Plant Identification Apps Market Size, Share, and Trends Analysis Report

CAGR :

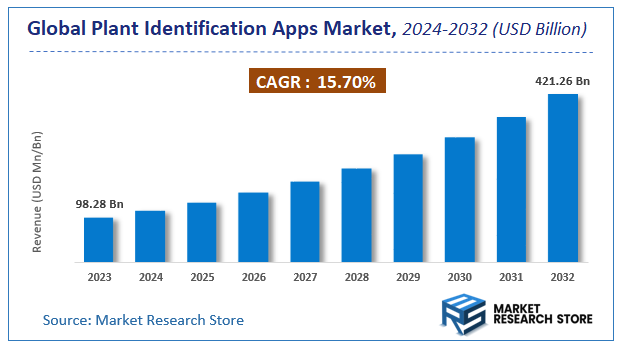

| Market Size 2023 (Base Year) | USD 98.28 Billion |

| Market Size 2032 (Forecast Year) | USD 421.26 Billion |

| CAGR | 15.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Plant Identification Apps Market Insights

According to Market Research Store, the global plant identification apps market size was valued at around USD 98.28 billion in 2023 and is estimated to reach USD 421.26 billion by 2032, to register a CAGR of approximately 15.7% in terms of revenue during the forecast period 2024-2032.

The plant identification apps report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Plant Identification Apps Market: Overview

Plant identification apps are mobile or web-based applications that use artificial intelligence (AI), machine learning (ML), and image recognition technology to help users identify plants, flowers, trees, and herbs by simply capturing images. These apps cater to a wide range of users, including gardening enthusiasts, botanists, researchers, and environmentalists, by providing detailed plant information, such as scientific classification, common names, habitat, and care guidelines. Many apps integrate additional features like disease detection, community forums, and plant care reminders to enhance user experience.

Key Highlights

- The plant identification apps market is anticipated to grow at a CAGR of 15.7% during the forecast period.

- The global plant identification apps market was estimated to be worth approximately USD 98.28 billion in 2023 and is projected to reach a value of USD 421.26 billion by 2032.

- The growth of the plant identification apps market is being driven by increasing interest in gardening, environmental awareness, and the adoption of digital solutions for plant care.

- Based on the type, the freemium apps segment is growing at a high rate and is projected to dominate the market.

- On the basis of platform, the android segment is projected to swipe the largest market share.

- In terms of functionality, the image recognition segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Plant Identification Apps Market: Dynamics

Key Growth Drivers

- Rising Interest in Gardening and Plant Care: Increasing popularity of home gardening, urban farming, and plant care as hobbies drives demand for plant identification apps.

- Growing Awareness of Biodiversity: Rising environmental consciousness and interest in biodiversity conservation encourage the use of apps to identify and learn about plants.

- Advancements in AI and Machine Learning: Improved accuracy in plant identification through AI and image recognition technologies enhances user experience and app adoption.

- Smartphone Penetration: High global smartphone usage provides a large user base for plant identification apps.

- Educational and Research Use: Schools, universities, and research institutions use these apps for teaching and fieldwork, boosting demand.

Restraints

- Limited Accuracy in Certain Regions: Apps may struggle to accurately identify plants in regions with less documented flora, reducing their reliability.

- High Development and Maintenance Costs: Continuous updates to databases and algorithms require significant investment, which can be a barrier for smaller developers.

- Dependence on Internet Connectivity: Many apps require internet access for real-time identification, limiting their use in remote or offline areas.

- Privacy Concerns: Users may be hesitant to share location data or images due to privacy and data security concerns.

Opportunities

- Integration with Smart Gardening Tools: Collaborating with smart gardening devices (e.g., soil sensors, watering systems) can create a comprehensive ecosystem for plant care.

- Expansion into New Markets: Targeting emerging markets with growing smartphone penetration and interest in gardening can drive user growth.

- Partnerships with Environmental Organizations: Collaborating with NGOs and environmental groups can enhance app credibility and reach.

- Monetization Strategies: Offering premium features, such as personalized plant care tips or ad-free experiences, can generate revenue.

- Augmented Reality (AR) Features: Incorporating AR for immersive plant identification and education can attract tech-savvy users.

Challenges

- Data Accuracy and Reliability: Ensuring the app's database is comprehensive and accurate for global flora is a significant challenge.

- User Engagement: Retaining users beyond the initial download requires continuous updates, engaging content, and new features.

- Competition from Free Alternatives: The availability of free or low-cost apps can make it difficult for premium apps to gain market share.

- Technological Limitations: Identifying plants with similar characteristics or in poor lighting conditions can reduce app accuracy.

- Regulatory Compliance: Adhering to data privacy laws and regulations across different regions can be complex and costly.

Plant Identification Apps Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plant Identification Apps Market |

| Market Size in 2023 | USD 98.28 Billion |

| Market Forecast in 2032 | USD 421.26 Billion |

| Growth Rate | CAGR of 15.7% |

| Number of Pages | 187 |

| Key Companies Covered | JustVisual, LuontoPortti, Pl@ntNet, Leafsnap, My Garden Answers, IPflanzen, FlowerChecker, PlantSnap |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plant Identification Apps Market: Segmentation Insights

The global plant identification apps market is divided by type, platform, functionality and region.

Segmentation Insights by Type

Based on type, the global plant identification apps market is divided into free apps, paid apps, and freemium apps.

The Freemium Apps segment is the most dominant in the plant identification apps market. These apps attract a large user base by offering free access to basic plant identification features while monetizing through in-app purchases, premium subscriptions, or ads. The freemium model allows users to experience the app's capabilities before committing to a paid version, making it a preferred choice for casual plant enthusiasts, hobbyists, and even professionals. The availability of high-quality databases, AI-powered identification, and additional premium features such as plant care tips and disease detection further drive the popularity of this segment.

The Free Apps segment follows as the second most dominant category. These apps primarily rely on ad-supported revenue models and attract users who prefer not to pay for app usage. Free plant identification apps often provide essential features like scanning and identifying plants using AI or image recognition. However, they may have limitations in terms of database size, accuracy, and advanced functionalities compared to freemium and paid alternatives. Despite these limitations, their accessibility makes them popular among beginners and casual users.

The Paid Apps segment is the least dominant, as users tend to prefer free or freemium models over upfront purchases. Paid plant identification apps usually offer advanced features, an ad-free experience, and offline accessibility, making them ideal for professionals, researchers, and dedicated plant enthusiasts. However, the initial cost often deters casual users, limiting the adoption of this segment. While these apps may provide superior accuracy and reliability, their lower user base compared to freemium and free alternatives makes them the least dominant category in the market.

Segmentation Insights by Platform

On the basis of platform, the global plant identification apps market is bifurcated into iOS, android and web-based.

The Android segment is the most dominant in the plant identification apps market. Android has a larger global market share compared to iOS, making plant identification apps more accessible to a wider audience. Many Android users, especially in developing regions, prefer free or freemium apps, which align with the business models of most plant identification platforms. Additionally, the Google Play Store allows developers to reach a diverse user base, including hobbyists, students, and professionals. The affordability of Android devices further contributes to the dominance of this segment, as users from various economic backgrounds can easily access plant identification tools.

The iOS segment follows as the second most dominant platform. While iOS has a smaller user base compared to Android, Apple users generally show a higher willingness to pay for premium apps and subscriptions. This makes iOS a lucrative platform for plant identification apps that operate on a paid or freemium model. Additionally, iOS devices are known for their high-performance cameras and advanced AI capabilities, which enhance the accuracy and efficiency of plant recognition features. The App Store’s strict quality standards also ensure that iOS plant identification apps offer a refined user experience, attracting a dedicated audience of plant enthusiasts and professionals.

The Web-Based segment is the least dominant in the market. While web-based plant identification platforms provide accessibility across different devices without requiring app downloads, they often lack the convenience of mobile apps, which allow users to quickly identify plants on the go. Additionally, web-based platforms may not fully utilize smartphone cameras and AI-based recognition technologies as effectively as mobile apps. However, they still serve a niche audience, including researchers and educators who prefer using plant identification tools on desktops or laptops for detailed analysis and documentation.

Segmentation Insights by Functionality

On the basis of functionality, the global plant identification apps market is bifurcated into image recognition, text-based identification, voice recognition, and augmented reality (AR).

The Image Recognition segment is the most dominant in the plant identification apps market. This functionality leverages AI-powered image analysis to identify plants from user-uploaded photos, making it the most accurate and user-friendly method. Image recognition is widely preferred by both casual users and professionals due to its speed, ease of use, and high accuracy. Most plant identification apps rely on large databases and machine learning algorithms to match plant images with known species, making this the go-to feature for the majority of users. The increasing integration of AI and deep learning further enhances the effectiveness of image-based plant identification.

The Augmented Reality (AR) segment follows as the second most dominant. AR technology enhances plant identification by overlaying real-time information onto the user's camera feed, providing interactive and immersive experiences. While still an emerging trend, AR-powered plant identification apps are gaining traction among tech-savvy users and educators. They allow users to explore plants in 3D, understand plant structures in detail, and even visualize plant growth over time. Although AR is not as widely adopted as image recognition yet, advancements in mobile technology and increasing interest in immersive learning experiences are driving its growth.

The Text-Based Identification segment ranks third in dominance. This functionality allows users to search for plant names, characteristics, or descriptions manually to identify species. While useful for research and detailed plant classification, it requires prior botanical knowledge, making it less accessible for casual users. Text-based identification is often used in combination with other features rather than as a standalone method. It is more popular among researchers, botanists, and educators who seek in-depth plant information beyond visual recognition.

The Voice Recognition segment is the least dominant. Although voice-activated search capabilities are becoming more common in mobile apps, they are less practical for plant identification compared to image recognition and AR. Voice-based plant identification requires users to describe a plant's characteristics verbally, which can be challenging due to the complexity and subjectivity of plant features. However, this functionality is still valuable for hands-free use cases and accessibility purposes, especially for visually impaired users. Despite its niche appeal, voice recognition has not yet reached the widespread adoption seen in other plant identification functionalities.

Plant Identification Apps Market: Regional Insights

- North America is expected to dominates the global market

North America leads the market for plant identification apps, driven by high technological adoption and a strong interest in gardening and outdoor activities. The United States, in particular, has seen significant engagement from both amateur gardeners and professionals seeking efficient plant identification tools. The presence of advanced technological infrastructure and a culture that values environmental awareness contribute to the widespread use of these applications in the region.

In Europe, the market has experienced substantial growth, propelled by a rising number of gardening enthusiasts and a deep-seated focus on environmental sustainability. Countries like Germany, France, and the United Kingdom have embraced these apps, integrating them into educational systems and conservation projects. The European commitment to biodiversity and ecological preservation has further cemented the role of plant identification technology in both recreational and professional contexts.

The Asia Pacific region is emerging as a significant player in the plant identification apps market, with rapid growth attributed to increasing smartphone penetration and heightened awareness of plant biodiversity. Nations such as China, India, and Japan are witnessing a surge in app adoption, driven by educational initiatives and a growing community of nature enthusiasts. The region's rich floral diversity and government-backed environmental programs are further encouraging the use of digital plant identification tools.

Latin America is seeing a steady increase in the adoption of plant identification apps, particularly in countries like Brazil and Mexico, where interest in environmental conservation and botanical research is rising. The growing use of smartphones and mobile internet has made these apps more accessible, while educational institutions and nature organizations are promoting their use in ecological studies.

The Middle East and Africa hold a smaller share of the market, but interest is growing, especially in regions with a strong emphasis on agriculture and environmental conservation. Countries with rich biodiversity, such as South Africa, are adopting plant identification apps for research and educational purposes. However, limited access to advanced technology and digital infrastructure challenges wider adoption in certain parts of the region.

Plant Identification Apps Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the plant identification apps market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global plant identification apps market include:

- FlowerChecker

- LuontoPortti

- PlantSnap

- JustVisual

- Leafsnap

- IPflanzen

- My Garden Answers

- Pl@ntNet

The global plant identification apps market is segmented as follows:

By Type

- Free Apps

- Paid Apps

- Freemium Apps

By Platform

- iOS

- Android

- Web-Based

By Functionality

- Image Recognition

- Text-Based Identification

- Voice Recognition

- Augmented Reality (AR)

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Plant Identification Apps

Request Sample

Plant Identification Apps