Pasted Valve Bags Market Size, Share, and Trends Analysis Report

CAGR :

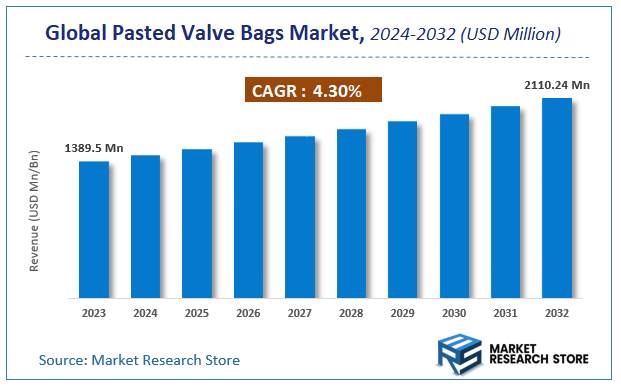

| Market Size 2023 (Base Year) | USD 1389.5 Million |

| Market Size 2032 (Forecast Year) | USD 2110.24 Million |

| CAGR | 4.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Pasted Valve Bags Market Insights

According to Market Research Store, the global pasted valve bags market size was valued at around USD 1389.5 million in 2023 and is estimated to reach USD 2110.24 million by 2032, to register a CAGR of approximately 4.3% in terms of revenue during the forecast period 2024-2032.

The pasted valve bags report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Pasted Valve Bags Market: Overview

Pasted valve bags are a type of industrial packaging used primarily for powdered or granular materials such as cement, chemicals, food products, and construction materials. These bags are manufactured by sealing the bottom and top using adhesives instead of stitching, providing a strong and secure closure that prevents leakage and contamination. The bags have a small valve opening through which materials are filled, and once filled, the valve closes automatically due to the pressure inside, ensuring efficient storage and transport. Pasted valve bags are commonly made from multiple layers of paper or plastic materials like polypropylene, offering durability, moisture resistance, and easy handling.

Key Highlights

- The pasted valve bags market is anticipated to grow at a CAGR of 4.3% during the forecast period.

- The global pasted valve bags market was estimated to be worth approximately USD 1389.5 million in 2023 and is projected to reach a value of USD 2110.24 million by 2032.

- The growth of the pasted valve bags market is being driven by the increasing demand from industries such as construction, chemicals, agriculture, and food processing, where secure and efficient packaging is crucial.

- Based on the material type, the plastic segment is growing at a high rate and is projected to dominate the market.

- On the basis of closure type, the sewed segment is projected to swipe the largest market share.

- In terms of bag size, the medium segment is expected to dominate the market.

- Based on the application, the construction segment is expected to dominate the market.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Pasted Valve Bags Market: Dynamics

Key Growth Drivers

- High Demand in Construction and Cement Industries: Pasted valve bags are extensively used for packaging cement, plaster, and other construction materials, driven by global infrastructure development.

- Dust-Free and Leak-Proof Design: The valve mechanism ensures a clean and efficient filling process, reducing dust and spillage, which is critical in industries like chemicals and food.

- Cost-Effective and Durable: These bags offer a balance of affordability and strength, making them ideal for bulk packaging of heavy materials.

- Automated Filling Compatibility: Their design allows for seamless integration with automated filling systems, enhancing operational efficiency.

- Sustainability Advantages: Made from paper, pasted valve bags are eco-friendly and align with the growing demand for sustainable packaging solutions.

Restraints

- Competition from Alternative Packaging: Woven polypropylene bags and FIBCs (Flexible Intermediate Bulk Containers) offer higher durability and moisture resistance, posing a challenge.

- Limited Moisture Resistance: Pasted valve bags are susceptible to damage in humid or wet conditions, restricting their use in certain environments.

- Fluctuating Raw Material Costs: Volatility in the prices of paper and adhesives can impact production costs and profitability.

- Low Awareness in Developing Regions: Lack of knowledge about the benefits of pasted valve bags in some markets limits their adoption.

Opportunities

- Innovations in Material Technology: Developing moisture-resistant or reinforced pasted valve bags can expand their application in challenging environments.

- Growth in Emerging Markets: Increasing industrialization and infrastructure projects in developing regions present significant growth opportunities.

- Customization and Branding: Offering customized printing and branding options can attract businesses looking to enhance their product visibility.

- Expansion into New Industries: Exploring applications in industries like pharmaceuticals, chemicals, and food can diversify the market.

- Focus on Sustainability: Leveraging the eco-friendly nature of these bags can appeal to environmentally conscious consumers and businesses.

Challenges

- Environmental Regulations: Stricter regulations on packaging materials and waste management may increase compliance costs.

- Competition from Recyclable Alternatives: The growing popularity of fully recyclable or biodegradable packaging materials could reduce demand for traditional pasted valve bags.

- Supply Chain Disruptions: Dependence on raw material suppliers and logistical challenges can impact production and delivery.

- Quality Consistency: Maintaining consistent quality across large-scale production can be challenging, affecting customer satisfaction.

- Moisture and Durability Limitations: The bags' susceptibility to moisture and wear limits their use in certain industries or climates.

Pasted Valve Bags Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pasted Valve Bags Market |

| Market Size in 2023 | USD 1389.5 Million |

| Market Forecast in 2032 | USD 2110.24 Million |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 140 |

| Key Companies Covered | Mondi, Coveris, Novey Bag, Langston, United Bag, Shinil PNS, Daman Polyfabs, Rosenflex, Trombini, Material Motion, Gelpac, Bag Supply, Apack Manufacturing Sdn Bhd |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pasted Valve Bags Market: Segmentation Insights

The global pasted valve bags market is divided by material type, closure type, bag size, application, and region.

Segmentation Insights by Material Type

Based on material type, the global pasted valve bags market is divided into plastic, paper, composite, and jute.

Plastic valve bags dominate the market due to their superior durability, moisture resistance, and cost-effectiveness. These bags are widely used in industries such as food, chemicals, and construction, where protection from external elements is crucial. Their lightweight nature and ease of customization make them a preferred choice for bulk packaging. Additionally, advancements in plastic recycling have made them more environmentally viable, further strengthening their market position.

Paper valve bags hold the second-largest market share, primarily driven by their eco-friendly and biodegradable properties. These bags are extensively used in the cement, agricultural, and food industries due to their breathability, which helps in preventing condensation and maintaining product freshness. The growing global push toward sustainable packaging solutions has led to an increased adoption of paper valve bags, particularly in regions with stringent environmental regulations.

Composite valve bags, made by combining plastic and paper materials, offer a balance between durability and environmental friendliness. These bags provide enhanced strength while still allowing for some level of biodegradability. They are commonly used in industries requiring robust packaging with minimal environmental impact, such as chemicals, fertilizers, and powdered food products. However, their relatively higher production costs limit their widespread adoption compared to purely plastic or paper alternatives.

Jute valve bags represent the smallest segment due to their limited durability and higher cost. While they are completely biodegradable and preferred in eco-conscious markets, their lower strength and susceptibility to moisture make them less suitable for industries requiring long-term storage or transportation of goods. Jute bags are mainly used in niche applications, such as organic food packaging and agricultural products, where sustainability is a key priority.

Segmentation Insights by Closure Type

Based on closure type, the global pasted valve bags market is divided into sewed, heat-sealed, taped, and laminated.

Sewed valve bags dominate the market due to their superior strength and reliability. These bags are widely used in industries such as cement, chemicals, and agriculture, where durability is essential for handling heavy loads. The sewing process ensures a secure closure that prevents leakage while allowing breathability, making them ideal for packaging powdered and granular materials. Additionally, sewed closures offer cost-effective sealing without requiring specialized machinery, further contributing to their dominance.

Heat-sealed valve bags hold the second-largest market share, driven by their tamper-proof and moisture-resistant properties. These bags are commonly used in food, pharmaceutical, and chemical industries where product contamination must be minimized. The heat-sealing process creates an airtight seal, enhancing product shelf life and protecting against environmental factors. However, the requirement for specialized sealing equipment slightly limits their widespread adoption compared to sewed closures.

Taped valve bags are a growing segment, particularly in applications requiring quick and efficient sealing. These bags use adhesive tapes for closure, which provides a balance between secure sealing and easy opening. They are favored in industries where reusability or easy access to contents is necessary, such as animal feed and construction materials. However, their reliance on adhesive tapes makes them less durable than sewed or heat-sealed alternatives, restricting their market penetration.

Laminated valve bags represent the smallest segment, mainly due to their higher production costs and limited flexibility in certain applications. These bags feature an additional laminated layer that enhances strength, moisture resistance, and printability, making them suitable for premium packaging applications in food and specialty chemicals. While they offer superior protection, their complex manufacturing process and limited recyclability reduce their appeal in cost-sensitive markets.

Segmentation Insights by Bag Size

Based on bag size, the global pasted valve bags market is divided into small, medium, and large.

Medium-sized valve bags dominate the market as they strike the perfect balance between capacity, handling convenience, and cost-effectiveness. These bags, typically ranging from 10 kg to 25 kg, are widely used across industries such as cement, food, chemicals, and agriculture. Their manageable size makes them easy to transport and store while still accommodating a substantial volume of product. Additionally, they are compatible with automated filling systems, enhancing efficiency in high-volume industrial applications.

Large valve bags hold the second-largest market share, catering to industries that require bulk packaging solutions. These bags, typically exceeding 25 kg, are commonly used in cement, construction materials, and chemical industries, where large quantities of powdered or granular materials need to be transported. Their reinforced structure provides durability, but handling challenges and labor-intensive transport limit their widespread adoption compared to medium-sized alternatives.

Small valve bags represent the smallest segment due to their limited capacity and niche applications. These bags, generally under 10 kg, are mainly used for specialized packaging in sectors such as pharmaceuticals, food, and high-value chemical products. While they offer ease of handling and precise portioning, their lower demand in heavy industries reduces their overall market share. However, growing demand for premium and retail-ready packaging solutions is gradually expanding their presence.

Segmentation Insights by Application

On the basis of application, the global pasted valve bags market is bifurcated into food beverage, pharmaceuticals, construction, and agriculture.

Construction dominates the valve bags market, primarily due to the extensive use of these bags for packaging cement, sand, and other building materials. The durability, easy handling, and dust-free filling capabilities of valve bags make them the preferred choice in the construction industry. Their ability to withstand heavy loads and provide moisture protection ensures that materials remain intact during storage and transportation. With rapid urbanization and infrastructure development worldwide, the demand for valve bags in this sector remains high.

Agriculture holds the second-largest market share, driven by the need for efficient packaging solutions for fertilizers, seeds, animal feed, and other agricultural products. Valve bags are favored for their ability to protect contents from environmental factors such as moisture and pests while allowing easy filling and controlled discharge. The increasing focus on improving agricultural productivity and storage solutions further boosts their adoption in this sector.

Food & Beverage is another significant segment, where valve bags are used to package flour, sugar, powdered milk, coffee, and other dry food products. The food industry benefits from valve bags due to their hygienic, airtight, and tamper-resistant properties. Paper and plastic valve bags with food-grade linings ensure product safety and extended shelf life. The growing demand for convenient and sustainable packaging in the food industry contributes to this segment’s steady growth.

Pharmaceuticals represent the smallest segment but are growing steadily due to the need for sterile and contamination-free packaging solutions. Valve bags are used for packaging powdered drugs, chemical ingredients, and other pharmaceutical raw materials. The industry demands high-barrier, moisture-resistant, and tamper-proof packaging, making specialized plastic and composite valve bags the preferred choice. However, strict regulatory requirements and the dominance of alternative pharmaceutical packaging methods limit the widespread use of valve bags in this sector.

Pasted Valve Bags Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

The Asia-Pacific region stands as the most dominant market for pasted valve bags, driven by rapid industrialization and urbanization in countries like China and India. The burgeoning construction industry in these nations demands efficient packaging solutions for materials such as cement and sand, significantly boosting the adoption of pasted valve bags. Additionally, the expanding food and beverage sector, coupled with the chemical industry, contributes to the heightened demand for these bags. The region's focus on infrastructure development and the availability of cost-effective raw materials further solidifies its leading position in the market.

North America holds a substantial share in the pasted valve bags market, primarily due to the presence of well-established industries and a strong emphasis on advanced packaging solutions. The region's stringent regulations regarding food safety and packaging standards have propelled the adoption of high-quality pasted valve bags, especially within the food and beverage, chemical, and pharmaceutical sectors. Moreover, the growing consumer preference for sustainable and eco-friendly packaging options has encouraged manufacturers to innovate and offer environmentally friendly pasted valve bags, thereby driving market growth in North America.

Europe represents a significant market for pasted valve bags, characterized by a strong commitment to environmental sustainability and rigorous packaging regulations. The region's well-established food and beverage industry, along with ongoing construction activities, fuels the demand for efficient packaging solutions like pasted valve bags. European consumers' increasing awareness of environmental issues has led to a preference for recyclable and biodegradable packaging materials, prompting manufacturers to develop eco-friendly pasted valve bags to meet this demand.

Latin America is emerging as a promising market for pasted valve bags, driven by increasing urbanization and infrastructure development in countries such as Brazil and Argentina. The region's growing construction industry necessitates reliable packaging solutions for materials like cement and sand, thereby boosting the demand for pasted valve bags. Additionally, the expanding agricultural sector, particularly in the packaging of fertilizers and animal feed, contributes to market growth. As disposable incomes rise, there is also a noticeable shift towards convenient and sustainable packaging solutions in the food industry, further enhancing the market prospects in Latin America.

The Middle East and Africa region is experiencing steady growth in the pasted valve bags market, attributed to rapid urbanization and industrialization. Infrastructure development projects, especially in the Gulf Cooperation Council (GCC) countries, have led to increased demand for construction materials, subsequently driving the need for effective packaging solutions like pasted valve bags. Moreover, the region's growing food and beverage industry, along with the chemical sector, requires efficient and safe packaging options, contributing to the market's expansion. The focus on sustainability and environmental concerns is also gradually influencing the adoption of eco-friendly pasted valve bags in this region.

Pasted Valve Bags Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the pasted valve bags market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global pasted valve bags market include:

- Mondi

- Coveris

- Novey Bag

- Langston

- United Bag

- Shinil PNS

- Daman Polyfabs

- Rosenflex

- Trombini

- Amcor

- Novolex

- Sealed Air

- Bischof + Klein

- Dunapak

- Smurfit Kappa

- Sappi

- Cascades

- International Paper

- Material Motion

- Gelpac

- Bag Supply

- Apack Manufacturing Sdn Bhd

- Schneider Packaging

- Bagcraft Papercon

- DS Smith

- Kruger Inc.

The global pasted valve bags market is segmented as follows:

By Material Type

- Plastic

- Paper

- Composite

- Jute

By Closure Type

- Sewed

- Heat-Sealed

- Taped

- Laminated

By Bag Size

- Small

- Medium

- Large

By Application

- Food Beverage

- Pharmaceuticals

- Construction

- Agriculture

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global pasted valve bags market size was projected at approximately US$ 1389.5 million in 2023. Projections indicate that the market is expected to reach around US$ 2110.24 million in revenue by 2032.

The global pasted valve bags market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 4.3% during the forecast period from 2024 to 2032.

Asia-Pacific is expected to dominate the global pasted valve bags market.

The global pasted valve bags market is driven by increasing demand from the construction, food, and chemical industries due to their efficient packaging and handling benefits. Growth in industrialization, infrastructure development, and rising environmental concerns promoting recyclable packaging solutions also contribute to market expansion.

Some of the prominent players operating in the global pasted valve bags market are; Mondi, Coveris, Novey Bag, Langston, United Bag, Shinil PNS, Daman Polyfabs, Rosenflex, Trombini, Amcor, Novolex, Sealed Air, Bischof + Klein, Dunapak, Smurfit Kappa, Sappi, Cascades, International Paper, Material Motion, Gelpac, Bag Supply, Apack Manufacturing Sdn Bhd, Schneider Packaging, Bagcraft Papercon, DS Smith, Kruger Inc., and others.

Table Of Content

Inquiry For Buying

Pasted Valve Bags

Request Sample

Pasted Valve Bags