Rayon Grade and Specialty Grade DWP Market Size, Share, and Trends Analysis Report

CAGR :

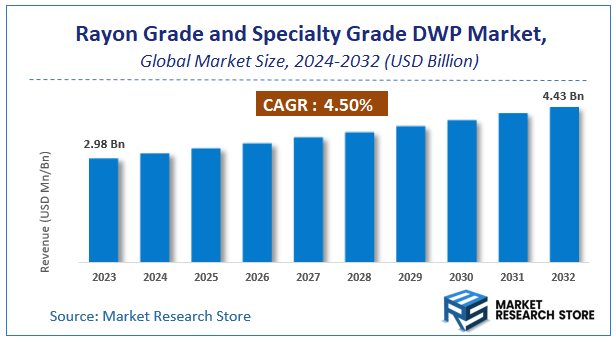

| Market Size 2023 (Base Year) | USD 2.98 Billion |

| Market Size 2032 (Forecast Year) | USD 4.43 Billion |

| CAGR | 4.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Rayon Grade and Specialty Grade DWP Market Insights

According to Market Research Store, the global rayon grade and specialty grade DWP market size was valued at around USD 2.98 billion in 2023 and is estimated to reach USD 4.43 billion by 2032, to register a CAGR of approximately 4.5% in terms of revenue during the forecast period 2024-2032.

The rayon grade and specialty grade DWP report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Rayon Grade and Specialty Grade DWP Market: Overview

Rayon grade and specialty grade Dissolving Wood Pulp (DWP) are high-purity forms of cellulose derived primarily from wood sources, used as key raw materials in various industrial and consumer applications. Rayon grade DWP, the more common of the two, is primarily used in the production of viscose rayon fibers—a popular semi-synthetic textile material valued for its silk-like texture, breathability, and affordability. This grade is also employed in the manufacturing of cellophane films and certain types of sponges. Specialty grade DWP, on the other hand, is a higher purity variant characterized by a lower hemicellulose content and consistent reactivity, making it suitable for applications that demand exceptional performance and purity. This includes use in producing cellulose derivatives like cellulose acetate (used in cigarette filters), microcrystalline cellulose (for pharmaceuticals and food products), carboxymethyl cellulose, and other niche chemical applications.

Key Highlights

- The rayon grade and specialty grade DWP market is anticipated to grow at a CAGR of 4.5% during the forecast period.

- The global rayon grade and specialty grade DWP market was estimated to be worth approximately USD 2.98 billion in 2023 and is projected to reach a value of USD 4.43 billion by 2032.

- The growth of the rayon grade and specialty grade DWP market is being driven by increasing demand in the textile, pharmaceutical, food, and personal care industries.

- Based on the product type, the rayon grade segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the textiles segment is projected to swipe the largest market share.

- In terms of end-user, the apparel segment is expected to dominate the market.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Rayon Grade and Specialty Grade DWP Market: Dynamics

Key Growth Drivers:

- Rising Demand from the Textile Industry: The growing demand for viscose and other regenerated fibers in the apparel and fashion industry is driving the consumption of rayon grade DWP globally.

- Increasing Popularity of Sustainable and Biodegradable Fibers: Consumers and brands are shifting toward eco-friendly materials, boosting demand for wood-based DWP as a sustainable alternative to synthetic fibers.

- Growth in Personal Care and Hygiene Products: Specialty grade DWP is extensively used in making non-woven fabrics for wipes, sanitary products, and medical applications, contributing to market growth.

- Expansion of Industrial Applications: Specialty grade DWP is increasingly used in producing cellophane, tire cords, and food casings, which is expanding the application base.

- Technological Advancements in Pulp Processing: Innovations in pulping technology are enhancing the quality and production efficiency of rayon and specialty grade DWP, making them more competitive.

Restraints:

- Environmental Concerns Related to Deforestation: Sourcing wood for DWP may lead to deforestation and biodiversity loss, drawing criticism and limiting expansion in regions with strict environmental regulations.

- Volatile Raw Material Prices: Fluctuations in the cost of wood and chemicals used in pulping processes can impact profitability and pricing stability.

- Stringent Regulatory Compliance: Environmental and industrial regulations related to emissions, wastewater, and sustainable sourcing can increase operational costs for producers.

Opportunities:

- Growing Demand in Emerging Economies: Rapid urbanization and increasing disposable incomes in regions like Asia-Pacific, Latin America, and Africa are fueling demand for textiles and hygiene products, opening up new market avenues.

- Product Innovation in Biodegradable Alternatives: There's a rising opportunity to innovate within the specialty grade segment to develop next-gen biodegradable products across packaging, healthcare, and FMCG sectors.

- Increased Focus on Circular Economy and Certified Products: Brands are seeking FSC-certified and sustainably sourced DWP for ethical branding, giving producers an edge if they align with green certification programs.

- Integration of AI and Automation in Manufacturing: Digital transformation in pulp manufacturing can improve yield, reduce waste, and enhance product customization, creating a competitive advantage.

Challenges:

- High Capital Investment for Production Facilities: Setting up or upgrading DWP production plants requires significant financial investment, which may deter new entrants or expansions.

- Substitution by Alternative Fibers: Growing R&D around alternative fibers like bamboo, hemp, and recycled materials can present competition to DWP-based fibers.

- Supply Chain Disruptions: Geopolitical tensions, trade restrictions, or logistics challenges can disrupt the sourcing of raw materials and distribution of finished products.

- Sustainability and Traceability Pressure from Brands: Major textile and FMCG companies are demanding complete transparency in sourcing and production, pressuring suppliers to invest in traceability tools and certifications.

Rayon Grade and Specialty Grade DWP Market: Report Scope

This report thoroughly analyzes the Rayon Grade and Specialty Grade DWP Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Rayon Grade and Specialty Grade DWP Market |

| Market Size in 2023 | USD 2.98 Billion |

| Market Forecast in 2032 | USD 4.43 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 182 |

| Key Companies Covered | Sappi Limited, Lenzing AG, Bracell Limited, Aditya Birla Group, Rayonier Advanced Materials Inc., Suzano S.A., Asia Pulp & Paper (APP) Sinar Mas, Nippon Paper Industries Co., Ltd., Domtar Corporation, Mercer International Inc., Shandong Henglian New Mater |

| Segments Covered | By Product Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rayon Grade and Specialty Grade DWP Market: Segmentation Insights

The global rayon grade and specialty grade DWP market is divided by product type, application, end-user, and region.

Segmentation Insights by Product Type

Based on product type, the global rayon grade and specialty grade DWP market is divided into rayon grade and specialty grade.

In the rayon grade and specialty grade DWP market, the Rayon Grade segment is the most dominant among the product types. Rayon Grade DWP holds a significant share primarily due to its widespread use in producing viscose and other regenerated cellulose fibers. These fibers are extensively used in the textile industry for making apparel, home furnishings, and non-woven fabrics, thanks to their cotton-like feel, breathability, and cost-effectiveness. The growth of fast fashion and rising demand for eco-friendly alternatives to synthetic fibers have further propelled the consumption of rayon-grade pulp. Additionally, the increasing industrial activity in emerging economies such as China and India has boosted the demand for rayon-grade DWP, solidifying its position as the market leader.

On the other hand, the Specialty Grade DWP segment, while smaller in volume, is gaining traction due to its application in high-value sectors such as food additives, pharmaceuticals, personal care products, and high-performance materials. Specialty grade pulp is used in the production of cellulose derivatives like cellulose acetate, carboxymethyl cellulose, and microcrystalline cellulose. These derivatives are essential in applications ranging from film coatings and thickeners to drug tablets and cosmetics. Although this segment does not match the sheer volume of rayon-grade usage, its higher value-added nature and growing demand for premium and sustainable materials contribute to its steady growth within the overall DWP market.

Segmentation Insights by Application

On the basis of application, the global rayon grade and specialty grade DWP market is bifurcated into textiles, non-wovens, industrial applications, and others.

In the rayon grade and specialty grade DWP market, Textiles represent the most dominant application segment. This is largely due to the extensive use of DWP in the production of viscose rayon and other regenerated cellulose fibers used in garments and home textiles. The global shift toward sustainable and biodegradable textiles has fueled demand for DWP-based fibers, especially as alternatives to petroleum-based synthetic fibers. With fashion brands increasingly emphasizing eco-friendly materials and consumers becoming more aware of environmental concerns, the textile industry continues to drive the largest share of the DWP market.

Following textiles, the Non-Wovens segment is an important and steadily growing application. DWP is used in the production of non-woven fabrics for hygiene products such as baby wipes, sanitary napkins, and medical supplies. The demand in this segment is supported by population growth, rising hygiene awareness, and increasing healthcare needs, especially in emerging economies. The softness, absorbency, and biodegradability of cellulose-based non-wovens make them a preferred material in these applications.

Industrial Applications come next and include the use of specialty grade DWP in areas such as film coatings, food additives, pharmaceutical excipients, and plastics. Although this segment is smaller in volume compared to textiles and non-wovens, it offers high value and is crucial for industries requiring high-purity cellulose. Innovation and development of high-performance materials using cellulose derivatives contribute to the gradual expansion of this segment.

Segmentation Insights by End-User

On the basis of end-user, the global rayon grade and specialty grade DWP market is bifurcated into apparel, home textiles, medical, automotive, and others.

In the rayon grade and specialty grade DWP market, Apparel is the most dominant end-user segment. This dominance is driven by the widespread adoption of rayon and other regenerated cellulose fibers derived from DWP in clothing production. The fashion industry, particularly fast fashion and sustainable fashion, relies heavily on these fibers due to their softness, breathability, and biodegradability. As consumers increasingly prefer eco-friendly materials, DWP-based fibers are gaining traction as a sustainable alternative to synthetic fabrics, boosting demand in the apparel segment globally.

Home Textiles follow as the second-largest end-user segment. DWP is used in manufacturing bed linens, curtains, towels, upholstery fabrics, and more. These applications benefit from the same characteristics that make DWP desirable in apparel—namely comfort, absorbency, and environmental friendliness. The rise in home improvement trends and increased consumer spending on interior decor have also supported the steady growth of this segment.

The Medical segment represents a growing niche with high value. DWP-derived materials are used in medical-grade non-woven fabrics, surgical gowns, masks, wound care products, and hygiene items. The demand for sterilizable, absorbent, and biodegradable materials has surged, especially post-pandemic, increasing the relevance of DWP in this sector. Though smaller in volume compared to apparel or home textiles, the medical segment is vital and expected to grow steadily.

Automotive is another emerging end-user segment where DWP finds application in interior textiles, insulation materials, and eco-friendly composites. As automakers seek sustainable alternatives for vehicle interiors and components, the interest in cellulose-based materials like DWP is rising. However, this segment still represents a relatively smaller share of the overall market.

Rayon Grade and Specialty Grade DWP Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

Asia-Pacific is the most dominant region in the global Rayon Grade and Specialty Grade Dissolving Wood Pulp (DWP) market. Its leadership is driven by a strong textile manufacturing base, large-scale production facilities, and a high demand for viscose fiber across countries like China, India, and Indonesia. China, in particular, stands out as both the leading producer and consumer of DWP, supported by cost-effective operations and significant export capacity. The region’s well-established supply chain and expanding industrial applications further strengthen its position at the top.

North America follows as a significant contributor to the rayon grade and specialty grade DWP market, largely influenced by technological innovation and a growing preference for sustainable raw materials. The United States and Canada play central roles, especially in specialty-grade DWP used in hygiene products and high-performance textiles. The demand is further propelled by stringent environmental standards that encourage the shift toward eco-friendly alternatives and biobased materials.

Europe maintains a strong presence in the rayon grade and specialty grade DWP market, driven by environmental consciousness and advanced manufacturing standards. Countries such as Germany, France, and the United Kingdom are key players, particularly in applications requiring high-purity specialty-grade DWP. The region benefits from policies that support sustainable sourcing and consumer demand for responsibly produced textiles and personal care items.

Latin America is an emerging player in the rayon grade and specialty grade DWP market, with growth led by countries like Brazil and Mexico. The region is experiencing a rise in demand due to the expansion of the local textile sector and a shift toward sustainable material use in industrial processes. While not as dominant as other regions, investment in manufacturing capabilities and a focus on export potential contribute to steady market development.

Middle East and Africa represent the least dominant region in the rayon grade and specialty grade DWP market but hold long-term growth prospects. Economic diversification efforts, especially in countries investing in non-oil industries, are fostering the development of local textile and chemical sectors. Although the current market share remains limited, gradual adoption of sustainable practices and infrastructure investment indicate future opportunities for expansion.

Rayon Grade and Specialty Grade DWP Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the rayon grade and specialty grade DWP market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global rayon grade and specialty grade DWP market include:

- Sappi Limited

- Lenzing AG

- Bracell Limited

- Aditya Birla Group

- Rayonier Advanced Materials Inc.

- Suzano S.A.

- Asia Pulp & Paper (APP) Sinar Mas

- Nippon Paper Industries Co. Ltd.

- Domtar Corporation

- Mercer International Inc.

- Shandong Henglian New Materials Co. Ltd.

- Shandong Silver Hawk Chemical Fibre Co. Ltd.

- Grasim Industries Limited

- Altri

- SGPS S.A.

- Borregaard ASA

- Cosmo Specialty Fibers Inc.

- Ence Energía y Celulosa S.A.

- Fortress Global Enterprises Inc.

- Hubei Chemical Fiber Co. Ltd.

- Södra Skogsägarna ekonomisk förening

The global rayon grade and specialty grade DWP market is segmented as follows:

By Product Type

- Rayon Grade

- Specialty Grade

By Application

- Textiles

- Non-Wovens

- Industrial Applications

- Others

By End-User

- Apparel

- Home Textiles

- Medical

- Automotive

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Rayon Grade and Specialty Grade DWP

Request Sample

Rayon Grade and Specialty Grade DWP