Lubricants Packaging Market Size, Share, and Trends Analysis Report

CAGR :

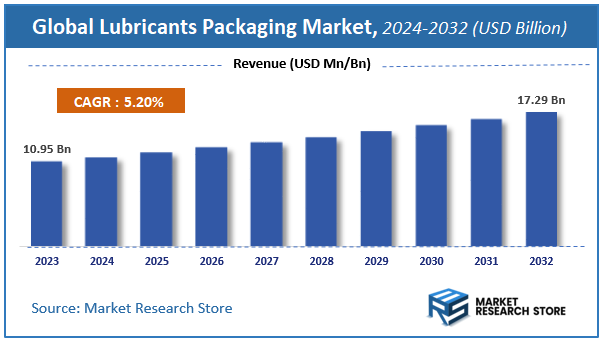

| Market Size 2023 (Base Year) | USD 10.95 Billion |

| Market Size 2032 (Forecast Year) | USD 17.29 Billion |

| CAGR | 5.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Lubricants Packaging Market Insights

According to Market Research Store, the global lubricants packaging market size was valued at around USD 10.95 billion in 2023 and is estimated to reach USD 17.29 billion by 2032, to register a CAGR of approximately 5.2% in terms of revenue during the forecast period 2024-2032.

The lubricants packaging report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Lubricants Packaging Market: Overview

Lubricants packaging refers to the various containers and packaging materials used to store and distribute lubricants, including oils, greases, and other lubricating products. The packaging serves multiple purposes: it ensures the product’s safety during transport, prevents contamination, extends shelf life, and provides important information such as product details, usage instructions, and branding. Lubricants packaging typically comes in different forms, including drums, barrels, bottles, pails, and sachets, depending on the type of lubricant, its volume, and the target market.

The lubricants packaging market is growing due to the increasing demand for lubricants across various industries such as automotive, industrial machinery, and consumer goods. The rise of electric vehicles, advancements in automotive technology, and greater awareness of the importance of high-quality lubricants for performance and longevity are all contributing factors. Additionally, the growth of the e-commerce sector and the need for small-volume lubricants packaged for retail sales have influenced packaging innovations. Manufacturers are focusing on enhancing the convenience, safety, and sustainability of packaging while also offering customized solutions to meet the unique needs of their customers.

Key Highlights

- The lubricants packaging market is anticipated to grow at a CAGR of 5.2% during the forecast period.

- The global lubricants packaging market was estimated to be worth approximately USD 10.95 billion in 2023 and is projected to reach a value of USD 17.29 billion by 2032.

- The growth of the lubricants packaging market is being driven by the increasing prevalence of shoulder injuries, the rising geriatric population susceptible to osteoarthritis and fractures, and advancements in orthopedic implant technology.

- Based on the material, the metal segment is growing at a high rate and is projected to dominate the market.

- On the basis of packaging type, the stand-up pouch segment is projected to swipe the largest market share.

- In terms of lubricant, the engine oil segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Lubricants Packaging Market: Dynamics

Key Growth Drivers:

- Growing Consumption of Lubricants in Automotive and Industrial Sectors: The increasing number of vehicles on the road and the expansion of industrial activities globally directly drive the demand for lubricants, consequently increasing the need for lubricant packaging solutions.

- Demand for Convenient and User-Friendly Packaging: Consumers and industrial users are increasingly seeking lubricant packaging that is easy to handle, pour, store, and dispose of. Features like spouts, ergonomic designs, and resealable closures drive the adoption of such packaging.

- Focus on Product Protection and Shelf Life: Lubricants need to be protected from contamination, moisture, and UV radiation to maintain their quality and extend their shelf life. High-performance packaging solutions that offer these protective properties are in demand.

- Stringent Regulations Regarding Lubricant Storage and Transportation: Regulations aimed at preventing leaks, spills, and environmental contamination during the storage and transportation of lubricants necessitate the use of robust and compliant packaging.

- Increasing Use of Synthetic and High-Performance Lubricants: These advanced lubricants often require specialized packaging materials that can maintain their integrity and prevent degradation, driving demand for high-quality containers.

- Growth of E-commerce for Automotive Aftermarket Products: The rising trend of purchasing automotive lubricants and related products online necessitates durable and leak-proof packaging that can withstand the rigors of shipping.

Restraints:

- Environmental Concerns Regarding Plastic Packaging: Traditional plastic lubricant containers raise environmental concerns regarding disposal and recyclability, leading to pressure for more sustainable packaging alternatives.

- Stringent Regulations on Packaging Materials and Waste Disposal: Regulations related to the use of specific plastics, labeling requirements, and waste management can increase the cost and complexity of lubricant packaging.

- Price Sensitivity in Certain Lubricant Categories: For some standard lubricant products, particularly in price-sensitive markets, there can be pressure to minimize packaging costs.

- Competition from Bulk Packaging and Dispensing Systems: Industrial users may opt for bulk packaging and dispensing systems for larger volumes of lubricants, potentially reducing the demand for smaller individual containers.

- Compatibility Issues Between Lubricants and Packaging Materials: Certain aggressive lubricants can react with or degrade some packaging materials, limiting the choice of suitable containers.

- Logistical Challenges and Storage Requirements for Packaging Materials: Storing and handling different types of lubricant packaging materials can present logistical challenges for manufacturers.

Opportunities:

- Development of Sustainable and Recyclable Packaging Solutions: There is a significant opportunity for innovative packaging made from recycled plastics, bioplastics, or other sustainable materials that reduce environmental impact.

- Introduction of Smart and Connected Packaging: Integrating technologies like sensors, RFID tags, or QR codes into lubricant packaging can enable tracking, authentication, and provide information to consumers.

- Design Innovations for Enhanced Functionality and User Experience: Developing packaging with improved pouring spouts, anti-glug features, integrated funnels, and easy-grip handles can enhance user convenience.

- Development of Packaging Solutions for Specific Lubricant Types: Tailoring packaging materials and designs to the unique requirements of different lubricant categories (e.g., high-temperature greases, synthetic oils) can offer added value.

- Focus on Lightweighting and Material Optimization: Reducing the weight of lubricant packaging while maintaining its integrity can lower material costs and transportation emissions.

- Adoption of Advanced Barrier Materials: Utilizing advanced barrier polymers and coatings can enhance product protection and extend shelf life, especially for sensitive lubricants.

Challenges:

- Balancing Cost-Effectiveness with Sustainability: Developing sustainable packaging solutions that are also cost-competitive with traditional plastics is a key challenge.

- Ensuring Compatibility of New Materials with Diverse Lubricant Formulations: Thorough testing is required to ensure that new packaging materials do not react with or degrade when in contact with various lubricant formulations.

- Meeting Stringent Performance Requirements for Industrial Applications: Packaging for industrial lubricants often needs to withstand harsh environments, extreme temperatures, and rough handling.

- Educating Consumers and End-Users on Sustainable Packaging Options: Raising awareness and encouraging the adoption of more sustainable lubricant packaging choices among consumers and industrial users is crucial.

- Standardization of Recycling Infrastructure for Lubricant Packaging: Developing effective and widespread recycling infrastructure for the diverse types of plastics used in lubricant packaging is a significant challenge.

- Adapting to Evolving Regulations and Compliance Requirements: Packaging manufacturers need to stay informed about and comply with changing regulations related to materials, labeling, and environmental standards.

Lubricants Packaging Market: Report Scope

This report thoroughly analyzes the Lubricants Packaging Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Lubricants Packaging Market |

| Market Size in 2023 | USD 10.95 Billion |

| Market Forecast in 2032 | USD 17.29 Billion |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 167 |

| Key Companies Covered | Mold Tek Packaging Ltd., Balmer Lawrie & Co. Ltd., Glenroy Inc., Time Technoplast Ltd., Grief Inc., CYL Corporation Berhad, Duplas Al Sharq LLC, Scholle IPN, Mauser Group B.V., Martin Operating Partnership L.P. |

| Segments Covered | By Material, By Packaging Type, By Lubricant, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lubricants Packaging Market: Segmentation Insights

The global lubricants packaging market is divided by material, packaging type, lubricant, and region.

Segmentation Insights by Material

Based on material, the global lubricants packaging market is divided into metal and plastic.

Metal packaging dominates the Lubricants Packaging Market due to its durability, strength, and ability to protect the contents from external elements such as moisture, heat, and contaminants. Metal containers, such as steel and aluminum, are commonly used for packaging lubricants because they provide excellent sealing properties, ensuring the product remains intact and effective for longer periods. These materials are also resistant to corrosion, which is critical for maintaining the quality of lubricants, especially when stored for extended periods. Furthermore, metal packaging is highly recyclable, which appeals to environmentally conscious consumers and manufacturers, further driving its dominance in the market.

Plastic packaging is also a significant segment in the Lubricants Packaging Market, primarily due to its lightweight, cost-effectiveness, and flexibility in design. Plastic containers, often made from high-density polyethylene (HDPE) or polyethylene terephthalate (PET), are commonly used for lubricants, particularly in smaller or consumer-grade packaging. The versatility of plastic packaging allows for various shapes and sizes, providing manufacturers with a range of options to cater to different customer needs. Additionally, plastic packaging offers benefits such as ease of handling, lower transportation costs, and the potential for resealable packaging. However, compared to metal, plastic may offer slightly less protection against external factors, though advancements in packaging technologies have helped improve its performance.

Segmentation Insights by Packaging Type

On the basis of packaging type, the global lubricants packaging market is bifurcated into stand up pouch, bottle, drum, and intermediate bulk container.

Stand Up Pouch packaging dominates the Lubricants Packaging Market, particularly for smaller volumes or consumer-sized products. The stand-up pouch offers several advantages, including its space-saving design, which allows for efficient storage and transport. It is also lightweight, which reduces shipping costs, and can be equipped with a resealable zipper for convenience and reusability. Stand-up pouches are often preferred for lubricants due to their flexibility, lower cost compared to rigid containers, and ability to be customized in terms of shape, size, and branding. The growing demand for environmentally friendly packaging solutions further supports the rise of stand-up pouches, as many pouches are made from recyclable materials.

Bottle packaging is another widely used form for lubricants, particularly for retail and consumer markets. Bottles, especially those made of plastic or metal, are popular for packaging smaller lubricant quantities used in automotive, industrial, or household applications. Bottles provide a convenient, easy-to-handle design and are often used in automotive lubricant products, such as motor oils and transmission fluids. Additionally, bottles offer good sealing and protection against contamination, ensuring the quality of the lubricant remains intact during storage and use.

Drum packaging is commonly used for larger quantities of lubricants, often in the industrial or commercial sectors. Drums, typically made of steel or plastic, are ideal for bulk storage and transportation of lubricants. They are highly durable and provide a secure method of packaging for larger volumes, reducing the need for multiple smaller containers. Drums are widely used in manufacturing plants, warehouses, and for industrial applications where large amounts of lubricants are required for machinery maintenance.

Intermediate Bulk Container (IBC) packaging is used for bulk lubricant storage and transportation, typically for large-scale industrial operations. IBCs are larger than drums and offer greater storage capacity, making them ideal for situations where large quantities of lubricants need to be moved or stored efficiently. These containers are designed for easy handling and can be stacked, which maximizes storage space and simplifies transportation. IBCs are widely used in industries where lubricants are used in large-scale operations, including manufacturing, automotive, and heavy equipment sectors.

Segmentation Insights by Lubricant

On the basis of lubricant, the global lubricants packaging market is bifurcated into engine oil and transmission & hydraulic fluid.

Engine Oil dominates the Lubricants Packaging Market due to its widespread use in automotive and industrial applications. Engine oil is essential for the smooth operation of internal combustion engines, and the demand for this lubricant type is driven by the large global automotive fleet and the increasing number of vehicles on the road. Engine oil is critical for reducing friction, preventing corrosion, and maintaining engine performance, which makes it one of the most commonly packaged lubricants. The demand for engine oil is further fueled by regular maintenance schedules for vehicles and the need for high-quality oils that can improve engine efficiency and reduce wear and tear. This segment remains the largest and most critical part of the lubricants packaging industry, with manufacturers offering various grades and formulations to meet the needs of different engine types, driving the volume of engine oil packaging.

Transmission & Hydraulic Fluid is also a significant segment in the Lubricants Packaging Market, particularly in industrial, automotive, and machinery applications. Transmission fluid is crucial for the proper functioning of manual and automatic transmissions in vehicles, while hydraulic fluids are used in machinery to transfer power and lubricate moving parts. The demand for these fluids is influenced by the expansion of the automotive, construction, and manufacturing sectors, where vehicles, machinery, and heavy equipment rely on high-quality transmission and hydraulic fluids for smooth operation. This segment sees steady demand as maintenance of transmission systems and hydraulic machinery is essential to ensure optimal performance and avoid costly repairs. Transmission and hydraulic fluids are often packaged in larger volumes due to their use in industrial settings, contributing to a substantial share of the lubricants packaging market.

Lubricants Packaging Market: Regional Insights

- North America is expected to dominate the global market.

North America dominates the Lubricants Packaging Market, driven by the presence of major lubricant manufacturers and the growing demand for high-quality packaging solutions in the United States and Canada. The U.S. is the largest market, where there is a significant need for packaging solutions that offer durability, ease of transport, and product safety. The growing automotive, industrial, and manufacturing sectors contribute to the increasing demand for lubricants, thus boosting the packaging market. Furthermore, the adoption of advanced packaging materials that are eco-friendly and sustainable is gaining momentum in this region due to regulatory pressures and consumer demand for environmentally responsible products. Canada follows closely, with an increasing focus on the oil and gas industry, where high-quality lubricants are essential for machinery maintenance. The strong regulatory standards in both countries, focusing on reducing environmental impact, are also encouraging the use of more sustainable packaging options.

Europe holds a significant share in the Lubricants Packaging Market, with countries like Germany, France, the United Kingdom, and Italy driving demand. The region’s well-established automotive and industrial sectors are the key drivers, as lubricants are heavily used in automotive, machinery, and manufacturing industries. Germany, known for its strong automotive industry, is one of the largest consumers of lubricants, and as a result, there is a high demand for innovative packaging solutions. The growth of the electric vehicle (EV) sector and advancements in automotive technologies are further influencing the demand for specialized lubricant products, thus boosting the packaging market. The United Kingdom and France also contribute significantly, with a focus on environmentally friendly packaging solutions due to stringent regulations and growing consumer preferences for sustainable products. The European Union's emphasis on reducing plastic waste and carbon footprints is pushing manufacturers to adopt recyclable, biodegradable, and reusable packaging options.

Asia-Pacific region is witnessing rapid growth in the Lubricants Packaging Market, driven by the increasing industrialization, automotive sector growth, and rising demand for lubricants in countries like China, India, Japan, and South Korea. China is the largest market in the region due to its booming manufacturing, automotive, and construction industries, all of which require significant volumes of lubricants. The growth of the country's heavy machinery and automotive sectors is directly impacting the demand for lubricants and their packaging. India is also a growing market, with the automotive industry expanding rapidly, leading to an increase in lubricant demand and, consequently, packaging solutions. Japan and South Korea are key players in the automotive industry, where high-performance lubricants are essential, driving demand for premium packaging solutions. The Asia-Pacific market is also experiencing a shift toward eco-friendly packaging, driven by increasing environmental awareness and government regulations aimed at reducing plastic usage.

Latin America is seeing gradual growth in the Lubricants Packaging Market, with countries like Brazil, Mexico, and Argentina emerging as key players. The increasing automotive production and industrial activities in these countries are driving the demand for lubricants, which in turn is boosting the need for effective packaging solutions. Brazil, with its large automotive and manufacturing sectors, leads the market in Latin America. The country’s growing infrastructure and automotive industries are essential drivers for lubricants and packaging solutions. Mexico is another key market, especially with its expanding automotive production and the increasing import of lubricants. In Argentina, the growing oil and gas sector and its expanding manufacturing industry are contributing to the demand for lubricants and their packaging. Despite economic challenges in some parts of the region, the overall growth of the automotive and industrial sectors is expected to support market expansion.

Middle East and Africa region is witnessing steady growth in the Lubricants Packaging Market, particularly in countries like Saudi Arabia, United Arab Emirates (UAE), South Africa, and Egypt. The increasing demand for lubricants in the oil and gas industry, coupled with expanding automotive sectors, is driving the growth of the packaging market in this region. Saudi Arabia and the UAE are major markets due to their strong oil and gas industries, which require large quantities of lubricants for machinery and equipment. The growing construction and automotive industries in these countries are further increasing the demand for lubricants and their packaging solutions. In South Africa, the automotive sector and the manufacturing industry are also contributing to market growth, and Egypt is emerging as a key market due to its industrial development and automotive growth. However, challenges such as economic instability and limited access to advanced packaging technologies in some parts of Sub-Saharan Africa may slow down the widespread adoption of high-quality packaging solutions.

Lubricants Packaging Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the lubricants packaging market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global lubricants packaging market include:

- Mold Tek Packaging Ltd.

- Balmer Lawrie & Co. Ltd.

- Glenroy Inc.

- Time Technoplast Ltd.

- Grief Inc.

- CYL Corporation Berhad

- Duplas Al Sharq LLC

- Scholle IPN

- Mauser Group B.V.

- Martin Operating Partnership L.P.

The global lubricants packaging market is segmented as follows:

By Material

- Metal

- Plastic

By Packaging Type

- Stand Up Pouch

- Bottle

- Drum

- Intermediate Bulk Container

By Lubricant

- Engine Oil

- Transmission & Hydraulic Fluid

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Lubricants Packaging

Request Sample

Lubricants Packaging