Rear Projection Television Market Size, Share, and Trends Analysis Report

CAGR :

| Market Size 2023 (Base Year) | USD 512.41 Million |

| Market Size 2032 (Forecast Year) | USD 634.33 Million |

| CAGR | 2.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Rear Projection Television Market Insights

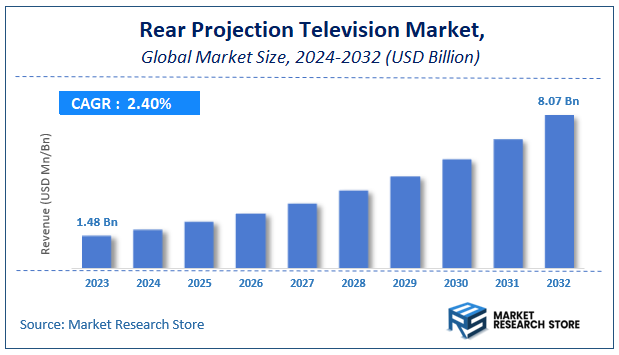

According to Market Research Store, the global rear projection television market size was valued at around USD 512.41 million in 2023 and is estimated to reach USD 634.33 million by 2032, to register a CAGR of approximately 2.4% in terms of revenue during the forecast period 2024-2032.

The rear projection television report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Rear Projection Television Market: Overview

Rear projection television (RPTV) is a display technology that projects images onto a screen from within the television unit. Unlike direct-view televisions such as LED or OLED, RPTVs use a projection system, typically based on Digital Light Processing (DLP), Liquid Crystal Display (LCD), or Liquid Crystal on Silicon (LCoS) technology. These televisions gained popularity due to their ability to deliver large screen sizes at a lower cost compared to flat-panel alternatives. However, they have been largely phased out in favor of slimmer and more efficient display technologies.

Key Highlights

- The rear projection television market is anticipated to grow at a CAGR of 2.4% during the forecast period.

- The global rear projection television market was estimated to be worth approximately USD 512.41 million in 2023 and is projected to reach a value of USD 634.33 million by 2032.

- The growth of the rear projection television market is being driven by growing preference for advanced display technologies like LED, OLED, and QLED, which offer higher resolution, better energy efficiency, and slimmer designs.

- Based on the product type, the DLP rear projection tv segment is growing at a high rate and is projected to dominate the market.

- On the basis of screen size, the 50-70 Inches segment is projected to swipe the largest market share.

- In terms of resolution, the full HD (1080p) segment is expected to dominate the market.

- Based on the end-user, the residential segment is expected to dominate the market.

- In terms of distribution channel, the offline stores segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Rear Projection Television Market: Dynamics

Key Growth Drivers

- Technological Advancements – Continuous improvements in display technology, such as better contrast ratios and higher resolutions, have enhanced the viewing experience, driving market demand.

- Cost-Effectiveness for Large Displays – Compared to other large-screen technologies like OLED or QLED, rear projection televisions (RPTVs) offer a more affordable alternative for big-screen viewing.

- Energy Efficiency – Modern RPTVs consume less power than older LCD and plasma TVs, making them an attractive option for energy-conscious consumers.

- Demand for Home Theaters – Increasing consumer interest in home entertainment and cinema-like experiences has fueled the adoption of large-screen televisions, including RPTVs.

Restraints

- Declining Popularity – The rise of flat-panel displays, such as LED and OLED TVs, has significantly reduced the demand for rear projection televisions.

- Bulky Design – Compared to sleek and ultra-thin LED and OLED screens, RPTVs are heavier and require more space, limiting their appeal in modern home settings.

- Limited Availability – Many major manufacturers have discontinued RPTV production, leading to a scarcity of new models and limited aftermarket support.

- Lower Picture Quality Compared to Modern Displays – While improvements have been made, RPTVs often struggle with brightness and viewing angles compared to newer display technologies.

Opportunities

- Niche Market for Large-Screen Enthusiasts – Some consumers still prefer RPTVs for their cost-effectiveness in large-screen applications, presenting an opportunity for specialized manufacturers.

- Innovations in Projection Technology – The integration of laser and LED projection systems could enhance image quality, making RPTVs more competitive.

- Growth in Commercial Applications – RPTVs can be used in auditoriums, conference halls, and educational institutions, where large screens are required.

- Refurbished and Second-Hand Market Growth – As new production declines, the demand for refurbished models and replacement parts is increasing.

Challenges

- Intense Competition from Flat-Panel Displays – LED, OLED, and QLED televisions dominate the market, making it difficult for RPTVs to compete.

- Shorter Lifespan of Projection Lamps – Frequent lamp replacements add to maintenance costs, discouraging potential buyers.

- Limited Consumer Awareness and Adoption – Many consumers are unfamiliar with RPTVs due to their declining market presence, leading to reduced demand.

- Difficulty in Repair and Maintenance – As manufacturers exit the market, sourcing replacement parts and expert repair services is becoming more challenging.

Rear Projection Television Market: Report Scope

This report thoroughly analyzes the Rear Projection Television Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Rear Projection Television Market |

| Market Size in 2023 | USD 512.41 Million |

| Market Forecast in 2032 | USD 634.33 Million |

| Growth Rate | CAGR of 2.4% |

| Number of Pages | 160 |

| Key Companies Covered | Sony Corporation, Samsung Electronics Co. Ltd., LG Electronics Inc., Mitsubishi Electric Corporation, Toshiba Corporation, Panasonic Corporation, Hitachi Ltd., Sharp Corporation, JVC Kenwood Corporation, RCA Corporation, Philips Electronics N.V., Sanyo El |

| Segments Covered | By Product Type, By Screen Size, By Resolution, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rear Projection Television Market: Segmentation Insights

The global rear projection television market is divided by product type, screen size, resolution, end-user, distribution channel, and region.

Segmentation Insights by Product Type

Based on product type, the global rear projection television market is divided into CRT rear projection TV, LCD rear projection TV, DLP rear projection TV, LCoS rear projection TV.

The DLP Rear Projection TV segment holds the dominant position in the rear projection television market due to its superior image quality, energy efficiency, and compact design compared to older CRT-based models. Digital Light Processing (DLP) technology utilizes micro-mirrors to project high-resolution images, offering sharper contrasts and smoother motion, making it popular for home theaters and large-screen entertainment. Its affordability and long-lasting performance compared to other projection technologies have contributed to its market leadership.

The LCD Rear Projection TV segment follows closely behind, benefiting from its ability to deliver bright and vibrant images with relatively lower power consumption. These televisions use liquid crystal display technology to produce clearer images than CRT-based models, making them a preferred choice for consumers seeking a balance between price and performance. However, limitations such as slower response times and potential screen burn-in issues have somewhat restricted its adoption compared to DLP models.

The LCoS (Liquid Crystal on Silicon) Rear Projection TV segment, while offering high-resolution images with deep blacks and excellent color accuracy, has remained a niche category. LCoS technology combines elements of LCD and DLP, providing superior image quality with fewer artifacts. However, its higher manufacturing cost and limited availability have made it less widespread among consumers, mainly appealing to high-end home theater enthusiasts.

The CRT Rear Projection TV segment is the least dominant and has largely become obsolete due to advancements in digital projection and flat-screen technology. While CRT-based rear projection TVs were once a staple in large-screen television markets, their bulky design, high power consumption, and lower image quality compared to modern alternatives have led to a sharp decline in demand. Most manufacturers have phased out CRT rear projection TVs in favor of more advanced and compact display technologies.

Segmentation Insights by Screen Size

On the basis of screen size, the global rear projection television market is bifurcated into below 50 inches, 50-70 inches, above 70 inches.

The 50-70 Inches segment is the most dominant in the rear projection television market, as it strikes the perfect balance between screen size, affordability, and practicality for home entertainment. Consumers favor this size range for its immersive viewing experience without requiring excessive space. It is particularly popular for living rooms and home theaters, where a large screen enhances the cinematic experience while remaining cost-effective compared to larger alternatives. The availability of DLP and LCD rear projection TVs in this size range has further driven demand, making it the preferred choice among buyers.

The Above 70 Inches segment follows, driven by enthusiasts seeking an even more immersive viewing experience. These large-format rear projection TVs are commonly used in high-end home theaters, corporate settings, and public displays where bigger screens are necessary. While this segment offers exceptional image quality and a theater-like experience, the higher price point and space requirements limit its adoption primarily to niche markets.

The Below 50 Inches segment is the least dominant, as consumers looking for smaller screens often opt for flat-panel LCD, LED, or OLED televisions instead of rear projection technology. The declining production of smaller rear projection TVs, combined with the affordability and superior resolution of modern flat-screen alternatives, has significantly reduced demand in this segment. Consequently, manufacturers have largely shifted focus away from this category.

Segmentation Insights by Resolution

Based on resolution, the global rear projection television market is divided into HD, Full HD, 4K, 8K.

The Full HD (1080p) segment is the most dominant in the rear projection television market due to its widespread adoption and balance between image quality and affordability. Full HD resolution provides crisp visuals, making it the standard choice for home entertainment, gaming, and general media consumption. It became the industry benchmark for rear projection TVs, especially in the 50–70-inch screen size range, as it delivers a high-quality viewing experience without the high costs associated with 4K or 8K models.

The 4K (Ultra HD) segment follows closely behind, growing in popularity due to increasing consumer demand for higher resolution and enhanced image clarity. 4K rear projection TVs offer four times the resolution of Full HD, making them ideal for home theaters and professional applications where sharpness and detail are crucial. However, the adoption rate has been slower compared to flat-panel 4K TVs, primarily due to the shift in consumer preference towards LED and OLED displays.

The HD (720p) segment, while once a major player, has significantly declined in dominance. HD resolution was widely used in early rear projection TVs but has largely been replaced by Full HD and 4K models. Today, HD rear projection TVs are mostly found in older models or budget-conscious consumer markets where affordability outweighs the need for higher resolution.

The 8K segment is the least dominant, with minimal presence in the rear projection television market. While 8K resolution offers unparalleled image clarity and detail, the technology is still emerging, and consumer demand for rear projection TVs in this resolution is extremely limited. Additionally, the high cost of 8K projectors and the lack of readily available 8K content further restrict its adoption, making it a niche option primarily for experimental or professional use.

Segmentation Insights by End-User

On the basis of end-user, the global rear projection television market is bifurcated into residential, commercial.

The Residential segment is the most dominant in the rear projection television market, driven by consumer demand for large-screen home entertainment systems. Rear projection TVs, particularly in the 50-70 inch range with Full HD and 4K resolutions, have been popular among households seeking an immersive viewing experience at a lower cost compared to early flat-screen alternatives. Home theater enthusiasts and budget-conscious buyers have contributed to the sustained demand for rear projection TVs, especially in spaces where screen size is a priority over ultra-thin design.

The Commercial segment, while significant, is less dominant due to the widespread adoption of alternative display technologies such as LED walls, projectors, and flat-panel displays. However, rear projection TVs have been utilized in corporate presentations, educational institutions, retail stores, and public venues where large-screen displays are needed for information sharing, digital signage, and presentations. Despite their advantages in certain applications, the commercial market has largely transitioned to newer, more space-efficient display solutions, limiting the overall growth of this segment in the rear projection television industry.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global rear projection television market is bifurcated into online stores, offline stores.

The Offline Stores segment is the most dominant in the rear projection television market, primarily due to the nature of the product and consumer purchasing behavior. Rear projection TVs are large and require in-person evaluation before purchase, as consumers often want to assess screen quality, size, and overall performance. Electronics retailers, specialty AV stores, and large appliance chains have been the preferred shopping destinations for these TVs, as they provide hands-on demonstrations, expert guidance, and after-sales support. Additionally, many consumers prefer offline stores for their ability to offer immediate product availability and installation services.

The Online Stores segment, while growing, remains less dominant in this market. E-commerce platforms provide the convenience of home delivery and competitive pricing, making them appealing for tech-savvy buyers who are already familiar with the product specifications. However, the bulky nature of rear projection TVs, high shipping costs, and consumer reluctance to purchase without seeing the product firsthand have slowed online adoption. Nevertheless, as digital retail platforms improve return policies and virtual product demonstrations, online sales are gradually gaining traction, particularly for well-known brands and models with established reputations.

Rear Projection Television Market: Regional Insights

- North America is expected to dominates the global market

The North America region is the most dominant segment in the rear projection television (RPTV) market. This dominance is driven by the region's early adoption of advanced display technologies, strong consumer demand for large-screen home entertainment, and a well-established market for high-definition content. Home theater enthusiasts in North America continue to favor RPTVs as a cost-effective alternative to large flat-panel displays, maintaining steady sales despite competition from newer technologies like LCD and OLED. Manufacturers in the region focus on innovation, integrating features such as improved resolution and enhanced brightness to sustain market relevance.

In Asia-Pacific, the RPTV market has seen rapid growth, fueled by rising disposable incomes and an expanding middle-class population, particularly in China and India. Consumers in these countries are increasingly investing in high-quality home entertainment systems, making RPTVs an attractive choice due to their affordability and large display capabilities. The presence of a strong manufacturing base for consumer electronics has further enabled competitive pricing, making RPTVs more accessible to a wider audience.

The European market for RPTVs has shown moderate growth, with consumers displaying a balanced interest in various television technologies. While flat-panel displays dominate in many households, RPTVs continue to appeal to niche segments such as home theater enthusiasts and specialized applications. A combination of traditional viewing preferences and the gradual acceptance of newer display technologies has shaped a diverse television market in this region.

In Latin America, demand for RPTVs has remained steady, particularly in areas where affordability is a major factor in purchasing decisions. Consumers looking for cost-effective large-screen televisions continue to opt for RPTVs over more expensive alternatives. Growing interest in home entertainment and increasing access to high-definition content have helped sustain market demand, though newer display technologies pose a challenge to long-term growth.

The Middle East and Africa region has a relatively smaller RPTV market, as consumer preferences have largely shifted toward newer television technologies. However, there is a niche demand for RPTVs in commercial and institutional settings, where large screens are required for presentations and educational purposes. Economic disparities and varying levels of technological infrastructure influence adoption rates, limiting the market’s overall expansion in this region.

Rear Projection Television Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the rear projection television market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global rear projection television market include:

- Sony Corporation

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Panasonic Corporation

- Hitachi Ltd.

- Sharp Corporation

- JVC Kenwood Corporation

- RCA Corporation

- Philips Electronics N.V.

- Sanyo Electric Co. Ltd.

- BenQ Corporation

- Optoma Corporation

- ViewSonic Corporation

- Hisense Group

- Vizio Inc.

- Changhong Electric Co. Ltd.

- Skyworth Group Limited

- TCL Corporation

The global rear projection television market is segmented as follows:

By Product Type

- CRT Rear Projection TV

- LCD Rear Projection TV

- DLP Rear Projection TV

- LCoS Rear Projection TV

By Screen Size

- Below 50 Inches

- 50-70 Inches

- Above 70 Inches

By Resolution

- HD

- Full HD

- 4K

- 8K

By End-User

- Residential

- Commercial

By Distribution Channel

- Online Stores

- Offline Stores

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Rear Projection Television

Request Sample

Rear Projection Television