Pharmaceutical Testing and Analytical Services Market Size, Share, and Trends Analysis Report

CAGR :

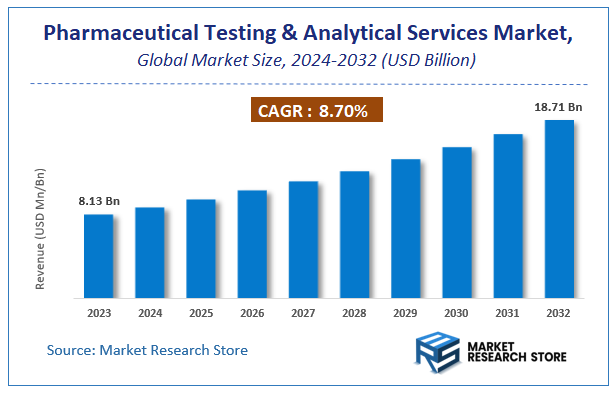

| Market Size 2023 (Base Year) | USD 8.13 Billion |

| Market Size 2032 (Forecast Year) | USD 18.71 Billion |

| CAGR | 8.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Market Research Store has published a report on the global pharmaceutical testing and analytical services market, estimating its value at USD 8.13 Billion in 2023, with projections indicating it will reach USD 18.71 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 8.7% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the pharmaceutical testing and analytical services industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Pharmaceutical Testing and Analytical Services Market: Overview

The growth of the pharmaceutical testing and analytical services market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The pharmaceutical testing and analytical services market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the pharmaceutical testing and analytical services market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Service Type, Application, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global pharmaceutical testing and analytical services market is estimated to grow annually at a CAGR of around 8.7% over the forecast period (2024-2032).

- In terms of revenue, the global pharmaceutical testing and analytical services market size was valued at around USD 8.13 Billion in 2023 and is projected to reach USD 18.71 Billion by 2032.

- The market is projected to grow at a significant rate due to Rising drug development and regulatory compliance requirements drive service demand.

- Based on the Service Type, the Bioanalytical Testing segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Raw Material Testing segment is anticipated to command the largest market share.

- In terms of End-User, the Pharmaceutical Companies segment is projected to lead the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Pharmaceutical Testing and Analytical Services Market: Report Scope

This report thoroughly analyzes the pharmaceutical testing and analytical services market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Testing and Analytical Services Market |

| Market Size in 2023 | USD 8.13 Billion |

| Market Forecast in 2032 | USD 18.71 Billion |

| Growth Rate | CAGR of 8.7% |

| Number of Pages | 208 |

| Key Companies Covered | Eurofins Scientific, SGS SA, Labcorp, Charles River Laboratories, Thermo Fisher Scientific, WuXi AppTec, PPD Inc., Intertek Group, Catalent Inc., Merck KGaA |

| Segments Covered | By Service Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical Testing and Analytical Services Market: Dynamics

Key Growth Drivers

The Pharmaceutical Testing and Analytical Services market is experiencing robust growth, primarily driven by the increasing stringency of global regulatory guidelines and the heightened focus on product safety, efficacy, and quality throughout the drug development lifecycle. The rising number of clinical trials for new drug development, particularly for complex biologics and biosimilars, necessitates extensive analytical testing at every stage. Furthermore, the growing trend of outsourcing analytical testing services by pharmaceutical and medical device companies contributes significantly to market expansion. This outsourcing is fueled by factors such as cost advantages, the need for specialized expertise and advanced infrastructure that in-house labs may lack, and the pressure to reduce time-to-market for new therapies.

Restraints

Despite the strong growth drivers, the Pharmaceutical Testing and Analytical Services market faces several notable restraints. The complexity of regulatory frameworks across various international markets poses a significant challenge, requiring service providers to navigate diverse and constantly evolving compliance requirements, which can be resource-intensive and time-consuming. The high cost associated with establishing and maintaining state-of-the-art analytical laboratories, including investments in advanced instrumentation and the need for highly skilled personnel, can be prohibitive, especially for smaller companies. Additionally, the increasing complexity of new drug molecules, such as biologics and gene therapies, demands highly specialized and often expensive analytical techniques, which can add to the overall cost burden and lead to bottlenecks in testing processes.

Opportunities

The Pharmaceutical Testing and Analytical Services market presents numerous opportunities for innovation and expansion. The increasing focus on personalized medicine and advanced therapies (e.g., cell and gene therapies) is creating a demand for more specialized and tailored analytical testing services, including genomics, proteomics, and metabolomics. The integration of advanced technologies such as automation, robotics, Artificial Intelligence (AI), and machine learning into analytical testing processes offers significant opportunities to enhance efficiency, accuracy, and cost-effectiveness. Furthermore, the growing trend of digital transformation in laboratories, including the adoption of Laboratory Information Management Systems (LIMS) and Electronic Lab Notebooks (ELN), improves data management, integrity, and regulatory compliance, creating new avenues for service providers.

Challenges

The Pharmaceutical Testing and Analytical Services market faces several critical challenges that demand continuous adaptation and strategic solutions. Managing the immense volume of analytical data generated from complex testing, while ensuring its accuracy, traceability, and integrity, remains a significant hurdle, particularly with legacy data systems. The persistent talent gap of skilled professionals proficient in operating advanced analytical instruments and interpreting complex data poses a challenge for service providers to meet the growing demand. Additionally, the pressure from pharmaceutical companies to fast-track drug development while simultaneously reducing costs creates a delicate balance, as analytical testing can be a multi-staged and multi-technique oriented bottleneck, making the dream of speed, cost, and quality difficult to achieve simultaneously.

Pharmaceutical Testing and Analytical Services Market: Segmentation Insights

The global pharmaceutical testing and analytical services market is segmented based on Service Type, Application, End-User, and Region. All the segments of the pharmaceutical testing and analytical services market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Service Type, the global pharmaceutical testing and analytical services market is divided into Bioanalytical Testing, Method Development & Validation, Stability Testing, Microbiology Testing, Others.

On the basis of Application, the global pharmaceutical testing and analytical services market is bifurcated into Raw Material Testing, Finished Product Testing, Clinical Testing, Environmental Monitoring, Others.

In terms of End-User, the global pharmaceutical testing and analytical services market is categorized into Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations, Academic Institutes.

Pharmaceutical Testing and Analytical Services Market: Regional Insights

The Pharmaceutical Testing and Analytical Services Market is currently dominated by North America, which holds the largest market share (over 42%), driven by stringent FDA regulations, high R&D investments, and a robust biopharmaceutical sector in the U.S. and Canada. The region benefits from advanced laboratory infrastructure, a strong presence of CROs (Contract Research Organizations) like LabCorp and Charles River Laboratories, and increasing demand for biologics and biosimilars testing. Europe follows as the second-largest market, with significant growth in Germany, the UK, and France, supported by EMA compliance requirements and a focus on precision medicine. The Asia-Pacific (APAC) region is the fastest-growing market, fueled by expanding pharmaceutical manufacturing, government initiatives, and clinical trial outsourcing in India, China, and Japan. Latin America and the Middle East & Africa show emerging potential but face challenges due to limited local expertise. North America’s dominance is reinforced by technological advancements in bioanalytical testing and partnerships with academic research centers.

Pharmaceutical Testing and Analytical Services Market: Competitive Landscape

The pharmaceutical testing and analytical services market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Pharmaceutical Testing and Analytical Services Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Eurofins Scientific

- SGS SA

- Labcorp

- Charles River Laboratories

- Thermo Fisher Scientific

- WuXi AppTec

- PPD Inc.

- Intertek Group

- Catalent Inc.

- Merck KGaA

The Global Pharmaceutical Testing and Analytical Services Market is Segmented as Follows:

By Service Type

- Bioanalytical Testing

- Method Development & Validation

- Stability Testing

- Microbiology Testing

- Others

By Application

- Raw Material Testing

- Finished Product Testing

- Clinical Testing

- Environmental Monitoring

- Others

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations

- Academic Institutes

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Evolution

This section evaluates the market position of the product or service by examining its development pathway and competitive dynamics. It provides a detailed overview of the product's growth stages, including the early (historical) phase, the mid-stage, and anticipated future advancements influenced by innovation and emerging technologies.

Porter’s Analysis

Porter’s Five Forces framework offers a strategic lens for assessing competitor behavior and the positioning of key players in the pharmaceutical testing and analytical services industry. This section explores the external factors shaping competitive dynamics and influencing market strategies in the years ahead. The analysis focuses on five critical forces:

- Competitive Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Supplier Bargaining Power

- Buyer Bargaining Power

Value Chain & Market Attractiveness Analysis

The value chain analysis helps businesses optimize operations by mapping the product flow from suppliers to end consumers, identifying opportunities to streamline processes and gain a competitive edge. Segment-wise market attractiveness analysis evaluates key dimensions like product categories, demographics, and regions, assessing growth potential, market size, and profitability. This enables businesses to focus resources on high-potential segments for better ROI and long-term value.

PESTEL Analysis

PESTEL analysis is a powerful tool in market research reports that enhances market understanding by systematically examining the external macro-environmental factors influencing a business or industry. The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors. By evaluating these dimensions, PESTEL analysis provides a comprehensive overview of the broader context within which a market operates, helping businesses identify potential opportunities and threats.

- Political factors assess government policies, stability, trade regulations, and political risks that could impact market operations.

- Economic factors examine variables like inflation, exchange rates, economic growth, and consumer spending power to determine market viability.

- Social factors explore cultural trends, demographics, and lifestyle changes that shape consumer behavior and preferences.

- Technological factors evaluate innovation, R&D, and technological advancements affecting product development and operational efficiencies.

- Environmental factors focus on sustainability, climate change impacts, and eco-friendly practices shaping market trends.

- Legal factors address compliance requirements, industry regulations, and intellectual property laws impacting market entry and operations.

Import-export Analysis & Pricing Analysis

An import-export analysis is vital for market research, revealing global trade dynamics, trends, and opportunities. It examines trade volumes, product categories, and regional competitiveness, offering insights into supply chains and market demand. This section also analyzes past and future pricing trends, helping businesses optimize strategies and enabling consumers to assess product value effectively.

Pharmaceutical Testing and Analytical Services Market: Company Profiles

The report identifies key players in the pharmaceutical testing and analytical services market through a competitive landscape and company profiles, evaluating their offerings, financial performance, strategies, and market positioning. It includes a SWOT analysis of the top 3-5 companies, assessing strengths, weaknesses, opportunities, and threats. The competitive landscape highlights rankings, recent activities (mergers, acquisitions, partnerships, product launches), and regional footprints using the Ace matrix. Customization is available to meet client-specific needs.

Regional & Industry Footprint

This section details the geographic reach, sales networks, and market penetration of companies profiled in the pharmaceutical testing and analytical services report, showcasing their operations and distribution across regions. It analyzes the alignment of companies with specific industry verticals, highlighting the industries they serve and the scope of their products and services within those sectors.

Ace Matrix

This section categorizes companies into four distinct groups—Active, Cutting Edge, Innovator, and Emerging—based on their product and business strategies. The evaluation of product strategy focuses on aspects such as the range and depth of offerings, commitment to innovation, product functionalities, and scalability. Key elements like global reach, sector coverage, strategic acquisitions, and long-term growth plans are considered for business strategy. This analysis provides a detailed view of companies' position within the market and highlights their potential for future growth and development.

Research Methodology

The qualitative and quantitative insights for the pharmaceutical testing and analytical services market are derived through a multi-faceted research approach, combining input from subject matter experts, primary research, and secondary data sources. Primary research includes gathering critical information via face-to-face or telephonic interviews, surveys, questionnaires, and feedback from industry professionals, key opinion leaders (KOLs), and customers. Regular interviews with industry experts are conducted to deepen the analysis and reinforce the existing data, ensuring a robust and well-rounded market understanding.

Secondary research for this report was carried out by the Market Research Store team, drawing on a variety of authoritative sources, such as:

- Official company websites, annual reports, financial statements, investor presentations, and SEC filings

- Internal and external proprietary databases, as well as relevant patent and regulatory databases

- Government publications, national statistical databases, and industry-specific market reports

- Media coverage, including news articles, press releases, and webcasts about market participants

- Paid industry databases for detailed market insights

Market Research Store conducted in-depth consultations with various key opinion leaders in the industry, including senior executives from top companies and regional leaders from end-user organizations. This effort aimed to gather critical insights on factors such as the market share of dominant brands in specific countries and regions, along with pricing strategies for products and services.

To determine total sales data, the research team conducted primary interviews across multiple countries with influential stakeholders, including:

- Distributors

- Marketing, Brand, and Product Managers

- Procurement and Production Managers

- Sales and Regional Sales Managers, Country Managers

- Technical Specialists

- C-Level Executives

These subject matter experts, with their extensive industry experience, helped validate and refine the findings. For secondary research, data was sourced from a wide range of materials, including online resources, company annual reports, industry publications, research papers, association reports, and government websites. These various sources provide a comprehensive and well-rounded perspective on the market.

Frequently Asked Questions

What will be the CAGR of the pharmaceutical testing and analytical services market during 2025-2032?

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Pharmaceutical Testing and Analytical Services Market Share by Type (2020-2026) 1.5.2 Raw Materials Testing 1.5.3 In-Process and Product Release Testing 1.5.4 Finished Pharmaceutical Products Testing 1.5.5 Environmental Samples 1.5.6 Others 1.6 Market by Application 1.6.1 Global Pharmaceutical Testing and Analytical Services Market Share by Application (2020-2026) 1.6.2 Clinics 1.6.3 Hospitals 1.6.4 Others 1.7 Pharmaceutical Testing and Analytical Services Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Pharmaceutical Testing and Analytical Services Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Pharmaceutical Testing and Analytical Services Market 3.1 Value Chain Status 3.2 Pharmaceutical Testing and Analytical Services Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Pharmaceutical Testing and Analytical Services 3.2.3 Labor Cost of Pharmaceutical Testing and Analytical Services 3.2.3.1 Labor Cost of Pharmaceutical Testing and Analytical Services Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 DYNALABS 4.1.1 DYNALABS Basic Information 4.1.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.1.3 DYNALABS Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.1.4 DYNALABS Business Overview 4.2 EAG Inc. 4.2.1 EAG Inc. Basic Information 4.2.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.2.3 EAG Inc. Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.2.4 EAG Inc. Business Overview 4.3 Exova Group PLC 4.3.1 Exova Group PLC Basic Information 4.3.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.3.3 Exova Group PLC Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.3.4 Exova Group PLC Business Overview 4.4 Eurofins Scientific SE 4.4.1 Eurofins Scientific SE Basic Information 4.4.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.4.3 Eurofins Scientific SE Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.4.4 Eurofins Scientific SE Business Overview 4.5 Envigo 4.5.1 Envigo Basic Information 4.5.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.5.3 Envigo Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.5.4 Envigo Business Overview 4.6 West Pharmaceutical Services, Inc. 4.6.1 West Pharmaceutical Services, Inc. Basic Information 4.6.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.6.3 West Pharmaceutical Services, Inc. Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.6.4 West Pharmaceutical Services, Inc. Business Overview 4.7 Intertek Group 4.7.1 Intertek Group Basic Information 4.7.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.7.3 Intertek Group Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.7.4 Intertek Group Business Overview 4.8 Boston Analytical 4.8.1 Boston Analytical Basic Information 4.8.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.8.3 Boston Analytical Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.8.4 Boston Analytical Business Overview 4.9 Microbac 4.9.1 Microbac Basic Information 4.9.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.9.3 Microbac Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.9.4 Microbac Business Overview 4.10 Polymer Solutions 4.10.1 Polymer Solutions Basic Information 4.10.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.10.3 Polymer Solutions Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.10.4 Polymer Solutions Business Overview 4.11 ADPEN Laboratories 4.11.1 ADPEN Laboratories Basic Information 4.11.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.11.3 ADPEN Laboratories Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.11.4 ADPEN Laboratories Business Overview 4.12 ARLBioPharma, Inc. 4.12.1 ARLBioPharma, Inc. Basic Information 4.12.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.12.3 ARLBioPharma, Inc. Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.12.4 ARLBioPharma, Inc. Business Overview 4.13 PPD Inc. 4.13.1 PPD Inc. Basic Information 4.13.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.13.3 PPD Inc. Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.13.4 PPD Inc. Business Overview 4.14 BioScreen Inc. 4.14.1 BioScreen Inc. Basic Information 4.14.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.14.3 BioScreen Inc. Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.14.4 BioScreen Inc. Business Overview 4.15 SGS 4.15.1 SGS Basic Information 4.15.2 Pharmaceutical Testing and Analytical Services Product Profiles, Application and Specification 4.15.3 SGS Pharmaceutical Testing and Analytical Services Market Performance (2015-2020) 4.15.4 SGS Business Overview 5 Global Pharmaceutical Testing and Analytical Services Market Analysis by Regions 5.1 Global Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Regions 5.1.1 Global Pharmaceutical Testing and Analytical Services Sales by Regions (2015-2020) 5.1.2 Global Pharmaceutical Testing and Analytical Services Revenue by Regions (2015-2020) 5.2 North America Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 5.3 Europe Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 5.6 South America Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 6 North America Pharmaceutical Testing and Analytical Services Market Analysis by Countries 6.1 North America Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Countries 6.1.1 North America Pharmaceutical Testing and Analytical Services Sales by Countries (2015-2020) 6.1.2 North America Pharmaceutical Testing and Analytical Services Revenue by Countries (2015-2020) 6.1.3 North America Pharmaceutical Testing and Analytical Services Market Under COVID-19 6.2 United States Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 6.2.1 United States Pharmaceutical Testing and Analytical Services Market Under COVID-19 6.3 Canada Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 6.4 Mexico Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 7 Europe Pharmaceutical Testing and Analytical Services Market Analysis by Countries 7.1 Europe Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Countries 7.1.1 Europe Pharmaceutical Testing and Analytical Services Sales by Countries (2015-2020) 7.1.2 Europe Pharmaceutical Testing and Analytical Services Revenue by Countries (2015-2020) 7.1.3 Europe Pharmaceutical Testing and Analytical Services Market Under COVID-19 7.2 Germany Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 7.2.1 Germany Pharmaceutical Testing and Analytical Services Market Under COVID-19 7.3 UK Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 7.3.1 UK Pharmaceutical Testing and Analytical Services Market Under COVID-19 7.4 France Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 7.4.1 France Pharmaceutical Testing and Analytical Services Market Under COVID-19 7.5 Italy Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 7.5.1 Italy Pharmaceutical Testing and Analytical Services Market Under COVID-19 7.6 Spain Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 7.6.1 Spain Pharmaceutical Testing and Analytical Services Market Under COVID-19 7.7 Russia Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 7.7.1 Russia Pharmaceutical Testing and Analytical Services Market Under COVID-19 8 Asia-Pacific Pharmaceutical Testing and Analytical Services Market Analysis by Countries 8.1 Asia-Pacific Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Pharmaceutical Testing and Analytical Services Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Pharmaceutical Testing and Analytical Services Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Pharmaceutical Testing and Analytical Services Market Under COVID-19 8.2 China Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 8.2.1 China Pharmaceutical Testing and Analytical Services Market Under COVID-19 8.3 Japan Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 8.3.1 Japan Pharmaceutical Testing and Analytical Services Market Under COVID-19 8.4 South Korea Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 8.4.1 South Korea Pharmaceutical Testing and Analytical Services Market Under COVID-19 8.5 Australia Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 8.6 India Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 8.6.1 India Pharmaceutical Testing and Analytical Services Market Under COVID-19 8.7 Southeast Asia Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Pharmaceutical Testing and Analytical Services Market Under COVID-19 9 Middle East and Africa Pharmaceutical Testing and Analytical Services Market Analysis by Countries 9.1 Middle East and Africa Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Pharmaceutical Testing and Analytical Services Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Pharmaceutical Testing and Analytical Services Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Pharmaceutical Testing and Analytical Services Market Under COVID-19 9.2 Saudi Arabia Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 9.3 UAE Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 9.4 Egypt Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 9.5 Nigeria Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 9.6 South Africa Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 10 South America Pharmaceutical Testing and Analytical Services Market Analysis by Countries 10.1 South America Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Countries 10.1.1 South America Pharmaceutical Testing and Analytical Services Sales by Countries (2015-2020) 10.1.2 South America Pharmaceutical Testing and Analytical Services Revenue by Countries (2015-2020) 10.1.3 South America Pharmaceutical Testing and Analytical Services Market Under COVID-19 10.2 Brazil Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 10.2.1 Brazil Pharmaceutical Testing and Analytical Services Market Under COVID-19 10.3 Argentina Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 10.4 Columbia Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 10.5 Chile Pharmaceutical Testing and Analytical Services Sales and Growth Rate (2015-2020) 11 Global Pharmaceutical Testing and Analytical Services Market Segment by Types 11.1 Global Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Pharmaceutical Testing and Analytical Services Sales and Market Share by Types (2015-2020) 11.1.2 Global Pharmaceutical Testing and Analytical Services Revenue and Market Share by Types (2015-2020) 11.2 Raw Materials Testing Sales and Price (2015-2020) 11.3 In-Process and Product Release Testing Sales and Price (2015-2020) 11.4 Finished Pharmaceutical Products Testing Sales and Price (2015-2020) 11.5 Environmental Samples Sales and Price (2015-2020) 11.6 Others Sales and Price (2015-2020) 12 Global Pharmaceutical Testing and Analytical Services Market Segment by Applications 12.1 Global Pharmaceutical Testing and Analytical Services Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Pharmaceutical Testing and Analytical Services Sales and Market Share by Applications (2015-2020) 12.1.2 Global Pharmaceutical Testing and Analytical Services Revenue and Market Share by Applications (2015-2020) 12.2 Clinics Sales, Revenue and Growth Rate (2015-2020) 12.3 Hospitals Sales, Revenue and Growth Rate (2015-2020) 12.4 Others Sales, Revenue and Growth Rate (2015-2020) 13 Pharmaceutical Testing and Analytical Services Market Forecast by Regions (2020-2026) 13.1 Global Pharmaceutical Testing and Analytical Services Sales, Revenue and Growth Rate (2020-2026) 13.2 Pharmaceutical Testing and Analytical Services Market Forecast by Regions (2020-2026) 13.2.1 North America Pharmaceutical Testing and Analytical Services Market Forecast (2020-2026) 13.2.2 Europe Pharmaceutical Testing and Analytical Services Market Forecast (2020-2026) 13.2.3 Asia-Pacific Pharmaceutical Testing and Analytical Services Market Forecast (2020-2026) 13.2.4 Middle East and Africa Pharmaceutical Testing and Analytical Services Market Forecast (2020-2026) 13.2.5 South America Pharmaceutical Testing and Analytical Services Market Forecast (2020-2026) 13.3 Pharmaceutical Testing and Analytical Services Market Forecast by Types (2020-2026) 13.4 Pharmaceutical Testing and Analytical Services Market Forecast by Applications (2020-2026) 13.5 Pharmaceutical Testing and Analytical Services Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Pharmaceutical Testing and Analytical Services

Request Sample

Pharmaceutical Testing and Analytical Services