Frozen French Fries and Frozen Potatoes Market Size, Share, and Trends Analysis Report

CAGR :

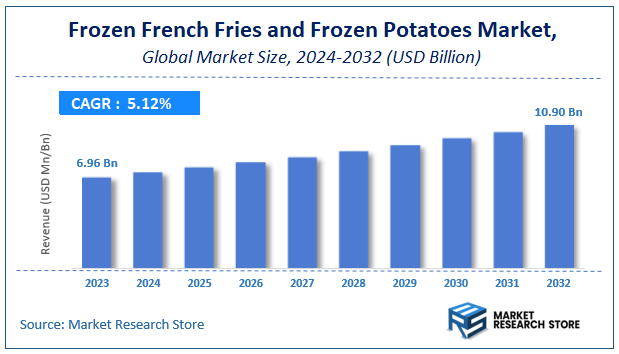

| Market Size 2023 (Base Year) | USD 6.96 Billion |

| Market Size 2032 (Forecast Year) | USD 10.90 Billion |

| CAGR | 5.12% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Frozen French Fries and Frozen Potatoes Market Insights

According to Market Research Store, the global frozen french fries and frozen potatoes market size was valued at around USD 6.96 billion in 2023 and is estimated to reach USD 10.90 billion by 2032, to register a CAGR of approximately 5.12% in terms of revenue during the forecast period 2024-2032.

The frozen french fries and frozen potatoes report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Frozen French Fries and Frozen Potatoes Market: Overview

Frozen French fries and frozen potatoes are processed potato products that are typically pre-cooked, frozen, and then packaged for retail or foodservice use. These products offer convenience, longer shelf life, and ease of preparation. Frozen French fries are typically cut into various shapes, such as straight, crinkle-cut, or shoestring, and are often deep-fried or baked before being frozen. Frozen potatoes, on the other hand, encompass a wider range of products, including mashed potatoes, potato wedges, tater tots, and hash browns. These items are produced from potatoes that are washed, peeled, sliced, and then frozen for preservation.

Key Highlights

- The frozen french fries and frozen potatoes market is anticipated to grow at a CAGR of 5.12% during the forecast period.

- The global frozen french fries and frozen potatoes market was estimated to be worth approximately USD 6.96 billion in 2023 and is projected to reach a value of USD 10.90 billion by 2032.

- The growth of the frozen french fries and frozen potatoes market is being driven by factors such as increasing demand for convenience foods, the expansion of quick-service restaurants (QSRs), and rising consumer preference for ready-to-cook products.

- Based on the type, the chips segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the quick service restaurant (QSR) segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Frozen French Fries and Frozen Potatoes Market: Dynamics

Growth Drivers:

- Rising Demand for Convenience Foods: Busy lifestyles and the increasing preference for quick and easy meal options are driving the demand for frozen French fries and potatoes.

- Expansion of the Food Service Industry: The growth of fast-food chains, restaurants, and cafes is a major factor contributing to the market's expansion.

- Increasing Urbanization: Urbanization leads to higher disposable incomes and a shift towards processed foods, boosting demand for frozen products.

- Growing Global Population: The increasing global population is creating a larger consumer base for frozen food products.

- Product Innovation: The introduction of new flavors, varieties, and value-added products is attracting consumers and driving market growth.

Restraints:

- Health Concerns: Growing awareness about the health risks associated with high sodium and fat content in frozen fries is a major restraint.

- Price Fluctuations: The prices of potatoes and other raw materials can fluctuate significantly, impacting the profitability of manufacturers.

- Stringent Regulations: Food safety and quality regulations can increase production costs and pose challenges for manufacturers.

Opportunities:

- Development of Healthier Options: The development of low-fat, low-sodium, and whole-grain frozen fries and potato products can tap into the growing health-conscious consumer segment.

- Expansion into Emerging Markets: The increasing demand for convenience foods in emerging economies presents significant growth opportunities.

- Private Label Products: The rising popularity of private label brands offers opportunities for manufacturers to cater to specific consumer preferences.

Challenges:

- Intense Competition: The market is characterized by intense competition from both established players and new entrants.

- Maintaining Quality and Consistency: Ensuring consistent quality and freshness of frozen products throughout the supply chain is a major challenge.

- Supply Chain Management: Efficient supply chain management is crucial for maintaining cost-effectiveness and ensuring timely delivery of products.

Frozen French Fries and Frozen Potatoes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Frozen French Fries and Frozen Potatoes Market |

| Market Size in 2023 | USD 6.96 Billion |

| Market Forecast in 2032 | USD 10.90 Billion |

| Growth Rate | CAGR of 5.12% |

| Number of Pages | 140 |

| Key Companies Covered | McCain Foods, Lamb Weston, Simplot Foods, Aviko Group, Kraft Heinz, Agristo, Cavendish Farms, Farm Frites, General Mills, Nomad Foods, Ardo, Pizzoli, Landun, Goya Foods, Seneca Foods |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Frozen French Fries and Frozen Potatoes Market: Segmentation Insights

The global frozen french fries and frozen potatoes market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global frozen french fries and frozen potatoes market is divided into chips and non-chips.

In the frozen French fries and frozen potatoes market, the chips segment dominates. Frozen chips, also known as French fries, are a staple in both the retail and foodservice sectors. Their popularity stems from their convenience, long shelf life, and versatility in meal preparation. They are widely consumed across various regions, particularly in fast food chains, restaurants, and households. The increasing demand for convenience foods, coupled with the growing preference for quick snacks, has solidified chips as the most dominant segment. They come in various forms, including thin-cut, crinkle-cut, and wedge-style, which further contributes to their widespread appeal.

The non-chips segment, while still significant, ranks second in terms of market dominance. This category includes other frozen potato products such as mashed potatoes, hash browns, potato tots, and wedges. These products are gaining traction, especially in the retail sector, where consumers seek alternatives to chips for variety in their meals. Non-chips offer unique textures and flavors, often used as side dishes or quick meals. However, they generally appeal to a more niche consumer group compared to frozen chips, which have broader usage in everyday meals and snacks. Despite this, the non-chips segment continues to grow, driven by the increasing demand for diverse and easy-to-prepare frozen potato products.

Segmentation Insights by Application

On the basis of application, the global frozen french fries and frozen potatoes market is bifurcated into quick service restaurant (QSR), household, and others.

In the frozen French fries and frozen potatoes market, the Quick Service Restaurant (QSR) segment is the most dominant. QSRs, such as fast food chains, rely heavily on frozen potato products like French fries to meet consumer demand for fast, convenient, and affordable meals. The global growth of the fast-food industry, combined with the increasing preference for fast and easy dining options, has propelled the QSR sector to dominate the frozen potato market. French fries are a staple menu item in these establishments, which makes the QSR sector a significant driver of market demand. Additionally, the ability of frozen potato products to maintain consistent quality and taste while being easy to prepare further reinforces their importance in the QSR industry.

The household segment follows as the second largest application for frozen potatoes. As consumers continue to seek convenience in meal preparation, frozen potato products like French fries, mashed potatoes, and hash browns have become common in household kitchens. Frozen French fries are popular for home consumption due to their ease of use and ability to be prepared with minimal effort, offering consumers a convenient and tasty option for family meals, snacks, and side dishes. The growing trend of cooking at home, especially in the wake of the COVID-19 pandemic, has contributed to an increase in household consumption of frozen potatoes.

Frozen French Fries and Frozen Potatoes Market: Regional Insights

- North America is expected to dominates the global market

North America leads the global market for frozen French fries and frozen potatoes, driven by a robust fast-food industry and high consumer demand for convenience foods. The United States and Canada are significant contributors, with frozen potato products being staples in households and restaurants. The prevalence of quick-service restaurants (QSRs) and the popularity of Western cuisine have further bolstered market growth in this region.

Europe holds a substantial share of the market, with countries like Belgium, the Netherlands, and the United Kingdom being major producers and consumers of frozen potato products. The region's long-standing tradition of frozen potato consumption, coupled with a strong export market, particularly to the United Kingdom, underscores its dominance. Additionally, European consumers are increasingly seeking healthier and organic frozen potato options, influencing market trends.

The Asia-Pacific region is experiencing rapid growth in the frozen potato market, with countries such as China, India, and Japan leading the demand. Urbanization, rising disposable incomes, and the influence of Western fast-food chains have significantly contributed to the increased consumption of frozen potatoes. China, in particular, benefits from its status as a leading potato producer, facilitating the availability of raw materials for frozen potato products.

Latin America exhibits a growing market for frozen potatoes, with Brazil and Argentina being key players. The region's expanding fast-food sector and changing dietary habits are driving the demand for frozen potato products. However, the market is still developing compared to North America and Europe, presenting opportunities for growth and investment.

The Middle East and Africa region is the smallest market for frozen potatoes, with limited consumption primarily in countries like South Africa and the United Arab Emirates. The market is influenced by factors such as urbanization and the presence of international fast-food chains. However, the region's market size remains relatively small, with potential for growth as consumer preferences evolve.

Frozen French Fries and Frozen Potatoes Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the frozen french fries and frozen potatoes market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global frozen french fries and frozen potatoes market include:

- McCain Foods

- Lamb Weston

- Simplot Foods

- Aviko Group

- Kraft Heinz

- Agristo

- Cavendish Farms

- Farm Frites

- General Mills

- Nomad Foods

- Ardo

- Pizzoli

- Landun

- Goya Foods

- Seneca Foods

The global frozen french fries and frozen potatoes market is segmented as follows:

By Type

- Chips

- Non-chips

By Application

- Quick Service Restaurant (QSR)

- Household

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global frozen french fries and frozen potatoes market size was projected at approximately US$ 6.96 billion in 2023. Projections indicate that the market is expected to reach around US$ 10.90 billion in revenue by 2032.

The global frozen french fries and frozen potatoes market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 5.12% during the forecast period from 2024 to 2032.

North America is expected to dominate the global frozen french fries and frozen potatoes market.

The global frozen French fries and frozen potatoes market is driven by the growing demand for convenience foods, the expansion of fast-food chains, and increasing consumer preference for ready-to-eat or easy-to-cook products. Additionally, rising disposable incomes and changing eating habits contribute to market growth.

Some of the prominent players operating in the global frozen french fries and frozen potatoes market are; McCain Foods, Lamb Weston, Simplot Foods, Aviko Group, Kraft Heinz, Agristo, Cavendish Farms, Farm Frites, General Mills, Nomad Foods, Ardo, Pizzoli, Landun, Goya Foods, Seneca Foods, and others.

Table Of Content

Inquiry For Buying

Frozen French Fries and Frozen Potatoes

Request Sample

Frozen French Fries and Frozen Potatoes