Lubricating Oil Refining Market Size, Share, and Trends Analysis Report

CAGR :

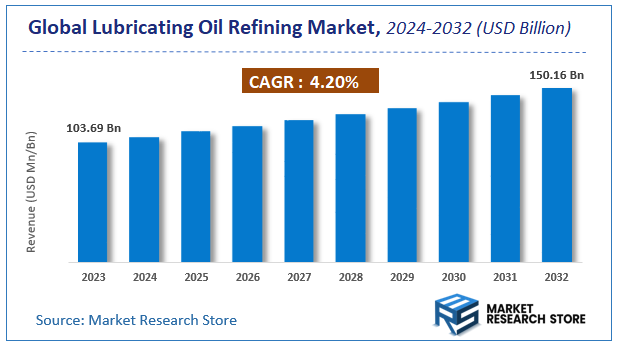

| Market Size 2023 (Base Year) | USD 103.69 Billion |

| Market Size 2032 (Forecast Year) | USD 150.16 Billion |

| CAGR | 4.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Lubricating Oil Refining Market Insights

According to Market Research Store, the global lubricating oil refining market size was valued at around USD 103.69 billion in 2023 and is estimated to reach USD 150.16 billion by 2032, to register a CAGR of approximately 4.2% in terms of revenue during the forecast period 2024-2032.

The lubricating oil refining report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Lubricating Oil Refining Market: Overview

Lubricating oil refining is the industrial process of converting crude oil or used lubricating oils into high-quality base oils, which are then formulated into various lubricant products. This process typically involves several stages such as vacuum distillation, solvent extraction, dewaxing, hydrocracking, and hydrotreating to remove impurities like sulfur, nitrogen, aromatics, and metals. The goal is to enhance the viscosity, thermal stability, and overall performance of the oil. Refining can be done from virgin crude (conventional refining) or from used oil (re-refining), contributing to both quality assurance and environmental sustainability.

Key Highlights

- The lubricating oil refining market is anticipated to grow at a CAGR of 4.2% during the forecast period.

- The global lubricating oil refining market was estimated to be worth approximately USD 103.69 billion in 2023 and is projected to reach a value of USD 150.16 billion by 2032.

- The growth of the lubricating oil refining market is being driven by Increasing vehicle production, growing industrialization, and the need for equipment efficiency.

- Based on the product type, the mineral oils segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the automotive oils segment is projected to swipe the largest market share.

- In terms of end-user, the automotive segment is expected to dominate the market.

- Based on the viscosity grade, the medium viscosity segment is expected to dominate the market.

- In terms of additive type, the detergents segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Lubricating Oil Refining Market: Dynamics

Key Growth Drivers:

- Increasing Demand from Automotive and Industrial Sectors: Growing vehicle ownership and expanding industrial activity are driving the demand for high-performance lubricants, boosting the need for refined lubricating oils.

- Advancements in Refining Technologies: Technological innovations such as hydrocracking and catalytic dewaxing are enhancing the efficiency and quality of lubricating oil production, encouraging market expansion.

- Emphasis on Enhancing Engine Efficiency and Longevity: OEMs and consumers are seeking lubricants that improve fuel economy and engine durability, creating demand for higher-quality base oils derived from advanced refining processes.

- Rising Focus on Environmental Sustainability: The push for low-emission, energy-efficient lubricants has accelerated the shift toward cleaner refining processes and synthetic base oils.

Restraints:

- High Capital Investment in Refining Infrastructure: Establishing or upgrading lubricating oil refining facilities requires substantial investment, which can limit the entry of new players and expansion by existing ones.

- Fluctuating Crude Oil Prices: Volatility in crude oil prices can impact the cost structure of lubricating oil refining, creating uncertainty in profit margins.

- Stringent Environmental Regulations: Increasing regulatory pressure on emissions and waste management in the refining process can pose operational challenges and raise compliance costs.

Opportunities:

- Rising Demand for Synthetic and Bio-Based Lubricants: As industries move toward more sustainable solutions, the demand for high-quality synthetic and environmentally friendly lubricants is opening new refining opportunities.

- Expansion in Emerging Economies: Rapid industrialization and growing automotive sectors in regions such as Asia-Pacific, Latin America, and the Middle East offer significant growth potential for lubricating oil refining.

- Re-refining of Used Lubricating Oils: The development of eco-friendly technologies for recycling used oils presents a promising area for expansion and resource efficiency.

- Integration of Digital Solutions in Refining Operations: Leveraging digital tools and automation can enhance operational efficiency, quality control, and cost management in lubricating oil refining.

Challenges:

- Competition from Alternative Lubrication Technologies: Emerging alternatives such as solid lubricants and dry lubricants may reduce the dependency on traditional lubricating oils in some applications.

- Complex Supply Chain Dynamics: Disruptions in raw material supply, transportation logistics, and geopolitical tensions can affect the consistent supply of base oils and refining materials.

- Slow Adoption of Advanced Refining in Some Regions: In developing markets, limited access to capital and technology may hinder the adoption of modern, efficient refining practices.

- Public Perception and Environmental Concerns: Growing awareness of the environmental impact of fossil-based lubricants may pressure companies to transition faster toward greener alternatives, posing challenges for traditional refineries.

Lubricating Oil Refining Market: Report Scope

This report thoroughly analyzes the Lubricating Oil Refining Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Lubricating Oil Refining Market |

| Market Size in 2023 | USD 103.69 Billion |

| Market Forecast in 2032 | USD 150.16 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 178 |

| Key Companies Covered | Exxon Mobil, Sinopec, Royal Dutch Shell, Eni S.P.A., Sasol, Total SA, Petrochina, Chevron, Repsol, LUKOIL, Petroliam Nasional Berhad, Grupa Lotos SA, Nippon Seiro, Hollyfrontier, Nynas, Petrobras, The International Group, Indian Oil Corporation, Honeywell International, Cepsa SA |

| Segments Covered | By Product Type, By Application, By End-User, By Viscosity Grade, By Additive Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lubricating Oil Refining Market: Segmentation Insights

The global lubricating oil refining market is divided by product type, application, end-user, viscosity grade, additive type, and region.

Segmentation Insights by Product Type

Based on product type, the global lubricating oil refining market is divided into mineral oils, synthetic oils, biolubricants, and semi-synthetic oils.

In the lubricating oil refining market, mineral oils hold the most dominant position among the product types. Derived directly from refining crude oil, mineral oils are widely used due to their affordability and adequate performance across a broad spectrum of automotive and industrial applications. Their dominance is driven by long-established use in emerging and developing markets, where cost-effectiveness is a crucial factor for end users. Additionally, they serve as a base for various blends, making them a versatile and accessible option.

Following mineral oils, synthetic oils represent the second most dominant segment. These are chemically engineered lubricants that offer superior performance in extreme temperatures and harsh operating conditions. Their enhanced thermal stability, longer service life, and better lubrication efficiency make them particularly popular in high-performance vehicles and industrial machinery. Although synthetic oils come at a higher price point, the performance benefits justify their growing adoption in more developed markets.

Next in line are semi-synthetic oils, which blend mineral oils with a small proportion of synthetic components. These oils aim to offer a middle-ground solution—delivering better performance than pure mineral oils while remaining more affordable than fully synthetic alternatives. Semi-synthetic oils are especially favored in the automotive aftermarket, where consumers seek improved engine protection without significantly increased costs.

The least dominant segment is biolubricants, which are derived from renewable sources like vegetable oils or animal fats. Despite growing interest in sustainable and eco-friendly alternatives, the biolubricants segment currently holds a smaller market share due to higher production costs, limited compatibility with existing systems, and lower thermal stability compared to traditional options. However, with increasing environmental regulations and technological advancements, this segment is expected to gain traction in the coming years.

Segmentation Insights by Application

On the basis of application, the global lubricating oil refining market is bifurcated into automotive oils, industrial oils, aerospace oils, marine oils, and specialty oils.

In terms of application, automotive oils are the most dominant segment in the lubricating oil refining market. This dominance is primarily driven by the massive and continuously growing global automotive fleet, encompassing passenger cars, commercial vehicles, and two-wheelers. Automotive oils, which include engine oils, gear oils, and transmission fluids, are essential for reducing friction, enhancing fuel efficiency, and extending engine life. The regular maintenance needs of vehicles and the increasing number of vehicles on the road contribute significantly to the demand for refined lubricating oils in this segment.

Industrial oils follow as the second most dominant application. These oils are critical in ensuring smooth operation and maintenance of machinery in manufacturing, construction, mining, and other industrial sectors. Industrial oils include hydraulic fluids, compressor oils, and turbine oils, and they are valued for their ability to reduce wear and tear, manage heat, and extend the operational life of heavy-duty equipment. The growth of industrialization in emerging economies supports the sustained demand in this segment.

Marine oils occupy the next position. These are specially formulated lubricants used in ship engines and auxiliary equipment. With international maritime trade on the rise, the need for reliable and durable lubricants that perform well under high-load and high-temperature conditions is essential. Marine oils are typically subject to stringent regulations due to environmental concerns, which influences their composition and usage patterns.

Aerospace oils come next and cater to the highly specialized needs of aircraft engines and components. These lubricants must withstand extreme temperatures and pressures while meeting strict safety and performance standards. Although the aerospace sector is comparatively smaller than automotive or industrial markets, the high cost and technical complexity of aerospace oils contribute to their significance despite their smaller volume demand.

Specialty oils are the least dominant application segment. This category includes lubricants for niche markets and specific equipment, such as refrigeration compressors, textile machinery, and food-grade machinery. Specialty oils often have tailored formulations for unique performance requirements or regulatory compliance, but their limited application scope and lower demand volumes make them the smallest segment in the lubricating oil refining market by application.

Segmentation Insights by End-User

Based on end-user, the global lubricating oil refining market is divided into automotive, aerospace, manufacturing, energy & power, and marine.

In the lubricating oil refining market, the automotive sector stands as the most dominant end-user. This dominance is attributed to the vast global vehicle population and the consistent need for maintenance and servicing, which involves the use of various lubricants such as engine oils, brake fluids, gear oils, and coolants. Whether in personal vehicles or commercial fleets, lubricants play a critical role in ensuring efficient engine performance, reducing wear and tear, and extending vehicle life. The expansion of the automotive industry, especially in emerging markets, continues to fuel this segment’s demand.

The manufacturing sector follows closely, representing the second most dominant end-user. In this sector, lubricants are vital for maintaining machinery and equipment used in production lines, construction, mining, textiles, and metalworking industries. Manufacturing operations often involve high-load, high-speed machinery that requires consistent lubrication to operate efficiently and reduce downtime. As global industrial activity continues to grow, particularly in Asia-Pacific and Latin America, so does the demand for refined lubricants in manufacturing.

Energy & power is the third major end-user segment. Power plants—whether coal-based, nuclear, wind, or hydro—rely heavily on high-performance lubricants for turbines, generators, and other rotating machinery. Lubricants in this sector must perform reliably under high temperatures and pressures. As global energy needs expand and as infrastructure modernizes, especially in developing nations, this segment maintains a steady demand for specialized lubricants.

The marine sector ranks next. Although smaller than automotive and manufacturing in terms of volume, it remains crucial due to the demands of heavy-duty ship engines and auxiliary systems. Marine lubricants need to perform under harsh marine environments and long operational cycles. The growth in global maritime trade and stricter environmental standards are influencing demand for high-quality marine lubricants.

Aerospace is the least dominant end-user segment. While it requires highly specialized, high-performance lubricants that must meet stringent safety and performance standards, the overall volume consumed is relatively low. The segment includes military and commercial aviation, where each aircraft uses a small quantity of very high-grade lubricant. Despite its technical significance and high value per unit, the limited number of aerospace applications places this segment at the lower end of the market share spectrum.

Segmentation Insights by Viscosity Grade

On the basis of viscosity grade, the global lubricating oil refining market is bifurcated into low viscosity, medium viscosity, and high viscosity.

In the lubricating oil refining market, medium viscosity lubricants represent the most dominant viscosity grade. These oils strike a balance between fluidity and thickness, making them suitable for a wide range of applications across both automotive and industrial sectors. Medium viscosity oils are commonly used in engine oils, hydraulic fluids, and gear oils, offering effective lubrication, wear protection, and thermal stability under moderate to high operational loads. Their versatility and reliability across varied temperature and pressure conditions make them the go-to choice for manufacturers and service providers.

Low viscosity lubricants follow as the second most dominant grade. These oils are particularly valued for their superior flow characteristics, especially in cold-start conditions, where quick circulation is critical to prevent engine wear. With increasing emphasis on fuel efficiency and environmental performance, low viscosity oils are gaining traction—especially in modern automotive engines and high-speed machinery that operate under tighter tolerances. The rise in adoption of synthetic base oils, which often fall into the low-viscosity category, also contributes to their growing popularity.

High viscosity lubricants are the least dominant segment by viscosity grade. These oils are used in heavy-duty applications where components are subjected to extreme loads, slow speeds, or high operating temperatures—such as in heavy industrial machinery, marine engines, and some specialty applications. While they offer superior film strength and protection under extreme conditions, their limited suitability for modern fuel-efficient engines and lower adaptability to cold environments restrict their broader use, keeping their market share relatively smaller.

Segmentation Insights by Additive Type

On the basis of additive type, the global lubricating oil refining market is bifurcated into detergents, antioxidants, anti-wear additives, viscosity index improvers, and corrosion inhibitors.

In the lubricating oil refining market, detergents are the most dominant additive type. Detergents are critical in maintaining engine cleanliness by preventing the formation of sludge and varnish. They help keep combustion chambers, pistons, and other engine components free from harmful deposits, ensuring optimal engine performance and longevity. Detergents are widely used in automotive oils and industrial lubricants, where maintaining cleanliness is essential to preventing operational issues and maximizing efficiency. Their essential role in engine protection, combined with growing demand for more efficient and environmentally friendly lubricants, contributes to their leading position in the market.

Anti-wear additives are the second most dominant additive type. These additives form a protective film on metal surfaces, reducing friction and wear, particularly in high-load applications like engine parts, transmission systems, and industrial machinery. Anti-wear additives are integral to ensuring the durability and smooth operation of moving parts, which is especially important in automotive and manufacturing sectors. As machinery gets more complex and operates under higher stresses, the need for anti-wear additives continues to grow, securing their place as a key component in lubricating oil formulations.

Antioxidants rank next in terms of dominance. These additives slow down the oxidation process, which can cause the lubricant to degrade, leading to the formation of sludge and acids. Antioxidants are particularly important in high-temperature and high-performance applications, where the oil is more susceptible to oxidation. Automotive oils, industrial lubricants, and oils used in power generation and heavy-duty machinery rely heavily on antioxidants to extend the life of the lubricant and prevent the buildup of harmful substances.

Viscosity index improvers come next in terms of demand. These additives are used to improve the flow properties of lubricants across a wide range of temperatures. In automotive oils, for instance, they help the lubricant flow smoothly at low temperatures and maintain its thickness at higher temperatures. This ensures consistent engine protection regardless of the operating conditions. Viscosity index improvers are particularly important in modern engines designed for better fuel efficiency, making them a vital additive in synthetic and semi-synthetic lubricants.

Corrosion inhibitors are the least dominant additive type. These additives are designed to protect metal surfaces from corrosion caused by water, acids, or other corrosive substances in the lubricant. While important, corrosion inhibitors are generally used in specific applications such as marine oils, industrial oils, and some automotive oils that operate in harsh environments. Although necessary for certain sectors, their use is more niche compared to the other additive types, resulting in a smaller share of the overall market.

Lubricating Oil Refining Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific is the most dominant region in the lubricating oil refining market. The region benefits from rapid industrialization, a large and growing automotive sector, and substantial infrastructure development. Countries such as China, India, and Japan are leading contributors, with China at the forefront due to its extensive manufacturing operations and high vehicle ownership. India’s expanding industrial base and rising consumer demand further fuel market growth. The increasing economic development and disposable incomes in Southeast Asia also contribute to higher consumption of lubricants across multiple industries, reinforcing the region's dominance.

North America follows closely, supported by a mature automotive industry and ongoing advancements in lubricant technologies. The United States plays a pivotal role, with high demand for high-performance lubricants in sectors such as transportation, construction, and manufacturing. The region is also seeing a rise in environmentally friendly and bio-based lubricants as sustainability becomes a central focus. Investments in innovation and specialized lubricants tailored for diverse industrial applications further enhance North America’s market position.

Europe maintains a strong presence in the lubricating oil refining market, driven by strict environmental regulations and a well-established automotive industry. Countries like Germany, the UK, and France are prominent contributors, with growing adoption of synthetic and eco-friendly lubricants. The regional emphasis on emission reductions and energy efficiency promotes the use of advanced lubrication technologies, ensuring steady market demand. Europe's push for sustainable industrial practices continues to shape the market landscape.

Latin America is gradually emerging in the lubricating oil refining market, with Brazil and Mexico leading regional growth. Increasing vehicle ownership, urbanization, and industrial activity are key drivers of lubricant demand. While the region faces challenges such as economic instability and infrastructure limitations, ongoing development initiatives are creating new opportunities for market expansion, especially in the automotive and construction sectors.

Middle East and Africa represent the least dominant region in the lubricating oil refining market, although steady growth is observed. Countries such as Saudi Arabia and the UAE are making significant investments in manufacturing and transportation infrastructure, contributing to rising lubricant demand. The region is also diversifying economically beyond traditional oil production, fostering industrial development. However, political and economic disparities across the region may restrain uniform growth, despite an overall positive outlook.

Lubricating Oil Refining Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the lubricating oil refining market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global lubricating oil refining market include:

- Exxon Mobil

- Sinopec

- Royal Dutch Shell

- Eni S.P.A.

- Sasol

- Total SA

- Petrochina

- Chevron

- Repsol

- LUKOIL

- Petroliam Nasional Berhad

- Grupa Lotos SA

- Nippon Seiro

- Hollyfrontier

- Nynas

- Petrobras

- The International Group

- Indian Oil Corporation

- Honeywell International

- Cepsa SA

The global lubricating oil refining market is segmented as follows:

By Product Type

- Mineral Oils

- Synthetic Oils

- Biolubricants

- Semi-synthetic Oils

By Application

- Automotive Oils

- Industrial Oils

- Aerospace Oils

- Marine Oils

- Specialty Oils

By End-User

- Automotive

- Aerospace

- Manufacturing

- Energy and Power

- Marine

By Viscosity Grade

- Low Viscosity

- Medium Viscosity

- High Viscosity

By Additive Type

- Detergents

- Antioxidants

- Anti-wear Additives

- Viscosity Index Improvers

- Corrosion Inhibitors

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Lubricating Oil Refining

Request Sample

Lubricating Oil Refining