Mobile Accounting Apps Market Size, Share, and Trends Analysis Report

CAGR :

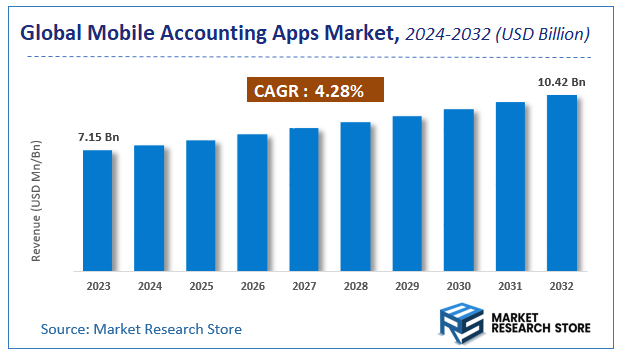

| Market Size 2023 (Base Year) | USD 7.15 Billion |

| Market Size 2032 (Forecast Year) | USD 10.42 Billion |

| CAGR | 4.28% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Mobile Accounting Apps Market Insights

According to Market Research Store, the global mobile accounting apps market size was valued at around USD 7.15 billion in 2023 and is estimated to reach USD 10.42 billion by 2032, to register a CAGR of approximately 4.28% in terms of revenue during the forecast period 2024-2032.

The mobile accounting apps report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Mobile Accounting Apps Market: Overview

The Mobile Accounting Apps Market focuses on software applications designed for managing financial transactions, bookkeeping, invoicing, and expense tracking on mobile devices. These apps cater to businesses, freelancers, and individuals, offering features such as real-time financial reporting, cloud synchronization, multi-device access, and integration with banking and tax systems. They are widely used in small and medium-sized enterprises (SMEs), startups, and self-employed professionals for seamless financial management on the go.

The growth of the market is driven by the increasing adoption of cloud-based financial solutions, the rising demand for remote accounting capabilities, and the growing preference for mobile-first business operations. Advancements in artificial intelligence (AI) and automation have enhanced app functionalities, including predictive analytics, automated categorization, and AI-driven financial insights. The surge in e-commerce, digital payments, and subscription-based business models has further fueled demand for mobile accounting solutions.

Key Highlights

- The mobile accounting apps market is anticipated to grow at a CAGR of 4.28% during the forecast period.

- The global mobile accounting apps market was estimated to be worth approximately USD 7.15 billion in 2023 and is projected to reach a value of USD 10.42 billion by 2032.

- The growth of the mobile accounting apps market is being driven by several factors, including the increasing adoption of smartphones and mobile devices, the growing demand for real-time access to financial data, the increasing need for businesses to improve efficiency and productivity, and the rising popularity of cloud-based accounting solutions.

- Based on the product, the on-premise segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the SMEs segment is projected to swipe the largest market share.

- In terms of pricing model, the subscription segment is expected to dominate the market.

- Based on the platform, the android segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Mobile Accounting Apps Market: Dynamics

Key Drivers

- Increased Mobile Device Usage: The widespread adoption of smartphones and tablets has made mobile access to accounting software a necessity for businesses of all sizes.

- Enhanced Mobility and Flexibility: Mobile accounting apps provide businesses with the flexibility to manage their finances anytime, anywhere, regardless of their location.

- Improved Efficiency and Productivity: Automating tasks like invoicing, expense tracking, and bank reconciliation through mobile apps streamlines operations and saves time for businesses.

- Real-time Insights: Mobile apps provide real-time access to financial data, enabling businesses to make informed decisions quickly and respond to changing market conditions.

Restraints

- Data Security and Privacy Concerns: Concerns about data security and privacy, especially with sensitive financial information being accessed and stored on mobile devices.

- Limited Functionality Compared to Desktop Versions: Some mobile apps may have limited functionality compared to their desktop counterparts, which can restrict their use for complex accounting tasks.

- Internet Connectivity Dependence: Reliance on a stable internet connection for accessing and using mobile accounting apps can be a limitation in areas with poor connectivity.

- User Interface and Experience: The user interface and user experience (UI/UX) of some mobile accounting apps can be complex or difficult to navigate, hindering user adoption.

Opportunities

- Integration with Other Business Applications: Integrating mobile accounting apps with other business applications, such as CRM software, e-commerce platforms, and payment gateways, to streamline workflows and improve data flow.

- Artificial Intelligence (AI) and Machine Learning (ML) Integration: Incorporating AI and ML capabilities to automate tasks, improve data analysis, and provide personalized insights and recommendations.

- Development of Industry-Specific Solutions: Developing specialized mobile accounting apps for specific industries, such as retail, healthcare, and construction, to address their unique needs and requirements.

- Focus on User Experience: Improving the user interface and user experience of mobile accounting apps to make them more intuitive, user-friendly, and accessible to a wider audience.

Challenges

- Maintaining Data Security and Privacy: Ensuring the security and privacy of sensitive financial data stored and accessed on mobile devices.

- Addressing Connectivity Issues: Ensuring reliable access to mobile accounting apps in areas with limited or unstable internet connectivity.

- Staying Competitive: Staying competitive in a rapidly evolving market with increasing competition from other software providers and the emergence of new technologies.

- Meeting Regulatory Requirements: Complying with evolving regulations related to data security, privacy, and financial reporting.

Mobile Accounting Apps Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Accounting Apps Market |

| Market Size in 2023 | USD 7.15 Billion |

| Market Forecast in 2032 | USD 10.42 Billion |

| Growth Rate | CAGR of 4.28% |

| Number of Pages | 140 |

| Key Companies Covered | Chargebee, Zoho, 2ndsite, NetSuite, FINSYNC, Deskera, Aplos, Workday, Certify, QuickBooks, Fyle, Oracle, ProSoft Solutions, Acumatica, ExpenseWire, IBM |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Accounting Apps Market: Segmentation Insights

The global mobile accounting apps market is divided by product, application, pricing model, platform and region.

Segmentation Insights by Product

Based on product, the global mobile accounting apps market is divided into on-premise, web-based, and cloud-based.

On-Premise solutions dominate in industries requiring full control over financial data, security, and compliance with strict regulations. These apps are preferred by large enterprises and financial institutions that prioritize data sovereignty and customization.

Web-Based accounting apps hold a substantial share, offering accessibility and ease of use without the need for extensive IT infrastructure. Small and medium-sized businesses (SMBs) favor these solutions due to their balance between flexibility and cost-effectiveness.

Cloud-Based solutions are rapidly growing as businesses seek scalability, real-time data synchronization, and remote accessibility. Cloud adoption is driven by integration with other financial tools, automation capabilities, and cost savings on IT infrastructure.

Segmentation Insights by Application

On the basis of application, the global mobile accounting apps market is bifurcated into SMEs, and large enterprises.

SMEs dominate the Mobile Accounting Apps Market due to their increasing adoption of cost-effective, cloud-based solutions. Small and medium-sized enterprises prioritize accessibility, automation, and real-time financial management, making mobile accounting apps a crucial tool for streamlining operations.

Large Enterprises also represent a significant segment, utilizing advanced accounting applications for complex financial reporting, compliance, and integration with enterprise resource planning (ERP) systems. While on-premise solutions remain relevant for large corporations, cloud adoption is growing due to its scalability and data analytics capabilities.

Segmentation Insights by Pricing Model

On the basis of pricing model, the global mobile accounting apps market is bifurcated into subscription, and one-time payment.

Subscription dominates the Mobile Accounting Apps Market as businesses increasingly prefer flexible, cloud-based solutions with regular updates, customer support, and scalability. The subscription model allows SMEs and large enterprises to access advanced features without high upfront costs, making it the most adopted pricing strategy.

One-Time Payment remains relevant, particularly for businesses seeking cost control and ownership over their accounting software. However, its adoption is lower compared to subscription models due to limited updates, scalability challenges, and higher initial investment.

Segmentation Insights by Platform

On the basis of platform, the global mobile accounting apps market is bifurcated into android, iOS, and windows.

Android dominates the Mobile Accounting Apps Market due to its widespread adoption, affordability, and compatibility with various devices. Many businesses, especially SMEs, prefer Android-based solutions for their flexibility and cost-effectiveness.

iOS holds a significant share, particularly among premium users and enterprises prioritizing security and seamless integration with Apple’s ecosystem. IOS-based accounting apps are popular in finance and corporate sectors.

Windows has a smaller presence in the mobile accounting space, mainly serving enterprises with Windows-based infrastructure. While not as dominant as Android or iOS, it remains relevant for specific business needs.

Mobile Accounting Apps Market: Regional Insights

- North America is expected to dominates the global market

North America dominates the mobile accounting apps market due to the widespread adoption of cloud-based financial solutions, strong presence of leading accounting software providers, and the high number of businesses leveraging mobile financial management tools. The high adoption of cloud-based financial solutions, strong presence of major accounting software providers, and increasing number of SMEs embracing digital transformation drive market growth. Additionally, the integration of AI-powered automation and compliance with financial regulations are further propelling adoption among businesses and individuals.

Europe is a key market for mobile accounting apps, with strong demand from countries such as the UK, Germany, and France. The region's strict financial regulations, along with a growing focus on digitalization and cloud accounting, are fueling market expansion. Many businesses in Europe are transitioning to mobile-first financial solutions, especially with the rise of remote work and the need for real-time financial management.

Asia-Pacific is witnessing rapid growth in the mobile accounting apps market, primarily driven by China, India, and Japan. The increasing adoption of digital payment systems, expansion of the fintech sector, and a growing number of SMEs are boosting demand for mobile accounting solutions. Governments in the region are also encouraging digital financial management through various initiatives, further driving market growth.

Latin America is an emerging market for mobile accounting apps, with Brazil, Mexico, and Argentina showing increasing adoption. The region’s growing entrepreneurship culture, rising smartphone penetration, and demand for cost-effective financial solutions are contributing to market expansion. However, challenges such as regulatory complexities and limited financial literacy in some areas may slow adoption.

Middle East and Africa region is gradually adopting mobile accounting apps, particularly in the UAE, Saudi Arabia, and South Africa. The push for digital transformation in financial services, growing SME sector, and increasing reliance on mobile-based business solutions are driving market growth. However, slower adoption in some parts of Africa due to infrastructure limitations poses a challenge.

Mobile Accounting Apps Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the mobile accounting apps market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global mobile accounting apps market include:

- 2ndsite

- Acumatica

- Aplos

- Certify

- Chargebee

- Deskera

- ExpenseWire

- FINSYNC

- Fyle

- IBM

- NetSuite

- Oracle

- ProSoft Solutions

- QuickBooks

- Workday

- Zoho

The global mobile accounting apps market is segmented as follows:

By Product

- On-Premise

- Web-Based

- Cloud-Based

By Applications

- SMEs

- Large Enterprises

By Pricing Model

- Subscription

- One-Time Payment

By Platform

- Android

- iOS

- Windows

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global mobile accounting apps market size was projected at approximately US$ 7.15 billion in 2023. Projections indicate that the market is expected to reach around US$ 10.42 billion in revenue by 2032.

The global mobile accounting apps market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 4.28% during the forecast period from 2024 to 2032.

North America is expected to dominate the global mobile accounting apps market.

The global mobile accounting apps market is being driven by a surge in digitalization, the increasing preference for cloud-based solutions, and the growing need for real-time financial insights.

Some of the prominent players operating in the global mobile accounting apps market are; 2ndsite, Acumatica, Aplos, Certify, Chargebee, Deskera, ExpenseWire, FINSYNC, Fyle, IBM, NetSuite, Oracle, ProSoft Solutions, QuickBooks, Workday, Zoho, and others.

Table Of Content

Inquiry For Buying

Mobile Accounting Apps

Request Sample

Mobile Accounting Apps