Purchase Order Software Market Size, Share, and Trends Analysis Report

CAGR :

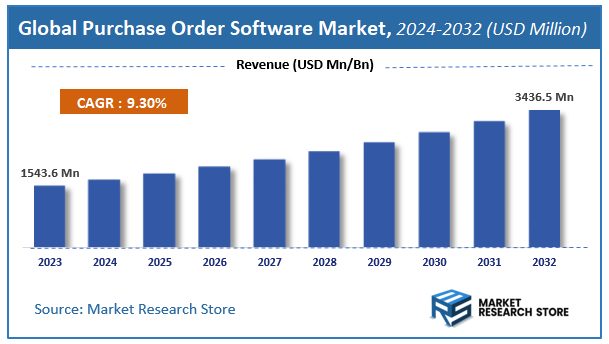

| Market Size 2023 (Base Year) | USD 1543.6 Million |

| Market Size 2032 (Forecast Year) | USD 3436.5 Million |

| CAGR | 9.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Purchase Order Software Market Insights

According to Market Research Store, the global purchase order software market size was valued at around USD 1543.6 million in 2023 and is estimated to reach USD 3436.5 million by 2032, to register a CAGR of approximately 9.3% in terms of revenue during the forecast period 2024-2032.

The purchase order software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Purchase Order Software Market: Overview

Purchase order software is a digital solution that automates and streamlines the process of creating, tracking, and managing purchase orders within a business. It helps businesses maintain control over their procurement process by enabling them to issue, track, and manage purchase orders (POs) to suppliers and vendors. This software typically offers features such as order approval workflows, budget management, supplier communication, and reporting tools. By integrating with inventory management, financial, and ERP systems, purchase order software helps businesses maintain accurate records, avoid overspending, and improve supplier relationships.

Key Highlights

- The purchase order software market is anticipated to grow at a CAGR of 9.3% during the forecast period.

- The global purchase order software market was estimated to be worth approximately USD 1543.6 million in 2023 and is projected to reach a value of USD 3436.5 million by 2032.

- The growth of the purchase order software market is being driven by the increasing adoption of automation in procurement and supply chain management across various industries.

- Based on the user type, the procurement professionals segment is growing at a high rate and is projected to dominate the market.

- On the basis of feature set, the bidding and quotation management segment is projected to swipe the largest market share.

- In terms of deployment type, the cloud-based solutions segment is expected to dominate the market.

- Based on the industry vertical, the manufacturing segment is expected to dominate the market.

- In terms of business size, the large enterprises segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Purchase Order Software Market: Dynamics

Key Growth Drivers:

- Increasing Demand for Automation in Procurement Processes: Businesses are adopting purchase order software to automate procurement tasks, such as order creation, approval workflows, and tracking, reducing manual effort and errors.

- Cost Efficiency and Time Savings: Purchase order software helps streamline the procurement process, resulting in cost savings by optimizing vendor negotiations, reducing order errors, and improving operational efficiency.

- Rising Need for Data Transparency and Visibility: Organizations seek better control over their procurement processes and real-time visibility into purchase orders, inventory, and spending, driving the adoption of purchase order software.

- Integration with Other Enterprise Systems: The growing trend of integrating purchase order software with other enterprise systems like ERP, accounting, and supply chain management tools is pushing market growth.

- Growing Adoption of Cloud-Based Solutions: Cloud-based purchase order software provides scalability, flexibility, and easy access, making it an attractive solution for businesses of all sizes.

Restraints:

- High Initial Setup and Integration Costs: Implementing purchase order software requires significant upfront investment, including licensing, training, and integration with existing systems, which may deter some organizations, especially small businesses.

- Resistance to Change in Traditional Procurement Practices: Some organizations are reluctant to move away from manual or legacy procurement systems due to familiarity or concerns about the disruption of established workflows.

- Data Security Concerns: The increased adoption of cloud-based solutions raises concerns about the security of sensitive procurement data, especially when it involves third-party providers.

Opportunities:

- Expansion in Small and Medium-Sized Enterprises (SMEs): As cloud-based purchase order software becomes more affordable and accessible, there is an opportunity to tap into the growing market of SMEs that are seeking to digitize their procurement processes.

- Advanced Analytics and Reporting Features: Purchase order software with advanced analytics capabilities can offer insights into spending patterns, supplier performance, and order trends, helping organizations make better purchasing decisions.

- Growth in E-Commerce and Online Procurement: The rise of e-commerce platforms and online procurement channels presents an opportunity for purchase order software providers to cater to businesses that are increasingly engaging in online purchasing.

- AI and Machine Learning Integration: Incorporating AI and machine learning into purchase order software can enhance predictive analytics, optimize procurement decisions, and automate repetitive tasks, offering businesses more advanced tools for procurement management.

Challenges:

- Complex Implementation and Customization: Customizing purchase order software to fit the specific needs of an organization can be complex and time-consuming, requiring skilled resources and expertise.

- Lack of Skilled Personnel: There is a shortage of professionals with the expertise required to implement and manage purchase order systems, which can hinder successful adoption and operation.

- Interoperability with Legacy Systems: Integrating purchase order software with existing, often outdated, legacy systems can be challenging and lead to disruptions in business operations.

- Vendor Lock-In Risks: Once a company has invested in a particular purchase order software solution, migrating to a different system or provider can be difficult, potentially resulting in long-term dependency on a specific vendor.

Purchase Order Software Market: Report Scope

This report thoroughly analyzes the Purchase Order Software Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Purchase Order Software Market |

| Market Size in 2023 | USD 1543.6 Million |

| Market Forecast in 2032 | USD 3436.5 Million |

| Growth Rate | CAGR of 9.3% |

| Number of Pages | 163 |

| Key Companies Covered | Procurify, Promena e-Sourcing, Precoro, Fishbowl, Infoplus, Wolin Design Group, Spendwise, AvidXchange, SkuVault, Rose Rocket, SpendBoss, Lead Commerce, NorthStar, Kuebix |

| Segments Covered | By User Type, By Feature Set, By Deployment Type, By Industry Vertical, By Business Size, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Purchase Order Software Market: Segmentation Insights

The global purchase order software market is divided by user type, feature set, deployment type, industry vertical, business size, and region.

Segmentation Insights by User Type

Based on user type, the global purchase order software market is divided into procurement professionals, finance and accounting teams, supply chain managers, business executives, and IT personnel.

In the purchase order software market, Procurement Professionals represent the most dominant segment. These users are primarily responsible for sourcing goods and services for organizations and play a critical role in managing and overseeing the procurement process. Their need for efficient purchase order software is driven by the desire to streamline procurement workflows, manage supplier relationships, and ensure cost-effectiveness. Procurement professionals benefit from software that helps automate purchasing tasks, track orders, and maintain accurate records for compliance and reporting purposes.

Following closely is the Finance and Accounting Teams segment. These professionals rely heavily on purchase order software to ensure accurate financial management, including the verification of invoices, budget monitoring, and expenditure tracking. The software allows finance teams to cross-reference purchase orders with invoices and receipts, ensuring that payments are processed only for authorized purchases. This helps maintain financial control and minimizes the risk of errors or fraud.

Next is the segment of Supply Chain Managers, who oversee the movement of goods from suppliers to end-users. For supply chain professionals, purchase order software is essential for managing inventory levels, tracking shipments, and ensuring timely delivery. It plays a key role in maintaining efficient operations, reducing lead times, and preventing stockouts or overstock situations. With the integration of purchase order software, supply chain managers can better coordinate with vendors and monitor the flow of materials through the supply chain.

Business Executives represent a less dominant segment but are still important users of purchase order software. Executives use the software for strategic decision-making, analyzing procurement data, and reviewing overall operational efficiency. They rely on the software to generate reports and insights that can guide procurement strategies, cost-saving initiatives, and overall business performance. However, their usage is generally more high-level compared to other segments.

Lastly, IT Personnel are the least dominant user group in the purchase order software market. While IT teams are responsible for the technical deployment, maintenance, and integration of the software within an organization’s existing systems, their direct use of the software for procurement tasks is minimal. Their involvement is critical from an implementation and support perspective but not necessarily from a day-to-day operational viewpoint.

Segmentation Insights by Feature Set

On the basis of feature set, the global purchase order software market is bifurcated into bidding and quotation management, approval workflows, inventory management, integration capability, and reporting & analytics.

In the purchase order software market, Bidding and Quotation Management stands as the most dominant feature set. This functionality is crucial for organizations that deal with multiple suppliers and complex procurement processes. The ability to manage bids, solicit quotations, and compare supplier offers within a unified platform helps procurement teams streamline their purchasing decisions and ensure they get the best value for money. This feature is especially significant for organizations that rely on competitive bidding or have frequent purchasing needs from different vendors. It provides transparency and helps maintain competitive pricing across different suppliers.

Following closely is Approval Workflows, which is highly valued in organizations looking to enforce internal controls and ensure proper authorization before purchase orders are finalized. Approval workflows help maintain compliance and reduce the risk of unauthorized spending by routing purchase orders through necessary managerial or departmental approvals. This feature is essential for larger organizations with multiple stakeholders involved in the procurement process and is a key component in safeguarding against procurement errors or fraud.

Inventory Management ranks next in importance, particularly for businesses that need to track and manage inventory levels alongside their purchasing processes. This feature enables organizations to prevent stockouts, overstocking, or unnecessary purchases by providing real-time visibility into current inventory levels and automatically generating purchase orders when stock runs low. It is particularly essential for companies in manufacturing, retail, or distribution, where inventory management is integral to their day-to-day operations.

Integration Capability follows as another crucial feature, especially for large enterprises that need to integrate their purchase order software with other enterprise systems like Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), or financial management software. This feature ensures that purchase orders, supplier data, inventory levels, and financial information can seamlessly flow between different business functions, enabling better coordination and reducing the risk of data silos. Integration capability is essential for organizations that require efficient end-to-end business process automation.

Lastly, Reporting & Analytics is a vital feature, though it ranks lower in dominance compared to the others. While reporting and analytics functionalities are valuable for providing insights into purchasing trends, supplier performance, and financial metrics, it is considered a secondary need compared to the operational features like bidding management and approval workflows. Organizations use these features for strategic decision-making, budgeting, and performance evaluation, but they don’t rely on them as heavily as the core procurement and approval processes.

Segmentation Insights by Deployment Type

Based on deployment type, the global purchase order software market is divided into cloud-based solutions, on-premises solutions, and hybrid solutions.

In the purchase order software market, Cloud-based Solutions dominate the deployment type segment, leading the market by a significant margin. Cloud-based solutions are highly favored due to their scalability, flexibility, and lower upfront costs. These solutions are particularly attractive to small and medium-sized businesses that prefer not to invest in expensive infrastructure or maintenance. Cloud deployment allows users to access purchase order software from anywhere, facilitating remote work and ensuring that teams can stay connected in real-time. The ease of updates and security features provided by cloud services further enhance its appeal. Additionally, cloud-based solutions enable seamless integration with other cloud tools and platforms, making them a preferred choice for businesses looking for flexibility and cost efficiency.

Following cloud-based solutions is the On-Premises Solutions segment. While not as popular as cloud-based options, on-premises solutions remain relevant, especially for larger organizations or those with strict data privacy and compliance requirements. These businesses prefer on-premises deployment because it gives them full control over their data and systems. It also allows them to customize the purchase order software to their specific needs and integrate it deeply into their existing infrastructure. However, the higher upfront investment, maintenance costs, and resource requirements for managing on-premises solutions are significant drawbacks compared to cloud alternatives.

The least dominant segment is Hybrid Solutions, which combine aspects of both cloud-based and on-premises deployment. Hybrid solutions provide businesses with the flexibility of using the cloud for certain functions while maintaining on-premises systems for other critical operations. This approach is often preferred by organizations that want to take advantage of cloud scalability for some processes while keeping sensitive data or highly customized applications on their own infrastructure. Despite offering a balance of benefits, hybrid solutions are less popular due to the complexity and cost of maintaining two systems simultaneously. Furthermore, not all businesses require this level of flexibility, making hybrid solutions a niche offering in the market.

Segmentation Insights by Industry Vertical

On the basis of industry vertical, the global purchase order software market is bifurcated into manufacturing, retail, construction, healthcare, information technology, and financial services.

In the purchase order software market, the Manufacturing industry vertical is the most dominant segment. Manufacturing businesses often require precise and efficient procurement processes to maintain the flow of raw materials, components, and finished goods. Purchase order software plays a crucial role in managing large volumes of orders, tracking inventory, and ensuring timely deliveries, which are critical to manufacturing operations. This sector also benefits from features like inventory management, supplier management, and integration with production schedules, making purchase order software an integral tool in manufacturing supply chains.

Retail follows closely as the second most dominant vertical. Retail businesses deal with high volumes of inventory and need to manage procurement efficiently to ensure they maintain stock levels that align with customer demand. Purchase order software in retail helps manage orders, track shipments, and streamline the purchasing process, especially with multiple suppliers and products. Retailers also use purchase order software to support various sales channels and integrate procurement with point-of-sale systems, ensuring seamless operations and preventing stockouts or overstocking.

Next is the Construction industry, where purchase order software is essential for managing the procurement of materials, tools, and services for various projects. Construction companies rely on software to ensure that they have the necessary resources available at the right time, as delays in material supply can halt progress on construction projects. This sector benefits from features such as supplier management, project-specific ordering, and integration with other project management tools. The need for accuracy in tracking material costs and managing budgets makes purchase order software vital for construction firms.

Healthcare comes next in terms of importance. The healthcare industry requires purchase order software to manage medical supplies, equipment, pharmaceuticals, and other critical goods. Healthcare institutions, including hospitals and clinics, use purchase order software to ensure the timely delivery of necessary supplies, track inventory, and adhere to regulatory requirements. Given the urgency and precision needed in healthcare procurement, purchase order software helps avoid shortages and ensures patient care is not disrupted.

The Information Technology (IT) sector ranks next, as IT companies rely on purchase order software for the procurement of hardware, software, and service contracts. While the IT sector has a specialized need for software that can manage technology-related procurements, such as licenses and subscriptions, the volume and complexity of orders are generally lower compared to manufacturing or retail. However, purchase order software remains crucial for managing these purchases and ensuring that the right technology is available at the right time for projects and clients.

Lastly, the Financial Services industry represents the least dominant sector in the purchase order software market. While financial institutions may use purchase order software for procuring office supplies, equipment, or services, their need for this type of software is less critical compared to industries like manufacturing or healthcare. Financial services tend to focus more on software solutions for managing financial transactions, compliance, and risk rather than for large-scale procurement processes.

Segmentation Insights by Business Size

On the basis of business size, the global purchase order software market is bifurcated into small enterprises, medium-sized enterprises, and large enterprises.

In the purchase order software market, Large Enterprises are the most dominant segment. Large organizations have complex procurement needs due to their expansive operations, multiple departments, and significant volumes of purchasing transactions. These companies require sophisticated purchase order software that can manage large-scale procurement processes, integrate with other enterprise systems (like ERP or finance software), and support multi-location and global operations. The need for detailed reporting, compliance, and advanced features such as approval workflows, supplier management, and inventory control makes purchase order software an essential tool for large enterprises.

Medium-sized Enterprises come next in terms of dominance. These businesses have more streamlined procurement processes compared to large enterprises but still face challenges in managing multiple suppliers, controlling costs, and ensuring that purchasing operations run efficiently. Medium-sized enterprises often seek purchase order software that offers a balance of advanced features with a more affordable price point than what large enterprises typically require. While they may not need the same level of customization or integration as large enterprises, they still benefit from features like inventory management, approval workflows, and supplier management.

Small Enterprises are the least dominant segment in the purchase order software market. These businesses typically have fewer purchasing transactions, smaller teams, and less complex procurement processes, which can make the need for sophisticated purchase order software less pressing. Small enterprises may rely on simpler, more cost-effective solutions, such as basic cloud-based software or even manual systems, to handle their procurement needs. However, as small enterprises grow, they may increasingly adopt purchase order software to streamline operations, reduce manual errors, and scale their procurement processes.

Purchase Order Software Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the global purchase order software market, driven by a highly advanced technological infrastructure and a high rate of digital adoption. The presence of leading software providers and a robust regulatory environment further contribute to its market leadership. The region's focus on optimizing procurement processes through automation and continuous innovation supports its dominant position.

Europe follows closely, with countries such as Germany, the UK, and France leading the way in digital transformation initiatives. The emphasis on compliance, efficiency, and collaboration between technology providers and enterprises makes Europe a strong player in the market. Procurement software solutions are being increasingly adopted to streamline operations across industries.

Asia Pacific is experiencing rapid growth, especially in developing countries like India, China, and Southeast Asia. Industrialization and significant investments in digital infrastructure are fueling the demand for procurement software. The booming e-commerce sector and the region's growing focus on automation further drive the adoption of such solutions.

Latin America has seen a steady increase in procurement software adoption, with Brazil and Mexico at the forefront. The shift towards cloud computing and digital solutions is accelerating the transformation of procurement processes. However, the region faces challenges due to varying levels of technological infrastructure across different countries, which somewhat moderates its growth.

Middle East and Africa are gradually embracing purchase order software, with the United Arab Emirates making significant strides through smart city projects and digital transformation initiatives. South Africa also shows promise with increased IT investments. However, the overall adoption rate remains lower compared to other regions, influenced by economic factors and infrastructure limitations.

Purchase Order Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the purchase order software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global purchase order software market include:

- Procurify

- Promena e-Sourcing

- Precoro

- Fishbowl

- Infoplus

- Wolin Design Group

- Spendwise

- AvidXchange

- SkuVault

- Rose Rocket

- SpendBoss

- Lead Commerce

- NorthStar

- Kuebix

The global purchase order software market is segmented as follows:

By User Type

- Procurement Professionals

- Finance and Accounting Teams

- Supply Chain Managers

- Business Executives

- IT Personnel

By Feature Set

- Bidding and Quotation Management

- Approval Workflows

- Inventory Management

- Integration Capability

- Reporting and Analytics

By Deployment Type

- Cloud-based Solutions

- On-Premises Solutions

- Hybrid Solutions

By Industry Vertical

- Manufacturing

- Retail

- Construction

- Healthcare

- Information Technology

- Financial Services

By Business Size

- Small Enterprises

- Medium-sized Enterprises

- Large Enterprises

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Purchase Order Software

Request Sample

Purchase Order Software