Pet Wearable Market Size, Share, and Trends Analysis Report

CAGR :

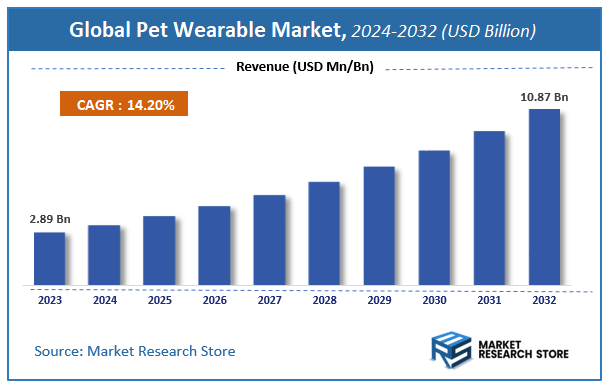

| Market Size 2023 (Base Year) | USD 2.89 Billion |

| Market Size 2032 (Forecast Year) | USD 10.87 Billion |

| CAGR | 14.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Pet Wearable Market Insights

According to Market Research Store, the global pet wearable market size was valued at around USD 2.89 billion in 2023 and is estimated to reach USD 10.87 billion by 2032, to register a CAGR of approximately 14.2% in terms of revenue during the forecast period 2024-2032.

The pet wearable report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Pet Wearable Market: Overview

Pet wearables are smart devices designed to monitor, track, and enhance the well-being of pets. These devices include GPS trackers, activity monitors, health monitoring collars, and smart harnesses, providing real-time data on a pet’s location, physical activity, and overall health. Pet owners use these wearables to ensure their pets' safety, manage their fitness levels, and detect early signs of illness. Advanced pet wearables integrate technologies like GPS, RFID, Bluetooth, and Wi-Fi, allowing seamless connectivity with mobile applications for real-time updates and alerts.

Key Highlights

- The pet wearable market is anticipated to grow at a CAGR of 14.2% during the forecast period.

- The global pet wearable market was estimated to be worth approximately USD 2.89 billion in 2023 and is projected to reach a value of USD 10.87 billion by 2032.

- The growth of the pet wearable market is being driven by the rising pet ownership rates and increasing concerns for pet health and safety.

- Based on the product, the smart collar segment is growing at a high rate and is projected to dominate the market.

- On the basis of animal type, the dogs segment is projected to swipe the largest market share.

- In terms of technology, the GPS segment is expected to dominate the market.

- Based on the application, the identification & tracking segment is expected to dominate the market.

- On the basis of sales channel, the online segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Pet Wearable Market: Dynamics

Key Growth Drivers

- Increasing Pet Ownership: Rising pet adoption, especially in urban areas, drives demand for pet wearables to monitor and enhance pet care.

- Technological Advancements: Innovations in IoT, GPS, and health monitoring technologies make pet wearables more efficient and accessible.

- Growing Awareness of Pet Health: Pet owners are increasingly focused on preventive healthcare, boosting demand for health-tracking wearables.

- Humanization of Pets: Pets are increasingly treated as family members, leading to higher spending on advanced pet care products.

- Rising Disposable Income: Higher disposable incomes enable pet owners to invest in premium pet care solutions.

Restraints

- High Costs: Advanced pet wearables can be expensive, limiting adoption among price-sensitive consumers.

- Limited Battery Life: Frequent charging requirements can be inconvenient for pet owners.

- Data Privacy Concerns: Collection and storage of pet health data raise privacy and security issues.

- Lack of Awareness: In some regions, low awareness about pet wearables hinders market growth.

Opportunities

- Emerging Markets: Untapped potential in developing regions with growing pet ownership and disposable incomes.

- Integration with Smart Home Devices: Opportunities to integrate pet wearables with smart home ecosystems for seamless monitoring.

- Customization and Personalization: Demand for breed-specific or health-condition-specific wearables offers growth opportunities.

- Partnerships with Veterinarians: Collaborations with veterinary clinics to promote wearables as part of pet healthcare solutions.

Challenges

- Regulatory Hurdles: Compliance with varying regulations across regions can be complex and time-consuming.

- Product Durability: Ensuring wearables are durable and comfortable for pets of all sizes and activity levels.

- Competition from Low-Counterfeit Products: Cheap, low-quality alternatives can undermine market growth.

- Limited Pet Owner Tech-Savviness: Some pet owners may find it challenging to use advanced wearable technologies.

Pet Wearable Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pet Wearable Market |

| Market Size in 2023 | USD 2.89 Billion |

| Market Forecast in 2032 | USD 10.87 Billion |

| Growth Rate | CAGR of 14.2% |

| Number of Pages | 140 |

| Key Companies Covered | Avid Identification Systems Inc., Allflex USA Inc., Whistle Labs Inc., Tractive, GoPro, IceRobotics, Datamars, FitBark, Nedap, Dropcam, Garmin Ltd., Voyce, Invisible Fence, KYON, Silent Herdsman Limited, Pet Vu Inc., Link AKC, Felcana, Invoxia, Loc8tor Ltd., Tag, Scollar, PetPace LLC, I4c Innovations, Garmin Ltd, Dogtra |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pet Wearable Market: Segmentation Insights

The global pet wearable market is divided by product, animal type, technology, application, sales channel, and region.

Segmentation Insights by Product

Based on product, the global pet wearable market is divided into smart camera, smart collar, smart vest, smart harness, and others.

The Smart Collar segment is the most dominant in the pet wearable market, driven by its multifunctionality and widespread adoption among pet owners. Smart collars offer GPS tracking, activity monitoring, and health insights, making them essential for pet safety and well-being. With pet owners increasingly concerned about their pets’ security and fitness, smart collars have gained immense popularity, especially in urban areas. Their compatibility with mobile apps and smart home systems further enhances their appeal, making them a preferred choice over other wearable devices.

Following smart collars, Smart Cameras hold a significant share in the market, primarily due to rising pet monitoring needs. These cameras allow owners to check in on their pets remotely via live video streaming, detect unusual activities, and even offer interactive features such as treat dispensers and two-way audio communication. The growing trend of pet humanization and concern for pet welfare while owners are away has contributed to the increasing demand for smart cameras, particularly among working professionals.

Smart Vests are another growing segment, primarily used for health monitoring and behavioral training. These vests are often equipped with sensors to track vital signs like heart rate, temperature, and stress levels, making them particularly useful for aging or medically sensitive pets. Additionally, they are gaining traction among pet trainers and law enforcement agencies for training service dogs. The integration of advanced analytics in these vests is further driving their adoption in specialized pet care.

The Smart Harness segment, though relatively smaller, is expanding as an alternative to smart collars, particularly for larger dog breeds and service animals. Smart harnesses provide ergonomic support along with GPS tracking, health monitoring, and even motion analysis, which is beneficial for dogs undergoing rehabilitation or training. While not as widely adopted as smart collars, their specialized functionalities are contributing to steady market growth.

Segmentation Insights by Animal Type

On the basis of animal type, the global pet wearable market is bifurcated into dogs, cats, and other.

The Dogs segment is the most dominant in the pet wearable market, accounting for the largest share due to the widespread adoption of wearable technology among dog owners. Dogs are more likely to wear smart collars, vests, and harnesses for tracking, training, and health monitoring. The demand for GPS-enabled smart collars is particularly high among dog owners, as they help in locating lost pets and ensuring their safety. Additionally, dog owners are more inclined to invest in activity-tracking devices to monitor their pets’ fitness and well-being. The increasing use of smart wearables in training service dogs and law enforcement K9 units further strengthens this segment’s market dominance.

The Cats segment follows, with a growing market share as cat owners gradually adopt smart wearables. Unlike dogs, cats tend to be more independent and are often allowed to roam freely, making GPS-enabled smart collars particularly useful for tracking their location. However, challenges such as lower acceptance of wearables by cats and their smaller size have limited the adoption of certain products like smart vests and harnesses. Despite this, advancements in lightweight and comfortable designs are encouraging more cat owners to invest in pet wearables, particularly for safety and health monitoring.

Segmentation Insights by Technology

Based on technology, the global pet wearable market is divided into GPS, RFID, and bluetooth.

The GPS segment is the most dominant in the pet wearable market, as pet owners prioritize location tracking for safety and security. GPS-enabled devices, particularly smart collars and harnesses, are widely used to monitor pets’ real-time location, reducing the risk of losing them. The demand for GPS technology is especially high among dog owners, as it allows for geofencing, route tracking, and remote monitoring via mobile apps. Additionally, advancements in GPS accuracy and battery efficiency are further driving adoption, making this segment the largest in the market.

The RFID (Radio Frequency Identification) segment follows, primarily used for identification and access control. Unlike GPS, RFID does not provide real-time location tracking but is widely implemented in microchips embedded under a pet’s skin or within smart tags. RFID technology is commonly used for pet identification and retrieval, helping veterinarians, shelters, and owners verify pet ownership. While it lacks tracking capabilities, its affordability and passive nature make it a popular choice for permanent pet identification, contributing to its steady market growth.

The Bluetooth segment holds the smallest share but is gaining traction due to its low energy consumption and short-range tracking capabilities. Bluetooth-enabled smart collars and tags allow pet owners to track their pets within a limited radius, making them useful for indoor applications. Some Bluetooth devices are integrated with GPS for enhanced tracking, but on their own, they are less effective for long-distance pet monitoring. Despite its lower dominance, Bluetooth technology is expanding due to its cost-effectiveness and seamless connectivity with smartphones and smart home devices.

Segmentation Insights by Application

On the basis of application, the global pet wearable market is bifurcated into identification & tracking, behavior monitoring & control, facilitation, safety & security, and medical diagnosis & treatment.

The Identification & Tracking segment is the most dominant in the pet wearable market, driven by the high demand for GPS, RFID, and Bluetooth-enabled devices. Pet owners prioritize tracking solutions, particularly GPS collars and microchipped RFID tags, to locate lost pets and verify their ownership. With growing concerns about pet safety, geofencing and real-time location tracking have become essential features in pet wearables. This segment continues to expand as more pet owners seek reliable tracking solutions, especially in urban areas where the risk of losing pets is higher.

The Behavior Monitoring & Control segment follows, focusing on tracking pets’ activity levels, habits, and emotional states. Smart collars and vests equipped with motion sensors and AI-driven analytics help owners and trainers assess pets' behavior patterns, detect anxiety, and improve training methods. Features such as bark control, activity tracking, and posture monitoring make behavior-focused wearables popular, particularly among dog owners and professional trainers. As pet humanization trends rise, this segment is seeing increased adoption.

The Facilitation segment includes smart wearables designed to improve the interaction between pets and their owners. This category covers devices such as automated feeders, communication-enabled smart collars, and pet-friendly smart home integrations. These products allow pet owners to automate tasks and stay connected with their pets remotely. Although this segment is growing, it remains behind tracking and monitoring applications in overall market dominance.

The Safety & Security segment primarily includes smart collars and harnesses designed to prevent theft or escape. Anti-theft wearables with geofencing and real-time alerts have gained traction, particularly among owners of expensive breeds and working dogs. Wearables designed to improve nighttime visibility, such as LED-equipped collars and reflective smart vests, also contribute to this segment’s steady growth.

The Medical Diagnosis & Treatment segment is the smallest but growing steadily, as pet healthcare technology advances. Smart vests and sensors capable of monitoring vital signs, detecting early signs of illness, and alerting owners about health issues are becoming more common. Veterinarians and pet owners are adopting these devices to track chronic conditions such as heart disease, arthritis, and diabetes. Although this segment is still in its early stages compared to tracking and behavior monitoring, it holds significant potential for future growth as pet healthcare awareness increases.

Segmentation Insights by Sales Channel

On the basis of sales channel, the global pet wearable market is bifurcated into online and offline.

The Online segment is the most dominant sales channel in the pet wearable market, driven by the convenience, variety, and competitive pricing offered by e-commerce platforms. Pet owners prefer online shopping due to easy access to a wide range of smart collars, vests, harnesses, and other wearables from different brands. Online marketplaces such as Amazon, Chewy, and pet-specific e-commerce stores provide detailed product reviews, comparison tools, and home delivery options, making it the preferred choice for many consumers. Additionally, discounts, subscription models, and bundled offers further boost sales through online channels. With the rise of digital shopping trends and direct-to-consumer brand strategies, online sales continue to dominate the market.

The Offline segment, while smaller, remains significant, particularly in pet specialty stores, veterinary clinics, and large retail chains. Many pet owners prefer buying wearables from physical stores where they can see and test the products before purchasing. Veterinary clinics and pet supply stores play a crucial role in recommending smart health-monitoring wearables, particularly for medical diagnosis and treatment applications. However, the offline segment faces challenges due to limited inventory and higher prices compared to online platforms. Despite this, physical retail stores continue to thrive by offering personalized customer service, expert recommendations, and immediate product availability.

Pet Wearable Market: Regional Insights

- North America is expected to dominates the global market

The North American pet wearable market leads globally, driven by a significant pet-owning population and a strong emphasis on pet health and safety. The region's technological infrastructure supports the adoption of advanced wearable devices, enabling pet owners to monitor their pets' activities and well-being effectively. The presence of major market players and a high level of consumer awareness further bolster the market's dominance in this region.

In Europe, the pet wearable market is experiencing substantial growth, fueled by increasing demand for pet monitoring solutions and technological advancements. Countries like Germany and the UK are at the forefront, with a rising number of pet tech startups and significant investments in innovative products. The trend of pet humanization and the growing focus on pet health and safety contribute to the market's expansion across the continent.

The Asia Pacific region is witnessing rapid growth in the pet wearable market, attributed to a rising pet population and increasing disposable incomes. Countries such as China, Japan, and Australia are leading this surge, with pet owners showing a heightened interest in integrating technology into pet care. The adoption of smart collars, cameras, and fitness trackers is on the rise, reflecting a broader trend of prioritizing pet well-being and health monitoring in the region.

In the Middle East and Africa, the pet wearable market is expanding steadily, driven by growing pet ownership and increased awareness of pet health monitoring. Technological advancements and the adoption of IoT-based pet monitoring solutions are contributing to market growth. Countries in the Gulf Cooperation Council (GCC) are witnessing a rise in demand for pet wearables, reflecting changing lifestyles and a greater emphasis on pet care.

South America is emerging as a promising market for pet wearables, with increasing pet adoption rates and a growing middle class. Countries like Brazil and Argentina are experiencing a surge in demand for pet health monitoring devices, driven by a heightened awareness of pet well-being and safety. The market's growth is supported by technological advancements and the availability of innovative pet care solutions in the region.

Recent Developments:

- In January 2024, Tractive launched pet insurance for UK dog and cat owners through its subsidiary, Tractive Pet U.K. Ltd. The Austrian pet tracking company now offers comprehensive coverage for accidents, illness, and dental treatment.

- In November 2023, PetPace partnered with Veterinary Health Research Centers (VHRC) to study Canine Alzheimer's Disease through the DOGMA initiative. PetPace's biometric collars will monitor aging dogs' health and behavior to identify similarities with human Alzheimer's.

Pet Wearable Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the pet wearable market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global pet wearable market include:

- Binatone Global

- Cybortra Technology

- FitBark

- Garmin

- KYON

- PETFON

- PetPace

- PetTech.co.uk.Ltd.

- Tractive

- Avid Identification Systems Inc.

- Barking Labs

- Datamars

- Felcana

- GoPro Inc.

- LATSEN

- Link My Pet

- Loc8tor Ltd.

- Mars Incorporated

The global pet wearable market is segmented as follows:

By Product

- Smart Camera

- Smart Collar

- Smart Vest

- Smart Harness

- Others

By Animal Type

- Dogs

- Cats

- Other

By Technology

- GPS

- RFID

- Bluetooth

By Application

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation

- Safety & Security

- Medical Diagnosis & Treatment

By Sales Channel

- Online

- Offline

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global pet wearable market size was projected at approximately US$ 2.89 billion in 2023. Projections indicate that the market is expected to reach around US$ 10.87 billion in revenue by 2032.

The global pet wearable market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 14.2% during the forecast period from 2024 to 2032.

North America is expected to dominate the global pet wearable market.

The global pet wearable market is driven by increasing pet ownership, rising awareness of pet health and safety, and advancements in smart technologies like GPS tracking, health monitoring, and behavior analysis. Growing disposable incomes and the trend of pet humanization further boost market growth.

Some of the prominent players operating in the global pet wearable market are; Binatone Global, Cybortra Technology, FitBark, Garmin, KYON, PETFON, PetPace, PetTech.co.uk.Ltd., Tractive, Avid Identification Systems Inc., Barking Labs, Datamars, Felcana, GoPro Inc., LATSEN, Link My Pet, Loc8tor Ltd., Mars Incorporated, and others.

The global pet wearable market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

Pet Wearable

Request Sample

Pet Wearable