Mining Equipment Rental Market Size, Share, and Trends Analysis Report

CAGR :

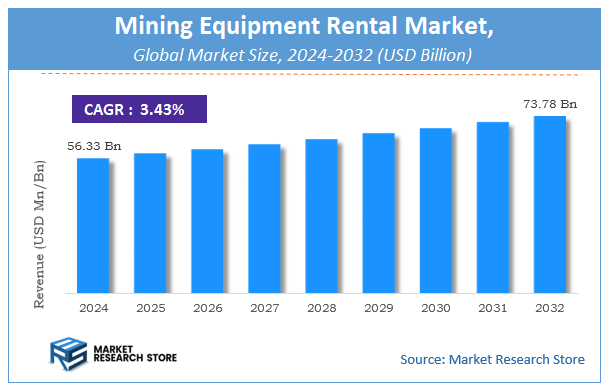

| Market Size 2024 (Base Year) | USD 56.33 Billion |

| Market Size 2032 (Forecast Year) | USD 73.78 Billion |

| CAGR | 3.43% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global mining equipment rental market size was valued at approximately USD 56.33 Billion in 2024. The market is projected to grow significantly, reaching USD 73.78 Billion by 2032, growing at a compound annual growth rate (CAGR) of 3.43% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the mining equipment rental industry.

To Get more Insights, Request a Free Sample

Mining Equipment Rental Market: Overview

The growth of the mining equipment rental market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The mining equipment rental market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the mining equipment rental market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Equipment Type, Application Area, End-User Industry, Rental Model, Rental Structure, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global mining equipment rental market is estimated to grow annually at a CAGR of around 3.43% over the forecast period (2024-2032).

- In terms of revenue, the global mining equipment rental market size was valued at around USD 56.33 Billion in 2024 and is projected to reach USD 73.78 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for cost-effective mining operations, increasing need for flexible equipment usage, and rising mineral exploration activities are fueling the Mining Equipment Rental market.

- Based on the Equipment Type, the Excavators segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application Area, the Surface Mining segment is anticipated to command the largest market share.

- In terms of End-User Industry, the Coal Mining segment is projected to lead the global market.

- By Rental Model, the Short-term Rentals segment is predicted to dominate the global market.

- Based on the Rental Structure, the Daily Rental segment is expected to swipe the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Mining Equipment Rental Market: Report Scope

This report thoroughly analyzes the mining equipment rental market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Mining Equipment Rental Market |

| Market Size in 2024 | USD 56.33 Billion |

| Market Forecast in 2032 | USD 73.78 Billion |

| Growth Rate | CAGR of 3.43% |

| Number of Pages | 214 |

| Key Companies Covered | Komatsu Ltd, United Mining Rentals., Caterpillar, Atlas Copco AB, Emeco Holdings Limited, Herc Rentals, MS Mining Services, American Equipment CompanyInc., Tim McDowell Equipment Ltd, Equipment ServicesInc |

| Segments Covered | By Equipment Type, By Application Area, By End-User Industry, By Rental Model, By Rental Structure, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mining Equipment Rental Market: Dynamics

Key Growth Drivers :

The mining equipment rental market is experiencing significant growth, primarily driven by the increasing need for cost-effective and flexible mining operations. In an industry characterized by fluctuating commodity prices and high capital investment, renting equipment allows mining companies to avoid substantial upfront costs and the burden of maintenance, storage, and depreciation. This is particularly appealing to smaller and medium-sized mining operators. Furthermore, the rising global demand for minerals and metals, fueled by rapid urbanization, industrialization, and the transition to a green economy (which requires materials like lithium and copper for electric vehicles and renewable energy infrastructure), is driving increased mining activity. The adoption of advanced technologies like automation, telematics, and IoT in modern equipment also acts as a driver, as companies can access these innovations through rental without committing to a permanent, expensive purchase.

Restraints :

Despite its growth, the mining equipment rental market faces several key restraints. The high cost of specialized and high-capacity equipment makes it a significant financial risk for rental companies to acquire and maintain large, diverse fleets. The inherent volatility of the mining sector, driven by unpredictable commodity prices, can lead to sudden changes in demand, making long-term planning difficult for rental providers. Another major challenge is the need for highly skilled operators and technicians, as a shortage of this labor can hinder the effective utilization and maintenance of the rented machinery. Furthermore, the risk of equipment downtime due to mechanical failures or the logistical complexities of transporting large, heavy equipment to remote mining sites can lead to costly delays and impact customer satisfaction.

Opportunities :

The mining equipment rental market is rich with opportunities, particularly in leveraging technology and expanding service offerings. The shift towards more sustainable and environmentally friendly mining practices creates a significant opportunity for rental companies to invest in and offer fleets of electric, hybrid, and more energy-efficient equipment, helping clients meet regulatory standards without heavy capital outlay. There is also a strong opportunity for a service-based model beyond just renting equipment, including offering on-site maintenance, operator training, and data analytics to help clients optimize their operations. The increasing focus on digital transformation within the industry presents an opportunity for rental companies to use telematics and predictive maintenance technologies to improve efficiency, reduce downtime, and provide greater value to their customers.

Challenges :

The mining equipment rental market must contend with several challenges to sustain its growth. Intense market competition can lead to price wars, eroding profit margins for rental companies. Ensuring equipment availability, especially for high-demand or specialized machines, is a constant challenge, and a failure to meet client needs can result in lost business. The industry also faces significant logistical hurdles related to the transportation of heavy equipment to often remote and challenging terrains, which can be costly and complex. Moreover, navigating a diverse landscape of safety and environmental regulations in different regions is a challenge, as rental fleets must comply with various standards, adding to the operational complexity and cost of doing business.

Mining Equipment Rental Market: Segmentation Insights

The global mining equipment rental market is segmented based on Equipment Type, Application Area, End-User Industry, Rental Model, Rental Structure, and Region. All the segments of the mining equipment rental market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Equipment Type, the global mining equipment rental market is divided into Excavators, Bulldozers, Loaders, Drills, Crushers, Dump Trucks, Haul Trucks, Screening Equipment.

On the basis of Application Area, the global mining equipment rental market is bifurcated into Surface Mining, Underground Mining, Quarrying, Tunneling, Material Handling.

In terms of End-User Industry, the global mining equipment rental market is categorized into Coal Mining, Metal Mining, Mineral Mining, Construction, Oil & Gas.

Based on Rental Model, the global mining equipment rental market is split into Short-term Rentals, Long-term Rentals, Leasing Options, Flexible Rental Solutions.

By Rental Structure, the global mining equipment rental market is divided into Daily Rental, Weekly Rental, Monthly Rental, Project-based Rental.

Mining Equipment Rental Market: Regional Insights

North America is the dominant region in the global mining equipment rental market, with the United States and Canada being the primary drivers. This dominance is fueled by a mature mining sector, a strong presence of major rental service providers like United Rentals and Sunbelt Rentals, and a well-established culture of opting for rental agreements over capital expenditure. This model offers mining companies crucial financial flexibility to manage project volatility and avoid the high costs of equipment maintenance and depreciation.

While the Asia-Pacific region is experiencing rapid growth due to extensive mining activity in Australia and India, and Latin America is a significant player with major operations in Chile and Peru, North America's advanced rental infrastructure and preference for operational expense (OpEx) models solidify its leading position in market revenue and service sophistication.

Mining Equipment Rental Market: Competitive Landscape

The mining equipment rental market Report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Mining Equipment Rental Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Komatsu Ltd

- United Mining Rentals.

- Caterpillar

- Atlas Copco AB

- Emeco Holdings Limited

- Herc Rentals

- MS Mining Services

- American Equipment CompanyInc.

- Tim McDowell Equipment Ltd

- Equipment ServicesInc

The Global Mining Equipment Rental Market is Segmented as Follows:

By Equipment Type

- Excavators

- Bulldozers

- Loaders

- Drills

- Crushers

- Dump Trucks

- Haul Trucks

- Screening Equipment

By Application Area

- Surface Mining

- Underground Mining

- Quarrying

- Tunneling

- Material Handling

By End-User Industry

- Coal Mining

- Metal Mining

- Mineral Mining

- Construction

- Oil & Gas

By Rental Model

- Short-term Rentals

- Long-term Rentals

- Leasing Options

- Flexible Rental Solutions

By Rental Structure

- Daily Rental

- Weekly Rental

- Monthly Rental

- Project-based Rental

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Mining Equipment Rental Market - Research Scope 1.1 Study Goals 1.2 Market Definition and Scope 1.3 Key Market Segments 1.4 Study and Forecasting Years 2 Mining Equipment Rental Market - Research Methodology 2.1 Methodology 2.2 Research Data Source 2.2.1 Secondary Data 2.2.2 Primary Data 2.2.3 Market Size Estimation 2.2.4 Legal Disclaimer 3 Mining Equipment Rental Market Forces 3.1 Global Mining Equipment Rental Market Size 3.2 Top Impacting Factors (PESTEL Analysis) 3.2.1 Political Factors 3.2.2 Economic Factors 3.2.3 Social Factors 3.2.4 Technological Factors 3.2.5 Environmental Factors 3.2.6 Legal Factors 3.3 Industry Trend Analysis 3.4 Industry Trends Under COVID-19 3.4.1 Risk Assessment on COVID-19 3.4.2 Assessment of the Overall Impact of COVID-19 on the Industry 3.4.3 Pre COVID-19 and Post COVID-19 Market Scenario 3.5 Industry Risk Assessment 4 Mining Equipment Rental Market - By Geography 4.1 Global Mining Equipment Rental Market Value and Market Share by Regions 4.1.1 Global Mining Equipment Rental Value ($) by Region (2015-2020) 4.1.2 Global Mining Equipment Rental Value Market Share by Regions (2015-2020) 4.2 Global Mining Equipment Rental Market Production and Market Share by Major Countries 4.2.1 Global Mining Equipment Rental Production by Major Countries (2015-2020) 4.2.2 Global Mining Equipment Rental Production Market Share by Major Countries (2015-2020) 4.3 Global Mining Equipment Rental Market Consumption and Market Share by Regions 4.3.1 Global Mining Equipment Rental Consumption by Regions (2015-2020) 4.3.2 Global Mining Equipment Rental Consumption Market Share by Regions (2015-2020) 5 Mining Equipment Rental Market - By Trade Statistics 5.1 Global Mining Equipment Rental Export and Import 5.2 United States Mining Equipment Rental Export and Import (2015-2020) 5.3 Europe Mining Equipment Rental Export and Import (2015-2020) 5.4 China Mining Equipment Rental Export and Import (2015-2020) 5.5 Japan Mining Equipment Rental Export and Import (2015-2020) 5.6 India Mining Equipment Rental Export and Import (2015-2020) 5.7 ... 6 Mining Equipment Rental Market - By Type 6.1 Global Mining Equipment Rental Production and Market Share by Types (2015-2020) 6.1.1 Global Mining Equipment Rental Production by Types (2015-2020) 6.1.2 Global Mining Equipment Rental Production Market Share by Types (2015-2020) 6.2 Global Mining Equipment Rental Value and Market Share by Types (2015-2020) 6.2.1 Global Mining Equipment Rental Value by Types (2015-2020) 6.2.2 Global Mining Equipment Rental Value Market Share by Types (2015-2020) 6.3 Global Mining Equipment Rental Production, Price and Growth Rate of Financial Rental (2015-2020) 6.4 Global Mining Equipment Rental Production, Price and Growth Rate of Operating Rental (2015-2020) 7 Mining Equipment Rental Market - By Application 7.1 Global Mining Equipment Rental Consumption and Market Share by Applications (2015-2020) 7.1.1 Global Mining Equipment Rental Consumption by Applications (2015-2020) 7.1.2 Global Mining Equipment Rental Consumption Market Share by Applications (2015-2020) 7.2 Global Mining Equipment Rental Consumption and Growth Rate of Coal mining (2015-2020) 7.3 Global Mining Equipment Rental Consumption and Growth Rate of Metal mining (2015-2020) 7.4 Global Mining Equipment Rental Consumption and Growth Rate of Mineral mining (2015-2020) 7.5 Global Mining Equipment Rental Consumption and Growth Rate of Others (2015-2020) 8 North America Mining Equipment Rental Market 8.1 North America Mining Equipment Rental Market Size 8.2 United States Mining Equipment Rental Market Size 8.3 Canada Mining Equipment Rental Market Size 8.4 Mexico Mining Equipment Rental Market Size 8.5 The Influence of COVID-19 on North America Market 9 Europe Mining Equipment Rental Market Analysis 9.1 Europe Mining Equipment Rental Market Size 9.2 Germany Mining Equipment Rental Market Size 9.3 United Kingdom Mining Equipment Rental Market Size 9.4 France Mining Equipment Rental Market Size 9.5 Italy Mining Equipment Rental Market Size 9.6 Spain Mining Equipment Rental Market Size 9.7 The Influence of COVID-19 on Europe Market 10 Asia-Pacific Mining Equipment Rental Market Analysis 10.1 Asia-Pacific Mining Equipment Rental Market Size 10.2 China Mining Equipment Rental Market Size 10.3 Japan Mining Equipment Rental Market Size 10.4 South Korea Mining Equipment Rental Market Size 10.5 Southeast Asia Mining Equipment Rental Market Size 10.6 India Mining Equipment Rental Market Size 10.7 The Influence of COVID-19 on Asia Pacific Market 11 Middle East and Africa Mining Equipment Rental Market Analysis 11.1 Middle East and Africa Mining Equipment Rental Market Size 11.2 Saudi Arabia Mining Equipment Rental Market Size 11.3 UAE Mining Equipment Rental Market Size 11.4 South Africa Mining Equipment Rental Market Size 11.5 The Influence of COVID-19 on Middle East and Africa Market 12 South America Mining Equipment Rental Market Analysis 12.1 South America Mining Equipment Rental Market Size 12.2 Brazil Mining Equipment Rental Market Size 12.3 The Influence of COVID-19 on South America Market 13 Company Profiles 13.1 Atlas Copco 13.1.1 Atlas Copco Basic Information 13.1.2 Atlas Copco Product Profiles, Application and Specification 13.1.3 Atlas Copco Mining Equipment Rental Market Performance (2015-2020) 13.2 McDowell 13.2.1 McDowell Basic Information 13.2.2 McDowell Product Profiles, Application and Specification 13.2.3 McDowell Mining Equipment Rental Market Performance (2015-2020) 13.3 Komatsu 13.3.1 Komatsu Basic Information 13.3.2 Komatsu Product Profiles, Application and Specification 13.3.3 Komatsu Mining Equipment Rental Market Performance (2015-2020) 13.4 H&E Equipment Services 13.4.1 H&E Equipment Services Basic Information 13.4.2 H&E Equipment Services Product Profiles, Application and Specification 13.4.3 H&E Equipment Services Mining Equipment Rental Market Performance (2015-2020) 13.5 EMECO 13.5.1 EMECO Basic Information 13.5.2 EMECO Product Profiles, Application and Specification 13.5.3 EMECO Mining Equipment Rental Market Performance (2015-2020) 13.6 Eqstra 13.6.1 Eqstra Basic Information 13.6.2 Eqstra Product Profiles, Application and Specification 13.6.3 Eqstra Mining Equipment Rental Market Performance (2015-2020) 13.7 Caterpillar 13.7.1 Caterpillar Basic Information 13.7.2 Caterpillar Product Profiles, Application and Specification 13.7.3 Caterpillar Mining Equipment Rental Market Performance (2015-2020) 13.8 SMS Rental 13.8.1 SMS Rental Basic Information 13.8.2 SMS Rental Product Profiles, Application and Specification 13.8.3 SMS Rental Mining Equipment Rental Market Performance (2015-2020) 13.9 Hertz Equipment Rental 13.9.1 Hertz Equipment Rental Basic Information 13.9.2 Hertz Equipment Rental Product Profiles, Application and Specification 13.9.3 Hertz Equipment Rental Mining Equipment Rental Market Performance (2015-2020) 13.10 United Rentals 13.10.1 United Rentals Basic Information 13.10.2 United Rentals Product Profiles, Application and Specification 13.10.3 United Rentals Mining Equipment Rental Market Performance (2015-2020) 13.11 United Mining Rentals 13.11.1 United Mining Rentals Basic Information 13.11.2 United Mining Rentals Product Profiles, Application and Specification 13.11.3 United Mining Rentals Mining Equipment Rental Market Performance (2015-2020) 13.12 AMECO 13.12.1 AMECO Basic Information 13.12.2 AMECO Product Profiles, Application and Specification 13.12.3 AMECO Mining Equipment Rental Market Performance (2015-2020) 13.13 Sunbelt Rentals 13.13.1 Sunbelt Rentals Basic Information 13.13.2 Sunbelt Rentals Product Profiles, Application and Specification 13.13.3 Sunbelt Rentals Mining Equipment Rental Market Performance (2015-2020) 14 Market Forecast - By Regions 14.1 North America Mining Equipment Rental Market Forecast (2020-2025) 14.2 Europe Mining Equipment Rental Market Forecast (2020-2025) 14.3 Asia-Pacific Mining Equipment Rental Market Forecast (2020-2025) 14.4 Middle East and Africa Mining Equipment Rental Market Forecast (2020-2025) 14.5 South America Mining Equipment Rental Market Forecast (2020-2025) 15 Market Forecast - By Type and Applications 15.1 Global Mining Equipment Rental Market Forecast by Types (2020-2025) 15.1.1 Global Mining Equipment Rental Market Forecast Production and Market Share by Types (2020-2025) 15.1.2 Global Mining Equipment Rental Market Forecast Value and Market Share by Types (2020-2025) 15.2 Global Mining Equipment Rental Market Forecast by Applications (2020-2025)

Inquiry For Buying

Mining Equipment Rental

Request Sample

Mining Equipment Rental