, post-operative monitoring, and rehabilitation support can improve patient outcomes and expand market reach.

- Development of Smart Orthotics and Wearable Devices: Beyond prosthetics, the integration of smart technology into orthotic devices for conditions like foot drop or gait analysis offers significant growth potential.

- Medical Tourism: Countries like India with developing healthcare infrastructure and competitive costs can attract medical tourism for lower extremity surgeries, further boosting market demand.

Challenges

- Intense Competition and Price Pressure: The market is highly competitive with numerous global and regional players, leading to significant price pressure and demands for cost-effectiveness.

- Managing Supply Chain and Logistics: Ensuring efficient production, distribution, and timely delivery of specialized medical devices, especially across diverse geographical regions, can be complex.

- Technological Obsolescence: The rapid pace of technological innovation means that existing products can quickly become obsolete, requiring continuous R&D investment from manufacturers.

- Ethical Considerations and Accessibility: Ensuring ethical use of advanced technologies and making life-improving devices accessible to all who need them, regardless of socioeconomic status, remains a global challenge.

- Awareness and Acceptance in Rural Areas (India Specific): In many rural parts of India, awareness about advanced lower extremity treatments and the availability of specialized devices might be low, and traditional methods or limited access to care remain prevalent.

- Post-Surgical Rehabilitation Adherence: Ensuring patient adherence to often lengthy and challenging rehabilitation protocols is crucial for the successful outcome of lower extremity interventions.

Lower Extremities Market: Report Scope

This report thoroughly analyzes the Lower Extremities Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Lower Extremities Market |

| Market Size in 2023 | USD 9.10 Billion |

| Market Forecast in 2032 | USD 16.45 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 195 |

| Key Companies Covered | DePuy Synthes, Stryker, Zimmer Biomet, Acumed, Biotech Limb and Brace, DJO Global, Evolutis, Integra LifeSciences, OsteoMed, Sigma Graft, Skye Biologics, Smith & Nephew, Wright Medical Group, Xtant Medical, CONMED, Skeletal Dynamics |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lower Extremities Market: Segmentation Insights

The global lower extremities market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global lower extremities market is divided into braces and supporting systems, accessories, and orthobiologics.

Braces and Supporting Systems represent the largest and most dominant segment in the lower extremities market. These devices are widely used to support and stabilize joints such as the knee, ankle, and hip in patients recovering from injuries, surgeries, or managing chronic conditions like osteoarthritis and ligament tears. The increasing prevalence of sports injuries, rising aging population, and growing demand for non-invasive support solutions have significantly driven the adoption of these products. Their design evolution—ranging from rigid orthoses to dynamic braces with advanced materials—continues to make them essential tools in orthopedic care and rehabilitation settings.

Accessories include a range of supplemental products used in conjunction with braces, orthotic systems, or standalone therapies. These may consist of padding, straps, liners, or adjustment tools that enhance patient comfort, improve the fit of orthopedic devices, and prolong product usability. While this segment is relatively smaller in terms of revenue, it plays a supportive role in ensuring the effectiveness of primary orthopedic solutions. Demand for accessories grows in parallel with the use of braces and other supportive equipment, particularly in post-operative and long-term therapeutic use.

Orthobiologics comprise biologically derived materials such as bone grafts, platelet-rich plasma (PRP), and stem cell-based products used to accelerate healing of bones, ligaments, and tendons in the lower extremities. These treatments are gaining momentum in surgical procedures and regenerative medicine due to their ability to enhance natural healing processes. Although orthobiologics currently represent a niche segment, technological advancements and clinical evidence supporting their efficacy are expanding their adoption, particularly in sports medicine and complex trauma recovery.

Segmentation Insights by Application

On the basis of application, the global lower extremities market is bifurcated into hospitals, ASCS, and clinics.

Hospitals hold the dominant share in the lower extremities market due to their comprehensive infrastructure, specialized orthopedic departments, and ability to handle complex surgical procedures such as joint reconstructions, fracture repair, and trauma interventions. Hospitals serve as primary centers for both acute care and elective surgeries involving lower extremity injuries or degenerative conditions. The availability of advanced diagnostic tools, multidisciplinary expertise, and post-operative rehabilitation services in hospital settings makes them the preferred choice for patients undergoing treatment for lower limb disorders. Additionally, increasing hospital admissions related to sports injuries and age-related orthopedic conditions continue to fuel this segment’s dominance.

Ambulatory Surgical Centers (ASCs) are emerging as a rapidly growing segment within the lower extremities market. These centers offer minimally invasive surgeries and outpatient orthopedic procedures, particularly those involving joint repairs, arthroscopies, and soft tissue corrections. ASCs are preferred for their cost-effectiveness, shorter recovery times, and reduced risk of hospital-acquired infections. As healthcare systems shift toward value-based care and same-day surgical interventions become more prevalent, ASCs are expected to capture a larger portion of lower extremity treatment volumes, especially for routine and elective procedures.

Clinics serve as the first point of contact for patients with lower extremity conditions, offering non-surgical treatments such as bracing, physiotherapy, pain management, and follow-up consultations. Orthopedic and rehabilitation clinics play a key role in managing chronic musculoskeletal conditions and providing long-term care for patients recovering from surgeries. Though smaller in scale compared to hospitals and ASCs, clinics are critical in preventive care and early intervention, which are essential in minimizing the progression of lower extremity disorders and reducing the need for surgical treatments.

Lower Extremities Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Lower Extremities Market due to its advanced healthcare infrastructure, high patient awareness, and strong presence of leading orthopedic device manufacturers. The United States leads regional growth, driven by a growing geriatric population, a high prevalence of osteoporosis and diabetes-related foot complications, and an increase in sports-related injuries. Additionally, favorable reimbursement policies, widespread adoption of minimally invasive surgical procedures, and the availability of cutting-edge technologies in joint reconstruction, trauma fixation, and biologics contribute to North America’s leading market position.

Europe holds a significant share of the market, supported by aging demographics and increasing cases of orthopedic conditions such as arthritis, fractures, and vascular disorders affecting the lower limbs. Countries like Germany, the UK, and France have well-established orthopedic care systems and are investing in advanced surgical tools and implants for foot, ankle, and hip treatments. The region also benefits from government-funded healthcare systems that support elective procedures, including lower extremity reconstruction and trauma surgeries, enhancing the demand for advanced orthopedic implants and biologics.

Asia-Pacific is the fastest-growing region in the Lower Extremities Market, owing to its expanding healthcare infrastructure, growing middle-class population, and rising healthcare expenditure in countries such as China, India, Japan, and South Korea. Increased awareness about orthopedic health, coupled with a rising incidence of road traffic accidents and age-related musculoskeletal disorders, drives demand for trauma fixation devices and reconstructive implants. Japan, with its rapidly aging population, and China, with its large diabetic patient base, are significant contributors to regional growth. Local manufacturing and government initiatives to improve surgical outcomes also support market expansion.

Latin America shows emerging growth potential in the Lower Extremities Market, particularly in Brazil, Mexico, and Argentina, where increasing urbanization and lifestyle changes have led to a rise in orthopedic issues. The region is seeing a growing number of elective surgeries for lower limb conditions, supported by improved access to healthcare and expanding private sector investment. However, economic instability and disparities in healthcare infrastructure continue to limit broader market penetration.

Middle East and Africa represent developing markets for lower extremities devices, with growth led by the UAE, Saudi Arabia, and South Africa. Rising investments in healthcare infrastructure, medical tourism, and growing awareness of orthopedic conditions are gradually increasing demand for surgical interventions related to the lower limbs. However, high costs, limited access to advanced care in rural areas, and a lack of skilled orthopedic surgeons in certain regions pose challenges to sustained market growth. Nonetheless, the introduction of specialized orthopedic centers and partnerships with international medical device companies are helping to bridge these gaps.

Lower Extremities Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the lower extremities market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global lower extremities market include:

- DePuy Synthes

- Stryker

- Zimmer Biomet

- Acumed

- Biotech Limb and Brace

- DJO Global

- Evolutis

- Integra LifeSciences

- OsteoMed

- Sigma Graft

- Skye Biologics

- Smith & Nephew

- Wright Medical Group

- Xtant Medical

- CONMED

- Skeletal Dynamics

The global lower extremities market is segmented as follows:

By Type

- Braces and Supporting Systems

- Accessories

- Orthobiologics

By Application

- Hospitals

- ASCs

- Clinics

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Lower Extremities Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Lower Extremities Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Lower Extremities Overall Market Size 2.1 Global Lower Extremities Market Size: 2021 VS 2028 2.2 Global Lower Extremities Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Lower Extremities Sales: 2017-2028 3 Company Landscape 3.1 Top Lower Extremities Players in Global Market 3.2 Top Global Lower Extremities Companies Ranked by Revenue 3.3 Global Lower Extremities Revenue by Companies 3.4 Global Lower Extremities Sales by Companies 3.5 Global Lower Extremities Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Lower Extremities Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Lower Extremities Product Type 3.8 Tier 1, Tier 2 and Tier 3 Lower Extremities Players in Global Market 3.8.1 List of Global Tier 1 Lower Extremities Companies 3.8.2 List of Global Tier 2 and Tier 3 Lower Extremities Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Lower Extremities Market Size Markets, 2021 & 2028 4.1.2 Metallic 4.1.3 Polymeric 4.1.4 Ceramic 4.1.5 Natural 4.2 By Type - Global Lower Extremities Revenue & Forecasts 4.2.1 By Type - Global Lower Extremities Revenue, 2017-2022 4.2.2 By Type - Global Lower Extremities Revenue, 2023-2028 4.2.3 By Type - Global Lower Extremities Revenue Market Share, 2017-2028 4.3 By Type - Global Lower Extremities Sales & Forecasts 4.3.1 By Type - Global Lower Extremities Sales, 2017-2022 4.3.2 By Type - Global Lower Extremities Sales, 2023-2028 4.3.3 By Type - Global Lower Extremities Sales Market Share, 2017-2028 4.4 By Type - Global Lower Extremities Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Lower Extremities Market Size, 2021 & 2028 5.1.2 Hospital 5.1.3 NSC 5.2 By Application - Global Lower Extremities Revenue & Forecasts 5.2.1 By Application - Global Lower Extremities Revenue, 2017-2022 5.2.2 By Application - Global Lower Extremities Revenue, 2023-2028 5.2.3 By Application - Global Lower Extremities Revenue Market Share, 2017-2028 5.3 By Application - Global Lower Extremities Sales & Forecasts 5.3.1 By Application - Global Lower Extremities Sales, 2017-2022 5.3.2 By Application - Global Lower Extremities Sales, 2023-2028 5.3.3 By Application - Global Lower Extremities Sales Market Share, 2017-2028 5.4 By Application - Global Lower Extremities Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Lower Extremities Market Size, 2021 & 2028 6.2 By Region - Global Lower Extremities Revenue & Forecasts 6.2.1 By Region - Global Lower Extremities Revenue, 2017-2022 6.2.2 By Region - Global Lower Extremities Revenue, 2023-2028 6.2.3 By Region - Global Lower Extremities Revenue Market Share, 2017-2028 6.3 By Region - Global Lower Extremities Sales & Forecasts 6.3.1 By Region - Global Lower Extremities Sales, 2017-2022 6.3.2 By Region - Global Lower Extremities Sales, 2023-2028 6.3.3 By Region - Global Lower Extremities Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Lower Extremities Revenue, 2017-2028 6.4.2 By Country - North America Lower Extremities Sales, 2017-2028 6.4.3 US Lower Extremities Market Size, 2017-2028 6.4.4 Canada Lower Extremities Market Size, 2017-2028 6.4.5 Mexico Lower Extremities Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Lower Extremities Revenue, 2017-2028 6.5.2 By Country - Europe Lower Extremities Sales, 2017-2028 6.5.3 Germany Lower Extremities Market Size, 2017-2028 6.5.4 France Lower Extremities Market Size, 2017-2028 6.5.5 U.K. Lower Extremities Market Size, 2017-2028 6.5.6 Italy Lower Extremities Market Size, 2017-2028 6.5.7 Russia Lower Extremities Market Size, 2017-2028 6.5.8 Nordic Countries Lower Extremities Market Size, 2017-2028 6.5.9 Benelux Lower Extremities Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Lower Extremities Revenue, 2017-2028 6.6.2 By Region - Asia Lower Extremities Sales, 2017-2028 6.6.3 China Lower Extremities Market Size, 2017-2028 6.6.4 Japan Lower Extremities Market Size, 2017-2028 6.6.5 South Korea Lower Extremities Market Size, 2017-2028 6.6.6 Southeast Asia Lower Extremities Market Size, 2017-2028 6.6.7 India Lower Extremities Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Lower Extremities Revenue, 2017-2028 6.7.2 By Country - South America Lower Extremities Sales, 2017-2028 6.7.3 Brazil Lower Extremities Market Size, 2017-2028 6.7.4 Argentina Lower Extremities Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Lower Extremities Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Lower Extremities Sales, 2017-2028 6.8.3 Turkey Lower Extremities Market Size, 2017-2028 6.8.4 Israel Lower Extremities Market Size, 2017-2028 6.8.5 Saudi Arabia Lower Extremities Market Size, 2017-2028 6.8.6 UAE Lower Extremities Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 DePuy Synthes 7.1.1 DePuy Synthes Corporate Summary 7.1.2 DePuy Synthes Business Overview 7.1.3 DePuy Synthes Lower Extremities Major Product Offerings 7.1.4 DePuy Synthes Lower Extremities Sales and Revenue in Global (2017-2022) 7.1.5 DePuy Synthes Key News 7.2 Smith & Nephew 7.2.1 Smith & Nephew Corporate Summary 7.2.2 Smith & Nephew Business Overview 7.2.3 Smith & Nephew Lower Extremities Major Product Offerings 7.2.4 Smith & Nephew Lower Extremities Sales and Revenue in Global (2017-2022) 7.2.5 Smith & Nephew Key News 7.3 Stryker 7.3.1 Stryker Corporate Summary 7.3.2 Stryker Business Overview 7.3.3 Stryker Lower Extremities Major Product Offerings 7.3.4 Stryker Lower Extremities Sales and Revenue in Global (2017-2022) 7.3.5 Stryker Key News 7.4 Integra Lifesciences Holdings 7.4.1 Integra Lifesciences Holdings Corporate Summary 7.4.2 Integra Lifesciences Holdings Business Overview 7.4.3 Integra Lifesciences Holdings Lower Extremities Major Product Offerings 7.4.4 Integra Lifesciences Holdings Lower Extremities Sales and Revenue in Global (2017-2022) 7.4.5 Integra Lifesciences Holdings Key News 7.5 Zimmer Biomet Holdings 7.5.1 Zimmer Biomet Holdings Corporate Summary 7.5.2 Zimmer Biomet Holdings Business Overview 7.5.3 Zimmer Biomet Holdings Lower Extremities Major Product Offerings 7.5.4 Zimmer Biomet Holdings Lower Extremities Sales and Revenue in Global (2017-2022) 7.5.5 Zimmer Biomet Holdings Key News 7.6 Wright Medical 7.6.1 Wright Medical Corporate Summary 7.6.2 Wright Medical Business Overview 7.6.3 Wright Medical Lower Extremities Major Product Offerings 7.6.4 Wright Medical Lower Extremities Sales and Revenue in Global (2017-2022) 7.6.5 Wright Medical Key News 7.7 CONMED 7.7.1 CONMED Corporate Summary 7.7.2 CONMED Business Overview 7.7.3 CONMED Lower Extremities Major Product Offerings 7.7.4 CONMED Lower Extremities Sales and Revenue in Global (2017-2022) 7.7.5 CONMED Key News 7.8 Acumed 7.8.1 Acumed Corporate Summary 7.8.2 Acumed Business Overview 7.8.3 Acumed Lower Extremities Major Product Offerings 7.8.4 Acumed Lower Extremities Sales and Revenue in Global (2017-2022) 7.8.5 Acumed Key News 7.9 Skeletal Dynamics 7.9.1 Skeletal Dynamics Corporate Summary 7.9.2 Skeletal Dynamics Business Overview 7.9.3 Skeletal Dynamics Lower Extremities Major Product Offerings 7.9.4 Skeletal Dynamics Lower Extremities Sales and Revenue in Global (2017-2022) 7.9.5 Skeletal Dynamics Key News 8 Global Lower Extremities Production Capacity, Analysis 8.1 Global Lower Extremities Production Capacity, 2017-2028 8.2 Lower Extremities Production Capacity of Key Manufacturers in Global Market 8.3 Global Lower Extremities Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Lower Extremities Supply Chain Analysis 10.1 Lower Extremities Industry Value Chain 10.2 Lower Extremities Upstream Market 10.3 Lower Extremities Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Lower Extremities Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Lower Extremities

Request Sample

Lower Extremities