Premium Absinthe Market Size, Share, and Trends Analysis Report

CAGR :

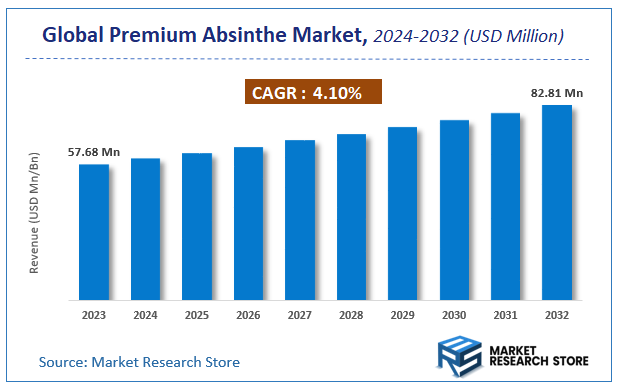

| Market Size 2023 (Base Year) | USD 57.68 Million |

| Market Size 2032 (Forecast Year) | USD 82.81 Million |

| CAGR | 4.1% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Premium Absinthe Market Insights

According to Market Research Store, the global premium absinthe market size was valued at around USD 57.68 million in 2023 and is estimated to reach USD 82.81 million by 2032, to register a CAGR of approximately 4.1% in terms of revenue during the forecast period 2024-2032.

The premium absinthe report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Premium Absinthe Market: Overview

Premium absinthe is a high-quality variant of the traditional anise-flavored spirit derived from botanicals, particularly Artemisia absinthium (wormwood), green anise, and sweet fennel. What distinguishes premium absinthe from standard versions is its artisanal production process, natural ingredients, and adherence to traditional distillation methods rather than the use of artificial flavoring or coloring. These premium products often have higher concentrations of herbal extracts and are free from added sugars, resulting in a more authentic, complex flavor profile and a higher price point. Some are produced in historic regions like France or Switzerland, renowned for their absinthe heritage.

Key Highlights

- The premium absinthe market is anticipated to grow at a CAGR of 4.1% during the forecast period.

- The global premium absinthe market was estimated to be worth approximately USD 57.68 million in 2023 and is projected to reach a value of USD 82.81 million by 2032.

- The growth of the premium absinthe market is being driven by increasing consumer interest in craft spirits, heritage alcohol, and luxury beverage experiences.

- Based on the consumer types, the enthusiasts segment is growing at a high rate and is projected to dominate the market.

- On the basis of product types, the traditional absinthe segment is projected to swipe the largest market share.

- In terms of packaging formats, the glass bottles segment is expected to dominate the market.

- Based on the distribution channels, the specialty liquor stores segment is expected to dominate the market.

- In terms of price segments, the premium price segment is expected to dominate the market.

- By region, Europe is expected to dominate the global market during the forecast period.

Premium Absinthe Market: Dynamics

Key Growth Drivers

- Rising Demand for Artisanal Spirits Consumers, especially millennials, are showing increased interest in handcrafted alcoholic beverages, which boosts demand for traditionally distilled premium absinthe.

- Expansion of Cocktail Culture The global rise of cocktail bars and mixology has popularized absinthe as a unique ingredient, enhancing its presence in the premium spirits scene.

- Increased Disposable Income Growth in consumer spending power, particularly in emerging markets, has enabled exploration of premium and niche alcohol like absinthe.

- E-commerce and Digital Marketing Online platforms have improved access to premium absinthe, while digital campaigns have helped educate consumers about its heritage and uses.

Restraints

- Regulatory Hurdles Absinthe's past reputation for psychoactive effects has led to strict regulations in various regions, restricting its market expansion.

- High Production Costs Craft production and the use of premium botanicals make absinthe expensive to produce, raising retail prices and limiting affordability.

- Limited Consumer Awareness A significant portion of the market remains unfamiliar with absinthe, making consumer education a necessary investment.

Opportunities

- Product Innovation Introducing new flavors and modern variations can attract a wider range of consumers with diverse taste preferences.

- Tourism and Experiential Marketing Distillery tours and tasting events provide immersive brand experiences and can help build loyal customer bases.

- Collaborations with Mixologists Partnering with bartenders and influencers to craft signature absinthe cocktails can boost brand visibility and credibility.

Challenges

- Competition from Other Premium Spirits Absinthe competes with well-established premium spirits like gin, whiskey, and tequila, making market penetration difficult.

- Supply Chain Disruptions Delays in logistics or ingredient sourcing can impact the consistent availability of premium absinthe.

- Changing Consumer Trends The rise of health-conscious drinking habits and interest in low- or no-alcohol beverages could slow demand for high-proof spirits.

Premium Absinthe Market: Report Scope

This report thoroughly analyzes the Premium Absinthe Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Premium Absinthe Market |

| Market Size in 2023 | USD 57.68 Million |

| Market Forecast in 2032 | USD 82.81 Million |

| Growth Rate | CAGR of 4.1% |

| Number of Pages | 169 |

| Key Companies Covered | La Fée Absinthe, Kübler Absinthe Superieure, Hill's Liquere North America, La Clandestine, Doubs Mystique |

| Segments Covered | By Consumer Types, By Product Types, By Packaging Formats, By Distribution Channels, By Price Segments, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Premium Absinthe Market: Segmentation Insights

The global premium absinthe market is divided by consumer types, product types, packaging formats, distribution channels, price segments, and region.

Segmentation Insights by Consumer Types

Based on consumer types, the global premium absinthe market is divided into casual consumers, enthusiasts, collectors, connoisseurs, and bartenders & mixologists.

In the premium absinthe market, the Enthusiasts segment emerges as the most dominant consumer group. Enthusiasts are individuals with a deep interest in absinthe who actively seek out premium and authentic brands, often driven by a passion for traditional distillation methods, unique botanical compositions, and the historical allure of the drink. They are highly engaged with the product, often participating in tastings, online forums, and niche communities, making them a crucial demographic for premium absinthe producers.

Following closely behind are the Connoisseurs, who are often more discerning than Enthusiasts and usually have a refined palate developed through extensive experience. They prioritize quality over quantity and are willing to pay a premium for rare or artisan-made absinthe products. Connoisseurs are instrumental in shaping market trends and brand reputations through word-of-mouth and expert recommendations, particularly in the luxury segment.

The third most significant segment is Bartenders & Mixologists, whose influence has grown with the rise of craft cocktail culture. While they may not be the largest direct consumers in terms of volume, their role in introducing absinthe to a broader audience through creative cocktails in upscale bars and lounges amplifies the visibility and desirability of premium brands. Their endorsement often leads to increased interest from other segments, particularly Casual Consumers and Enthusiasts.

Casual Consumers come next and represent a moderate but steadily growing segment. These individuals purchase premium absinthe occasionally, often out of curiosity or for special events. Their interest is usually sparked by marketing campaigns, social media, or peer recommendations. While not deeply knowledgeable about the nuances of the spirit, they are open to exploration and may transition into Enthusiasts over time.

At the lower end of the spectrum are the Collectors, a niche but valuable segment. These individuals focus on acquiring limited-edition or vintage bottles, often for investment purposes or personal display. Their purchases are infrequent but high-value, and they are less concerned with consumption and more interested in rarity and provenance. Though small in number, Collectors can significantly impact brand prestige and secondary market dynamics.

Segmentation Insights by product types

On the basis of product types, the global premium absinthe market is bifurcated into traditional absinthe, modern/flavored absinthe, organic absinthe, and high-proof absinthe.

In the premium absinthe market, Traditional Absinthe stands as the most dominant product type. This category includes absinthes crafted using historic recipes, authentic botanical blends (notably grande wormwood, anise, and fennel), and traditional distillation methods. Consumers—especially Enthusiasts and Connoisseurs—gravitate toward traditional absinthe for its authenticity, cultural heritage, and ritualistic preparation methods (such as the absinthe drip). The allure of its historical mystique and association with famous artists and writers further enhances its dominance in the premium space.

Modern/Flavored Absinthe ranks second in market share. This product type includes absinthes infused with a variety of flavors beyond the traditional herbal profile—such as citrus, fruit, or spice elements—to appeal to a broader and often younger consumer base. These absinthes are typically more approachable in flavor and alcohol content, making them popular among Casual Consumers and Bartenders & Mixologists looking to diversify cocktail offerings. While they may lack the purist appeal of traditional absinthe, their versatility and accessibility contribute to their strong market position.

Next in line is High-Proof Absinthe, characterized by alcohol content often exceeding 70% ABV. This product type appeals mainly to a niche audience of seasoned Enthusiasts and Connoisseurs who value the intensity and authenticity that high-proof spirits bring. Though not for everyday consumption due to their potency, high-proof absinthes are often regarded as superior in terms of botanical concentration and ritualistic use, enhancing their desirability among traditionalists.

Organic Absinthe holds the smallest market share among the product types but is steadily gaining traction. Targeting health-conscious and environmentally-aware consumers, this segment emphasizes the use of organically-grown botanicals and sustainable production practices. While its appeal is still limited—primarily attracting niche consumers within the Enthusiast and Casual Consumer groups—the growing global trend toward organic and clean-label products suggests potential for expansion in the near future.

Segmentation Insights by Packaging Formats

Based on packaging formats, the global premium absinthe market is divided into glass bottles, plastic bottles, miniature bottles, gift sets, and cask or barrel-aged packaging.

In the premium absinthe market, Glass Bottles are by far the most dominant packaging format. This is largely due to their premium aesthetic, durability, and association with quality. Glass not only preserves the integrity and flavor of absinthe better than other materials but also enhances the product’s visual appeal—crucial for a spirit steeped in tradition and ritual. Most premium brands package their absinthe in ornate, often vintage-style glass bottles that resonate with Enthusiasts, Connoisseurs, and Collectors alike, making it the preferred and most widely accepted format.

Gift Sets come next in market prominence, particularly popular around holidays and special occasions. These sets typically include a glass bottle of absinthe accompanied by accessories like traditional absinthe spoons, sugar cubes, and branded glasses. They appeal to both new buyers seeking the full absinthe experience and existing fans looking for collectible or gift-worthy items. Gift sets also serve as an effective entry point for Casual Consumers and an appealing purchase for Bartenders & Mixologists seeking curated tools of the trade.

The Miniature Bottles segment follows, catering to consumers interested in sampling various absinthe brands or styles without committing to a full-size bottle. This format is especially useful for new consumers, promotional events, or travel retail. While not typically associated with connoisseurship, miniatures are instrumental in expanding brand reach and attracting first-time buyers.

Cask or Barrel-aged Packaging, though niche, holds a unique and growing position in the premium market. These products often come in limited-edition packaging and appeal to high-end consumers and Collectors who value the complexity and aged character that barrel maturation can impart to absinthe. While rare and typically priced at a premium, these offerings enhance brand prestige and provide a point of differentiation in a crowded marketplace.

Lastly, Plastic Bottles occupy the least significant position in the premium absinthe sector. While they may offer convenience and cost efficiency, plastic packaging is generally associated with lower-end or mass-market products and is often perceived as undermining the premium image of absinthe. As such, plastic bottles are rarely used by high-end brands targeting discerning consumers.

Segmentation Insights by Distribution Channels

On the basis of distribution channels, the global premium absinthe market is bifurcated into online retailers, specialty liquor stores, supermarkets & hypermarkets, bars & restaurants, and direct-to-consumer sales.

In the premium absinthe market, Specialty Liquor Stores represent the most dominant distribution channel. These stores offer curated selections tailored to discerning consumers, making them a preferred destination for Enthusiasts, Connoisseurs, and Bartenders & Mixologists seeking authentic, high-quality absinthe. Specialty retailers often provide knowledgeable staff, tastings, and educational resources that enhance the purchasing experience and reinforce the premium positioning of absinthe brands.

Online Retailers come next in significance, having gained considerable traction due to convenience, wide selection, and direct access to global brands that may not be available locally. This channel appeals to all consumer types—especially Collectors and Connoisseurs—who are searching for rare or imported absinthes. Additionally, e-commerce platforms often offer detailed product descriptions, user reviews, and subscription models that make them especially attractive for repeat purchases and discovery of new brands.

Bars & Restaurants follow closely, playing a crucial role in driving awareness and consumption, especially among Casual Consumers and Enthusiasts. High-end bars and cocktail lounges help reintroduce absinthe to the mainstream through curated cocktail menus and absinthe rituals. This exposure can significantly influence retail demand, particularly when bartenders and mixologists recommend specific premium brands.

Direct-to-Consumer (DTC) Sales, including purchases made via brand websites or tasting rooms, represent a growing but still limited channel. DTC allows producers to control brand messaging, offer exclusives, and build deeper customer relationships. While it's more commonly used by niche or craft absinthe producers, its influence is rising, especially in regions where alcohol e-commerce regulations are becoming more relaxed.

Lastly, Supermarkets & Hypermarkets hold the smallest share in the premium absinthe segment. These mass-market outlets typically focus on higher-volume, lower-priced products and lack the specialized knowledge or product diversity required to effectively sell premium absinthe. As such, they are generally not the go-to choice for serious absinthe buyers and are rarely used for luxury or artisan offerings.

Segmentation Insights by Price Segments

On the basis of price segments, the global premium absinthe market is bifurcated into premium price segment, mid-tier price segment, budget price segment, and luxury price segment.

In the premium absinthe market, the Premium Price Segment is the most dominant. This segment typically includes bottles priced moderately high but still accessible to dedicated Enthusiasts and Bartenders & Mixologists. Products in this range strike a balance between quality and affordability, offering authentic ingredients, traditional production methods, and appealing packaging. Consumers in this segment are often repeat buyers who value craftsmanship and experience without stepping into ultra-exclusive territory. The premium segment forms the backbone of the market in terms of both volume and brand recognition.

Following that is the Luxury Price Segment, which caters to high-end Connoisseurs and Collectors. These absinthes are often limited editions or aged variations with unique provenance, intricate packaging, and extremely high-quality botanicals. Brands in this space focus heavily on exclusivity, heritage, and artisanal processes. Though smaller in volume, the luxury segment commands high profit margins and contributes significantly to brand prestige and market visibility.

The Mid-tier Price Segment ranks third and serves as a transition point for Casual Consumers who are exploring absinthe but aren’t ready to commit to premium or luxury pricing. These products are generally more approachable in both taste and cost, often featuring simplified flavor profiles and less ornate packaging. While they help expand the consumer base, mid-tier products don’t typically dominate among core Enthusiasts or Connoisseurs, limiting their influence on premium market trends.

The Budget Price Segment is the least relevant in the premium absinthe landscape. Budget absinthes often sacrifice quality for affordability, using artificial flavorings or shortcuts in production. As a result, they tend to be avoided by serious consumers and are rarely found in premium retail or specialty spirits shops. While this segment may have a presence in broader spirits markets, it holds minimal significance within the context of premium absinthe.

Premium Absinthe Market: Regional Insights

- Europe is expected to dominates the global market

Europe stands as the most dominant region in the premium absinthe market. Countries like France, Switzerland, and Germany possess long-standing traditions in absinthe production and consumption, contributing significantly to their market leadership. A resurgence of interest in artisanal and heritage spirits continues to drive demand, particularly among consumers who value authenticity and craftsmanship. The presence of well-established distilleries and favorable cultural attitudes towards absinthe further reinforce Europe's leading position.

North America follows as a strong contender in the premium absinthe market. The United States has experienced a revival in absinthe popularity following regulatory changes that lifted previous bans. The rise of craft cocktail culture, combined with increasing consumer interest in unique, historically rich spirits, has spurred growth. Despite regional regulatory variations that affect distribution, the market continues to expand, especially in metropolitan areas where mixology trends are more prominent.

Asia Pacific is emerging as a promising growth region for premium absinthe. Countries such as Japan and Australia are driving this expansion through their evolving cocktail scenes and growing appreciation for imported Western spirits. While absinthe does not have a deep-rooted cultural presence in the region, exposure to global drinking trends and a rising middle-class consumer base are key factors supporting its increasing popularity.

Latin America maintains a smaller, niche market for premium absinthe. Although countries like Brazil and Argentina show pockets of interest, the region traditionally favors other types of spirits, which limits broader market penetration. However, in major urban areas where nightlife and high-end hospitality sectors are developing, premium absinthe is gradually gaining visibility among adventurous and trend-sensitive consumers.

Middle East and Africa represent the least dominant region in the premium absinthe market. Strict alcohol regulations in many parts of the region, influenced by cultural and religious factors, significantly restrict consumption and sales. Nevertheless, in select markets where alcohol policies are more permissive and tourism or expatriate communities are prominent, there are limited but growing opportunities for premium absinthe brands to enter the market.

Premium Absinthe Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the premium absinthe market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global premium absinthe market include:

- La Fée Absinthe

- Kübler Absinthe Superieure

- Hill's Liquere North America

- La Clandestine

- Doubs Mystique

The global premium absinthe market is segmented as follows:

By Consumer Types

- Casual Consumers

- Enthusiasts

- Collectors

- Connoisseurs

- Bartenders and Mixologists

By Product Types

- Traditional Absinthe

- Modern/Flavored Absinthe

- Organic Absinthe

- High-Proof Absinthe

By Packaging Formats

- Glass Bottles

- Plastic Bottles

- Miniature Bottles

- Gift Sets

- Cask or Barrel-aged Packaging

By Distribution Channels

- Online Retailers

- Specialty Liquor Stores

- Supermarkets and Hypermarkets

- Bars and Restaurants

- Direct-to-Consumer Sales

By Price Segments

- Premium Price Segment

- Mid-tier Price Segment

- Budget Price Segment

- Luxury Price Segment

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Premium Absinthe

Request Sample

Premium Absinthe