Pension Administration Software Market Size, Share, and Trends Analysis Report

CAGR :

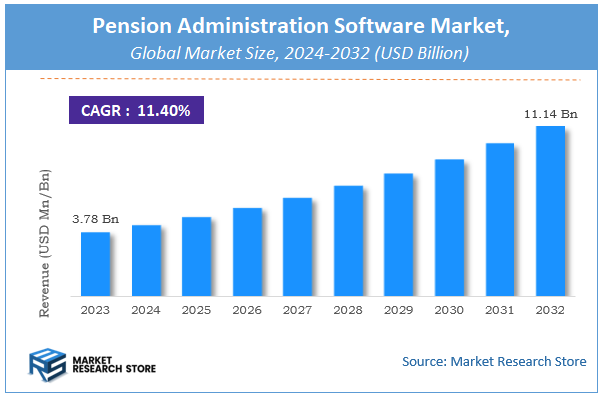

| Market Size 2023 (Base Year) | USD 3.78 Billion |

| Market Size 2032 (Forecast Year) | USD 11.14 Billion |

| CAGR | 11.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Pension Administration Software Market Insights

According to Market Research Store, the global pension administration software market size was valued at around USD 3.78 billion in 2023 and is estimated to reach USD 11.14 billion by 2032, to register a CAGR of approximately 11.4% in terms of revenue during the forecast period 2024-2032.

The pension administration software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Pension Administration Software Market: Overview

Pension administration software is a specialized digital solution designed to manage and streamline pension-related processes for organizations, government bodies, and financial institutions. It automates key functions such as benefits calculation, contribution tracking, compliance management, member record maintenance, and retirement fund disbursement. By integrating advanced technologies like cloud computing, artificial intelligence, and blockchain, modern pension administration software enhances efficiency, reduces errors, and ensures regulatory compliance, making it a crucial tool for pension fund managers and employers offering retirement benefits.

Key Highlights

- The pension administration software market is anticipated to grow at a CAGR of 11.4% during the forecast period.

- The global pension administration software market was estimated to be worth approximately USD 3.78 billion in 2023 and is projected to reach a value of USD 11.14 billion by 2032.

- The growth of the pension administration software market is being driven by increasing regulatory compliance requirements, the growing aging population, and the need for automation in pension management.

- Based on the component, the software segment is growing at a high rate and is projected to dominate the market.

- On the basis of deployment model, the cloud-based segment is projected to swipe the largest market share.

- In terms of industry vertical, the government segment is expected to dominate the market.

- Based on the organization size, the large enterprises segment is expected to dominate the market.

- On the basis of functionality, the contribution management segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Pension Administration Software Market: Dynamics

Key Growth Drivers

- Aging Population: Increasing life expectancy and the growing number of retirees drive demand for efficient pension management solutions.

- Regulatory Compliance: Strict government regulations and reporting requirements necessitate advanced software for accurate pension administration.

- Digital Transformation: Organizations are adopting digital tools to streamline operations, reduce errors, and improve efficiency in pension management.

- Cost Efficiency: Automation of pension processes reduces administrative costs and minimizes manual errors.

- Employee Demand for Transparency: Employees and retirees seek greater visibility into their pension plans, pushing organizations to adopt user-friendly software.

Restraints

- High Implementation Costs: Initial setup and customization of pension administration software can be expensive.

- Resistance to Change: Organizations may hesitate to adopt new systems due to legacy processes and employee reluctance.

- Data Security Concerns: Handling sensitive employee data requires robust cybersecurity measures, which can be a barrier.

- Complexity of Pension Plans: Diverse and complex pension schemes can make software implementation and integration challenging.

Opportunities

- Cloud-Based Solutions: Growing adoption of cloud technology offers scalable, flexible, and cost-effective pension administration solutions.

- AI and Analytics Integration: Incorporating AI and data analytics can enhance decision-making, forecasting, and personalized pension planning.

- Emerging Markets: Expanding into developing regions with growing pension systems presents significant growth potential.

- Partnerships with Financial Institutions: Collaborating with banks and financial service providers can create integrated pension management ecosystems.

Challenges

- Regulatory Changes: Frequent updates in pension laws and regulations require continuous software updates and compliance checks.

- Interoperability Issues: Integrating pension software with existing HR and payroll systems can be technically challenging.

- User Training and Adoption: Ensuring employees and administrators are adequately trained to use the software effectively.

- Competition from Established Players: Competing with well-established vendors in a mature market can be difficult for new entrants.

Pension Administration Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pension Administration Software Market |

| Market Size in 2023 | USD 3.78 Billion |

| Market Forecast in 2032 | USD 11.14 Billion |

| Growth Rate | CAGR of 11.4% |

| Number of Pages | 140 |

| Key Companies Covered | Aquila, Oracle, SAP, Visma, DATEV, UNIT4, Version Systems, Malam Payroll, SYNEL MLL PayWay, L&P Systems, Sagitec Solutions, Exaxe, Vitech Systems, Capita, Civica, Equiniti |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pension Administration Software Market: Segmentation Insights

The global pension administration software market is divided by component, deployment model, industry vertical, organization size, functionality, and region.

Segmentation Insights by Component

Based on component, the global pension administration software market is divided into software, services, and consulting.

The Software segment holds the dominant position in the pension administration software market. As the core component of pension administration, software solutions provide automation, compliance tracking, and data management, significantly improving efficiency for pension providers, government agencies, and enterprises. These solutions streamline benefits calculations, contributions tracking, and disbursement processing, reducing errors and enhancing transparency. The increasing adoption of cloud-based platforms and AI-driven analytics further drives demand for pension administration software, making it the most influential segment in the market.

The Services segment follows as the second-largest, driven by the need for implementation, maintenance, and support services. Organizations adopting pension administration software require professional services such as system integration, customization, and training to ensure seamless deployment. Additionally, ongoing maintenance and technical support services are crucial for keeping the software updated with regulatory changes and ensuring operational continuity. As pension systems become more complex, managed services and outsourcing solutions are also gaining traction, contributing to the segment's steady growth.

The Consulting segment holds the smallest share in the market but remains essential for guiding organizations in selecting, implementing, and optimizing pension administration solutions. Consulting firms provide expertise in regulatory compliance, process optimization, and risk management, helping businesses navigate evolving pension regulations and digital transformation initiatives. While it is the least dominant segment, demand for consulting services is expected to grow as companies seek specialized guidance to enhance their pension administration strategies.

Segmentation Insights by Deployment Model

On the basis of deployment model, the global pension administration software market is bifurcated into on-premises and cloud-based.

The Cloud-based segment is the most dominant in the pension administration software market, driven by its scalability, cost-effectiveness, and flexibility. Organizations increasingly prefer cloud-based solutions due to their ability to provide real-time access to pension data, seamless integration with other enterprise systems, and automatic updates to stay compliant with evolving regulations. Cloud deployment reduces the need for heavy upfront investments in IT infrastructure, making it a popular choice among businesses of all sizes. Additionally, features such as data security, disaster recovery, and remote accessibility make cloud-based pension administration software the preferred option for enterprises and government agencies looking to enhance efficiency and streamline operations.

The On-premises segment, while still relevant, holds a smaller market share compared to cloud-based solutions. This deployment model is primarily favored by organizations with strict data security requirements, such as financial institutions and government agencies handling sensitive pension data. On-premises solutions offer greater control over data storage and system customization, which appeals to businesses with complex legacy systems. However, the high costs of hardware, software maintenance, and IT support make this model less attractive compared to the more agile and cost-efficient cloud alternatives. Despite its declining preference, on-premises deployment remains essential for organizations with stringent regulatory and compliance needs.

Segmentation Insights by Industry Vertical

Based on industry vertical, the global pension administration software market is divided into government, healthcare, financial services, manufacturing, and retail.

The Government sector is the most dominant industry vertical in the pension administration software market, as public sector organizations manage large-scale pension schemes for government employees and retirees. Governments require highly secure, compliant, and automated pension administration solutions to efficiently handle complex benefit calculations, contribution tracking, and regulatory reporting. With the rising adoption of digital transformation initiatives and cloud-based pension platforms, government agencies continue to invest heavily in modernizing their pension administration systems, making this the leading segment in the market.

The Financial Services sector follows as the second-largest industry vertical, driven by banks, insurance companies, and pension fund managers that administer retirement plans for both corporate clients and individual investors. These institutions rely on pension administration software to manage funds, ensure regulatory compliance, and optimize financial planning for pension payouts. With the increasing need for data analytics, risk assessment, and fraud detection, financial service providers are continuously upgrading their pension management systems, contributing to the strong growth of this segment.

The Healthcare sector holds a significant share in the market, as hospitals, medical institutions, and healthcare providers manage pension plans for their employees. Given the long-term employment nature of healthcare professionals, pension benefits play a critical role in employee retention and financial security. Healthcare organizations use pension administration software to streamline benefits management, ensure compliance with industry regulations, and provide accurate retirement planning tools for their workforce.

The Manufacturing sector also utilizes pension administration software but at a slightly lower scale compared to the leading industries. Large manufacturing companies, especially those with unionized workforces, manage employee retirement benefits through structured pension schemes. The need for efficient record-keeping, benefits calculations, and compliance with labor laws drives the adoption of pension administration software in this sector. However, the adoption rate varies based on company size and digital transformation strategies.

The Retail sector represents the smallest share of the market, as many retail businesses rely on defined contribution plans rather than traditional pension schemes. However, large retail chains and corporations with substantial workforces still require pension administration solutions to manage employee benefits efficiently. Cloud-based pension management platforms are gaining traction in this industry, offering cost-effective and flexible solutions for businesses with high employee turnover rates. Despite being the least dominant segment, the retail sector’s adoption of pension administration software is expected to grow with increasing workforce management demands.

Segmentation Insights by Organization Size

On the basis of organization size, the global pension administration software market is bifurcated into SMEs and large enterprises.

The Large Enterprises segment is the dominant force in the pension administration software market, as these organizations typically manage complex, large-scale pension schemes for thousands of employees. Large enterprises, including multinational corporations, financial institutions, and government agencies, require robust, feature-rich pension administration solutions to handle contributions, disbursements, compliance tracking, and data security. These organizations often invest in advanced technologies such as AI-driven analytics, cloud-based platforms, and automation to streamline pension management and ensure regulatory compliance. The need for scalability, integration with existing HR and finance systems, and enhanced security features further drives the dominance of this segment.

The SMEs (Small and Medium Enterprises) segment, while growing, holds a smaller market share compared to large enterprises. Many SMEs rely on third-party pension providers or simple payroll-integrated retirement plans, reducing the need for standalone pension administration software. However, as regulatory requirements become more stringent and SMEs focus on improving employee benefits to attract and retain talent, there is increasing adoption of cloud-based and cost-effective pension management solutions. The demand in this segment is primarily driven by the need for user-friendly, affordable, and scalable solutions that cater to smaller workforces with limited IT infrastructure.

Segmentation Insights by Functionality

On the basis of functionality, the global pension administration software market is bifurcated into contribution management, benefit calculations, investment management, reporting and analytics.

The Contribution Management segment is the most dominant functionality in the pension administration software market. This feature is crucial for tracking employer and employee contributions, ensuring compliance with pension regulations, and managing different types of retirement plans. Organizations, especially government bodies and financial institutions, rely heavily on automated contribution management systems to prevent errors, ensure timely deposits, and streamline payroll integration. With the increasing complexity of pension structures and regulatory requirements, advanced contribution management tools are in high demand to maintain accuracy and efficiency.

The Benefit Calculations segment follows closely as a critical component of pension administration software. This functionality automates the process of determining retirement payouts, survivor benefits, and other entitlements based on years of service, salary history, and pension plan rules. Large enterprises and government agencies benefit significantly from accurate, automated benefit calculations to avoid disputes, ensure fairness, and improve employee satisfaction. The growing demand for AI-driven predictive modeling in pension planning is further driving the adoption of sophisticated benefit calculation tools.

The Investment Management segment holds significant importance, especially for financial institutions and pension fund managers. This functionality helps organizations monitor and optimize pension fund investments, track market performance, and manage risk. With pension funds increasingly diversifying into various asset classes, investment management tools are becoming essential for maximizing returns while ensuring compliance with investment regulations. Although primarily used by financial services firms, large enterprises with self-managed pension funds are also adopting this functionality to enhance decision-making.

The Reporting and Analytics segment, while the least dominant, is gaining traction due to the growing emphasis on data-driven decision-making. This functionality provides organizations with real-time insights into pension fund performance, employee retirement trends, and regulatory compliance. Advanced analytics tools help pension administrators optimize fund allocations, predict future liabilities, and ensure transparency. With the rise of AI and machine learning in pension administration, reporting and analytics are becoming increasingly valuable, though they are often integrated as part of broader pension management solutions.

Pension Administration Software Market: Regional Insights

- North America is expected to dominates the global market

North America leads the pension administration software market due to its advanced financial services industry, strict regulatory landscape, and high technology adoption. Companies in this region prioritize compliance with pension laws, driving the need for robust software solutions. The growing aging population and increasing complexities in retirement planning further fuel demand for sophisticated pension administration systems tailored to North American requirements.

Europe follows closely, driven by demographic shifts and complex pension regulations across countries like the UK, Germany, France, and Italy. The need for compliance with diverse pension structures and sustainability considerations, such as integrating ESG factors into pension management, boosts software adoption. The market benefits from a strong emphasis on digital transformation and automation in financial services.

The Asia-Pacific region is experiencing rapid growth, fueled by economic expansion and evolving pension systems in countries such as China, India, Japan, and Australia. As these economies mature, there is a rising demand for modern pension administration solutions to streamline operations and improve efficiency. Governments and organizations are increasingly investing in pension management systems to address the growing workforce and retirement planning needs.

Latin America is witnessing steady growth, particularly in countries like Brazil and Mexico, where industrial expansion and workforce formalization drive demand for pension administration software. As pension schemes become more structured, organizations seek digital solutions to enhance compliance, efficiency, and security.

The Middle East & Africa region is showing moderate growth, supported by economic diversification and infrastructure development. Increasing urbanization and innovation in financial services contribute to the adoption of pension management solutions. Governments and private sector organizations are gradually recognizing the importance of digital pension administration systems to modernize retirement planning and benefits management.

Pension Administration Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the pension administration software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global pension administration software market include:

- Aquila

- Oracle

- SAP

- Visma

- DATEV

- UNIT4

- Capita

- Civica

- Equiniti

- TIAA

- BNY Mellon

- P. Morgan

- Fidelity

- Vanguard

- Northern Trust

- Broadridge

- ADP

- BlackRock

- Version Systems

- Malam Payroll

- SYNEL MLL PayWay

- L&P Systems

- Sagitec Solutions

- Exaxe

- Vitech Systems

- State Street

- FIS

The global pension administration software market is segmented as follows:

By Component

- Software

- Services

- Consulting

By Deployment Model

- On-premises

- Cloud-based

By Industry Vertical

- Government

- Healthcare

- Financial services

- Manufacturing

- Retail

By Organization Size

- SMEs

- Large enterprises

By Functionality

- Contribution Management

- Benefit Calculations

- Investment Management

- Reporting and Analytics

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global pension administration software market size was projected at approximately US$ 3.78 billion in 2023. Projections indicate that the market is expected to reach around US$ 11.14 billion in revenue by 2032.

The global pension administration software market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 11.4% during the forecast period from 2024 to 2032.

North America is expected to dominate the global pension administration software market.

The global pension administration software market is driven by increasing regulatory compliance requirements, the growing aging population, and the need for automation in pension management. Additionally, digital transformation, rising adoption of cloud-based solutions, and demand for secure, efficient pension administration systems contribute to market growth.

Who are the leading players functioning in the global pension administration software market growth?

Some of the prominent players operating in the global pension administration software market are; Aquila, Oracle, SAP, Visma, DATEV, UNIT4, Capita, Civica, Equiniti, TIAA, BNY Mellon, P. Morgan, Fidelity, Vanguard, Northern Trust, Broadridge, ADP, BlackRock, Version Systems, Malam Payroll, SYNEL MLL PayWay, L&P Systems, Sagitec Solutions, Exaxe, Vitech Systems, State Street, FIS, and others.

Table Of Content

Inquiry For Buying

Pension Administration Software

Request Sample

Pension Administration Software