Personal Protective Equipment (PPE) Gloves Market Size, Share, and Trends Analysis Report

CAGR :

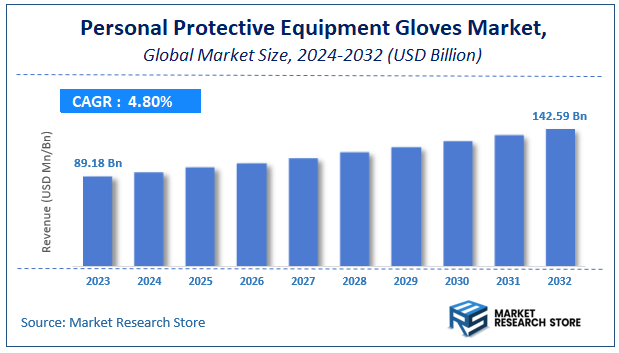

| Market Size 2023 (Base Year) | USD 89.18 Billion |

| Market Size 2032 (Forecast Year) | USD 142.59 Billion |

| CAGR | 4.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Personal Protective Equipment (PPE) Gloves Market Insights

According to Market Research Store, the global personal protective equipment (PPE) gloves market size was valued at around USD 89.18 billion in 2023 and is estimated to reach USD 142.59 billion by 2032, to register a CAGR of approximately 4.8% in terms of revenue during the forecast period 2024-2032.

The personal protective equipment (PPE) gloves report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Personal Protective Equipment (PPE) Gloves Market: Overview

Personal Protective Equipment (PPE) gloves are specialized gloves designed to protect individuals from various hazards in workplaces and daily activities. These gloves serve as a barrier against chemical exposure, biological contaminants, extreme temperatures, cuts, abrasions, and other risks. They are commonly used in industries such as healthcare, manufacturing, construction, food processing, and laboratories. PPE gloves are made from different materials, including latex, nitrile, vinyl, and neoprene, each offering unique protective properties. They play a crucial role in ensuring occupational safety by minimizing the risk of injuries and contamination.

Key Highlights

- The personal protective equipment (PPE) gloves market is anticipated to grow at a CAGR of 4.8% during the forecast period.

- The global personal protective equipment (PPE) gloves market was estimated to be worth approximately USD 89.18 billion in 2023 and is projected to reach a value of USD 142.59 billion by 2032.

- The growth of the personal protective equipment (PPE) gloves market is being driven by increasing awareness of workplace safety regulations and the rising demand for protective gear in various industries.

- Based on the type, the disposable gloves segment is growing at a high rate and is projected to dominate the market.

- In terms of material, the nitrile segment is expected to dominate the market.

- On the basis of application, the healthcare segment is projected to swipe the largest market share.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Personal Protective Equipment (PPE) Gloves Market: Dynamics

Key Growth Drivers

- Stringent Safety Regulations: Increasing workplace safety standards and regulations mandate the use of PPE gloves in various industries.

- Healthcare Sector Growth: Rising demand for disposable gloves in healthcare settings due to infection control and hygiene requirements.

- Industrial Expansion: Growth in industries such as manufacturing, chemicals, and oil & gas drives the need for protective gloves.

- Pandemic Impact: The COVID-19 pandemic has significantly increased the demand for PPE gloves globally.

- Technological Advancements: Innovations in glove materials and designs enhance comfort, durability, and protection.

Restraints

- Raw Material Price Volatility: Fluctuations in the prices of raw materials like latex and nitrile can impact production costs.

- Environmental Concerns: Disposal of disposable gloves contributes to environmental waste, leading to regulatory and consumer pushback.

- Allergic Reactions: Some users may experience allergic reactions to materials like latex, limiting their use.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and cost of PPE gloves.

Opportunities

- Eco-Friendly Products: Developing biodegradable and sustainable gloves to address environmental concerns.

- Emerging Markets: Expanding into developing regions with growing industrial and healthcare sectors.

- Product Diversification: Offering specialized gloves for specific industries or applications, such as cut-resistant or chemical-resistant gloves.

- E-commerce Growth: Increasing online sales channels provide broader market access and convenience for buyers.

Challenges

- Regulatory Compliance: Meeting diverse and evolving safety standards across different regions can be complex.

- Competition: High competition from local and international manufacturers can pressure prices and margins.

- Quality Control: Ensuring consistent quality and performance of gloves to meet safety standards.

- Post-Pandemic Demand Normalization: Managing the transition from pandemic-driven demand to more stable, long-term growth.

Personal Protective Equipment (PPE) Gloves Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Personal Protective Equipment (PPE) Gloves Market |

| Market Size in 2023 | USD 89.18 Billion |

| Market Forecast in 2032 | USD 142.59 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 140 |

| Key Companies Covered | Honeywell International, Kimberly-Clark, Superior Gloves, Shamrock Manufacturing, United Glove, Lakeland Industries, Safety Supply, Magid Glove and Safety Manufacturing, Uvex group, Ansell |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Personal Protective Equipment (PPE) Gloves Market: Segmentation Insights

The global personal protective equipment (PPE) gloves market is divided by type, material, application, and region.

Segmentation Insights by Type

Based on type, the global personal protective equipment (PPE) gloves market is divided into disposable gloves and reusable gloves.

The disposable gloves segment dominates the personal protective equipment (PPE) gloves market due to their widespread use in industries such as healthcare, food processing, and pharmaceuticals. These gloves are preferred for their cost-effectiveness, hygiene benefits, and convenience, as they are designed for single use, reducing the risk of contamination and cross-infection. The demand for disposable gloves surged significantly during the COVID-19 pandemic, and their continued use remains high, particularly in medical and laboratory settings where infection control is a priority. Additionally, regulatory bodies mandate the use of disposable gloves in certain industries, further driving their adoption.

On the other hand, reusable gloves hold a smaller market share but are essential in industries requiring durability and extended protection, such as manufacturing, construction, and chemical processing. Made from materials like nitrile, latex, or neoprene, reusable gloves provide enhanced resistance against chemicals, abrasions, and punctures. While their initial cost is higher than disposable gloves, their long-term usability makes them a cost-effective choice for heavy-duty applications. The demand for reusable gloves is also growing in industrial and household cleaning applications, driven by sustainability concerns and the need to reduce waste from single-use products.

Segmentation Insights by Material

Based on material, the global personal protective equipment (PPE) gloves market is divided into nitrile, latex, neoprene, butyl rubber, and others.

The nitrile gloves segment is the most dominant in the PPE gloves market, primarily due to its superior chemical resistance, durability, and hypoallergenic properties. Nitrile gloves are widely used in healthcare, food processing, and industrial applications as they provide excellent protection against chemicals, oils, and punctures. Their latex-free nature makes them an ideal choice for individuals with latex allergies, further driving their adoption. Additionally, nitrile gloves have gained popularity due to their high tensile strength and flexibility, making them a reliable alternative to latex gloves in medical and laboratory settings.

Latex gloves follow closely behind, valued for their comfort, elasticity, and high tactile sensitivity. They are commonly used in healthcare, dental, and laboratory environments where precision is crucial. However, the presence of latex allergens has led to a gradual decline in their usage, particularly in regions where regulatory restrictions favor latex-free alternatives. Despite this, latex gloves remain popular in certain medical and industrial applications due to their superior fit and affordability compared to nitrile gloves.

Neoprene gloves hold a moderate market share, primarily used in industries that require enhanced chemical resistance, such as laboratories, automotive, and chemical processing. Neoprene provides excellent flexibility, resistance to acids and oils, and durability, making it a preferred choice for applications where protection against harsh substances is needed. Although more expensive than latex and nitrile, neoprene gloves offer a balance between comfort and chemical protection.

Butyl rubber gloves are less common but highly valued in specialized applications requiring resistance to highly corrosive chemicals, gases, and ketones. Industries such as aerospace, pharmaceuticals, and chemical handling rely on butyl rubber gloves for their impermeability and long-lasting protection. However, their high cost and limited flexibility make them less popular for general use.

Segmentation Insights by Application

On the basis of application, the global personal protective equipment (PPE) gloves market is bifurcated into chemical, automotive, healthcare, construction, food and beverage, and others.

The healthcare segment dominates the PPE gloves market due to the stringent safety requirements in hospitals, clinics, and laboratories. Medical professionals, including doctors, nurses, and laboratory technicians, rely on gloves for infection control, patient protection, and hygiene compliance. The demand for disposable gloves, especially nitrile and latex, surged during the COVID-19 pandemic and remains high due to ongoing health and safety regulations. The frequent need for glove changes in medical settings ensures consistent demand, making this the most significant application segment in the market.

The food and beverage industry is another major consumer of PPE gloves, driven by hygiene regulations in food processing, handling, and service. Disposable gloves, primarily nitrile, latex, and vinyl, are commonly used to prevent contamination and ensure food safety. Regulatory bodies such as the FDA and EU food safety authorities mandate the use of gloves in many food-handling environments, further fueling demand. The preference for powder-free, non-latex gloves has increased due to allergy concerns and growing hygiene standards in this sector.

The chemical industry follows, requiring high-performance gloves for handling hazardous substances. Gloves made from materials like neoprene, butyl rubber, and nitrile provide essential protection against corrosive chemicals, acids, and solvents. Industries such as pharmaceuticals, petrochemicals, and laboratory research rely on chemically resistant gloves to safeguard workers from exposure to toxic materials. The demand for chemical-resistant gloves remains steady, with innovations focusing on improved durability and flexibility.

The automotive sector also represents a significant application, with workers using PPE gloves for protection against oils, greases, solvents, and mechanical hazards. Nitrile and neoprene gloves are widely used in automotive repair, painting, and assembly lines due to their resistance to chemicals and abrasions. The growing emphasis on worker safety and compliance with occupational health regulations contributes to the steady demand for protective gloves in this industry.

The construction industry, while a smaller segment compared to healthcare and food, still plays a vital role in PPE glove demand. Workers handling concrete, metals, and hazardous materials require durable gloves made from nitrile, neoprene, or heavy-duty rubber for impact and abrasion resistance. Gloves in construction provide protection against cuts, punctures, and exposure to harsh environmental conditions. While demand is significant, this segment is less dominant than healthcare and food due to the occasional use of gloves depending on the specific task.

Personal Protective Equipment (PPE) Gloves Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

Asia-Pacific stands as the most dominant region in the PPE gloves market, driven by rapid industrialization and the expansion of healthcare infrastructure in countries such as China, Malaysia, and Thailand. Malaysia, in particular, has established itself as a leading producer and exporter of nitrile gloves, with major manufacturers operating extensive production facilities. The region's manufacturing capabilities, coupled with favorable production costs and proximity to raw material sources, have solidified its leading position in the global market. Additionally, growing awareness regarding workplace safety and stringent regulations in various industries further boost demand for PPE gloves across the region.

Europe holds a significant share of the PPE gloves market, supported by a well-established healthcare infrastructure and stringent safety regulations across industries. Countries like Germany, France, and the United Kingdom are major consumers, with the automotive, healthcare, and food processing sectors leading glove usage. Additionally, there is a growing emphasis on eco-friendly and sustainable glove options, reflecting the region's commitment to environmental responsibility. The increasing adoption of advanced materials and innovations in glove production further strengthens the market presence in the region.

North America is a key player in the PPE gloves market, with demand propelled by strict occupational safety regulations and a heightened focus on personal protective equipment, especially in the healthcare, manufacturing, and food processing industries. The United States leads in glove consumption, with hospitals and clinics requiring substantial supplies for medical procedures. The industrial sector also contributes significantly, with gloves being essential for worker safety across various applications. Technological advancements in glove manufacturing and rising consumer awareness regarding protective gear continue to drive market expansion.

The Middle East and Africa region, while currently holding a smaller portion of the global market, is experiencing gradual growth. This expansion is driven by increasing investments in healthcare infrastructure and industrial development in countries such as Saudi Arabia, the United Arab Emirates, and South Africa. The rising awareness of workplace safety and hygiene standards is contributing to the steady demand for PPE gloves across medical and industrial sectors. Government initiatives and regulations promoting worker safety further support the market's development.

Latin America presents emerging opportunities in the PPE gloves market, with growth supported by investments in infrastructure and industrial development. Countries like Brazil and Mexico are key contributors, with increasing awareness of workplace safety driving demand across sectors such as construction, mining, and healthcare. The region's focus on enhancing occupational health standards is expected to further stimulate market growth in the coming years. Rising foreign investments and collaborations with international PPE manufacturers contribute to the steady expansion of the market.

Personal Protective Equipment (PPE) Gloves Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the personal protective equipment (PPE) gloves market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global personal protective equipment (PPE) gloves market include:

- Honeywell International

- Kimberly-Clark

- Superior Gloves

- Shamrock Manufacturing

- United Glove

- Lakeland Industries

- Safety Supply

- Magid Glove and Safety Manufacturing

- Uvex group

- Ansell

The global personal protective equipment (PPE) gloves market is segmented as follows:

By Type

- Disposable Gloves

- Reusable Gloves

- Chemical Resistant

- Cut Resistant

- Puncture Resistant

- Others

By Material

- Nitrile

- Latex

- Neoprene

- Butyl Rubber

- Others

By Application

- Chemical

- Automotive

- Healthcare

- Construction

- Food and Beverage

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global personal protective equipment (PPE) gloves market size was projected at approximately US$ 89.18 billion in 2023. Projections indicate that the market is expected to reach around US$ 142.59 billion in revenue by 2032.

The global personal protective equipment (PPE) gloves market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 4.8% during the forecast period from 2024 to 2032.

Asia-Pacific is expected to dominate the global personal protective equipment (PPE) gloves market.

The global PPE gloves market is driven by stringent workplace safety regulations, increasing awareness of hygiene and infection control, and rapid industrialization, particularly in healthcare, manufacturing, and food processing sectors. Additionally, technological advancements in glove materials and growing demand for eco-friendly options further propel market growth.

Some of the prominent players operating in the global personal protective equipment (PPE) gloves market are; Honeywell International, Kimberly-Clark, Superior Gloves, Shamrock Manufacturing, United Glove, Lakeland Industries, Safety Supply, Magid Glove and Safety Manufacturing, Uvex group, Ansell, and others.

The global personal protective equipment (PPE) gloves market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

Personal Protective Equipment (PPE) Gloves

Request Sample

Personal Protective Equipment (PPE) Gloves