Ready to Drink (RTD) Coffee and Tea Market Size, Share, and Trends Analysis Report

CAGR :

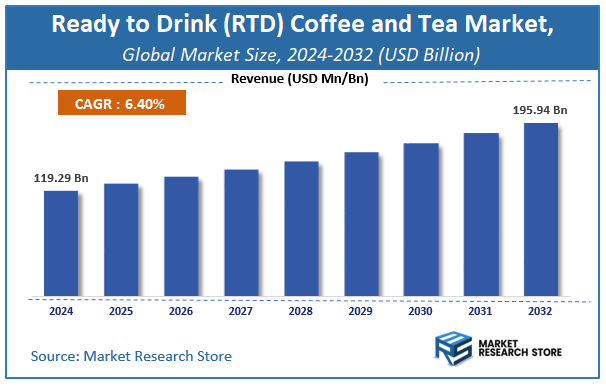

| Market Size 2024 (Base Year) | USD 119.29 Billion |

| Market Size 2032 (Forecast Year) | USD 195.94 Billion |

| CAGR | 6.4% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global ready to drink (RTD) coffee and tea market size was valued at approximately USD 119.29 Billion in 2024. The market is projected to grow significantly, reaching USD 195.94 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the ready to drink (RTD) coffee and tea industry.

To Get more Insights, Request a Free Sample

Ready to Drink (RTD) Coffee and Tea Market: Overview

The growth of the ready to drink (RTD) coffee and tea market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The ready to drink (RTD) coffee and tea market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the ready to drink (RTD) coffee and tea market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global ready to drink (RTD) coffee and tea market is estimated to grow annually at a CAGR of around 6.4% over the forecast period (2025-2032).

- In terms of revenue, the global ready to drink (RTD) coffee and tea market size was valued at around USD 119.29 Billion in 2024 and is projected to reach USD 195.94 Billion by 2032.

- The market is projected to grow at a significant rate due to Increasing consumer demand for convenient, on-the-go beverages, growing coffee and tea culture, and rising innovation in flavors drive.

- Based on the Products, the Canned segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the Supermarkets/Hypermarkets segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Ready to Drink (RTD) Coffee and Tea Market: Report Scope

This report thoroughly analyzes the ready to drink (RTD) coffee and tea market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Ready to Drink (RTD) Coffee and Tea Market |

| Market Size in 2024 | USD 119.29 Billion |

| Market Forecast in 2032 | USD 195.94 Billion |

| Growth Rate | CAGR of 6.4% |

| Number of Pages | 210 |

| Key Companies Covered | Dr Pepper Snapple Group, Starbucks Corporation, Taisun Enterprises Co Ltd., The Coca-Cola Company, Pepsico In, San Benedetto, Monster Beverage Company, Ferolito Vulataggio and Sons |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ready to Drink (RTD) Coffee and Tea Market: Dynamics

Key Growth Drivers :

The Ready to Drink (RTD) coffee and tea market is experiencing strong growth primarily driven by the increasing consumer demand for convenience and on-the-go beverages that fit into busy, modern lifestyles. As a growing number of people, particularly millennials and Gen Z, seek quick and easy refreshment, RTD products offer a hassle-free alternative to traditional brewed drinks. This trend is further fueled by a significant shift in consumer preferences away from high-sugar carbonated soft drinks towards healthier alternatives. Consumers are increasingly aware of the health benefits of coffee and tea, such as their antioxidant properties and ability to provide a natural energy boost, which is contributing to the market's expansion. The rise of "cafe culture" and the popularity of cold brew and iced beverages, which are easy to commercialize in RTD format, also play a crucial role.

Restraints :

Despite its growth, the RTD coffee and tea market faces several restraints. A major challenge is the intense competition from a multitude of established players and new entrants, which can lead to price wars and market saturation. For many consumers, there is still a strong cultural preference for freshly brewed coffee and tea, which is perceived as superior in taste and quality. This traditional mindset can hinder the adoption of RTD alternatives. Furthermore, the price volatility of key raw materials, particularly coffee beans and tea leaves, can impact production costs and squeeze profit margins. The high sugar content in many flavored RTD beverages also remains a significant concern for health-conscious consumers, which can act as a deterrent.

Opportunities :

The RTD coffee and tea market is ripe with opportunities for innovation and growth. A key opportunity lies in the development of "better-for-you" products that align with health trends, such as low-sugar, organic, and plant-based (oat, almond, soy milk) options. The growing consumer interest in functional beverages presents a chance to introduce products fortified with vitamins, protein, or adaptogens for specific health benefits. Additionally, manufacturers can capitalize on the demand for unique and premium flavors inspired by artisanal brewing methods and global cuisines. The expansion of e-commerce platforms and direct-to-consumer delivery models also provides an excellent avenue for reaching a wider audience and offering subscription-based services, thereby building brand loyalty.

Challenges :

The market is challenged by the need for a robust and costly cold chain logistics infrastructure for chilled and fresh RTD products, which can be a barrier for new players and a challenge for expanding into less-developed markets. The industry also faces the challenge of consumer perception, as many view RTD beverages as a less authentic or less sophisticated experience compared to a barista-made drink. Overcoming this requires significant investment in marketing to highlight the quality and craftsmanship of RTD products. Lastly, the short shelf life of some products, particularly those with no preservatives, can lead to food waste and operational complexities for both manufacturers and retailers.

Ready to Drink (RTD) Coffee and Tea Market: Segmentation Insights

The global ready to drink (RTD) coffee and tea market is segmented based on Products, Applications, and Region. All the segments of the ready to drink (RTD) coffee and tea market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global ready to drink (RTD) coffee and tea market is divided into Canned, Glass Bottle, PET Bottle, Others.

On the basis of Applications, the global ready to drink (RTD) coffee and tea market is bifurcated into Supermarkets/Hypermarkets, Specialty Retailers, Convenience Stores, E-Commerce.

Ready to Drink (RTD) Coffee and Tea Market: Regional Insights

The Asia-Pacific (APAC) region is the dominant and most mature market for Ready-to-Drink (RTD) Coffee and Tea beverages, with Japan being the historic epicenter of innovation and per capita consumption. According to market data from Euromonitor International and Statista, APAC holds the largest global market share, driven by Japan's deeply ingrained vending machine culture, on-the-go lifestyle, and early adoption of products from giants like Suntory and Coca-Cola (Japan).

While countries like China and South Korea are massive and rapidly growing markets, Japan sets the regional standard for product variety, premium offerings, and innovation. Although North America is a significant and valuable market, its growth is largely in the coffee segment and from a much newer base. The APAC region's combination of established consumption habits, high population density, and a sophisticated, competitive landscape solidifies its position as the global leader in both value and volume.

Ready to Drink (RTD) Coffee and Tea Market: Competitive Landscape

The ready to drink (RTD) coffee and tea market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Ready to Drink (RTD) Coffee and Tea Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Dr Pepper Snapple Group

- Starbucks Corporation

- Taisun Enterprises Co Ltd.

- The Coca-Cola Company

- Pepsico In

- San Benedetto

- Monster Beverage Company

- Ferolito Vulataggio and Sons

The Global Ready to Drink (RTD) Coffee and Tea Market is Segmented as Follows:

By Products

- Canned

- Glass Bottle

- PET Bottle

- Others

By Applications

- Supermarkets/Hypermarkets

- Specialty Retailers

- Convenience Stores

- E-Commerce

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Ready to Drink (RTD) Coffee and Tea Market Share by Type (2020-2026) 1.5.2 Canned 1.5.3 Glass Bottle 1.5.4 PET Bottle 1.5.5 Others 1.6 Market by Application 1.6.1 Global Ready to Drink (RTD) Coffee and Tea Market Share by Application (2020-2026) 1.6.2 Supermarkets/Hypermarkets 1.6.3 Specialty Retailers 1.6.4 Convenience Stores 1.6.5 E-Commerce 1.7 Ready to Drink (RTD) Coffee and Tea Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Ready to Drink (RTD) Coffee and Tea Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Ready to Drink (RTD) Coffee and Tea Market 3.1 Value Chain Status 3.2 Ready to Drink (RTD) Coffee and Tea Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Ready to Drink (RTD) Coffee and Tea 3.2.3 Labor Cost of Ready to Drink (RTD) Coffee and Tea 3.2.3.1 Labor Cost of Ready to Drink (RTD) Coffee and Tea Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Dr Pepper Snapple Group 4.1.1 Dr Pepper Snapple Group Basic Information 4.1.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.1.3 Dr Pepper Snapple Group Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.1.4 Dr Pepper Snapple Group Business Overview 4.2 Starbucks Corporation 4.2.1 Starbucks Corporation Basic Information 4.2.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.2.3 Starbucks Corporation Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.2.4 Starbucks Corporation Business Overview 4.3 Taisun Enterprises Co Ltd. 4.3.1 Taisun Enterprises Co Ltd. Basic Information 4.3.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.3.3 Taisun Enterprises Co Ltd. Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.3.4 Taisun Enterprises Co Ltd. Business Overview 4.4 The Coca-Cola Company 4.4.1 The Coca-Cola Company Basic Information 4.4.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.4.3 The Coca-Cola Company Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.4.4 The Coca-Cola Company Business Overview 4.5 Pepsico In 4.5.1 Pepsico In Basic Information 4.5.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.5.3 Pepsico In Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.5.4 Pepsico In Business Overview 4.6 San Benedetto 4.6.1 San Benedetto Basic Information 4.6.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.6.3 San Benedetto Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.6.4 San Benedetto Business Overview 4.7 Monster Beverage Company 4.7.1 Monster Beverage Company Basic Information 4.7.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.7.3 Monster Beverage Company Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.7.4 Monster Beverage Company Business Overview 4.8 Ferolito Vulataggio and Sons 4.8.1 Ferolito Vulataggio and Sons Basic Information 4.8.2 Ready to Drink (RTD) Coffee and Tea Product Profiles, Application and Specification 4.8.3 Ferolito Vulataggio and Sons Ready to Drink (RTD) Coffee and Tea Market Performance (2015-2020) 4.8.4 Ferolito Vulataggio and Sons Business Overview 5 Global Ready to Drink (RTD) Coffee and Tea Market Analysis by Regions 5.1 Global Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Regions 5.1.1 Global Ready to Drink (RTD) Coffee and Tea Sales by Regions (2015-2020) 5.1.2 Global Ready to Drink (RTD) Coffee and Tea Revenue by Regions (2015-2020) 5.2 North America Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 5.3 Europe Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 5.6 South America Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 6 North America Ready to Drink (RTD) Coffee and Tea Market Analysis by Countries 6.1 North America Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Countries 6.1.1 North America Ready to Drink (RTD) Coffee and Tea Sales by Countries (2015-2020) 6.1.2 North America Ready to Drink (RTD) Coffee and Tea Revenue by Countries (2015-2020) 6.1.3 North America Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 6.2 United States Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 6.2.1 United States Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 6.3 Canada Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 6.4 Mexico Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 7 Europe Ready to Drink (RTD) Coffee and Tea Market Analysis by Countries 7.1 Europe Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Countries 7.1.1 Europe Ready to Drink (RTD) Coffee and Tea Sales by Countries (2015-2020) 7.1.2 Europe Ready to Drink (RTD) Coffee and Tea Revenue by Countries (2015-2020) 7.1.3 Europe Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 7.2 Germany Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 7.2.1 Germany Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 7.3 UK Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 7.3.1 UK Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 7.4 France Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 7.4.1 France Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 7.5 Italy Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 7.5.1 Italy Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 7.6 Spain Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 7.6.1 Spain Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 7.7 Russia Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 7.7.1 Russia Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 8 Asia-Pacific Ready to Drink (RTD) Coffee and Tea Market Analysis by Countries 8.1 Asia-Pacific Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Ready to Drink (RTD) Coffee and Tea Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Ready to Drink (RTD) Coffee and Tea Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 8.2 China Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 8.2.1 China Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 8.3 Japan Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 8.3.1 Japan Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 8.4 South Korea Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 8.4.1 South Korea Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 8.5 Australia Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 8.6 India Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 8.6.1 India Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 8.7 Southeast Asia Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 9 Middle East and Africa Ready to Drink (RTD) Coffee and Tea Market Analysis by Countries 9.1 Middle East and Africa Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Ready to Drink (RTD) Coffee and Tea Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Ready to Drink (RTD) Coffee and Tea Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 9.2 Saudi Arabia Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 9.3 UAE Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 9.4 Egypt Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 9.5 Nigeria Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 9.6 South Africa Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 10 South America Ready to Drink (RTD) Coffee and Tea Market Analysis by Countries 10.1 South America Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Countries 10.1.1 South America Ready to Drink (RTD) Coffee and Tea Sales by Countries (2015-2020) 10.1.2 South America Ready to Drink (RTD) Coffee and Tea Revenue by Countries (2015-2020) 10.1.3 South America Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 10.2 Brazil Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 10.2.1 Brazil Ready to Drink (RTD) Coffee and Tea Market Under COVID-19 10.3 Argentina Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 10.4 Columbia Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 10.5 Chile Ready to Drink (RTD) Coffee and Tea Sales and Growth Rate (2015-2020) 11 Global Ready to Drink (RTD) Coffee and Tea Market Segment by Types 11.1 Global Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Ready to Drink (RTD) Coffee and Tea Sales and Market Share by Types (2015-2020) 11.1.2 Global Ready to Drink (RTD) Coffee and Tea Revenue and Market Share by Types (2015-2020) 11.2 Canned Sales and Price (2015-2020) 11.3 Glass Bottle Sales and Price (2015-2020) 11.4 PET Bottle Sales and Price (2015-2020) 11.5 Others Sales and Price (2015-2020) 12 Global Ready to Drink (RTD) Coffee and Tea Market Segment by Applications 12.1 Global Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Ready to Drink (RTD) Coffee and Tea Sales and Market Share by Applications (2015-2020) 12.1.2 Global Ready to Drink (RTD) Coffee and Tea Revenue and Market Share by Applications (2015-2020) 12.2 Supermarkets/Hypermarkets Sales, Revenue and Growth Rate (2015-2020) 12.3 Specialty Retailers Sales, Revenue and Growth Rate (2015-2020) 12.4 Convenience Stores Sales, Revenue and Growth Rate (2015-2020) 12.5 E-Commerce Sales, Revenue and Growth Rate (2015-2020) 13 Ready to Drink (RTD) Coffee and Tea Market Forecast by Regions (2020-2026) 13.1 Global Ready to Drink (RTD) Coffee and Tea Sales, Revenue and Growth Rate (2020-2026) 13.2 Ready to Drink (RTD) Coffee and Tea Market Forecast by Regions (2020-2026) 13.2.1 North America Ready to Drink (RTD) Coffee and Tea Market Forecast (2020-2026) 13.2.2 Europe Ready to Drink (RTD) Coffee and Tea Market Forecast (2020-2026) 13.2.3 Asia-Pacific Ready to Drink (RTD) Coffee and Tea Market Forecast (2020-2026) 13.2.4 Middle East and Africa Ready to Drink (RTD) Coffee and Tea Market Forecast (2020-2026) 13.2.5 South America Ready to Drink (RTD) Coffee and Tea Market Forecast (2020-2026) 13.3 Ready to Drink (RTD) Coffee and Tea Market Forecast by Types (2020-2026) 13.4 Ready to Drink (RTD) Coffee and Tea Market Forecast by Applications (2020-2026) 13.5 Ready to Drink (RTD) Coffee and Tea Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Ready to Drink (RTD) Coffee and Tea

Request Sample

Ready to Drink (RTD) Coffee and Tea