Real Estate Investment Management Software Market Size, Share, and Trends Analysis Report

CAGR :

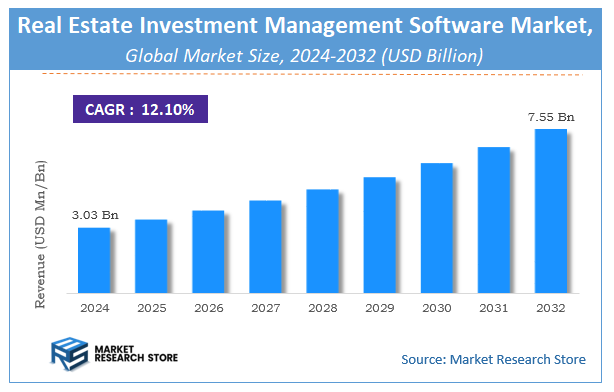

| Market Size 2024 (Base Year) | USD 3.03 Billion |

| Market Size 2032 (Forecast Year) | USD 7.55 Billion |

| CAGR | 12.1% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global real estate investment management software market, estimating its value at USD 3.03 Billion in 2024, with projections indicating it will reach USD 7.55 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 12.1% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the real estate investment management software industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Real Estate Investment Management Software Market: Overview

The growth of the real estate investment management software market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The real estate investment management software market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the real estate investment management software market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Component, Deployment Mode, Application, End User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global real estate investment management software market is estimated to grow annually at a CAGR of around 12.1% over the forecast period (2025-2032).

- In terms of revenue, the global real estate investment management software market size was valued at around USD 3.03 Billion in 2024 and is projected to reach USD 7.55 Billion by 2032.

- The market is projected to grow at a significant rate due to growing need for portfolio tracking, risk management, and reporting drives software adoption.

- Based on the Component, the Software segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Deployment Mode, the Cloud segment is anticipated to command the largest market share.

- In terms of Application, the Asset Management segment is projected to lead the global market.

- By End User, the Real Estate Investment Trusts (REITs) segment is predicted to dominate the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Real Estate Investment Management Software Market: Report Scope

This report thoroughly analyzes the real estate investment management software market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Real Estate Investment Management Software Market |

| Market Size in 2024 | USD 3.03 Billion |

| Market Forecast in 2032 | USD 7.55 Billion |

| Growth Rate | CAGR of 12.1% |

| Number of Pages | 226 |

| Key Companies Covered | Argus Financial Software, IBM Tririga, Climbsoft, Trulia, Yardi Systems, Zillow, IFCA, Real Insights, MRI Software, Oracle Corp, Mingyuanyun, SAP, Kingdee, RealPage, AMSI Property Management, Propertybase, CoStar Group, WxSoft Zhuhai, Accruent, Fiserv, Juniper Square, Yonyou Software |

| Segments Covered | By Component, By Deployment Mode, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Real Estate Investment Management Software Market: Dynamics

Key Growth Drivers

The Real Estate Investment Management Software market is experiencing robust growth driven primarily by the increasing complexity and globalization of real estate investments, which necessitate sophisticated tools for managing diverse portfolios across multiple geographies and asset classes. The growing demand for data-driven decision-making and enhanced transparency in real estate investment mandates the use of analytical software for risk assessment, performance tracking, and market insights. The need for improved operational efficiency and automation to reduce manual errors, streamline workflows, and enhance collaboration among investment teams is a major catalyst for adoption. Furthermore, stringent regulatory requirements and increased investor scrutiny are compelling real estate firms to adopt robust software solutions for compliance reporting, audit trails, and transparent communication with stakeholders. In India, the rapid growth of institutional real estate investments and the increasing professionalization of the sector are key drivers.

Restraints

Despite the compelling growth drivers, the Real Estate Investment Management Software market faces several significant restraints. The high initial cost of implementation, including software licenses, customization, and integration with existing systems, can be a major barrier, particularly for smaller investment firms or those with legacy IT infrastructure. Concerns regarding data security and privacy are paramount, as these platforms handle sensitive financial data, investment strategies, and investor information, making robust cybersecurity a non-negotiable but costly requirement. Additionally, the complexity of integrating diverse data sources from various property management systems, financial software, and market data providers, often fragmented across different formats and platforms, can lead to significant technical challenges and data synchronization issues, hindering seamless adoption.

Opportunities

The Real Estate Investment Management Software market presents numerous opportunities for innovation and expansion. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, automated valuation models, market trend analysis, and intelligent risk assessment offers immense potential to revolutionize investment strategies and identify lucrative opportunities. The growing adoption of cloud-based SaaS (Software-as-a-Service) models provides scalability, flexibility, reduced upfront costs, and easier accessibility, making sophisticated REIMS solutions more attractive to a wider range of investment firms, including mid-sized players. The development of specialized modules for emerging asset classes like data centers, logistics parks, and affordable housing, which have unique investment characteristics and data requirements, can unlock new market segments. In India, the increasing foreign and domestic institutional investment in real estate, the growth of REITs (Real Estate Investment Trusts), the push for digitalization in property transactions, and the need for greater transparency and efficiency are creating substantial opportunities for REIMS, particularly for scalable, cloud-based solutions that cater to the evolving regulatory landscape and diverse investment strategies in the country.

Challenges

The Real Estate Investment Management Software market faces critical challenges related to ensuring interoperability and seamless data exchange with a multitude of disparate legacy systems used by various stakeholders across the real estate value chain (e.g., property managers, brokers, legal firms). Overcoming resistance to change and the steep learning curve for end-users, especially seasoned professionals accustomed to traditional methods, requires comprehensive training, intuitive user interfaces, and strong change management strategies. Maintaining data accuracy and consistency across integrated platforms, given the dynamic nature of real estate markets and the volume of transactional data, is a continuous operational challenge. Lastly, intense competition from a mix of global enterprise software providers and specialized PropTech startups, coupled with the need to constantly innovate, provide competitive pricing, and offer robust customer support, demands significant R&D investment and agile product development to secure and maintain market share.

Real Estate Investment Management Software Market: Segmentation Insights

The global real estate investment management software market is segmented based on Component, Deployment Mode, Application, End User, and Region. All the segments of the real estate investment management software market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Component, the global real estate investment management software market is divided into Software, Services.

On the basis of Deployment Mode, the global real estate investment management software market is bifurcated into Cloud, On-premise.

In terms of Application, the global real estate investment management software market is categorized into Asset Management, Property Management, Accounting & Financial Reporting, Leasing Management, Investor Reporting.

Based on End User, the global real estate investment management software market is split into Real Estate Investment Trusts (REITs), Property Managers, Fund Managers, Institutional Investors.

Real Estate Investment Management Software Market: Regional Insights

The North America region dominates the global Real Estate Investment Management Software market, holding the largest revenue share due to its mature proptech ecosystem, high adoption of cloud-based solutions, and concentration of institutional real estate investors. The U.S. accounts for over 80% of the regional market, driven by demand from REITs, private equity firms, and commercial real estate operators leveraging AI-powered analytics and portfolio optimization tools. According to 2024 data, North America captured ~52% of global market revenue, with a 24% YoY growth fueled by ESG compliance needs and hybrid work-driven asset repurposing. Europe follows, led by the UK and Germany’s regulated fund structures, while Asia-Pacific (notably Australia and Singapore) shows rapid growth in PropTech adoption. North America’s dominance stems from its 60% share of proptech unicorns (e.g., MRI Software, CoStar), $9B+ in annual CRE tech investments, and advanced integrations with FedNow for instant rent payments. The region’s software penetration exceeds 65% among large asset managers, with predictive modeling emerging as a key differentiator.

Real Estate Investment Management Software Market: Competitive Landscape

The real estate investment management software market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Real Estate Investment Management Software Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Argus Financial Software

- IBM Tririga

- Climbsoft

- Trulia

- Yardi Systems

- Zillow

- IFCA

- Real Insights

- MRI Software

- Oracle Corp

- Mingyuanyun

- SAP

- Kingdee

- RealPage

- AMSI Property Management

- Propertybase

- CoStar Group

- WxSoft Zhuhai

- Accruent

- Fiserv

- Juniper Square

- Yonyou Software

The Global Real Estate Investment Management Software Market is Segmented as Follows:

By Component

- Software

- Services

By Deployment Mode

- Cloud

- On-premise

By Application

- Asset Management

- Property Management

- Accounting & Financial Reporting

- Leasing Management

- Investor Reporting

By End User

- Real Estate Investment Trusts (REITs)

- Property Managers

- Fund Managers

- Institutional Investors

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Which are the major players leveraging the real estate investment management software market growth?

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Real Estate Investment Management Software Market Share by Type (2020-2026) 1.5.2 Real Estate Investment Trusts 1.5.3 Private Equity Firms 1.5.4 Insurance Companies 1.5.5 RE Professionals 1.5.6 Others 1.6 Market by Application 1.6.1 Global Real Estate Investment Management Software Market Share by Application (2020-2026) 1.6.2 Small Enterprise 1.6.3 Medium Enterprise 1.6.4 Large Enterprise 1.7 Real Estate Investment Management Software Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Real Estate Investment Management Software Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Real Estate Investment Management Software Market 3.1 Value Chain Status 3.2 Real Estate Investment Management Software Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Real Estate Investment Management Software 3.2.3 Labor Cost of Real Estate Investment Management Software 3.2.3.1 Labor Cost of Real Estate Investment Management Software Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Argus Financial Software 4.1.1 Argus Financial Software Basic Information 4.1.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.1.3 Argus Financial Software Real Estate Investment Management Software Market Performance (2015-2020) 4.1.4 Argus Financial Software Business Overview 4.2 IBM Tririga 4.2.1 IBM Tririga Basic Information 4.2.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.2.3 IBM Tririga Real Estate Investment Management Software Market Performance (2015-2020) 4.2.4 IBM Tririga Business Overview 4.3 Climbsoft 4.3.1 Climbsoft Basic Information 4.3.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.3.3 Climbsoft Real Estate Investment Management Software Market Performance (2015-2020) 4.3.4 Climbsoft Business Overview 4.4 Trulia 4.4.1 Trulia Basic Information 4.4.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.4.3 Trulia Real Estate Investment Management Software Market Performance (2015-2020) 4.4.4 Trulia Business Overview 4.5 Yardi Systems 4.5.1 Yardi Systems Basic Information 4.5.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.5.3 Yardi Systems Real Estate Investment Management Software Market Performance (2015-2020) 4.5.4 Yardi Systems Business Overview 4.6 Zillow 4.6.1 Zillow Basic Information 4.6.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.6.3 Zillow Real Estate Investment Management Software Market Performance (2015-2020) 4.6.4 Zillow Business Overview 4.7 IFCA 4.7.1 IFCA Basic Information 4.7.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.7.3 IFCA Real Estate Investment Management Software Market Performance (2015-2020) 4.7.4 IFCA Business Overview 4.8 Real Insights 4.8.1 Real Insights Basic Information 4.8.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.8.3 Real Insights Real Estate Investment Management Software Market Performance (2015-2020) 4.8.4 Real Insights Business Overview 4.9 MRI Software 4.9.1 MRI Software Basic Information 4.9.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.9.3 MRI Software Real Estate Investment Management Software Market Performance (2015-2020) 4.9.4 MRI Software Business Overview 4.10 Oracle Corp 4.10.1 Oracle Corp Basic Information 4.10.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.10.3 Oracle Corp Real Estate Investment Management Software Market Performance (2015-2020) 4.10.4 Oracle Corp Business Overview 4.11 Mingyuanyun 4.11.1 Mingyuanyun Basic Information 4.11.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.11.3 Mingyuanyun Real Estate Investment Management Software Market Performance (2015-2020) 4.11.4 Mingyuanyun Business Overview 4.12 SAP 4.12.1 SAP Basic Information 4.12.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.12.3 SAP Real Estate Investment Management Software Market Performance (2015-2020) 4.12.4 SAP Business Overview 4.13 Kingdee 4.13.1 Kingdee Basic Information 4.13.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.13.3 Kingdee Real Estate Investment Management Software Market Performance (2015-2020) 4.13.4 Kingdee Business Overview 4.14 RealPage 4.14.1 RealPage Basic Information 4.14.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.14.3 RealPage Real Estate Investment Management Software Market Performance (2015-2020) 4.14.4 RealPage Business Overview 4.15 AMSI Property Management 4.15.1 AMSI Property Management Basic Information 4.15.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.15.3 AMSI Property Management Real Estate Investment Management Software Market Performance (2015-2020) 4.15.4 AMSI Property Management Business Overview 4.16 Propertybase 4.16.1 Propertybase Basic Information 4.16.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.16.3 Propertybase Real Estate Investment Management Software Market Performance (2015-2020) 4.16.4 Propertybase Business Overview 4.17 CoStar Group 4.17.1 CoStar Group Basic Information 4.17.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.17.3 CoStar Group Real Estate Investment Management Software Market Performance (2015-2020) 4.17.4 CoStar Group Business Overview 4.18 WxSoft Zhuhai 4.18.1 WxSoft Zhuhai Basic Information 4.18.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.18.3 WxSoft Zhuhai Real Estate Investment Management Software Market Performance (2015-2020) 4.18.4 WxSoft Zhuhai Business Overview 4.19 Accruent 4.19.1 Accruent Basic Information 4.19.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.19.3 Accruent Real Estate Investment Management Software Market Performance (2015-2020) 4.19.4 Accruent Business Overview 4.20 Fiserv 4.20.1 Fiserv Basic Information 4.20.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.20.3 Fiserv Real Estate Investment Management Software Market Performance (2015-2020) 4.20.4 Fiserv Business Overview 4.21 Juniper Square 4.21.1 Juniper Square Basic Information 4.21.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.21.3 Juniper Square Real Estate Investment Management Software Market Performance (2015-2020) 4.21.4 Juniper Square Business Overview 4.22 Yonyou Software 4.22.1 Yonyou Software Basic Information 4.22.2 Real Estate Investment Management Software Product Profiles, Application and Specification 4.22.3 Yonyou Software Real Estate Investment Management Software Market Performance (2015-2020) 4.22.4 Yonyou Software Business Overview 5 Global Real Estate Investment Management Software Market Analysis by Regions 5.1 Global Real Estate Investment Management Software Sales, Revenue and Market Share by Regions 5.1.1 Global Real Estate Investment Management Software Sales by Regions (2015-2020) 5.1.2 Global Real Estate Investment Management Software Revenue by Regions (2015-2020) 5.2 North America Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 5.3 Europe Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 5.6 South America Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 6 North America Real Estate Investment Management Software Market Analysis by Countries 6.1 North America Real Estate Investment Management Software Sales, Revenue and Market Share by Countries 6.1.1 North America Real Estate Investment Management Software Sales by Countries (2015-2020) 6.1.2 North America Real Estate Investment Management Software Revenue by Countries (2015-2020) 6.1.3 North America Real Estate Investment Management Software Market Under COVID-19 6.2 United States Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 6.2.1 United States Real Estate Investment Management Software Market Under COVID-19 6.3 Canada Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 6.4 Mexico Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 7 Europe Real Estate Investment Management Software Market Analysis by Countries 7.1 Europe Real Estate Investment Management Software Sales, Revenue and Market Share by Countries 7.1.1 Europe Real Estate Investment Management Software Sales by Countries (2015-2020) 7.1.2 Europe Real Estate Investment Management Software Revenue by Countries (2015-2020) 7.1.3 Europe Real Estate Investment Management Software Market Under COVID-19 7.2 Germany Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 7.2.1 Germany Real Estate Investment Management Software Market Under COVID-19 7.3 UK Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 7.3.1 UK Real Estate Investment Management Software Market Under COVID-19 7.4 France Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 7.4.1 France Real Estate Investment Management Software Market Under COVID-19 7.5 Italy Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 7.5.1 Italy Real Estate Investment Management Software Market Under COVID-19 7.6 Spain Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 7.6.1 Spain Real Estate Investment Management Software Market Under COVID-19 7.7 Russia Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 7.7.1 Russia Real Estate Investment Management Software Market Under COVID-19 8 Asia-Pacific Real Estate Investment Management Software Market Analysis by Countries 8.1 Asia-Pacific Real Estate Investment Management Software Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Real Estate Investment Management Software Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Real Estate Investment Management Software Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Real Estate Investment Management Software Market Under COVID-19 8.2 China Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 8.2.1 China Real Estate Investment Management Software Market Under COVID-19 8.3 Japan Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 8.3.1 Japan Real Estate Investment Management Software Market Under COVID-19 8.4 South Korea Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 8.4.1 South Korea Real Estate Investment Management Software Market Under COVID-19 8.5 Australia Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 8.6 India Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 8.6.1 India Real Estate Investment Management Software Market Under COVID-19 8.7 Southeast Asia Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Real Estate Investment Management Software Market Under COVID-19 9 Middle East and Africa Real Estate Investment Management Software Market Analysis by Countries 9.1 Middle East and Africa Real Estate Investment Management Software Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Real Estate Investment Management Software Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Real Estate Investment Management Software Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Real Estate Investment Management Software Market Under COVID-19 9.2 Saudi Arabia Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 9.3 UAE Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 9.4 Egypt Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 9.5 Nigeria Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 9.6 South Africa Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 10 South America Real Estate Investment Management Software Market Analysis by Countries 10.1 South America Real Estate Investment Management Software Sales, Revenue and Market Share by Countries 10.1.1 South America Real Estate Investment Management Software Sales by Countries (2015-2020) 10.1.2 South America Real Estate Investment Management Software Revenue by Countries (2015-2020) 10.1.3 South America Real Estate Investment Management Software Market Under COVID-19 10.2 Brazil Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 10.2.1 Brazil Real Estate Investment Management Software Market Under COVID-19 10.3 Argentina Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 10.4 Columbia Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 10.5 Chile Real Estate Investment Management Software Sales and Growth Rate (2015-2020) 11 Global Real Estate Investment Management Software Market Segment by Types 11.1 Global Real Estate Investment Management Software Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Real Estate Investment Management Software Sales and Market Share by Types (2015-2020) 11.1.2 Global Real Estate Investment Management Software Revenue and Market Share by Types (2015-2020) 11.2 Real Estate Investment Trusts Sales and Price (2015-2020) 11.3 Private Equity Firms Sales and Price (2015-2020) 11.4 Insurance Companies Sales and Price (2015-2020) 11.5 RE Professionals Sales and Price (2015-2020) 11.6 Others Sales and Price (2015-2020) 12 Global Real Estate Investment Management Software Market Segment by Applications 12.1 Global Real Estate Investment Management Software Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Real Estate Investment Management Software Sales and Market Share by Applications (2015-2020) 12.1.2 Global Real Estate Investment Management Software Revenue and Market Share by Applications (2015-2020) 12.2 Small Enterprise Sales, Revenue and Growth Rate (2015-2020) 12.3 Medium Enterprise Sales, Revenue and Growth Rate (2015-2020) 12.4 Large Enterprise Sales, Revenue and Growth Rate (2015-2020) 13 Real Estate Investment Management Software Market Forecast by Regions (2020-2026) 13.1 Global Real Estate Investment Management Software Sales, Revenue and Growth Rate (2020-2026) 13.2 Real Estate Investment Management Software Market Forecast by Regions (2020-2026) 13.2.1 North America Real Estate Investment Management Software Market Forecast (2020-2026) 13.2.2 Europe Real Estate Investment Management Software Market Forecast (2020-2026) 13.2.3 Asia-Pacific Real Estate Investment Management Software Market Forecast (2020-2026) 13.2.4 Middle East and Africa Real Estate Investment Management Software Market Forecast (2020-2026) 13.2.5 South America Real Estate Investment Management Software Market Forecast (2020-2026) 13.3 Real Estate Investment Management Software Market Forecast by Types (2020-2026) 13.4 Real Estate Investment Management Software Market Forecast by Applications (2020-2026) 13.5 Real Estate Investment Management Software Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Real Estate Investment Management Software

Request Sample

Real Estate Investment Management Software