Next-Generation Communication Devices Market Size, Share, and Trends Analysis Report

CAGR :

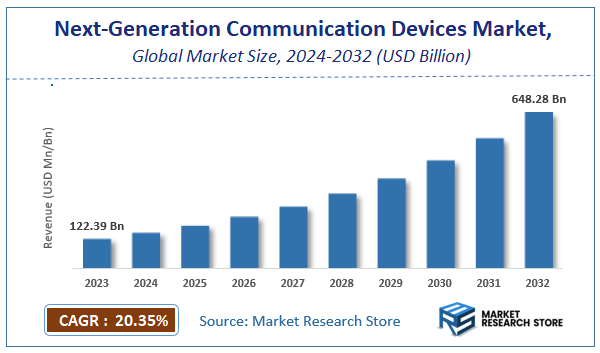

| Market Size 2023 (Base Year) | USD 122.39 Billion |

| Market Size 2032 (Forecast Year) | USD 648.28 Billion |

| CAGR | 20.35% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Next-Generation Communication Devices Market Insights

According to Market Research Store, the global next-generation communication devices market size was valued at around USD 122.39 billion in 2023 and is estimated to reach USD 648.28 billion by 2032, to register a CAGR of approximately 20.35% in terms of revenue during the forecast period 2024-2032.

The next-generation communication devices report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Next-Generation Communication Devices Market: Overview

Next-generation communication devices refer to advanced technological solutions that enable faster, more efficient, and more secure communication. These devices incorporate cutting-edge innovations such as 5G and 6G connectivity, artificial intelligence (AI), edge computing, and Internet of Things (IoT) integration. Examples include smart wearables, AI-powered voice assistants, next-gen satellite communication systems, and ultra-fast broadband devices. The evolution of these devices is driven by the growing demand for seamless connectivity, real-time data transmission, and enhanced user experience across industries such as telecommunications, healthcare, automotive, and defense.

Key Highlights

- The next-generation communication devices market is anticipated to grow at a CAGR of 20.35% during the forecast period.

- The global next-generation communication devices market was estimated to be worth approximately USD 122.39 billion in 2023 and is projected to reach a value of USD 648.28 billion by 2032.

- The growth of the next-generation communication devices market is being driven by the rapid expansion of 5G infrastructure, increasing demand for IoT devices, and advancements in mobile networks.

- Based on the technology, the 5G technology segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user industry, the manufacturing segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Next-Generation Communication Devices Market: Dynamics

Key Growth Drivers:

- Demand for Higher Bandwidth and Faster Speeds: The increasing consumption of data-intensive applications like video streaming, online gaming, and virtual reality fuels the demand for devices that can support higher bandwidth and faster speeds (e.g., 5G, Wi-Fi 6E and beyond).

- Growing Adoption of IoT: The proliferation of Internet of Things (IoT) devices creates a need for communication devices that can seamlessly connect and manage a vast network of interconnected devices.

- Rise of Cloud Computing: Cloud-based services and applications require reliable and high-speed connectivity, driving the demand for advanced communication devices that can support cloud access.

- Advancements in Technology: Continuous innovations in areas like chipsets, antennas, and network protocols are enabling the development of more powerful and efficient communication devices.

Restraints:

- High Cost of Deployment: Deploying next-generation communication infrastructure (e.g., 5G networks) can be expensive, which can hinder market growth, especially in developing regions.

- Spectrum Availability: The availability of suitable spectrum for next-generation networks is a crucial factor, and spectrum allocation can be a complex and time-consuming process.

- Security Concerns: As communication networks become more complex, security threats also increase, raising concerns about data breaches and cyberattacks.

Opportunities:

- Expansion of 5G and Beyond: The rollout of 5G networks and the development of even more advanced technologies (e.g., 6G) present significant growth opportunities for communication device manufacturers.

- Edge Computing: The rise of edge computing creates a demand for communication devices that can process data closer to the source, reducing latency and improving performance.

- Integration with AI and Machine Learning: Integrating AI and machine learning capabilities into communication devices can enable smarter and more efficient network management.

Challenges:

- Interoperability Issues: Ensuring interoperability between different devices and networks can be challenging, especially as new technologies emerge.

- Regulatory Landscape: The regulatory landscape for communication devices can be complex and vary across different regions, creating challenges for manufacturers.

- Competition: The communication device market is highly competitive, requiring companies to constantly innovate and offer competitive pricing.

Next-Generation Communication Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Next-Generation Communication Devices Market |

| Market Size in 2023 | USD 122.39 Billion |

| Market Forecast in 2032 | USD 648.28 Billion |

| Growth Rate | CAGR of 20.35% |

| Number of Pages | 140 |

| Key Companies Covered | Huawei, Cisco, Analong Devices Inc., Ericsson, Netgear, Koninklijke Philips NV, Panasonic, Purelifi, Arris International, Nokia, ZTE |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Next-Generation Communication Devices Market: Segmentation Insights

The global next-generation communication devices market is divided by technology, end-user industry, and region.

Segmentation Insights by Type

Based on type, the global next-generation communication devices market is divided into 5G, visible light communication / li-fi, wireless sensor networks (WSN), and other.

The 5G technology segment dominates the next-generation communication devices market due to its widespread adoption across various industries, including telecommunications, automotive, healthcare, and industrial automation. The high-speed, low-latency, and massive connectivity capabilities of 5G make it essential for applications such as smart cities, autonomous vehicles, and IoT networks. With continuous investments in infrastructure development and network expansion, 5G remains at the forefront of next-generation communication technology, driving significant market growth.

Following 5G, Wireless Sensor Networks (WSN) represent a crucial segment, primarily due to their role in industrial automation, environmental monitoring, and smart agriculture. These networks enable real-time data collection and analysis, enhancing efficiency and predictive maintenance in various sectors. The growing adoption of Industry 4.0 and the increasing need for remote monitoring solutions contribute to the rising demand for WSN technology.

Visible Light Communication (VLC) or Li-Fi is an emerging segment that leverages light waves for wireless data transmission. While it offers advantages such as high-speed connectivity and enhanced security, its market penetration is still limited compared to 5G and WSN. VLC finds applications in areas where radio frequency (RF) communication is restricted, such as hospitals, airplanes, and underwater communication. However, challenges related to infrastructure development and integration with existing networks hinder its widespread adoption.

Segmentation Insights by End-User Industry

On the basis of end-user industry, the global next-generation communication devices market is bifurcated into manufacturing, military & defense, automotive and other.

The Manufacturing sector dominates the next-generation communication devices market due to the rapid adoption of Industry 4.0, automation, and IoT-enabled smart factories. Advanced communication technologies such as 5G and Wireless Sensor Networks (WSN) enhance real-time monitoring, predictive maintenance, and machine-to-machine communication, leading to improved efficiency and productivity. With the increasing need for seamless connectivity and data-driven decision-making, manufacturing continues to be the largest end-user of next-generation communication devices.

The Military & Defense sector follows closely, leveraging advanced communication technologies for secure and high-speed data transmission in critical operations. 5G, Li-Fi, and encrypted wireless communication networks play a vital role in battlefield management, drone communication, and secure military networking. Governments worldwide are investing heavily in upgrading defense communication infrastructure, driving significant market growth in this segment.

The Automotive industry is another key adopter of next-generation communication technologies, particularly with the rise of connected and autonomous vehicles. 5G plays a crucial role in enabling vehicle-to-everything (V2X) communication, enhancing road safety, traffic management, and infotainment systems. Wireless Sensor Networks (WSN) also contribute to vehicle diagnostics and predictive maintenance, making communication technology a critical component in the future of mobility.

Next-Generation Communication Devices Market: Regional Insights

- North America is expected to dominates the global market

North America stands as a prominent leader in the next-generation communication devices market, driven by early adoption of advanced technologies and a robust digital infrastructure. The presence of major technology companies and continuous innovation significantly contribute to the market's expansion. The United States and Canada are key contributors, with substantial investments in 5G technology and IoT deployments. The region's focus on research and development, coupled with strategic partnerships, has solidified its dominant position in the market.

Asia Pacific is witnessing remarkable growth in the next-generation communication devices market, attributed to the rapid expansion of 5G infrastructure, increasing smartphone penetration, and the growing demand for smart transportation and automotive solutions. Countries like China, India, Japan, and South Korea are at the forefront of this technological advancement, with significant investments in communication technologies and infrastructure. The region's emphasis on digital transformation and smart city initiatives further propels the market's expansion.

Europe holds a significant share in the next-generation communication devices market, characterized by strong government initiatives, advancements in communication technologies, and increasing demand from various industries. Countries such as Germany, the United Kingdom, and France are key contributors, focusing on the development and deployment of advanced communication solutions. The region's commitment to research and development, along with strategic investments, fosters a conducive environment for market growth.

The Middle East and Africa region are experiencing steady growth in the next-generation communication devices market, driven by digital transformation, infrastructure investments, and increasing connectivity. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are adopting advanced communication technologies to enhance their networks and services. The region's focus on smart city projects and technological innovation contributes to the market's positive trajectory.

Latin America is also contributing to the growth of the next-generation communication devices market, with countries such as Brazil, Argentina, and Chile witnessing a surge in demand for advanced communication solutions. Economic development, infrastructure investments, and rising disposable incomes are key factors driving the market in this region. The focus on enhancing telecommunication networks and adopting new technologies supports the market's expansion in Latin America.

Next-Generation Communication Devices Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the next-generation communication devices market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global next-generation communication devices market include:

- Huawei

- Cisco

- Analong Devices Inc.

- Ericsson

- Netgear

- Koninklijke Philips NV

- Panasonic

- Purelifi

- Arris International

- Nokia

- ZTE

The global next-generation communication devices market is segmented as follows:

By Technology

- 5G

- Visible Light Communication / Li-Fi

- Wireless Sensor Networks (WSN)

- Other

End-User Industry

- Manufacturing

- Military & Defense

- Automotive

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global next-generation communication devices market size was projected at approximately US$ 122.39 billion in 2023. Projections indicate that the market is expected to reach around US$ 648.28 billion in revenue by 2032.

The global next-generation communication devices market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 20.35% during the forecast period from 2024 to 2032.

North America is expected to dominate the global next-generation communication devices market.

The global next-generation communication devices market is primarily driven by the rapid expansion of 5G infrastructure, increasing demand for IoT devices, and advancements in mobile networks. Additionally, growing investments in smart city projects, automation, and digital transformation are fueling market growth.

Some of the prominent players operating in the global next-generation communication devices market are; Huawei, Cisco, Analong Devices Inc., Ericsson, Netgear, Koninklijke Philips NV, Panasonic, Purelifi, Arris International, Nokia, ZTE, and others.

Table Of Content

Inquiry For Buying

Next-Generation Communication Devices

Request Sample

Next-Generation Communication Devices