Recovery Rhenium Market Size, Share, and Trends Analysis Report

CAGR :

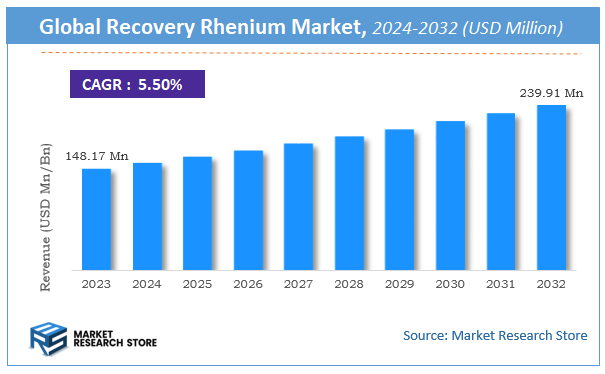

| Market Size 2023 (Base Year) | USD 148.17 Million |

| Market Size 2032 (Forecast Year) | USD 239.91 Million |

| CAGR | 5.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Recovery Rhenium Market Insights

According to Market Research Store, the global recovery rhenium market size was valued at around USD 148.17 million in 2023 and is estimated to reach USD 239.91 million by 2032, to register a CAGR of approximately 5.5% in terms of revenue during the forecast period 2024-2032.

The recovery rhenium report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Recovery Rhenium Market: Overview

Recovery rhenium refers to the process of extracting and reclaiming rhenium—a rare and valuable metal—primarily from industrial waste streams, spent catalysts, and superalloy scrap used in high-temperature and high-performance applications such as aerospace and petroleum refining. Given its limited natural abundance and critical role in enhancing the properties of nickel-based superalloys and platinum-rhenium catalysts, rhenium recovery is essential for ensuring a sustainable and cost-effective supply. The recovery process typically involves hydrometallurgical or pyrometallurgical techniques.

The growth of recovery rhenium is driven by increasing demand for rhenium in jet engines and industrial catalysts, coupled with high raw material costs and supply constraints. Environmental regulations and circular economy initiatives further encourage industries to invest in efficient recycling and recovery systems. As reliance on high-performance materials grows across strategic industries, rhenium recovery plays a vital role in minimizing waste, reducing dependence on mining, and ensuring long-term material availability.

Key Highlights

- The recovery rhenium market is anticipated to grow at a CAGR of 5.5% during the forecast period.

- The global recovery rhenium market was estimated to be worth approximately USD 148.17 million in 2023 and is projected to reach a value of USD 239.91 million by 2032.

- The growth of the recovery rhenium market is being driven by the increasing global demand for rhenium, particularly in high-temperature superalloys for the aerospace and defense industries.

- Based on the source of rhenium recovery, the primary rhenium recovery segment is growing at a high rate and is projected to dominate the market.

- On the basis of type of recovery process, the leaching techniques segment is projected to swipe the largest market share.

- In terms of end-user industries, the aerospace industry segment is expected to dominate the market.

- Based on the product form, the rhenium powder segment is expected to dominate the market.

- Based on the technology adoption, the use of nanotechnology segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Recovery Rhenium Market: Dynamics

Key Growth Drivers:

- Increasing Demand for Rhenium in High-Performance Applications: Over 70% of global rhenium demand comes from the aerospace industry, primarily for nickel-based superalloys used in jet engine turbine blades and industrial gas turbines. As air travel expands and the need for more fuel-efficient and durable engines grows, the demand for rhenium, and consequently its recovery, intensifies.

- Rarity and Scarcity of Primary Rhenium Sources: Rhenium is one of the rarest elements, with an average abundance of only 1 part per billion in the Earth's crust. Its production is limited to a few by-product sources (mainly from copper and molybdenum mining). This inherent scarcity and the risk of supply disruptions make recovery and recycling economically and strategically vital.

- Rising Rhenium Prices: The high rarity and critical applications of rhenium contribute to its high market price, often exceeding $10,000 per kilogram. This high value provides a strong economic incentive for recovering rhenium from secondary sources, making recycling a more attractive and cost-effective alternative to primary extraction.

- Growing Focus on Circular Economy and Sustainability: Global initiatives and corporate sustainability goals are driving industries to adopt circular economy principles. Recycling rhenium aligns perfectly with these goals by reducing reliance on virgin materials, minimizing waste, and lowering the environmental impact associated with mining and refining.

- Technological Advancements in Recovery Processes: Continuous research and development in hydrometallurgical (e.g., solvent extraction, ion exchange, precipitation, adsorption, membrane techniques) and pyrometallurgical methods are improving the efficiency, purity, and cost-effectiveness of rhenium recovery from complex scrap materials like superalloys and spent catalysts.

- Stringent Environmental Regulations: Increasing environmental regulations related to waste management and resource conservation compel industries to explore and implement recycling solutions for valuable and hazardous materials like rhenium, creating a regulatory push for the recovery market.

- Strategic Importance and Supply Chain Security: Governments and industries view rhenium as a critical strategic metal due to its irreplaceable role in defense and aerospace. Recovering rhenium domestically or within allied supply chains enhances national security and reduces vulnerability to geopolitical supply disruptions.

Restraints:

- Limited Availability of Rhenium-Containing Scrap: A significant restraint is the relatively small volume of rhenium-containing scrap available for recycling compared to other metals. Rhenium is used in small percentages within superalloys and catalysts, and the long lifespan of products like jet engines means scrap generation is slow and dispersed.

- Complexity and High Cost of Recovery Technologies: Extracting high-purity rhenium from complex alloys or spent catalysts requires sophisticated, multi-step pyrometallurgical and hydrometallurgical processes. These technologies are often capital-intensive, energy-intensive, and require specialized expertise, making them costly.

- Variability in Scrap Composition: The composition of rhenium-containing scrap can vary significantly depending on the alloy or catalyst type and its end-of-life condition. This variability makes it challenging to design a universal, highly efficient recovery process, often requiring customized approaches that add to complexity and cost.

- Logistical Challenges in Scrap Collection and Classification: Collecting, sorting, and transporting rhenium-containing scrap from diverse sources (e.g., aerospace repair facilities, petrochemical plants) globally poses significant logistical hurdles. Identifying and classifying rhenium-rich materials within mixed scrap streams is also a challenge.

- Contamination and Purity Requirements: Rhenium's applications demand extremely high purity. Removing impurities from recovered rhenium, especially from complex superalloys, is a technical challenge. Contamination can compromise the performance of new superalloys or catalysts.

- Economic Viability for Small-Scale Operations: The high capital investment and technical complexity often favor large, integrated recycling operations. Small-scale or independent recyclers may find it difficult to achieve economic viability due to economies of scale and expertise requirements.

- Competition from Primary Production (When Prices are Low): While rhenium is rare and expensive, fluctuations in global commodity prices can sometimes make primary extraction more competitive if prices drop significantly, potentially reducing the economic incentive for recovery in the short term.

Opportunities:

- Development of More Efficient and Sustainable Recovery Technologies: Continued R&D into novel, less energy-intensive, and more environmentally friendly recovery methods (e.g., greener solvents, advanced adsorption materials, electro-extraction) can significantly improve the market's efficiency and appeal.

- Expansion of Recycling from Industrial Catalysts: Beyond aerospace scrap, increasing efforts to recover rhenium from spent platinum-rhenium catalysts used in the petrochemical industry (for high-octane gasoline production) present a growing opportunity, especially with stricter emission regulations.

- Urban Mining and End-of-Life Product Recycling: As more rhenium-containing components (e.g., turbine blades, electronic components) reach their end-of-life, the volume of secondary raw materials for urban mining will increase, creating a long-term opportunity for dedicated recycling facilities.

- Closed-Loop Recycling Partnerships: Opportunities exist for direct partnerships between rhenium consumers (e.g., aerospace manufacturers) and recycling companies to establish closed-loop systems, ensuring a consistent supply of recycled rhenium and enhancing supply chain resilience.

- Certification and Traceability of Recycled Rhenium: Developing certification standards for recycled rhenium (e.g., confirming purity, source, and environmental impact) can add value and build trust, encouraging more industries to adopt recovered material as part of their sustainability mandates.

- Market Growth in Asia Pacific: With the rapid expansion of aerospace and industrial sectors in countries like China and India, these regions are poised to become significant drivers for both primary rhenium consumption and, consequently, the demand for local recovery and recycling capabilities.

- Innovation in Material Design for Easier Recycling: Future research into designing rhenium-containing alloys or components with "design for recycling" principles in mind could make the recovery process significantly easier and more cost-effective in the long run.

Challenges:

- Achieving High Purity Levels from Complex Feedstocks: The most significant challenge is consistently achieving the ultra-high purity levels required for rhenium's critical applications when dealing with diverse and complex scrap materials, which often contain numerous other alloying elements.

- Economic Viability of Processing Low-Concentration Scrap: Many rhenium-containing waste streams have very low concentrations of the metal. Developing economically viable methods to recover rhenium from these dilute sources without excessive energy or chemical consumption is a major technical and financial hurdle.

- Global Standardization of Scrap Collection and Classification: The lack of global standards for the collection, sorting, and pre-treatment of rhenium-containing scrap hinders efficient large-scale recycling operations. Establishing such standards is crucial for streamlining the supply chain for recyclers.

- Managing Environmental Footprint of Recovery Processes: While recycling is generally more sustainable than mining, some recovery processes still involve hazardous chemicals or significant energy consumption. The challenge is to continually reduce the environmental footprint of rhenium recovery itself.

- Technological Readiness and Scale-Up: Many promising new recovery technologies are still at the laboratory or pilot scale. Scaling these processes up to industrial volumes efficiently and cost-effectively presents significant engineering and financial challenges.

- Fluctuating Primary Rhenium Supply and Price Volatility: The recovery market is sensitive to the dynamics of primary rhenium production, which can be influenced by molybdenum and copper mining output and geopolitical factors. Significant shifts in primary supply or price volatility can impact the profitability and demand for recycled rhenium.

- Lack of Government Incentives and Policies: In some regions, the absence of strong government incentives (e.g., subsidies, tax breaks, mandates for using recycled content) or supportive policies for critical raw material recycling can slow the growth and investment in the recovery rhenium market.

Recovery Rhenium Market: Report Scope

This report thoroughly analyzes the Recovery Rhenium Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Recovery Rhenium Market |

| Market Size in 2023 | USD 148.17 Million |

| Market Forecast in 2032 | USD 239.91 Million |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 193 |

| Key Companies Covered | Umicore, Colonial Metals, Meridian Metals Management, Sabin Metal Corporation, Titan International, Maritime House, Toma Group, Buss & Buss Spezialmetalle, Lipmann Walton & Co Ltd, SEKOM, Heraeus, Avon Specialty Metals |

| Segments Covered | By Source of Rhenium Recovery, By Type of Recovery Process, By End-User Industries, By Product Form, By Technology Adoption, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recovery Rhenium Market: Segmentation Insights

The global recovery rhenium market is divided by source of rhenium recovery, type of recovery process, end-user industries, product form, technology adoption, and region.

Segmentation Insights by Source of Rhenium Recovery

Based on source of rhenium recovery, the global recovery rhenium market is divided into primary rhenium recovery, secondary rhenium recovery, and recycling of rhenium materials.

Primary Rhenium Recovery dominates the Recovery Rhenium Market as it represents the initial extraction of rhenium directly from natural ore deposits, particularly as a byproduct of molybdenite concentrates found in copper-molybdenum ores. This process typically involves roasting the molybdenite to release rhenium as a vapor, which is then captured as rhenium heptoxide and further processed into ammonium perrhenate or metallic rhenium. Primary recovery is capital-intensive and requires sophisticated extraction infrastructure, but it remains the most consistent and high-yield method of obtaining rhenium. Due to rhenium’s extremely rare geological availability and its critical role in superalloys for aerospace and industrial gas turbines, primary recovery ensures a stable and traceable supply, which is essential for meeting stringent quality standards in high-tech applications.

Secondary Rhenium Recovery refers to the extraction of rhenium from intermediate industrial residues, particularly spent catalyst waste from petroleum refining and metallurgical processing. This segment plays a vital role in supplementing primary sources by recovering rhenium from waste streams that would otherwise be discarded. The process often involves hydrometallurgical methods to leach rhenium from residual materials, followed by purification and conversion into reusable forms. Secondary recovery is considered more cost-effective and sustainable than primary extraction, especially in regions or facilities with consistent access to high-volume industrial waste. It also helps industries reduce dependence on mining operations and supports resource conservation initiatives.

Recycling of Rhenium Materials encompasses the reprocessing of end-of-life rhenium-bearing products such as turbine blades, engine components, and alloy scraps. This method focuses on retrieving rhenium from high-performance metal parts that have reached the end of their operational lifecycle. The recycling process includes disassembly, sorting, chemical separation, and refining to recover rhenium with minimal quality degradation. While the yield is generally lower compared to primary recovery, recycling contributes to circular economy practices and minimizes environmental impact. This segment is gaining traction due to the growing demand for sustainable supply chains in the aerospace and defense industries, where rhenium plays a critical role and component recycling offers cost and resource advantages.

Segmentation Insights by Type of Recovery Process

On the basis of type of recovery process, the global recovery rhenium market is bifurcated into leaching techniques and solvent extraction.

Leaching Techniques dominate the Recovery Rhenium Market as they form the foundation of most extraction processes, particularly in both primary and secondary recovery operations. This method involves using chemical solutions—often sulfuric acid or nitric acid—to dissolve rhenium from ore, concentrate, or industrial residues. The rhenium is then recovered from the leachate through further chemical treatment or precipitation. Leaching is favored for its ability to efficiently extract rhenium from complex materials like molybdenite roaster flue dust or spent catalysts. It offers high selectivity, scalability, and control over recovery yield, making it essential for large-scale operations. The flexibility of leaching—whether applied in heap, tank, or pressure conditions—enables its widespread adoption across different recovery environments. Moreover, advancements in controlled leaching chemistry continue to improve extraction rates and environmental compatibility.

Solvent Extraction serves as a critical complementary step in refining and purifying rhenium from leach solutions, especially when targeting high-purity end products like ammonium perrhenate or metallic rhenium. This process involves transferring rhenium from an aqueous leach solution into an organic solvent, where it can be selectively separated from impurities before being stripped and recovered in a purer form. Solvent extraction is valued for its high efficiency, precise separation capabilities, and suitability for processing low-concentration solutions. It is particularly useful in industrial setups where consistent rhenium quality is required for high-performance applications such as superalloys and catalysts. While not typically used as a standalone recovery method, solvent extraction plays a vital role in enhancing the purity and economic value of recovered rhenium.

Segmentation Insights by End-User Industries

On the basis of end-user industries, the global recovery rhenium market is bifurcated into aerospace industry, electronics industry, renewable energy sector, automotive industry, and medical applications.

Aerospace Industry dominates the Recovery Rhenium Market due to rhenium’s indispensable role in the production of high-performance superalloys used in turbine engines. Rhenium enhances the strength, creep resistance, and thermal stability of nickel-based superalloys, which are critical for manufacturing turbine blades and engine components that operate under extreme temperatures and stress conditions. These materials are widely used in both commercial and military aircraft, where durability and fuel efficiency are paramount. The aerospace sector also drives demand for recycled and recovered rhenium due to the high cost of primary sources and the strategic importance of material traceability and sustainability. The long service life of components and stringent safety standards in this industry make consistent and high-purity rhenium supply a key requirement, ensuring steady market growth in recovery processes.

Electronics Industry utilizes rhenium for its exceptional electrical properties, such as high melting point, excellent conductivity, and corrosion resistance. Rhenium is used in electrical contact materials, thermocouples, and filaments in mass spectrometers and X-ray equipment. While the volume of rhenium used in this sector is relatively lower compared to aerospace, its applications are critical and require extremely pure forms of the element. Recovered rhenium, especially from discarded electrical components or manufacturing residues, offers a cost-efficient and sustainable source for these precision applications. The growth of microelectronics and precision instruments continues to support the niche but essential role of rhenium in this segment.

Renewable Energy Sector is an emerging end-user in the recovery rhenium market, particularly as interest grows in advanced turbine technologies used in concentrated solar power (CSP) systems and next-generation gas turbines for power generation. These systems demand superalloys with exceptional heat resistance, where rhenium is used to extend operational life and improve efficiency. Recovered rhenium is increasingly being considered as a sustainable input to reduce reliance on mining and support the development of low-emission energy solutions. Though still a developing segment, the sector's push toward decarbonization and energy innovation is gradually integrating rhenium into long-term technology pathways.

Automotive Industry incorporates rhenium in niche applications such as turbocharger components, exhaust systems, and advanced catalytic converters. The metal’s resistance to heat and corrosion enhances the durability and efficiency of high-performance engines, especially in motorsports and luxury vehicles. With growing focus on hybrid and performance vehicles, there is increasing demand for materials that maintain integrity under thermal cycling, where rhenium-containing superalloys provide significant value. Recovered rhenium is often used in alloy reprocessing, helping reduce costs and support sustainable supply chains in this competitive industry segment.

Medical Applications of rhenium, while limited in volume, are vital in specialized areas such as radiopharmaceuticals and diagnostic imaging. Rhenium isotopes, particularly Rhenium-186 and Rhenium-188, are used in targeted cancer therapies and bone pain treatment. The precision and purity required for medical-grade materials make high-quality recovered rhenium especially relevant for pharmaceutical companies and research institutions. Moreover, the recycling of medical equipment and isotopic byproducts is increasingly contributing to this small but significant market, supporting circular resource models in healthcare innovation.

Segmentation Insights by Product Form

On the basis of product form, the global recovery rhenium market is bifurcated into rhenium powder, rhenium wire, rhenium alloys, and rhenium foils.

Rhenium Powder dominates the Recovery Rhenium Market due to its versatility and widespread application across multiple high-tech industries. This fine metallic powder is the preferred form for manufacturing superalloys, especially in powder metallurgy processes used to produce high-strength turbine blades and structural components. It is also a critical input in catalyst production for reforming processes in petroleum refining. Rhenium powder derived from recovery methods—especially secondary sources and recycled components—retains high purity and performance standards, making it economically attractive. Its fine particle size and high surface area allow for efficient blending with other metals, enabling precise control of alloy composition. Additionally, its ease of transport and storage further contributes to its dominance in the market.

Rhenium Wire is primarily used in applications that require high-temperature stability and consistent electrical performance, such as thermocouples, electron beam equipment, and mass spectrometry. It is often fabricated from high-purity rhenium recovered from primary and secondary processes and refined into ductile, corrosion-resistant wire suitable for sensitive instrumentation. The demand for rhenium wire remains stable in industries such as aerospace, defense, and analytical instrumentation, where precision and thermal endurance are paramount. Though a smaller segment compared to powder, it commands high value per unit due to its specialized use and manufacturing complexity.

Rhenium Alloys include rhenium blended with other metals—most notably tungsten and molybdenum—to form materials with superior mechanical and thermal characteristics. These alloys are critical in producing parts for jet engines, rocket nozzles, and heat-resistant electrical components. Tungsten-rhenium and molybdenum-rhenium alloys are prized for their stability at temperatures exceeding 2000°C. Recovery-based production of rhenium alloys allows manufacturers to lower costs without compromising on performance, supporting sustainable supply chains in defense and aerospace sectors. The increasing demand for long-life, high-stress components continues to elevate the importance of this segment.

Rhenium Foils are ultra-thin sheets of rhenium used in highly specialized environments such as vacuum electronics, high-energy physics experiments, and X-ray generation equipment. These foils offer exceptional strength, ductility, and electron emission characteristics while withstanding thermal and mechanical stress. Although representing a niche segment in terms of volume, rhenium foils require extremely pure starting materials—often sourced from recovered rhenium—to meet stringent technical specifications. Their applications in research labs, nuclear facilities, and precision imaging devices ensure a steady demand from institutions and OEMs involved in advanced technology development.

Segmentation Insights by Technology Adoption

On the basis of technology adoption, the global recovery rhenium market is bifurcated into use of nanotechnology and ion exchange methods.

Use of Nanotechnology dominates the Technology Adoption segment in the Recovery Rhenium Market due to its ability to significantly enhance the precision, efficiency, and yield of rhenium extraction and purification. Nanotechnology enables the design of nanoscale materials—such as functionalized nanoparticles and nanostructured membranes—that exhibit superior adsorption capabilities, selectivity, and surface area for rhenium ions. These technologies are particularly valuable in recovering rhenium from low-concentration sources like industrial effluents or spent catalysts, where traditional methods may not be economically viable. The nanoscale systems facilitate faster reactions, improved leaching performance, and higher metal recovery with minimal waste generation. As sustainability and cost-efficiency become increasingly important, the adoption of nanotechnology offers promising solutions for improving both environmental performance and operational scalability in rhenium recovery operations.

Ion Exchange Methods are widely applied in the selective separation and purification of rhenium from mixed metal solutions, especially in hydrometallurgical recovery processes. In this method, specially designed ion exchange resins are used to selectively adsorb rhenium ions from acidic leach solutions, allowing for efficient downstream recovery and refinement into high-purity compounds such as ammonium perrhenate. Ion exchange is valued for its reliability, chemical specificity, and ability to operate in continuous flow systems. It is particularly useful in processing complex feedstocks such as roaster flue dust, spent catalysts, and mixed metal residues. Although less technologically advanced than nanotechnology-based approaches, ion exchange remains a mature and proven method, well-integrated into commercial-scale rhenium recovery plants due to its operational stability and relatively low cost.

Recovery Rhenium Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the global recovery rhenium market due to its well-established aerospace and defense sectors, which are the largest end-users of rhenium-based superalloys. The United States leads with a highly developed infrastructure for rhenium recovery from spent catalysts and superalloy scrap, especially from gas turbine engine components. Major companies such as Freeport-McMoRan and specialty chemical processors have developed efficient rhenium recovery facilities co-located with molybdenum roasting plants, particularly in Arizona and Utah. Additionally, North America benefits from integrated supply chains and recycling networks that recover rhenium from petroleum refinery catalysts used in reforming units. The region also enforces strong environmental and resource conservation regulations, further incentivizing recovery operations from secondary sources. This ensures North America maintains leadership in both technological capability and volume of recovered rhenium.

Europe holds a significant share in the recovery rhenium market, supported by the region’s emphasis on circular economy practices and high demand from aerospace component manufacturers. Countries like Germany, the United Kingdom, and France have advanced metallurgical recycling systems that include recovery of rhenium from end-of-life superalloys and industrial catalysts. European aerospace OEMs and engine manufacturers, including Rolls-Royce and Safran, actively support rhenium recovery to ensure a stable supply of critical materials for turbine blade production. Additionally, stringent EU regulations concerning the recycling of critical raw materials push for greater recovery efficiency. Although strong in environmental policy and recycling innovation, Europe trails North America in total recovered volume due to smaller reserves and more limited upstream rhenium extraction infrastructure.

Asia-Pacific is an emerging region in the recovery rhenium market, led by China, Japan, and South Korea, which are rapidly expanding their high-performance materials and aerospace sectors. China, in particular, has made notable progress in recovering rhenium from molybdenum concentrates and refinery waste streams, supported by state-driven resource security strategies. Japanese firms are focused on precision recovery from spent catalysts and used components in specialty steel and alloy production. South Korea’s emphasis on rare metal recycling technologies also supports growth in this market. However, most recovery operations in Asia are still developing, and the scale of recovered rhenium remains lower compared to North America’s mature and fully integrated recovery supply chains.

Latin America holds modest potential in the recovery rhenium market, mainly through countries like Chile and Peru, which are major molybdenum producers. Rhenium is typically extracted as a byproduct during molybdenum roasting, and recovery systems have been gradually introduced at major mining operations. However, most recovered rhenium is exported as part of primary production, and dedicated recycling or secondary recovery from industrial waste is minimal. Investment in recovery technologies remains limited, and regional demand for rhenium itself is low due to underdeveloped aerospace and high-tech manufacturing sectors. North America continues to lead due to its advanced recovery infrastructure and local demand for superalloy applications.

Middle East & Africa region has minimal direct involvement in rhenium recovery, with only a few industrial-scale molybdenum processing operations that generate trace rhenium as a byproduct. Countries like South Africa have metallurgical capabilities, but no significant infrastructure for rhenium recovery from secondary sources. The region’s oil refining sector, especially in the Gulf countries, uses rhenium-based catalysts, but local recovery and recycling infrastructure for such materials is underdeveloped. Most spent catalysts are either disposed of or exported for processing abroad. North America thus remains far ahead in terms of both recovery capacity and technological integration in the rhenium recycling value chain.

Recovery Rhenium Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the recovery rhenium market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global recovery rhenium market include:

- Umicore

- Colonial Metals

- Meridian Metals Management

- Sabin Metal Corporation

- Titan International

- Maritime House

- Toma Group

- Buss & Buss Spezialmetalle

- Lipmann Walton & Co Ltd

- SEKOM

- Heraeus

- Avon Specialty Metals

The global recovery rhenium market is segmented as follows:

By Source of Rhenium Recovery

- Primary Rhenium Recovery

- Secondary Rhenium Recovery

- Recycling of Rhenium Materials

By Type of Recovery Process

- Leaching Techniques

- Solvent Extraction

By End-User Industries

- Aerospace Industry

- Electronics Industry

- Renewable Energy Sector

- Automotive Industry

- Medical Applications

By Product Form

- Rhenium Powder

- Rhenium Wire

- Rhenium Alloys

- Rhenium Foils

By Technology Adoption

- Use of Nanotechnology

- Ion Exchange Methods

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Recovery Rhenium

Request Sample

Recovery Rhenium