Oil Platform Market Size, Share, and Trends Analysis Report

CAGR :

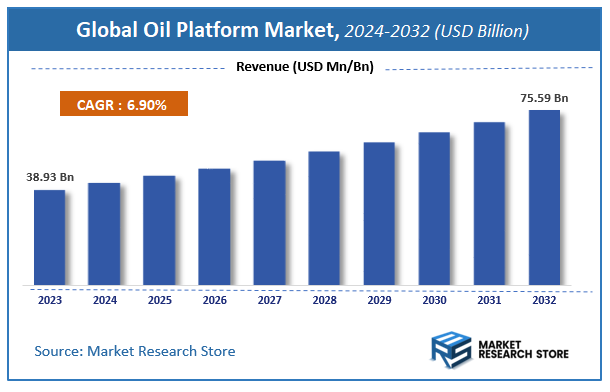

| Market Size 2023 (Base Year) | USD 38.93 Billion |

| Market Size 2032 (Forecast Year) | USD 75.59 Billion |

| CAGR | 6.9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Oil Platform Market Insights

According to Market Research Store, the global oil platform market size was valued at around USD 38.93 billion in 2023 and is estimated to reach USD 75.59 billion by 2032, to register a CAGR of approximately 6.9% in terms of revenue during the forecast period 2024-2032.

The oil platform report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Oil Platform Market: Overview

An oil platform, also known as an offshore platform, is a large structure used for extracting and processing oil and natural gas from beneath the seabed. These platforms are designed to withstand harsh marine environments and can be either fixed to the ocean floor or floating, depending on the depth of the water and geological conditions. They house drilling rigs, processing equipment, and living quarters for workers, enabling continuous extraction and initial processing of hydrocarbons before transportation to refineries. Oil platforms play a crucial role in the global energy supply chain, supporting offshore exploration and production activities.

Key Highlights

- The oil platform market is anticipated to grow at a CAGR of 6.9% during the forecast period.

- The global oil platform market was estimated to be worth approximately USD 38.93 billion in 2023 and is projected to reach a value of USD 75.59 billion by 2032.

- The growth of the oil platform market is being driven by rising energy demand, increasing offshore exploration activities, and advancements in drilling technology.

- Based on the platform type, the fixed platforms segment is growing at a high rate and is projected to dominate the market.

- On the basis of component types, the drilling equipment segment is projected to swipe the largest market share.

- In terms of depth of operation, the shallow water (up to 500m) segment is expected to dominate the market.

- Based on the ownership, the publicly traded companies segment is expected to dominate the market.

- In terms of application, the oil extraction segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Oil Platform Market: Dynamics

Key Growth Drivers:

- Global Energy Demand: The world's growing energy needs, driven by population growth and economic development, continue to support the demand for oil and gas, thus driving the need for oil platforms.

- Offshore Reserves: Many significant oil and gas reserves are located offshore, requiring the use of oil platforms for their extraction.

- Technological Advancements: Improvements in drilling technology, platform design, and subsea production systems are making it possible to access deeper and more remote offshore reserves, expanding the market.

Restraints:

- Fluctuating Oil Prices: The oil and gas industry is cyclical, and periods of low oil prices can significantly impact investment in new oil platforms, as they are expensive to build and operate.

- Environmental Concerns: Offshore oil and gas operations carry environmental risks, such as oil spills and habitat disruption, which can lead to regulatory hurdles and public opposition, restraining market growth.

- High Capital Costs: Constructing and operating oil platforms requires substantial upfront investment, which can be a barrier for some companies, particularly smaller players.

Opportunities:

- Deepwater and Ultra-Deepwater Exploration: Significant untapped reserves lie in deep and ultra-deep water, presenting opportunities for companies with the technology and expertise to explore and develop these resources.

- Aging Platform Redevelopment: Many existing oil platforms are aging, creating opportunities for companies specializing in platform refurbishment, life extension, or decommissioning.

- Focus on Efficiency and Cost Reduction: Developing more efficient and cost-effective platform designs and operational strategies can enhance profitability and attract investment.

Challenges:

- Safety and Operational Risks: Offshore oil and gas operations are inherently risky, with potential for accidents, spills, and equipment failures. Ensuring safety and operational integrity is a major challenge.

- Regulatory Compliance: The oil platform industry is subject to stringent environmental and safety regulations, which can be complex and costly to comply with.

- Geopolitical Factors: Geopolitical instability and conflicts in certain regions can impact access to offshore reserves and create challenges for oil platform development.

Oil Platform Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oil Platform Market |

| Market Size in 2023 | USD 38.93 Billion |

| Market Forecast in 2032 | USD 75.59 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 140 |

| Key Companies Covered | Kvaerner, Ramboll, Mammoet, Keppel, Brasbauer, Wintershall Dea, MODEC, SBM Offshore, BW Offshore |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Oil Platform Market: Segmentation Insights

The global oil platform market is divided by platform type, component types, depth of operation, ownership, application, and region.

Segmentation Insights by Platform Type

Based on type, the global oil platform market is divided into fixed platforms, floating platforms, subsea systems, tension leg platforms (TLP), and spar platforms.

Fixed platforms dominate the oil platform market due to their extensive use in shallow and mid-depth waters. These platforms, typically constructed from concrete or steel, are permanently anchored to the seabed, providing high stability and durability. They are widely preferred for long-term drilling operations, especially in mature offshore regions such as the Gulf of Mexico and the North Sea. The ability to support multiple wells and production facilities makes fixed platforms the go-to choice for major oil companies seeking cost-effective and stable offshore extraction solutions.

Floating platforms hold the second-largest market share, favored for their adaptability in deepwater and ultra-deepwater exploration. These platforms, which include semi-submersibles and drillships, are not fixed to the seabed but instead use anchoring or dynamic positioning systems. Their flexibility allows oil companies to explore and produce hydrocarbons in previously inaccessible areas, making them crucial for offshore operations in regions like the North Atlantic and West Africa. The growing focus on deepwater reserves continues to drive the demand for floating platforms.

Subsea systems are gaining momentum as oil companies seek cost-efficient and flexible extraction methods. These systems, installed on the seafloor, include wellheads, manifolds, and flowlines that connect directly to processing facilities. They are particularly advantageous in harsh environments and deepwater operations, reducing the need for large surface structures. The expansion of deep-sea projects, particularly in the Gulf of Mexico and Brazil’s pre-salt fields, is fueling the growth of subsea systems.

Tension Leg Platforms (TLP) represent a smaller but significant portion of the market, mainly used in deepwater fields. These platforms are tethered to the seabed using vertical tendons, providing a stable structure for drilling and production. Their design minimizes vertical movement, making them suitable for areas with strong ocean currents. The adoption of TLPs is primarily seen in the Gulf of Mexico and offshore Brazil, where deepwater reserves necessitate stable yet mobile extraction platforms.

SPAR platforms hold the smallest share of the market, primarily used for ultra-deepwater drilling and production. These platforms consist of a cylindrical hull that extends deep into the water, providing excellent stability. While SPAR platforms are highly effective in extreme offshore conditions, their high installation costs and complex engineering requirements limit widespread adoption. They are primarily deployed in select deepwater fields, such as the Gulf of Mexico and the South China Sea, where their long-term operational efficiency outweighs initial investment costs.

Segmentation Insights by Component Types

Based on component types, the global oil platform market is divided into drilling equipment, production equipment, power generation equipment, subsea processing systems, and safety & security systems.

Drilling equipment dominates the oil platform market as it is essential for extracting hydrocarbons from beneath the seabed. This category includes drill bits, mud pumps, blowout preventers (BOPs), and derricks, all of which play a critical role in both exploratory and production drilling. The increasing global energy demand and the expansion of offshore drilling activities, particularly in deepwater and ultra-deepwater regions, continue to drive the demand for advanced drilling equipment. Companies invest heavily in high-performance and automated drilling systems to improve efficiency, reduce operational risks, and enhance well productivity.

Production equipment holds the second-largest market share, as it is crucial for separating, processing, and transporting extracted oil and gas. This category includes separators, compressors, pipelines, and storage units that help optimize production efficiency and ensure the smooth flow of hydrocarbons from wells to onshore facilities. With advancements in enhanced oil recovery (EOR) techniques and the need for efficient processing in deep-sea environments, production equipment remains a vital component in offshore operations.

Power generation equipment is another significant segment, providing the necessary energy to operate drilling and production systems on offshore platforms. This includes gas turbines, diesel generators, and renewable energy systems used to ensure uninterrupted operations. As offshore platforms move into deeper and more remote waters, the demand for reliable and fuel-efficient power generation solutions is growing. Moreover, increasing environmental regulations are pushing companies to adopt cleaner and more energy-efficient power systems.

Subsea processing systems are gaining prominence as offshore oil exploration moves into deepwater and ultra-deepwater fields. These systems, which include subsea separators, boosting stations, and injection systems, enable processing at the seabed, reducing the reliance on surface platforms. The ability to optimize production efficiency while minimizing costs and infrastructure requirements makes subsea processing an attractive solution, particularly in regions like the Gulf of Mexico and the North Sea.

Safety & security systems represent the smallest but essential segment of the market. These systems include fire suppression, gas detection, cybersecurity, and emergency response mechanisms designed to protect offshore assets, personnel, and the environment. As offshore drilling faces increasing scrutiny due to environmental and safety concerns, companies are investing in advanced safety technologies to prevent accidents, comply with regulations, and enhance operational reliability. While this segment may not drive revenue like drilling or production equipment, it remains a crucial component for ensuring the long-term viability of offshore operations.

Segmentation Insights by Depth of Operation

Based on depth of operation, the global oil platform market is divided into shallow water (up to 500m), deep water (500m - 1500m), and ultra-deep water (beyond 1500m).

Shallow water (up to 500m) platforms dominate the oil platform market due to their cost-effectiveness and long-established infrastructure. These platforms, including fixed platforms and jack-up rigs, are widely used in mature offshore regions such as the Gulf of Mexico, the North Sea, and Southeast Asia. The relatively lower exploration and production costs, ease of maintenance, and accessibility make shallow-water platforms the preferred choice for oil companies. Additionally, many shallow-water reserves are still productive, and enhanced oil recovery (EOR) techniques are extending their operational lifespan, further driving demand.

Deep water (500m - 1500m) platforms hold the second-largest market share, as offshore oil exploration has expanded into deeper waters to tap into larger, untapped reserves. Floating platforms such as semi-submersibles and tension leg platforms (TLPs) are commonly used in these depths, offering stability and flexibility in harsh offshore environments. The increasing focus on deepwater exploration, particularly in regions like Brazil’s pre-salt fields, the Gulf of Mexico, and West Africa, is driving the growth of this segment. Although deepwater projects involve higher operational costs, advancements in drilling and production technologies are making them more viable.

Ultra-deep water (beyond 1500m) platforms represent the smallest but rapidly growing segment of the market. These platforms, including SPAR platforms and advanced subsea processing systems, are designed to operate in extreme conditions where traditional platforms are not feasible. Ultra-deepwater reserves, such as those found off the coasts of Brazil and the South China Sea, contain significant untapped oil and gas resources, prompting oil companies to invest in high-tech solutions to extract hydrocarbons efficiently. Despite the high capital and operational expenditures, the long-term production potential and increasing energy demand are driving investments in ultra-deepwater exploration.

Segmentation Insights by Ownership

Based on ownership, the global oil platform market is divided into private operators, publicly traded companies, joint ventures, and government agencies.

Publicly traded companies dominate the oil platform market due to their extensive resources, technological expertise, and ability to undertake large-scale offshore projects. Major oil corporations like ExxonMobil, Shell, and BP operate numerous offshore platforms globally, leveraging shareholder investments to fund exploration and production activities. These companies focus on both shallow and deepwater drilling, investing in advanced extraction technologies and sustainability initiatives. Their financial stability and operational scale allow them to lead offshore development in key regions such as the Gulf of Mexico, the North Sea, and West Africa.

Government agencies hold the second-largest market share, as many countries regulate and control their offshore oil and gas resources. State-owned enterprises like Saudi Aramco, Petrobras, and China National Offshore Oil Corporation (CNOOC) dominate oil production in their respective regions, ensuring energy security and economic stability. These agencies often collaborate with private and publicly traded companies for offshore exploration, particularly in deepwater and ultra-deepwater reserves. The involvement of national oil companies is especially prominent in the Middle East, Latin America, and Asia-Pacific, where governments play a critical role in resource management.

Joint ventures are a significant segment, enabling multiple stakeholders to share investment risks and technological expertise. These partnerships often involve publicly traded companies, private operators, and government agencies collaborating on offshore projects that require substantial capital and innovation. Joint ventures are particularly common in deepwater and ultra-deepwater exploration, where costs and risks are high. Successful examples include partnerships like BP and Petrobras in Brazil’s pre-salt fields and ExxonMobil’s collaborations with local firms in Guyana’s offshore reserves.

Private operators hold the smallest share of the oil platform market, primarily focusing on smaller offshore projects, shallow-water drilling, and niche exploration opportunities. These companies, often independent oil and gas firms, lack the financial scale of major corporations but remain competitive in regional markets. Some private operators specialize in innovative extraction techniques or service contracts with larger oil firms. While they play a role in the industry, their market presence is limited compared to publicly traded oil giants and state-owned enterprises.

Segmentation Insights by Application

On the basis of application, the global oil platform market is bifurcated into oil extraction, natural gas extraction, and integrated oil & gas extraction.

Oil extraction dominates the oil platform market as crude oil remains the primary focus of offshore exploration and production. Most offshore platforms, including fixed, floating, and subsea systems, are designed to extract and process crude oil efficiently. Oil extraction platforms are heavily concentrated in regions like the Gulf of Mexico, the North Sea, and offshore Brazil, where large reserves drive investment. The continuous global demand for petroleum products, including transportation fuels and petrochemicals, sustains the dominance of this segment, with companies prioritizing advanced drilling technologies and enhanced oil recovery (EOR) techniques to maximize production.

Natural gas extraction holds the second-largest market share, driven by the rising global demand for cleaner energy alternatives. Offshore natural gas production has expanded significantly in regions such as the Eastern Mediterranean, Southeast Asia, and the Middle East, where substantial gas reserves are located. Floating Liquefied Natural Gas (FLNG) platforms and subsea processing systems have enabled efficient gas extraction and transportation, reducing the need for onshore infrastructure. The transition toward natural gas as a lower-carbon fuel source, along with increasing liquefied natural gas (LNG) exports, continues to boost investments in offshore gas extraction.

Integrated oil & gas extraction represents a smaller but strategically significant market segment, where platforms are designed for the simultaneous production of both crude oil and natural gas. These platforms are particularly beneficial in deepwater and ultra-deepwater fields, where mixed hydrocarbon reserves require versatile extraction capabilities. Integrated extraction operations are commonly found in offshore fields in West Africa, Brazil, and the Gulf of Mexico, where companies optimize production efficiency by extracting and processing both resources in a single facility. While this segment is smaller compared to dedicated oil or gas extraction, its importance is growing as energy companies seek to maximize offshore resource utilization.

Oil Platform Market: Regional Insights

- North America is expected to dominates the global market

North America stands as the leading region in the oil platform market, primarily due to extensive offshore exploration and production activities in the Gulf of Mexico. The region's well-established oil and gas infrastructure, combined with significant investments in deepwater and ultra-deepwater projects, has solidified its dominant position. Technological advancements in drilling and production equipment, along with a supportive regulatory environment, have further propelled market growth in North America. The region's commitment to energy independence and innovation continues to attract substantial investments, ensuring its prominence in the global oil platform industry.

Asia Pacific is experiencing notable growth in the oil platform market, driven by escalating energy demands in rapidly developing economies such as China and India. Efforts to explore untapped offshore reserves, particularly in the South China Sea, are intensifying to meet the region's burgeoning energy needs. Investments in advanced drilling technologies and the development of resilient production equipment are enhancing the region's offshore capabilities. As infrastructure development accelerates and energy consumption rises, Asia Pacific is poised to become a significant player in the global oil platform market.

Europe maintains a substantial presence in the oil platform market, with active offshore exploration and production in areas like the North Sea. The region's mature oil and gas sector focuses on optimizing production processes and improving recovery rates from existing fields. A robust regulatory framework and governmental initiatives supporting offshore drilling activities have bolstered market stability. Despite facing challenges such as aging infrastructure and a shift towards renewable energy sources, Europe's strategic investments and technological innovations continue to sustain its role in the global oil platform industry.

The Middle East and Africa region holds significant potential in the oil platform market, attributed to vast offshore oil and gas reserves in areas like the Persian Gulf and West Africa. The region benefits from favorable geological conditions and substantial investments from both domestic and international oil companies. However, geopolitical complexities and fluctuating oil prices present challenges to market expansion. Efforts are underway to enhance offshore exploration and production capabilities, with a focus on modernizing infrastructure and adopting advanced technologies to capitalize on the region's abundant resources.

South America, particularly Brazil, is emerging as a noteworthy region in the oil platform market, driven by the discovery of substantial offshore reserves, especially in the pre-salt layers. These findings have attracted considerable attention from international oil companies, leading to increased investments in offshore exploration and production. Despite challenges related to regulatory frameworks and political uncertainties in certain countries, the region offers promising opportunities for market growth. Ongoing efforts to improve regulatory stability and infrastructure development are expected to further enhance South America's position in the global oil platform industry.

Oil Platform Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the oil platform market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global oil platform market include:

- Kvaerner

- Ramboll

- Mammoet

- Keppel

- Brasbauer

- Wintershall Dea

- MODEC

- SBM Offshore

- BW Offshore

- ExxonMobil

- Royal Dutch Shell

- BP plc

- Chevron Corporation

- TotalEnergies SE

- Saudi Aramco

- Petrobras

- China National Offshore Oil Corporation (CNOOC)

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Transocean Ltd.

- Valaris plc

- Noble Corporation

- Maersk Drilling

- Seadrill Limited

- Weatherford International plc

- Saipem S.p.A.

- TechnipFMC plc

- Woodside Energy

The global oil platform market is segmented as follows:

By Platform Type

- Fixed Platforms

- Floating Platforms

- Subsea Systems

- Tension Leg Platforms (TLP)

- SPAR Platforms

By Component Types

- Drilling Equipment

- Production Equipment

- Power Generation Equipment

- Subsea Processing Systems

- Safety and Security Systems

By Depth of Operation

- Shallow Water (up to 500m)

- Deep Water (500m - 1500m)

- Ultra-Deep Water (beyond 1500m)

By Ownership

- Private Operators

- Publicly Traded Companies

- Joint Ventures

- Government Agencies

By Application

- Oil Extraction

- Natural Gas Extraction

- Integrated Oil and Gas Extraction

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global oil platform market size was projected at approximately US$ 38.93 billion in 2023. Projections indicate that the market is expected to reach around US$ 75.59 billion in revenue by 2032.

The global oil platform market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 6.9% during the forecast period from 2024 to 2032.

North America is expected to dominate the global oil platform market.

The global oil platform market is driven by rising energy demand, increasing offshore exploration in deepwater and ultra-deepwater regions, and advancements in drilling and extraction technologies. Additionally, government policies, investments in renewable-integrated platforms, and the need for energy security further propel market growth.

Some of the prominent players operating in the global oil platform market are; Kvaerner, Ramboll, Mammoet, Keppel, Brasbauer, Wintershall Dea, MODEC, SBM Offshore, BW Offshore, ExxonMobil, Royal Dutch Shell, BP plc, Chevron Corporation, TotalEnergies SE, Saudi Aramco, Petrobras, China National Offshore Oil Corporation (CNOOC), Schlumberger Limited, Halliburton Company, Baker Hughes Company, Transocean Ltd., Valaris plc, Noble Corporation, Maersk Drilling, Seadrill Limited, Weatherford International plc, Saipem S.p.A., TechnipFMC plc, Woodside Energy, and others.

The global oil platform market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

Oil Platform

Request Sample

Oil Platform