Pressure Sensitive Adhesives Films Market Size, Share, and Trends Analysis Report

CAGR :

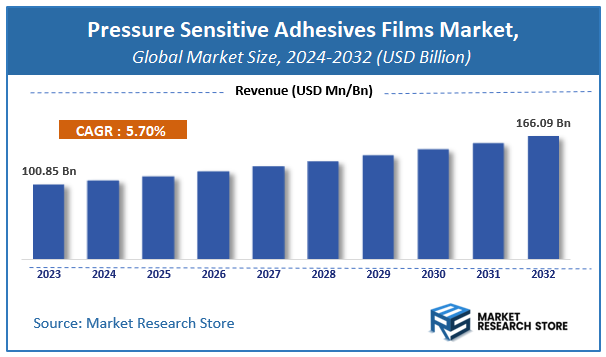

| Market Size 2023 (Base Year) | USD 100.85 Billion |

| Market Size 2032 (Forecast Year) | USD 166.09 Billion |

| CAGR | 5.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Pressure Sensitive Adhesives Films Market Insights

According to Market Research Store, the global pressure sensitive adhesives films market size was valued at around USD 100.85 billion in 2023 and is estimated to reach USD 166.09 billion by 2032, to register a CAGR of approximately 5.7% in terms of revenue during the forecast period 2024-2032.

The pressure sensitive adhesives films report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Pressure Sensitive Adhesives Films Market: Overview

Pressure sensitive adhesive (PSA) films are a type of adhesive product that bonds to surfaces when light pressure is applied, without the need for heat, water, or solvent activation. These films are composed of a thin adhesive layer supported by a carrier such as paper, plastic, or foam, and are commonly used for applications including labels, tapes, decals, protective films, and graphic films. PSA films are valued for their ease of use, versatility, and clean removability in many cases. They offer strong adhesion to a wide range of substrates like glass, metal, plastic, and paper, and are used across industries such as automotive, packaging, electronics, healthcare, and construction. Technological advancements have led to the development of high-performance PSA films with enhanced properties such as UV resistance, high-temperature stability, and moisture resistance.

Key Highlights

- The pressure sensitive adhesives films market is anticipated to grow at a CAGR of 5.7% during the forecast period.

- The global pressure sensitive adhesives films market was estimated to be worth approximately USD 100.85 billion in 2023 and is projected to reach a value of USD 166.09 billion by 2032.

- The growth of the pressure sensitive adhesives films market is being driven by rising demand in sectors like packaging, automotive, and electronics.

- Based on the product type, the acrylic segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the packaging segment is projected to swipe the largest market share.

- In terms of end-user, the consumer goods segment is expected to dominate the market.

- Based on the distribution channel, the offline segment is expected to dominate the market.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Pressure Sensitive Adhesives Films Market: Dynamics

Key Growth Drivers

- Growing Demand in Packaging Industry: The e-commerce boom and increasing need for secure and tamper-evident packaging are driving the demand for PSA films for tapes, labels, and protective films in packaging applications.

- Rising Adoption in Automotive Industry: PSA films are increasingly used in automotive applications for interior and exterior trim, protective films, and sound dampening, driven by the sector's growth and demand for lightweighting.

- Increasing Use in Healthcare: PSA films are essential in medical tapes, wound dressings, and transdermal drug delivery systems, fueled by the growing healthcare sector and advancements in medical adhesives.

- Versatility and Ease of Application: PSA films offer ease of use, strong adhesion with minimal pressure, and versatility across various substrates, making them a preferred choice in numerous applications.

- Advancements in Film Technology: Innovations in film materials, adhesive formulations, and multi-layer films are enhancing the performance characteristics of PSA films, expanding their application scope.

Restraints

- Price Sensitivity of End-Users: Certain end-use industries, particularly packaging, can be highly price-sensitive, putting pressure on PSA film manufacturers to maintain competitive pricing.

- Environmental Concerns and Regulations: Growing environmental awareness and stricter regulations regarding VOC emissions and recyclability can restrict the use of certain solvent-based adhesives and non-recyclable films.

- Performance Limitations in Extreme Conditions: Some PSA films may exhibit limitations in adhesion strength or performance under extreme temperatures, humidity, or chemical exposure.

- Competition from Alternative Bonding Methods: In some applications, PSA films face competition from alternative bonding methods like liquid adhesives, welding, and mechanical fasteners.

Opportunities

- Development of Sustainable and Bio-Based PSA Films: The increasing focus on sustainability creates opportunities for manufacturers to develop and market bio-based and recyclable PSA films.

- Expanding Applications in Electronics and Wearables: The growth of the electronics and wearable technology sectors presents opportunities for PSA films in bonding components, displays, and providing skin-friendly adhesion.

- Customization and Specialization: Offering customized PSA films with specific properties like high tack, repositionability, or specialized release liners can cater to niche application requirements.

- Growth in Emerging Economies: The expanding manufacturing and consumer sectors in emerging economies are expected to drive increased demand for PSA films across various applications.

- Integration of Smart Features: Incorporating features like conductivity or sensors into PSA films for specialized applications in electronics or healthcare could create new high-value markets.

Challenges

- Intense Competition: The PSA films market is characterized by a large number of global and regional players, leading to intense price competition.

- Fluctuations in Raw Material Prices: Volatility in the prices of raw materials like polymers and solvents can impact the profitability of PSA film manufacturers.

- Meeting Stringent Performance and Regulatory Standards: End-use industries often have stringent performance and regulatory requirements that PSA films must meet, requiring continuous innovation and quality control.

- Developing High-Performance Films for Demanding Applications: Creating PSA films that can withstand harsh environments or provide specific functionalities for advanced applications remains a technological challenge.

- Supply Chain Disruptions: Global events and logistical challenges can disrupt the supply chain of raw materials and finished PSA film products.

Pressure Sensitive Adhesives Films Market: Report Scope

This report thoroughly analyzes the pressure sensitive adhesives films market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Pressure Sensitive Adhesives Films Market |

| Market Size in 2023 | USD 100.85 Billion |

| Market Forecast in 2032 | USD 166.09 Billion |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 180 |

| Key Companies Covered | 3M Company, Avery Dennison Corporation, Henkel AG & Co. KGaA, H.B. Fuller Company, Arkema Group, Sika AG, Dow Inc., Ashland Global Holdings Inc., Berry Global Inc., Lintec Corporation, Tesa SE, Nitto Denko Corporation, Scapa Group plc, Intertape Polymer G |

| Segments Covered | By Product Type, By Application, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pressure Sensitive Adhesives Films Market: Segmentation Insights

The global pressure sensitive adhesives films market is divided by product type, application, end-user, distribution channel, and region.

Segmentation Insights by Product Type

Based on product type, the global pressure sensitive adhesives films market is divided into acrylic, rubber, silicone, and others.

In the pressure sensitive adhesive (PSA) films market, acrylic-based films represent the most dominant segment. Acrylic adhesives are widely preferred due to their excellent balance of performance and cost-effectiveness. They offer strong adhesion to a variety of substrates, long-term aging stability, resistance to environmental factors such as UV light and temperature changes, and clarity—making them ideal for applications in automotive, electronics, and medical sectors. Their versatility has allowed them to lead the market, especially in demanding uses where durability and transparency are crucial.

Rubber-based PSA films follow as the next dominant segment. These adhesives provide high initial tack and bond strength, especially on low-energy surfaces such as plastics. They are often used in packaging, labeling, and general-purpose applications due to their affordability and quick bonding characteristics. However, rubber adhesives tend to have lower resistance to heat, UV, and chemicals compared to acrylics, which limits their use in more demanding environments.

Silicone-based PSA films come next, serving niche but critical applications. These films exhibit excellent performance in extreme temperature conditions and offer superior chemical resistance. They are primarily used in the medical field, electronics, and aerospace industries, where performance under harsh conditions is essential. Although they are less common due to their high cost, their unique properties justify their use in specialized applications.

Segmentation Insights by Application

On the basis of application, the global pressure sensitive adhesives films market is bifurcated into packaging, automotive, electronics, medical, and others.

In the pressure sensitive adhesive (PSA) films market, the packaging segment holds the most dominant position by application. PSA films are extensively used in labels, tapes, and sealing applications across the packaging industry due to their ease of application, removability, and strong initial tack. The increasing demand for consumer goods, e-commerce growth, and the need for efficient and secure packaging solutions have propelled the use of PSA films in this segment. Their ability to adhere to a wide variety of surfaces and materials makes them ideal for both flexible and rigid packaging formats.

The automotive segment is the second most prominent application area. PSA films are used for bonding, sealing, noise reduction, and surface protection within vehicles. As automakers seek lighter and more efficient materials, PSA films offer a compelling alternative to traditional fasteners and liquid adhesives. Their ability to withstand temperature fluctuations and exposure to various environmental elements makes them well-suited for automotive interiors and exteriors, contributing to the segment’s growing importance.

Electronics follow closely, with PSA films being used in smartphones, tablets, displays, and various consumer electronic devices. They are utilized for component assembly, insulation, and thermal management. The precision and cleanliness required in electronics manufacturing benefit from the clean bonding offered by PSA films. As the demand for miniaturized and more sophisticated electronic products increases, this segment continues to grow in significance.

The medical segment leverages PSA films in products such as medical tapes, wound dressings, and wearable devices. These adhesives are formulated for skin-friendly applications, offering breathability, hypoallergenic properties, and ease of removal. With the rise in home healthcare, wearable health monitors, and advanced wound care products, the use of PSA films in this field is expanding, though it remains less dominant compared to packaging and automotive.

Segmentation Insights by Type

Based on type, the global pressure sensitive adhesives films market is divided into consumer goods, industrial, healthcare, and others.

In the pressure sensitive adhesive (PSA) films market, the consumer goods segment stands as the most dominant end-user category. This dominance is largely driven by the extensive use of PSA films in packaging, labeling, personal care products, and household items. The rapid growth of e-commerce, increasing demand for branded and aesthetically appealing packaging, and the need for tamper-evident labels and easy-to-use closure systems in daily consumer products contribute significantly to the segment’s leadership in the market.

The industrial segment follows closely, as PSA films play a vital role in manufacturing, assembly, and maintenance operations across various industries such as automotive, construction, electronics, and machinery. In these sectors, PSA films are valued for their ability to offer clean and strong bonding solutions that eliminate the need for mechanical fasteners or liquid adhesives. Their application in insulation, vibration dampening, mounting, and component protection makes them indispensable in industrial processes where performance, durability, and efficiency are key.

The healthcare segment, while smaller in comparison, is growing steadily due to the increasing use of PSA films in medical tapes, transdermal patches, surgical drapes, and wearable devices. These adhesives are specially designed to be skin-friendly, breathable, and easy to remove without causing irritation. As healthcare shifts toward more personalized, home-based, and wearable technologies, the demand for PSA films tailored for medical applications continues to rise.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global pressure sensitive adhesives films market is bifurcated into online and offline.

In the pressure sensitive adhesive (PSA) films market, the offline distribution channel is the most dominant. This includes traditional methods such as direct sales, distributors, wholesalers, and specialty retail outlets. Industrial buyers and businesses often prefer offline channels because they allow for direct interaction, bulk purchasing, product customization, technical support, and inspection of samples before procurement. The complex nature of some PSA film applications—especially in sectors like automotive, electronics, and healthcare—requires professional consultation, making offline distribution the go-to channel for many end-users.

On the other hand, the online distribution channel is rapidly gaining traction, especially for standard and widely-used PSA film products. E-commerce platforms, manufacturer websites, and B2B marketplaces offer convenience, broader product availability, and competitive pricing. Small and medium-sized enterprises (SMEs) and individual consumers are increasingly turning to online channels for their ease of access, faster delivery, and product comparisons. While currently less dominant than offline channels, the online segment is expected to grow significantly as digital adoption increases across industries and supply chains become more streamlined.

Pressure Sensitive Adhesives Films Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

Asia-Pacific is the most dominant region in the pressure sensitive adhesive films market, driven by rapid industrial growth, urbanization, and expanding end-user industries such as packaging, automotive, and electronics. Countries like China, India, Japan, and South Korea contribute significantly to the regional demand, with China being a key global supplier of PSA films. Continuous investment in R&D, infrastructure development, and manufacturing capabilities across these countries supports sustained market expansion. Additionally, India's rising demand for filmic and flexible label applications further strengthens the region's leadership position.

North America follows closely behind, benefiting from high demand for technologically advanced, eco-friendly, and sustainable adhesive film solutions. The region's well-established packaging and construction sectors are key contributors to growth, alongside a strong focus on UV/EB curable and hot-melt PSA technologies. The market here is bolstered by stringent performance standards and the presence of major manufacturers with strong innovation pipelines.

Europe represents a significant share of the market, with countries like Germany, France, and the UK playing central roles. Although regulatory restrictions such as REACH have added complexity to operations, they have also encouraged innovation and development of safer, more compliant PSA films. Demand is largely driven by applications in automotive, electronics, and consumer goods, with the region showing strong interest in bio-based and recyclable adhesives.

Latin America is an emerging region in the pressure-sensitive adhesive films market, showing signs of steady growth. Countries such as Brazil, Argentina, and Chile are experiencing increasing adoption of PSA films in packaging and industrial applications. Market expansion is being aided by economic recovery, greater access to imported materials and machinery, and rising consumer demand across various sectors.

Middle East and Africa holds the smallest share of the global PSA films market but is witnessing gradual growth. This is mainly supported by increasing infrastructure development and industrialization, particularly in the Gulf Cooperation Council countries. Growing investments in the construction, automotive, and logistics sectors are creating new opportunities for PSA film adoption across the region.

Pressure Sensitive Adhesives Films Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the pressure sensitive adhesives films market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global pressure sensitive adhesives films market include:

- 3M Company

- Avery Dennison Corporation

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Arkema Group

- Sika AG

- Dow Inc.

- Ashland Global Holdings Inc.

- Berry Global Inc.

- Lintec Corporation

- Tesa SE

- Nitto Denko Corporation

- Scapa Group plc

- Intertape Polymer Group Inc.

- Lohmann GmbH & Co. KG

- Mactac LLC

- Adhesives Research Inc.

- Shurtape Technologies LLC

- CCT Tapes

- Covalence Specialty Adhesives LLC

The global pressure sensitive adhesives films market is segmented as follows:

By Product Type

- Acrylic

- Rubber

- Silicone

- Others

By Application

- Packaging

- Automotive

- Electronics

- Medical

- Others

By End-User

- Consumer Goods

- Industrial

- Healthcare

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Pressure Sensitive Adhesives Films

Request Sample

Pressure Sensitive Adhesives Films