Packaged Fluoride Varnish Market Size, Share, and Trends Analysis Report

CAGR :

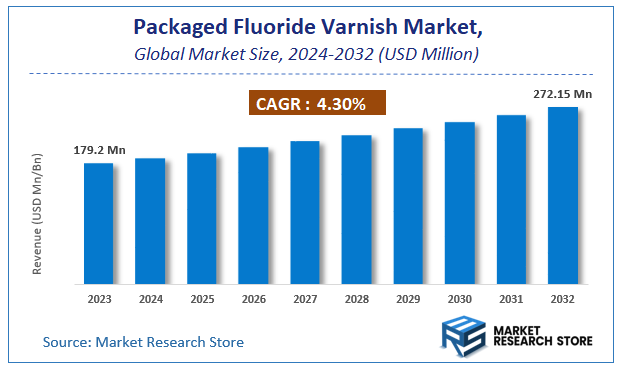

| Market Size 2023 (Base Year) | USD 179.2 Million |

| Market Size 2032 (Forecast Year) | USD 272.15 Million |

| CAGR | 4.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Packaged Fluoride Varnish Market Insights

According to Market Research Store, the global packaged fluoride varnish market size was valued at around USD 179.2 million in 2023 and is estimated to reach USD 272.15 million by 2032, to register a CAGR of approximately 4.3% in terms of revenue during the forecast period 2024-2032.

The packaged fluoride varnish report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032

To Get more Insights, Request a Free Sample

Global Packaged Fluoride Varnish Market: Overview

Packaged fluoride varnish is a professionally applied dental treatment that contains a high concentration of fluoride in a quick-drying, easy-to-apply form. It is primarily used to prevent tooth decay, remineralize enamel, and reduce tooth sensitivity. Unlike traditional fluoride treatments, fluoride varnish adheres to teeth for an extended period, allowing for prolonged fluoride absorption. Typically packaged in single-dose units or multi-dose containers, it is widely used in dental clinics, schools, and public health programs due to its convenience and effectiveness.

Key Highlights

- The packaged fluoride varnish market is anticipated to grow at a CAGR of 4.3% during the forecast period.

- The global packaged fluoride varnish market was estimated to be worth approximately USD 179.2 million in 2023 and is projected to reach a value of USD 272.15 million by 2032.

- The growth of the packaged fluoride varnish market is being driven by increasing awareness of oral health, rising incidences of dental caries, and growing pediatric and geriatric populations.

- Based on the product type, the single-dose varnish segment is growing at a high rate and is projected to dominate the market.

- Based on the composition, the fluoride-based varnish segment is expected to dominate the market.

- On the basis of usage method, the professional application segment is projected to swipe the largest market share.

- On the basis of end-user, the dental clinics segment is projected to swipe the largest market share.

- In terms of distribution channel, the dental supply stores segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Packaged Fluoride Varnish Market: Dynamics

Key Growth Drivers

- Rising Awareness of Oral Health: Increasing awareness about the importance of oral hygiene and preventive dental care is driving demand for fluoride varnishes, particularly in packaged formats for ease of use.

- Growing Prevalence of Dental Caries: The high incidence of dental caries, especially among children and the elderly, is boosting the adoption of fluoride varnishes as a preventive measure.

- Government and Dental Association Recommendations: Many governments and dental associations worldwide recommend the use of fluoride varnishes for cavity prevention, supporting market growth.

- Expansion in Pediatric Dentistry: The focus on early dental care for children is increasing the use of fluoride varnishes in pediatric dental practices.

- Advancements in Packaging Technology: Innovations in packaging, such as single-dose applicators, are making fluoride varnishes more convenient and hygienic for both dental professionals and patients.

Restraints

- Limited Awareness in Developing Regions: In many low- and middle-income countries, there is limited awareness about the benefits of fluoride varnishes, hindering market growth.

- Regulatory Challenges: Stringent regulatory requirements for product approval and safety can delay the launch of new fluoride varnish products.

- Cost Sensitivity: In price-sensitive markets, the cost of packaged fluoride varnishes can be a barrier to adoption, particularly for low-income populations.

- Side Effects and Misuse Concerns: Potential side effects (e.g., mild irritation) and misuse of fluoride varnishes can deter some consumers and healthcare providers.

Opportunities

- Expansion in Emerging Markets: Untapped potential in developing regions with high rates of dental caries presents significant growth opportunities for packaged fluoride varnishes.

- Product Innovation: Developing flavored or organic fluoride varnishes can attract a broader consumer base, including children and health-conscious individuals.

- E-commerce Growth: The rise of online platforms for dental products provides an accessible channel for distributing packaged fluoride varnishes to a wider audience.

- Partnerships with Dental Clinics and Schools: Collaborations with dental clinics, schools, and public health programs can increase the adoption of fluoride varnishes for preventive care.

Challenges

- Competition from Alternative Products: The availability of alternative dental care products, such as fluoride toothpaste and mouthwashes, can limit the demand for fluoride varnishes.

- Supply Chain Disruptions: Global supply chain challenges, including raw material shortages and logistical issues, can impact the availability and cost of packaged fluoride varnishes.

- Regulatory Compliance: Meeting varying regulatory standards across different regions can be complex and costly for manufacturers.

- Environmental Concerns: The use of non-recyclable or non-biodegradable packaging materials can lead to environmental concerns, pushing manufacturers to adopt sustainable packaging solutions.

Packaged Fluoride Varnish Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaged Fluoride Varnish Market |

| Market Size in 2023 | USD 179.2 Million |

| Market Forecast in 2032 | USD 272.15 Million |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 140 |

| Key Companies Covered | Colgate, VOCO, DÃœRRDENTAL, Philips, 3M, Dentsply Sirona, DMG Dental, Ivoclar Vivadent, Ultradent Products, DenMat, Young Dental, Centrix |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Packaged Fluoride Varnish Market: Segmentation Insights

The global packaged fluoride varnish market is divided by product type, composition, usage method, end-user, distribution channel, and region.

Segmentation Insights by Product Type

Based on product type, the global packaged fluoride varnish market is divided into single-dose varnish, multi-dose varnish, universal varnish, plain varnish, and flavored varnish.

The single-dose varnish segment holds the dominant position in the packaged fluoride varnish market. This dominance is driven by its convenience, precise dosage, and hygienic application, making it a preferred choice in dental clinics and hospitals. Single-dose varnish eliminates cross-contamination risks and ensures consistent fluoride application, which is particularly beneficial in pediatric and geriatric dental care. Additionally, its ease of use and pre-measured quantity make it an attractive option for dental professionals, contributing to its widespread adoption.

The multi-dose varnish segment follows as the second most significant category. Multi-dose varnishes offer cost-effectiveness and flexibility, allowing dental professionals to use a single container for multiple patients. However, they require careful handling to prevent contamination, making them more suitable for controlled clinical environments. Their affordability makes them a popular choice in high-volume dental practices and public health programs.

The universal varnish segment holds a moderate share in the market. These varnishes are designed for broad-spectrum use across various patient demographics, including children and adults. Their balanced formulation ensures compatibility with different dental needs, making them a versatile choice for general dentistry. However, they lack the specialized appeal of flavored or plain varnishes, which cater to specific patient preferences.

The plain varnish segment has a smaller market share but remains relevant, particularly for patients sensitive to artificial flavors or additives. These varnishes provide an option for individuals who prefer a neutral taste and minimal ingredients while still benefiting from fluoride application. They are often used in clinical settings where patient preference for unflavored treatments is high.

Lastly, the flavored varnish segment, while growing, currently holds the smallest market share. These varnishes are primarily designed to improve patient experience, particularly for children, by masking the natural taste of fluoride. Flavors like strawberry, bubblegum, and mint make fluoride application more tolerable for young patients, increasing compliance. However, the demand remains niche, as some patients and dental professionals prefer traditional formulations without added flavors.

Segmentation Insights by Composition

Based on composition, the global packaged fluoride varnish market is divided into fluoride-based varnish, calcium-based varnish, hydroxyapatite varnish, and other.

The fluoride-based varnish segment is the most dominant in the packaged fluoride varnish market. Fluoride varnishes have been widely used for decades in preventive dentistry due to their proven effectiveness in remineralizing enamel, reducing tooth decay, and treating dental hypersensitivity. They are the gold standard for cavity prevention, endorsed by dental associations worldwide. Their widespread acceptance among dental professionals, easy application, and strong clinical evidence supporting their benefits contribute to their market leadership.

The calcium-based varnish segment follows as the second-largest category. These varnishes contain calcium and phosphate compounds that aid in enamel remineralization, often used as an alternative for patients who are fluoride-sensitive or prefer non-fluoride treatments. Calcium-based varnishes are gaining traction due to their biocompatibility and natural approach to strengthening teeth, especially among pediatric and geriatric patients. However, they are not as widely adopted as fluoride-based varnishes.

The hydroxyapatite varnish segment holds a moderate market share but is growing steadily. Hydroxyapatite, a naturally occurring mineral in teeth, is used in varnishes to mimic the natural remineralization process. These varnishes are increasingly preferred by patients looking for fluoride-free solutions while still benefiting from enamel protection and sensitivity relief. Their rising popularity in holistic dentistry and among patients seeking biocompatible alternatives is driving demand, but their market penetration remains lower than fluoride-based options.

Segmentation Insights by Usage Method

Based on usage method, the global packaged fluoride varnish market is divided into professional application, at-home application, school-based programs, and community health initiatives.

The professional application segment is the most dominant in the packaged fluoride varnish market. Dental clinics and hospitals rely heavily on professionally applied fluoride varnishes, as they ensure precise application, effective fluoride absorption, and better patient outcomes. Dentists and hygienists use these varnishes in routine checkups, preventive care, and treatments for dental sensitivity. The dominance of this segment is driven by strong clinical recommendations, higher trust in professional application, and the frequent use of fluoride varnish in both adult and pediatric dentistry.

The school-based programs segment follows as the second-largest usage method. Many governments and health organizations implement fluoride varnish programs in schools to provide preventive dental care to children. These programs help reduce cavities, particularly in underserved communities where access to dental care is limited. The ease of application, cost-effectiveness, and large-scale outreach make school-based fluoride varnish programs a significant contributor to market growth.

The community health initiatives segment holds a moderate share in the market. Public health programs, mobile dental units, and outreach initiatives often distribute fluoride varnishes to low-income populations, rural communities, and senior care centers. These programs aim to prevent dental diseases in vulnerable groups and are often supported by government funding and nonprofit organizations. The growing focus on preventive oral healthcare is driving increased adoption of fluoride varnish in these settings.

The at-home application segment holds the smallest market share but is gradually expanding. Some fluoride varnish formulations are being designed for home use under the guidance of a dentist, catering to individuals who prefer self-care solutions. The rise of tele-dentistry and patient-driven oral care has contributed to a growing interest in at-home fluoride treatments. However, due to the need for proper application techniques and safety concerns, this segment remains less prevalent compared to professionally applied fluoride varnishes.

Segmentation Insights by End-user

Based on end-user, the global packaged fluoride varnish market is divided into dental clinics, research institutions, hospitals, home care, and mobile dental services.

The dental clinics segment is the most dominant end-user in the packaged fluoride varnish market. Dental clinics are the primary point of fluoride treatment, serving both preventive and therapeutic needs. The high patient footfall in private and group dental practices, along with the routine use of fluoride varnish in cavity prevention and sensitivity treatment, drives demand. Additionally, the preference for single-dose varnishes in clinics due to their convenience and hygiene benefits further strengthens this segment's market share.

The hospitals segment follows as the second-largest contributor. Hospitals with dedicated dental departments provide fluoride treatments, particularly for patients requiring specialized care, such as those with underlying health conditions or high-risk pediatric cases. The availability of multi-disciplinary treatment options and institutional purchasing of dental supplies contribute to steady demand for fluoride varnishes in this setting.

The research institutions segment holds a moderate share in the market. Academic and clinical research institutions play a crucial role in studying fluoride varnish formulations, efficacy, and innovations. These institutions drive demand for fluoride varnishes for experimental purposes, product development, and clinical trials. Although not a large consumer base, their influence on market advancements is significant.

The mobile dental services segment, while smaller, is gaining traction. Mobile dental units focus on providing preventive dental care, including fluoride applications, in underserved communities, schools, and rural areas. The growing emphasis on accessible dental care and public health initiatives has led to increased adoption of portable and easy-to-use fluoride varnish solutions in this segment.

The home care segment holds the smallest market share but is gradually expanding. With the rise of tele-dentistry and at-home dental care products, some fluoride varnish formulations are being marketed for self-application under professional guidance. However, due to the need for proper application techniques and safety concerns, home care fluoride varnish use remains limited compared to professional applications in clinical settings.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global packaged fluoride varnish market is bifurcated into pharmacies, online retail, dental supply stores, direct sales, and medical institutions.

The dental supply stores segment is the most dominant distribution channel in the packaged fluoride varnish market. These stores are the primary source for dental professionals, offering a wide range of fluoride varnish options from various manufacturers. Dental supply stores cater specifically to clinics, hospitals, and mobile dental services, ensuring a steady demand. Their ability to provide bulk purchasing options, professional-grade products, and direct relationships with manufacturers makes them the preferred choice for most dental practitioners.

The direct sales segment follows as the second-largest distribution channel. Many fluoride varnish manufacturers engage in direct sales to dental clinics, hospitals, and research institutions, offering customized pricing, bulk discounts, and product training. Direct sales provide a reliable and efficient supply chain, ensuring that professionals receive high-quality, regulated fluoride varnish directly from manufacturers or authorized distributors.

The pharmacies segment holds a moderate market share, serving as an accessible point of sale for fluoride varnishes used in home care and small dental practices. Some over-the-counter fluoride varnish products are available for preventive dental care, particularly in regions where dental accessibility is limited. Pharmacies are also a trusted source for dental professionals and individual consumers seeking reliable oral care solutions.

The online retail segment is growing rapidly, driven by the convenience of e-commerce platforms. Online retailers offer a diverse selection of fluoride varnishes, catering to both professionals and individual buyers. The availability of bulk purchasing options, competitive pricing, and home delivery services make online channels increasingly popular. However, concerns regarding product authenticity and the need for professional-grade certification limit its dominance compared to dental supply stores and direct sales.

The medical institutions segment holds the smallest share but remains a relevant distribution channel. Hospitals, public healthcare programs, and research institutions procure fluoride varnishes through institutional purchasing agreements. These bulk procurement processes ensure a stable supply for government-funded dental health programs, clinical trials, and research studies. While not as commercially driven as other channels, medical institutions play a crucial role in public health fluoride applications.

Packaged Fluoride Varnish Market: Regional Insights

- North America is expected to dominates the global market

The North American packaged fluoride varnish market is the most dominant globally, primarily due to the region's advanced healthcare infrastructure and heightened awareness of oral hygiene. The United States leads this market, with significant contributions from Canada. Factors such as substantial investments in oral health initiatives and a proactive approach to preventive dental care have propelled the adoption of fluoride varnish treatments. The presence of major industry players further strengthens the market's position in this region.

Europe holds the second-largest share in the packaged fluoride varnish market, driven by a strong emphasis on preventive dental care and stringent government regulations. Countries like Germany, France, and the United Kingdom are at the forefront, supported by advanced healthcare systems and significant investments in oral health programs. The rising prevalence of dental caries across various age groups has increased the demand for effective preventive measures, thereby boosting the market for fluoride varnish products.

The Asia Pacific region is emerging as a lucrative market for packaged fluoride varnish, attributed to its large population base and increasing disposable income. Nations such as China, India, and Japan are experiencing a surge in the adoption of fluoride varnish products, fueled by growing awareness about oral health and government-led initiatives promoting dental hygiene. Improvements in healthcare infrastructure and expanded access to dental care services further contribute to the market's growth in this region.

Latin America presents significant growth potential in the packaged fluoride varnish market, with increasing awareness about oral hygiene and a focus on preventive dental care. Countries like Brazil and Mexico are witnessing a rise in the adoption of fluoride varnish treatments, supported by efforts to improve healthcare access and education on dental health. The region's market growth is also influenced by collaborations between public health organizations and dental care providers to address the prevalence of dental caries.

The Middle East and Africa region, while currently holding a smaller share of the packaged fluoride varnish market, is experiencing gradual growth. This is due to rising dental care expenditure and the increasing availability of dental services. Efforts to enhance healthcare infrastructure and a growing emphasis on preventive care are expected to drive the adoption of fluoride varnish products in the coming years. However, challenges such as limited access to dental care in remote areas and economic constraints may impact the market's expansion in this region.

Recent Developments:

- In March 2021, Colgate-Palmolive has been strengthening its position in the oral care market through strategic partnerships, including collaborations with Philips to integrate fluoride varnish products with electric toothbrushes and smart dental devices.

Packaged Fluoride Varnish Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the packaged fluoride varnish market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global packaged fluoride varnish market include:

- Colgate-Palmolive Company

- 3M Company

- Dentsply Sirona Inc.

- VOCO GmbH

- Philips

- DÜRRDENTAL

- Ultradent Products Inc.

- Young Dental

- DMG Dental

- Ivoclar Vivadent AG

- Water Pik Inc.

- Medicom Group

- Centrix Inc.

- GC Corporation

- Preventech

- Premier Dental Products Company

- Pulpdent Corporation

- Elevate Oral Care

- DenMat Holdings LLC

- Kerr Corporation

The global packaged fluoride varnish market is segmented as follows:

By Product Type

- Single-dose Vaish

- Multi-dose Vaish

- Universal Vaish

- Plain Vaish

- Flavored Vaish

By Composition

- Fluoride-based Vaish

- Calcium-based Vaish

- Hydroxyapatite Vaish

- Other

By Usage Method

- Professional Application

- At-home Application

- School-based Programs

- Community Health Initiatives

By End-user

- Dental Clinics

- Research Institutions

- Hospitals

- Home Care

- Mobile Dental Services

By Distribution Channel

- Pharmacies

- Online Retail

- Dental Supply Stores

- Direct Sales

- Medical Institutions

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global packaged fluoride varnish market size was projected at approximately US$ 179.2 million in 2023. Projections indicate that the market is expected to reach around US$ 272.15 million in revenue by 2032.

The global packaged fluoride varnish market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 4.3% during the forecast period from 2024 to 2032.

North America is expected to dominate the global packaged fluoride varnish market.

The global packaged fluoride varnish market is driven by increasing awareness of oral hygiene, rising prevalence of dental caries, and growing adoption of preventive dental care. Advancements in dental treatments, government initiatives, and the expansion of healthcare infrastructure further boost market growth.

Some of the prominent players operating in the global packaged fluoride varnish market are; Colgate-Palmolive Company, 3M Company, Dentsply Sirona Inc., VOCO GmbH, Philips, DÜRRDENTAL, Ultradent Products Inc., Young Dental, DMG Dental, Ivoclar Vivadent AG, Water Pik Inc., Medicom Group, Centrix Inc., GC Corporation, Preventech, Premier Dental Products Company, Pulpdent Corporation, Elevate Oral Care, DenMat Holdings LLC, Kerr Corporation, and others.

Table Of Content

Inquiry For Buying

Packaged Fluoride Varnish

Request Sample

Packaged Fluoride Varnish